Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

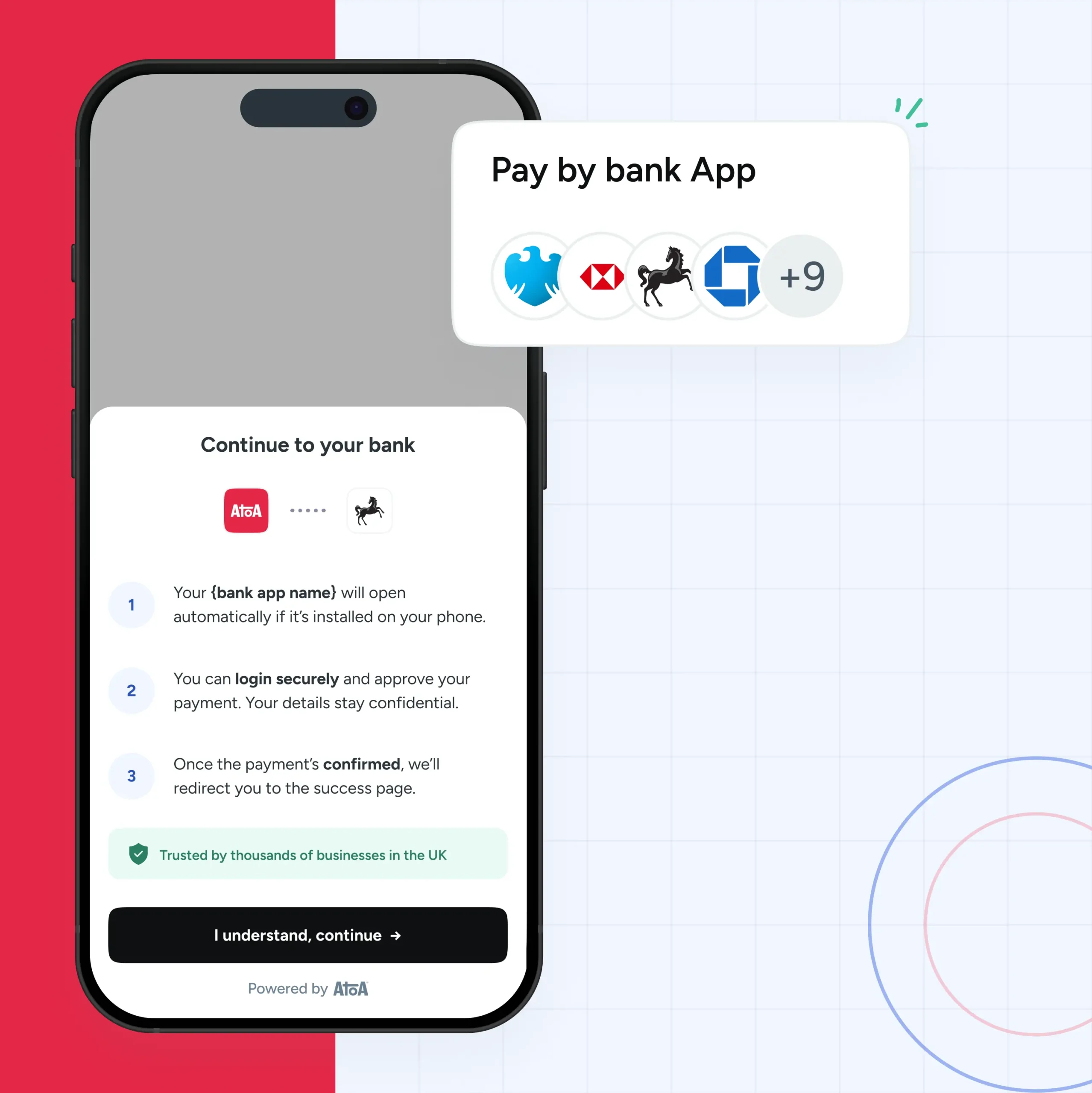

The way people book and pay for travel is evolving. Customers want speed, security, and convenience. And travel businesses need cost-effective solutions that support smooth transactions—an important factor in an industry where the online booking abandonment rate is as high as 81%. Pay by Bank is becoming an increasingly popular payment method in the travel sector. It allows customers to make direct bank-to-bank transfers, bypassing traditional card networks.For travel operators, this means lower transaction costs, faster payments, and a more secure way to process bookings. Here’s what you need to know about implementing Pay by Bank and why it’s worth considering for your business.

Why travel operators should consider Pay by Bank

Traditional payment methods can be costly, slow, and prone to fraud. Here’s why Pay by Bank has more to offer as an alternative payment method that improves both business operations and customer experience.

Lower transaction costs

Traditional card payments come with multiple fees, including interchange fees, merchant service charges, and processing fees. These add up quickly, cutting into your revenue. Pay by Bank removes unnecessary middlemen, which means fewer fees and more money in your business.

Instant and secure payments

With Pay by Bank, funds are transferred immediately, so you’re not waiting 2-3 days for settlement like with traditional card payments. This improves cash flow and ensures your business has access to funds faster. Plus, because transactions are authenticated directly through the customer’s banking app, fraud risks and chargebacks are significantly reduced.

Say goodbye to chargebacks

Chargebacks are a major headache for travel operators—costly, time-consuming, and often unfair. Fraudulent disputes can lead to lost revenue and extra admin work. With Pay by Bank, chargebacks are eliminated because transactions are final and fully authenticated by the customer’s bank. No disputes, no clawbacks—just secure, reliable payments that let you focus on running your business.

Better customer trust and satisfaction

Booking a holiday should feel exciting, not stressful. When payments are simple and secure, customers feel more confident booking their trips. Letting them pay directly through their banking app adds a layer of familiarity, making the process feel effortless. This not only builds trust and loyalty but also reduces booking drop-offs. A smooth, stress-free payment experience keeps customers coming back, making it easier for travel operators to grow lasting relationships.

How to implement Pay by Bank in the travel industry

With the right provider and a few simple steps, you can easily integrate this payment method into your booking and payment systems.

1. Assess your current payment setup

Start by reviewing how your business currently processes payments. For example, do you use an online booking system? Or perhaps you take payments over the phone or via invoices? Understanding your existing setup will help you plan for a smooth integration.

2. Choose a trusted Pay by Bank provider

Not all Pay by Bank providers offer the same level of service. Look for a provider that understands the travel industry and offers reliable support. Atoa is designed specifically for businesses looking for fast settlements, low fees, and easy integration.

3. Integrate the payment solution into your systems

Once you’ve selected a provider, the next step is integration. To begin, work closely with your provider to ensure Pay by Bank is added to your website, booking system, and payment processes. With Atoa, setting up is simple—using QR codes and payment links—so you can integrate it seamlessly without disrupting your business.

4. Make it easy for customers to use Pay by Bank

Encouraging customers to use Pay by Bank is key. Here’s how you can promote it:

- Display it as a primary payment option on your booking page

- Use QR codes for in-person transactions

- Educate customers on its benefits—faster payments, 50% lower fees, and water-tight security

5. Train your team

Your team should feel confident explaining how Pay by Bank in the travel industry works. Also, quick training session will ensure staff can answer customer questions and encourage adoption.

6. Monitor and optimise

Keep an eye on how many customers are using Pay by Bank. If adoption is slow, consider offering a small incentive, like a discount or a free upgrade for customers who choose it over card payments.

What are the challenges you will face? How to overcome them?

Like any new system, implementing Pay by Bank in the travel industry comes with a few hurdles, from technical integration to customer adoption. Let’s take a look at how you can overcome them.

- Regulatory compliance: Make sure your provider complies with UK financial regulations, including PSD2 and GDPR. Partnering with a knowledgeable provider will help you through these complexities so you can focus on running your business.

- Technical integration: While most Pay by Bank solutions are easy to implement, there may be minor technical adjustments required. Make sure your IT team (or payment provider) can offer support if needed.

- Customer awareness: Some customers may not be familiar with Pay by Bank. Clear messaging and an easy-to-use checkout experience will help drive adoption.

- Keep an eye on things: After setting up Pay by Bank, check that everything is running smoothly. Ask customers and staff for feedback to identify any areas for improvement. Additionally, regularly review transaction success rates, customer satisfaction, and cost savings to measure how well it’s benefiting your business.

Key takeaways

Pay by Bank is a cost-effective and efficient way for travel businesses to process payments. It reduces transaction fees, speeds up payments, and improves security. Plus, customers love the ease of a seamless and secure booking experience, making them more likely to book with confidence.

Atoa makes it easy to integrate Pay by Bank with low fees and instant payouts.

If you’re ready to cut payment costs and improve customer experience, now is the time to explore Pay by Bank. Try Atoa free for 7 days and see how it can transform your payment process. Are you ready to book a demo today?