Open banking blockchain. It all sounds a bit serious, doesn’t it? But there’s no need for it to be difficult. In its simplest form, blockchain is essentially a secure network that offers transparency to all parties involved. Ready to find out more? Let’s lose the jargon and explore blockchain for UK business owners in simple terms. We’ll pull apart its potential benefits, current limitations, and what you need to consider before signing up.

You’re in the right place. In this article, I will explore the following:

- What blockchain is and how it works in open banking

- How UK business payments could benefit from blockchain solutions

- Things to consider before adding new payment technology

- Blockchain FAQs and how Atoa can help.

What is blockchain, anyway?

Imagine a big digital notebook that everyone can use to write down important things like how much money they have or what they bought. Everyone can see what’s written in the notebook, but nobody can change it once it’s written. That’s basically what a blockchain is.

A blockchain links blocks of data together in a chain, which explains its name! In transactions, every payment and its record is securely stored and visible to all authorised parties. The information is then shared throughout the entire network rather than being held by a single organisation. It’s incredibly resistant to tampering or manipulation, making it super secure. Blockchain is usually associated with cryptocurrencies like Bitcoin, but its potential applications could reach much further.

It may be a relatively fresh concept, but blockchain is gaining steady traction. But why? Mainly because it disrupts traditional banking systems.

Why UK businesses might get excited about blockchain

- It’s faster and cheaper. Blockchain lets you ditch intermediaries and their hefty fees. Blockchain transactions happen directly between you and whoever you pay, saving you time and money.

- Once information is recorded in a block, it’s virtually impossible to change it. This creates a permanent and transparent record of all transactions.

- Every step of the payment journey is transparent. This means easy fund tracking and building better trust with other businesses or customers.

- Forget fraudulent transactions and chargebacks. Blockchain is decentralised, which makes it incredibly hard to meddle with. This keeps your money safe. Decentralisation means no single entity is in control of data. Instead, it’s distributed across a network of computers, making it more secure and less prone to central attacks.

- No more chasing down invoices or reconciling bank statements. Blockchain records are synced in real-time, reducing errors and paperwork.

Beyond cryptocurrencies, blockchain has exciting potential in other industries, such as supply chain management, healthcare records and even tamper-proof elections. But how could it join forces with open banking systems? Let’s find out…

Open banking blockchain – a perfect match?

One feature crypto and open banking share is that they both need tech support to do their jobs. Open banking leans on APIs, whilst cryptocurrency needs a blockchain.

Both blockchain and open banking technology offer unprecedented levels of transparency and security, making payments safe and secure. Blockchain comes with decentralised transactions, making it easier and faster to manage your finances. And with enhanced customer experience, you can build stronger relationships with your clients, increasing loyalty and return visits as you go. Is it time to explore the potential of open banking blockchain and take your business to the next level? We think so.

Benefits of blockchain in open banking

While blockchain technology is still being explored in the wider open banking space, it holds promising potential for increased security, transparency, and efficiency. Here are some perks it could bring to fintechs and third-party providers.

Enhanced security

- Transactions are recorded on a distributed ledger, making them tamper-proof and providing a single source of truth. This reduces the risk of fraud and errors.

- Decentralisation means no single entity controls the data, reducing the vulnerability to central attacks.

- Authentication used in blockchain can integrate with biometric security tools for secure access.

Improved transparency

- All users see the same transaction history, promoting transparency, trust and effortess audits.

- Blockchain enables the sharing of financial data (with permission), breaking down barriers between institutions and giving users more control over their data.

- Sharing verified identity information through blockchain can make Know Your Customer (KYC) and Anti-Money Laundering (AML) processes easier.

Increased efficiency

- Automation can speed up processes and reduce manual work.

- Cross-border payments and micropayments become faster and cheaper.

- Access to data means tailored financial products and services can be developed based on unique individual needs.

Current blockchain applications

- Know Your Customer (KYC) verification: Blockchain can store and share verified customer information securely for faster onboarding.

- Cross-border payments: Blockchain-based platforms can provide faster, cheaper, and more transparent cross-border payment solutions.

- Trade finance: Blockchain could provide a secure and transparent platform to track goods and manage payments across any industry.

- Identity checks: ID solutions built on blockchain can give users more control over their identity information.

Challenges of an open banking blockchain

The outlook is promising, but blockchain faces challenges that need to be addressed, such as scalability, regulations, and links between different blockchain platforms. Yet, still, collaborations between financial institutions, technology companies, and regulators continue to push innovation and progress in this future-forward space. It’s most definitely one to watch in open banking and beyond.

Is blockchain worth it?

Hold your horses! While blockchain’s potential power is undeniable, it’s not the answer to every business conundrum. Here are some hard realities to consider.

- The technology is still maturing. Expect bugs, glitches, and changing regulations.

- Limited adoption, still. Many businesses and banks still need to embrace blockchain, so widespread use hasn’t taken off yet.

- Technical complexity lies ahead. Setting up and using blockchain-based payment systems can be complex, requiring specialised expertise.

- It’s not so green. Some blockchain networks consume a lot of energy, raising a few environmental concerns.

Blockchain payments checklist

Before you throw all your energy into blockchain payments, here are some questions to ask yourself:

- What are your current payment pain points? Are fees, fraud, or slow processing times major concerns?

- Do your partners or suppliers use blockchain? Without widespread adoption, benefits are limited.

- Is your team prepared for the technical challenges?

- Are you willing to invest or wait for user-friendly solutions?

- Does the potential cost savings outweigh the investment? Blockchain systems cost money to maintain.

The future of open banking with blockchain technology

It’s important to note that blockchain is not a silver bullet for all open banking needs. Each use case needs careful evaluation to see if blockchain offers a clear advantage over existing solutions. It’s essential to remember that blockchain is still an evolving technology, but its potential for secure, transparent, and efficient operations is undeniable, and its future looks bright.

FAQS

Will blockchain help reduce my payment costs?

Blockchain can lower transaction fees and enable faster processing times, reducing payment costs for UK businesses.

How does blockchain improve the security of my business payments?

Blockchain creates a digital ledger stored across a distributed network, making it incredibly difficult to tamper with, which improves the security of business payments.

How does blockchain improve the transparency of my transactions?

Blockchain makes all transactions visible on the ledger, which enhances transparency and builds trust with customers and partners.

Can blockchain help automate payments?

Blockchain can be used to automate payments through the use of smart contracts that handle payments automatically, helping businesses save time and money.

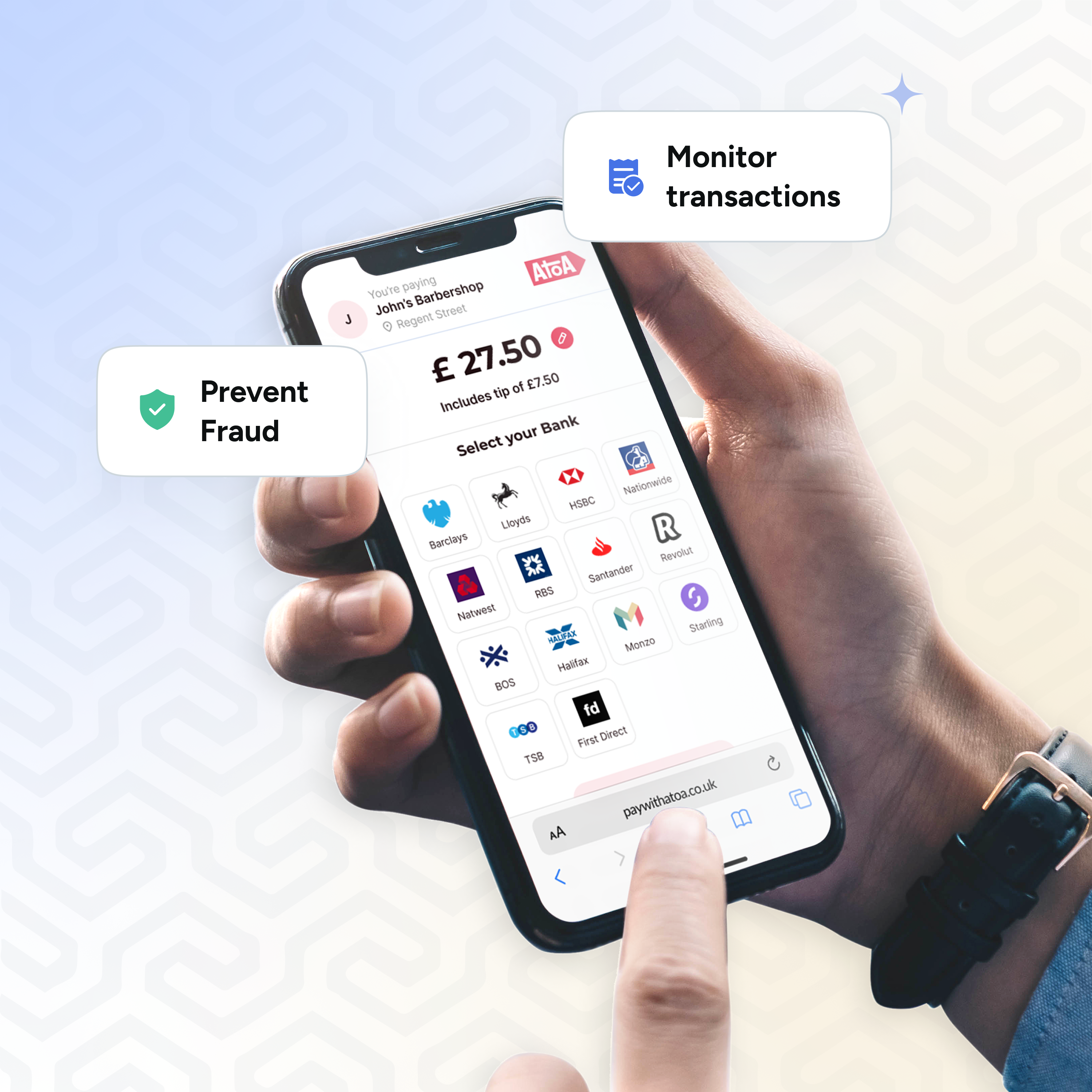

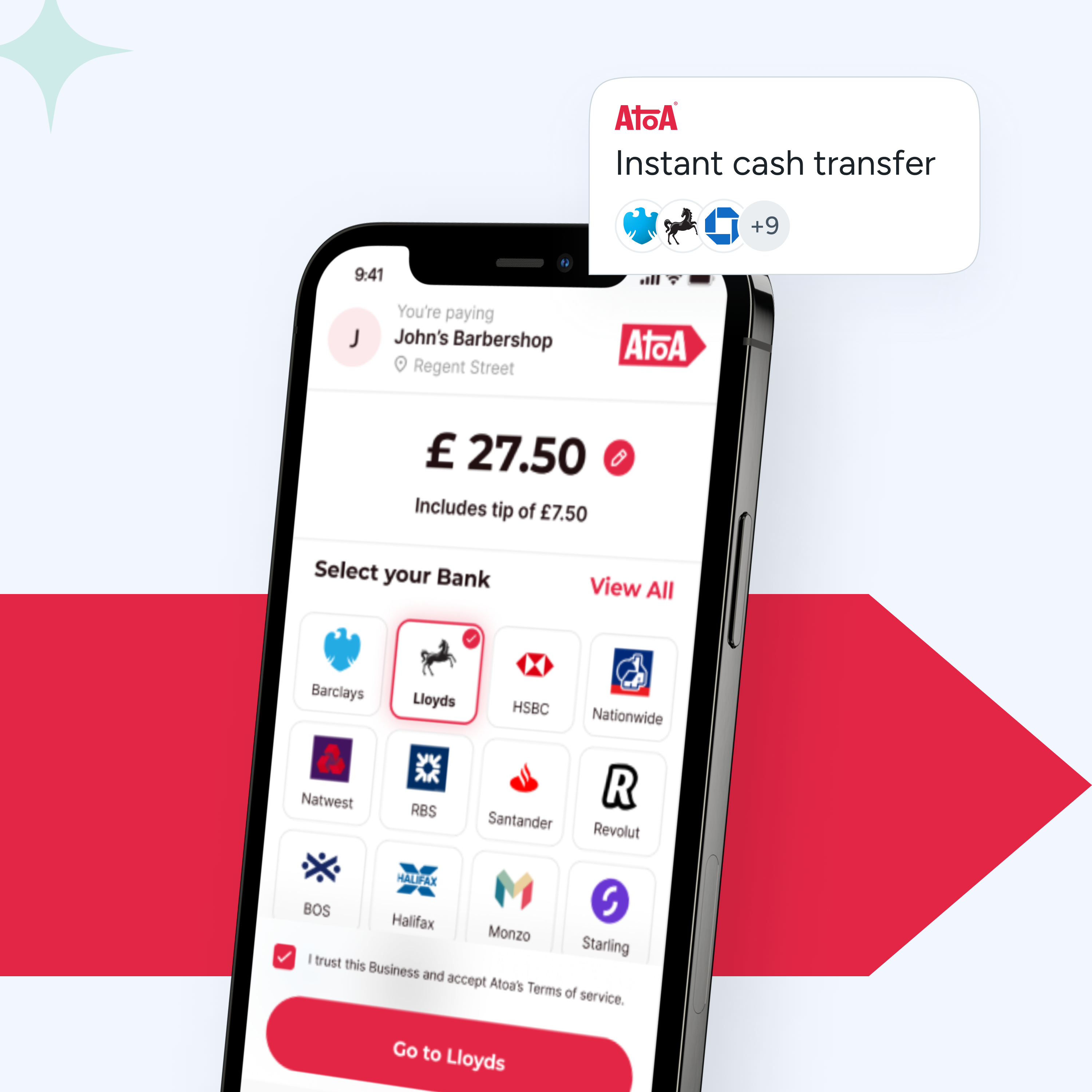

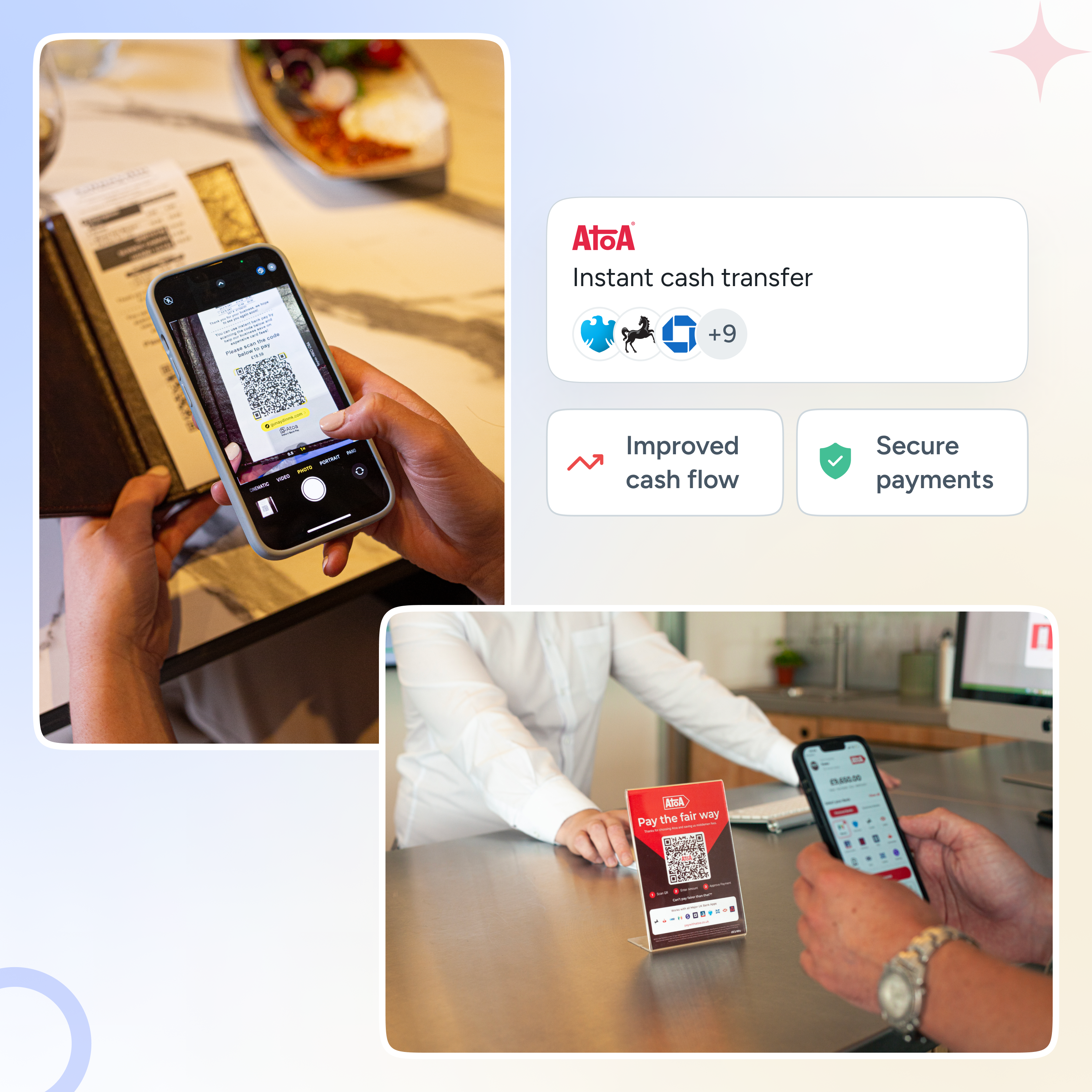

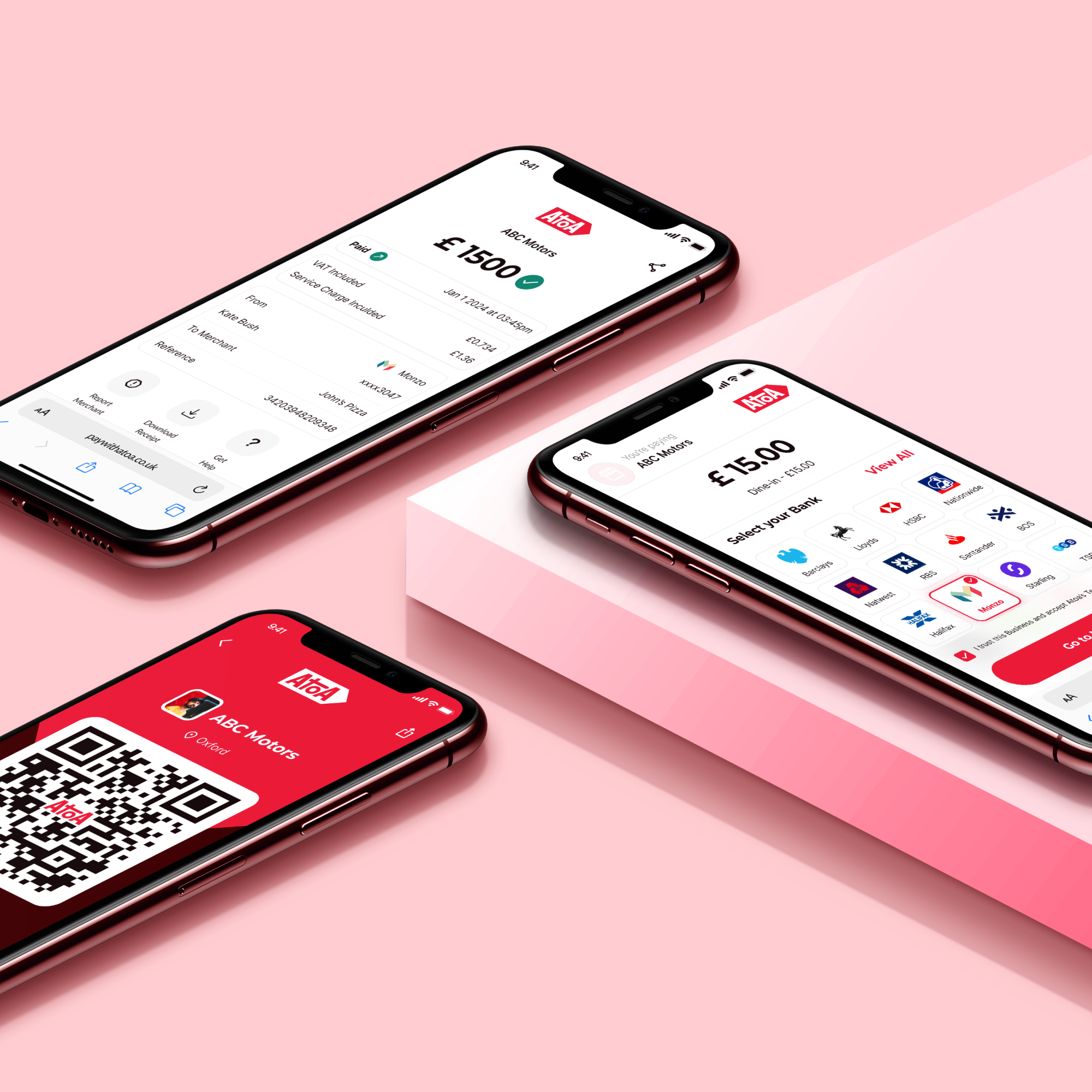

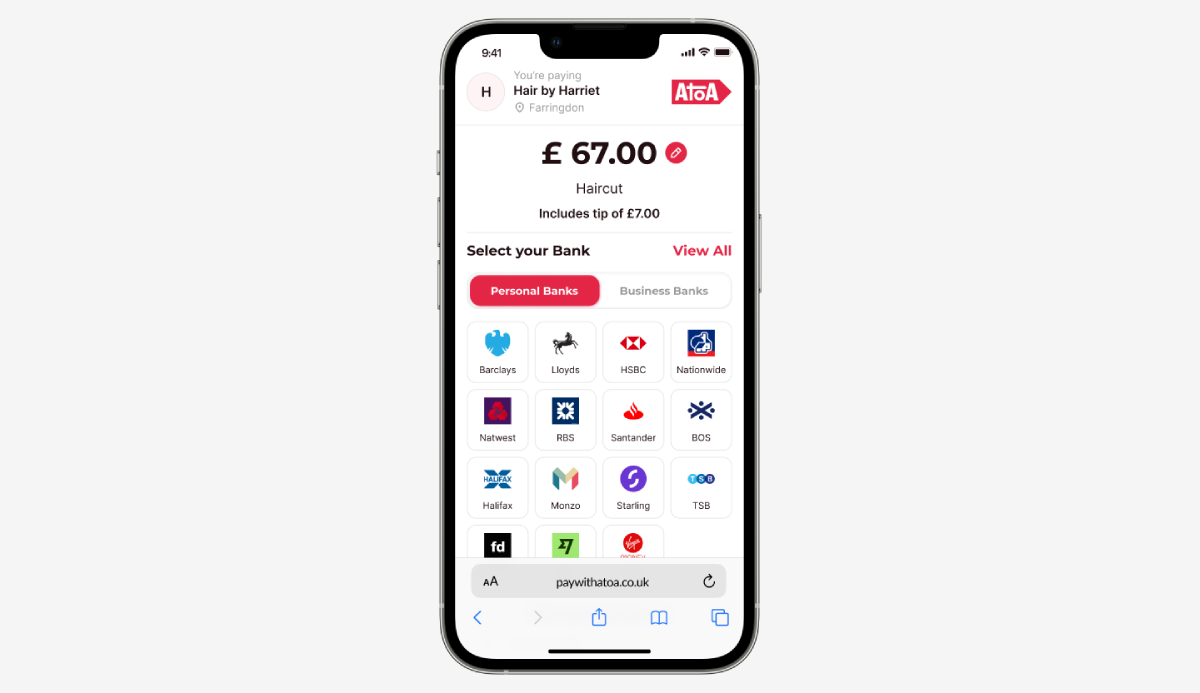

How Atoa can help

We’ll keep you updated as this tech evolves and more UK businesses jump on board. Let’s see whether blockchain holds the key to unlocking easy, transparent, cost-effective business payments for UK entrepreneurs like you.

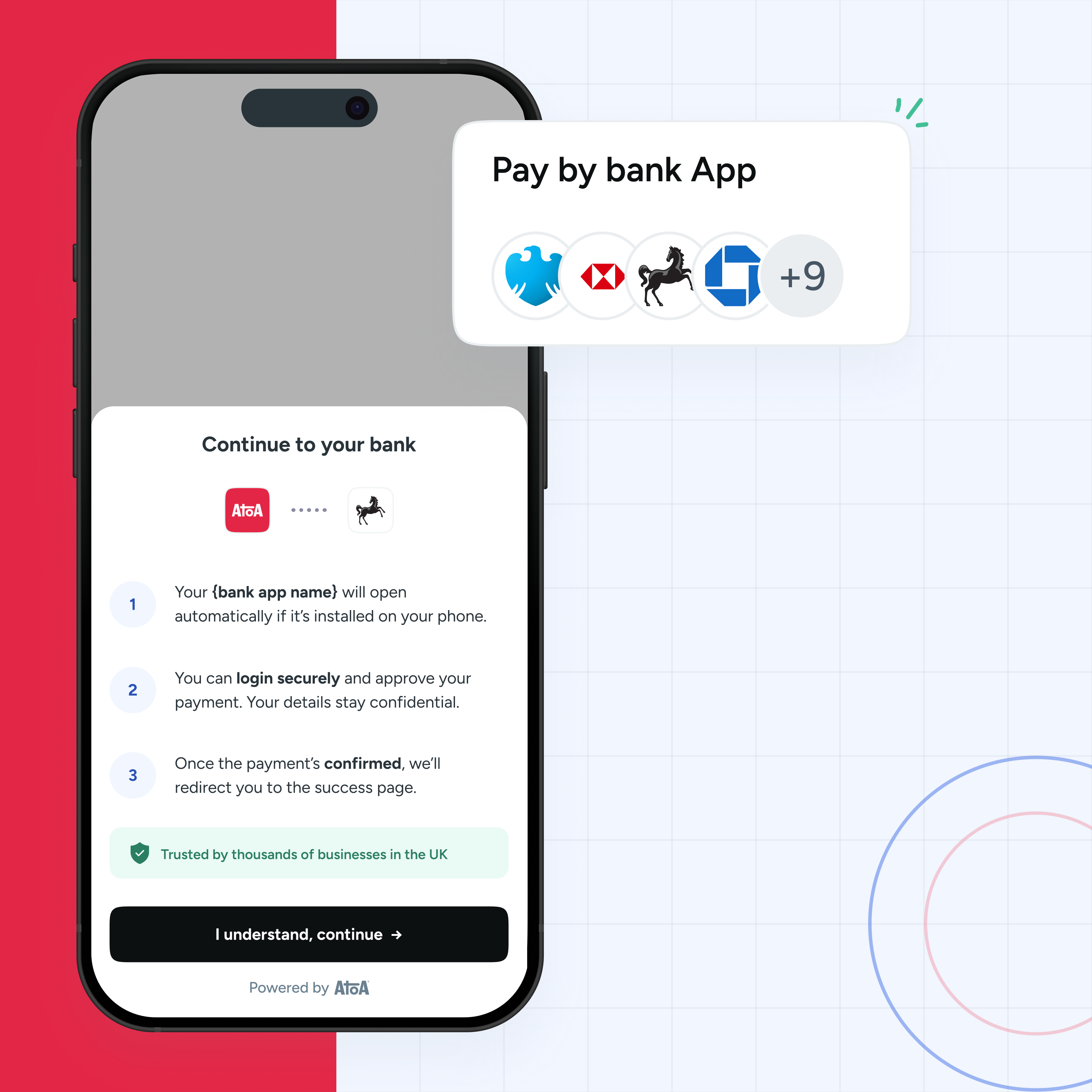

In the meantime, we have an easy business payment solution for you. Atoa delivers instant payments that avoid card rails. Fees are lower and capped, meaning you can take home more of what you earn. No tech know-how is required, and it’s free from contracts and hidden fees. Why not book a quick call with Conor to find out more?