Are you a local business owner struggling with high fees and slow cash flow? Don’t fear, as open banking can change the game for your independent business. This simple yet powerful technology has the potential to improve your finances and help bring in more money. Read on to find out how open banking helps local businesses…

What is open banking?

Running a local business can be like running a marathon full of hurdles. From managing cash flow to unfair transaction fees chipping away at your profits, it can feel like the world is against you. But fear not, and learn to take every obstacle as an opportunity in disguise! By tackling these challenges head-on, local business owners can switch adversity for growth and prosperity.

Open banking might be the answer your business is looking for…

This innovative system was introduced to UK consumers in January 2018 as part of the Open Banking Initiative. It aimed to increase competition and innovation in the banking sector by allowing customers to share their financial data securely with third-party providers using APIs. Since then, open banking has been adopted by banks and fintech companies to reshape how they manage their money.

Finextra recently reported that 99% of Gen Z and 98% of millennials use mobile banking apps to manage most of their finances, so why not use them to send payments?

Why your local business needs open banking

Open banking lets you securely connect your bank accounts with approved apps and services, which means:

- Faster, cheaper loans: Share up-to-date financial data for instant approval and better interest rates.

- Say goodbye to costly card fees: Let customers pay directly from their bank accounts or pay by bank, saving you money.

- Get paid on time: Share payment links with customers so they can settle up instantly, wherever they are.

- Master your cash flow: Sync your accounting software with open banking payments for up-to-date financial data and easy tax records.

Open banking is already reshaping how UK businesses manage their finances. It’s a secure and powerful tool that can help you save time, reduce costs, and unlock new growth opportunities.

How open banking helps local businesses: the benefits

Adopting open banking can change how UK businesses operate, offering advantages and benefits for owners. From reducing payment fees to real-time spending, here’s why local businesses should consider using open banking in their daily operations.

First up, make it easier for customers to pay you. Using pay-by-bank options instead of traditional payments can reduce processing fees and time. Letting customers pay you directly from their bank app offers an easy cashless alternative. Furthermore, imagine every £1 saved on transaction fees add up, and how you could spend or save it…

Late payments can impact cash flow and limit growth. However, business owners can use open banking to accept payments using links. Automatic payment reminders help nudge customers to pay quickly, ensuring a healthier cash flow.

The Federation of Small Businesses estimates that 70% of SMEs can’t forecast their finances. Open banking removes this struggle by offering businesses detailed insights into their financial transactions and accounts. This means more accurate cash flow tracking, finding potential bottlenecks, and better growth opportunities.

Need a loan to expand? By giving lenders access to their financial data, businesses can speed up the application process and potentially get better interest rates.

Open banking isn’t just about staying ahead of the curve—it’s about harnessing your business’s full potential. From reducing processing fees to tackling late payments, its benefits are clear. So, by harnessing the power of open banking, UK business owners can pave the way for greater efficiency, profitability, and growth.

Get a real-time view of cash flow across all your business accounts, enabling better decision-making and spotting potential shortfalls.

Plus, you can connect your business bank accounts to accounting software like Xero or Quickbooks to reduce manual data entry and errors.

Potential risks and disadvantages of open banking

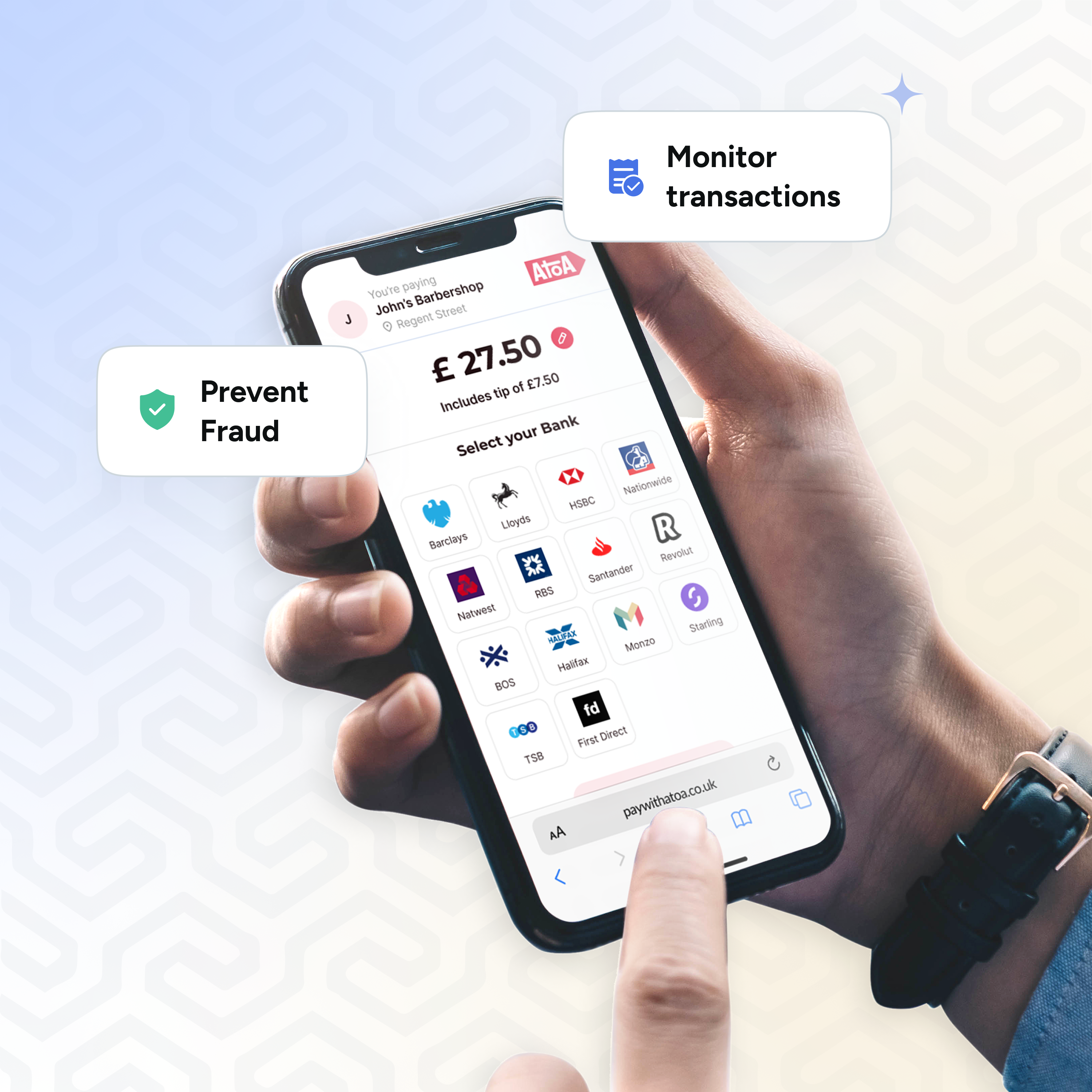

The primary risk is the potential for data breaches or unauthorised access to sensitive financial information, so it’s important to understand your potential liability in the event of fraud or errors on third-party platforms. However, the chances of these risks happening are low.

- Check security measures: Meet data security regulations by opting for reputable open banking providers who use SCA and biometrics.

- Data sharing control: Thoroughly review the terms and conditions of open banking services to understand how your and your customer’s financial data will be used and shared.

- Dependence on third parties: You may experience disruptions if there are technical issues on the provider’s end.

- Adoption: Open banking payments require customers to have a smartphone with an active UK bank app downloaded. This may not cater to every demographic, so it’s wise to offer a variety of payment methods.

How local businesses can use open banking

Faster payments and more convenience for your local business and its customers? Where do you sign up? But the use cases go much further than just accepting payments. Here are a few ways your business could use open banking:

- Offer convenient in-store and online payment methods for customers without using cash or cards, which also gives you lower fees and faster settlement.

- Send multiple payment requests in one go, saving your team time.

- Automatically move funds across accounts to boost balances and interest.

- Generate custom financial reports to understand your business’s health.

- Make staff payments easier by integrating open banking with your payroll software.

- Automate VAT calculations and link directly to HMRC for easier bookkeeping and records.

- Track your business expenses and link transactions to accounting records for accurate reporting.

Choosing the open banking payments provider

Here is a handy checklist to run through as you research and choose a payment solution for your business. Remember, the most important thing is that the provider works for your business type, and customer preferences…and has fair fees.

- Consider your business needs first and foremost. What is your average volume of transactions and are you looking for in-person or online payments?

- Are there any upfront costs for your business or hardware to invest in?

- Transaction fees vary and can impact your cash flow if you don’t research them, so prioritise plans with lower rates.

- How confident with tech are you, and what level of customer support do you need?

- Does the provider integrate with your existing tools, such as POS or accounting software?

- How important is the cost? Are you willing to pay more for extra features or lower transaction fees?

How we can help

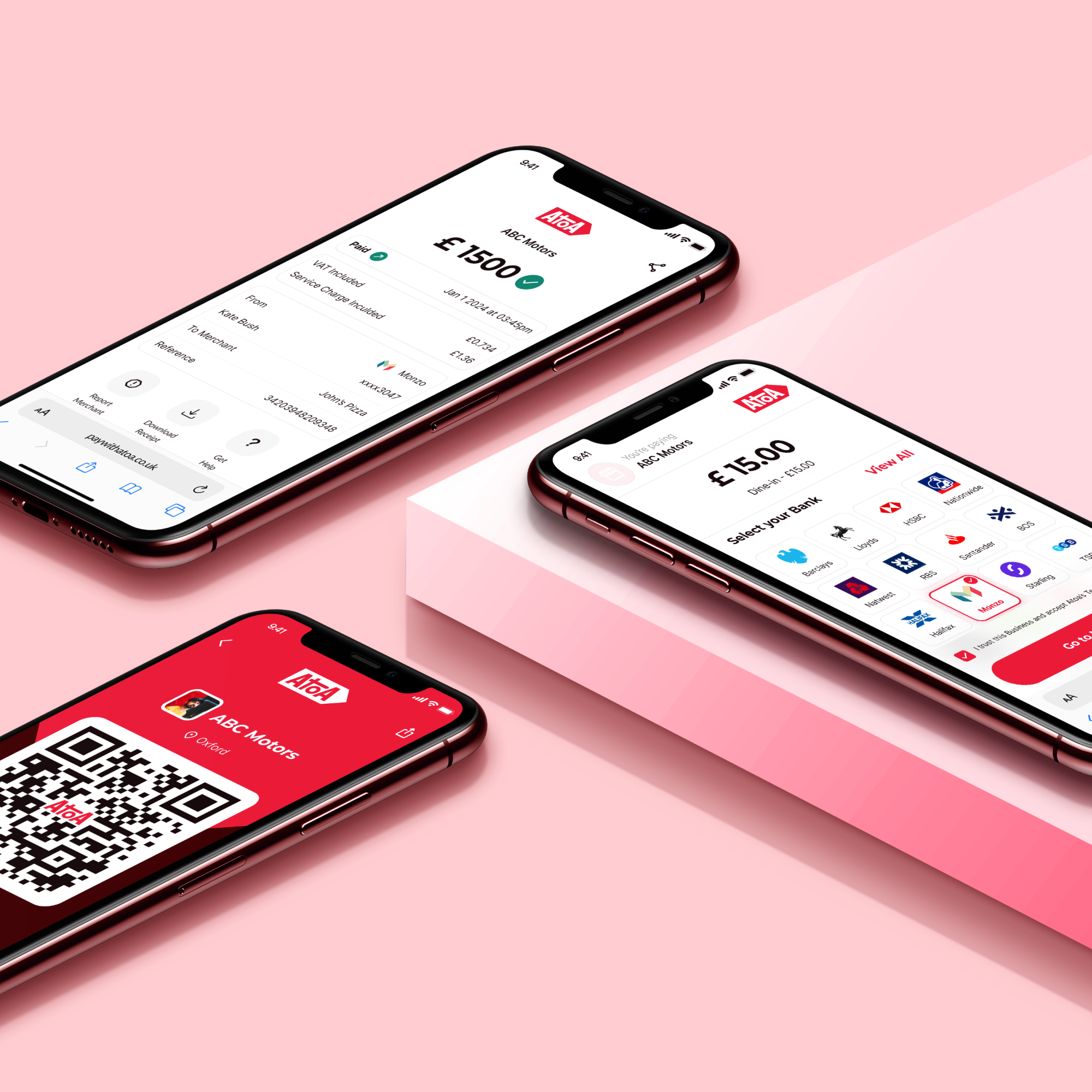

Budding UK businesses, it’s time to level up your payment game with Atoa! We’ve harnessed the power of the UK’s open banking system to make your life easier.

Here’s why you should try a 7-day free trial:

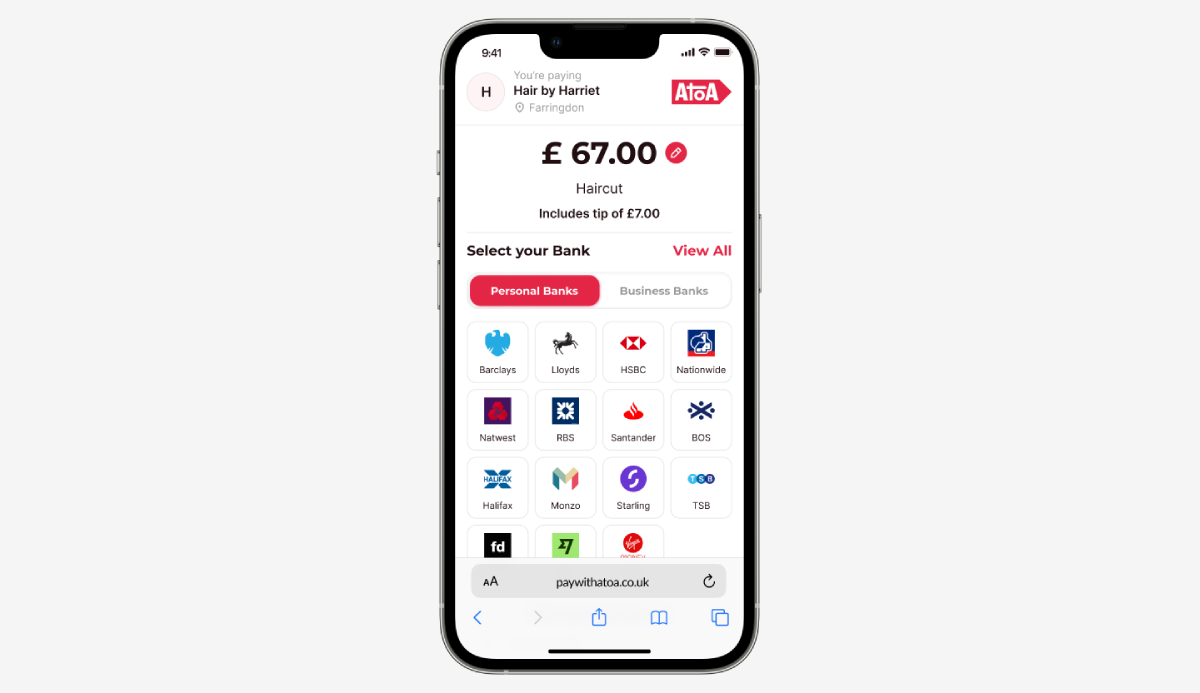

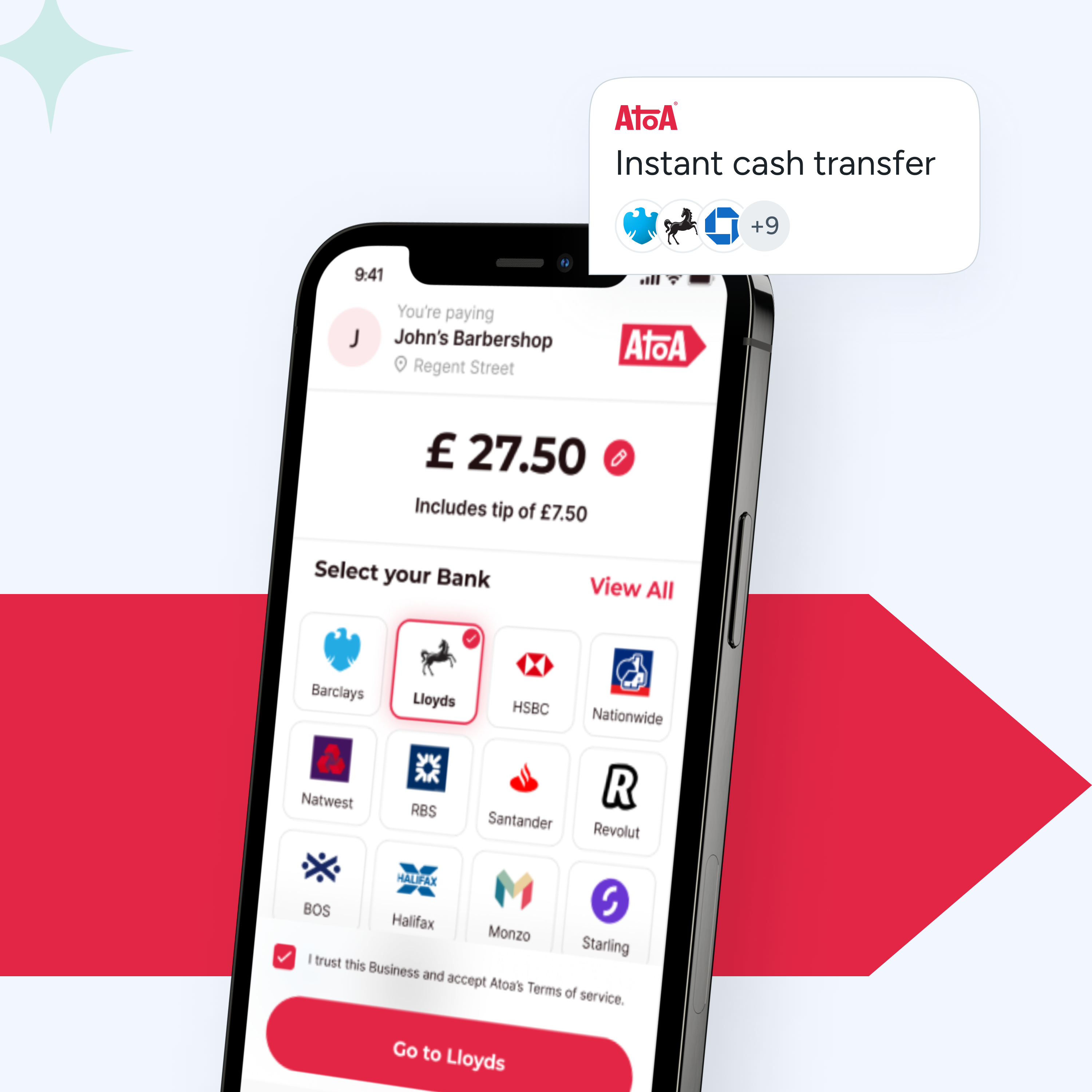

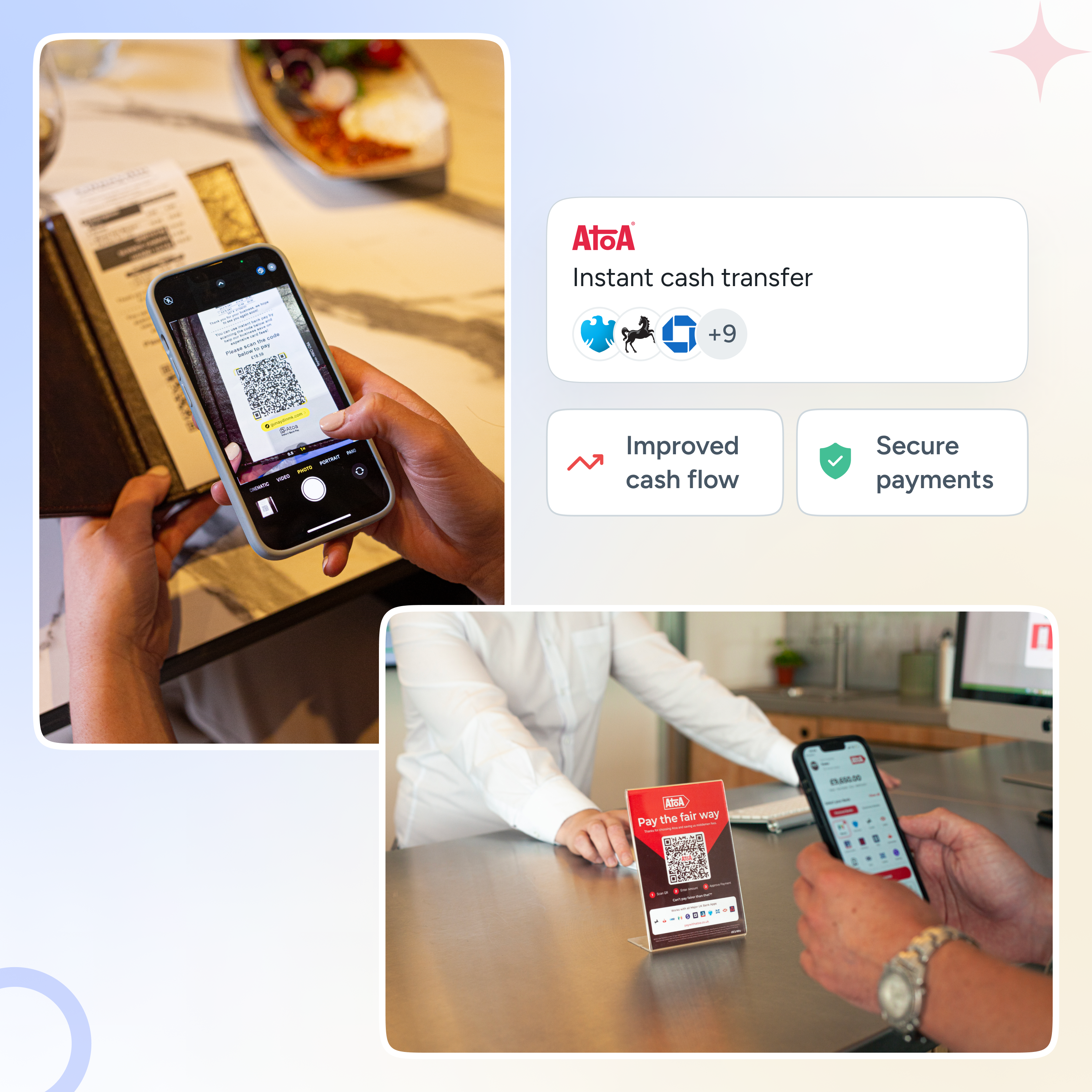

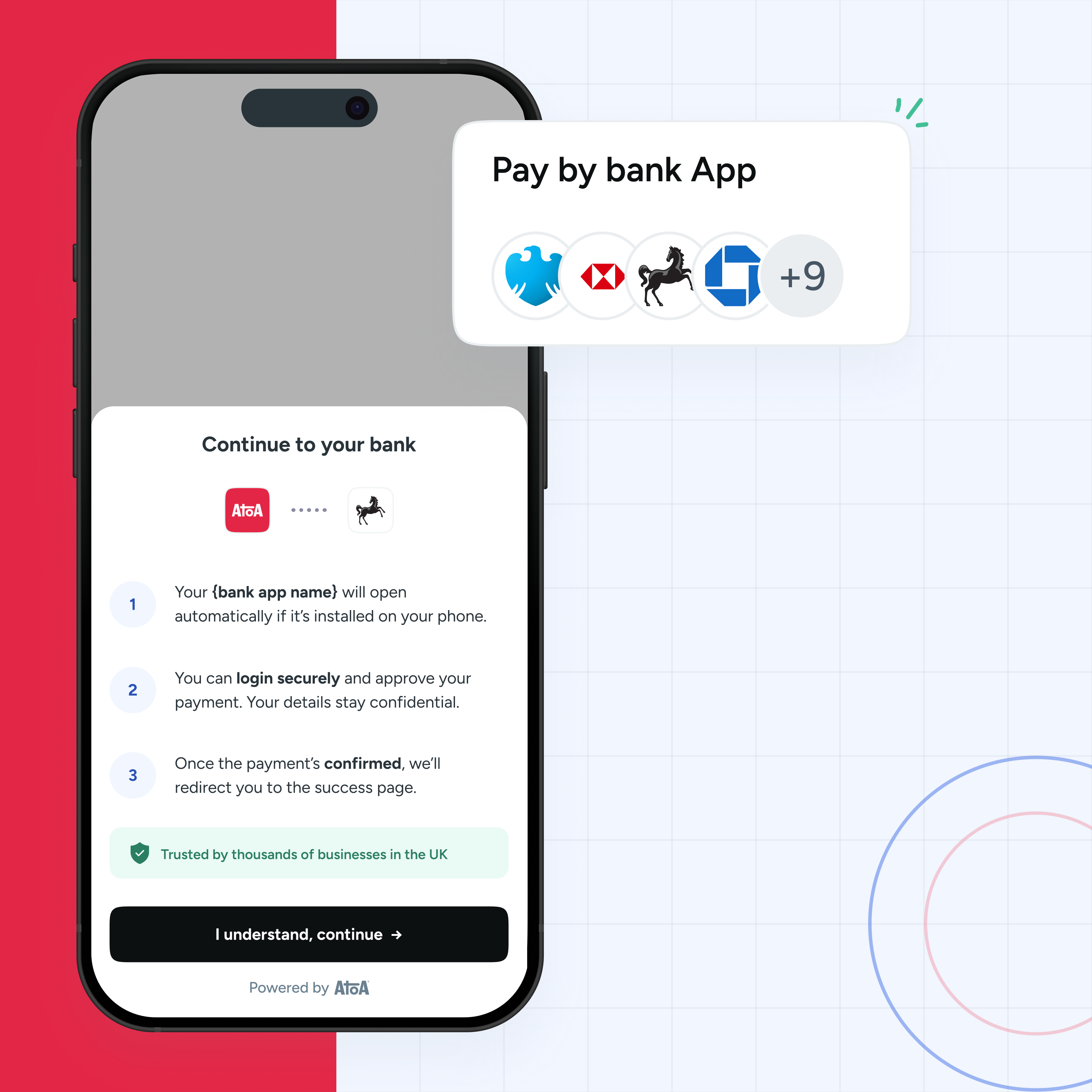

- Skip the card machines. Atoa lets customers pay directly from their bank accounts using QR codes or links. There is no need for expensive card readers or complicated setups.

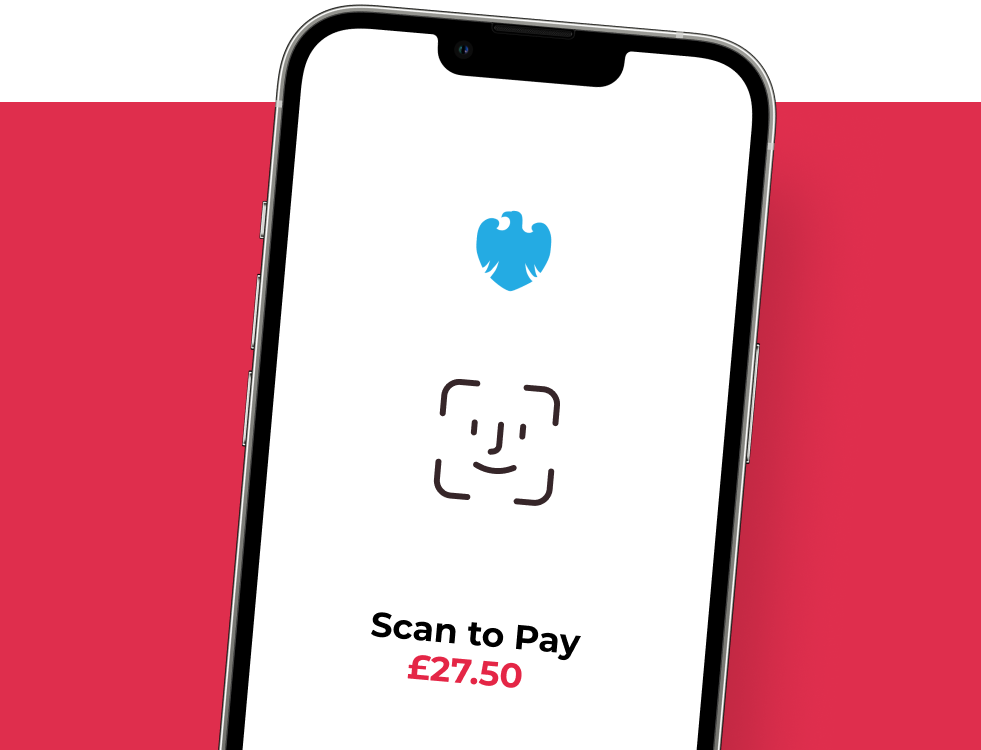

- Scan, approve, done. For customers, it’s easy. No fiddling with cards or entering bank details, which is a massive win if you run a pop-up stall or take payments on the go.

- Instant payments for a happy cash flow. Funds are transferred instantly into your business account, which can help you stay afloat during quiet periods.

- Perfect for entrepreneurs. Whether you’re a tradesperson, market seller, or beyond, Atoa has you covered. Accept instant payments, so you can focus on what truly matters—growing your business.

FAQs

How does open banking help my local business?

Open banking lets you share your financial data with third-party apps and services. Some of the benefits include reduced transaction fees and better cash flow management.

Is open banking safe?

Yes, data security is at the top of open banking’s list. So, choose reputable providers and review their security measures to protect your financial information.

How do I start using open banking?

Getting up and running with open banking payments is easy. Start by researching trusted providers like Atoa, who offer simple setups and guides to help you up and running.

What if I have more questions or need help along the way?

Don’t worry, you’re not alone! If you have any questions or need assistance, contact your payment provider’s customer support team. They’re there to help you navigate the process and get the most from this powerful tool.