Digital vs mobile wallets? Good question! Both offer secure and convenient ways to pay for goods and services without carrying actual wallets, cash or physical cards…but what sets them apart?

Digital wallets can be used to make online payments on devices with an internet connection, while mobile wallets are designed for smartphones. Both types of wallets offer a number of benefits, including convenience, security, and rewards.

Digital and mobile wallets make it easier for businesses to get paid. Let’s take a closer look at how.

Digital wallets: An easy way to pay online

A digital wallet is an electronic payment system that stores your financial information and allows you to make payments online without carrying cash or credit cards.

How do digital wallets work?

- Choose a digital wallet provider.

- Create an account by providing your basic information.

- Verify your account.

- Add your credit cards, debit cards, bank account, and other forms of payment to your digital wallet.

- Make payments!

To make a payment online, select your digital wallet as the payment method.

Digital wallets in action…

- Check-in and check-out: Many hotels allow guests to speed up visits using electronic wallets. This can save guests time and hassle waiting around at the front desk.

- Settle the bill in seconds: Guests can use their digital wallet to pay for food and drinks at hotel restaurants and bars without carrying cash or cards.

- Buying vehicles: Some car dealerships now allow customers to purchase vehicles this way. This can make the car buying process faster and easier for customers and dealers.

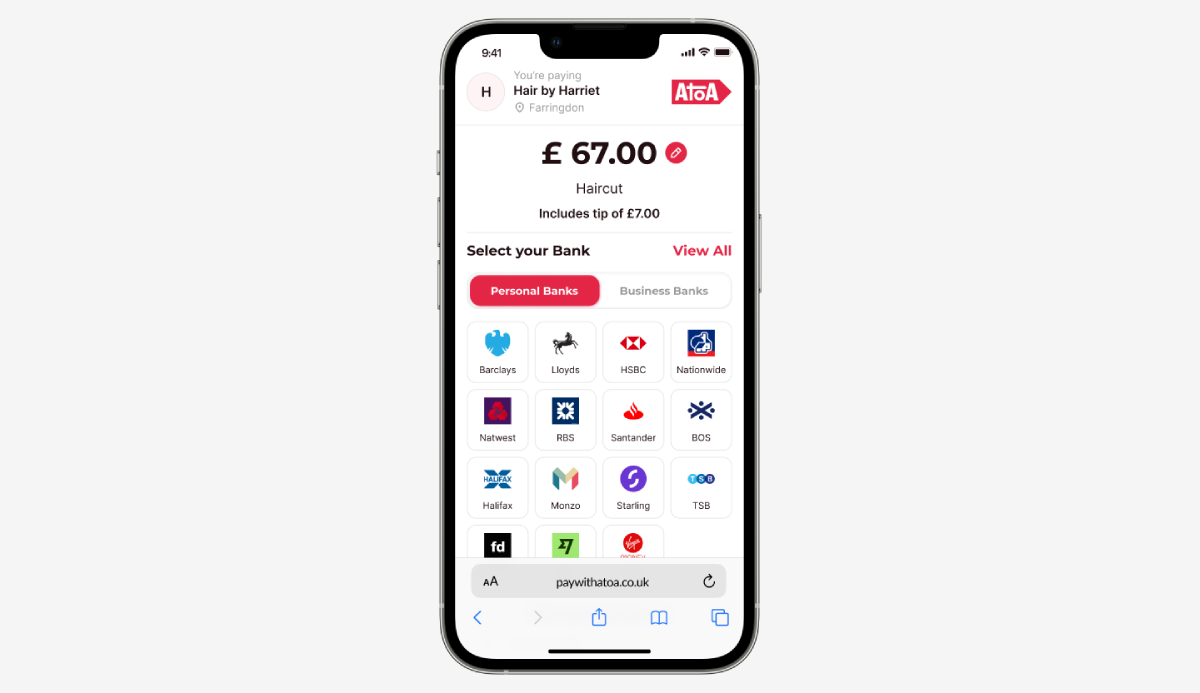

- Paying and booking appointments: Some beauty salons now allow customers to book appointments using their virtual wallets. Customers use their digital wallets to pay for treatments anywhere in the salon.

Digital wallets are a convenient and secure way to pay for goods and services across many industries, including hospitality, car dealerships, and beauty salons. Consider using a digital wallet for a more convenient and secure payment method.

Mobile wallets: A convenient and secure way to pay on the go

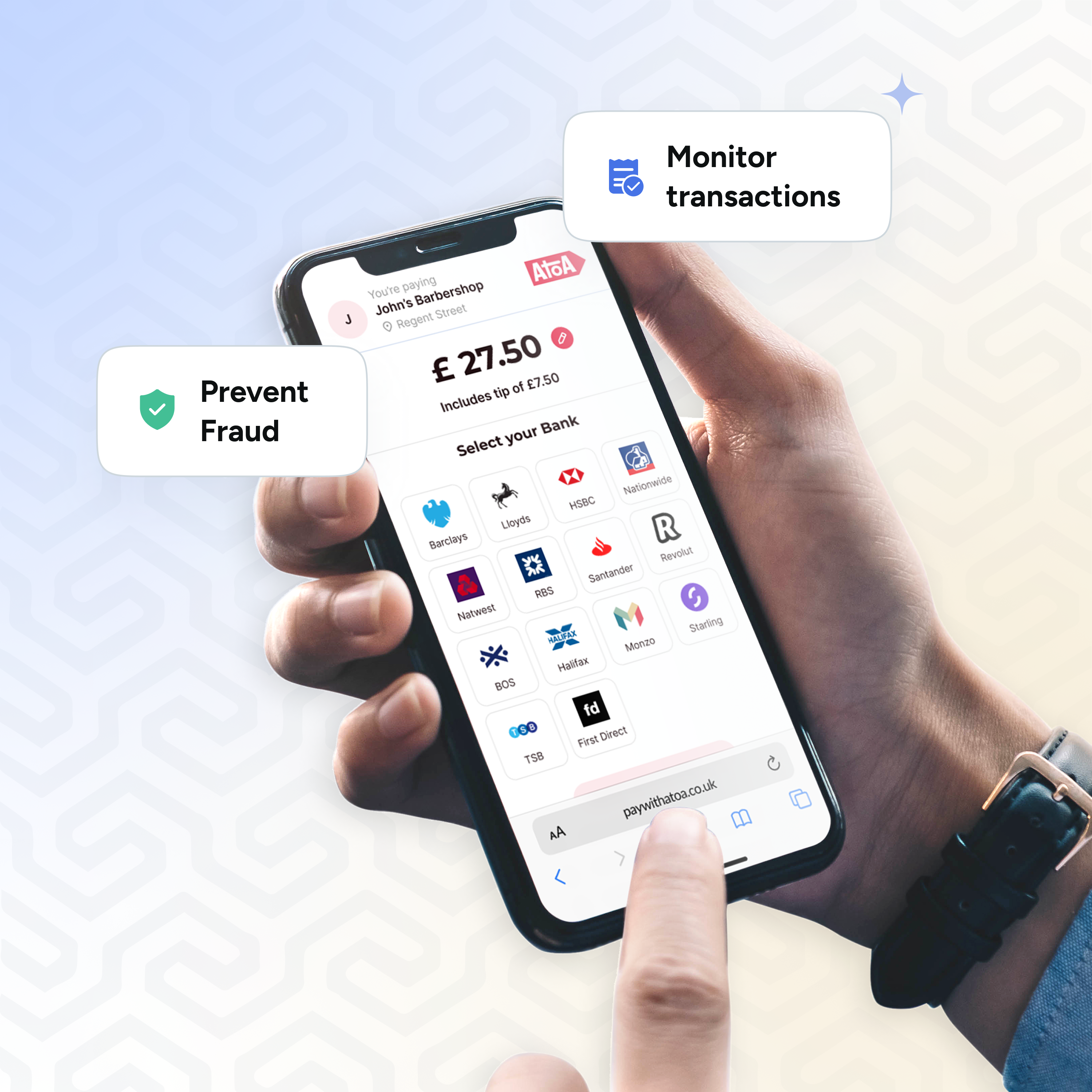

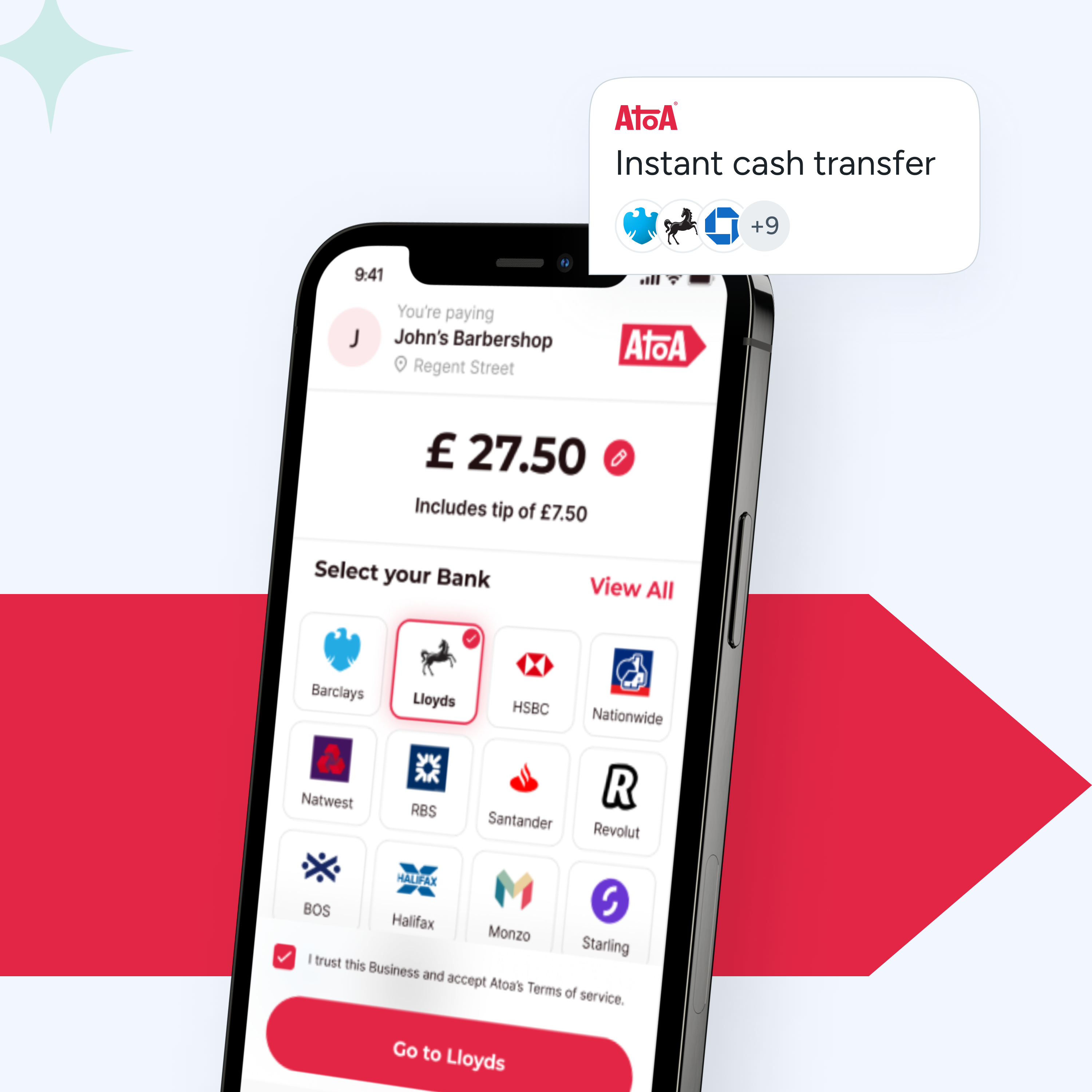

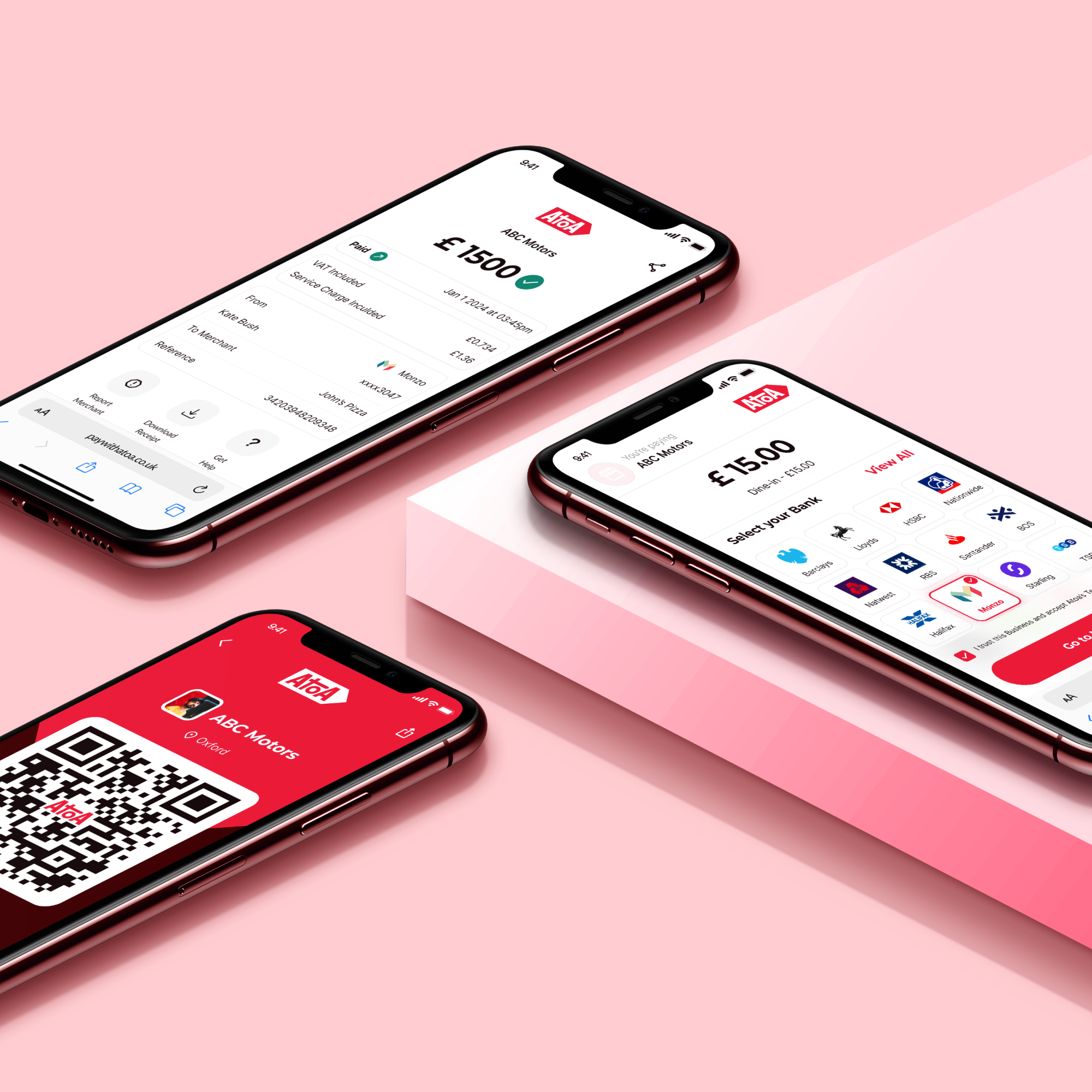

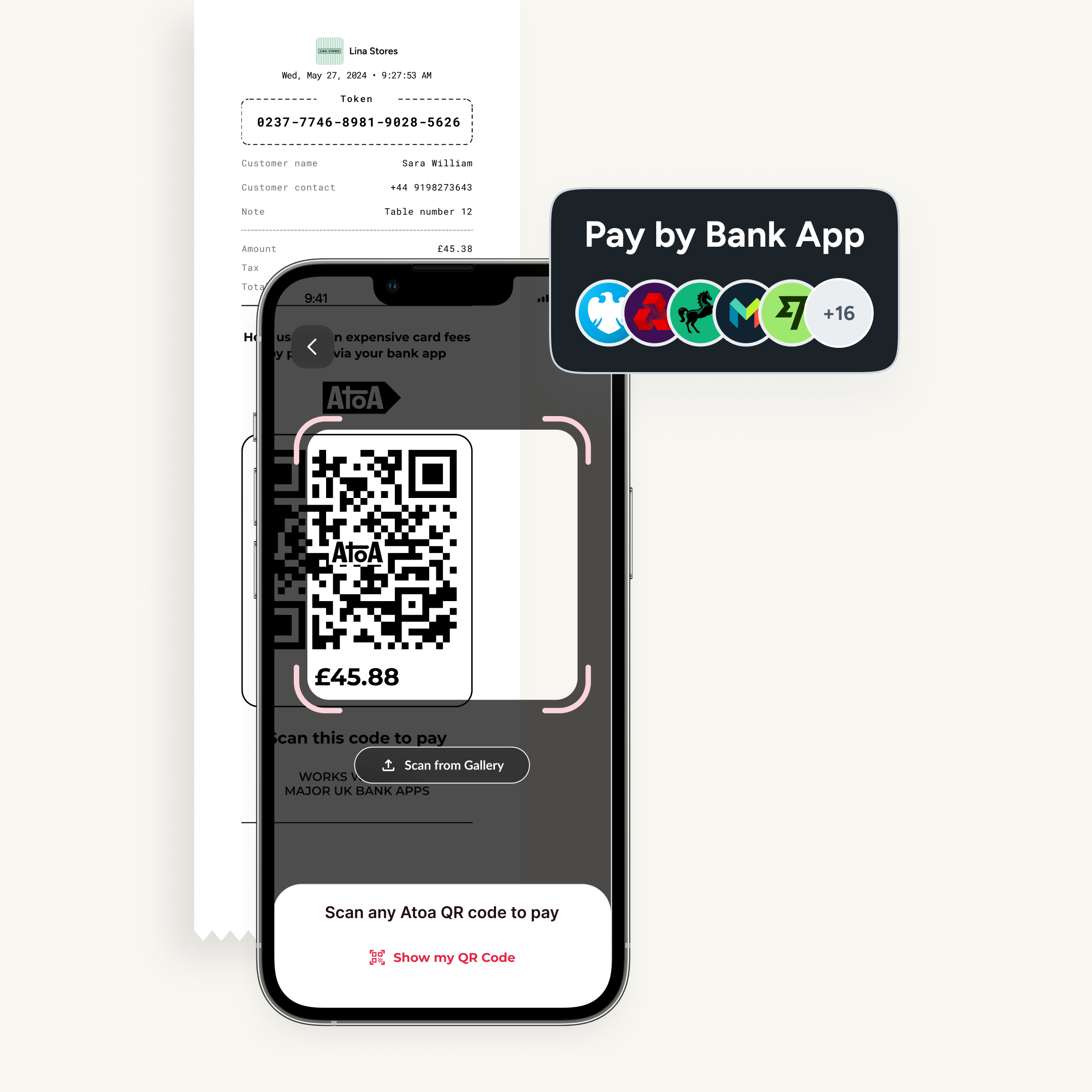

A mobile wallet is specifically designed for smartphones and other mobile devices. Mobile wallets can be used to make payments for goods and services online, in-app, and in person.

How do mobile wallets work?

You’ll be pleased to know that it’s easy for customers to set up mobile wallets!

- Download a mobile wallet app of your choice from the app store.

- Create an account by providing your basic information.

- Add your credit, debit, gift, and loyalty cards to your mobile wallet.

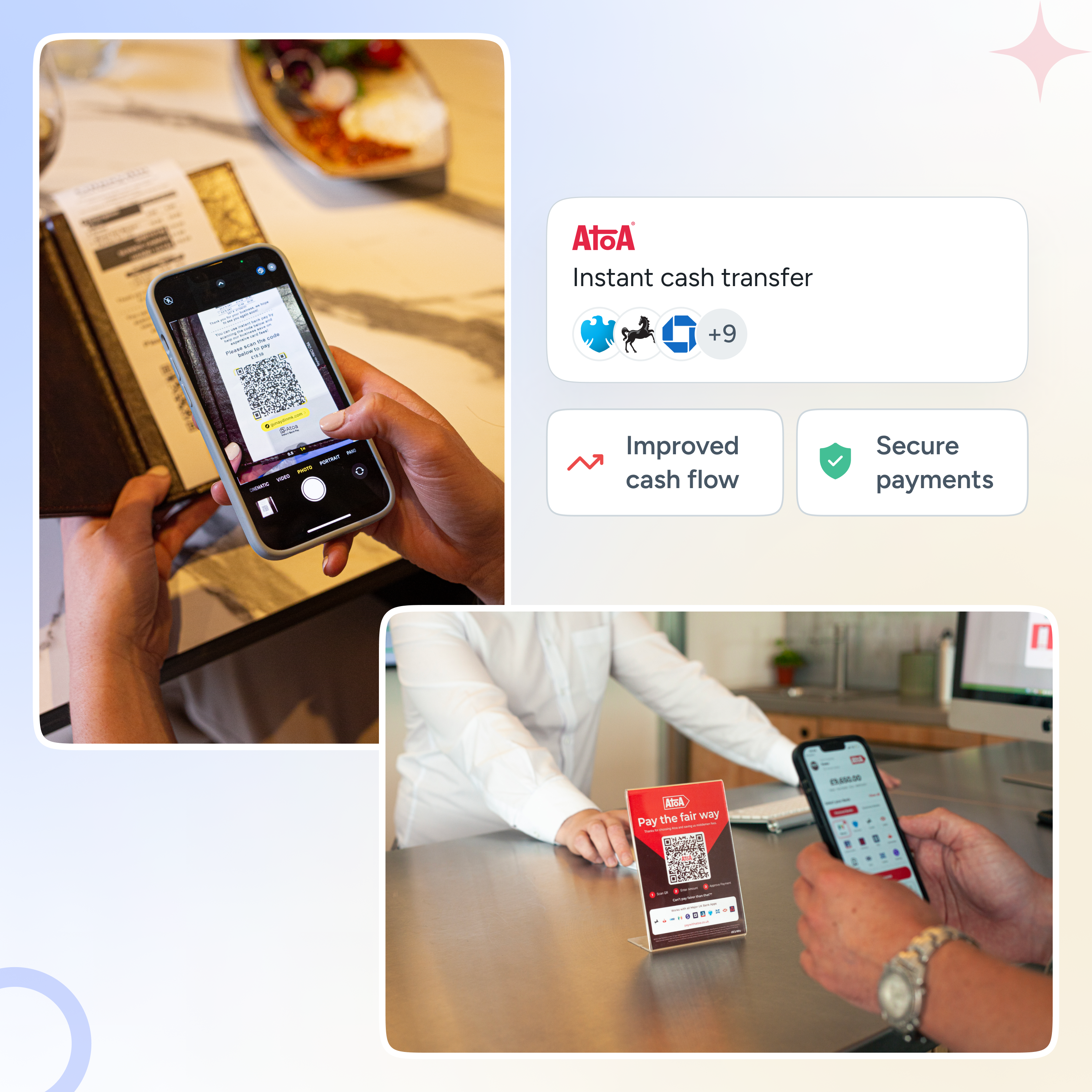

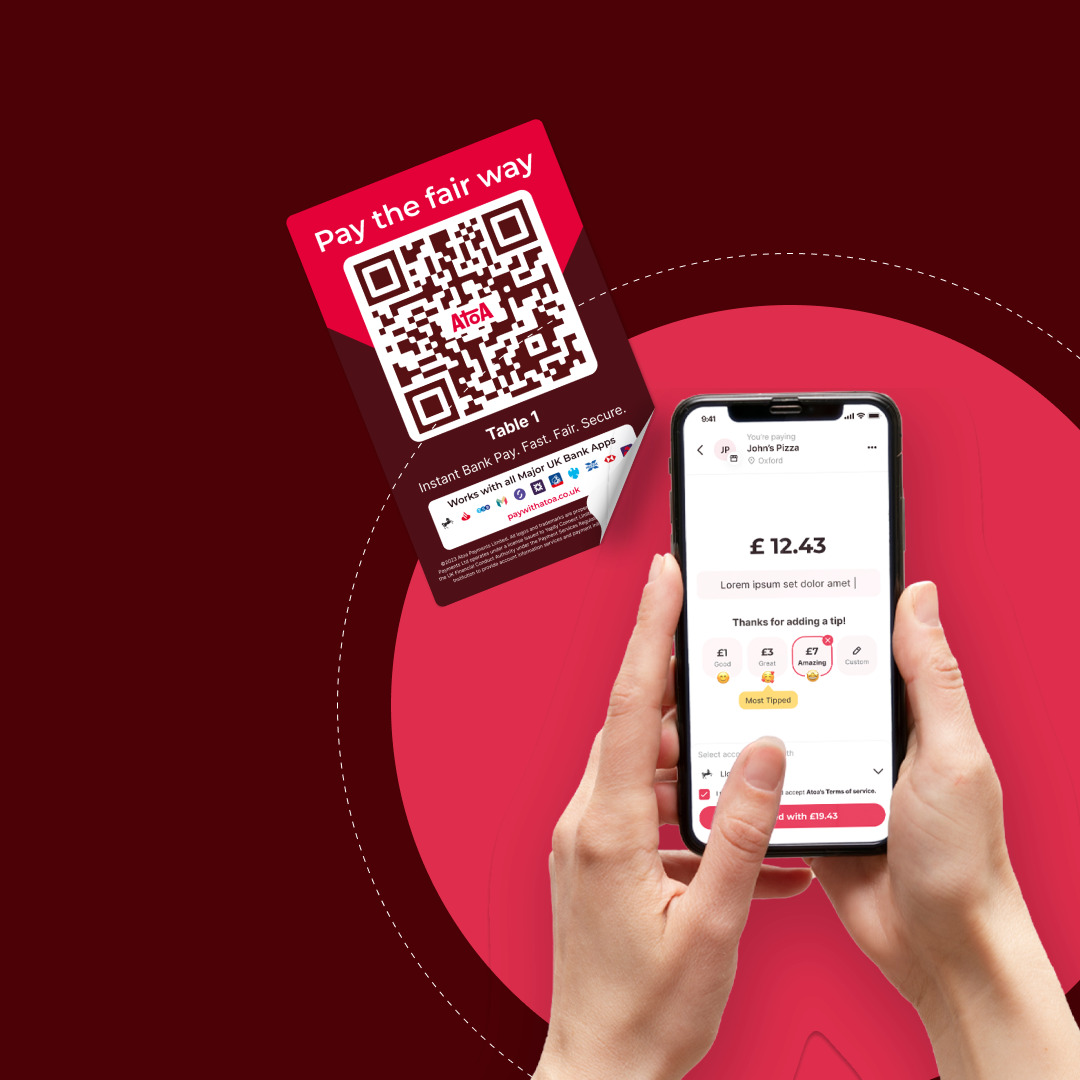

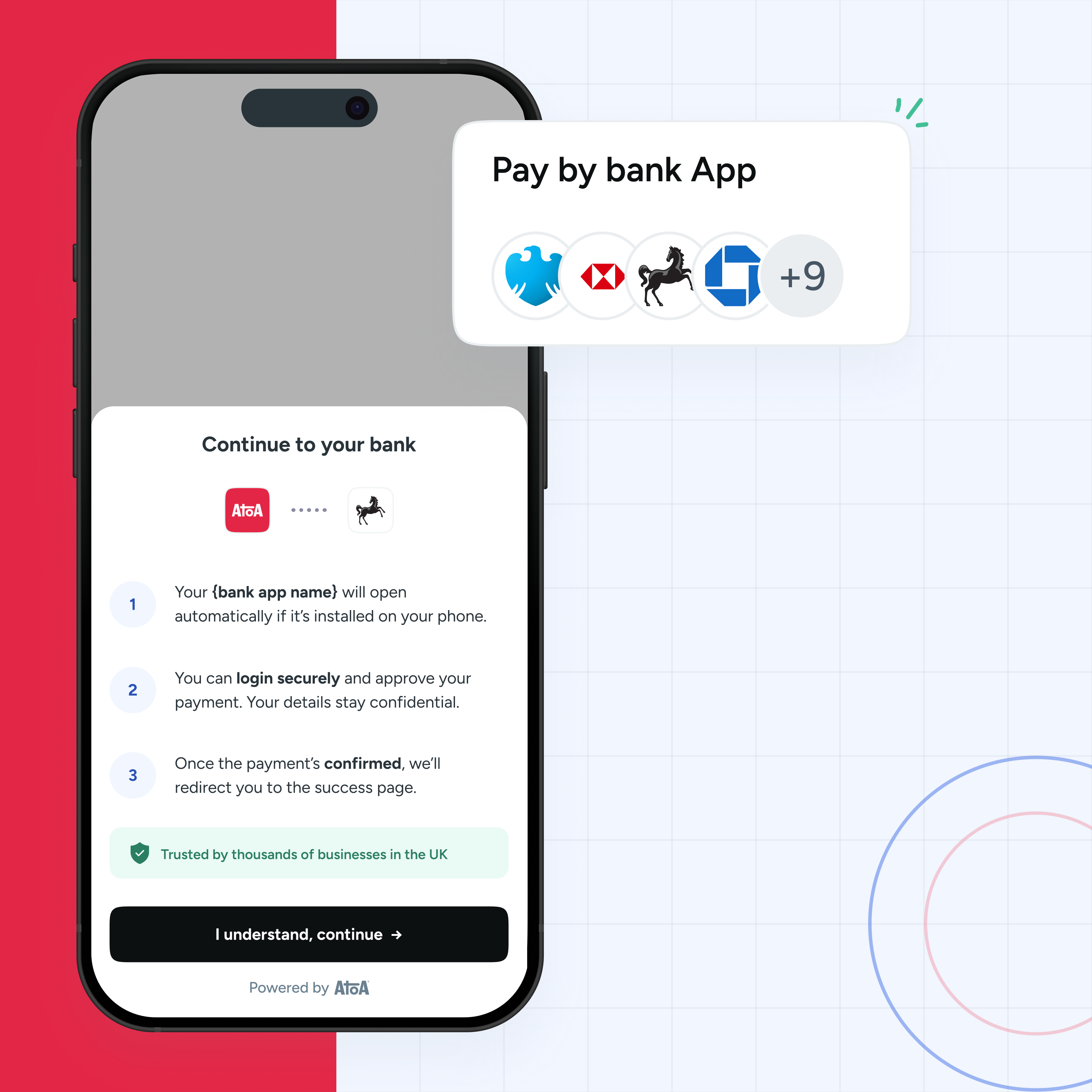

- Make payments online, in-app, or in person by tapping your phone on a contactless payment terminal.

To make an app or online payment, select your mobile wallet to pay. To make an in-person payment, look for a checkout that accepts contactless payments. Quickly tap your phone on the payment terminal and leave!

What are the benefits of smartphone wallets?

There are a number of benefits to using a mobile wallet, including:

- Contactless convenience: Mobile wallets offer quick and easy contactless payments with a tap.

- Security: Mobile wallets use advanced encryption and security measures to protect your financial information and data.

- Rewards: Smartphone-based wallets often offer reward schemes to encourage use.

Examples of mobile wallets

Apple Pay and Google Pay are mobile wallet solutions available on Apple or Android devices. These options allow payments in-store, online, and on apps.

PayPal is a mobile wallet available on all devices. It can make payments online, in apps, and person-to-person transfers.

Mobile wallets are a convenient and secure way to pay for goods and services on the go. Consider using a mobile wallet for a more convenient and secure payment method.

Digital vs mobile wallets – putting them to the test

It’s time to go head-to-head with digital vs mobile wallets…

| Feature | Digital wallet | Mobile wallet |

| How to use | Can be used on any device with an internet connection | Can only be used on a smartphone but offer contactless payments |

| Acceptance | Accepted by a wide range of e-commerce stores | Accepted by online and physical stores |

| Risks | If the device is lost or stolen your payment information is at risk | If the device is lost or stolen, your payment information is at risk |

| Rewards | Some digital wallets have reward programmes | Some mobile wallets have rewards programmes and can also store loyalty cards and QR code passes like boarding cards |

| Ease of use | Can be more complex to set up and use | Usually easier to set up and use |

| Offline support | May not work offline | If the device is lost or stolen, your payment information is at risk |

How do they differ?

- Digital wallets work on devices with an internet connection. Mobile wallets can only be used on mobile devices.

- Mobile wallets offer the benefit of being a contactless payment method. You can tap your phone to pay at checkout without inserting your card.

Which one is right for me?

- If you’re looking for a secure way to pay online and in-store, digital and mobile wallets are good options.

- If you want to make contactless payments, a mobile wallet is the way to go.

Bonus tip: When choosing between a digital wallet and a mobile wallet, consider which stores you shop at most often. Some merchants only accept certain digital or mobile wallets, so checking where you shop regularly is important.

The “better” option depends on your customer’s usage patterns. Do customers tend to make in-store purchases by tapping their smartphone? If so, explore mobile wallet payment solutions. For a more versatile and broader range of online and offline payment options, digital wallets may be the way to go. It’s all about what suits your business best!