Are you tired of customers ditching their carts at the last minute? Or maybe you’re looking for ways to improve your payments and bottom line. If so, it’s time to embrace pay by bank, which is a simple, fast, and secure way for customers to pay directly from their existing bank accounts. Also known as instant bank pay, it liberates customers from flicking through cards or remembering bank details for a smoother experience. Sounds like a good plan, right?

This article aims to uncover the benefits of instant bank payments for your business and customers. While still in its early stages, this shouldn’t stop you from giving this speedy payment method a go.

Ready to find out how? Let’s get this show on the road…

What is pay by bank and how does it work?

First up, we need to put this into simple terms. Pay by bank is a simple solution that lets customers pay directly from their bank accounts in just a few taps. No cash, cards, sharing bank details, or anxiety.

How instant bank pay works for customers

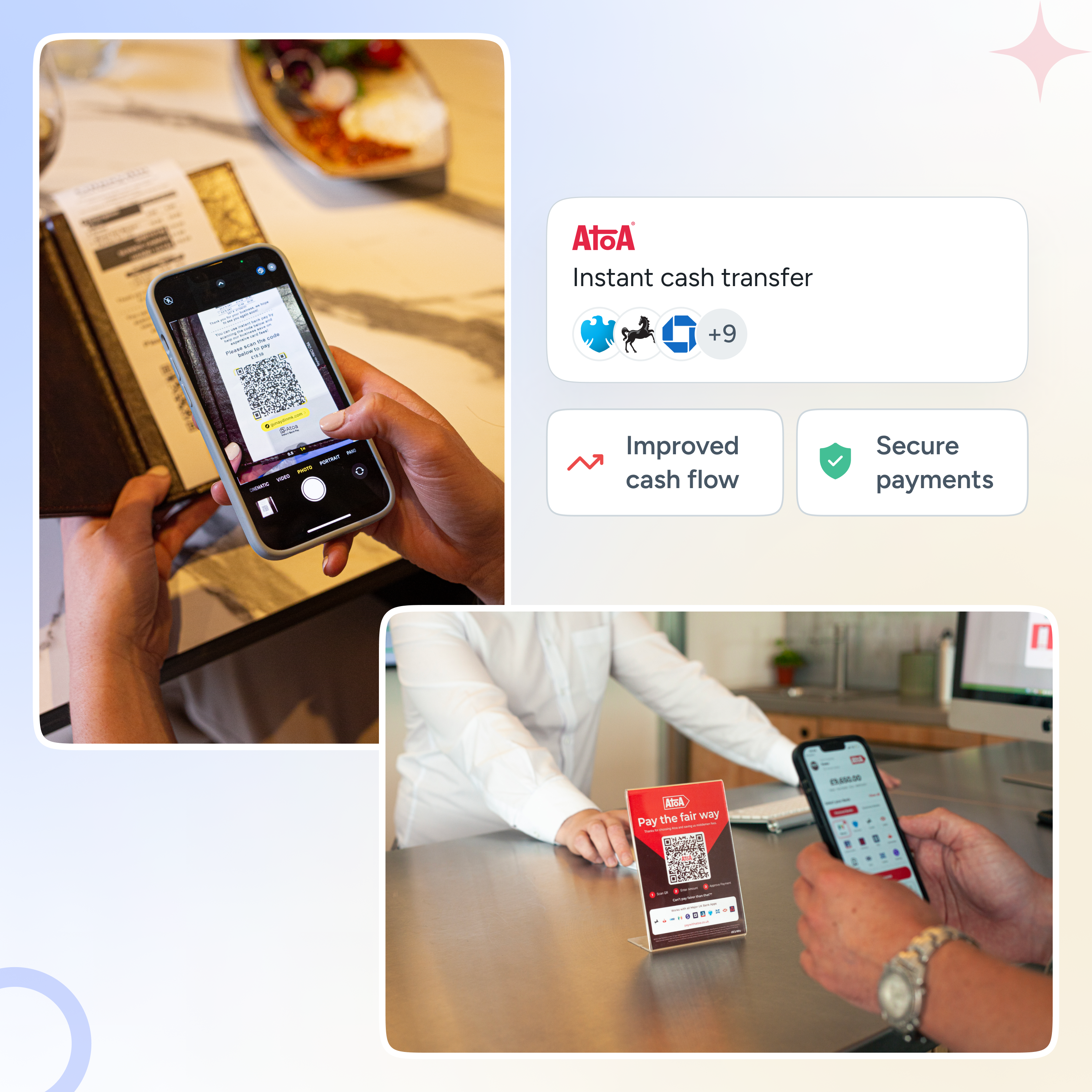

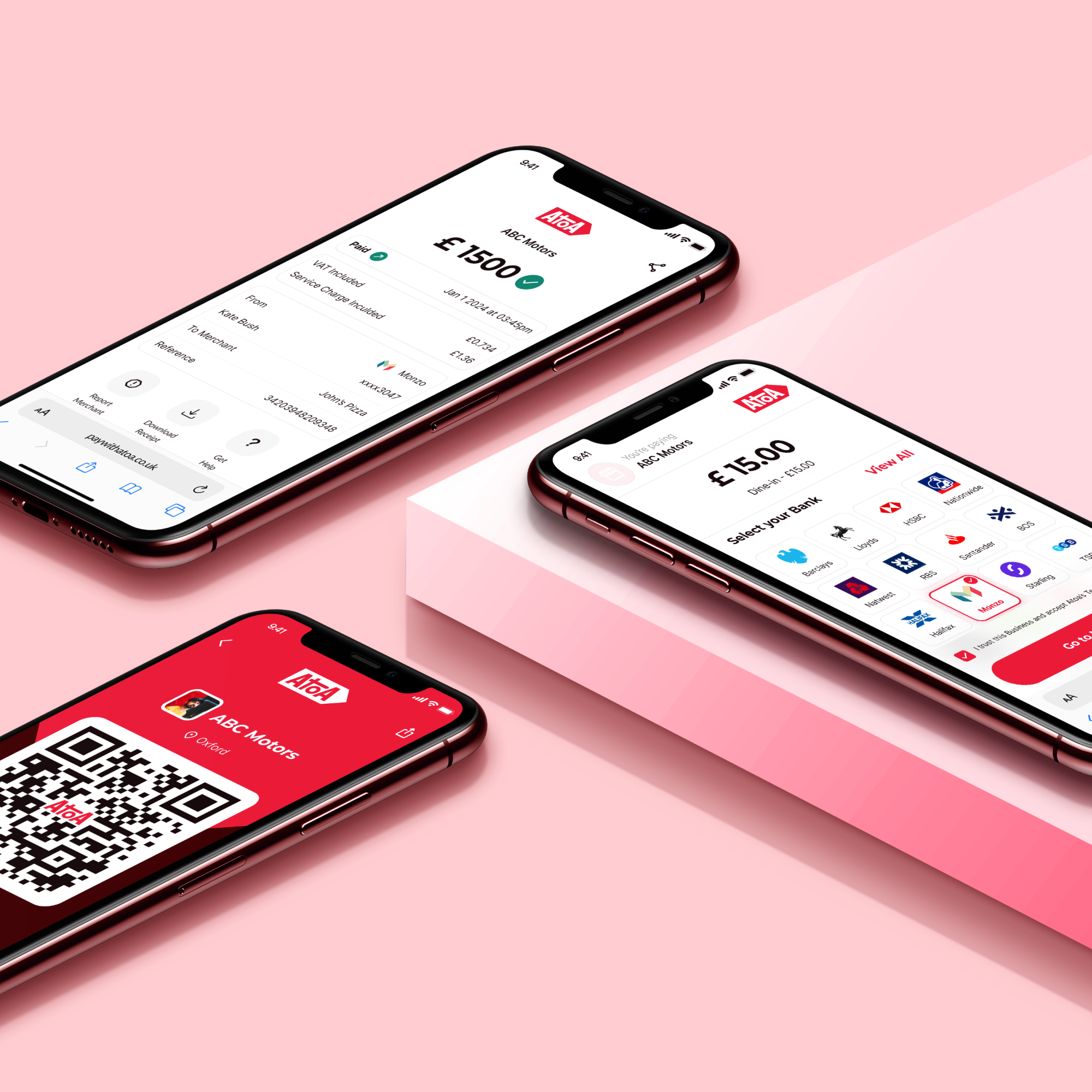

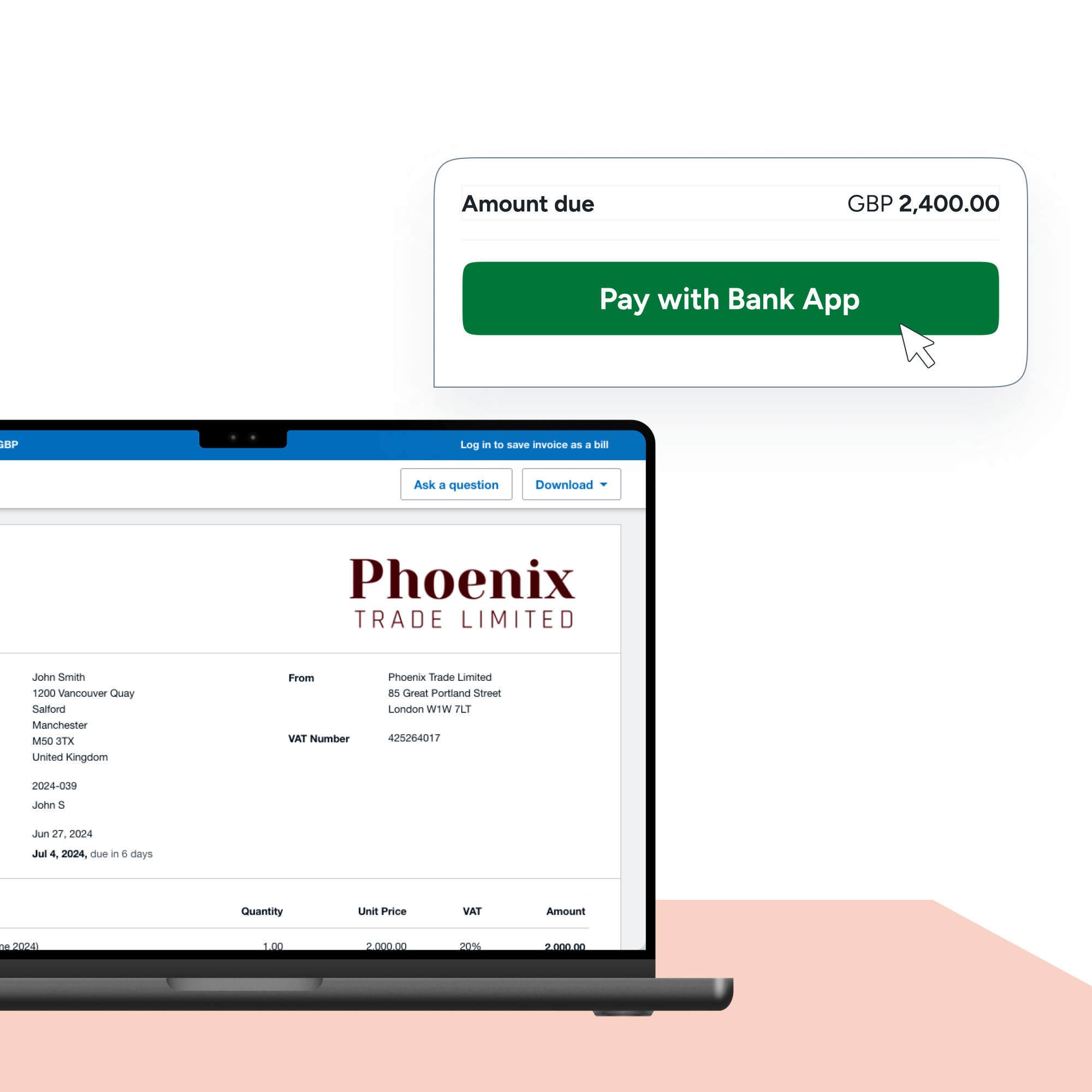

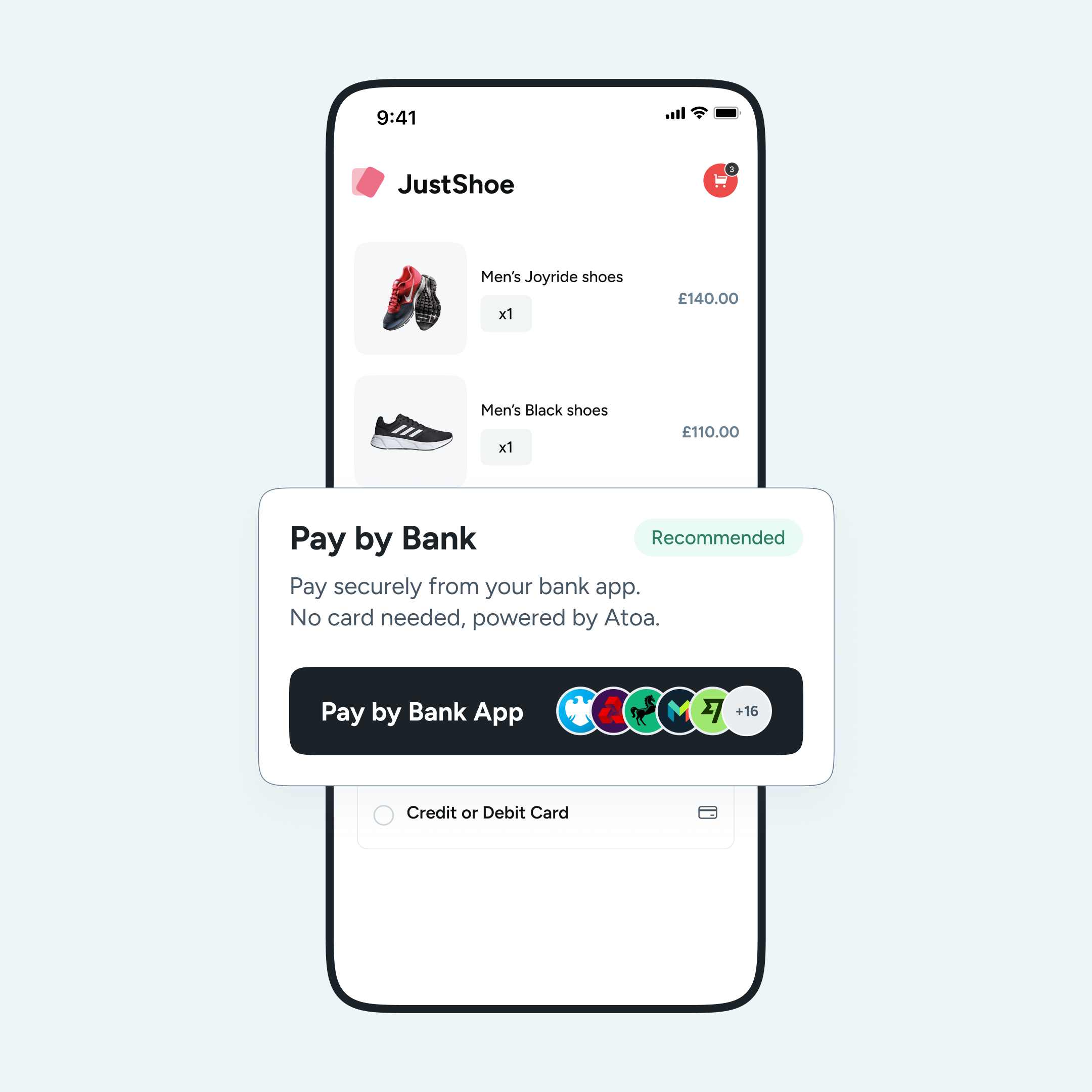

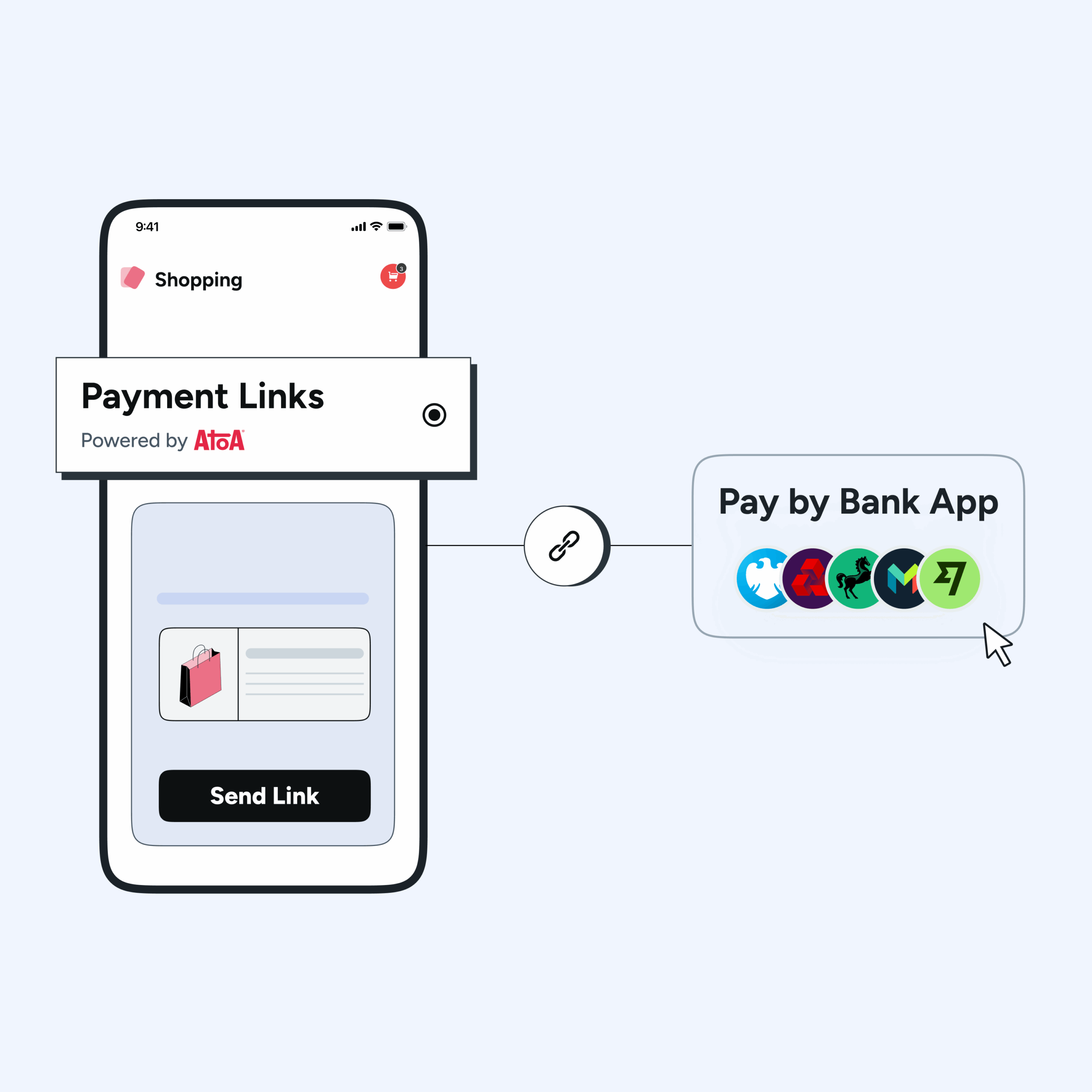

- At checkout, the customer chooses instant bank pay. This may include scanning an in-store QR code or clicking payment links to pay remotely.

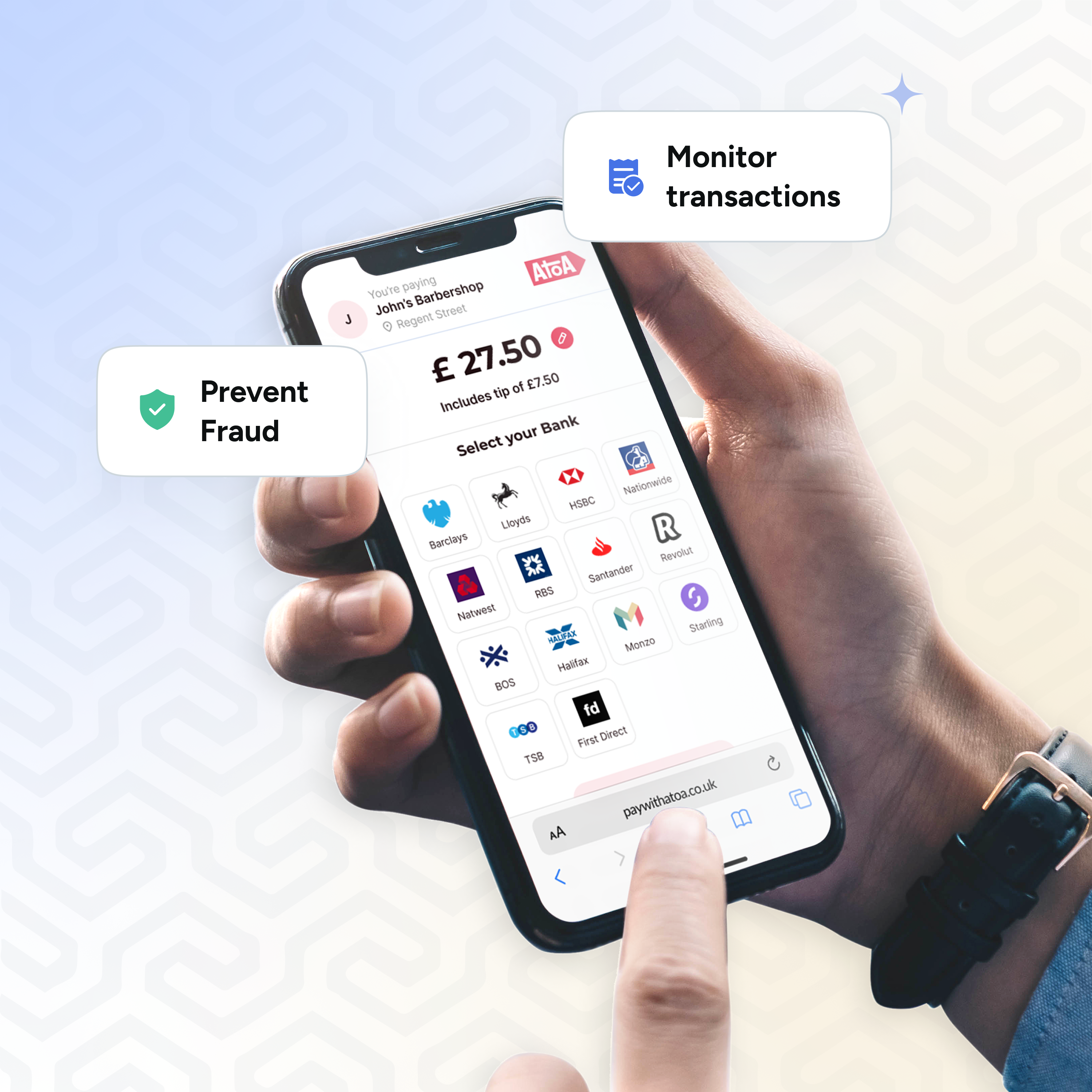

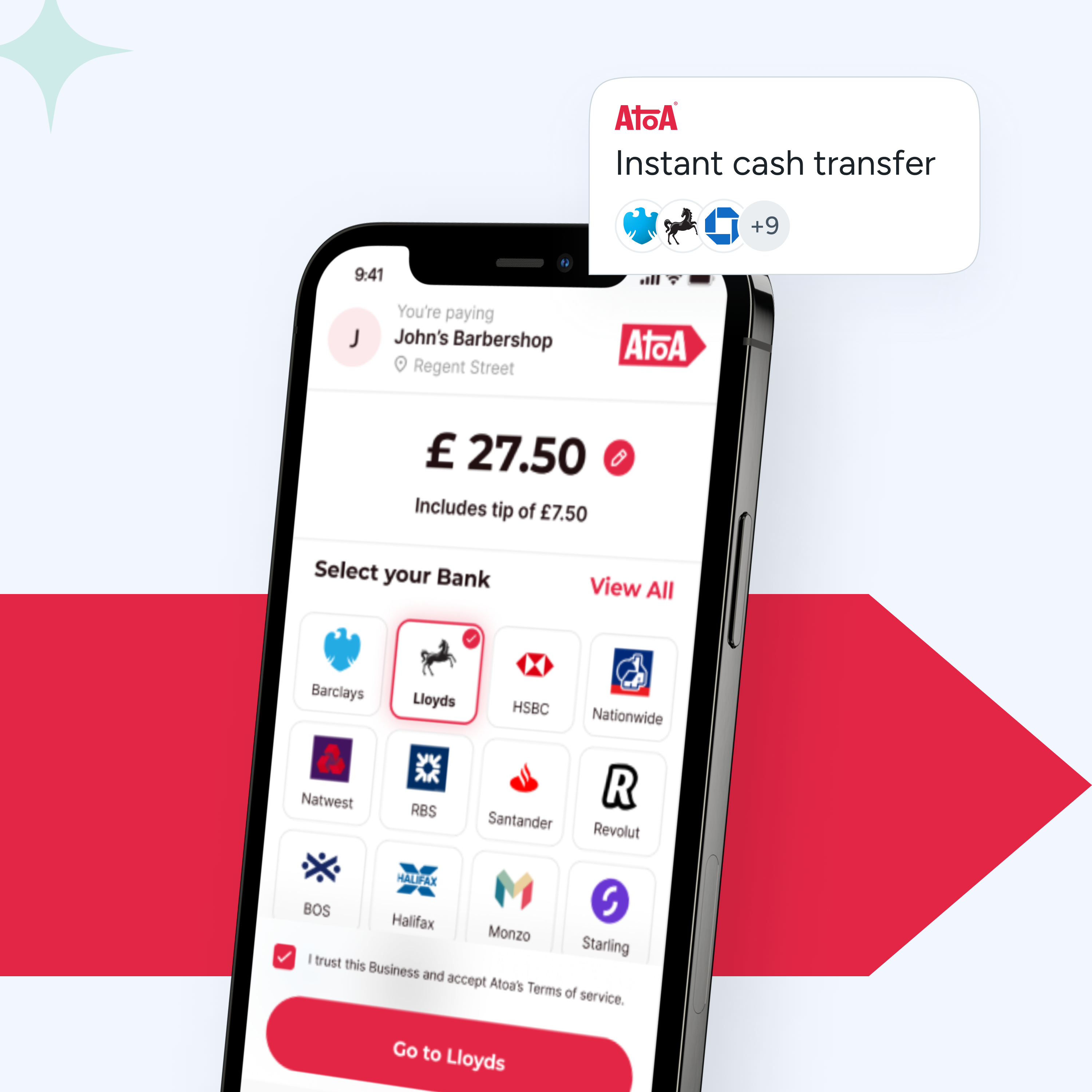

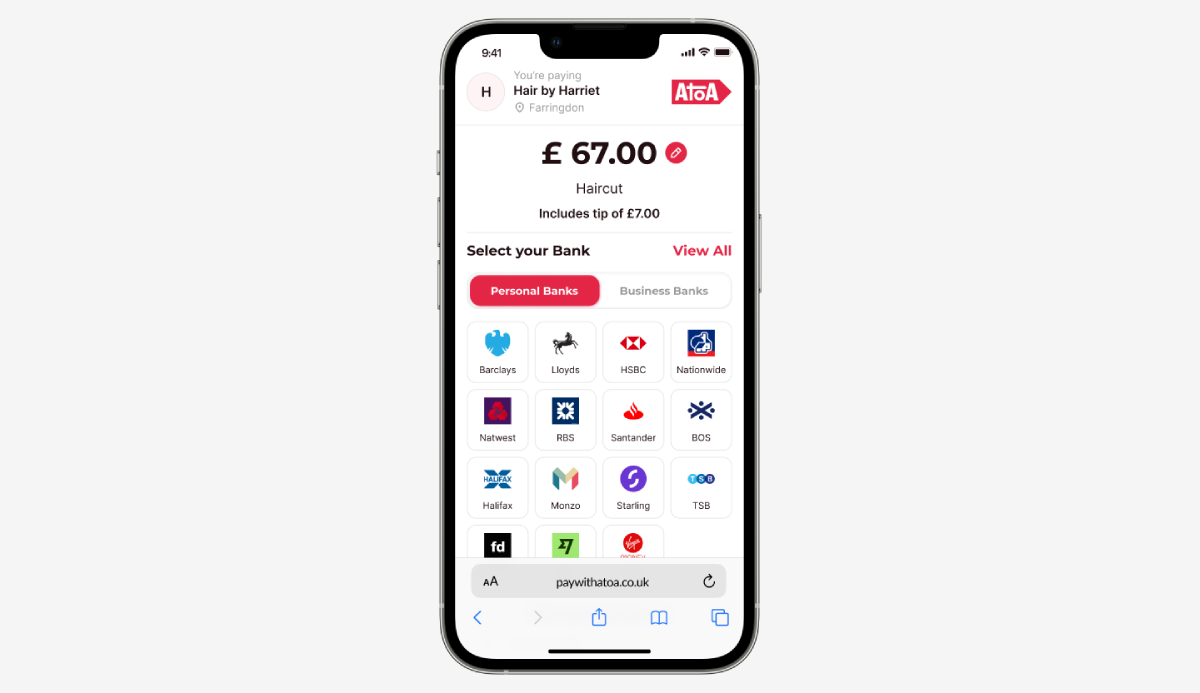

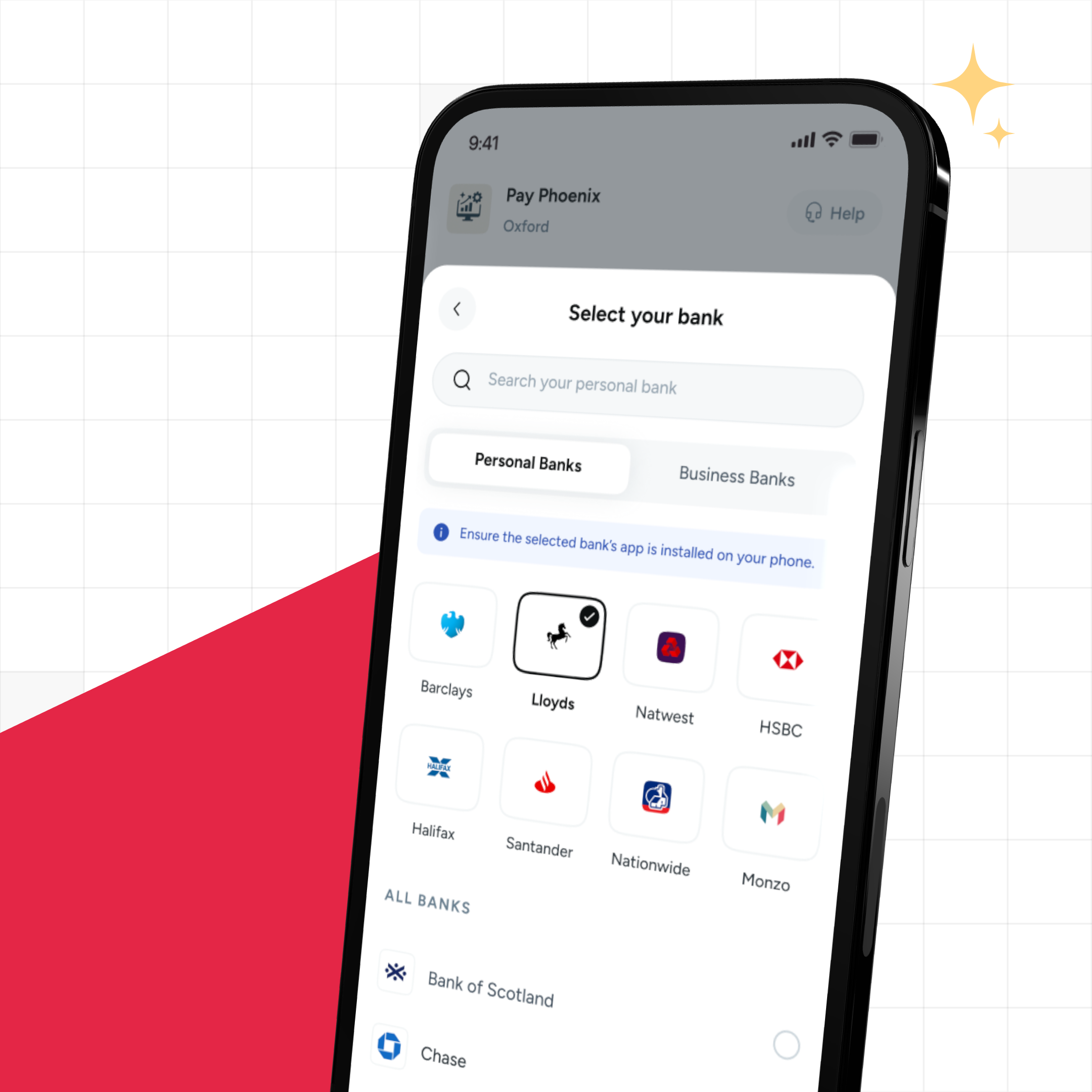

- They select their bank from a list of supported banks.

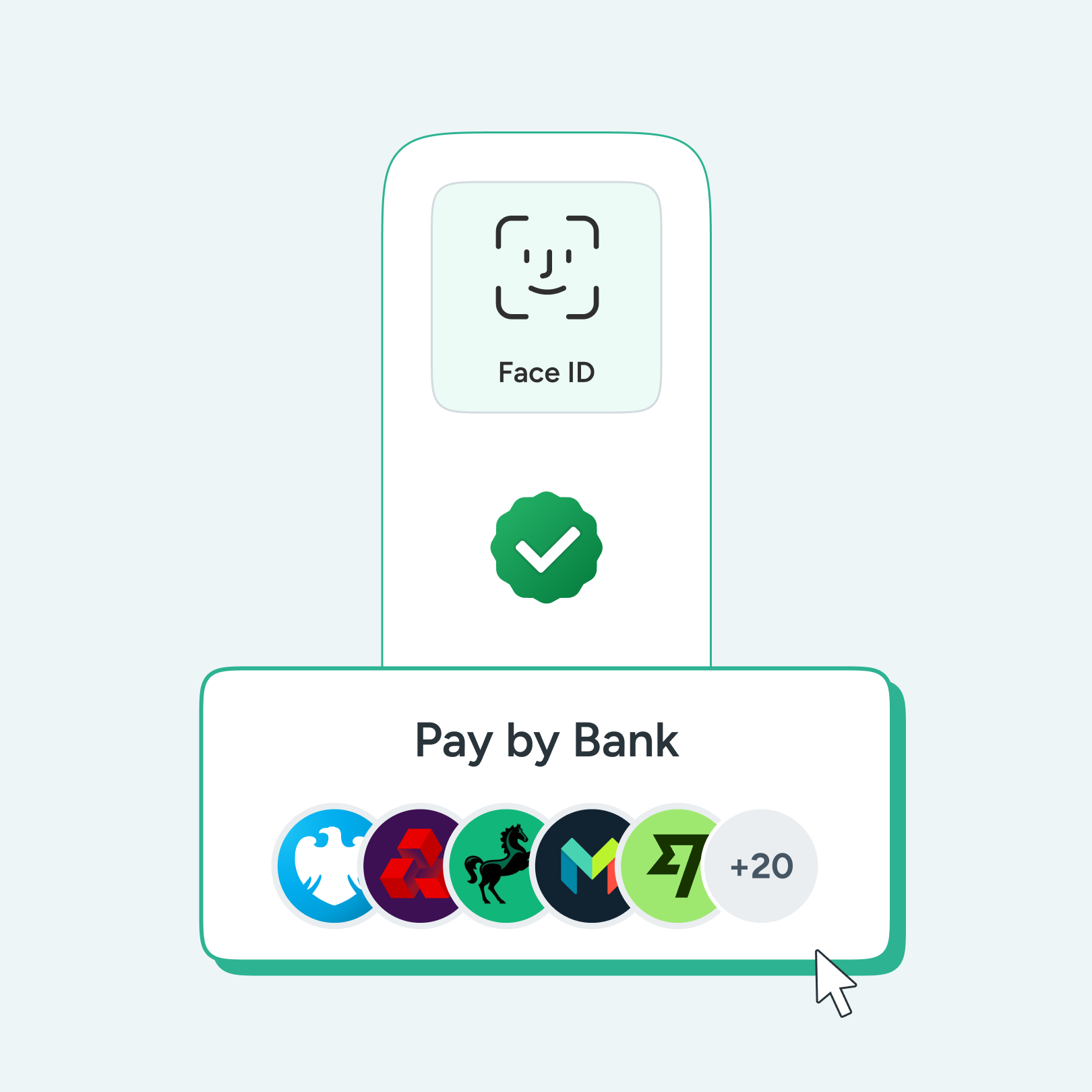

- The customer securely logs in to their banking app (using existing methods like passcodes or strong customer authentication).

- They confirm the payment details within the app.

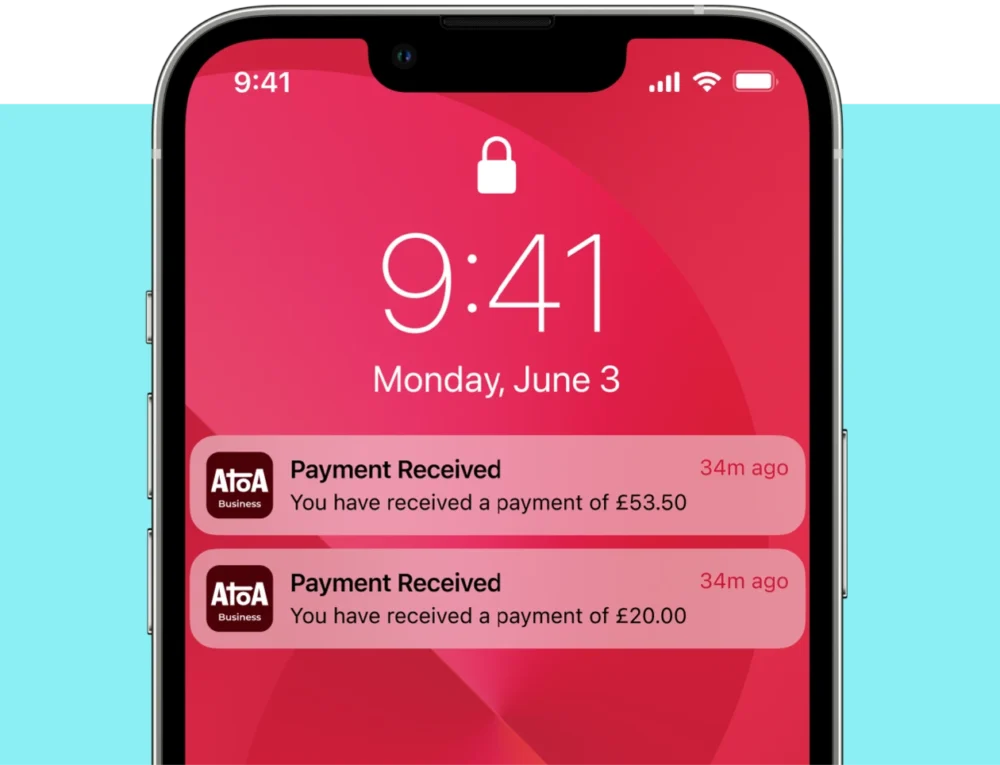

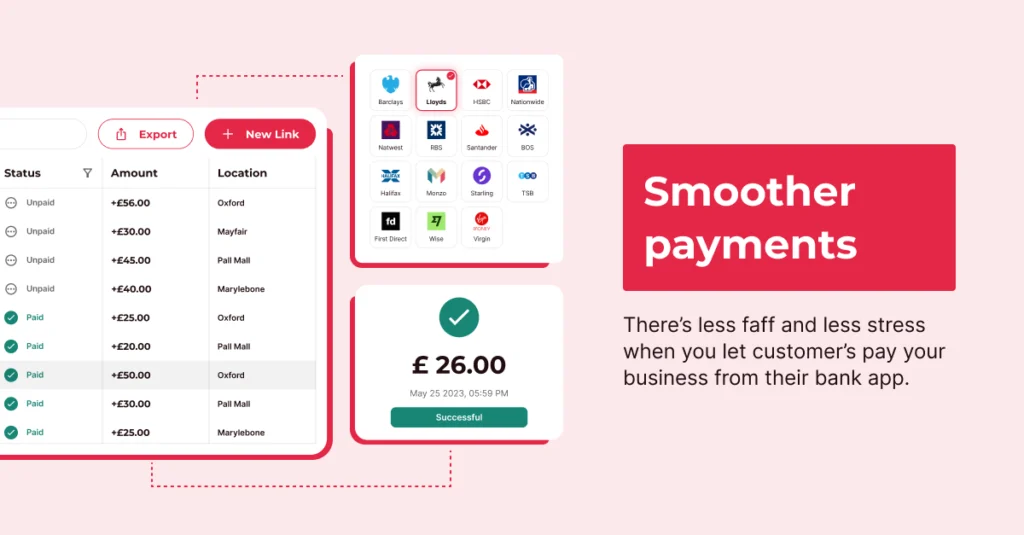

- Finally, the business receives an immediate payment and notification.

But what about behind the scenes? Good question. Pay by bank uses secure open banking APIs to send a payment request to the customer’s bank so it can communicate with it. This sounds more complex than it is, but we’ll go into this now.

Why open banking APIs matter for instant bank payments

- They’re fast. The communication between your bank and the payment service is quick and efficient.

- And secure. Strict security standards keep your banking information safe.

- The customer is in control. They need to approve transactions through their bank app, which protects your business from unauthorised payments.

How pay by bank works behind the scenes

As we just mentioned, open banking APIs (or Application Programming Interfaces) play a huge part in making instant bank payments happen. APIs are the backbone of fintech services and essential for them to operate.

Step 1 – it’s checkout time

Imagine you’re shopping online and you’re ready to pay.

You navigate to your cart, start checkout, and choose “Pay by bank” on the payment page.

The store or website connects with whichever instant payment provider the business uses.

Step 2 – the open banking API steps in

The payment provider needs permission to talk to your bank and start the payment.

This is where the open banking API provides a secure communication channel that lets the payment provider and banks exchange information safely.

Step 3 – how the open banking API does its work

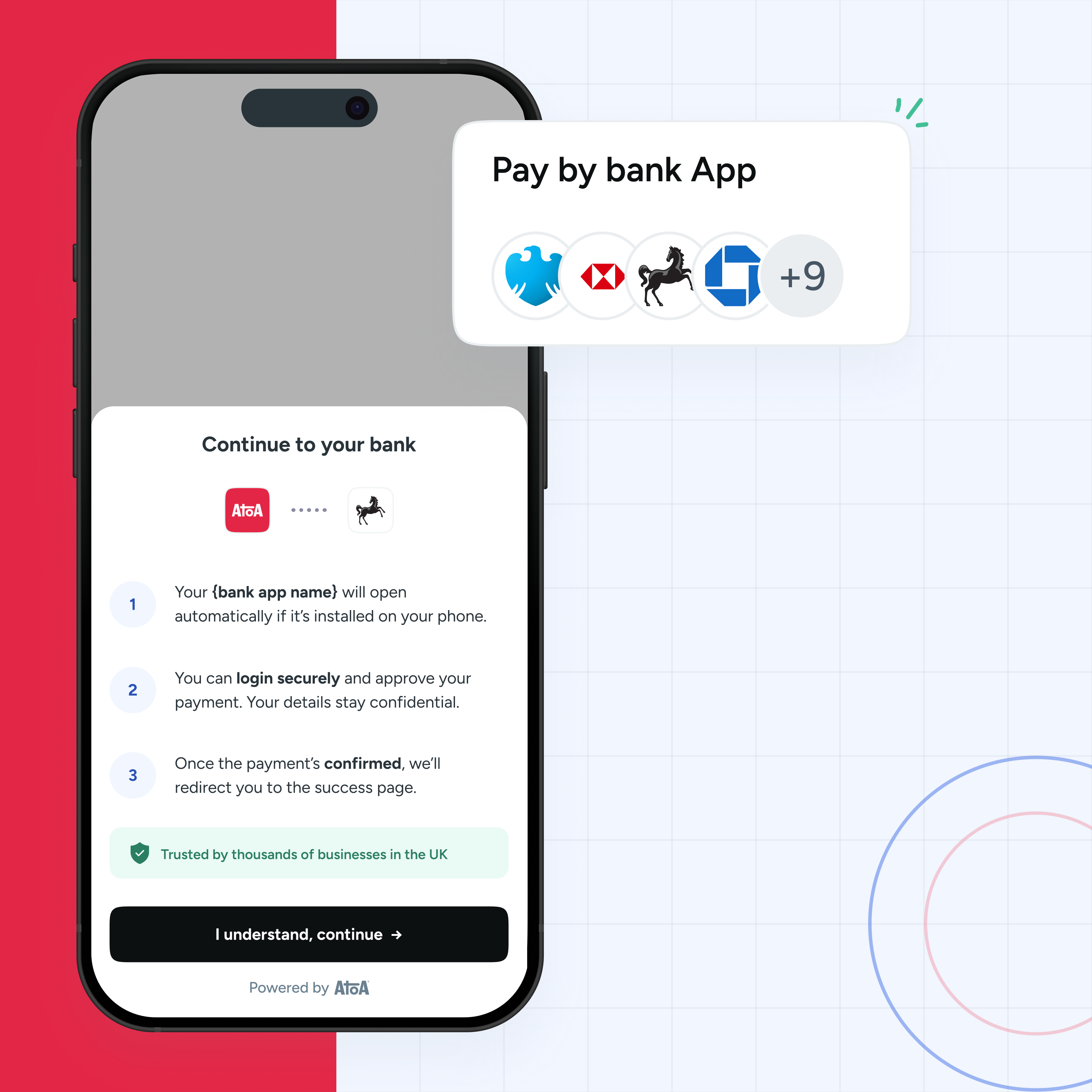

- Your customer selects their bank from a list.

- Then the open banking API redirects to their bank app.

- They log into the bank app as usual, providing all the security details required.

- Once they confirm the payment, the API sends approval back to the pay by bank provider.

- The pay-by-bank provider sends the store a notification that the payment was successful.

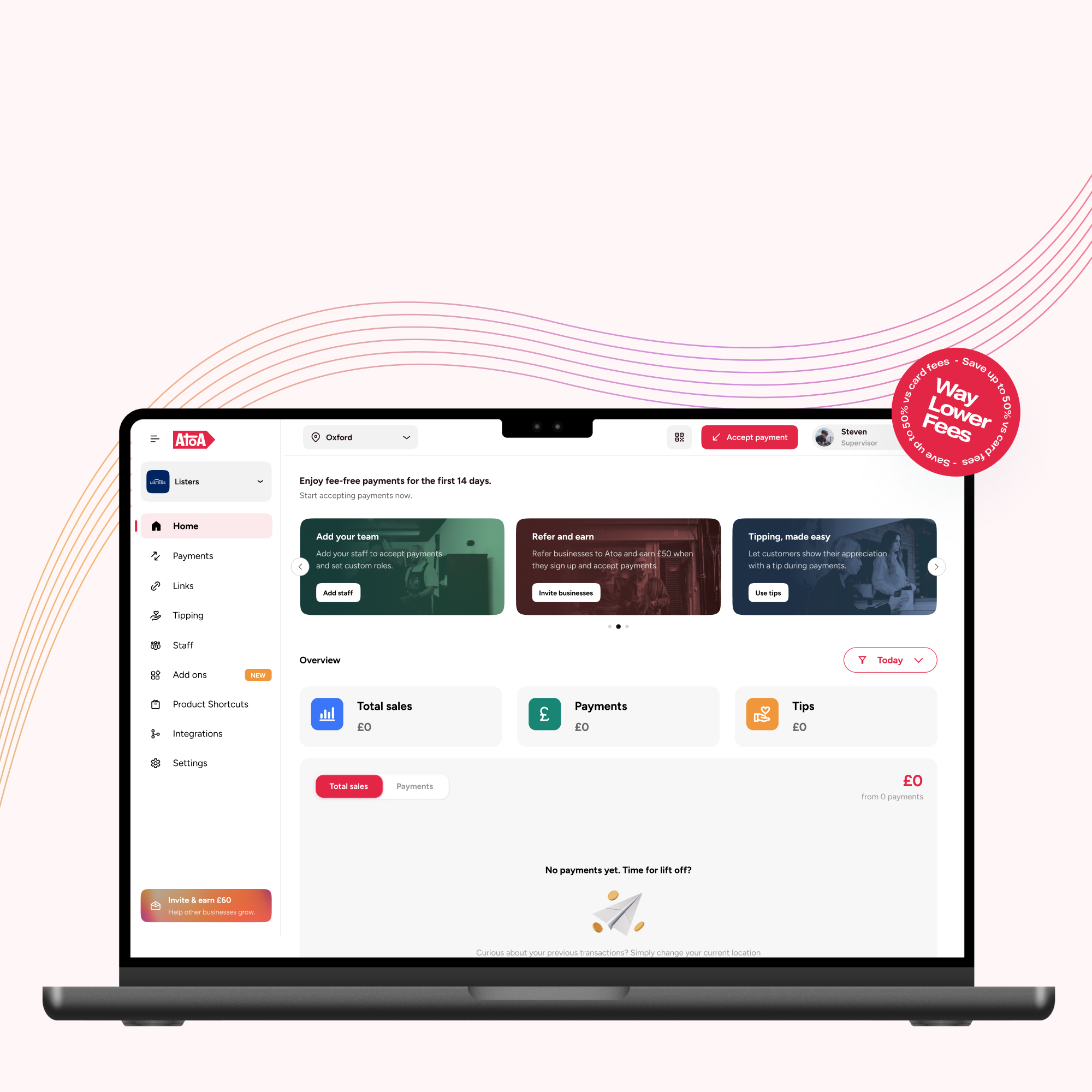

Why is a business owner like you going to love this?

- Fast and easy payments: It becomes easier for your customers to pay, which gives them a much smoother buying experience.

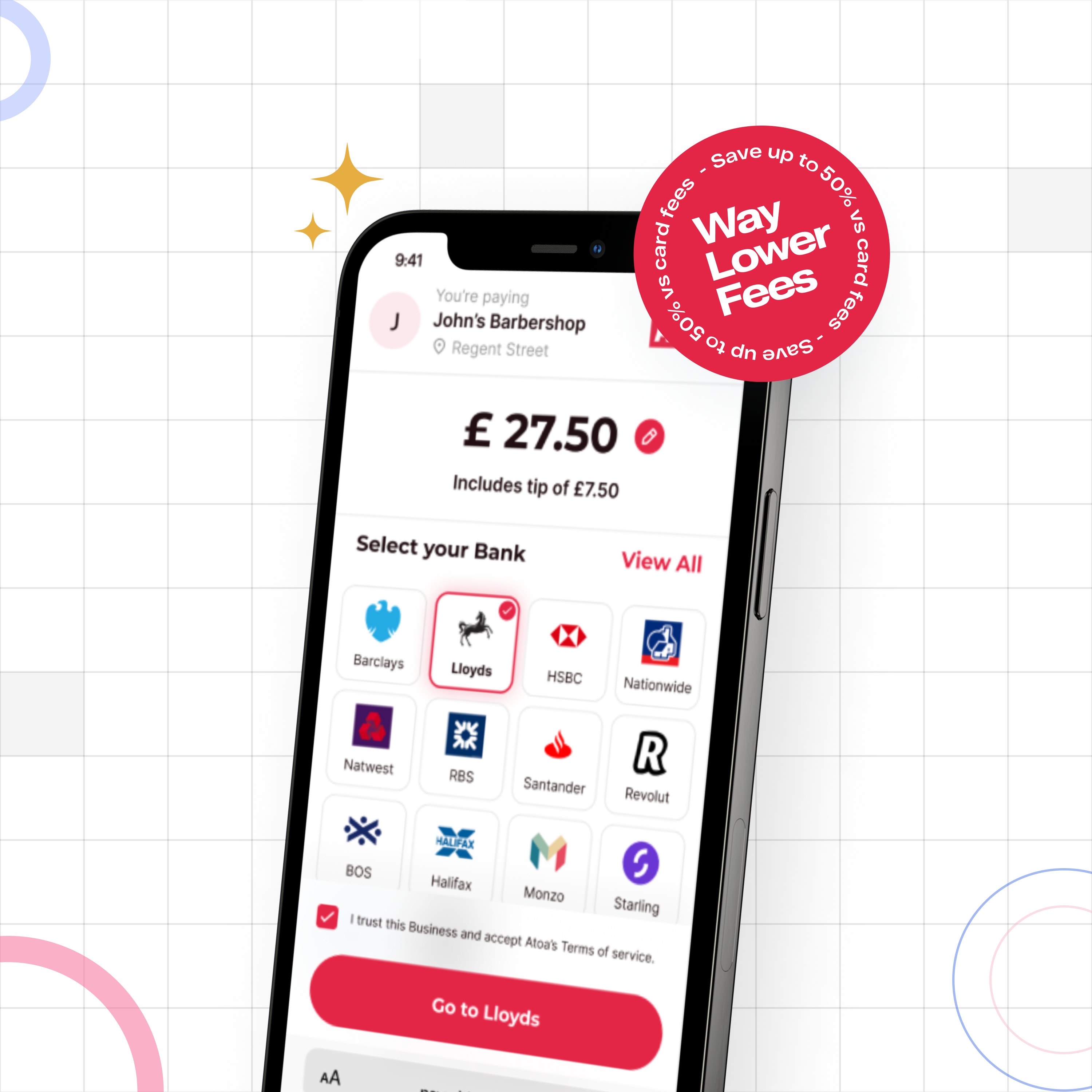

- Lower fees, more profit: Accepting payments directly from your customer’s bank app means cheaper fees than card payments.

- Less fraud: Customers log into their bank app, which makes these payments seriously secure.

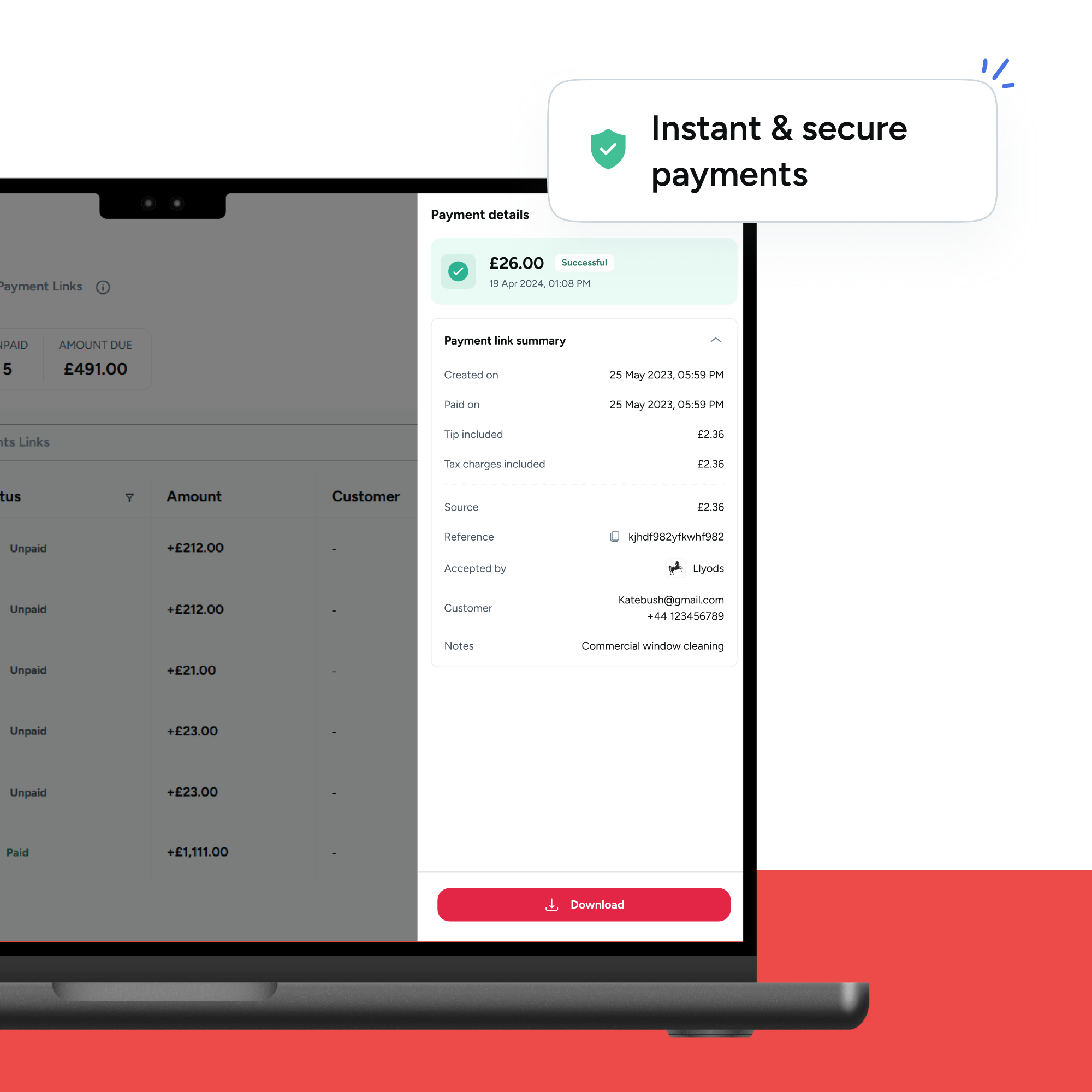

- Money lands faster: No more waiting for payments to clear as your funds arrive instantly.

How pay by bank compares to other payment methods

With its many benefits, here’s a quick table referencing how instant payment solutions compare to more familiar business payment methods.

| Payment method | Convenience | Security | Payout | Fees | Notes |

|---|---|---|---|---|---|

| Pay by bank (Atoa) | Easy integration and setup | Bank-level security with less fraud | Instant | Much lower than card payments | Instant refunds, limited chargeback risk |

| Cash | Requires cash handling and processing, which can mean errors | Risk of non-payment, theft, loss or counterfeit cash | Instant but may require a deposit into a business account | High collection fees or risk of theft | Only suitable for some business models like food, trades, etc |

| Debit cards | Widespread use and familiarity | Chargebacks possible | Can be up to 3 days | Subject to variable processing and network fees | A standard choice for most businesses but has potential for fraud risk |

| Credit cards | Widespread use and familiarity | Chargebacks possible | 1-3 business days | Typically higher processing and interchange fees | A standard choice for most businesses but for potential fraud risk |

| Bank Transfer | Manual process that may require customer follow-up and chasing | Depends on bank security | From instant to variable, depends on the payment amount | Low upfront fees, but possible hidden costs and inputting errors (which can result in lost funds) | A standard choice for most businesses but has the potential for fraud risk |

| Direct debit | Offers automated recurring payments | Guaranteed payments with a low fraud risk | Integration is needed, customer adoption varies | Low per transaction, setup fees possible | Ideal for subscriptions and memberships, mandate required |

| PayPal | Easy setup | Disputes and buyer protection may lean towards the customer | Instant | Variable on payment type, some fees can be high | Potential for holds on funds |

| Mobile wallet | Integration required and customer adoption varies | It depends on the provider | Instant | Variable processing fees | Requires customer to make a transfer |

The future of instant payments in the UK

Now that you know the ins and outs of instant bank payments, hopefully, you can see how this could become the new way for customers to pay.

Honestly, it could change how you do business. As these services progress, they are starting to integrate with online shopping experiences, offering direct payments without the hassle of redirects or multiple logins. Think how easy it could be for customers to pay directly from your website without getting bounced around to other logins or forms. The growth potential is there, with expanded uses and features expected, which make it a powerful alternative to cards.

Instant bank payment is still relatively new. Some business owners could be waiting for popularity to grow before adopting it. But that shouldn’t hold you back; as more businesses offer instant payments, customers will try them, leading to wider use.

FAQs

Is instant bank pay safe?

Yes, it makes payments through your bank app and uses unique security features like face or fingerprint confirmation, reducing the risk of fraud and chargebacks.

How much does it cost my business?

Fees can be much lower than card payments, which boosts your bottom line and can help increase profits.

How quickly do I get paid?

Unlike card payments, your funds arrive instantly, giving you quicker access to your cash flow.

Final thoughts

Instant bank pay offers significant advantages to UK businesses, as it’s simpler for customers, more secure, and can save your business money. Therefore, adding instant bank pay services, like Atoa, into your checkout could boost customer satisfaction and your bottom line. Why don’t you give us a try?