Snail-paced payments got you down? Memorising endless digits driving you up the wall? Enter UPI payments, the Indian innovation that’s changing how the whole country pays up. But what exactly is it, and how could it impact your business, even beyond borders? It’s time to find out…

In this article, I will explore:

- What UPI payments are

- How to use them

- What the future holds for UPI payments

Unified Payments Interface (UPI) explained

Imagine an app that lets you send and receive money, pay bills, and authorise instant payments in just a few taps. That’s basically the Unified Payments Interface, or UPI for short. Developed by the National Payments Corporation of India (NPCI) and rolled out in August 2016, it has paved the way for cashless payments in India. The Reserve Bank of India (RBI) regulates this tech, which is popular across the country. Fast forward eight years, and it’s garnering international attention, too…

But what is UPI all about? Think of it as a one-stop shop for all your financial needs. For Indian citizens, it means no more memorising 11-digit long Indian Financial System Codes (IFSC) or waiting for days for transactions to clear. By using peer-to-peer bank transfers between account holders from different banks, everything happens instantly and without fuss.

How UPI works

If you’re in India, getting started with UPI is super easy! All you need to do is download the app of your choice, create an ID for receiving payments, and link your bank account to access instant and secure transactions. To use UPI payments, you only need a few things. Check our handy checklist below.

UPI payments checklist

- You need a smartphone as the entire process happens through a mobile app.

- UPI requires an Indian bank account linked to your mobile number. Currently, over 200 Indian financial providers are signed up.

- UPI app. Popular downloads include Google Pay, Paytm, PhonePe, and BHIM.

- The mobile number needs to be active and linked to your bank account for verification and receiving payments.

- Create your virtual ID. This unique identifier is your public address for receiving payments.

- Link your bank account. Connect your existing bank account to the app for instant funds.

- Go cashless! Send and receive money, pay bills, and authorise payments in just a few taps.

But is UPI safe?

Security leads the way in digital payments, and UPI is no exception. Multi-layered security measures like 4-6 digit MPINs chosen by the user, mobile number verification, and merchant authentication protect your transactions.

Registration is paired with the user’s mobile number. If the device or contact details are changed, then verification has to be completed again.

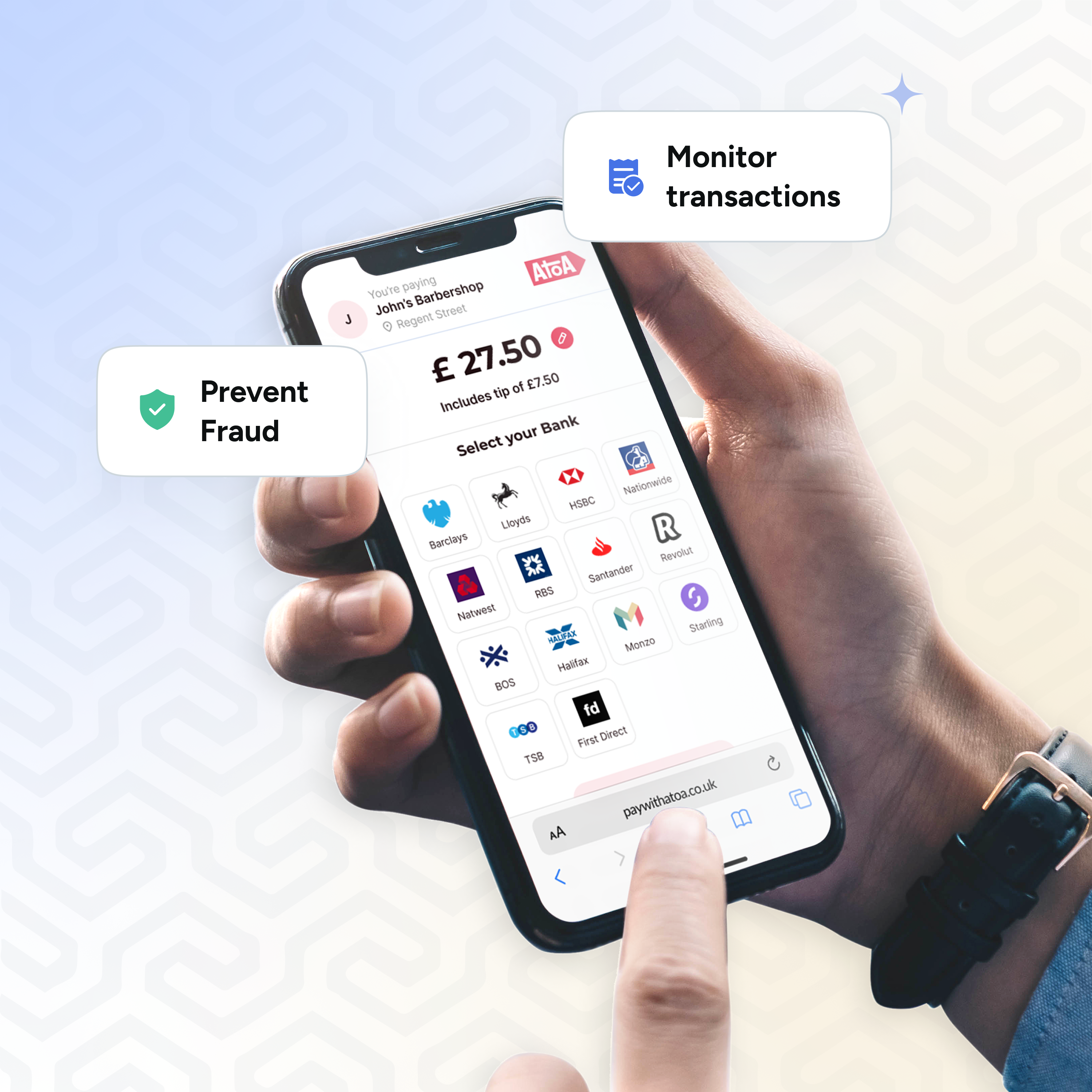

Customers can check a merchant is verified before paying with a quick QR code check to avoid any fraudulent payments. The same also goes for merchants avoiding unauthorised transactions or chargebacks.

Indian citizens can also choose to link their Aadhaar card for an extra layer of security. This voluntarily obtained ID card comes with a unique 12-digit number, which is added to UPI accounts for further protection.

Is UPI the future of mobile banking?

UPI’s simplicity, security, and instant settlement powers make it an ideal alternative to cash and cards. Its growing popularity may well place it as a major player in the global mobile banking scene.

What does this mean for UK businesses?

What does this mean for you, the UK business owner? While UPI might not be available for UK transactions just yet, it’s worth keeping an eye on. As it gains traction in other countries, it could become a valuable business tool for cross-border transactions and tapping into new markets.

Here are some potential benefits for UK businesses:

- Simple international payments: Accept payments from customers in UPI-enabled countries instantly and securely.

- Reduced transaction fees: Avoid card rails and international transfer fees with real-time transactions.

- Expanded reach: Tap into growing consumer bases in UPI-enabled countries to expand your customer reach.

UPI FAQs

Can I use UPI without a bank account?

You need a bank account linked to your mobile number to use UPIs.

Is UPI secure?

UPI protects transactions with mobile verification, merchant authentication and more.

Will UPI payments go global?

While UPI is currently dominating the Indian market, its reach is ready to creep around the globe. Plans are underway to introduce it in several Asian countries, including Singapore, Malaysia, and Thailand.

Where can I learn more about UPI payments?

The NPCI website provides detailed information about their tech’s features, functionalities, and more.

The takeaway

By understanding the power of UPI versus traditional payments, you can keep your business up-to-date in the ever-changing financial landscape. Remember, UPI is just one of the many fintech innovations rapidly changing the face of payments. Keep an open mind and be ready to run with it!

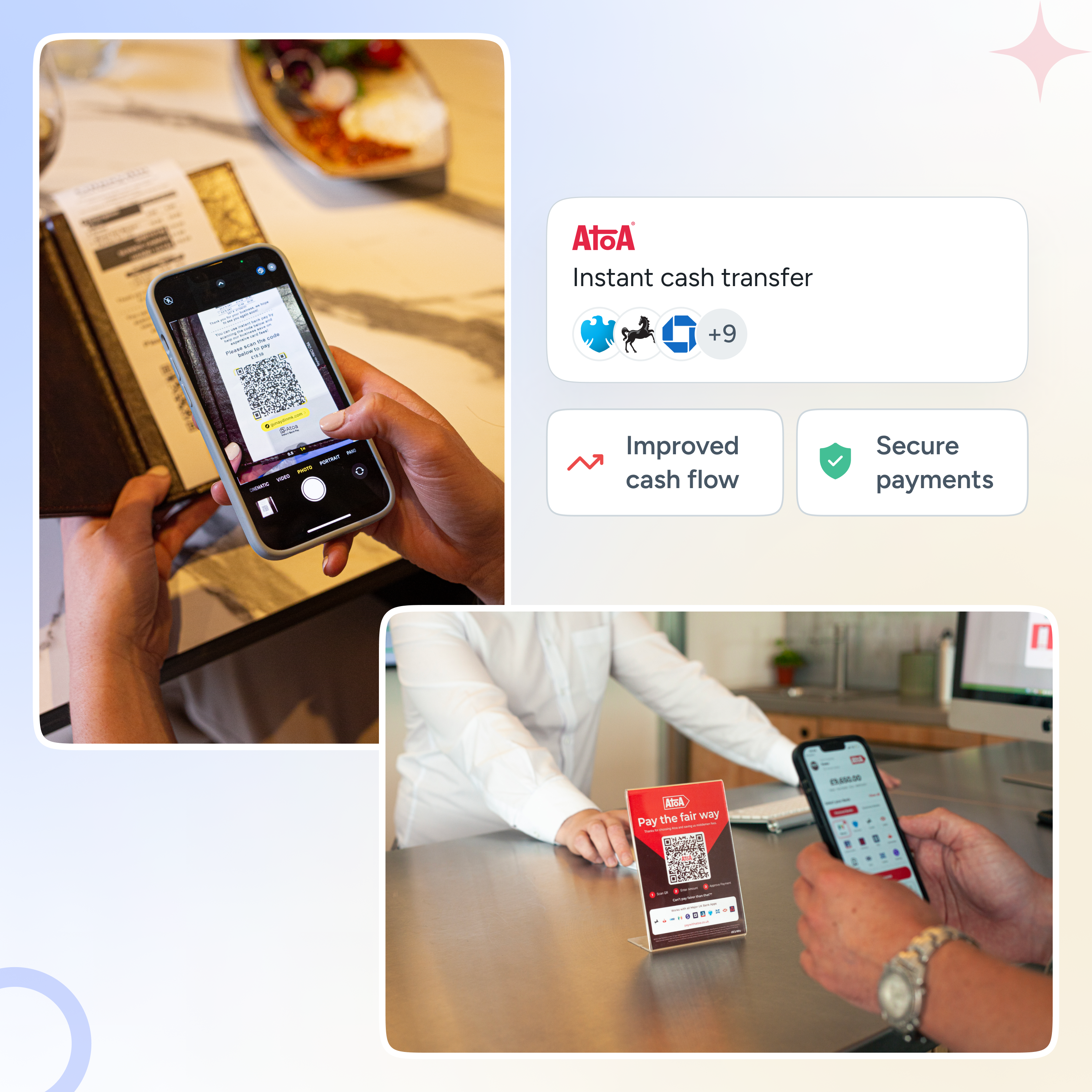

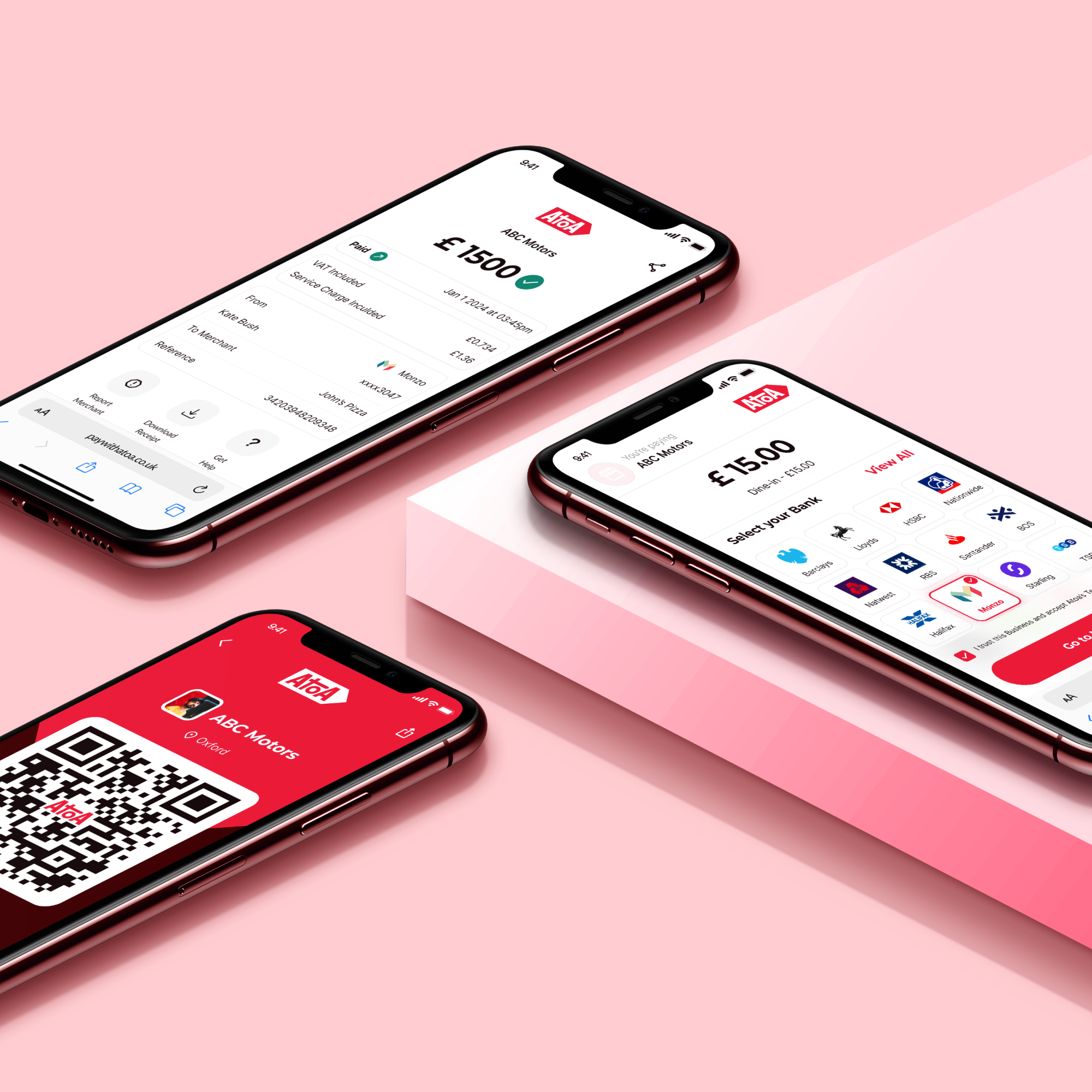

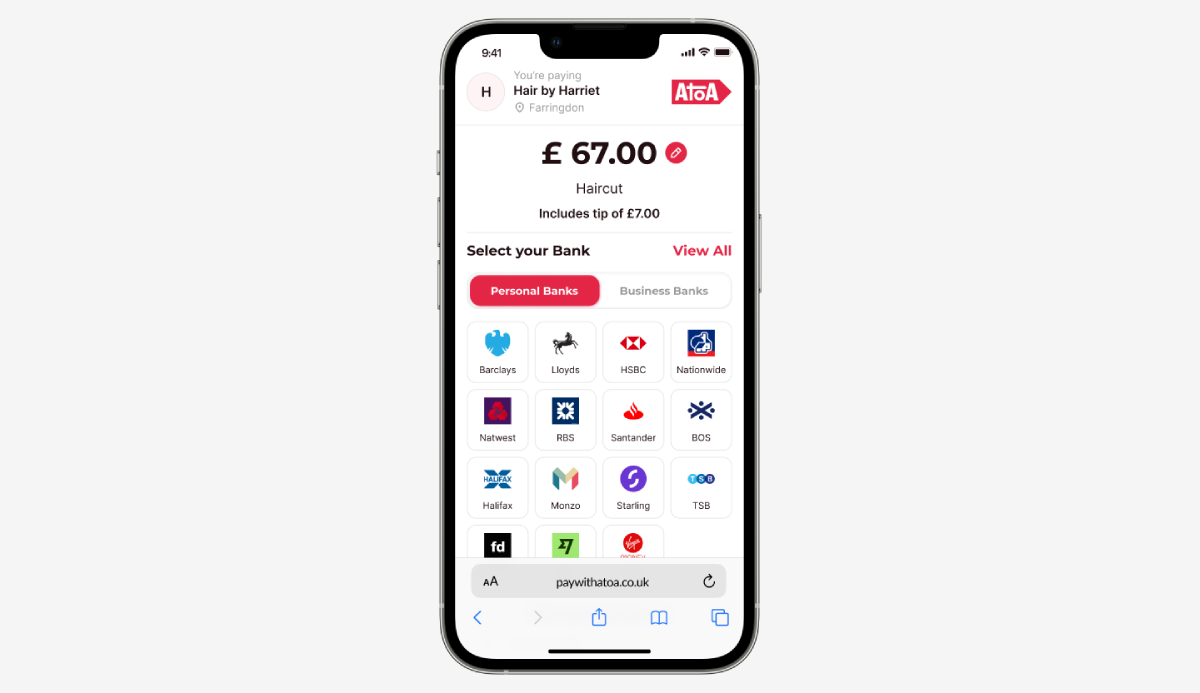

How Atoa can help

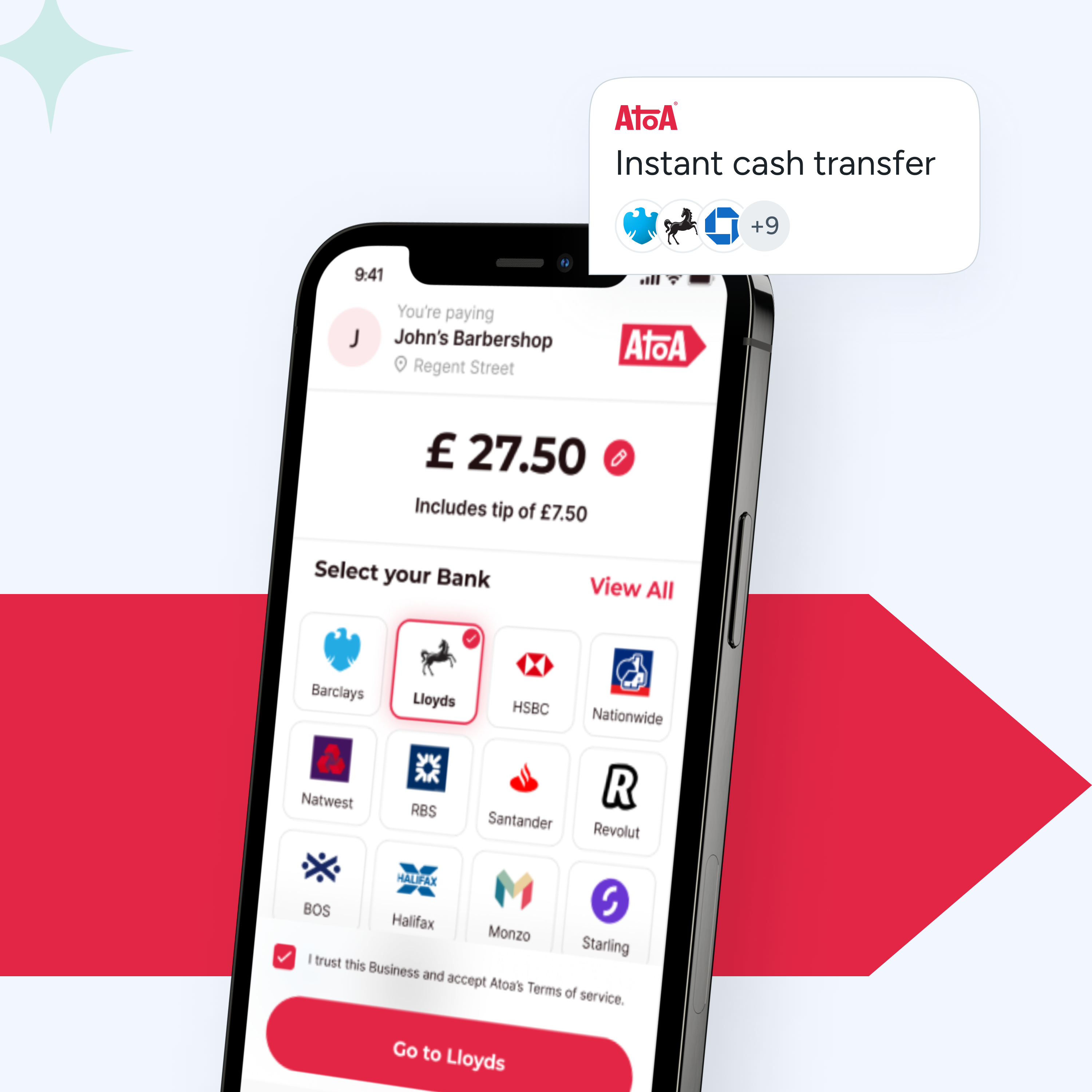

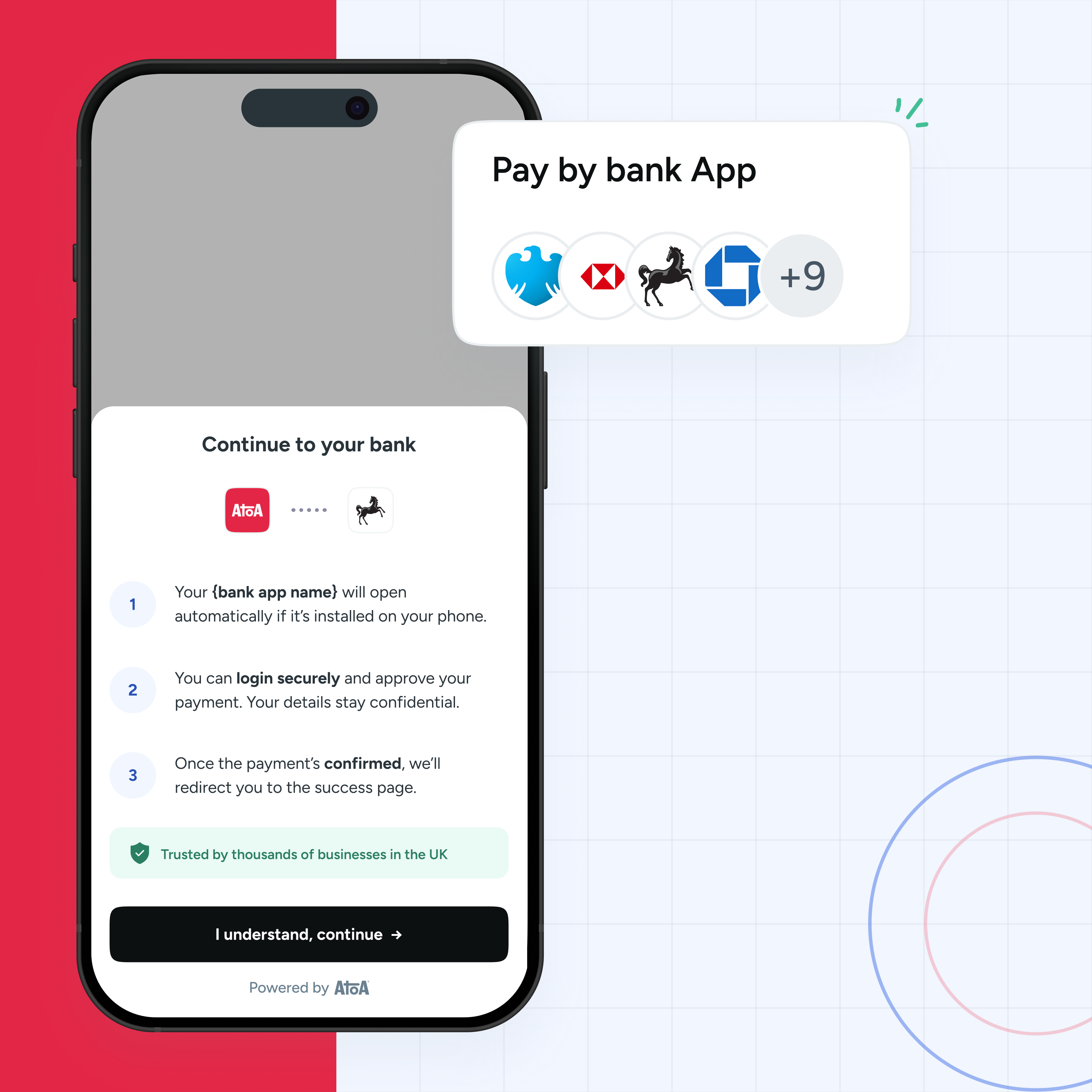

In a world that craves easy digital payments, embracing new methods is key for any business. While UPI payments may not be available for UK transactions just yet, our QR codes and payment links offer a secure cashless alternative with instant settlement. Atoa reduces your transaction fees, gets you paid faster and boosts customer experience. So why wait?