Get cars off

the lot faster

Halve your fees, close more deals with instant deposit payment links, and get real-time payment notifications that keep your team in the loop.

See our reviews on

How payment links work

Take control of your automotive payments

Find out how our solution can make your dealership or garage stand out from the competition with fuss-free payments.

Desktop friendly

From deposits to repairs, your team can send payment requests from their desktop and get instant alerts when funds arrive.

Learn More about Atoa Web Dashboard

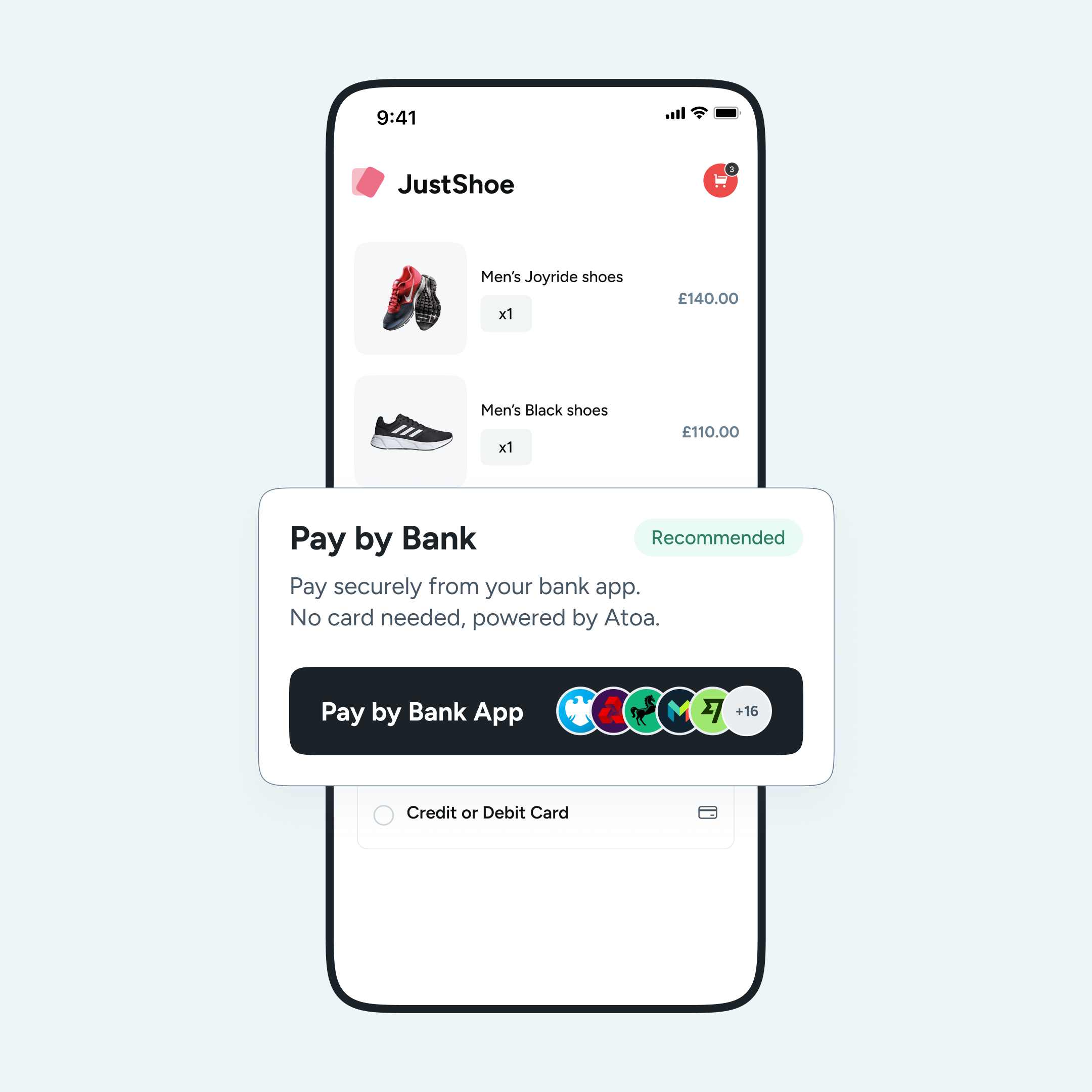

Get paid in-person…

Accept faster payments anywhere in your dealership or garage to boost cash flow.

Learn More about Atoa Web Dashboard

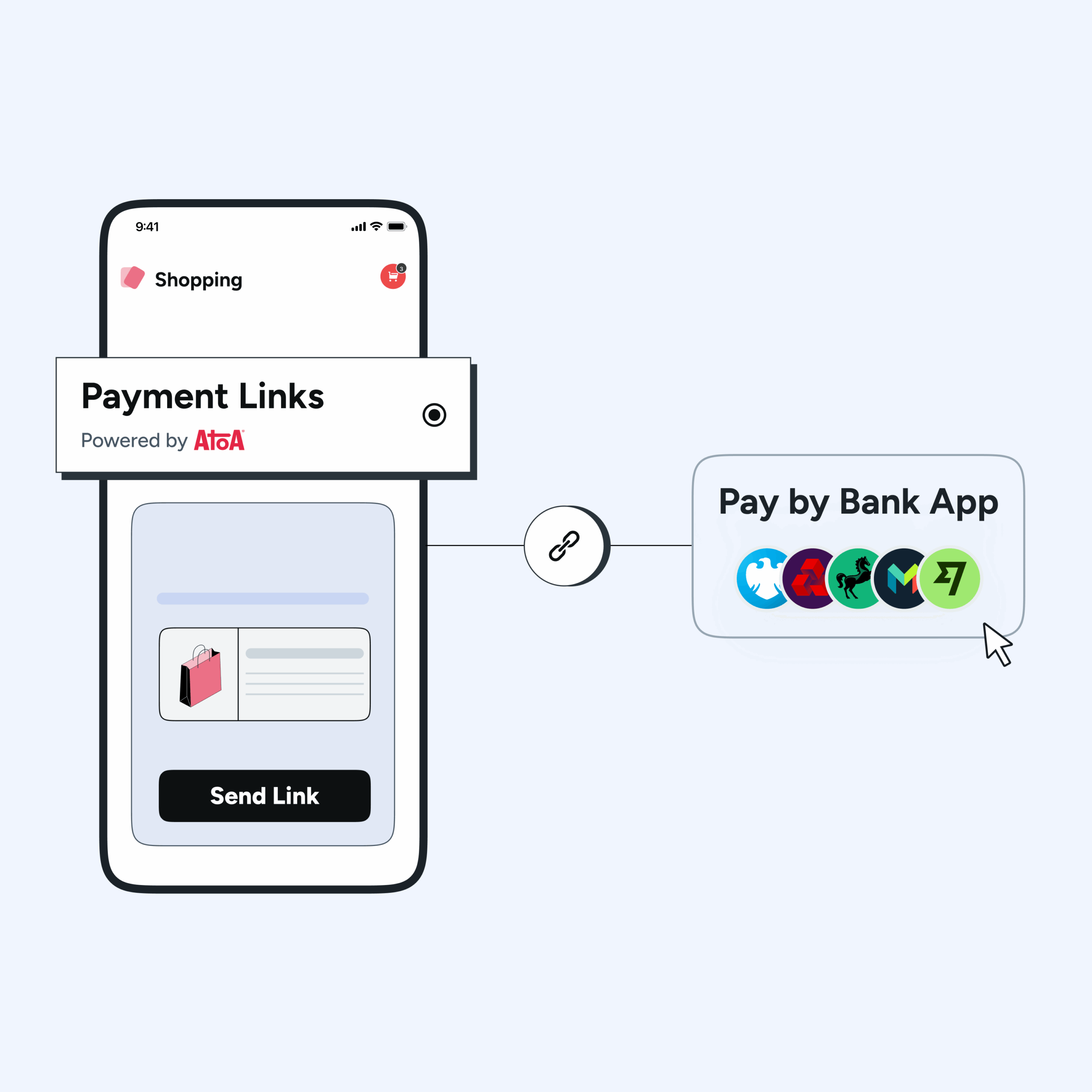

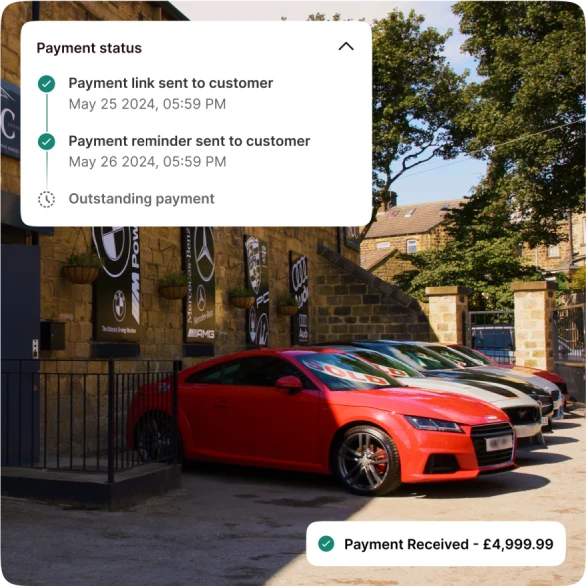

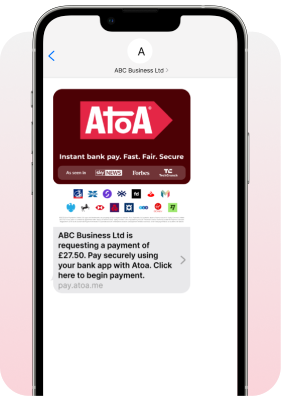

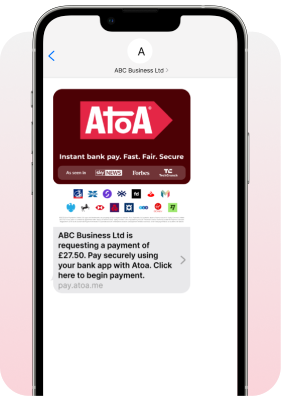

Send SMS payment links

Collect deposits for sales and repairs remotely using SMS. Follow up with your customers to boost conversion and keep stock moving.

Learn More about Atoa Web Dashboard

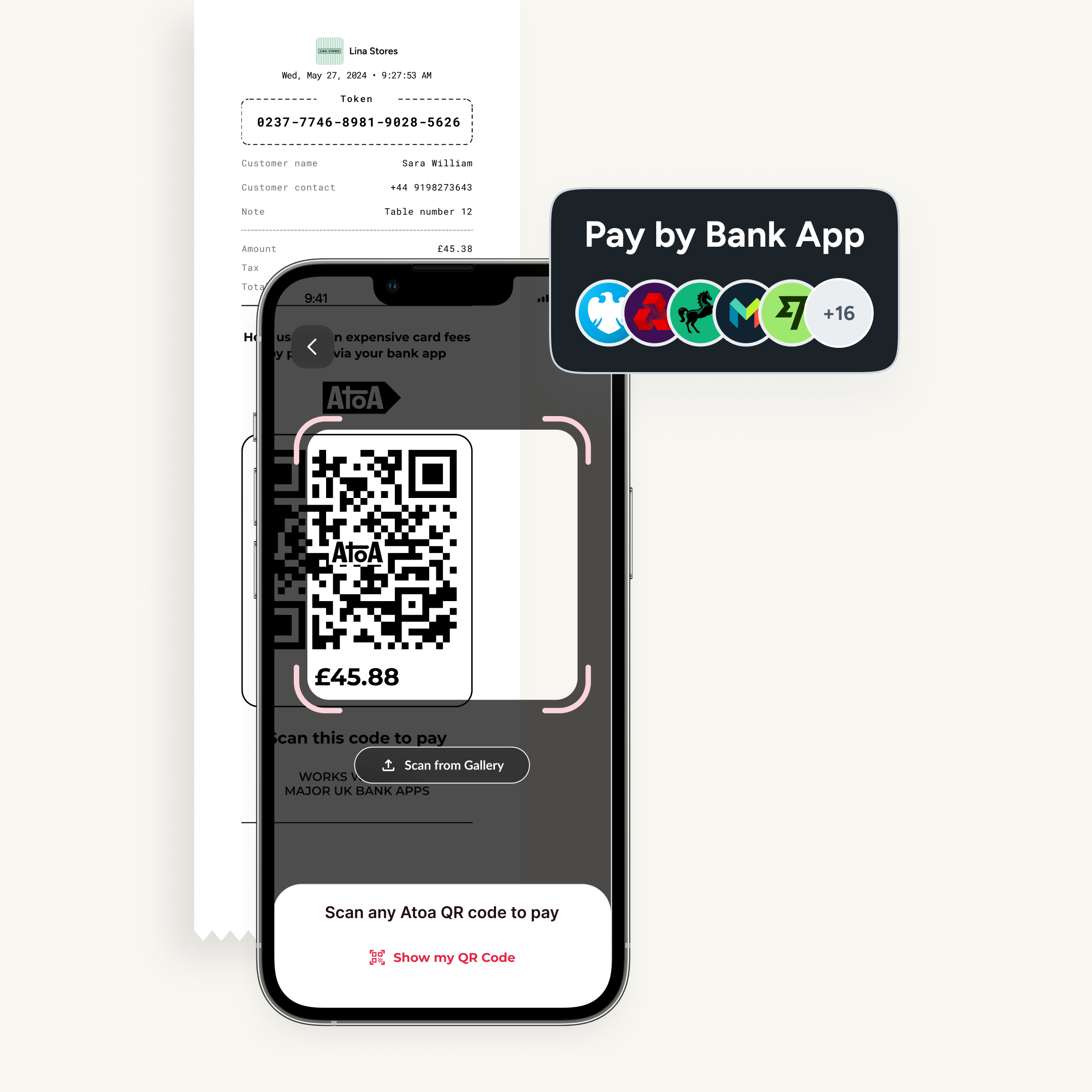

Collect payments on the forecourt

Forget PDQ machines and unreliable bank transfers – customers pay from their bank app by scanning a QR code.

Learn More about Atoa Web Dashboard

Desktop friendly

From deposits to repairs, your team can send payment requests from their desktop and get instant alerts when funds arrive.

Learn More about Atoa Web Dashboard

Get paid in-person…

Accept faster payments anywhere in your dealership or garage to boost cash flow.

Learn More about Atoa Web Dashboard

Send SMS payment links

Collect deposits for sales and repairs remotely using SMS. Follow up with your customers to boost conversion and keep stock moving.

Learn More about Atoa Web Dashboard

Collect payments on the forecourt

Forget PDQ machines and unreliable bank transfers – customers pay from their bank app by scanning a QR code.

Learn More about Atoa Web DashboardAtoa supports all major UK banks

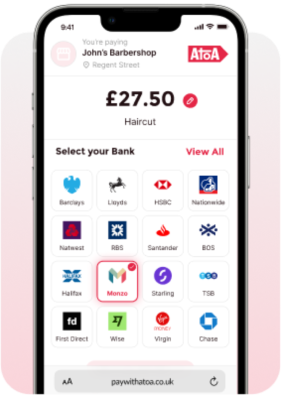

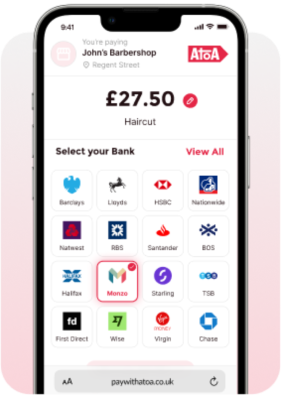

Pay instantly from your personal or business bank app

Atoa helps Ponko save on fees and sell more cars

Ponko, a leading car dealership and workshop in Cambridge with over 300 vehicles found a new automotive payment solution in Atoa. They now accept instant payments directly from their customers’ bank apps, and use Atoa for 96% of their transactions. This switch has saved them over £6,000 in card fees every month and brings a big cash flow boost.

General Manager, Jason Drury, and his team love how easy Atoa makes instant bank payments. They also use SMS payment links to improve the sales experience, allowing customers to pay for cars, deposits, and servicing even when they aren’t at the dealership. This straightforward process has helped Ponko close deals faster and increase its revenue.

“Since moving to Atoa, we’ve saved £6,000 a month in payment fees… 96% of our payments are taken via Atoa now.”

Jason Drury, General Manager

Atoa vs. traditional payments

|

Instant payment confirmation to release cars faster

|

|

A better experience for customers with increased loyalty and return visits

|

|

Higher conversion with SMS payments and deposits

|

|

Syncs with accounting software such as Xero, Quickbooks and Sage

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instant payment confirmation

|

|

No need for bank or card details

|

|

Increase conversion with SMS links

|

|

Add staff with custom access levels

|

|

Collect Google Reviews

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments for every business

Hair & Beauty

Hair & Beauty

Restaurants

Restaurants

Retail

Retail

Tradespeople

Tradespeople

Clinics

Clinics

Join thousands of businesses growing with Atoa

- Registration takes 5 minutes

- Get 7 days of free payments

- No sneaky contracts or hidden fees

-

Efficiency boosting features like tips,

Google Reviews, and much more

Featured stories

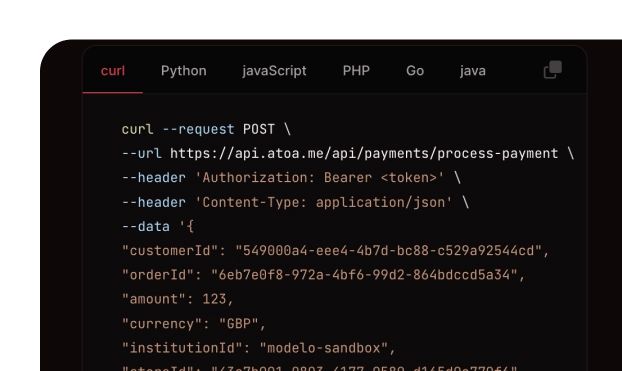

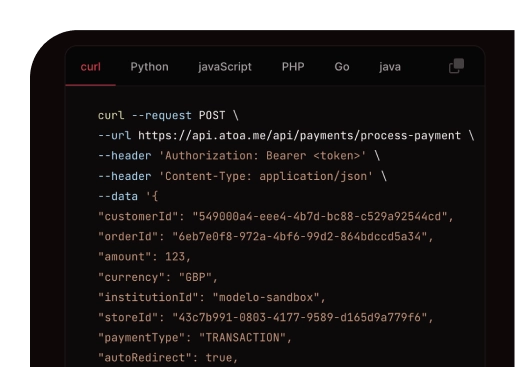

Atoa allows customers to pay automotive retailers using their UK bank app. Our name is short for “account-to-account payments”.

Atoa uses the UK Government’s Open Banking network, which lets customers make an instant ‘bank transfer’ to businesses without entering their bank details. Atoa helps local auto businesses save on card fees and get paid faster. We sidestep card networks like Visa and Mastercard, which lowers business owners’ costs and improves cash flow.

Customers enjoy a safe and secure payment experience with Atoa. All they need is a UK bank app on their phone to pay your dealership or garage instantly without signing up or downloading any new apps.

Read our beginner’s guide to open banking to find out more.

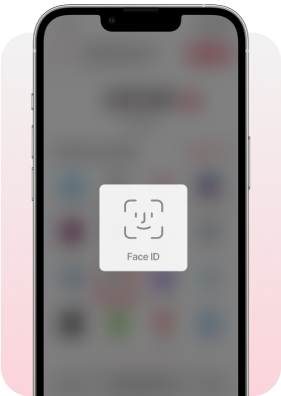

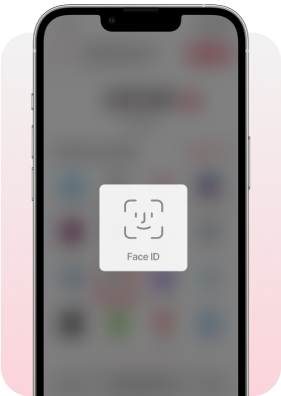

When customers are ready to pay, they scan a QR code stand in the showroom, which starts an account-to-account (A2A) payment in their smartphone browser. The customer enters the amount they wish to pay and selects their bank. They are then automatically redirected to their bank app to securely confirm the payment using their face ID or fingerprint scan.

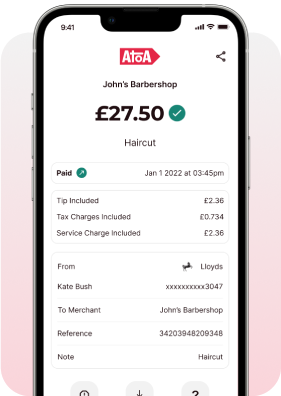

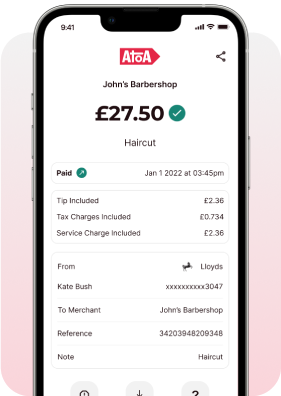

Once the payment is approved, funds are released instantly to the car dealership. The salesperson gets a real-time notification that payment was successful without needing access to the dealership’s bank account or contacting the finance department.

Our payment links can be shared with customers over SMS, WhatsApp, social media or email. When the customer clicks on the link, they’ll see the amount due and an optional reference or note from the business. The customer selects their bank from the list provided and securely approves the payment in their bank app using their face ID or fingerprint scan. This is great for collecting deposits, repair estimates, loan down payments, and more. Payment links can be sent to prospective customers to increase sales conversion.

Bank transfers can slow the customer experience and create inefficient processes in your dealership. Atoa provides a smooth payment experience with low fees that can help finalise sales faster. Plus you get:

- Real-time payment visibility – When customers pay by bank transfer, the finance team becomes a bottleneck as sales teams need them to confirm funds have cleared. With Atoa, salespersons are notified as soon as a customer payment is made, removing finance teams from the process to get cars off the lot faster.

- Smoother payment handling – Large bank transfers (such as car purchases) can often be flagged by the customer’s bank for review. This creates a “limbo” situation where neither party has the funds and the car can’t be released. Atoa tracks the movement of funds in real-time and provides updates when payments are delayed. This helps salespeople resolve issues quickly and reassure buyers.

- Better customer experiences – Bank transfers require customers to enter bank details, which can make them question the purchase. With Atoa, the customer scans your QR code, performs face ID and funds are released directly to your business account. Atoa also shows your company name and logo so customers know who they are making a payment to.

Atoa is safer than card payments. Unlike cards that can be lost or stolen, Atoa transactions are made from the customer’s bank app. Every payment is approved by the customer’s bank and confirmed using a face ID or a fingerprint scan, removing the chances of chargeback fraud.

Atoa skips Visa and Mastercard’s card rails and instead taps directly into the UK government’s secure Faster Payments and Open Banking networks. The UK Financial Conduct Authority monitors every transaction, and banks handle all funds directly, meaning Atoa never touches your money. We’re rated “Excellent” on Trustpilot and trusted by thousands of UK businesses.

Atoa is an automotive payment solution that helps car dealerships in the UK with low-fee, instant transactions for sales, servicing, and workshops. We’re trusted by 1000s of automotive businesses with new dealers signing up daily.

Atoa is an official partner of the Independent Motor Dealers Association (IMDA) and we are rated “Excellent” on Trustpilot.

Atoa works with leading dealer management systems such as Keyloop and DealerKit, automotive website providers such as Starkwood Media Group and Haswent, and auto CRM such as Eskimo Software.

You can sign up by clicking the “Start 7-day free trial” button on the top of our website. You can also download our mobile app by searching for “Atoa Business” in the App Store or Play Store.

Registration takes about five minutes and is quick and easy. When you sign up, we offer 7 days of free transactions to get you started.