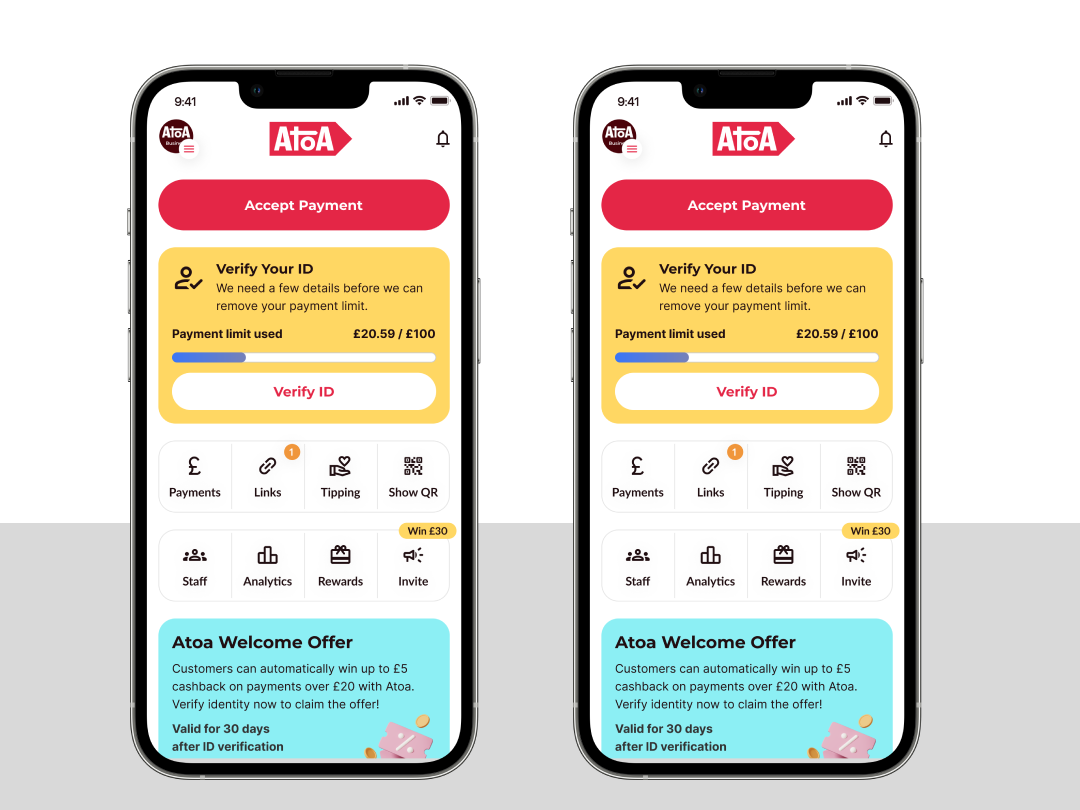

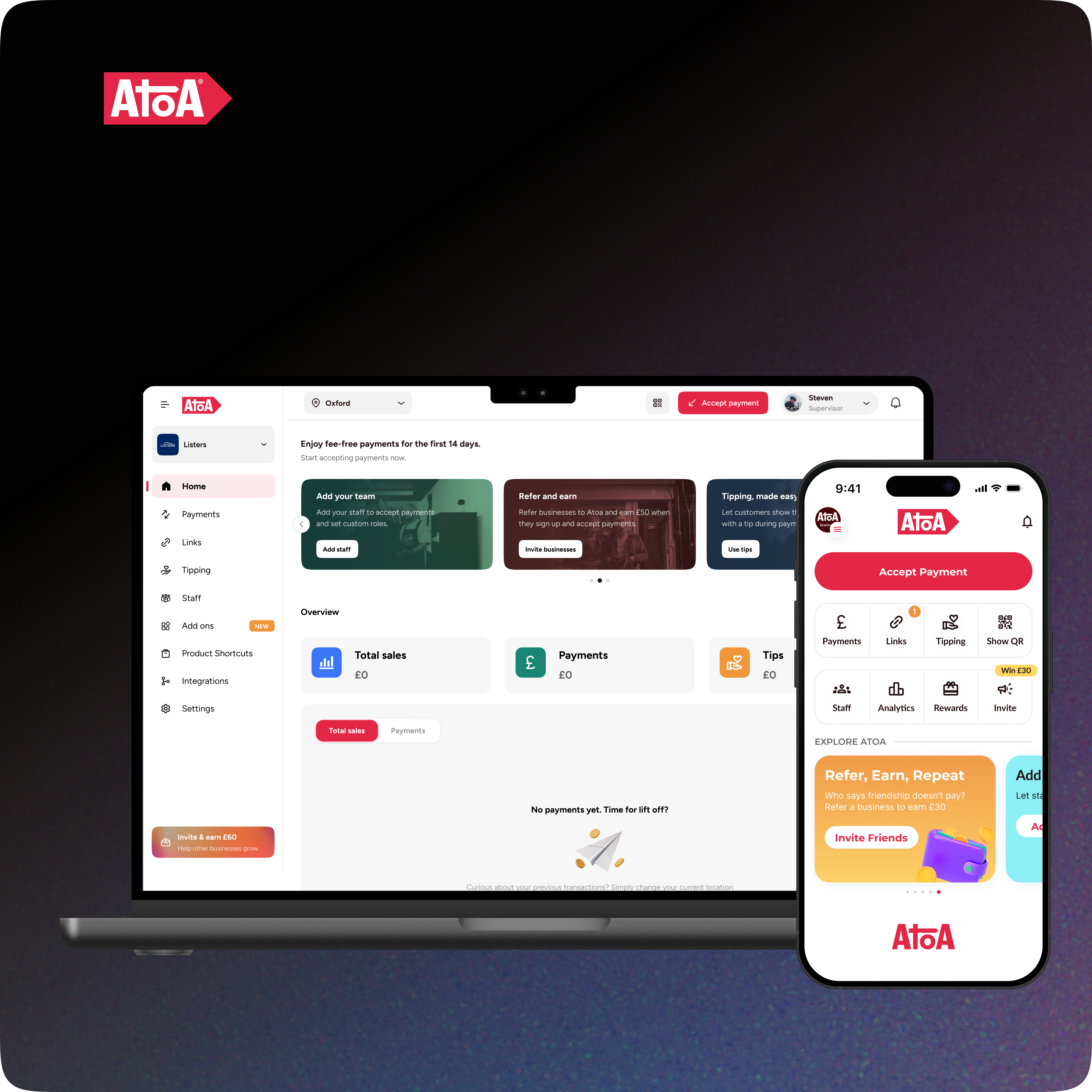

Let’s face it; we could all do with some extra cash. Atoa uses open banking and account-to-account (A2A) payments to help small businesses maximise profits without any extra fuss. Here’s a little more information on what we offer:

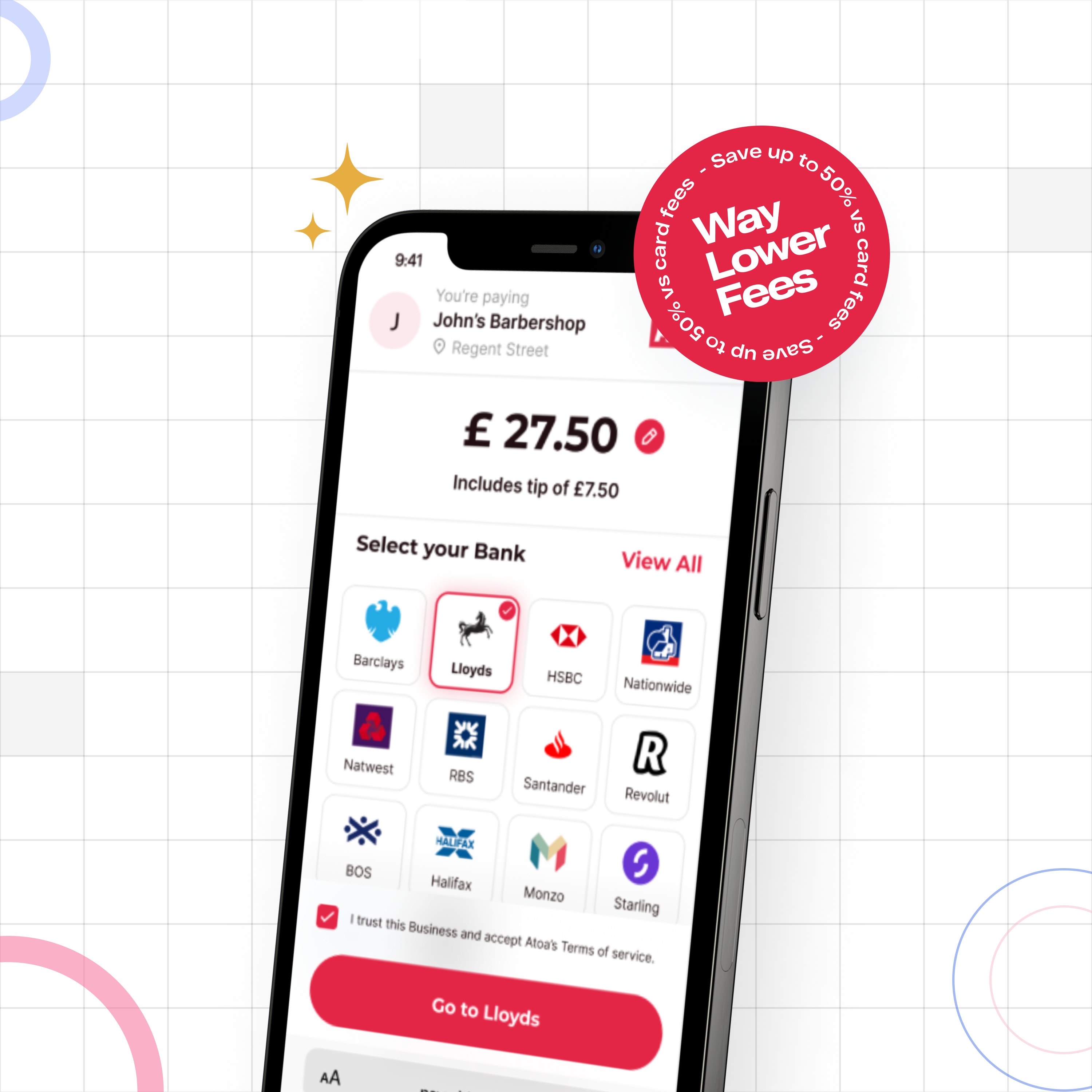

Lower transaction fees

Our bread and butter. At a starting rate of only 0.7% per transaction and lowering with increased volume, Atoa is here to ensure you get the most from your payments, regardless of their amount. Fewer fees = more profit for you.

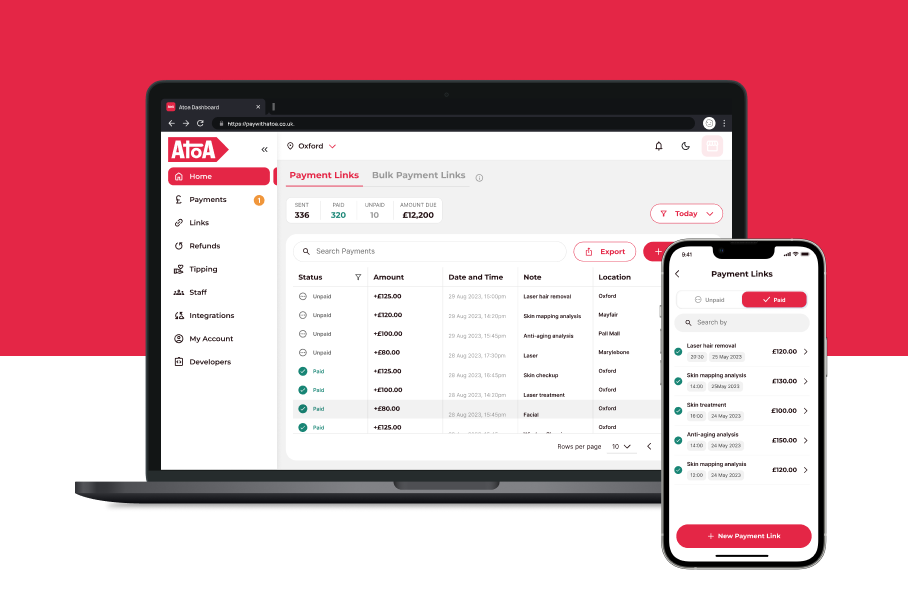

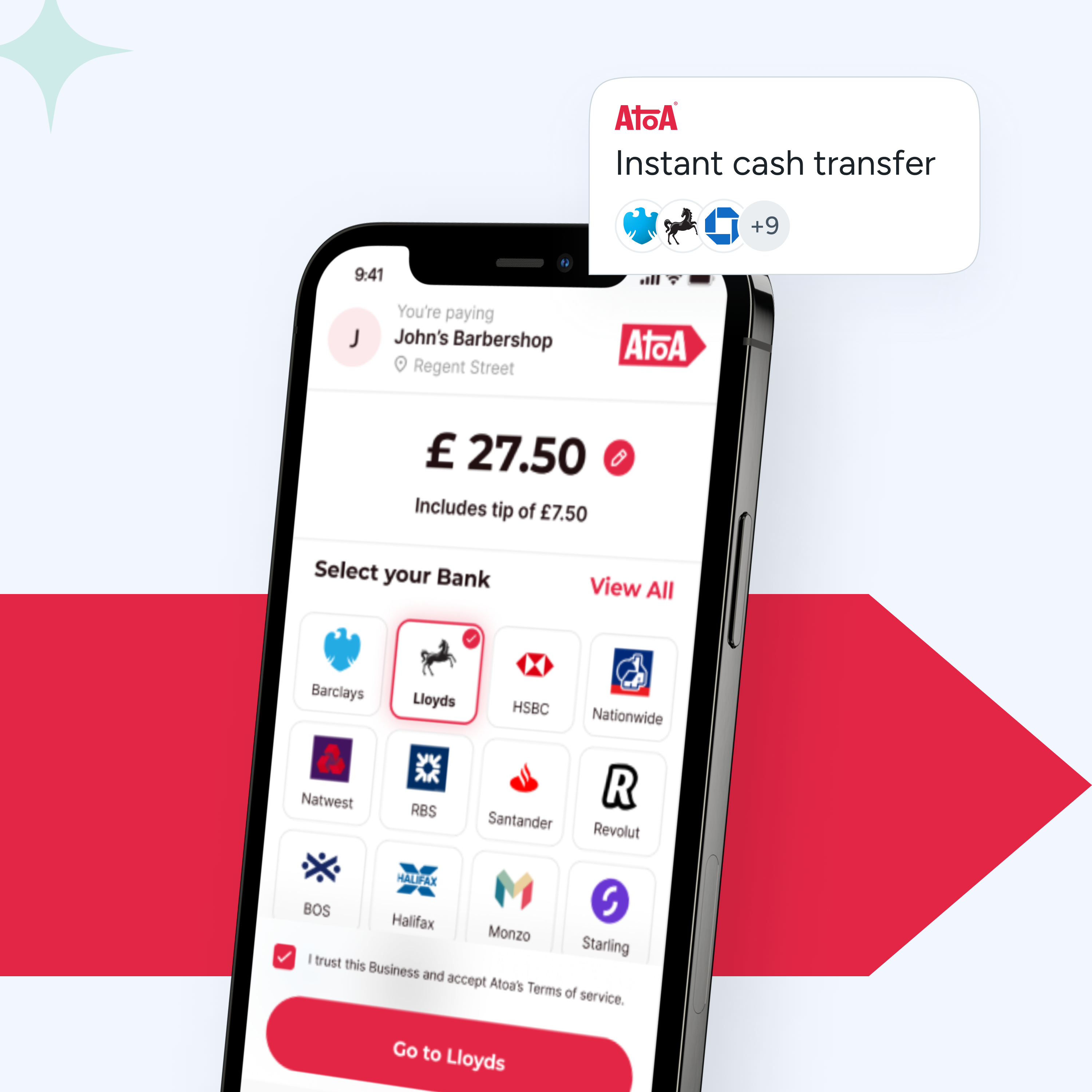

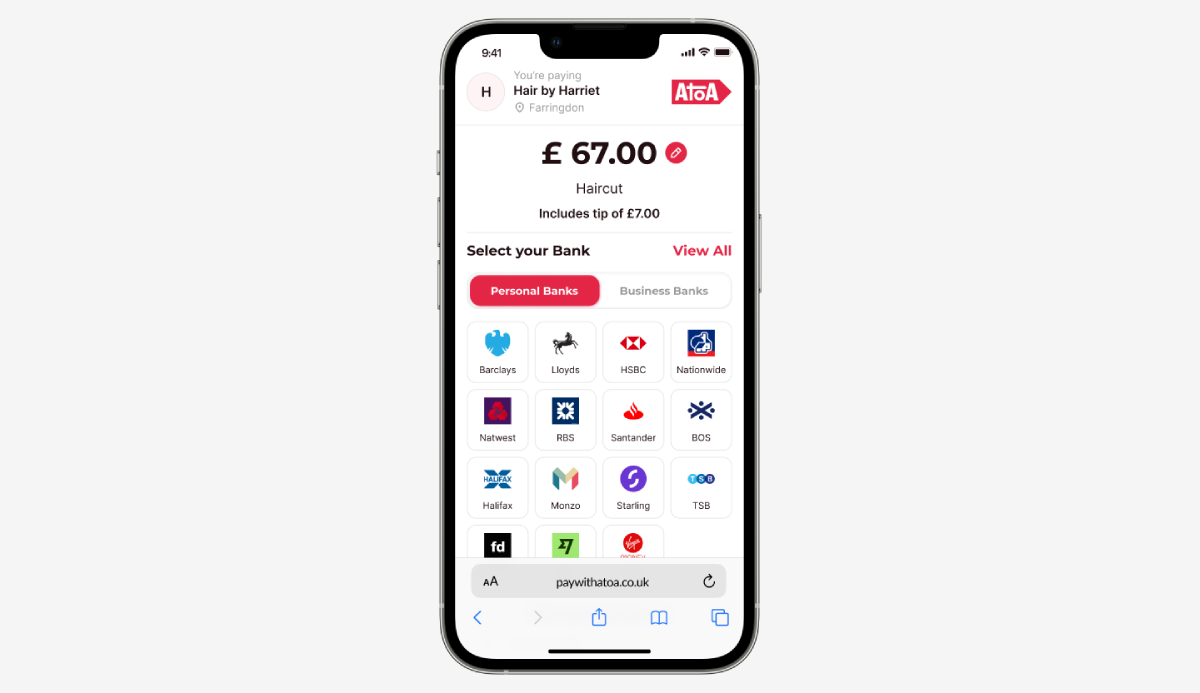

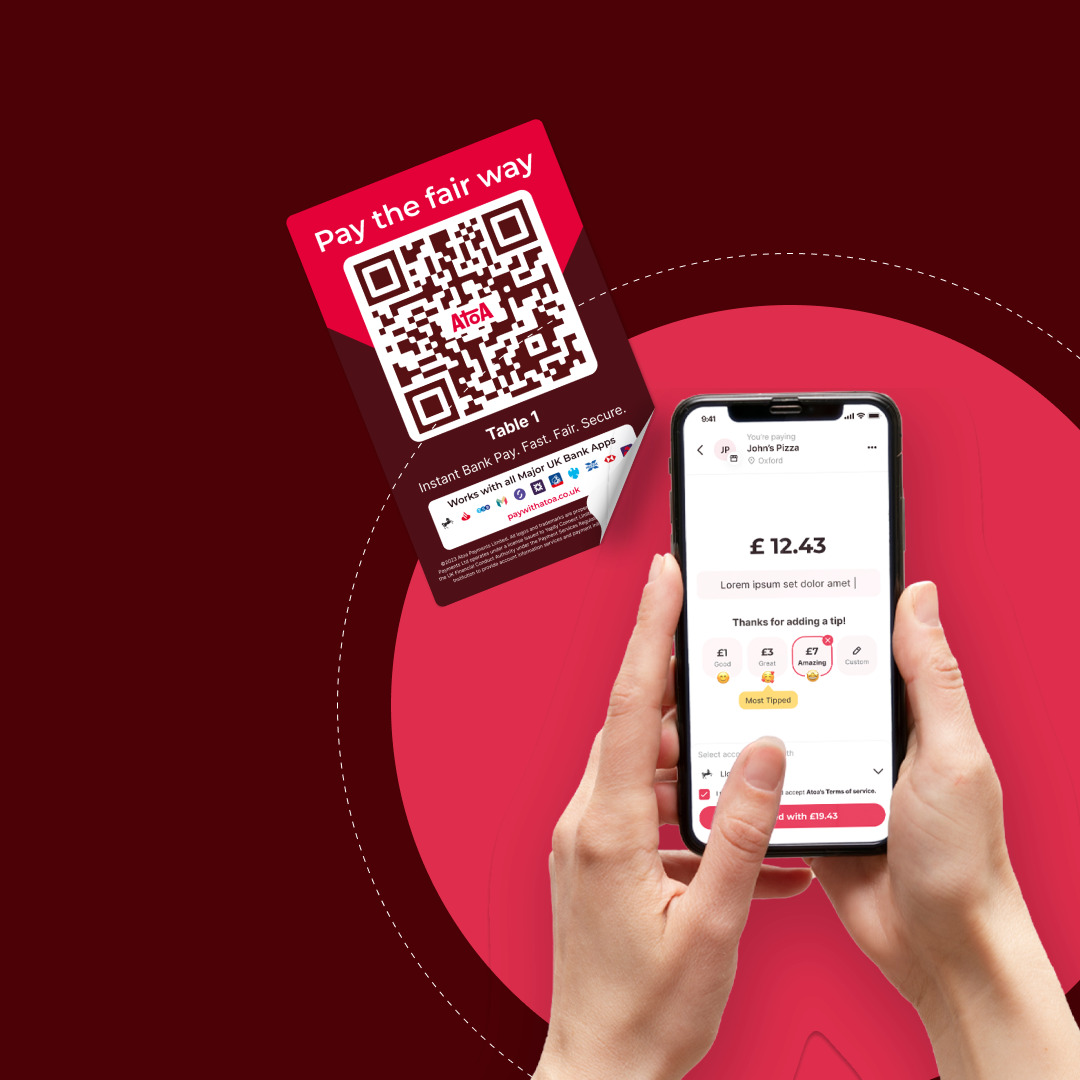

No card machines!

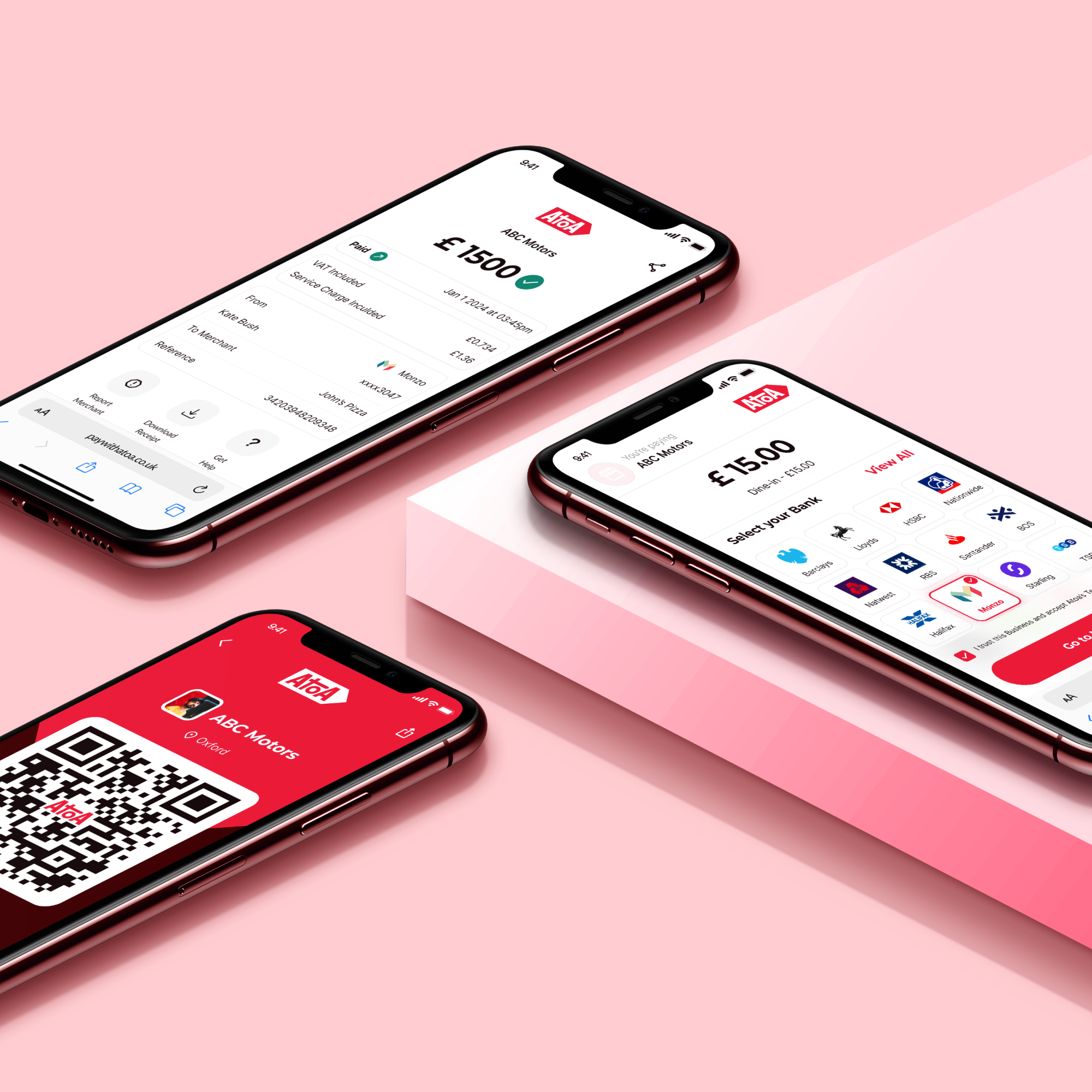

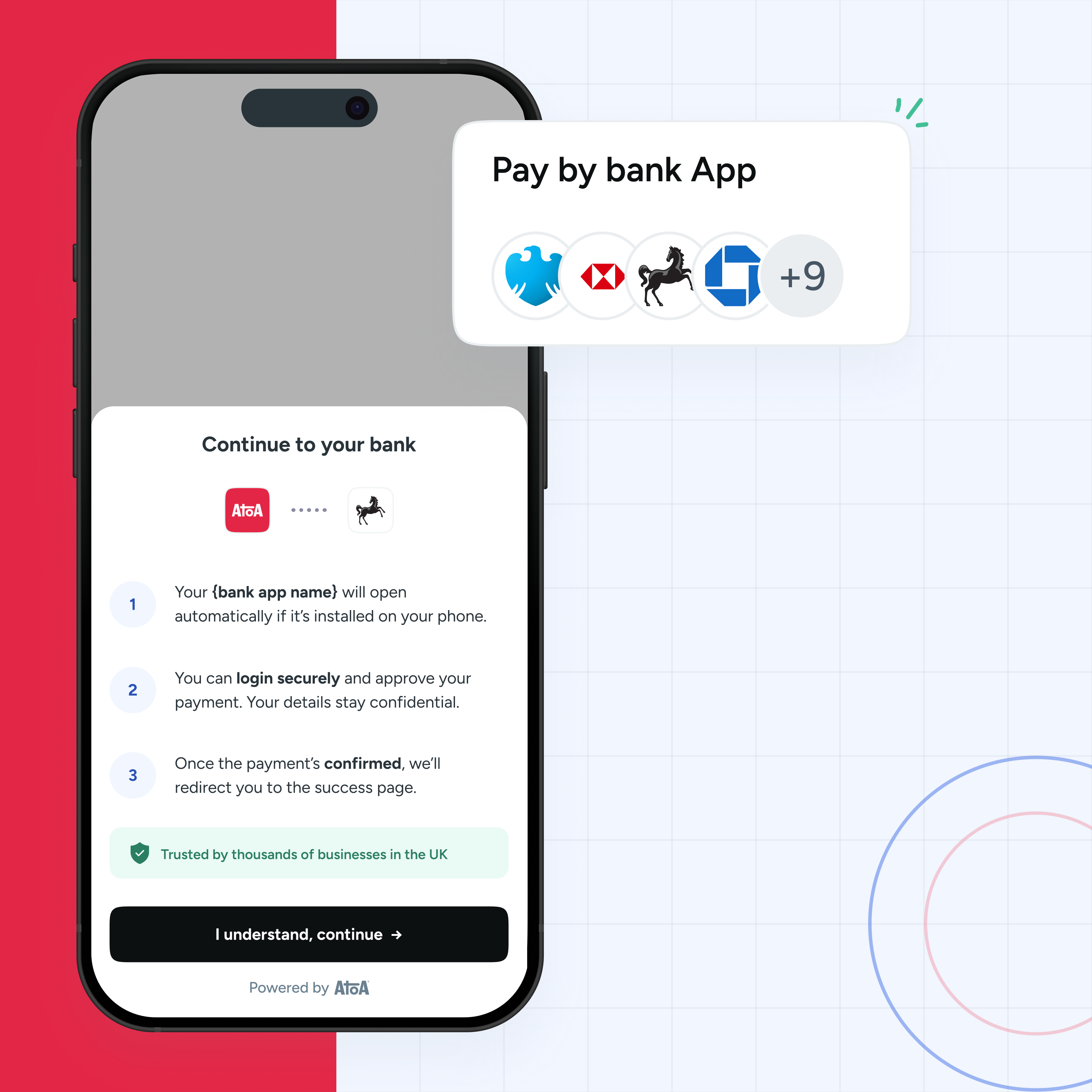

This cuts our costs and yours too. We also don’t expect any commitment or contracts to be signed, meaning there are no hidden fees, service charges or sneaky hardware payments. We want you to be paid fairly, so all you need to do is download the app and securely link up your bank details; then, you’re all set up in a matter of minutes.

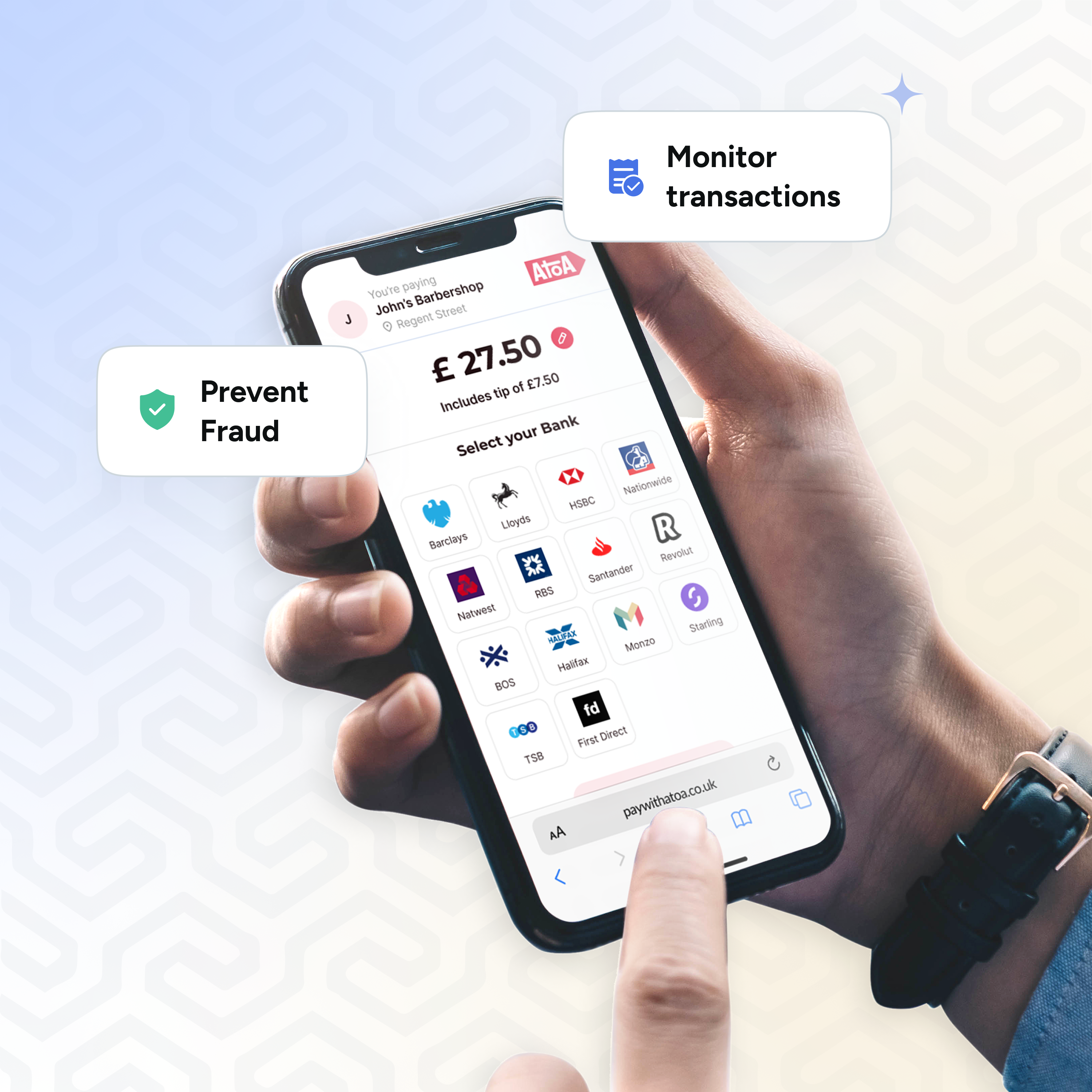

Stops fraud in its tracks

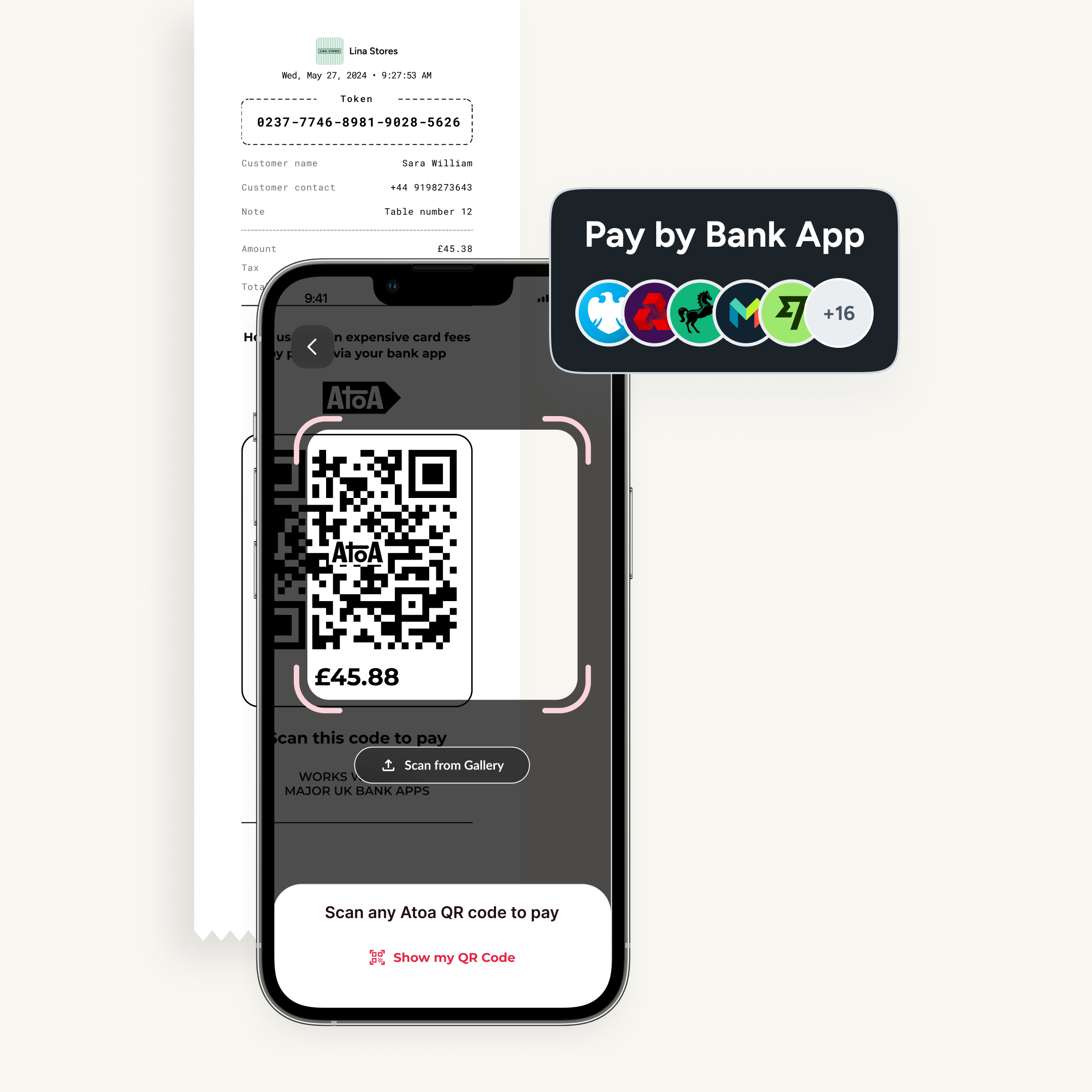

Open banking payments come correct with tightened security, which we’ve harnessed at Atoa. All payments made through our app are instantly verified by the customer’s unique fingertip scan or Face ID, meaning chargeback fraud becomes a thing of the past.

…and human error.

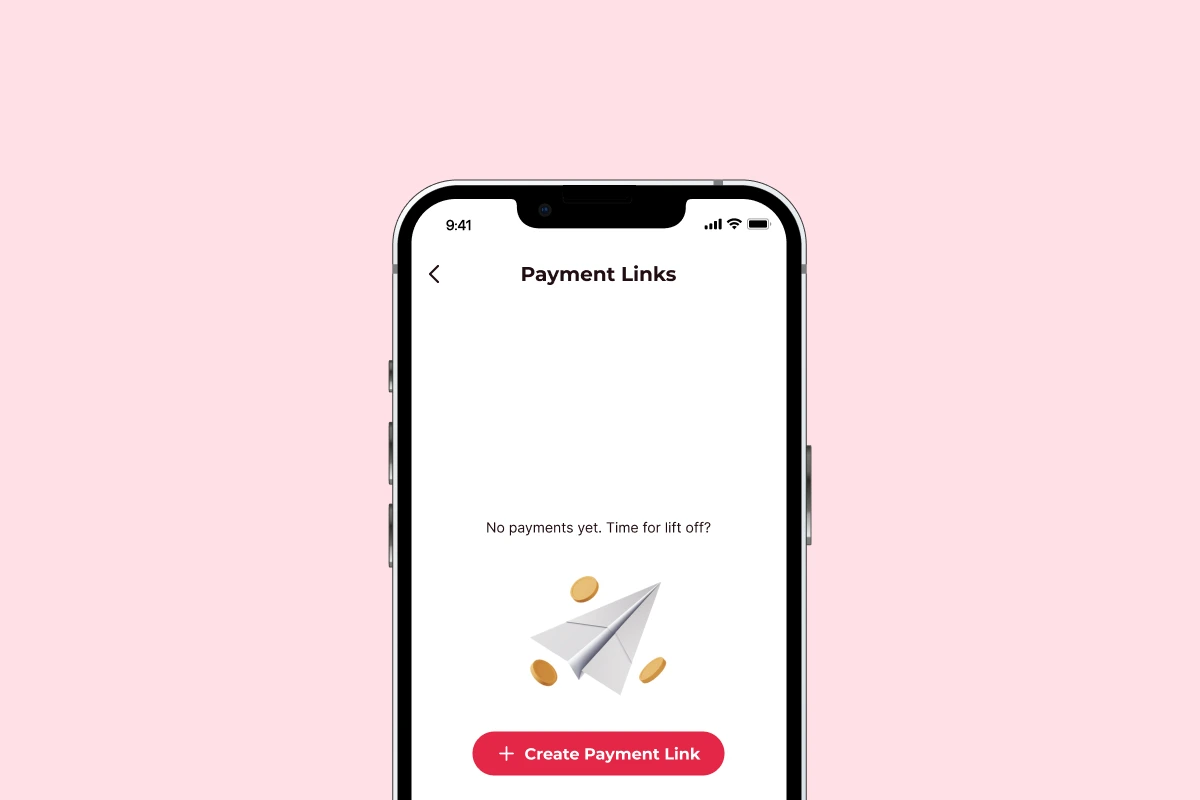

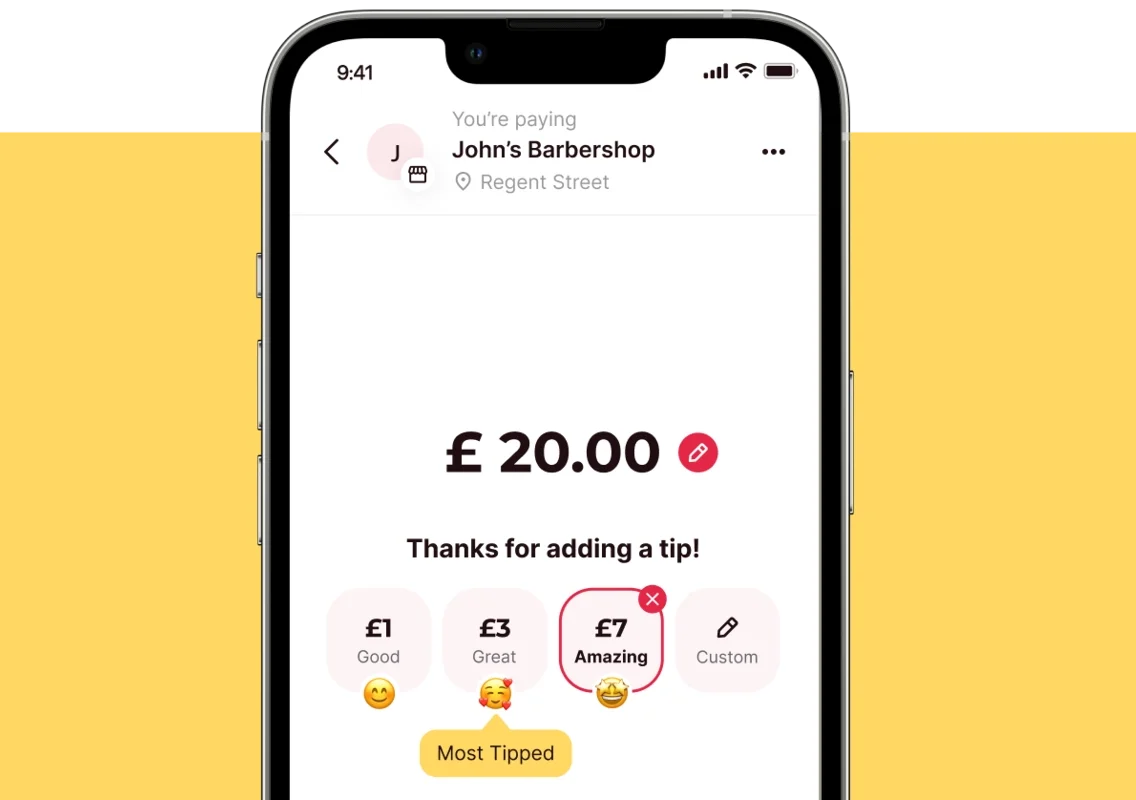

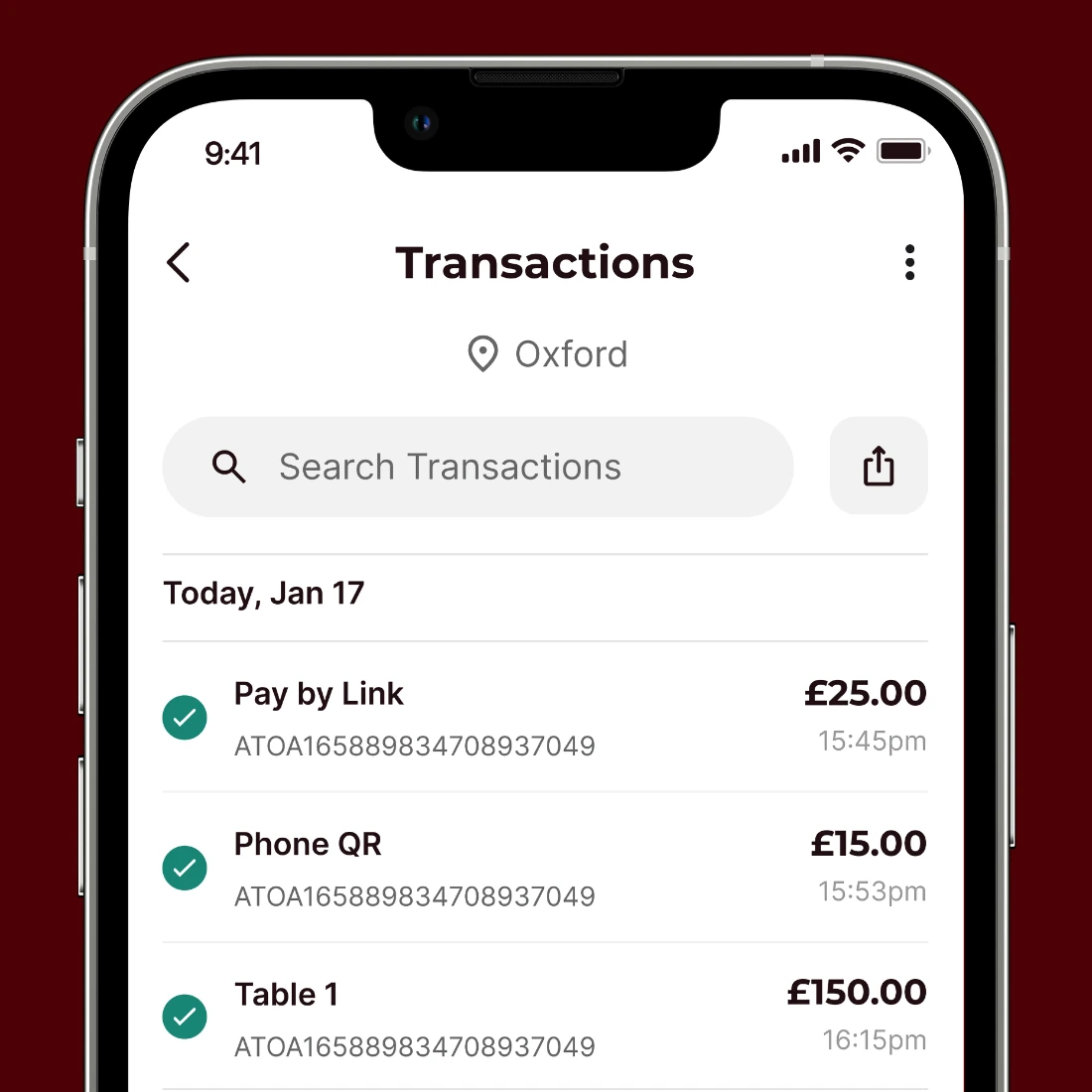

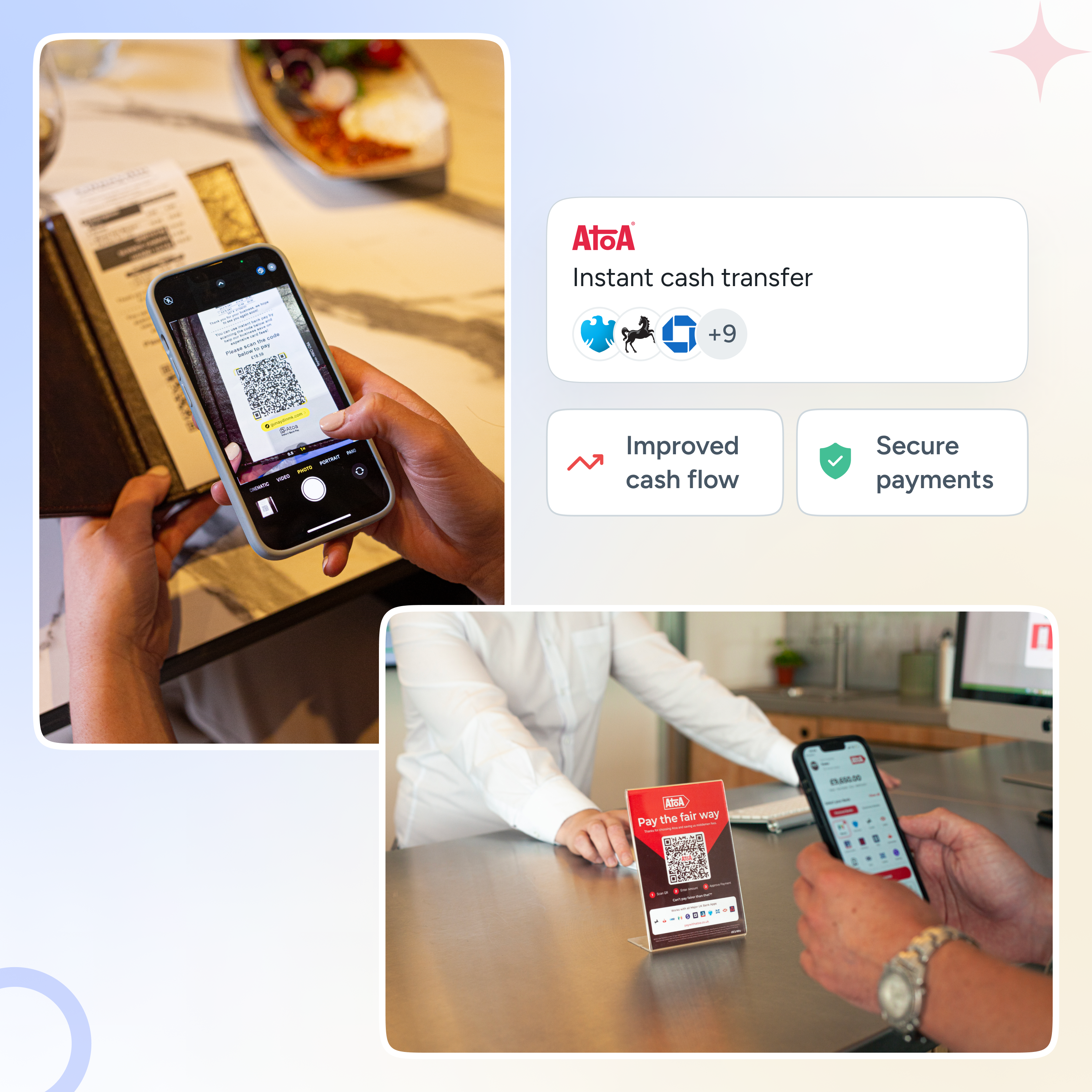

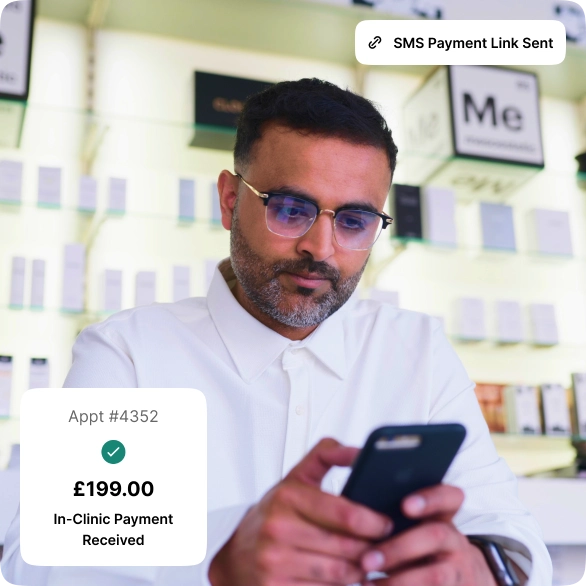

Atoa removes the need for customers to enter payee details; we all know this is tiresome and anxiety-inducing! Forget last-minute dashes to the ATM or customers checking card details twenty times over. Our app securely links your bank account and removes any room for mistakes. The customer scans the QR code or clicks an SMS payment link and…kerching!

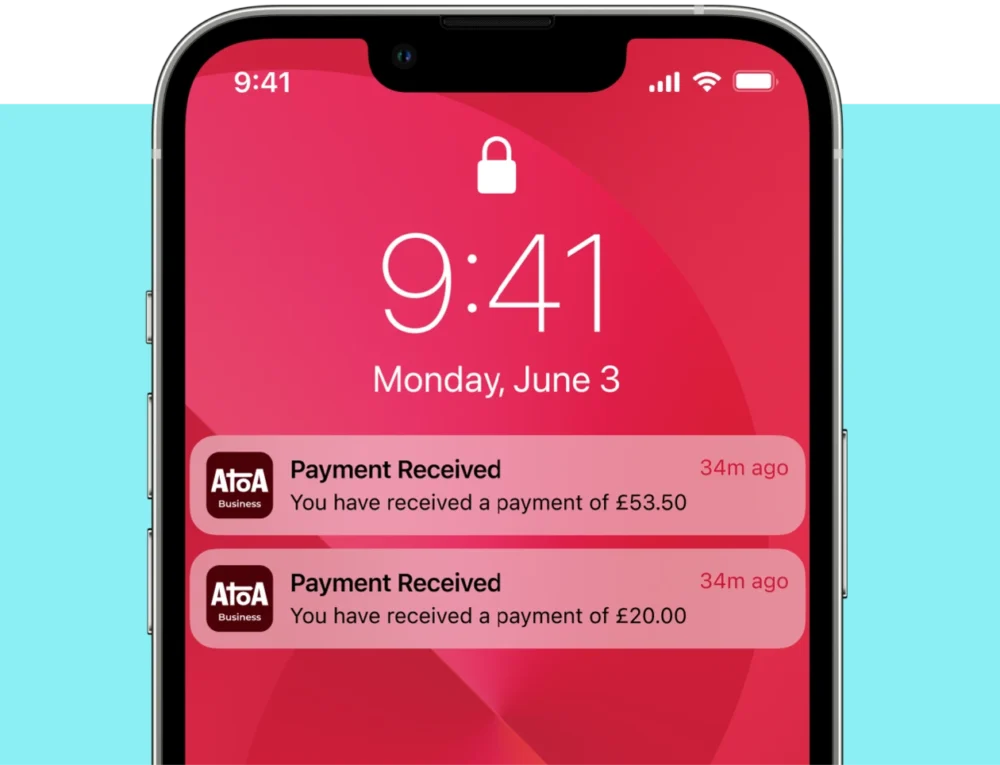

Deposits your money even faster

Thanks to Faster Payments, open banking’s rapid payment processing times allow Atoa to release funds to your business account instantly. That little “kerching” notification lets you know money has landed safely in the bank, giving you satisfaction in seconds.

Atoa is ideal for many businesses, including tradespeople, vape stores and more. So why not enter the future and enjoy the benefits of open banking payments with Atoa? Your business (and brain) will thank you! Download the app today and enjoy 7 days of transaction-free payments as a thank-you for choosing us.

Or, if you’d like extra help getting started with Atoa, don’t hesitate to book a demo with our team today!

Related content: