So, you want to know how to register a UK business? Maybe you’ve got your sights on a tech empire or a friendly local business. Whether you’ve got a fully forged business plan or just contemplating what being your own boss feels like, there are a few rules and regulations to follow. Proper registration is one of them! Why is it so important, you ask? This UK business registration guide should answer all your burning questions…

Why registering your business in the UK is a big deal

Registering your business isn’t just a box to tick – it’s your key to legitimacy and growth. An official stamp of approval to gain credibility and protect your game plan. Plus, it’s a smart move regarding taxes (you’ll thank us later). Proper registration includes perks like resources, support, and a network to help your UK business. You may also be able to tap into handy government incentives and grants if eligible.

It’s time to roll up those sleeves and make your UK business dreams a reality!

Different types of UK businesses

Before you register a UK business, you need to determine the exact type you need!

Sole Trader

As a sole trader, you are the only one running the show. You have total control and responsibility but are also personally responsible for business debts.

Advantages? Minimal paperwork lets you hit the ground running. You steer the ship and keep all of the profits. You handle accountancy, so you can claim business expenses against your income and enjoy some handy tax deductions.

Disadvantages? Any debts are your debts; putting your assets on the line, plus expansion and growth, can be tough.

Limited Company

Limited company finances are separate from your personal finances. This structure can offer perks like protection and a sense of professionalism.

Advantages? Your assets remain separate from your business, keeping your stuff safe if you hit a rough patch. Clients and investors may take you more seriously with ‘Ltd.’ at the end of your name. Taking dividends can be tax-efficient to take money out of your business.

Disadvantages? Admin and paperwork, mainly! You might have to share some decision-making with shareholders and directors. It’s like a group chat, only there’s a chance not everyone will agree on the emoji to use 😂

Partnership

Two or more partners share ownership, responsibilities…and the ups and downs.

Advantages? Strength in numbers and shared responsibility. In many partnerships, profits are taxed as personal income, potentially resulting in lower taxes than the other business types. Partners can sometimes offset losses against personal income. You’ll likely benefit from a broader network and better chances of accessing capital and funding.

Disadvantages? Profits must be shared, plus there is a potential for conflict in decision-making. Each partner is personally liable for the partnership’s debts and obligations. Raising capital for growth and expansion can be challenging compared to other business structures like corporations.

Steps to register your business

Before you begin the business registration process, gather all the relevant documents and information, such as ID, proof of address, and any other business documents. Most importantly, you’ll also need a business name that is not already in use!

First, decide on your structure. Will you form your UK business as a sole trader, limited company, or partnership?

When that’s in the bag, it’s time to go legit. Registering a business with Companies House makes it the real deal. A seal of approval! Visit their website to complete the process online.

The forms you must complete will depend on your business structure. Companies House will point you in the right direction. Ensure all information is correct, and include details of directors and shareholders if required.

Unfortunately, this comes at a price! The registration fee will vary depending on your business type and structure and can usually be settled online.

After submitting your registration, Companies House will review your application. Once approved, you’ll receive a Certificate of Incorporation or Partnership Certificate.

Steps to take when your business is up and running

It’s time to rock and roll! Set up a business bank account to manage your finances separately and ensure you’re registered for the correct taxes, such as Valued Added Tax (VAT) or Pay as You Earn (PAYE). This is important, so get it done as a priority.

Once you’re up and running, stay current with any requirements and responsibilities, such as annual filing and tax returns.

The steps you need to take will depend on your business location and type. Use government resources and seek professional advice to set up correctly and keep your business running smoothly.

Navigating taxes and finances

Tax is an important element of having your own business. Here’s a brief overview:

Sole traders

You must report your income and expenses by completing an annual self-assessment tax return, including National Insurance contributions.

Limited company

Your tax is separate from your personal affairs and requires filing annual statements with Companies House. You will also pay Corporation Tax on your profits.

Partnerships

Each partner reports their share of the business profits and losses on their tax return.

Tax checklist

- Open a dedicated business bank account to separate your personal and business finances.

- Sync the bank account you use for payments with accountancy software like Xero.

- Make sure you’re aware of your tax responsibilities in line with your business type.

- Keep good records and track your income, expenses and receipts or use software to help.

- If your business’s annual turnover exceeds the current threshold of £85,000, then you must complete VAT registration to stay compliant. Registration lets you charge VAT on your sales and reclaim it on your expenses.

Tax and UK startups

The UK offers various tax incentives for startups, such as the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS). These can also attract potential investors to your business.

If your startup is involved in innovative activities, you might be eligible for Research and Development (R&D) tax credits, which can help offset development costs.

Remember, the tax landscape can be bumpy, but staying informed and seeking professional advice can help you navigate it successfully. Your financial journey with your business is like a marathon, not a sprint – steady and well-managed wins the race!

Legal requirements for UK businesses

Operating a business in the UK comes with rules and regulations to keep things ticking over on the right side of the law. It’s important to stay updated on changing legal requirements for UK businesses to stay compliant and avoid penalties.

Ensuring your business structure – whether a sole proprietorship, limited company or partnership – is compliant and registered correctly is important! Stay up to date with annual tax and reporting requirements, too.

If you have a location, create a safe working environment that is aligned with health and safety regulations. As for employees, adhere to employment laws and workers’ rights.

Protect your intellectual property by considering trademark registration for your company and its products, if relevant.

Ensure you hold any relevant licenses or permits to operate your business, such as alcohol licenses. Check with local authorities, as this varies across different counties and boroughs.

If your business handles customer data, you must follow General Data Protection Regulation (GDPR) rules to protect your customer’s privacy.

Find support for your UK business

Starting a business and keeping it running healthily can be challenging, but you’re not alone! Check out the following resources and support to guide you along the way.

The UK government offers low-interest startup loans to help you start your business. These loans are a great way to secure initial funding. Contact the government’s Business Support Helpline for advice on starting, growing, or restructuring your business.

Explore the various tax relief schemes and incentives for startups, like the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS).

Many regions have specific business support organisations that can provide local insights, networking opportunities, and funding advice. Join your local Chamber of Commerce to connect with other business owners, attend networking events, and access valuable resources.

Remember, finding support for your business is like building a support network. Don’t hesitate to explore these resources—they’re here to help you succeed.

FAQs about registering a business in the UK

What’s the first step in getting my UK business started?

It all starts with choosing your business type, whether you’re a one-person show, a limited company, or teaming up in a partnership. Once that is sorted, you’re ready to start your registration journey…

How can I make sure my business name is unique and good to go?

Checking if your business name is available is easy. Just hop onto the Companies House website or use their handy name checker tool. You want a name that’s just as unique as your business idea!

What papers do I need for the UK business registration process?

The paperwork can vary depending on your business type. But generally, you’ll need your ID, proof of where you’re at, and any relevant business documents you might already have.

Is there a difference between registering a business name and a trademark?

Absolutely. Registering your business name with Companies House doesn’t mean it’s trademarked. Consider getting a trademark if you want to shield your brand from copycats.

How long does registering a business in the UK take?

The waiting game can differ depending on your business type and how you apply. Some solo ventures might be ready to roll in hours, while bigger operations could take a few weeks.

Do I need a business bank account?

While it’s not set in stone, having a dedicated business bank account is a pretty good idea. It helps keep your finances separate and straightforward to keep those tax records straight!

What are the ongoing legal requirements for UK businesses?

Staying on the right side of the rules means things like annual filings, tax returns, and reporting duties. The specifics depend on your business structure, so staying updated and meeting these requirements is essential.

Can I change my business structure after registration?

You’re not locked into your business structure. If you fancy a change, chat with an advisor to help you switch things up!

Remember, these FAQs are only a guide through the registration process. If you’ve got more questions or need a hand, don’t hesitate to contact the pros at Companies House or a certified accountant. Good luck on your business journey!

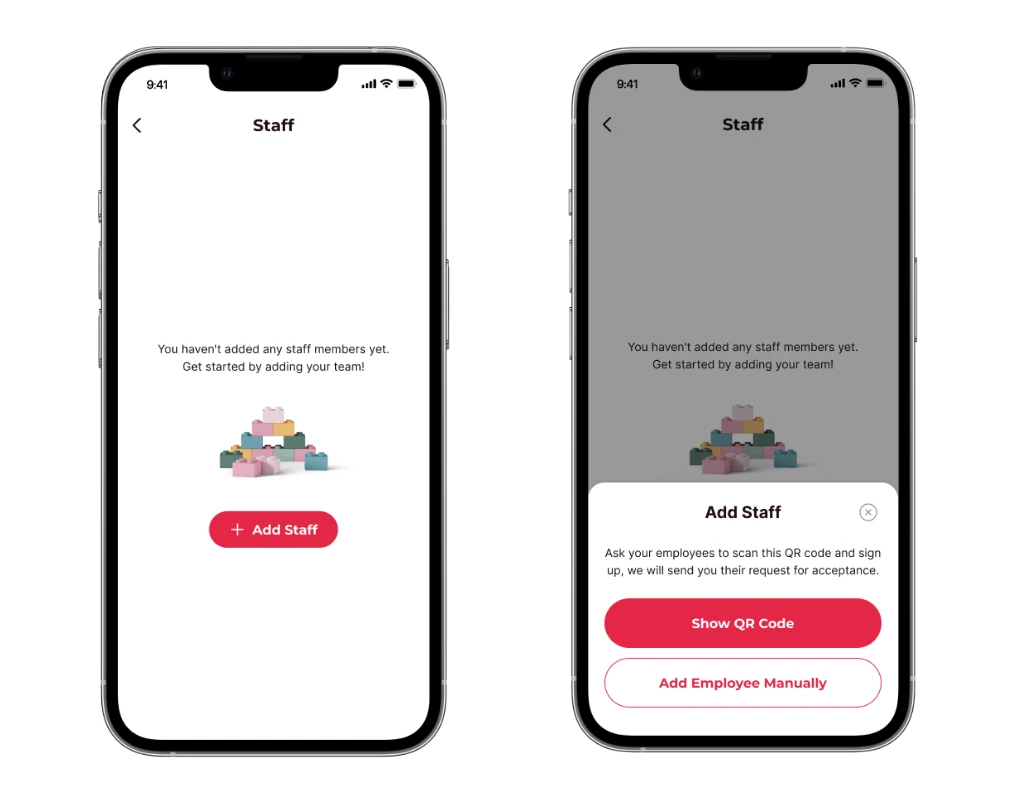

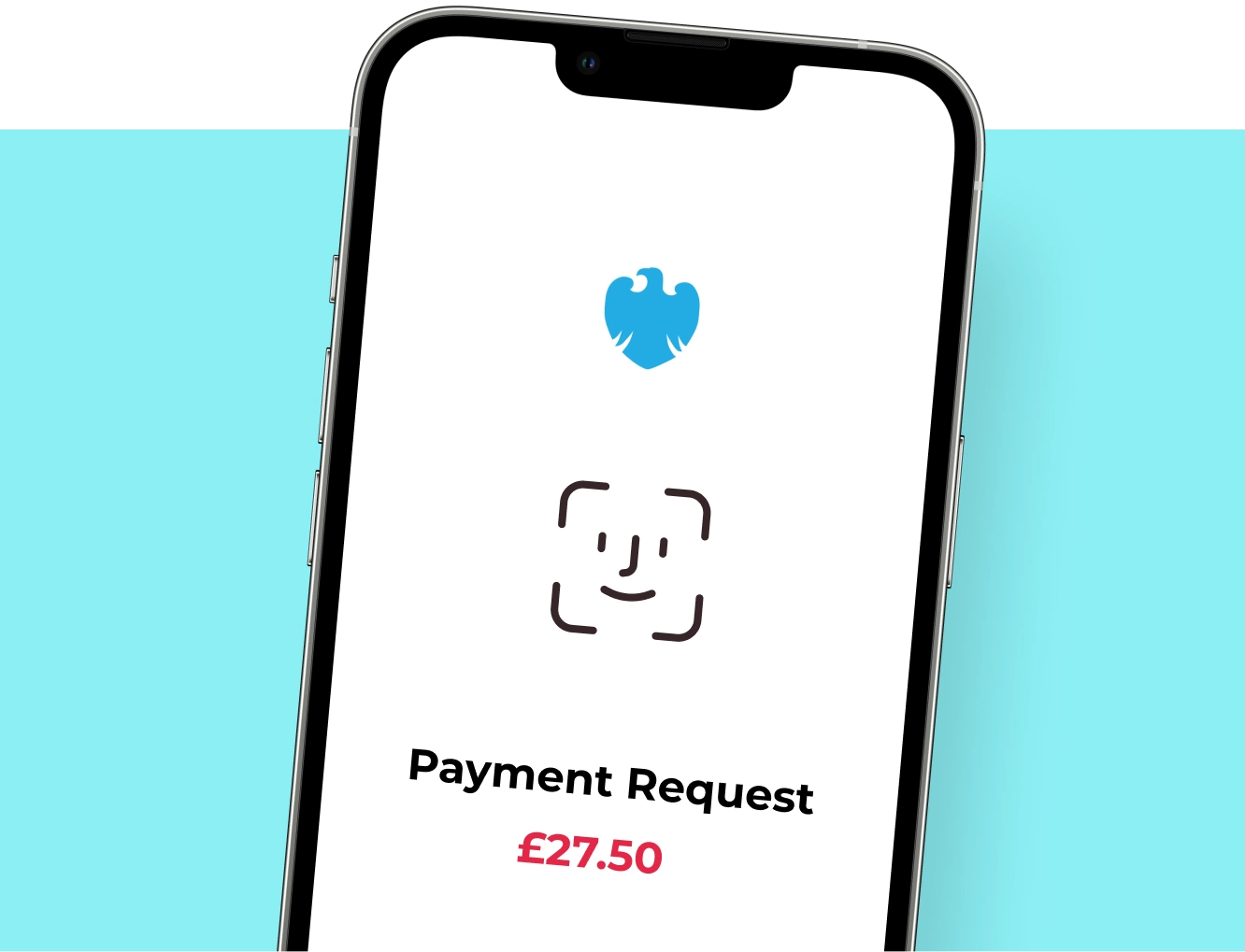

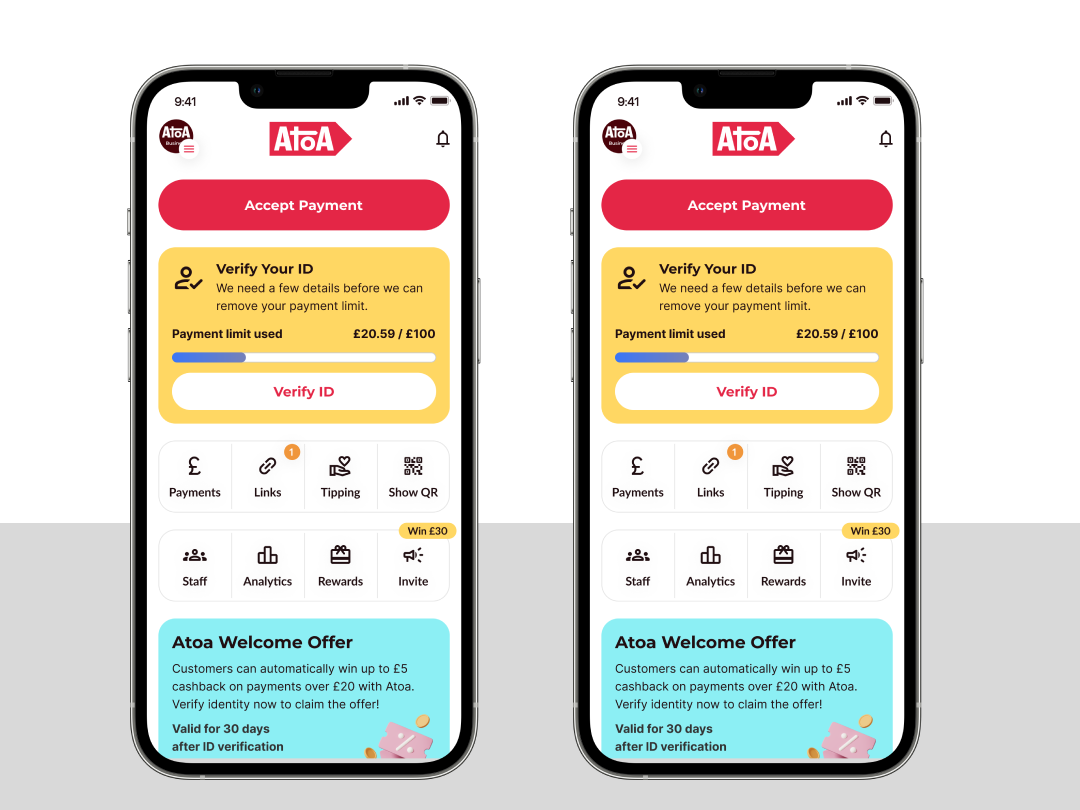

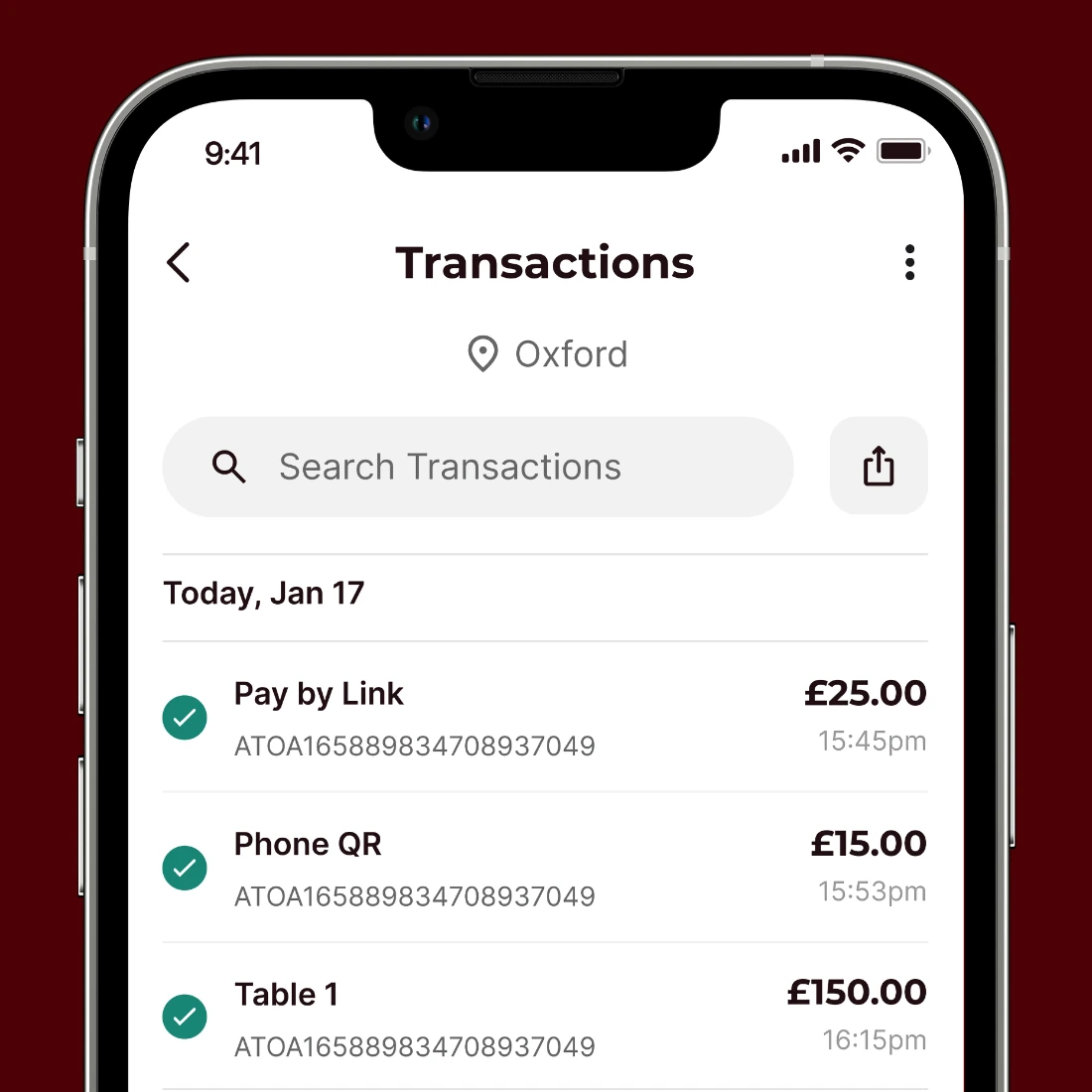

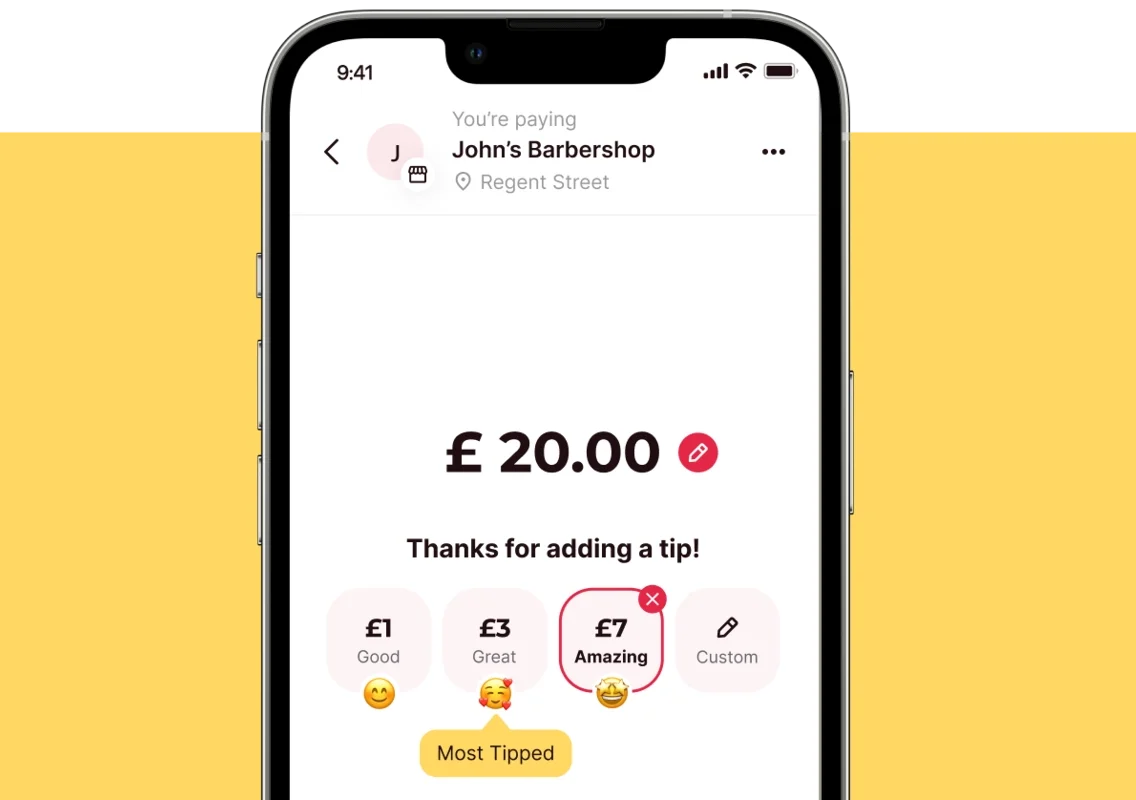

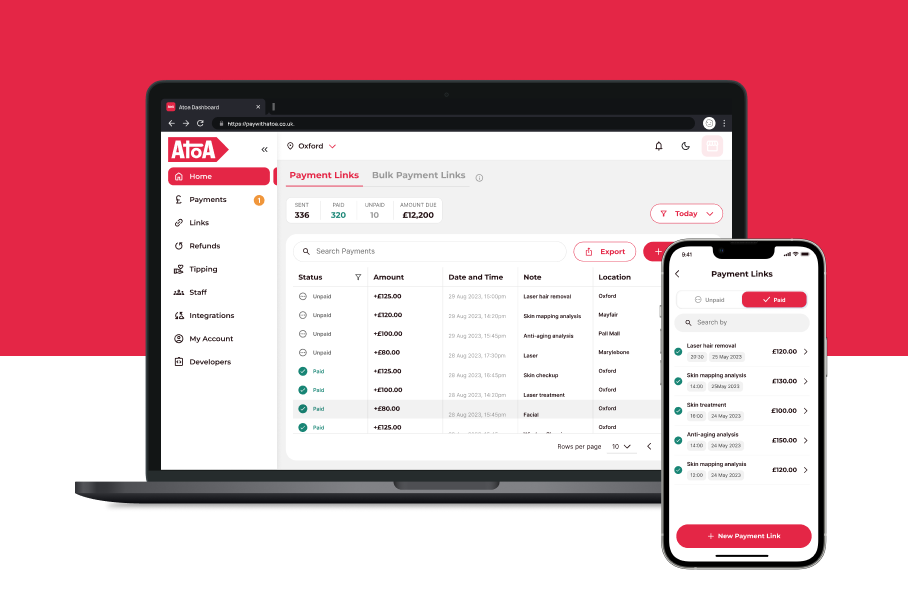

Looking for a payment solution for your new business? Why not give Atoa Business a test drive with 14 days of completely free transactions when you sign up? Follow the banner below to download and create an account with us today to see what the fuss is about…