Remember the days of fumbling with bills, dipping chipped cards, and waiting for receipts? Fast forward to 2024, and diners are looking for convenience. Enter contactless payments in restaurants: the instant and secure solution that’s adding a little spice to the way we dine. But with POS competitors all vying for attention, how can your restaurant stand out in the contactless game?

In this article, I will explore:

- Why customers and businesses love using contactless payments in restaurants.

- How to choose the best digital payment method for your business.

- What the future holds for contactless payments.

- How Atoa can help.

Contactless payments, simplified

Forget jargon; let’s keep it straightforward. Contactless payment means paying without physically placing your card in the terminal. Think tap-and-go with your debit or credit card or a quick scan with your smartphone using Apple Pay or Google Pay. It’s fast and secure and lets diners enjoy their food and drinks as fast or slow as they like. But why are these types of payments so important when we go out to eat?

Why customers love contactless payments in restaurants

Your restaurant’s success hinges on satisfied customers. And what makes them happier than a seamless, contactless payment experience? No more waiting for the card machine or worrying about germs on shared devices. Contactless payment is the secret ingredient for a frictionless dining experience, boosting both speed and hygiene.

A few reasons why customers love to tap and pay…

- Wine, dine, and go: No more waiting for servers to process cards or bring over change. Tap-and-go or QR code payments help reduce queues and improve dining experiences.

- Less waiting around: QR code systems allow customers to view and pay their bills directly on their phones, which means no more waiting for staff.

- Fuss-free bill splitting: Split that shared pizza in just a few taps to avoid on-the-spot maths and incorrect totals.

- Reduced risk of fraud: Contactless payments often involve PIN or fingerprint authentication, making them less susceptible to fraud and unauthorised payments.

- Peace of mind: Customers usually eat out so they can relax and not worry about washing up, so helping them know their payment is secure can leave customers feeling more relaxed.

- Tech, please: Contactless payments make dining feel cutting-edge, which appeals to customers who appreciate convenience and innovation.

- Seamless integration: Many restaurants can pair payments with online ordering or reservation systems, creating a smooth experience from start to finish.

- Loyalty programs: Many contactless payment systems feature cashback offers, allowing customers to earn and redeem points on certain visits.

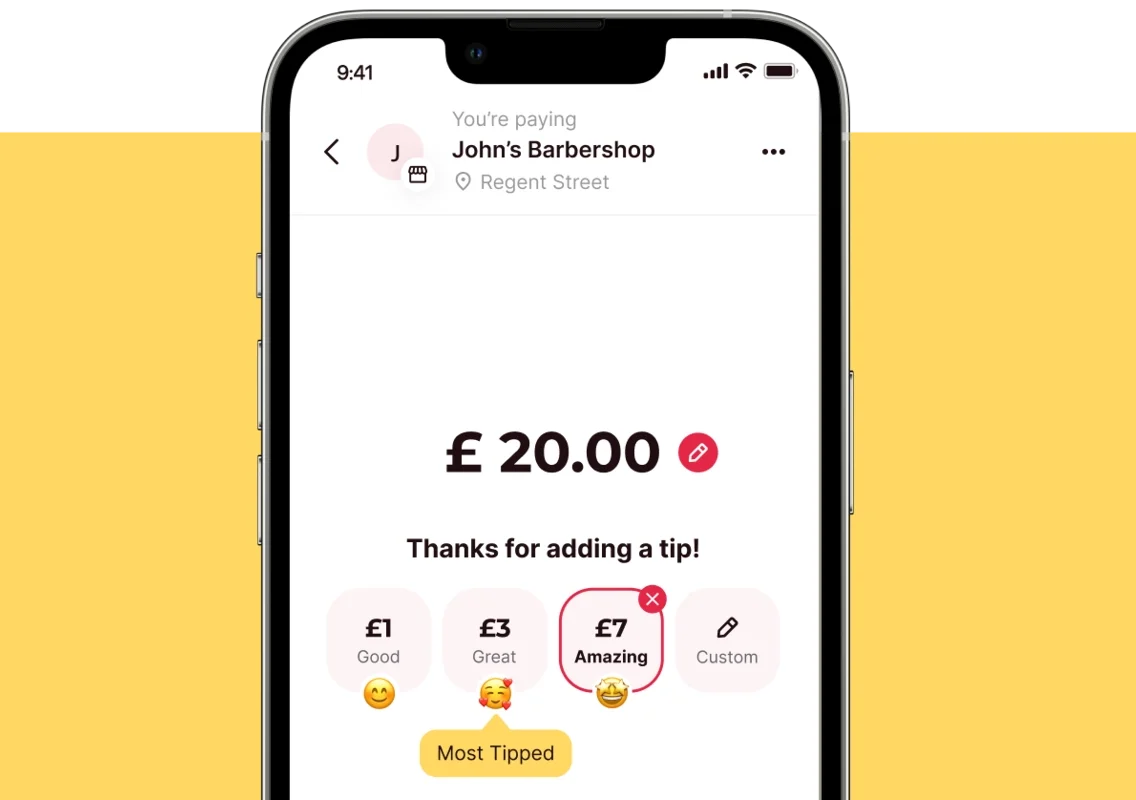

- Potential for higher tips: Studies suggest that customers tip more generously when using contactless payments, possibly due to the perceived ease and speed of the transaction. We built a flow for that!

Overall, adding contactless payments offers a win-win situation for both restaurants and customers as they provide convenience, speed, and a modern dining experience. In turn, this makes them a popular choice in today’s fast-paced and tech-focused world.

And the benefits for merchants…

We can’t miss you, the merchant, out. Contactless payments let you wave goodbye to checkout queues. Tap or scan to pay payments can help speed up the dining process, freeing up your staff to focus on what they do best: service with a smile. Don’t forget the improved cash flow when you get paid instantly with contactless payments, unlocking smoother operations for your business.

And you better get used to those tips. Studies show that contactless payments lead to higher gratuity. And guess what? We built a subtle tips option into our payment flow, which can increase takings by 5-10%.

Embrace the future! Because it’s definitely coming. Offering contactless options shows your customers you’re at the forefront of the restaurant industry and want to make it easy for diners.

Which contactless method is best for my restaurant?

Is a QR code contactless payment better than a debit card payment? It’s a very good question. It’s the kind of answer that depends on the business needs and customer preferences. Interestingly, a survey in April 2021 found that 37% of people in the US and UK were willing to use QR code payments in bars and restaurants. Why? Because QR codes are fast, secure, and completely contactless. However, the advantages and disadvantages of both methods are still worth weighing up.

Contactless QR code payments vs debit card payments

| Feature | QR code payments | Debit card payments |

|---|---|---|

| Cost | Lower setup costs. Often managed on a smartphone. Typical transaction fees sit below 1% but vary by provider. | Higher setup costs. Requires purchase or rental of card readers and terminals. Typical transaction fees are around 1% but vary by provider. |

| Speed | Fast, but they may require the customer to scan an app and complete payment in their smartphone browser. | Very fast, contactless tap-and-go transactions. |

| Security | Secure and usually protected with biometric steps like face or fingerprint ID and 2FA. | Uses advanced encryption and authentication. It’s easy to make unauthorised payments if a card is lost or stolen. |

| Customer preference | Growing popularity in the UK, especially among younger demographics. Integrates with popular UK banking apps and POS. | Familiar and widely accepted payment method. |

| UK business benefits | Integrate with popular UK banking apps to avoid card rails, which is ideal for contactless payments in restaurants, food stalls and salons. | Widely supported by UK banks and POS systems. |

| Integration and flexibility | Easily integrates with POS and accountancy software. Flexible for in-person, remote, online, and invoice payments. | Contactless card payments can only be made in person. |

| Things to consider | Consider customer preferences and your business needs. Pitch QR code payments through staff and in-store signs. | Be aware of the costs from security risks like chargebacks and cancelled payments. |

What’s a winning recipe for restaurant payments?

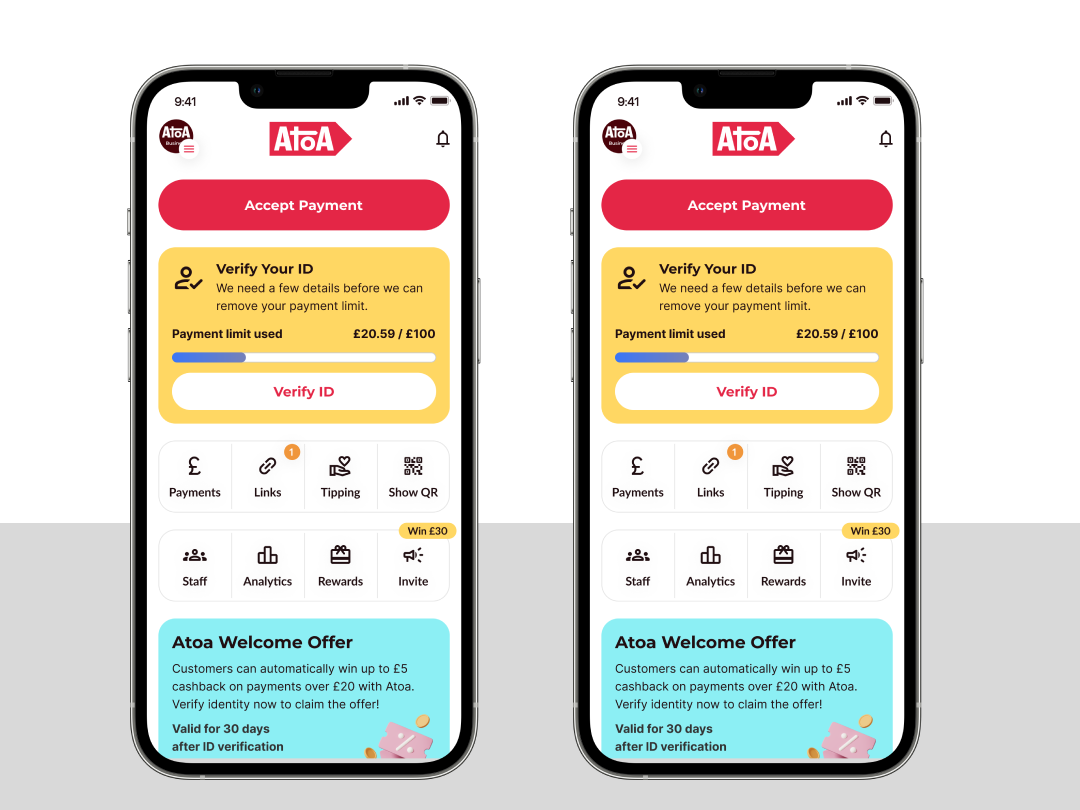

While our competitors offer basic contactless options, Atoa brings extra flavour to the table with fair fees and rapid payouts. We’re the secret recipe behind your restaurant’s contactless payments, which will leave other businesses wondering, “Just how do they do it?”

Here’s what sets us apart:

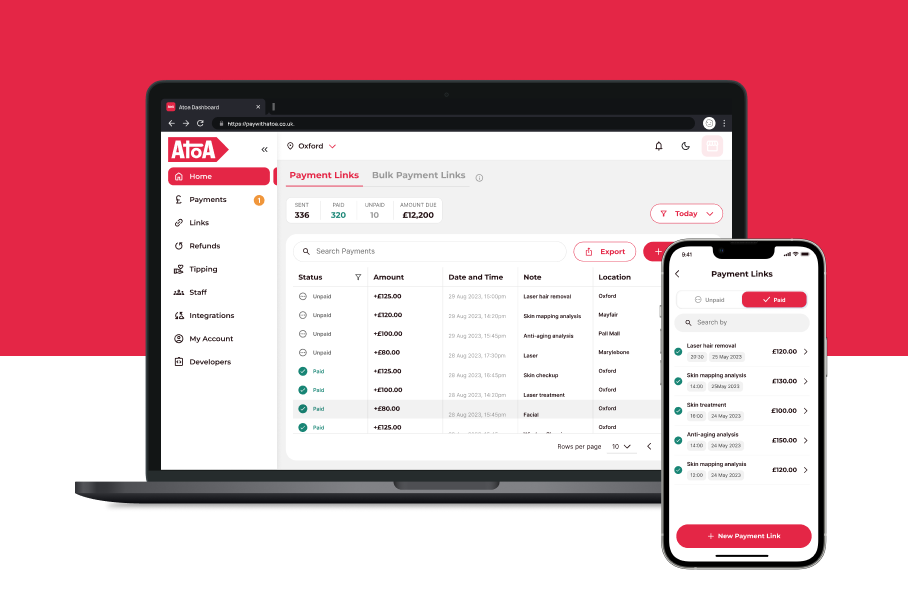

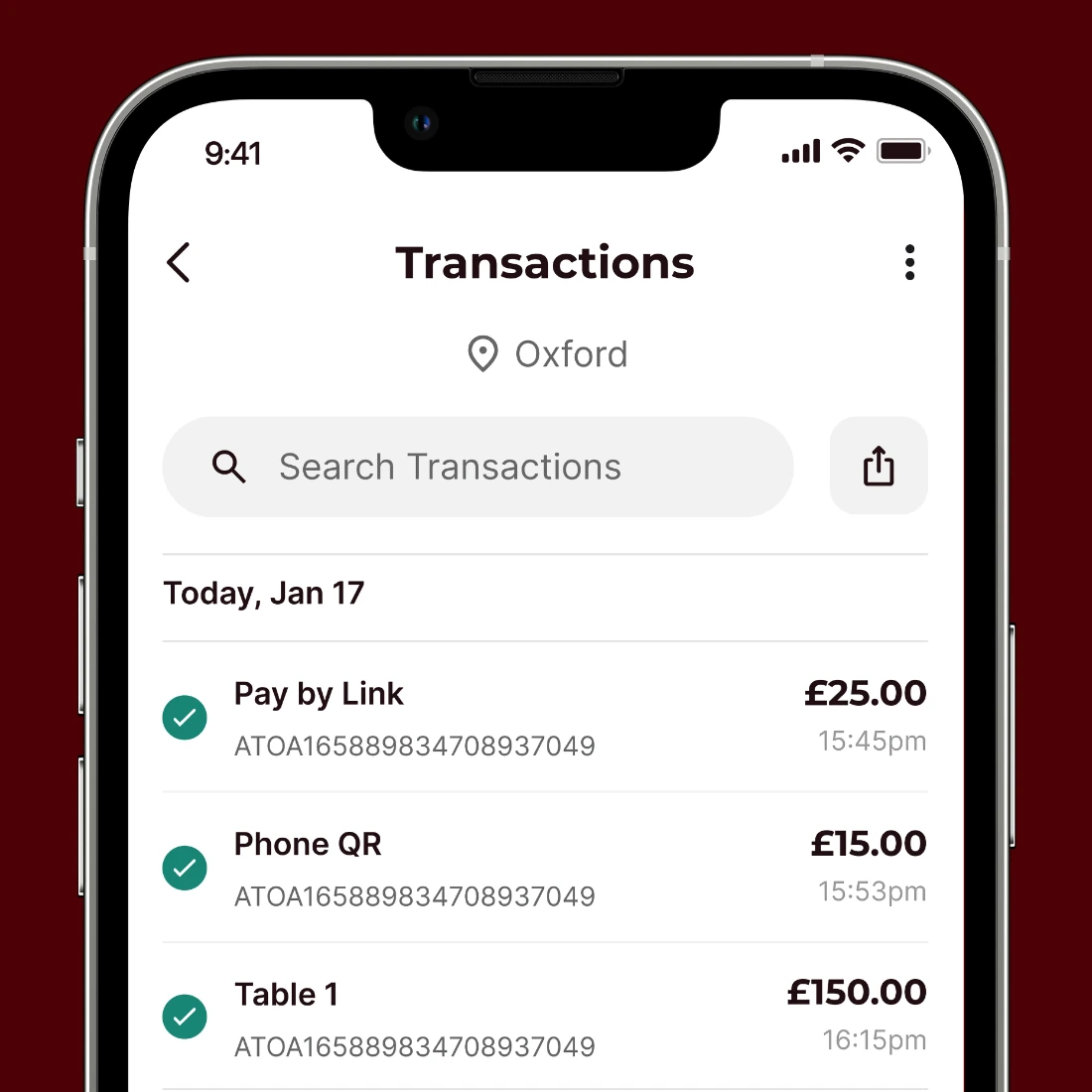

- Instant payments: Transactions are made directly in your customer’s bank app, with money sent to your bank account in seconds.

- Seamless integration: Enjoy easy integrations using your existing POS system without expensive hardware shopping lists.

- Bank-level security: We prioritise data security with advanced encryption and fraud prevention measures to keep your customer’s information safe. Furthermore, each payment is confirmed by face or fingerprint ID to reduce chargeback.

- Beyond the basics: Go beyond tap-and-go with innovative features like QR payments on table stickers or self-service kiosks, putting the power in your customers’ hands.

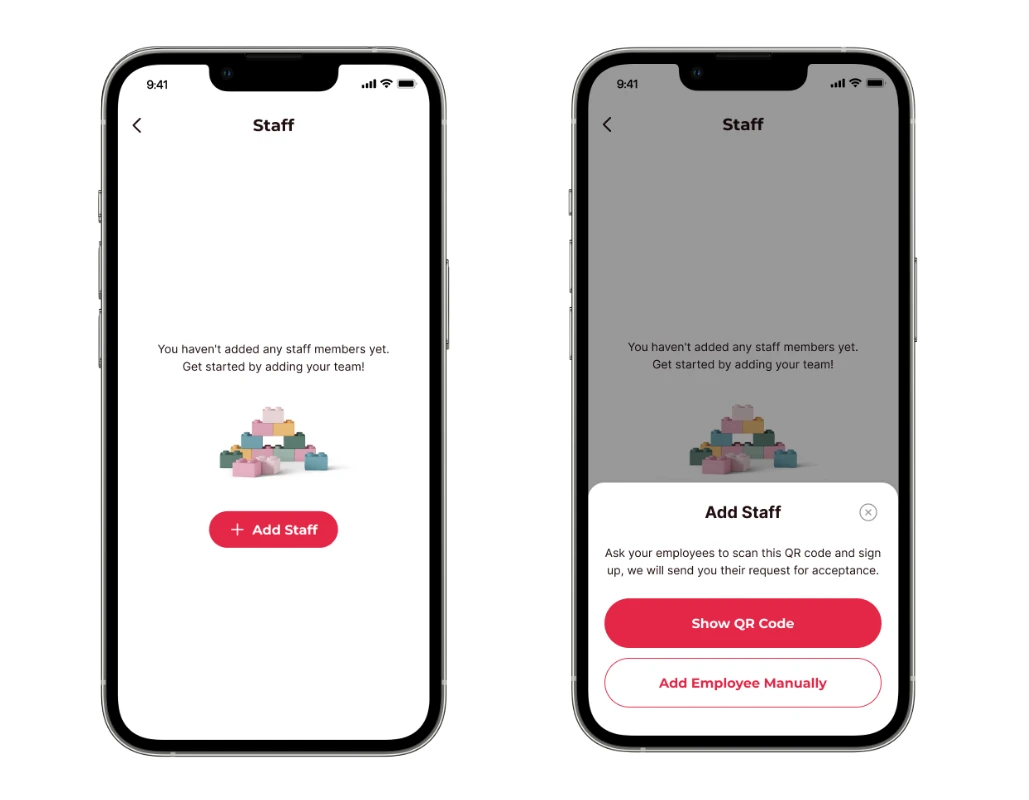

- Add staff for payments: Got a team raring to go? If so, add employees to Atoa as cashiers or supervisors and make your payments even more efficient.

- Plus, easy tipping: Adding staff also allows them to take easy tips during payment helping boost takings by up to 5-10%.

- Are you growing a mini-empire? You can also add other locations or businesses on your Atoa app to manage payments and staff in one place.

FAQs

How secure are contactless payments?

Contactless payments are regulated to protect your transactions from fraud. However, you should always be careful with your card or device and report any suspicious activity to your bank or payment provider. QR codes protected with biometric steps are much more secure (in our humble opinion!)

What rules and regulations protect contactless payments?

Contactless payments are subject to the same rules and regulations as other payment methods, such as the Payment Services Regulations 2017 and the Consumer Rights Act 2015. Additionally, contactless payments in the UK and EU must comply with the Secure Customer Authentication (SCA) requirements, which strengthen security online and remote transactions.

How much can I spend with contactless payments?

The UK government has increased the contactless payment limit from £45 to £100 in October 2023. Some payment providers may have limits or restrictions on contactless payments, but they will tell you at checkout.

How do contactless payments affect my spending habits?

Contactless payments offer convenience and speed, but they may also affect your spending habits. Therefore, you should always monitor spending and budget carefully to use contactless payments responsibly. Open banking has helped many consumers manage their finances better, thanks to budgeting and spending category tools.

Ready for your first bite?

Don’t settle for basic contactless solutions. Choose Atoa to savour the benefits of a truly integrated, secure, and data-driven payment experience. Book a free demo today or visit our Knowledge Hub, and let’s cook up a contactless payment solution to make your bar or restaurant really stand out.