Running a business in the UK isn’t easy. You’ve got the whole creative and planning process to tackle; then, you must register your business correctly. Once you’re up and running, there’s staff, stock, rates and taxes to juggle, not to mention bouts of terrible weather! Jokes aside, one of the most daunting hurdles owners face is UK payment regulations and compliance. If you’re new to the game, it may feel like a tall order, but this blog post aims to break it down into something more manageable.

What are Payment Service Regulations?

Start your UK payment regulations journey with the bare essentials! First on the list, let’s define Payment Service Regulations or PSRs. Introduced in 2018, they’re the main rules that govern payment services here in the UK. They maintain the payment system so money can move between businesses and individuals securely and efficiently. PSRs cover various services, from card payments to bank transfers, aiming to make your transactions flow without the slightest hitch.

The UK used PSRs to implement the EU’s PSD2. They require any business or person who provides in-scope payment services regularly to be authorised or registered.

In-scope payments include traditional and open banking methods such as:

- Direct debits

- Credit transfers

- Debit card payments in-store and online

- Standing orders

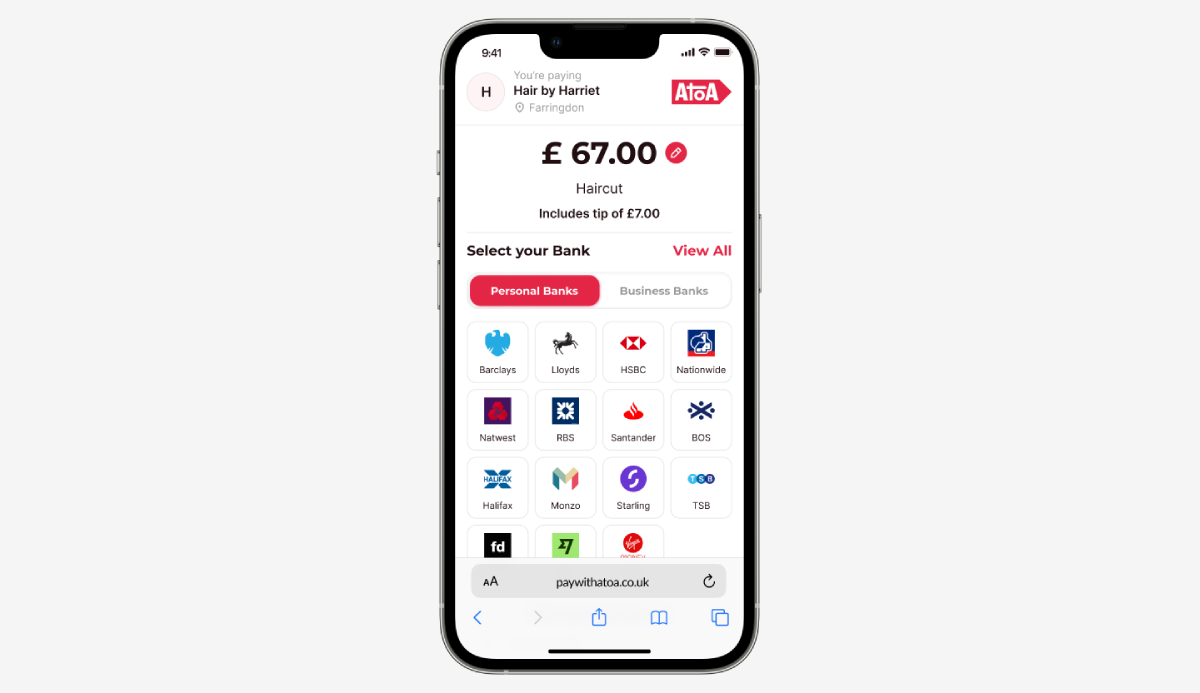

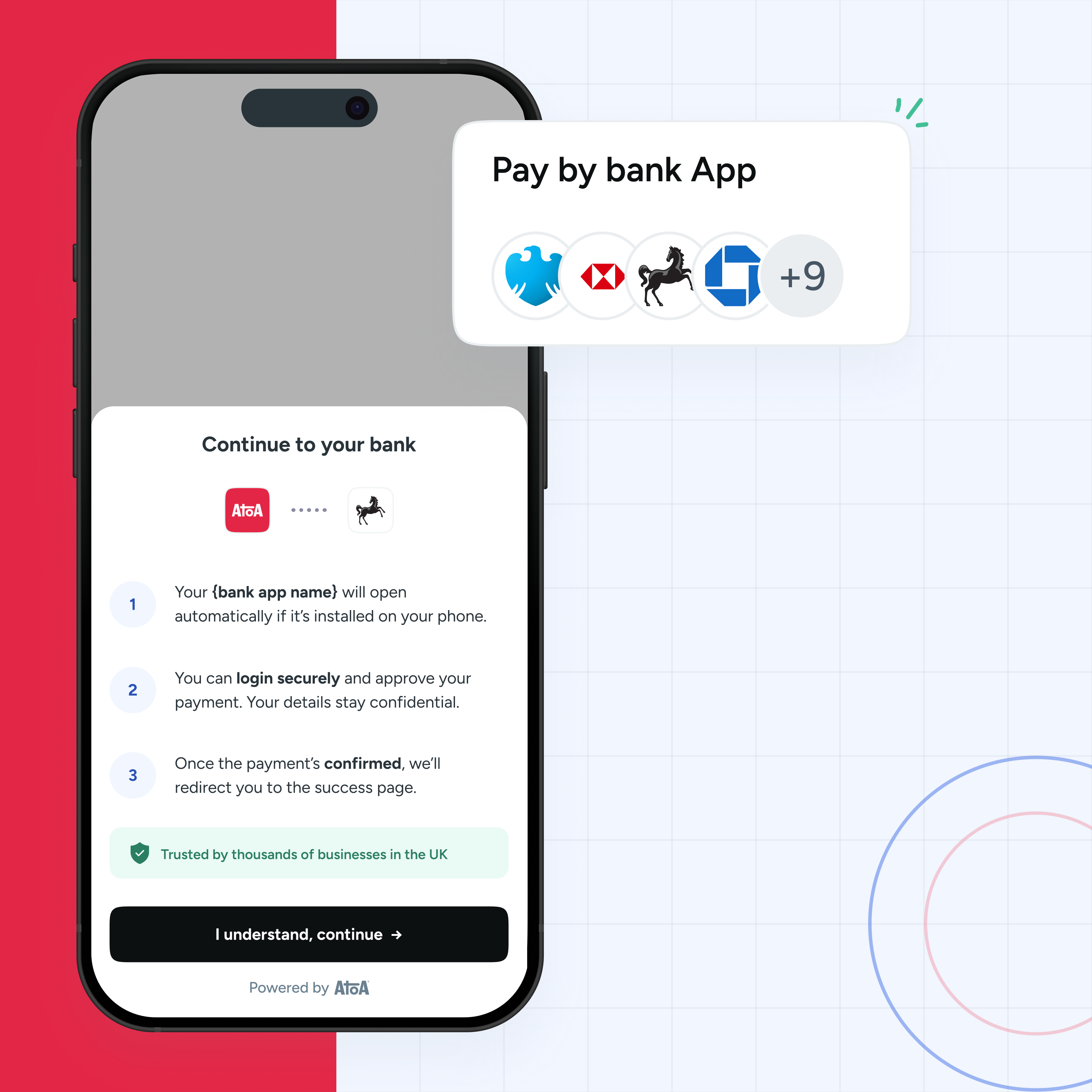

- Payment initiation services that transfer money from one bank account to another

- Account information services

Why do businesses need to follow PSR?

Understanding PSR is crucial for any UK business, big or small. These regulations safeguard money and give your customers peace of mind. When customers feel secure making payments, they’re much more likely to do business with you. Plus, complying with PSR isn’t just about avoiding fines; it’s about building trust, growing your business, and staying ahead of the competition.

Imagine you run an online homeware store. Your customers often pay online using debit or credit cards. If you’re not up to speed with PSRs, you might unknowingly mishandle card payments, leading to privacy issues and customer complaints. If you’re clued up on the rules, your payment process will be smooth and secure, keeping customers happy to encourage repeat business.

How does Payment Service Regulation work in the UK?

In the UK, PSRs are overseen by the Financial Conduct Authority (FCA), who ensure everyone plays by the rules. The FCA do this by issuing licenses to payment providers and monitoring their activities. If you want to provide payment services, you’ll need an FCA license. They evaluate your business model, checking it complies with PSRs. If everything’s in order, you’ll get the green light to operate.

Changes and developments in regulations

You better believe the payment services landscape moves fast, and so do its regulations! Significant changes have occurred in recent years, like the Payment Services Directive 2 (PSD2). This European directive aims to improve security and boost innovation in payment services.

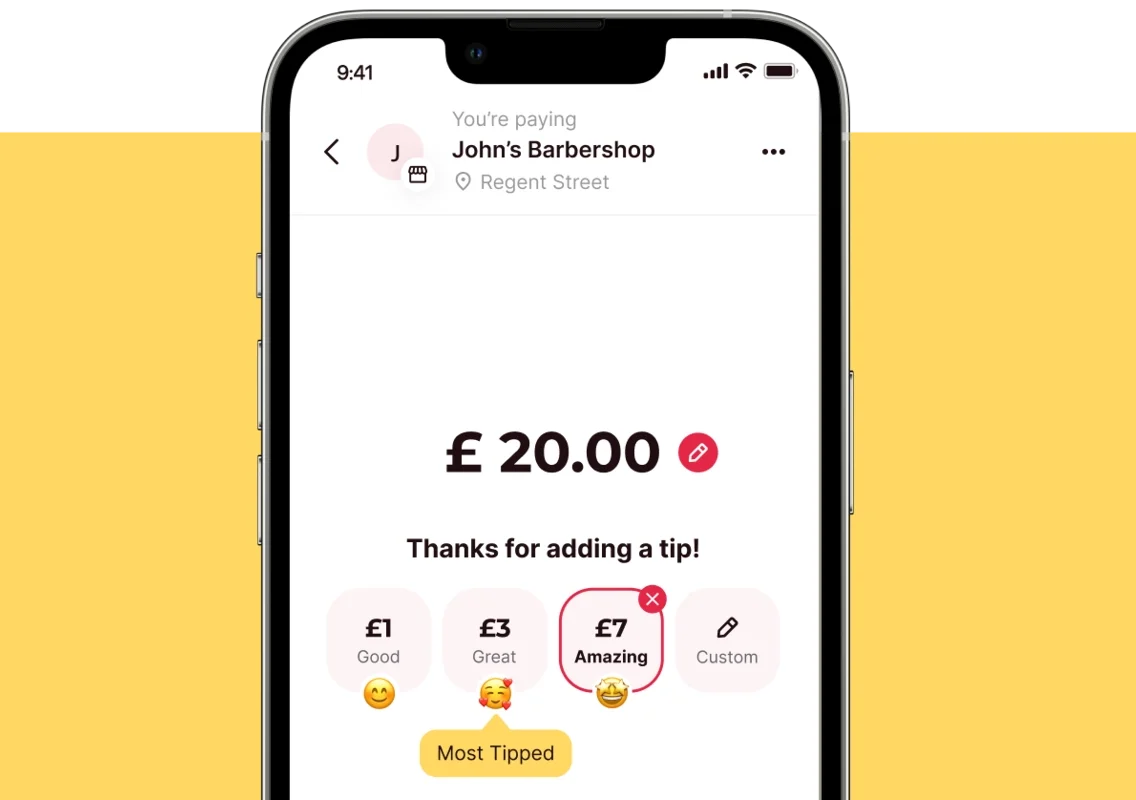

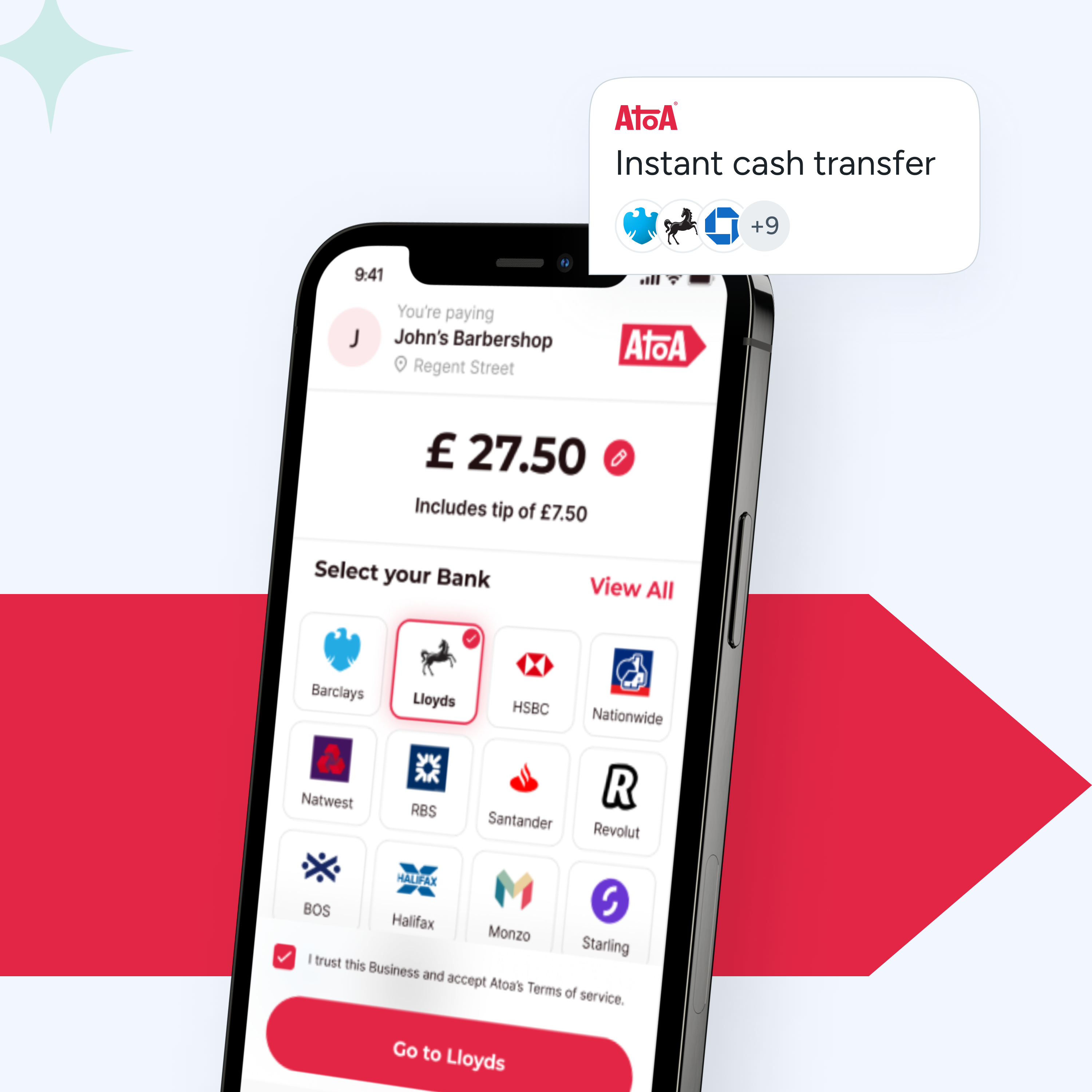

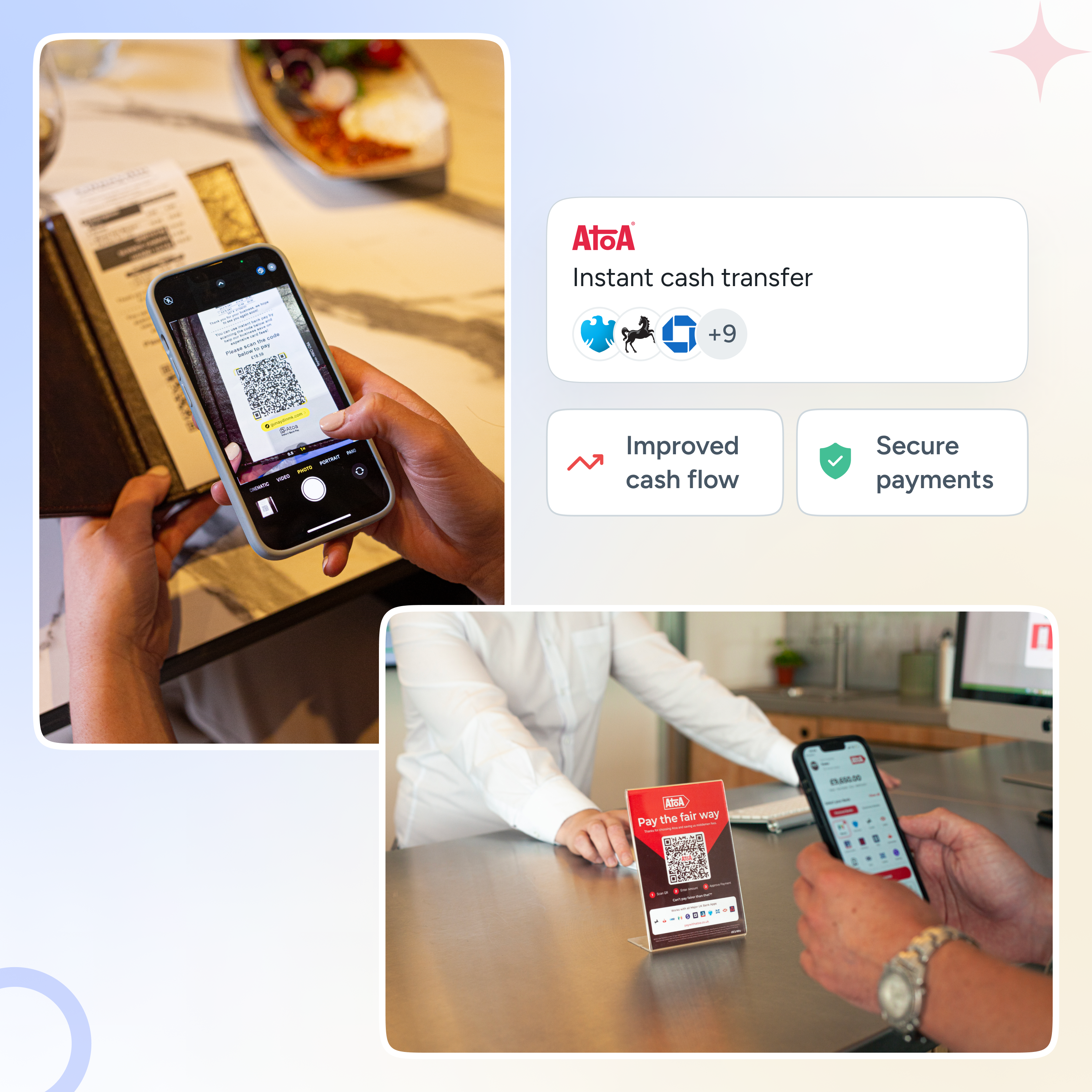

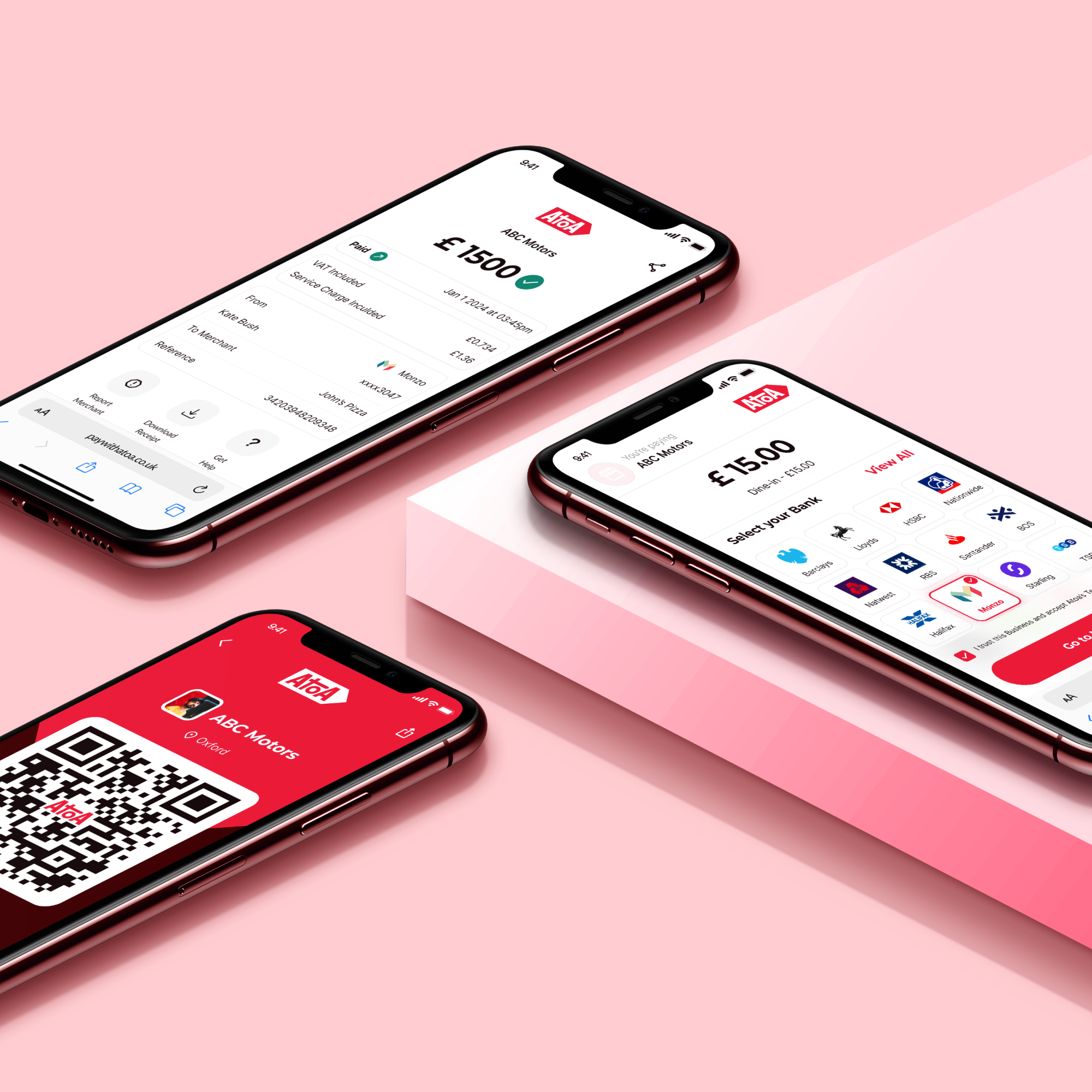

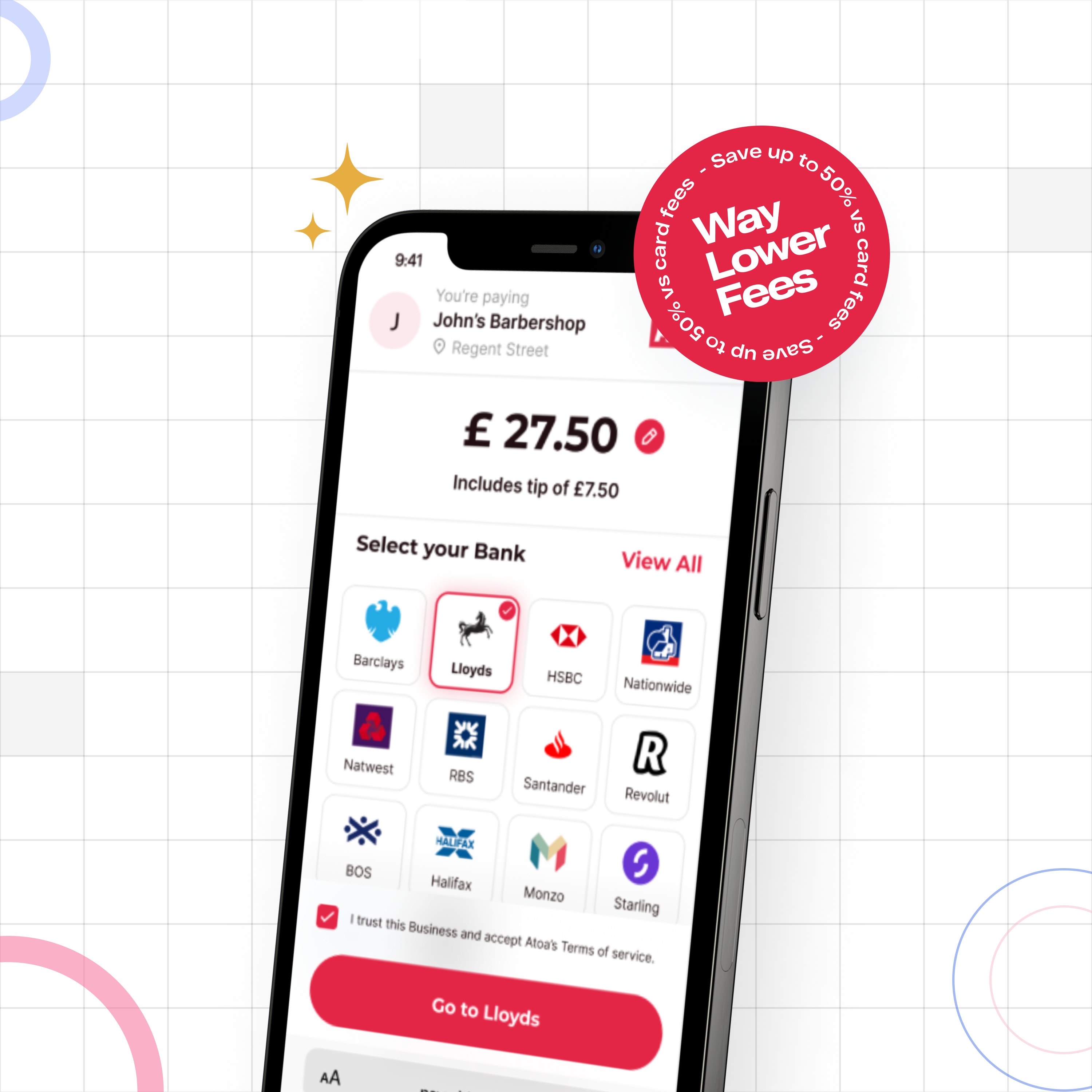

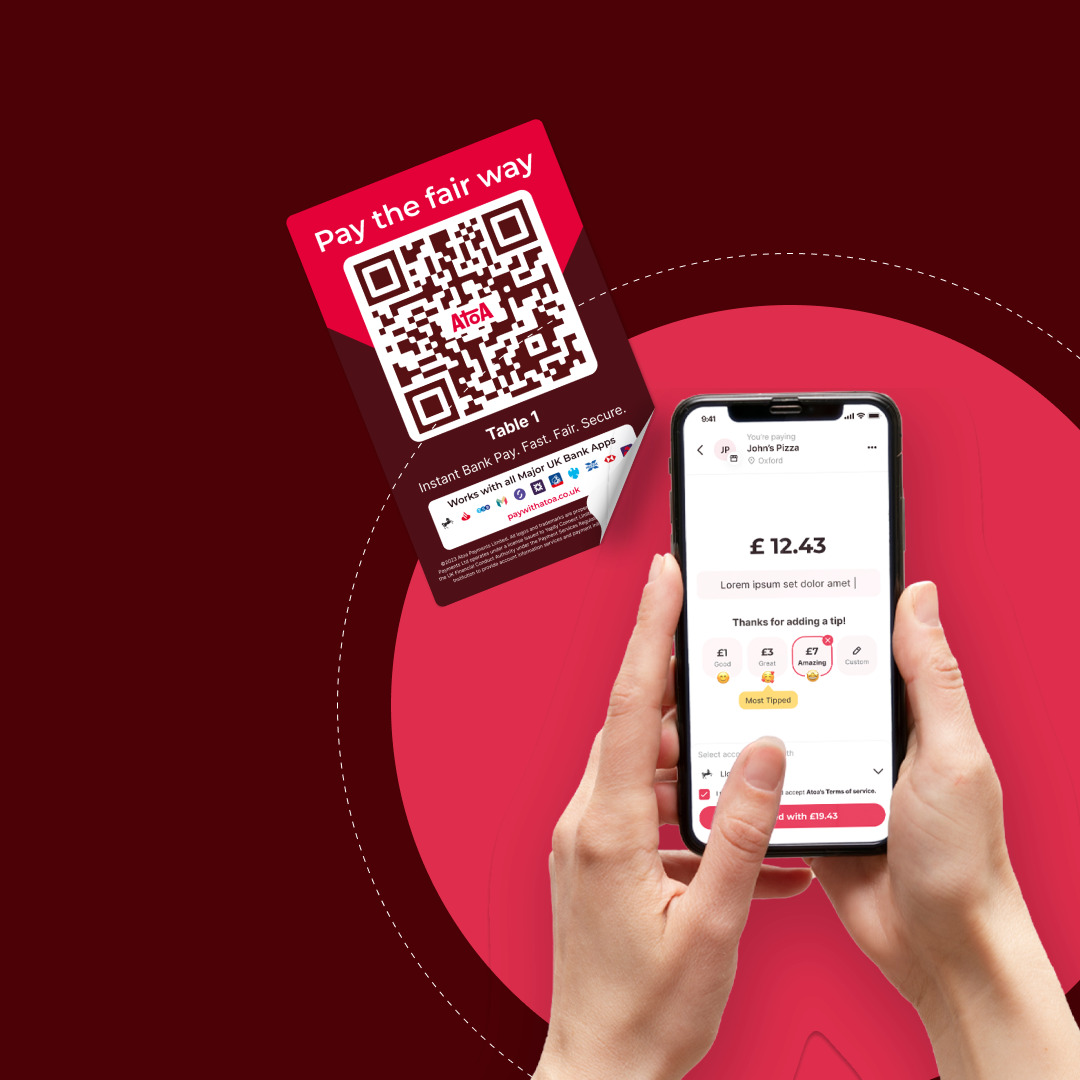

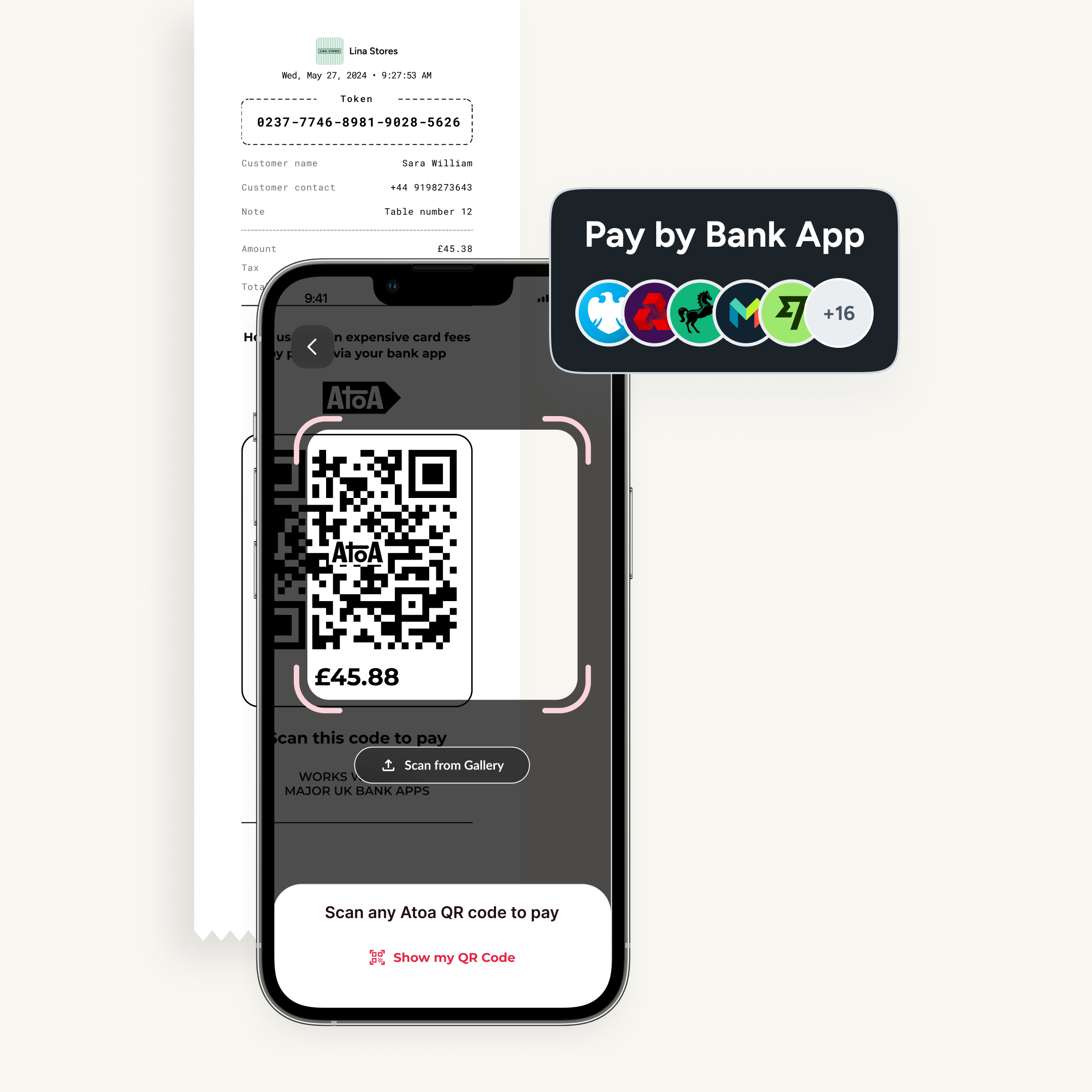

Thanks to PSD2, merchants can enjoy better protection using secure open banking payments. Payment innovations like these have opened avenues to lower fees, enhanced chargeback protection and a more streamlined experience. How hospitality operators are using QR code menus and payments is the perfect example of this.

PSD2 also requires businesses to include trong customer authentication (SCA) in online payments, such as confirming transactions in their bank app. Fraud can be a problem in e-commerce, so this extra layer of security means only the authorised cardholder can make payments. It strengthens the trust between businesses and customers and protects merchants from fraudulent transactions.

Remember, UK payment laws are here to guide you. They secure business transactions, help you gain customer trust and follow important industry changes. Keep reading for more intel on how various payment services are affected and ways you can stay compliant.

Payment services vs. payment service providers

Let’s clear up a common source of confusion: the difference between payment services and payment service providers.

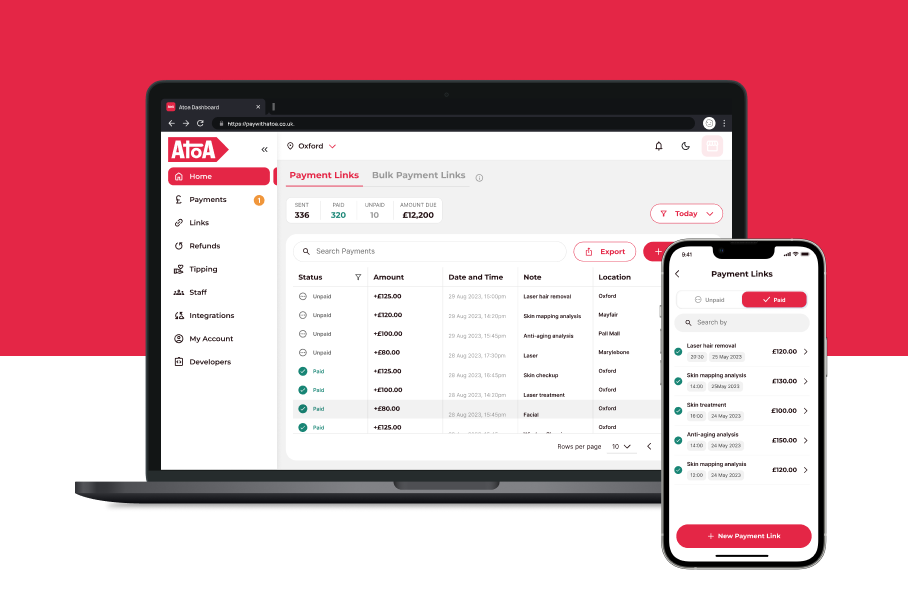

Payment Services refer to how money can change hands, like card payments, direct debits, or bank transfers. Payment Service Providers, on the other hand, are the companies that offer these services. They’re the ones making sure your transactions are smooth and secure.

Think of running a busy bar in the heart of London. You accept a mixture of payment methods from your customers, which are the payment services. But you don’t have the infrastructure to process these card payments, so you partner with a payment service provider (PSP). They work behind the scenes to deliver payments safely to your business account.

Types of payment services regulated in the UK

Payment services are the gears that keep your operation running smoothly. In the UK, these services range from card payments and bank transfers to mobile wallets and QR codes. Each service has its own set of rules and regulations that keep them well-oiled. If a business accepts a wide range of payment methods, they have to keep them working correctly by following the specific regulations each service comes with.

Which businesses need to comply?

You’re probably wondering whether Payment Service Regulations apply to your business. The answer largely depends on what you offer and to what scale. In the UK, most businesses that handle payments are subject to at least some regulations. Compliance isn’t just for the big players, though; small businesses also play an important role in maintaining payment services.

It’s likely your POS provider or payment processor is covering most of it for you, leaving you to focus more on data protection such as GDPR. If you are unsure whether your business needs to comply with the PSRs, contact the FCA.

So there you go: UK business owners need to understand the various payment services available and know which regulations apply to them to stay up to speed. In our next section, we’ll dive into the benefits of compliance, helping you see why playing your part pays dividends.

The business benefits of compliance

It’s about more than just staying on the right side of the law and avoiding fines and fuss; adhering to PSR in the UK comes with many benefits, too. Let’s fish around for just a few:

Customer trust: Compliance demonstrates to your customers that their financial transactions are safe and secure, bringing you repeat business.

Staying within the law: Adhering to payment regulations keeps you on the right side, avoiding costly fines or legal issues.

Competition: Staying up-to-date with PSR gives you an advantage over competitors falling behind.

Reduced fraud: Many rules, like those in open banking, protect you from chargebacks, fraud and cancelled payments. This saves you time and money forked out on fees and payouts.

Smoother payment experience: Compliance often leads to streamlined and efficient payment processes, benefiting both your business and your customers.

Good reputation: Taking payment regulations seriously may enhance your reputation in the industry and expand your reach. Many customers actively look for businesses that comply with payment regulations.

Risk mitigation: PSR often requires measures to manage payment risks, which can protect your business from unforeseen financial challenges.

Adaptability: If you follow regulations, you’re well-prepared to adapt and add new ones to your operations.

How businesses can stay compliant

As a UK business owner, being in line with Payment Service Regulation doesn’t have to be a headache. Most common issues are fairly easy to avoid with a little organisation and communication. One of the biggest downfalls is getting behind on updates, which can put your business at risk of non-compliance. Combat this by keeping a close eye on any changes, adapting if you need to, and making sure your team understands regulations.

Don’t forget about data security or fall victim to procrastination, as waiting until issues arise can be costly. Instead, be proactive and address problems as and when they come up. Here are a few more ways to help manage compliance:

Understand your regulations

Start by understanding the Payment Service Regulations for your business. Spend some time diving deep into legal requirements and outlining your obligations.

Appoint a compliance officer

If your business is big enough, add a compliance officer to your team to ensure your operation follows the rules. They should help create clear pathways on policies and procedures, outlining how your business meets regulatory requirements. Make sure they are shared with new and existing staff and are easy to access.

Train your employees

Provide training so employees understand the importance of compliance and how to deliver it. Regular training sessions help keep everyone on the same page.

Protect customer data

Compliance often includes data security and protection requirements, so ensure you have secure systems to protect sensitive customer information.

Stay informed with changes in UK payment regulations

To stay informed, regularly check the official sources listed below.

- Financial Conduct Authority (FCA) – the official body overseeing PSR in the UK.

- PSD2 and Payment Services Regulations 2017 – the official text for Payment Services Regulations 2017.

- Gov.uk – Financial Services and Regulation – information on financial services and regulations in the UK.