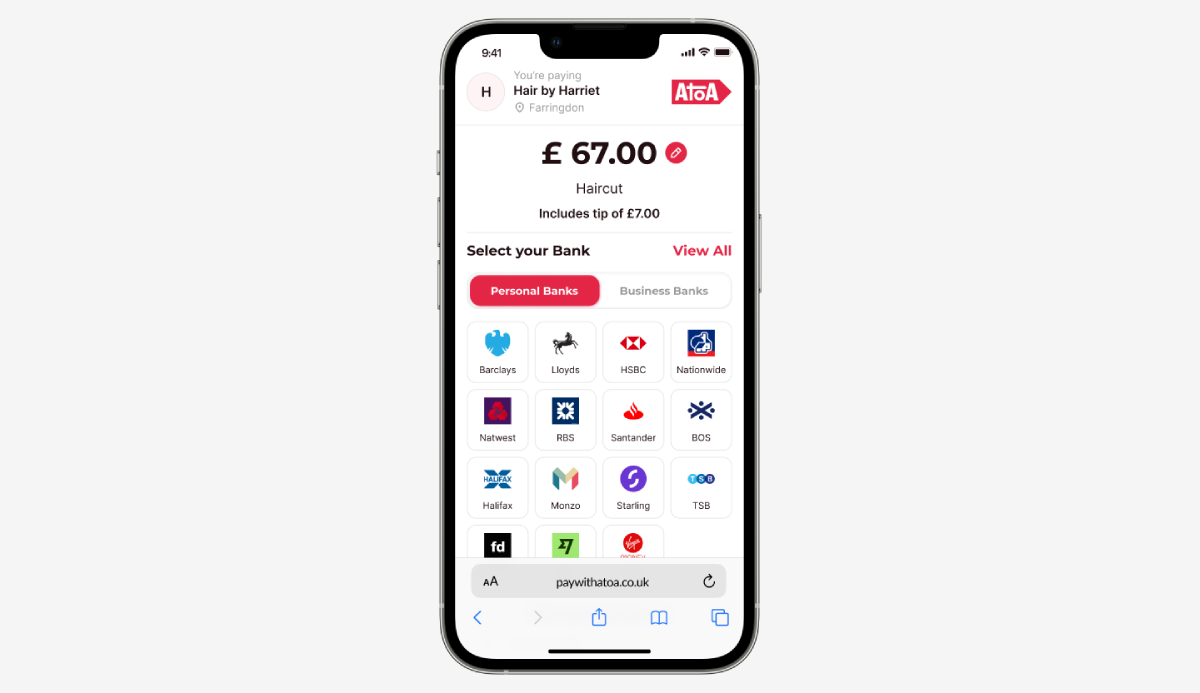

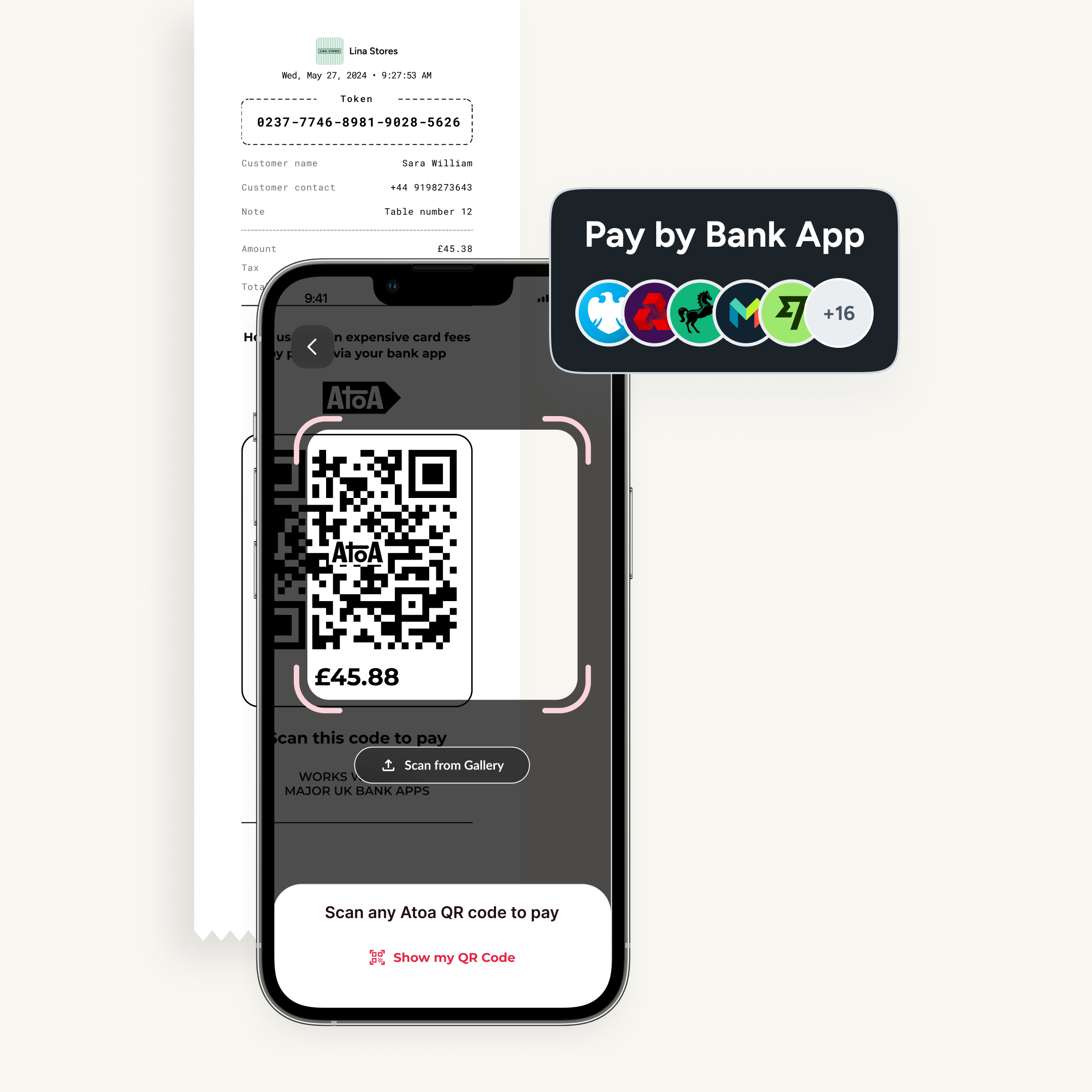

Account-to-account (A2A) payments are steadily on the rise as they offer a number of benefits that traditional payment methods don’t. In a fast-paced world, they’re a convenient, secure and cost-friendly way to send and receive money. As the name suggests, they allow you to transfer funds directly from your bank account to another, cutting out third-party card processors and the unfair fees they impose.

What are the benefits of A2A payments?

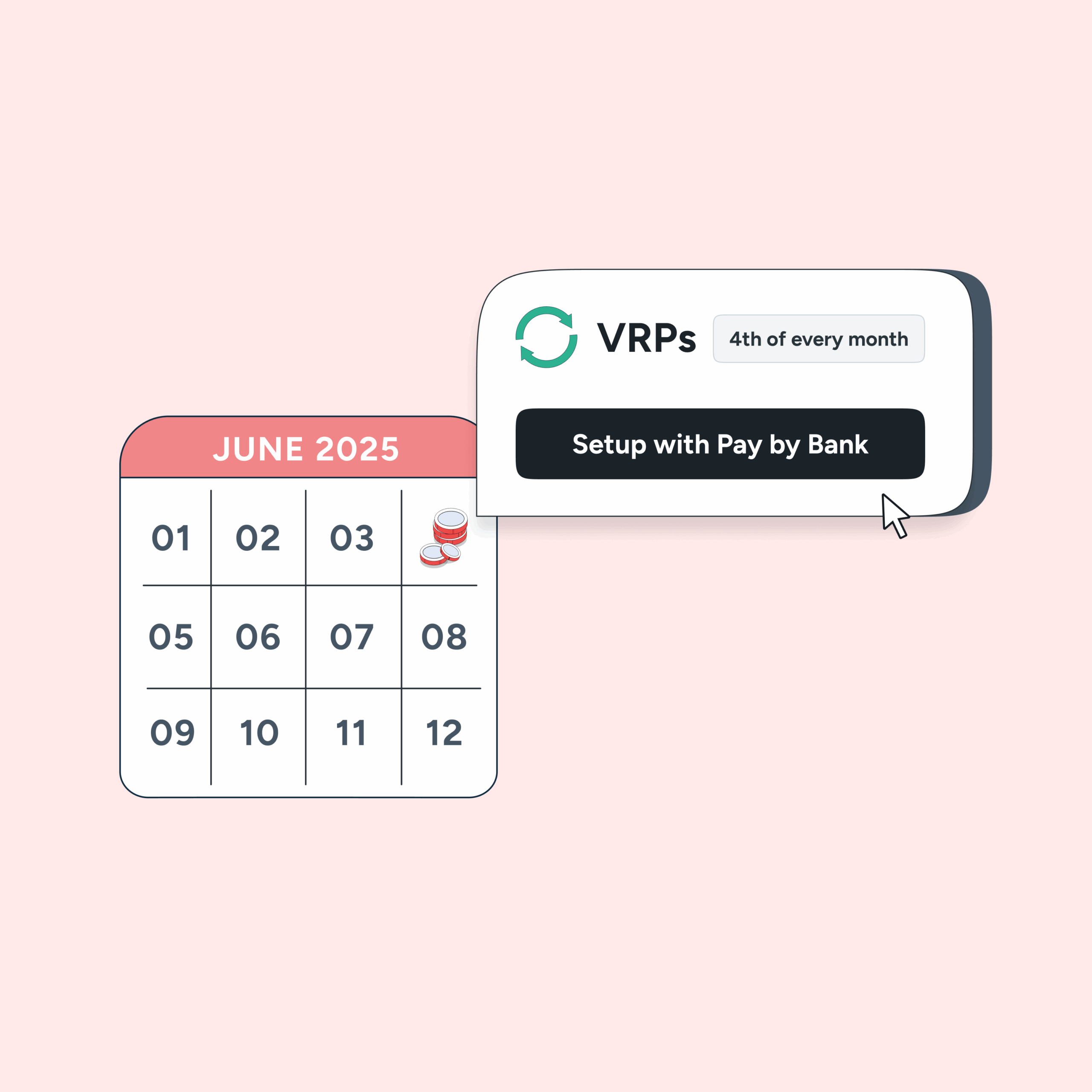

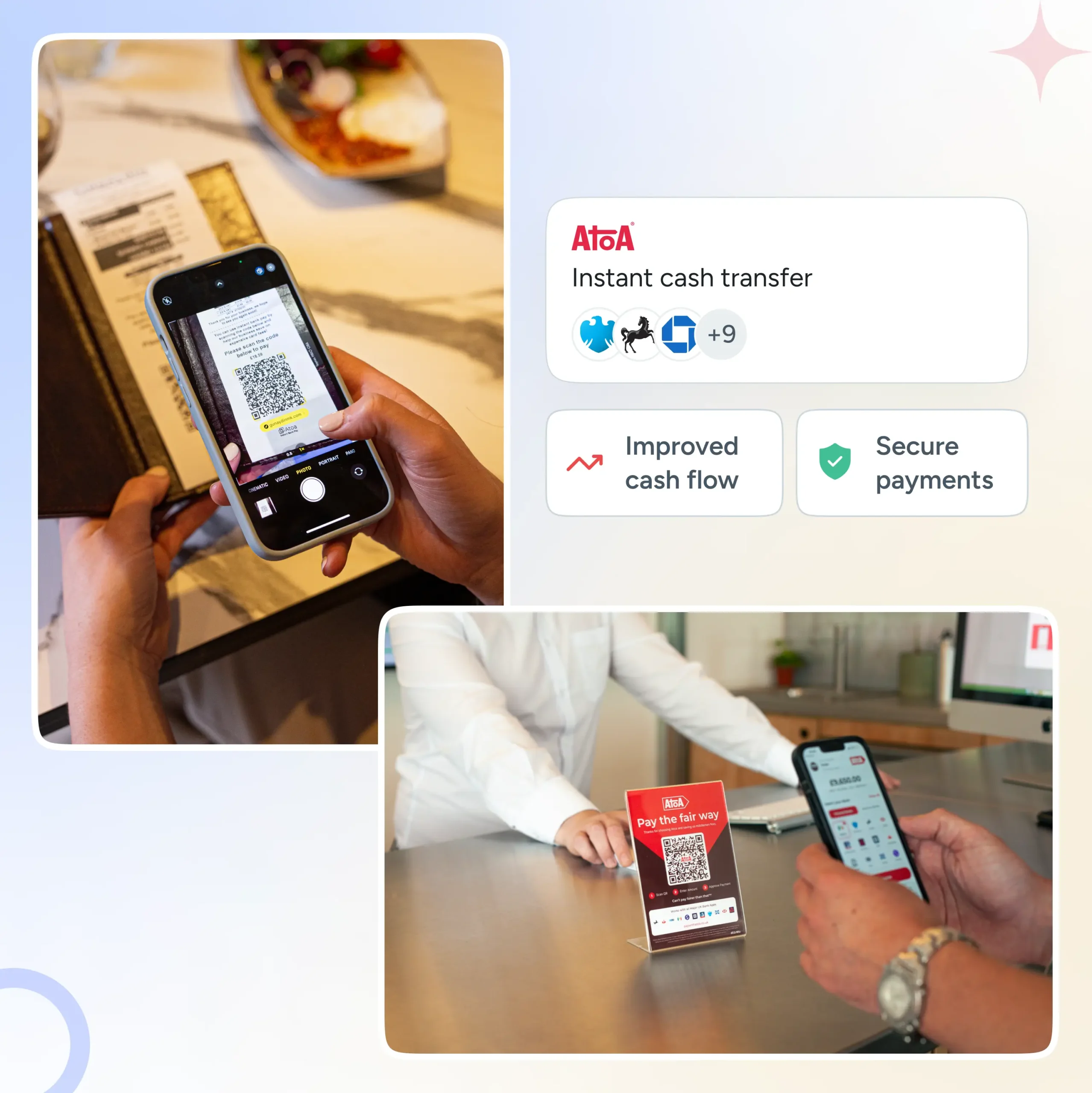

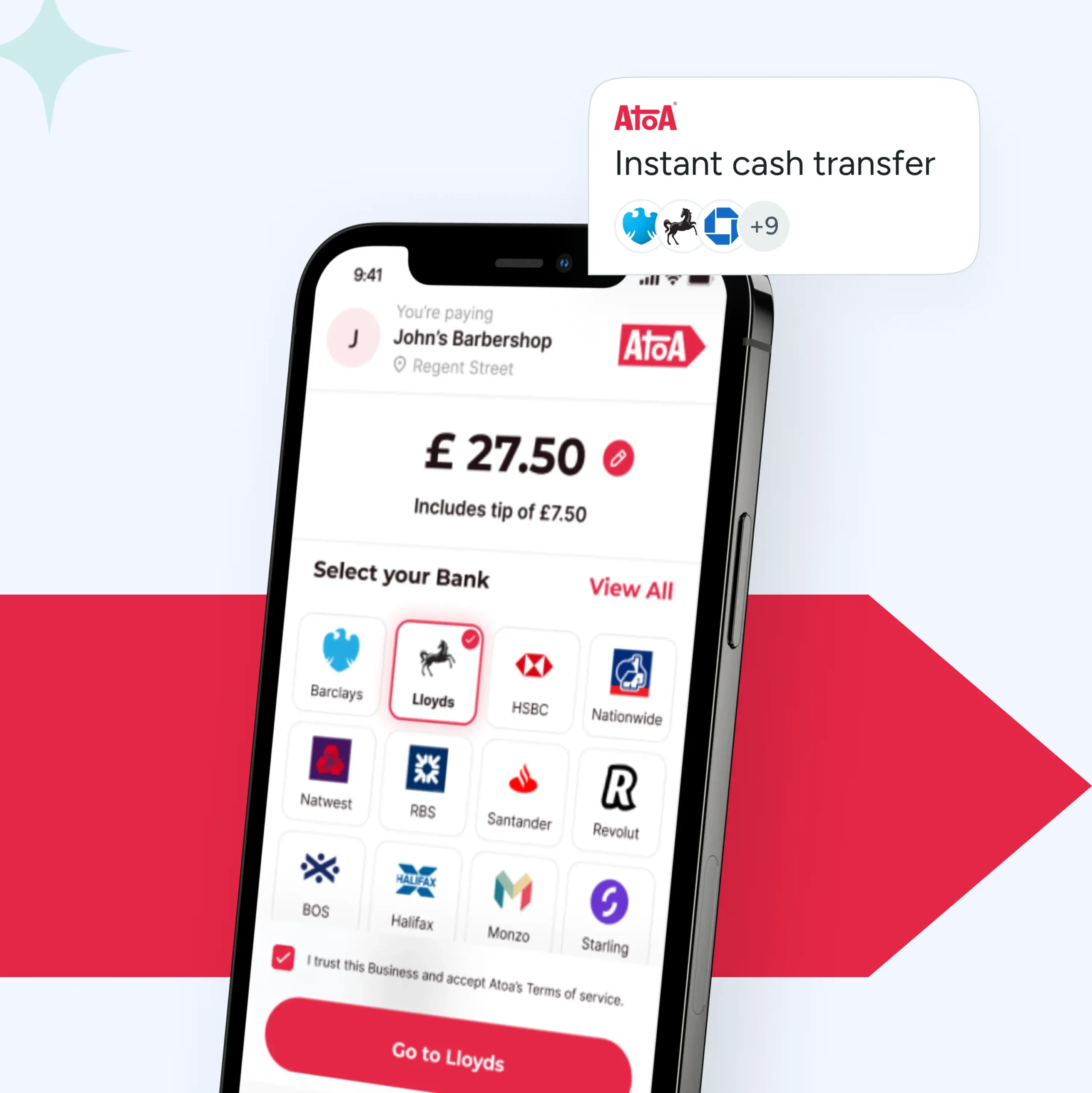

A2A payments are faster and more efficient than traditional payment methods. Unlike debit card transactions, which can take several days to process, A2A payments can be completed within minutes. This means that businesses can receive payments near-instantly, improving cash flow and reducing the risk of late payments.

A2A payments are cheaper than traditional payment methods. Card transactions typically incur processing fees ranging from 2% to 5% of the transaction amount. Why not cut out card processing fees to put more profit in your pocket?

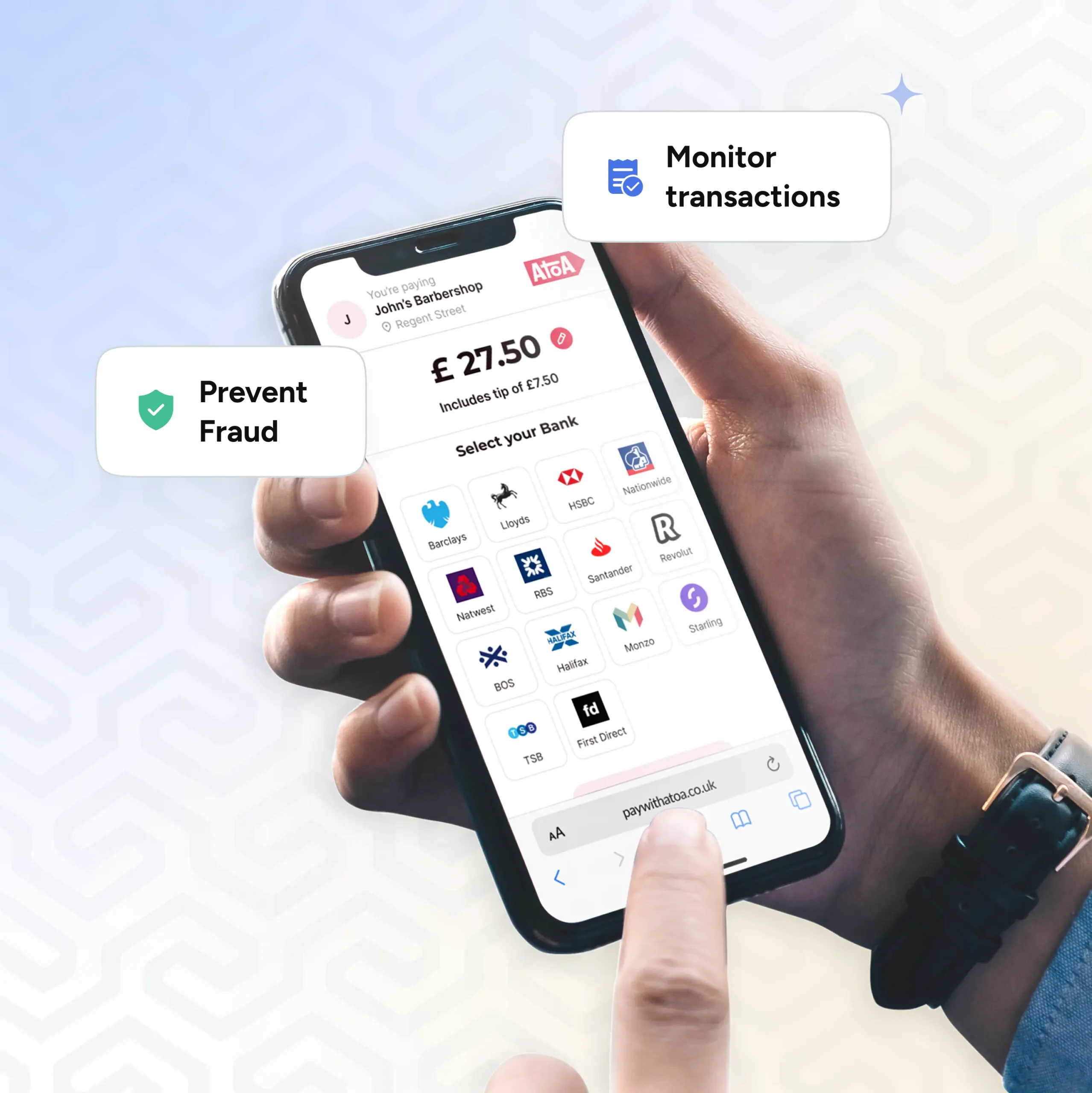

Finally, A2A payments are more secure than traditional payment methods. Because A2A payments are made directly between bank accounts, there is a much lower risk of fraud, reducing the risk of financial losses.

Why are A2A payments safe?

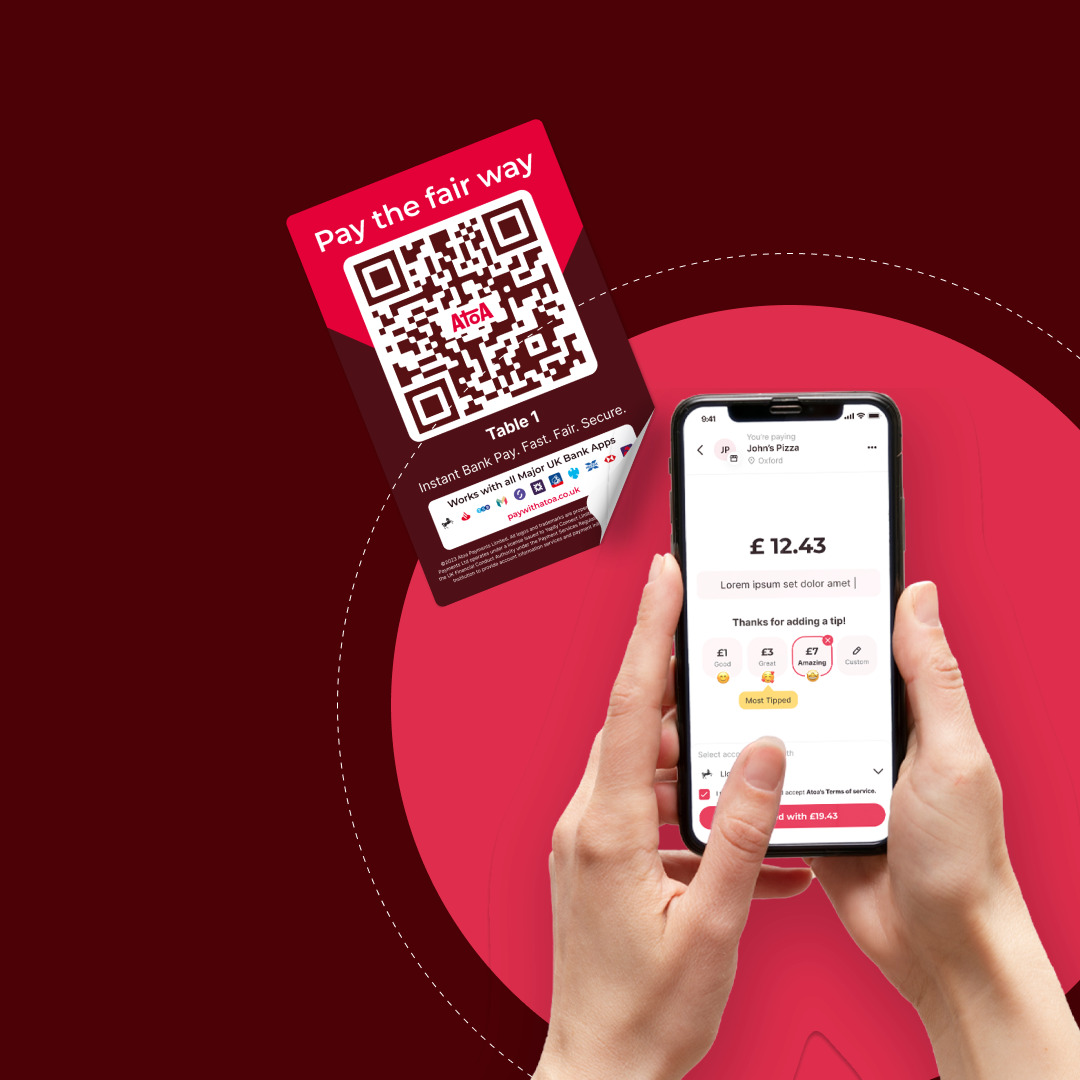

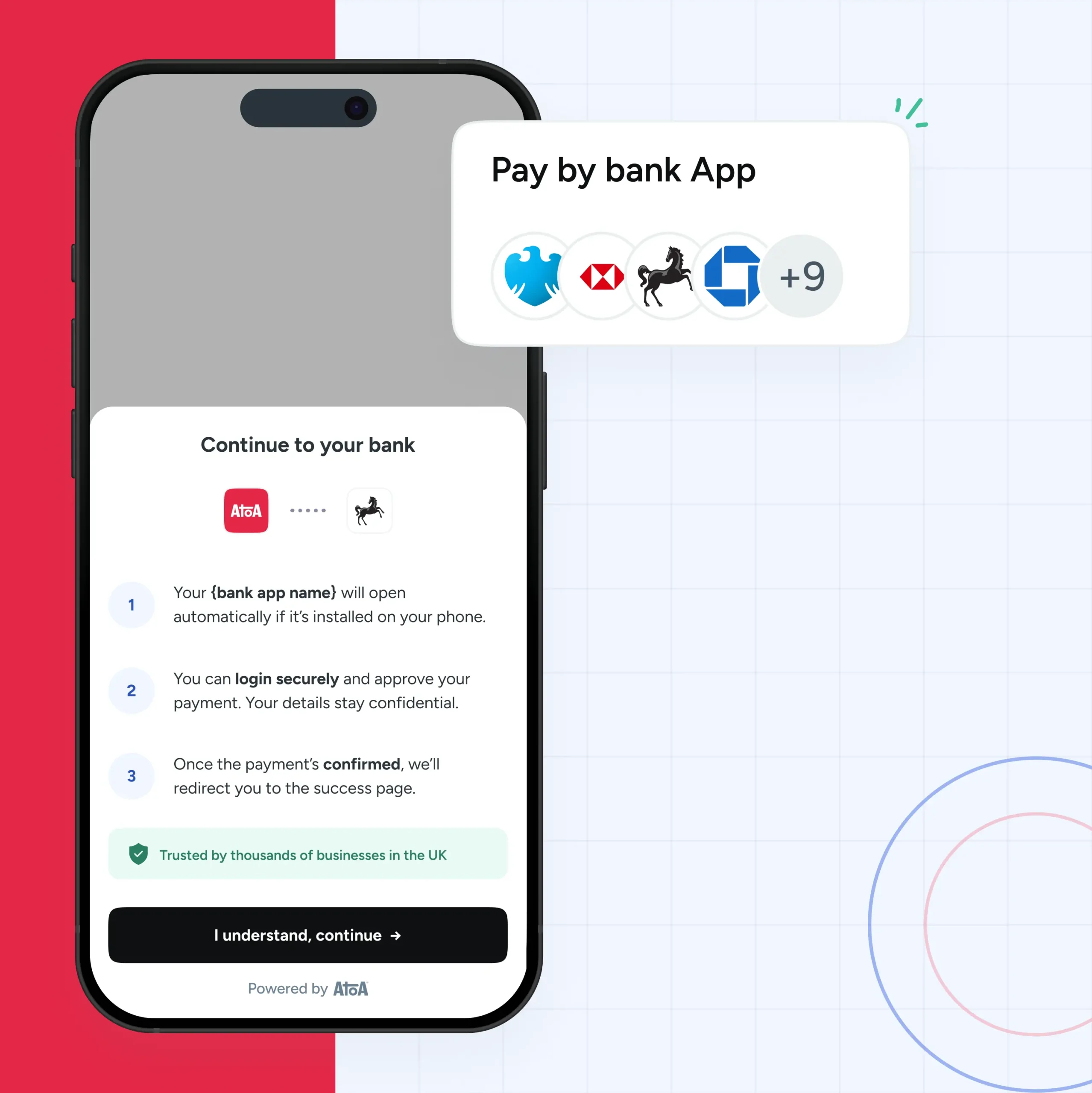

To start using an A2A payment app, a merchant or customer must have a UK bank account, which requires strict identification screening to open. This ensures that only legitimate users can create an account.

Most people protect their smartphones with biometric security or passcodes. A2A apps like ours can be protected with biometrics, adding an extra layer of security so only you can access it.

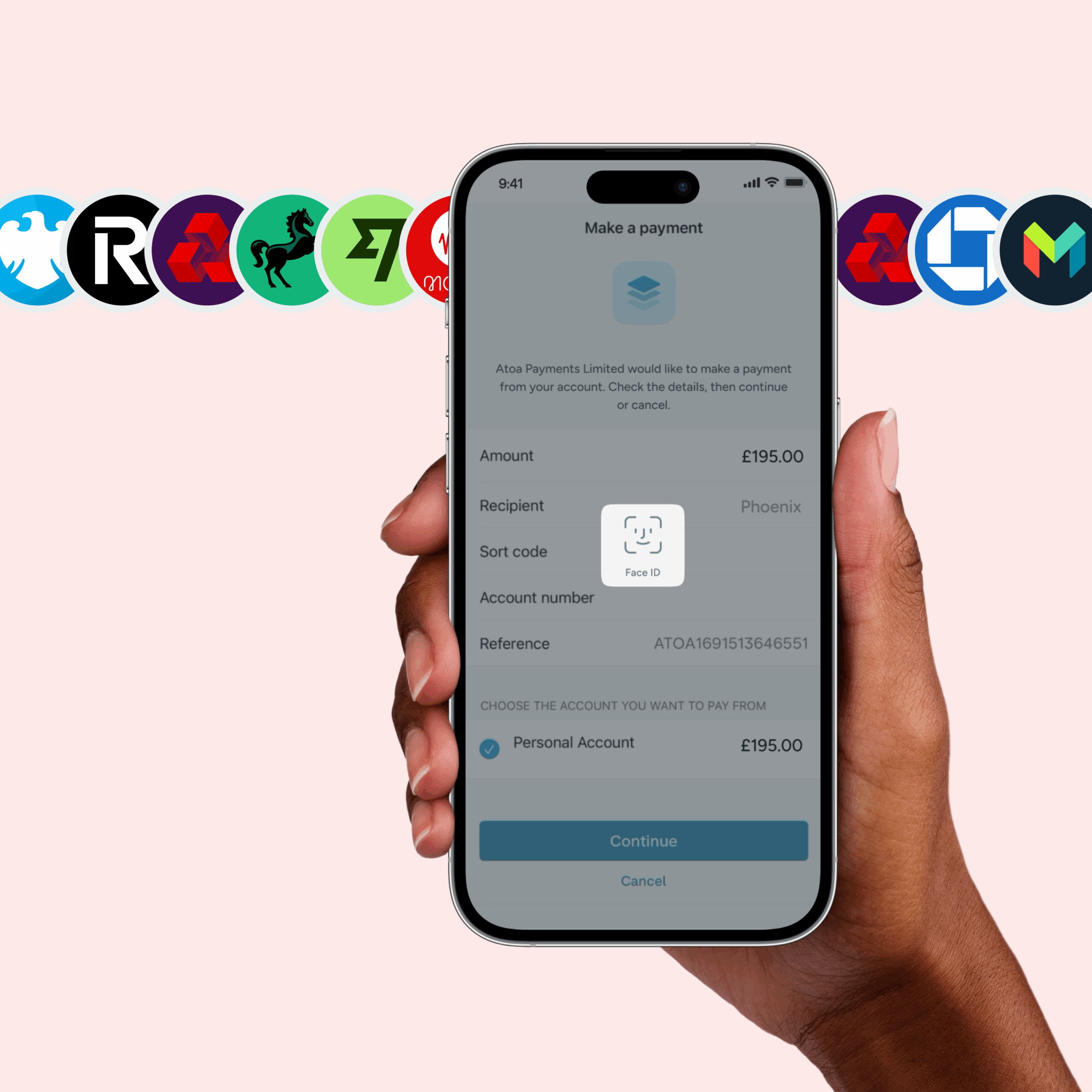

The same biometric security used on your mobile banking app is required to approve and complete A2A payments. This means that even if someone steals your phone, they won’t be able to release money as they don’t have your face or fingerprint!

Money is sent via Faster Payments, a secure real-time payment system. Funds are sent instantly and securely to the recipient’s bank account.

Your own bank’s fraud rules may also still apply. This means they may still have additional checks after ours, like requiring you to verify payment before it is sent.

A2A services approve payments using the biometric data registered to your smartphone banking app, making them as equally secure as your bank. However, as a consumer, you should stay aware of other risk factors, just as you would with traditional payments.

The takeaway

A2A payments are a convenient and secure way to send and receive money. However, following the best practices for A2A payment security can help protect your money from fraud and other threats.

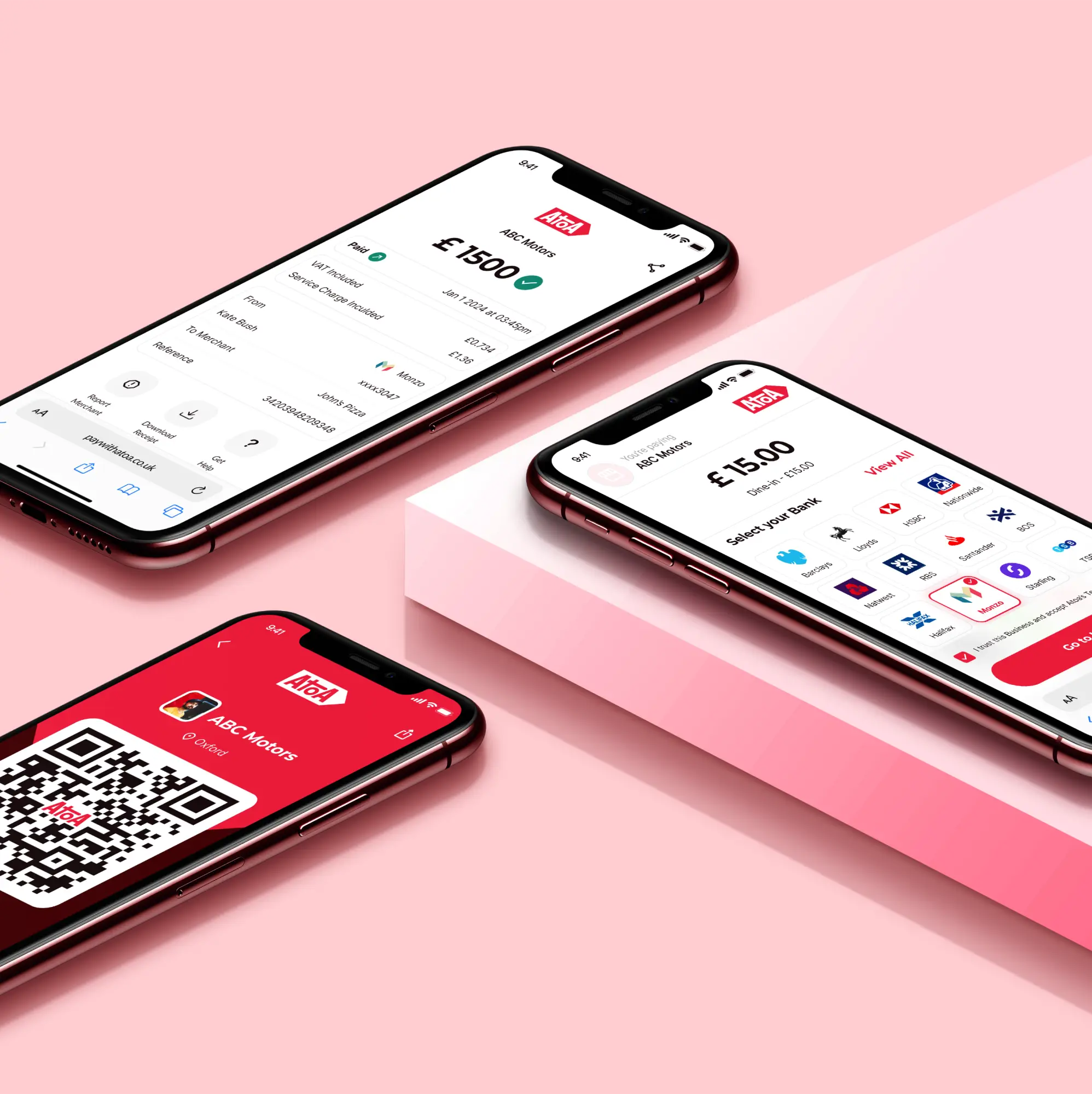

If you’d like to learn how our fast, fair and secure payments can help you take home more of what you earn, follow the banner to download the app or book a demo with our team. As a thank you for choosing us, we’ll give you 7 days of completely free transactions. After that, you’ll be charged a maximum of 0.7% of your total transactions.