Are you tired of dated mobile banking apps that are like stepping into a time machine back to the early 2000s? Sorry, desktop computer, we must part. My smartphone is calling, and it lets me do much more. Outdated interfaces move aside, and if you haven’t already, then say hello to the future of banking on a shiny, fresh app.

Maybe you’re fashionably late to the banking app party or looking for pastures new. Either way, this article runs through:

- Why we should care about mobile banking apps

- The handy features they can bring to your life

- Which ones you should be paying attention to

- And what to consider when you’re making a choice

Why are mobile banking apps so important?

It’s official: new-gen digital banks are setting the pace, and the demand for a preened, polished, user-friendly mobile app is high. But the competition is heating up. Even age-old high-street banks are stepping up to the plate to integrate features into their app.

Mobile banking vs internet banking

Internet banking was the first significant technological advance in banking, and most high-street providers made this leap successfully. Depending on when you started working with personal finances, adoption varied. They were handier than branches and could be accessed around the clock, but some administrative tasks still required pen and paper, which was kind of tedious.

Then came the advent of mobile banking apps just like that. Smartphone ownership is doing nothing but rise. USwitch reported that 86% of people used their mobile to go online in 2022, compared to 28% in 2009. You can pick your jaw up off the floor now. But with this in mind, it’s no surprise that mobile banking apps have also eclipsed internet banking. I can’t remember the last time I logged in. I definitely don’t know my password. And so on and so forth.

Consider how smartphone security has progressed from passcodes to fingerprint scans to full-on facial recognition systems. If we’re banking on these devices, our apps also benefit from this robust security protection. It’s much easier to access your latest transactions and balances with a quick glance than hammering letters into a toolbar and remembering your dog’s birthday. Tech and user experience have gone beyond being a bonus. Consumers now want and expect it. But that’s only one tiny element: the security is pretty tough to intercept. So what are the other benefits?

The benefits of banking on mobile apps

There are many smartphone banking app benefits designed for users across the board, boosted with new regulated tech like open banking. Let’s run through a few key ones to look out for…

Real-time account management

Access your bank accounts anytime, anywhere, with just a few taps on your smartphone. Stay up-to-date with your finances in real-time, including account balances, transaction history, and pending transactions. Get notifications each time you make a purchase showing the amount and retailer.

Easy as pie payments and transfers, whenever you like

Pay bills directly from your mobile app, saving you time and hassle. Send and receive money quickly, whether you want to split bills with friends or pay back family members.

Spending insights to boss budgeting

Thanks to open banking, you can track your spending with budgeting tools to manage your finances more effectively. Multiple accounts? See them all in one place with a total balance across all your debit, credit and savings accounts.

Set your goals to save more

Create and track savings goals, making saving for that dream vacation, a new gadget, or an emergency fund a little bit closer.

Custom alerts

Stay on top of the finance game with customisable push or SMS alerts for account activity, weekly balance updates, or new payees.

Advice and support around the clock

Gone are 5 pm helpline cutoffs. Many apps offer “always on” customer support through in-app chat or messaging, meaning assistance is always available.

Block unauthorised use

Benefit from unique security like biometric login and instant card freezing. Lock or unlock your debit or credit card if you can’t find it, avoiding a cancelled card meltdown if it’s only under the sofa.

Paperless statements

Keep the planet green by using paperless statements and reducing your carbon footprint. Analyse and review your past transactions without a filofax.

Get yourself integrated

Some mobile banking apps allow integration with accountancy apps, budgeting services and more to get a wider financial picture.

Travel-friendly

Enjoy the freedom to manage your finances on the go with features like currency conversion and free withdrawals. Plus, apps give you access to your accounts from your device anywhere with data signal.

Make some cash back with cashback

Some apps provide exclusive offers, discounts, or rewards for using their services, adding extra value to payments.

Virtual wallets and spending categories

Organise your spending by creating expenditure categories, giving you a clearer picture of where your money goes.

The best mobile banking apps for 2024

We’ve sifted through the digital wheat from the chaff to bring you the best banking apps in the UK. We’ve chosen our outlook for 2024 to ensure you start the year fresh, equipped with the power to control your finances in just a few taps.

Meet Monzo

Monzo gave personal banking a facelift when it launched with a zingy hot coral card and flashy user interface in 2015. Its growth since has been phenomenal. Top features include lockable savings posts, investment ops, split bills features, easy transfers, and budgeting. Monzo recently launched a shiny cashback program, so you can earn as you spend with high-street brands. Their social media game has us in stitches, too.

Starling is ready and waiting

Starling is close behind, keeping pace with a few handsome features. They may or may not be waiting for Monzo to slip on a banana peel. Manage your account effortlessly, from categorising spending to setting savings goals and sending nearby payments to other Starling customers nearby.

Barclays for basic banking with a little more

That old high street favourite, Barclays. This big blue bird caters to your basic banking needs and more. Get spending notifications, pay cheques in by photo, freeze misplaced cards, and access 24/7 in-app customer support.

Nationwide has got your back

Nationwide is a building society, so they hold their customers in high regard. Biometric login and automatic logouts mean security is high with this contender. The app lets you confirm online shopping purchases, which is pretty nifty. New transfer requests require a card reader, which can pose a problem if you travel without it.

Halifax, a northern powerhouse?

Halifax delivers a solid banking app experience with face or touch ID login, spending insights, in-app credit score reviews and the option to round up your spare change. But oh, how we miss you, Howard.

New Year’s Revolut?

Revolut seamlessly integrates into your daily financial routine. Enjoy spending notifications, savings pots, and other future-forward features like crypto. Get extra perks with a paid monthly account. Don’t judge a bank’s reliability by its fancy card, though.

What to look out for in a mobile banking app

Whether a business or consumer, you should consider choosing a mobile banking app a meticulous process. Here are a bunch of things worth looking out for if you’re switching or opening a new account in 2024.

Future forward features

We love attractive apps that empower you to manage your money however you want. Whether budgeting tools and spending categories or savings pots and automatic round-ups are on your agenda, make sure they’re top-tier. I recommend checking for biometric login, usage rewards like cashback, and 24/7 customer support.

How apps score

Don’t just look for snazzy metal cards or cute graphics. Value the opinions of real-life users by diving into the App Store and Google Play Store reviews.

While sleek user interfaces are important, they shouldn’t be your sole focus. Consider useful features like interest rates and rewards when choosing your bank. Need access to a local bank branch? Some top apps are digital-only, so think outside the app. From budgeting assistance to specific features, your choice should reflect what matters most.

Mobile banking app FAQs

How do I get started with mobile banking?

Easy! You’ll need an account with the provider first. Then, download the app from your bank’s website or app store and link your bank account. You may also be asked to set up a PIN or fingerprint to access your app.

Are mobile banking apps secure?

Mobile banking apps are very secure as they use various security measures to protect your data, such as two-factor authentication, biometric checks, encryption and automatic logouts. Plus, your device also has security blocks. However, it is important to protect your information with a strong password, keep your app up to date, and don’t use public Wi-Fi to access the app.

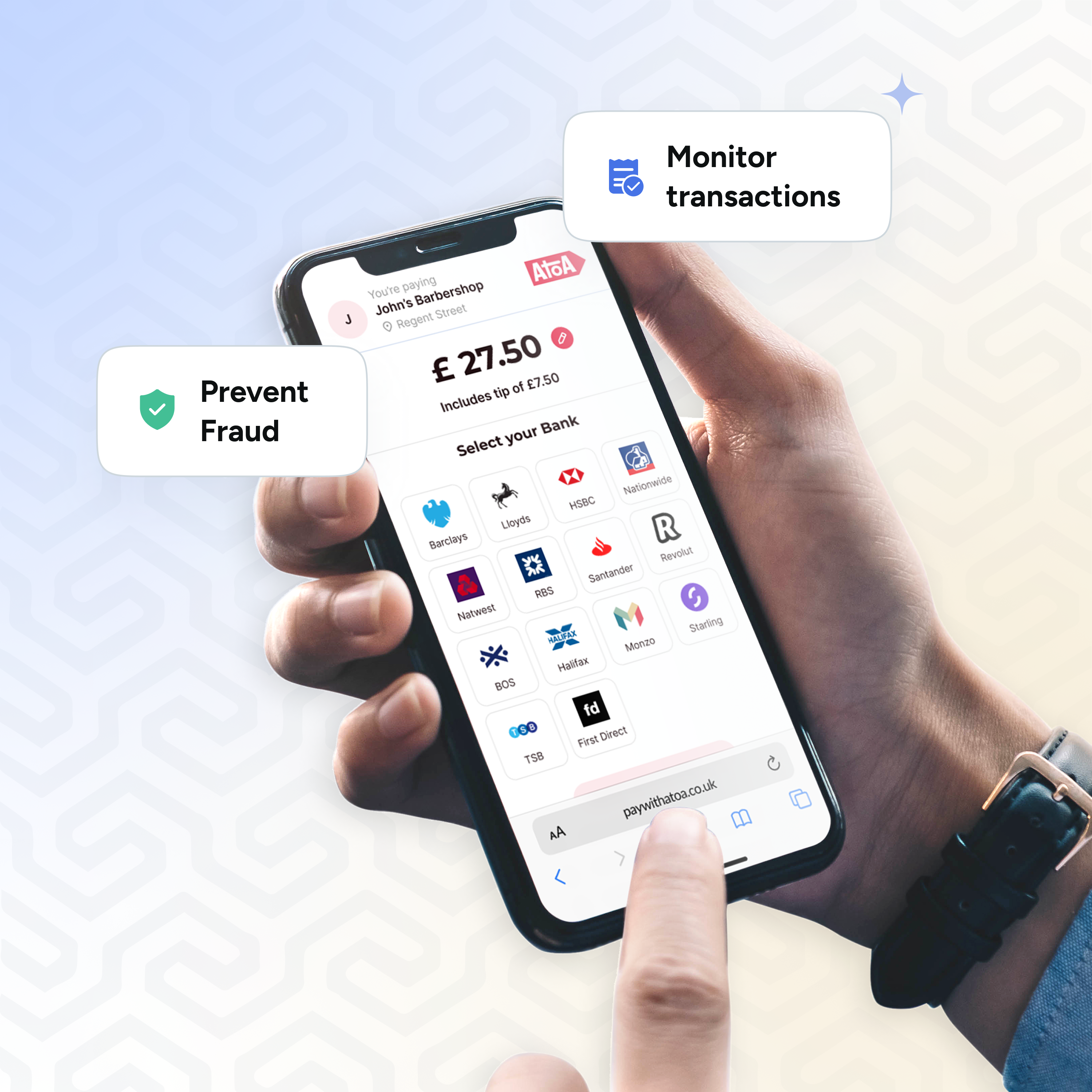

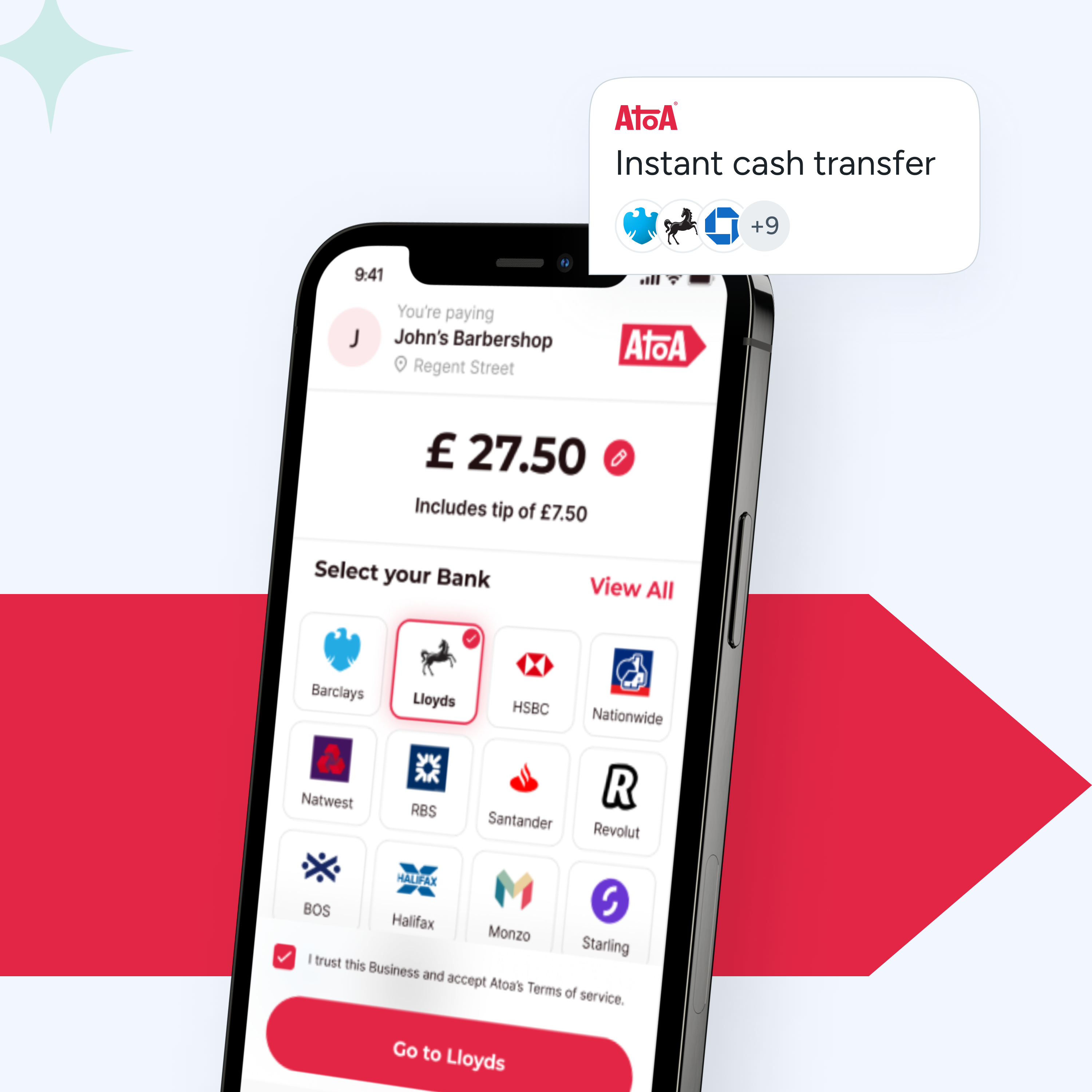

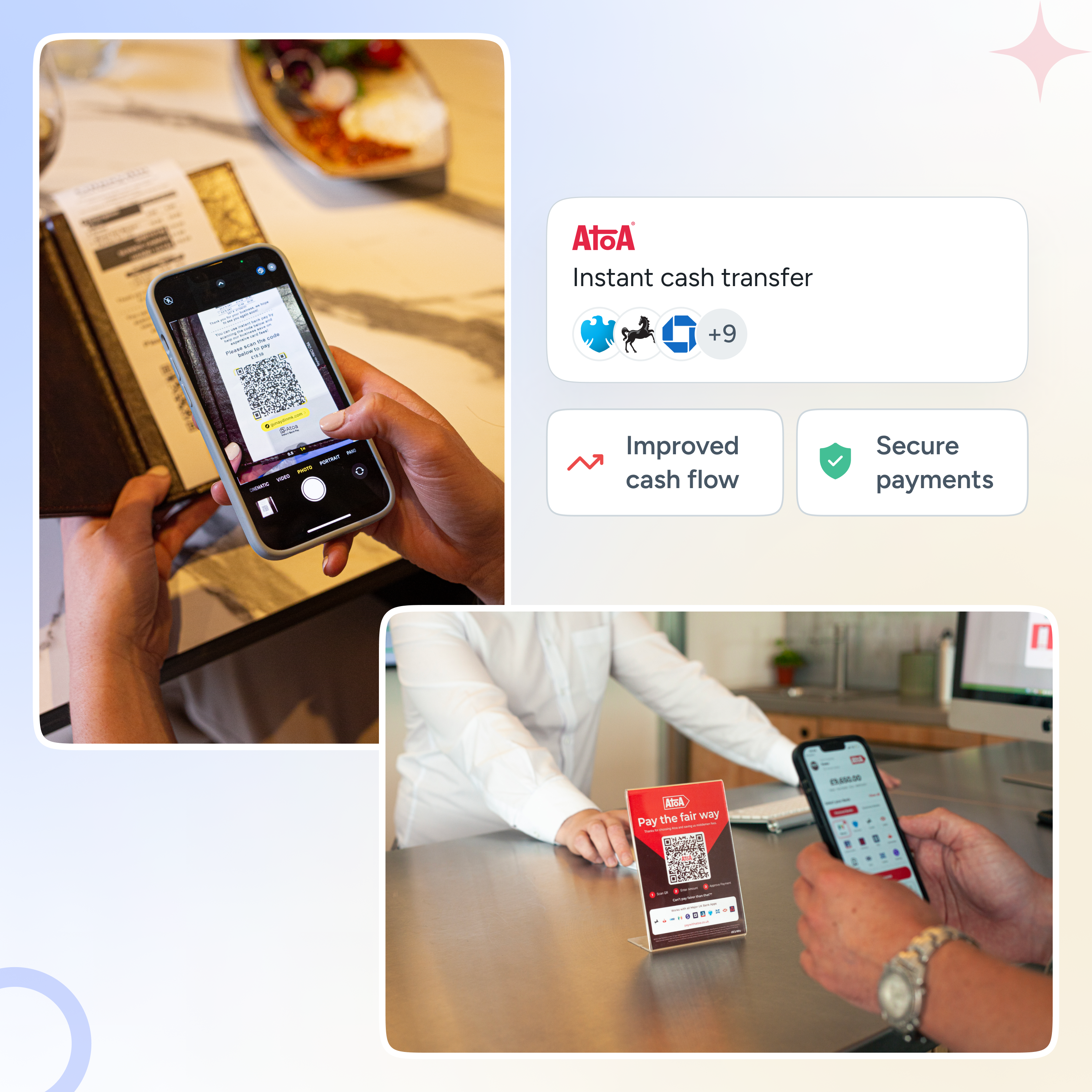

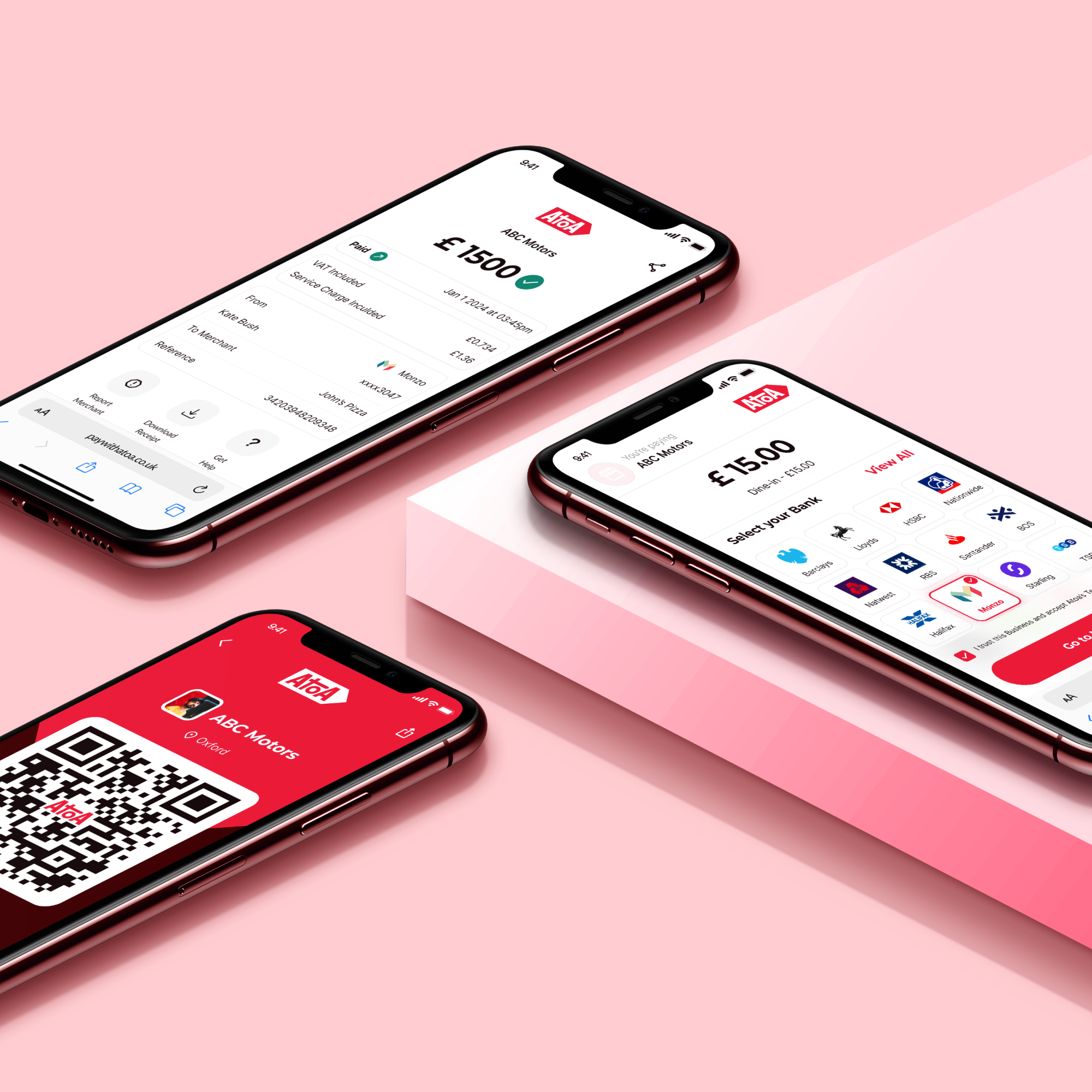

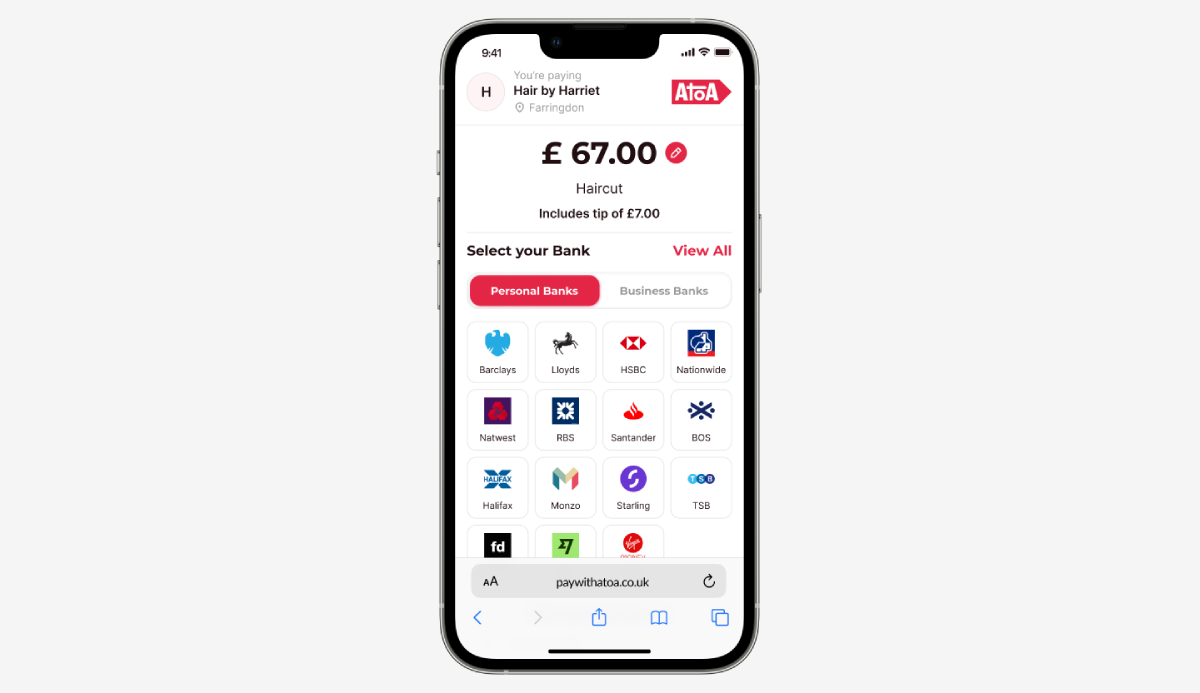

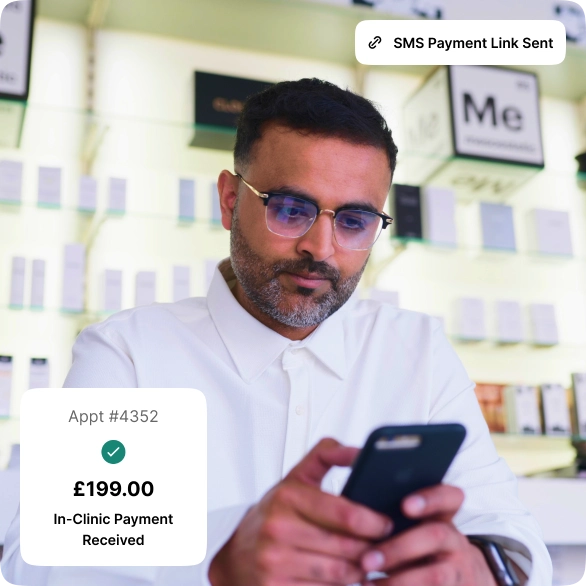

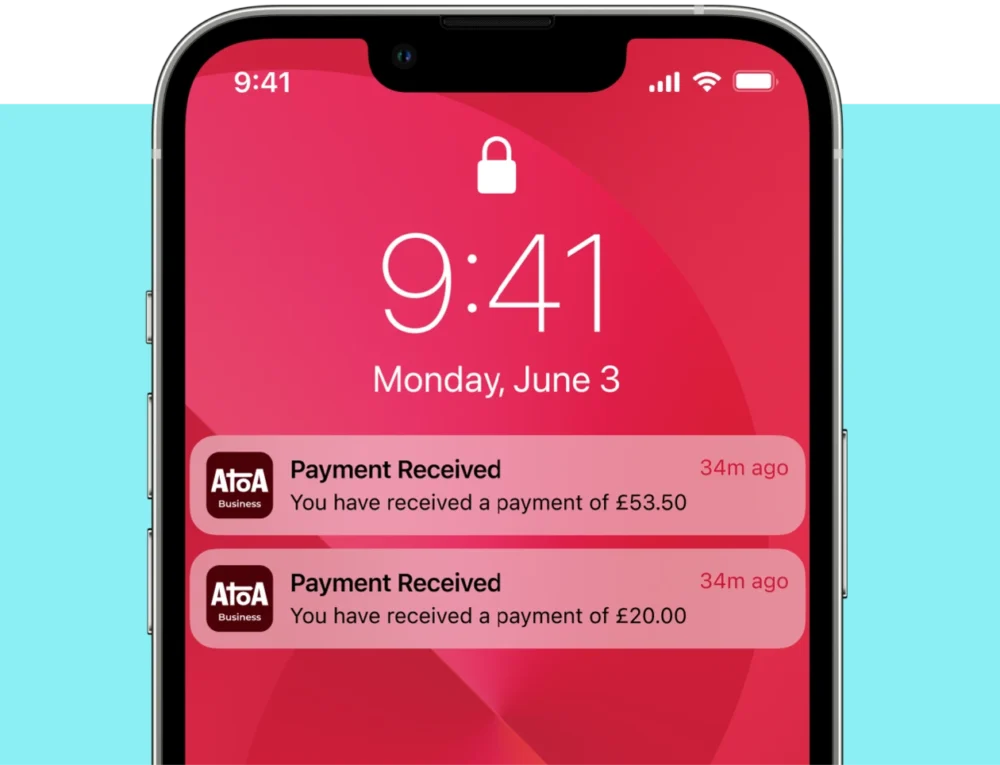

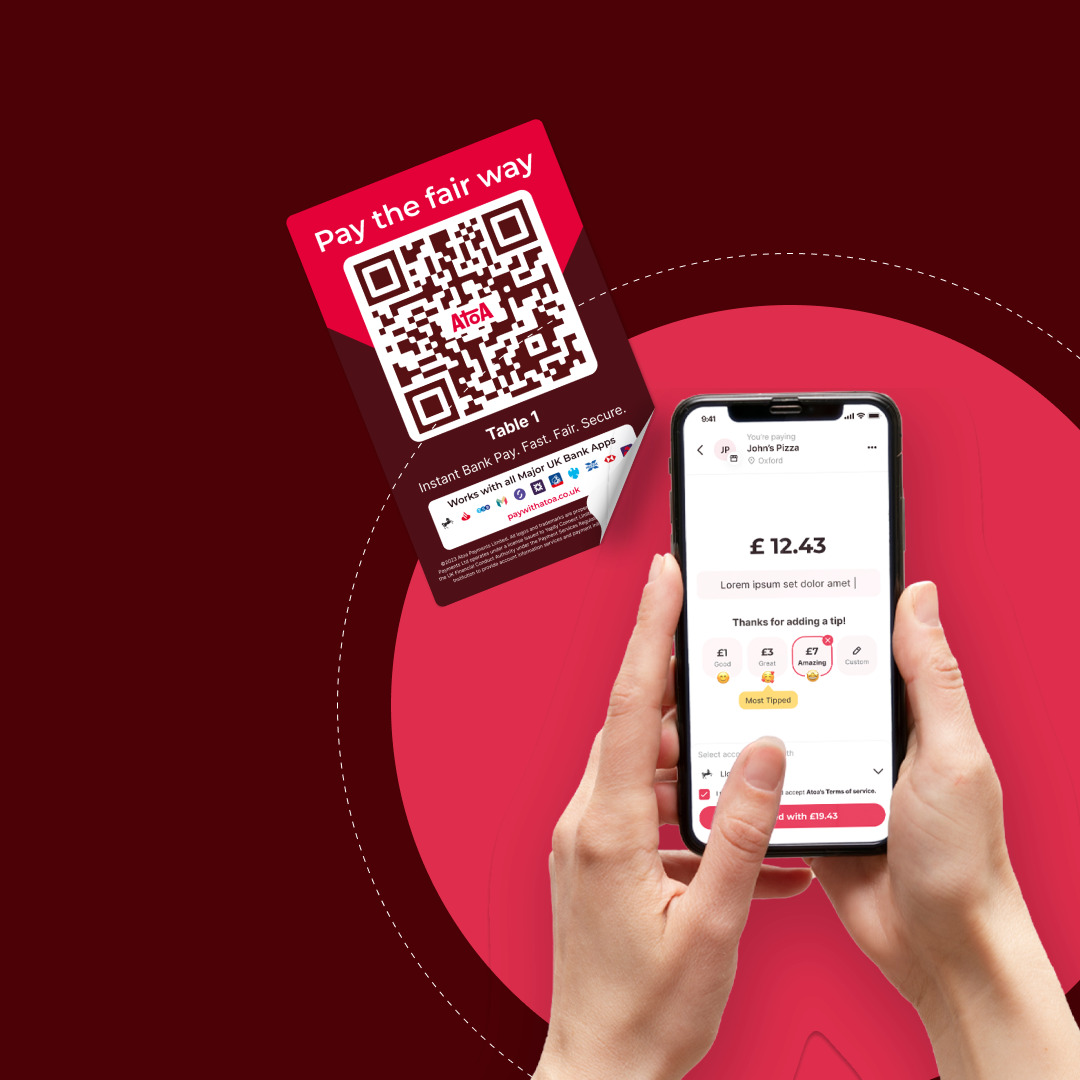

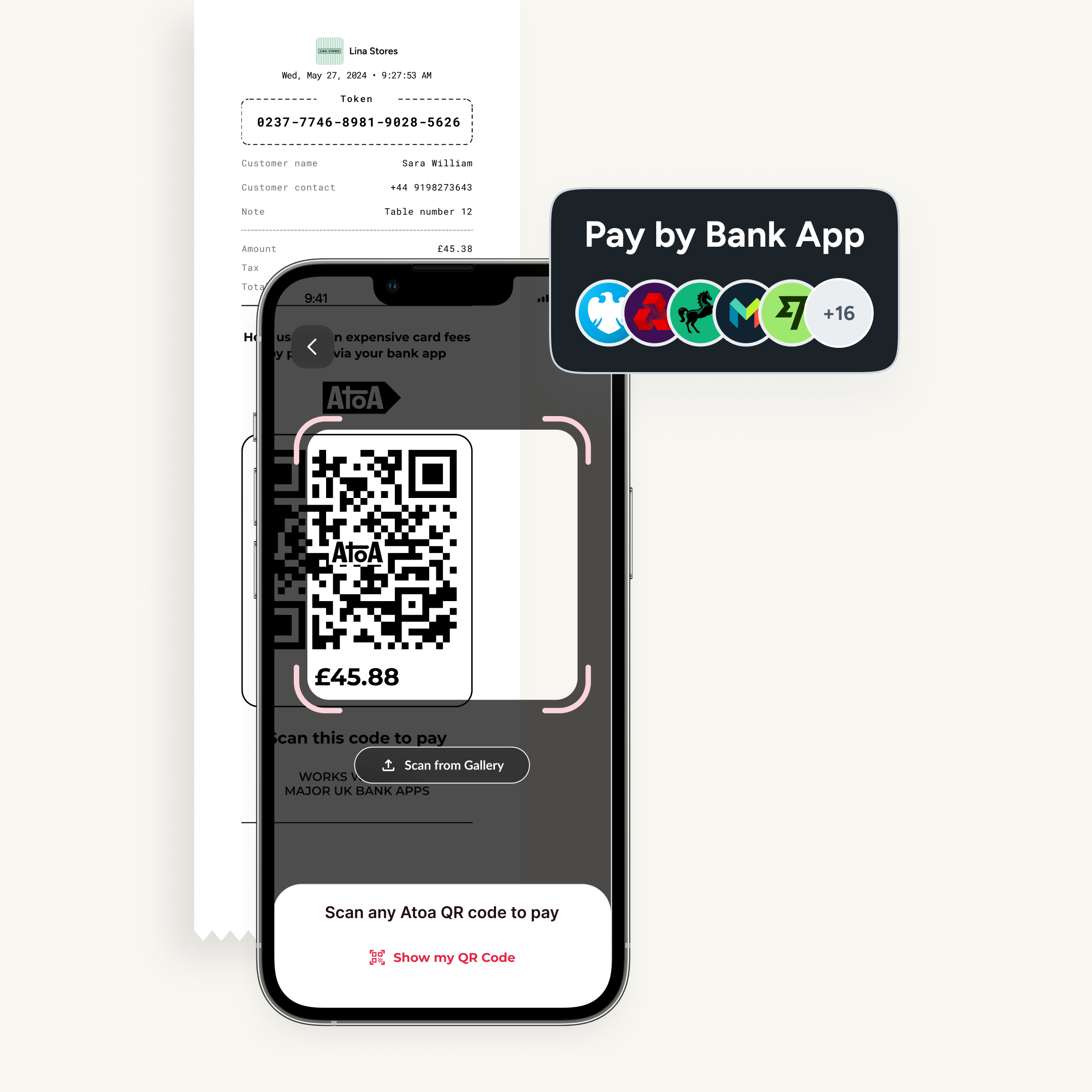

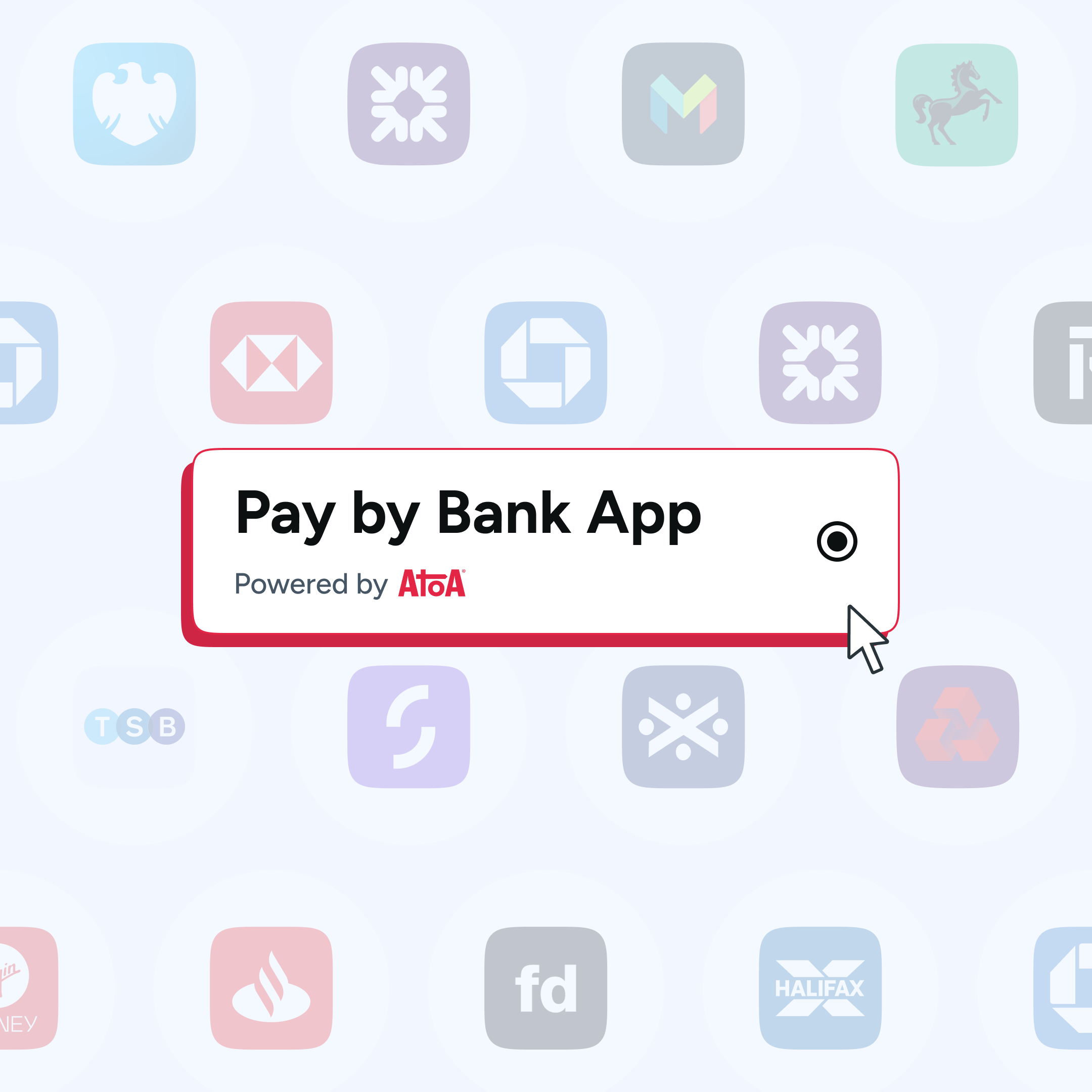

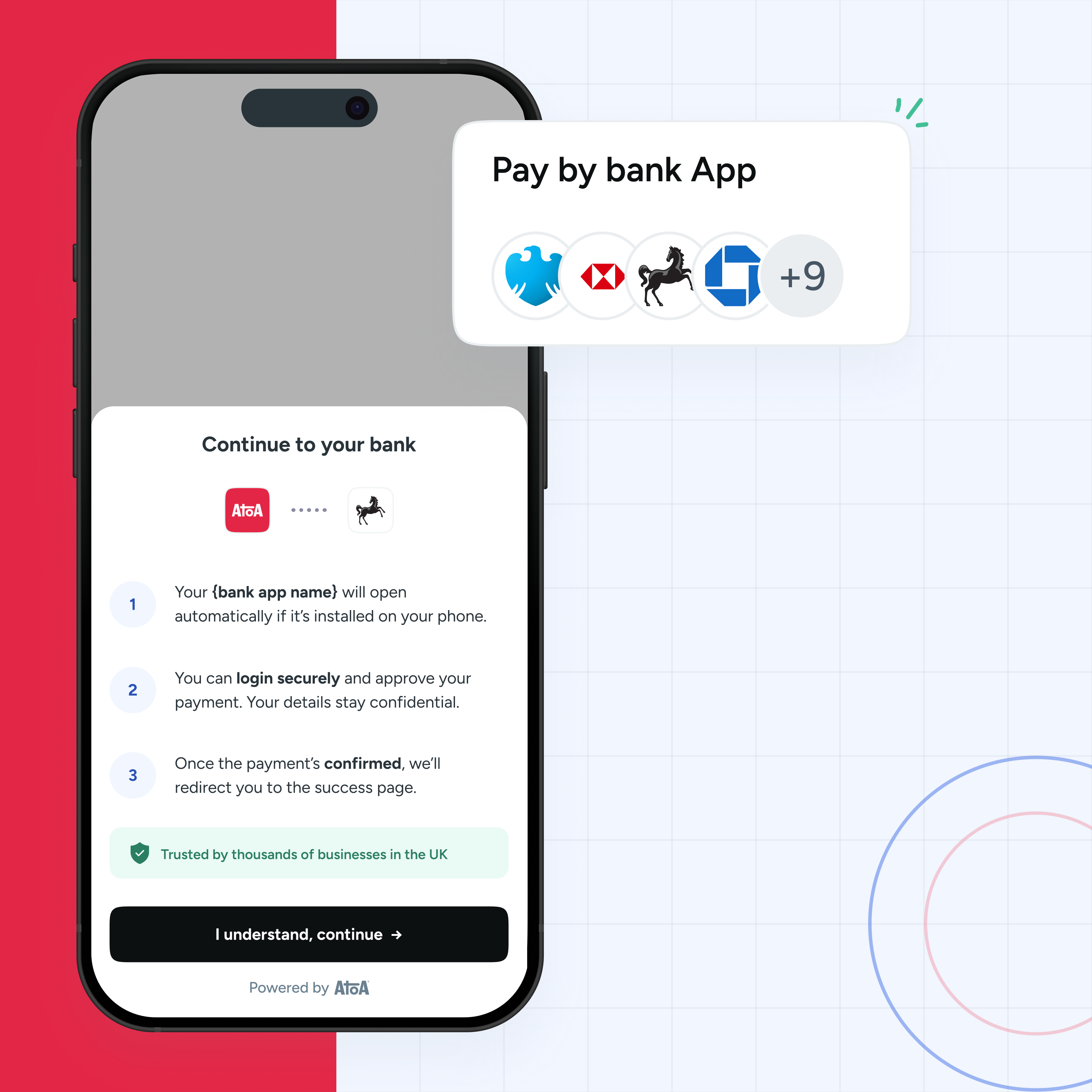

Looking for a fair business payment solution that works in harmony with mobile banking apps? Look no further than Atoa, an instant bank pay app that makes payments from the customer’s bank app to yours. No contracts, hardware, or risks of chargebacks. Head over to the Atoa features section to find out more.