You may not know it, but near-field communication or NFC payments surround you. If you use a contactless card or mobile wallet to pay, you’ve already interacted with this technology. These touch-free and convenient tap-to-pay transactions are becoming commonplace in everyday payments, and it’s no surprise. They’re quick, easy and secure, allowing users to pay and go in seconds.

Sounds like your kind of payment, right? A recent UK Finance study found that in 2022, 87% of people made contactless payments at least once a month or more. With that in mind, let’s learn more about these effortless transactions and how UK businesses can stay ahead…

What to expect from this post:

- What near-field communication payments are and how they work

- How these touch-free payment work

- The pros and cons for UK businesses

- Common questions around contactless payments

How NFC payments work

NFC are what makes contactless payments tick. The technology enables two devices, like a smartphone and a payment terminal, to transmit electromagnetic radio fields carrying information when they’re close to each other. If you use contactless cards or mobile wallet apps like Apple Pay, Google Pay, or Samsung Pay, you already use NFC. These are the most common providers in the UK. Picture this: you’re grabbing a cup of coffee at your local shop, and instead of patting around your pockets for cash or entering a PIN, you tap your card or smartphone on the reader.

NFC technology uses a tiny chip in a device that multitasks as an antenna and a receiver. This chip communicates with a reader that scans and allows devices to access information. A software application on the device interprets the data received from the chip, and an Internet Service Provider (ISP) manages all communication between the devices. At its most basic, see it as a chain passing information down. However, near-field communication payments can work in a few different ways, which we’re exploring in the next section…

NFC in a nutshell

- A secure chip in your customer’s phone or modern card communicates wirelessly with your NFC reader.

- Transactions occur within a short range, making them difficult for fraudsters to intercept.

- There is no need for Wi-Fi or data.

NFC payment modes

Three different methods of NFC payments keep the wheels turning. We’ve saved you some legwork by outlining them below.

Read write: A reader/writer is an NFC-enabled device that manages and coordinates information sent between and received by NFC devices and other devices that don’t feature the technology. In this case, you’re buying a coffee. The (POS) system acts as the reader/writer, and your NFC-enabled smartphone exchanges payment information with it. Just tap and go…

Peer-to-peer or P2P: This is when two NFC-enabled devices exchange information directly. A peer-to-peer device may exchange data with an RFID or NFC-enabled device without the assistance of a reader/writer. A great example would be putting two phones close together to share information or send money.

Card-emulated: In this mode, an NFC-enabled device functions as an NFC payment or virtual credit or debit card, letting customers make payments directly from a smartphone. Say you’re heading out and want to catch the underground. You tap your smartphone on the card readers at your entry and exit station, and the correct fare is calculated and charged just like a debit card. The MTA introducing this on New York transport was how this payment method gathered momentum.

The NFC payment process

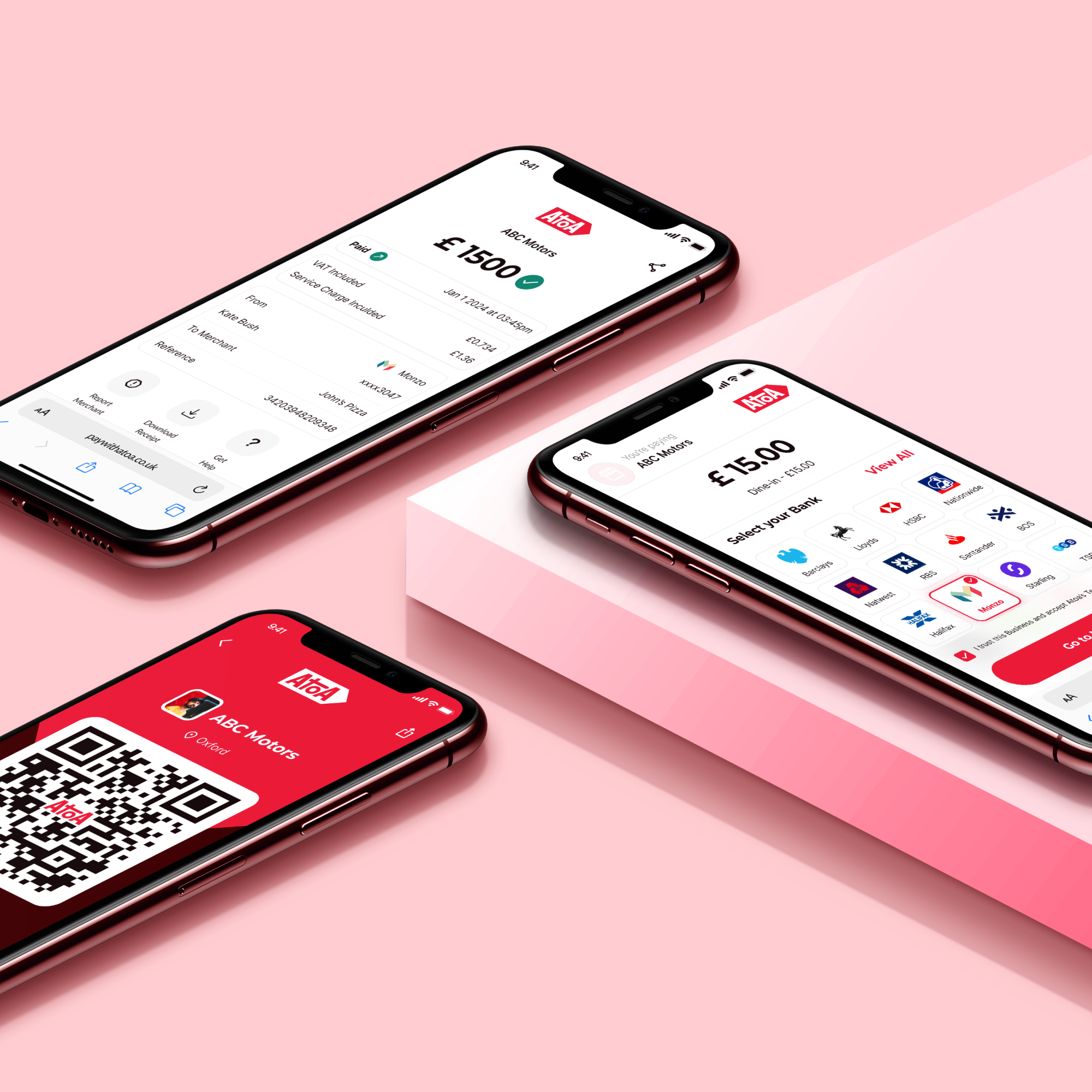

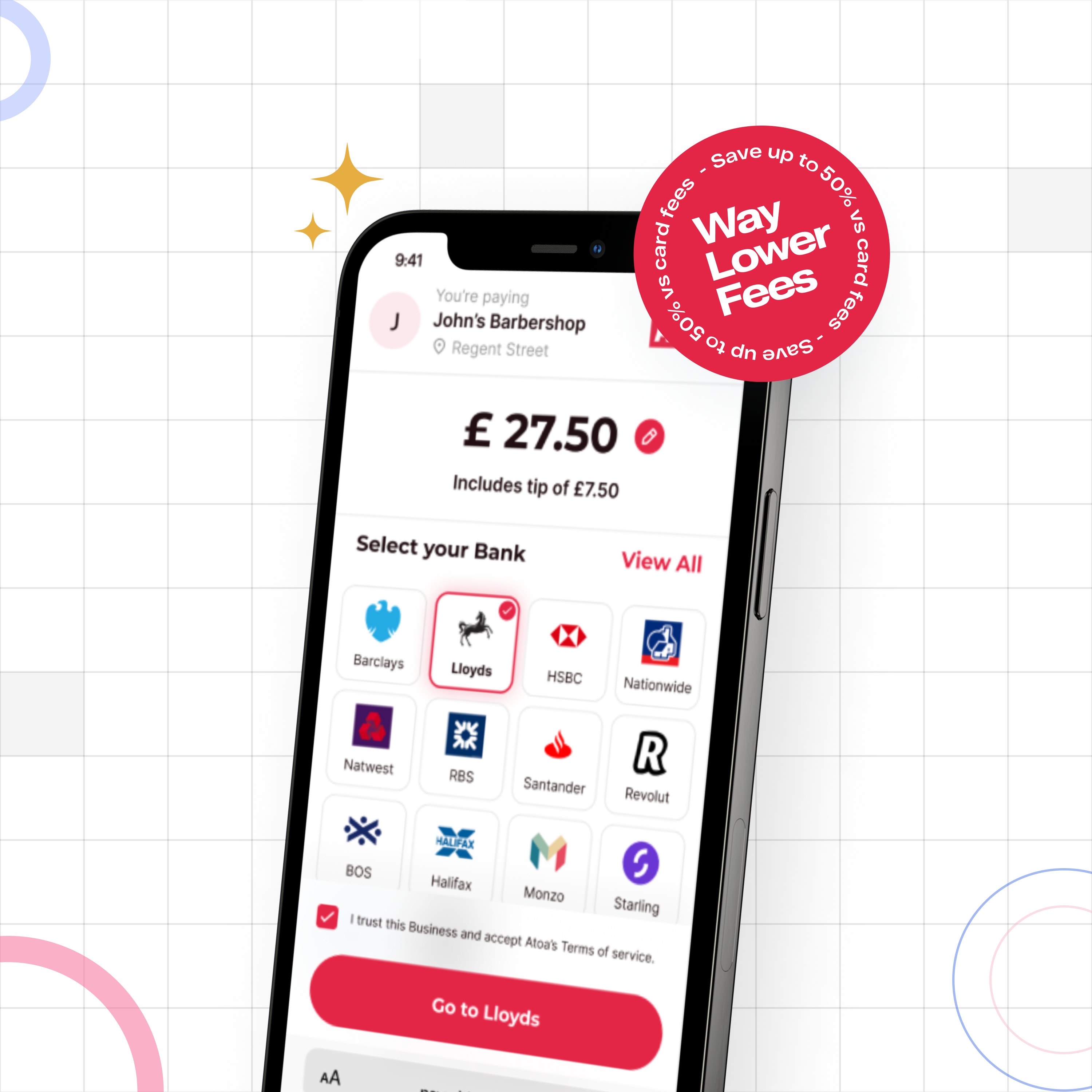

There are three main components required to make or take an NFC payment. The customer needs an NFC-enabled device like a smartphone, tablet, or wearable. The business or store needs an NFC reader to read and write data like a POS, enabling devices to accept funds. Finally, an application, usually pre-installed on NFC devices, enables the device’s chip to communicate with readers. Once this is in place, it’s time to start firing funds here and there.

- The customer taps their NFC device on a compatible reader. This activates the chip on the device to start communicating.

- The reader requests information about the transaction, such as the payment amount, from the device’s chip.

- The chip responds to the request with the customer’s payment information, which is securely encrypted.

- The reader sends the encrypted payment information to the payment processor.

- The payment processor then decrypts the information and confirms the customer’s identity. If this is successful, the payment processor authorises the transaction.

- The payment processor sends an authorisation code to the reader. The reader then sends the authorisation code to the customer’s device with a confirmation that the NFC payment was successful.

NFC payment benefits and drawbacks

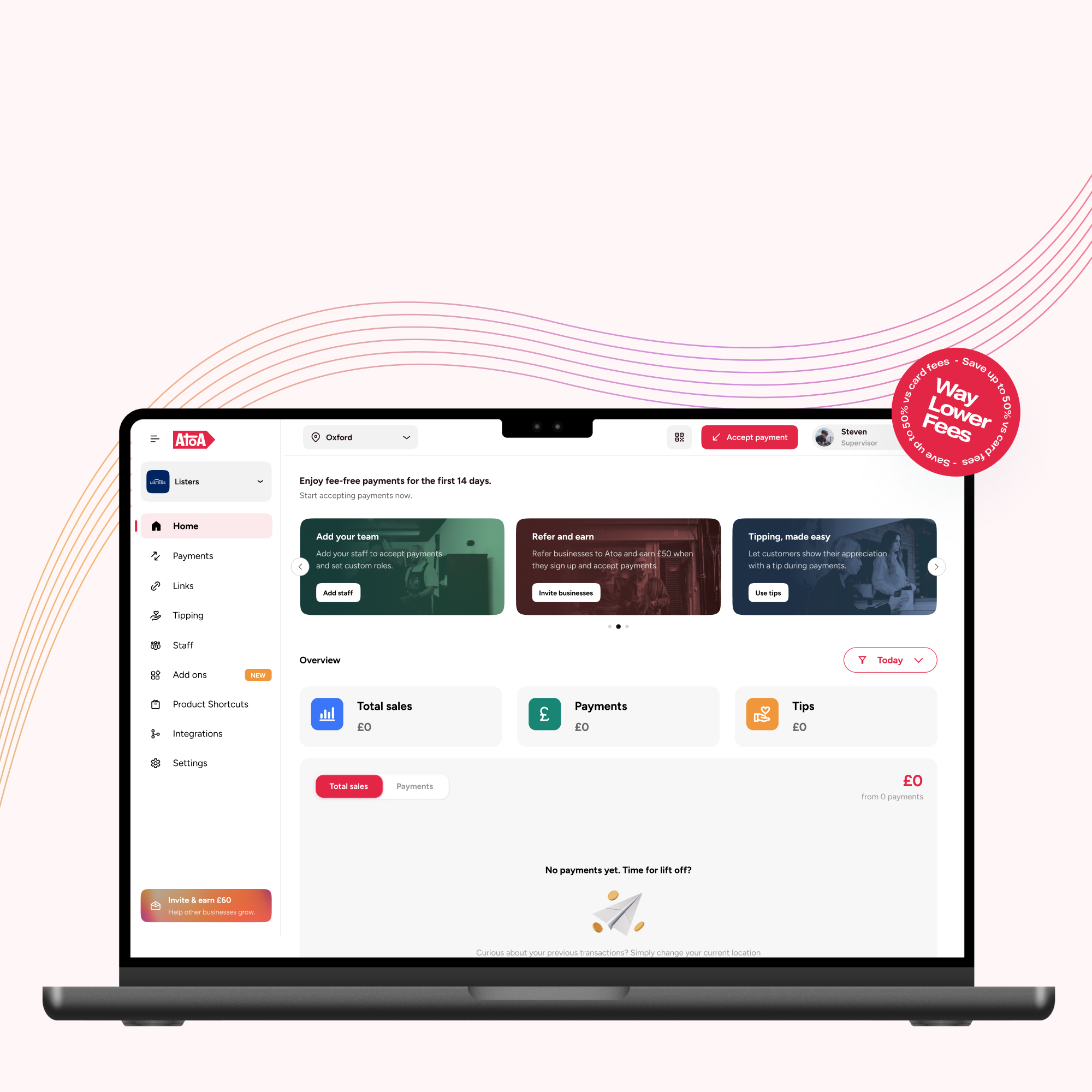

If you’re a merchant considering adding NFC transactions to your operations, they are a convenient, secure, and fast way for customers to pay. They require a compatible device, but with smartphones in wide use, it’s not as much of a hurdle as before.

The benefits of using NFC to pay

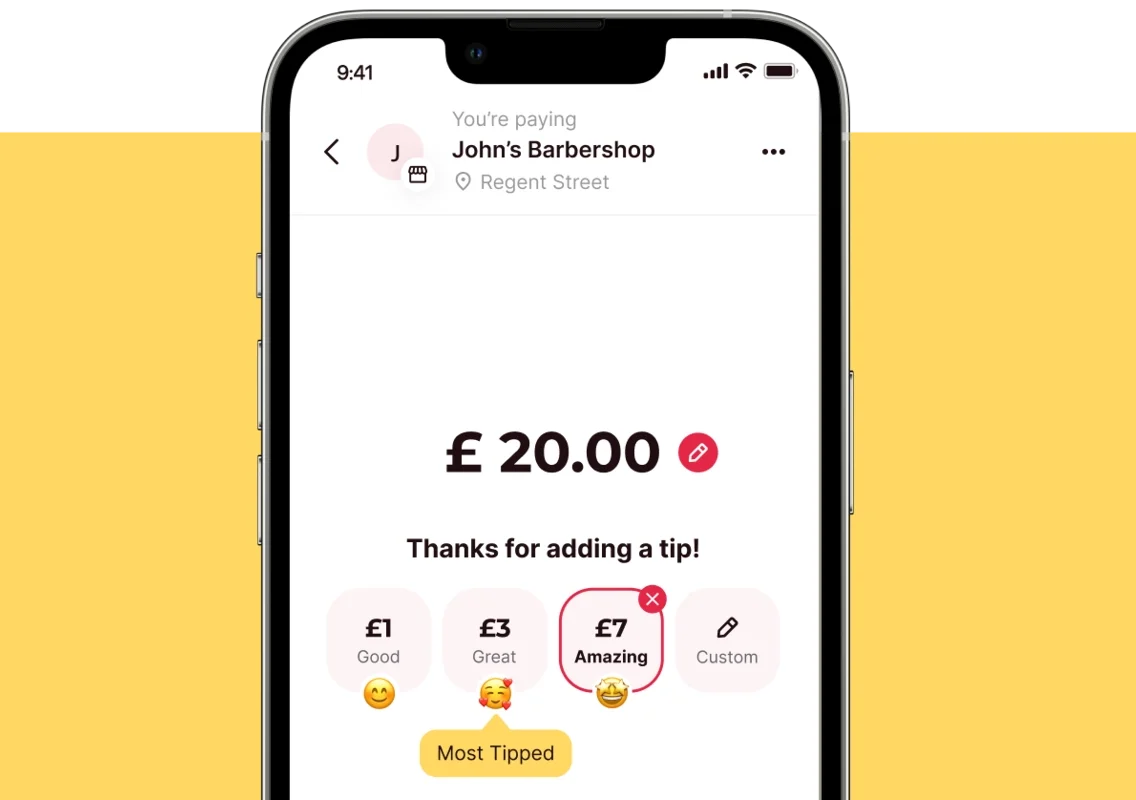

- Convenient checkout: All you need to do is tap your device on a reader to pay for your purchase. No more last-minute anxiety-inducing searches for wallets or cards! “Dipping” chip and pin cards could feel a little drawn out and awkward, but this removes the additional waiting time.

- Secure: They use tokenisation to protect your data, which replaces sensitive payment information with a unique token only used for a single transaction. This makes it very difficult for fraudsters to steal your information. When you use a mobile wallet, you have double protection from the device and data encryption security.

- Fast: Touch-free payments only take a few seconds to complete, saving you time at checkout.

- Cost-effective: Skip the tech shopping list, especially if yoy consider other alternative payment methods like QR codes.

- Flexible: They can be used by many industries when paying for goods and services, money transfers, and sharing information. They can also be taken anywhere with an internet connection.

- Contactless: NFC payments are contactless, allowing touch-free payments that reduce the spread of germs.

- Customer experience: Enhancing convenience and security can help boost in-store customer experience and help return visits.

- Stay ahead of the curve: Offer a modern payment method that customers appreciate.

A few NFC drawbacks

- Not accepted everywhere: They may be less accepted than traditional payment methods, such as cash and credit cards.

- Needs a compatible device: You need an NFC-enabled device to take funds this way.

- Potential for data breaches: Devices can be stolen or hacked, which could put your customer’s payment information at risk.

As you can see, the pros outweigh the cons! Remember, you need payments that meet your business and customers’ needs. Considering your set-up and customer demographic beforehand is essential to make the right decision.

NFC payments and security (it’s pretty unbreakable)

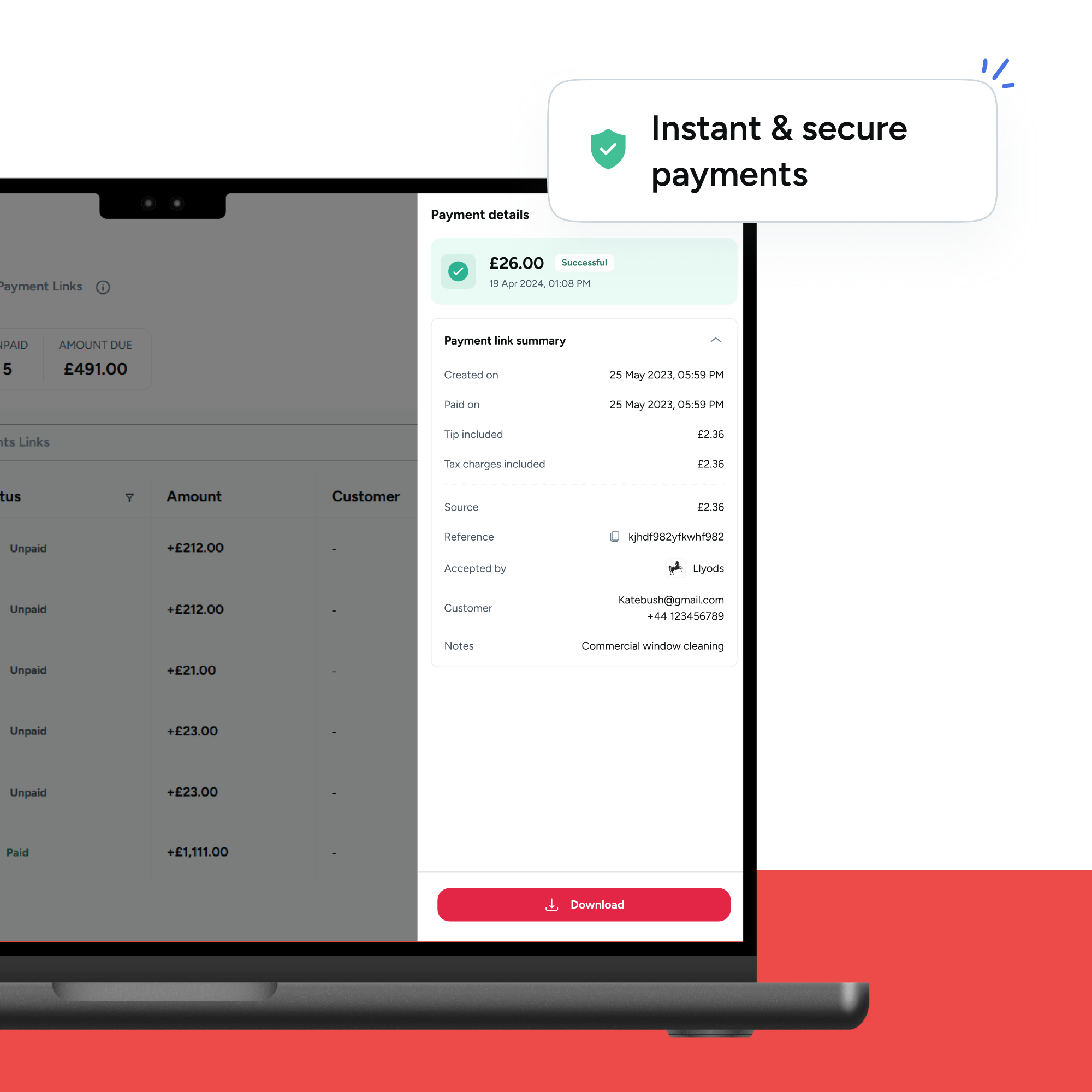

While NFC offers strong security measures, it’s important to remain vigilant. Precautions against lost devices and potential hacking are always wise. Keeping your customers’ money and data safe during transactions is essential, and using NFC payments is the answer. Encryption and authentication keep these payments secure, which means shoppers’ details are always protected. But some people still worry about scammers, so it’s time to break down the tech and add some reassurance.

NFC payments only work over a short distance, like a few inches, making it hard for anyone to steal or skim details. They also use dynamic data exchange or tokenisation, which means the data sent between the payment terminal and the card changes every time, making it impossible for anyone to copy it.

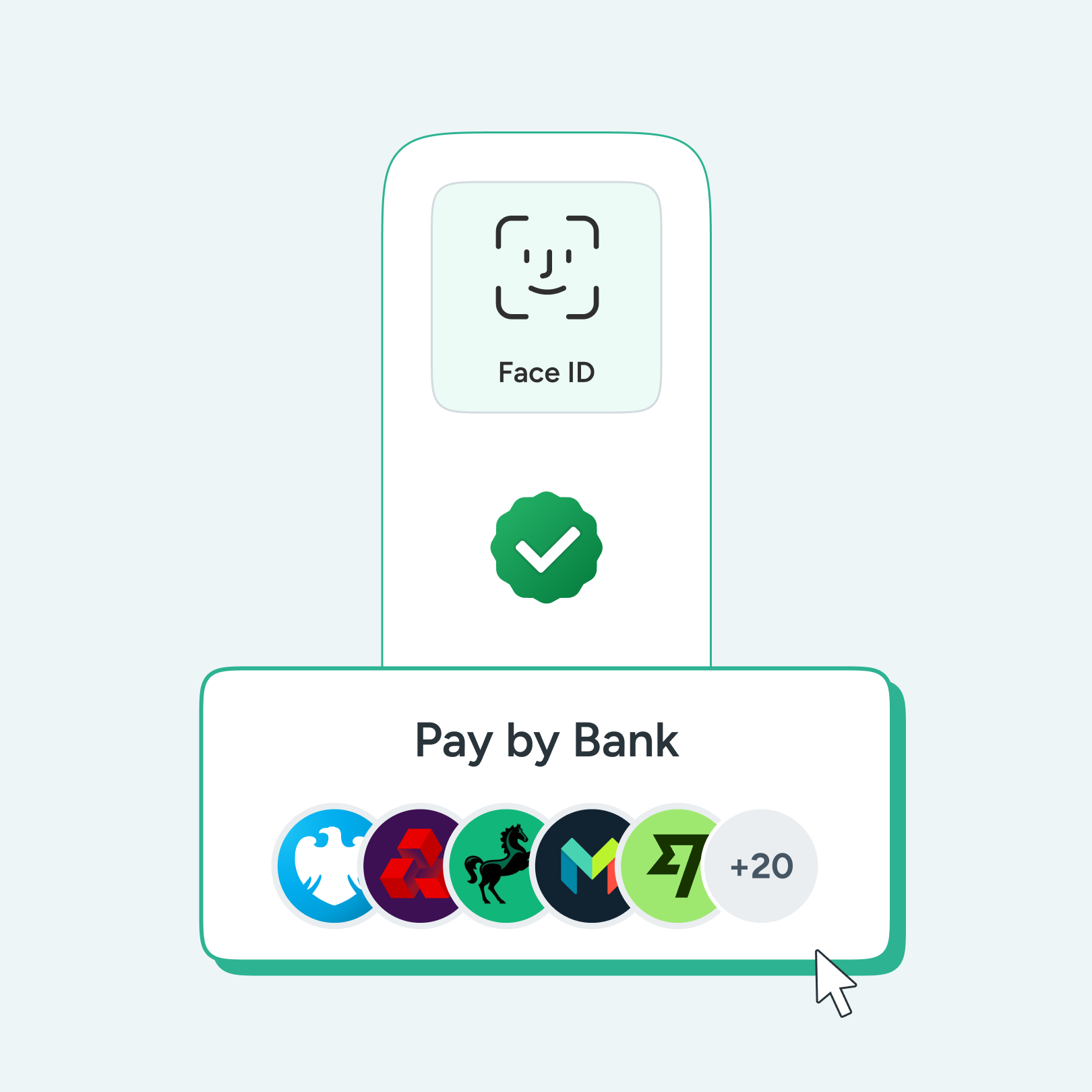

Finally, NFC payments often use two-factor or biometric authentication, meaning customers must verify their identity using a PIN code, fingerprint, or facial recognition. Only you have your face or fingerprint, so it’s tough for anyone to make unauthorised payments.

Not only are touch-free payments super secure, but they’re also quick and easy to use. So, what are you waiting for? Embrace the future of payments with NFC technology and give your customers the security and enhanced experience they deserve.

FAQS

Still not really sure what all the fuss is about or need a little extra info? We’ve answered some burning questions below…

What is NFC?

Near-field communication is essentially a wireless transfer used to make payments or transmit data. It’s the technology behind today’s rapidly growing payment methods like mobile wallets and contactless payments.

Are NFC and contactless the same?

Similar to radio-frequency identification (RFID), NFC is the technology that makes contactless payments possible, so yes! It allows enabled devices to communicate with each other to carry out tasks, from sharing information to making payments.

How can I tell if my phone has NFC?

In the settings or search settings bar, type NFC. Open and toggle on to activate NFC. If you can’t find NFC, your phone can’t make contactless payments.

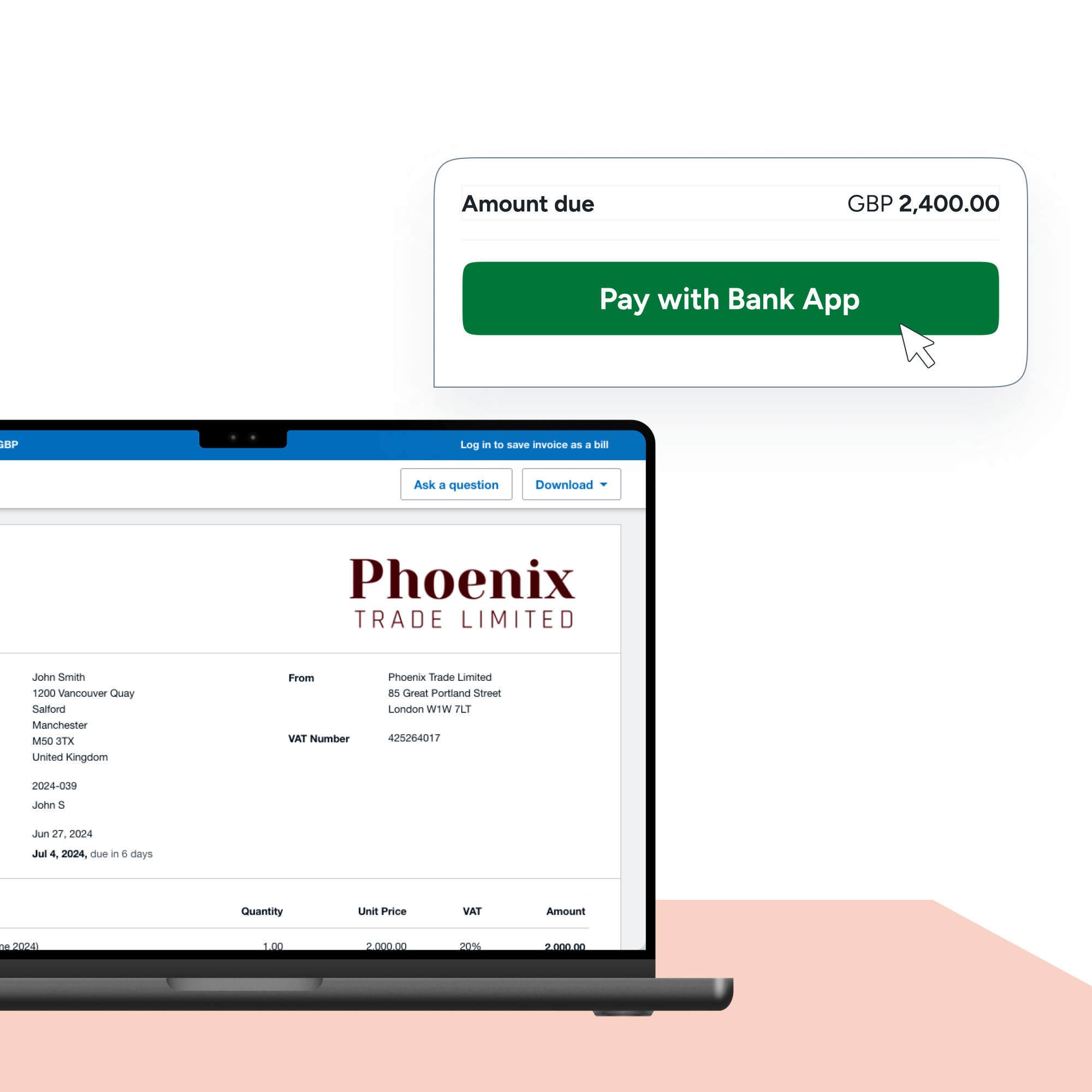

How do you pay with an NFC card?

First, add your debit or credit card details to your Apple, Google or Samsung wallet. Once set up and you’re ready to pay, open the mobile wallet. Choose the card you want to pay with and tap or wave over the reader to pay. When approved, your device will send a notification with the transaction amount and retailer.

Are contactless payments safe?

This is probably one of the most burning questions. Contactless card payments can be tricky as lost or misplaced cards can be easily tapped to make payments up to £100. However, you can’t get much safer than mobile wallet payments. First, you have the device to unlock, which is likely protected by face or fingerprint scans. Plus, card data is only shared when you add it to mobile wallets. Therefore, payment data is encrypted and long card numbers hidden, which means you can trust NFC payments to keep your money safe and secure.