Real-time payments (RTP) are transactions between bank accounts that initiate and clear to pay within seconds. In effect, they’re a financial powerhouse, moving funds instantly no matter the time or day. RTP isn’t slacking off during holidays or weekends, either! Instant payments made up nearly 10% of UK payments in 2021, and it keeps growing.

But why is getting instant funds important? Immediate payments boost transparency and confidence in business transactions, making it easier for consumers, banks, and businesses to manage money. The UK recorded 3.4 billion real-time transactions in 2021, which resulted in an estimated cost savings of over £750 billion for businesses and consumers. Whether you’re new to this or just snooping around, let’s explore real-time transfers further…

This article aims to uncover:

- What real-time payments are and why they’re important

- Which networks and banks offer real-time funds

- How real-time payments work in-store and online

- Examples of these rapid payments in UK business

What are real-time payments?

It’s simple: real-time payments allow customers to pay merchants instantly. The UK was an early adopter of instant transfers with the Faster Payments (FPS) service launched in 2008. UK banks use this real-time electronic payment system to send instant transactions up to £1,000,000.

How to take real-time payments

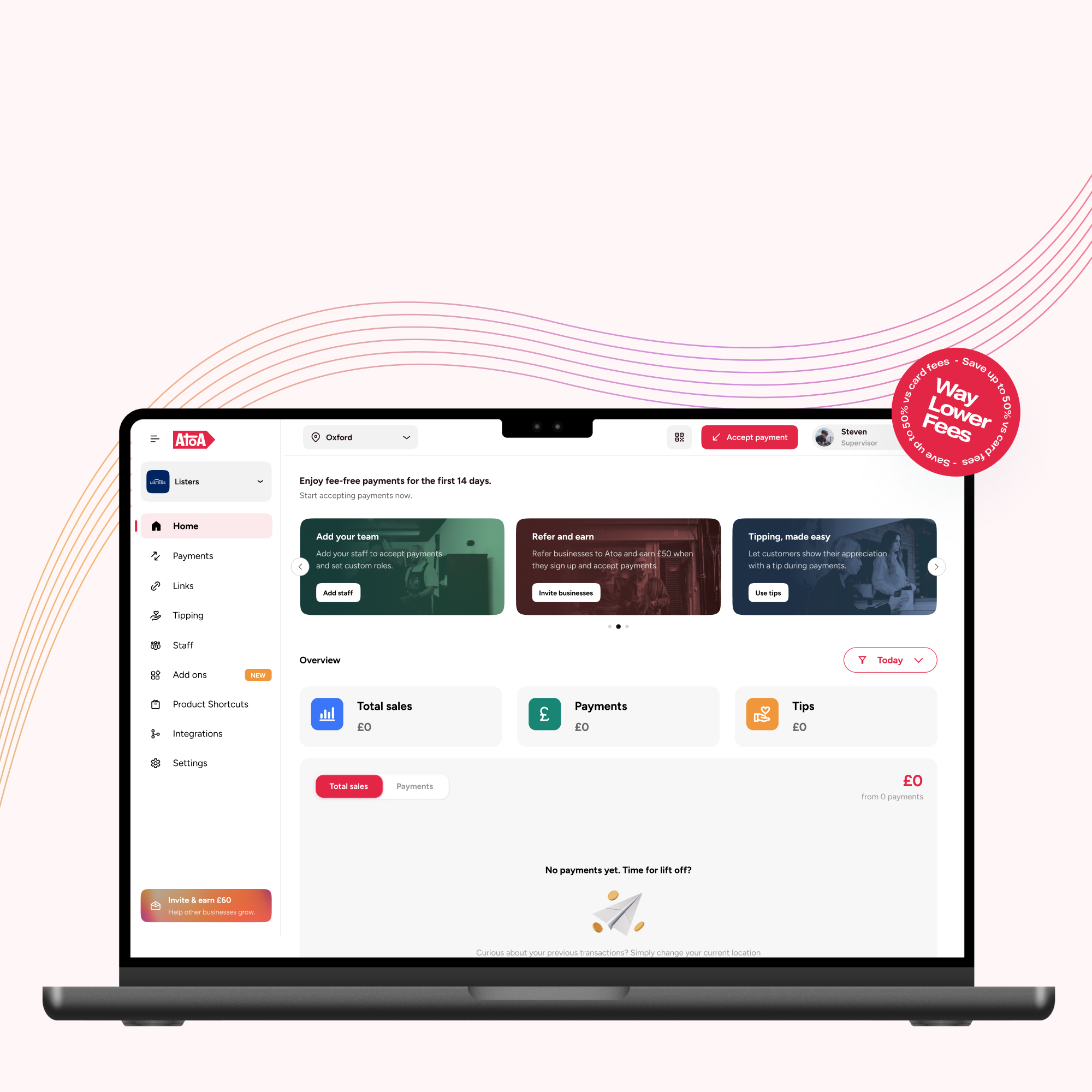

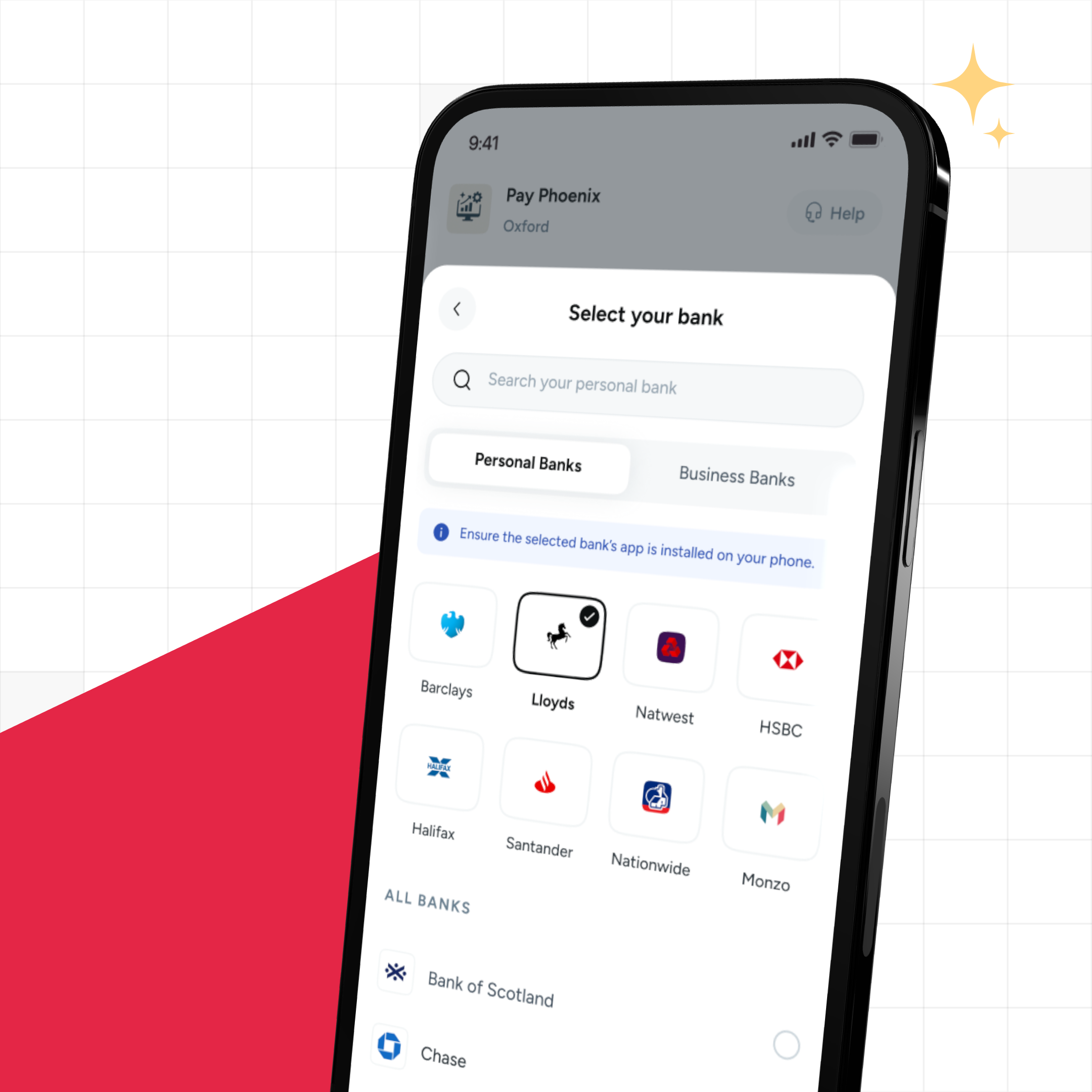

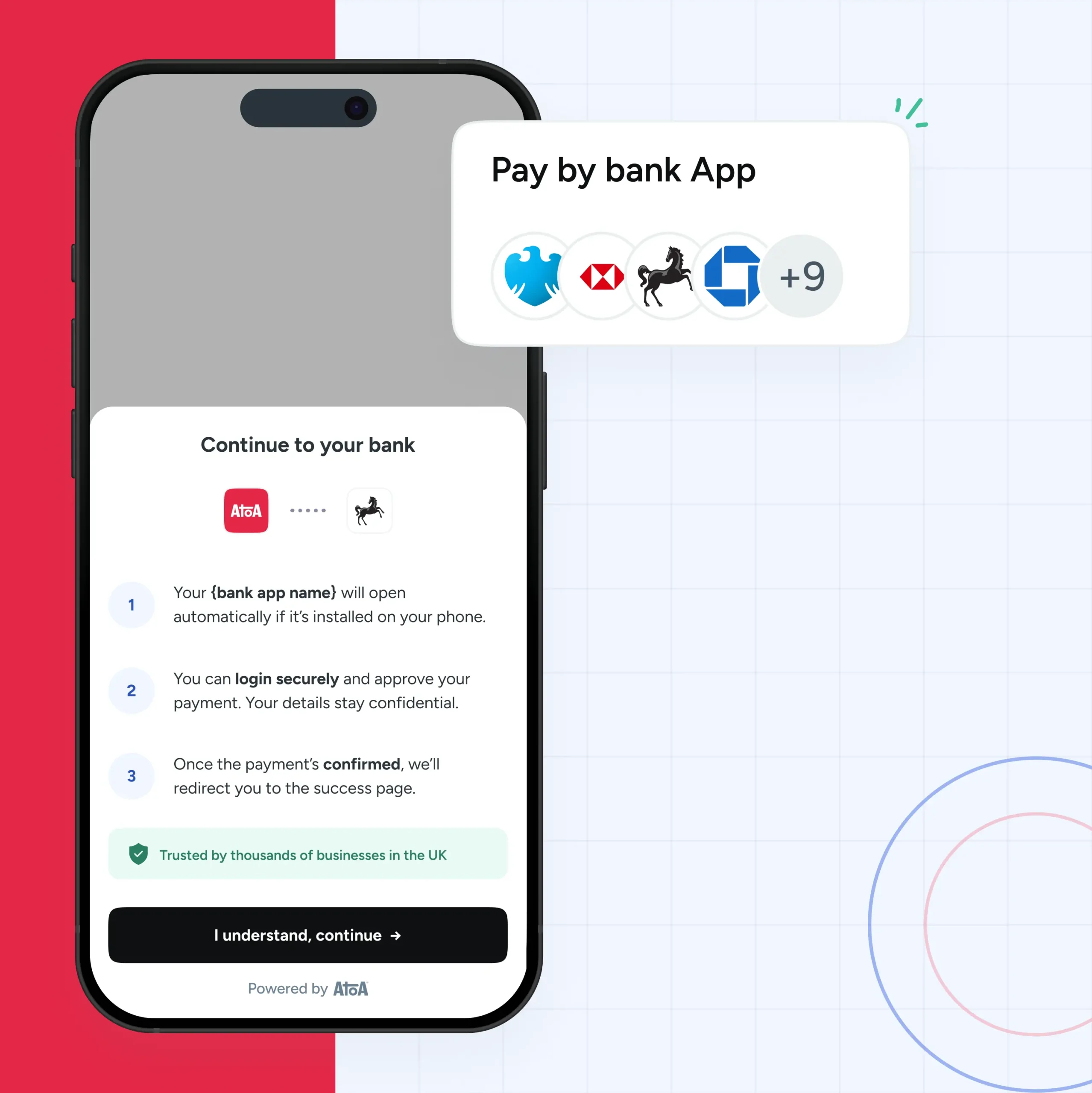

The most common way for merchants to accept real-time payments is Faster Payments. This UK payment network allows funds to be settled in seconds, at any time or day. To accept Faster Payments, link your business bank account to a payment gateway or provider. There’s a long list of providers, but the most crucial factor is to choose one that supports your needs and budget.

Here are some popular payment gateways and merchant services that support Faster Payments in the UK:

- Atoa

- GoCardless

- PayPal

- WorldPay

You can take payments as soon as a payment gateway is added to your website or app! Funds will be settled directly to your business bank account in seconds.

Which UK banks use Faster Payments?

All banks or building societies can send Faster Payments, but some providers are direct participants of Faster Payments, which we’ve listed below.

- The Access Bank UK

- Atom Bank

- Barclays

- BFC Bank

- Cashplus

- Citi

- Clear Bank

- Clydesdale Bank

- The co-operative Bank

- CreDec

- Danske Bank

- Ebury

- Elavon

- HSBC

- HSBC UK

- JP Morgan

- LHV

- Lloyds Bank

- Metro Bank

- Mettle

- Modulr

- Monzo

- Nationwide

- NatWest

- PayrNet

- PPS

- Prepaid Financial Services

- Revolut

- Santander

- Equals Money

- Square

- Starling Bank

- Tandem

- Tesco Bank

- Wise

- TSB

- Turkish Bank UK

- Virgin Money

Beyond Faster Payments, there are a few alternative instant payment methods to consider.

Peer-to-peer (P2P) payments

Consumers can send and receive money directly from their bank accounts using mobile apps or digital platforms. PayPal is one of the most well-known global P2P payment services. This can be used in many ways, from splitting bills to paying back friends and family. By the way, we have an app for that!

Business-to-business (B2B) payments

Maybe you’re a hospitality operator relying on suppliers to provide ingredients and stock. Your business can settle invoices and payments to other companies on the spot, reducing any disruption to cash flow.

In-store and online payments

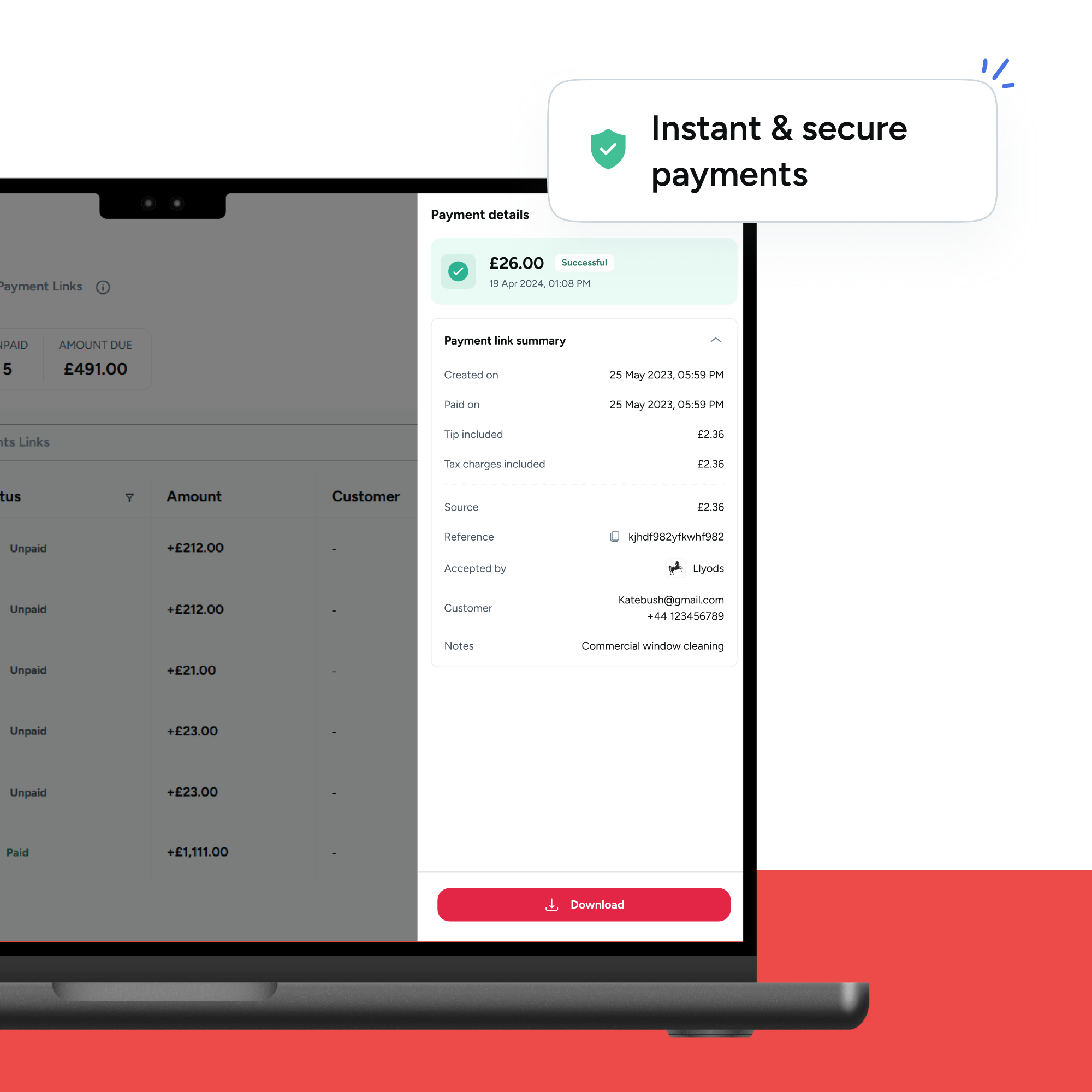

Merchants get payment confirmation and can send receipts in real time, improving customer satisfaction.

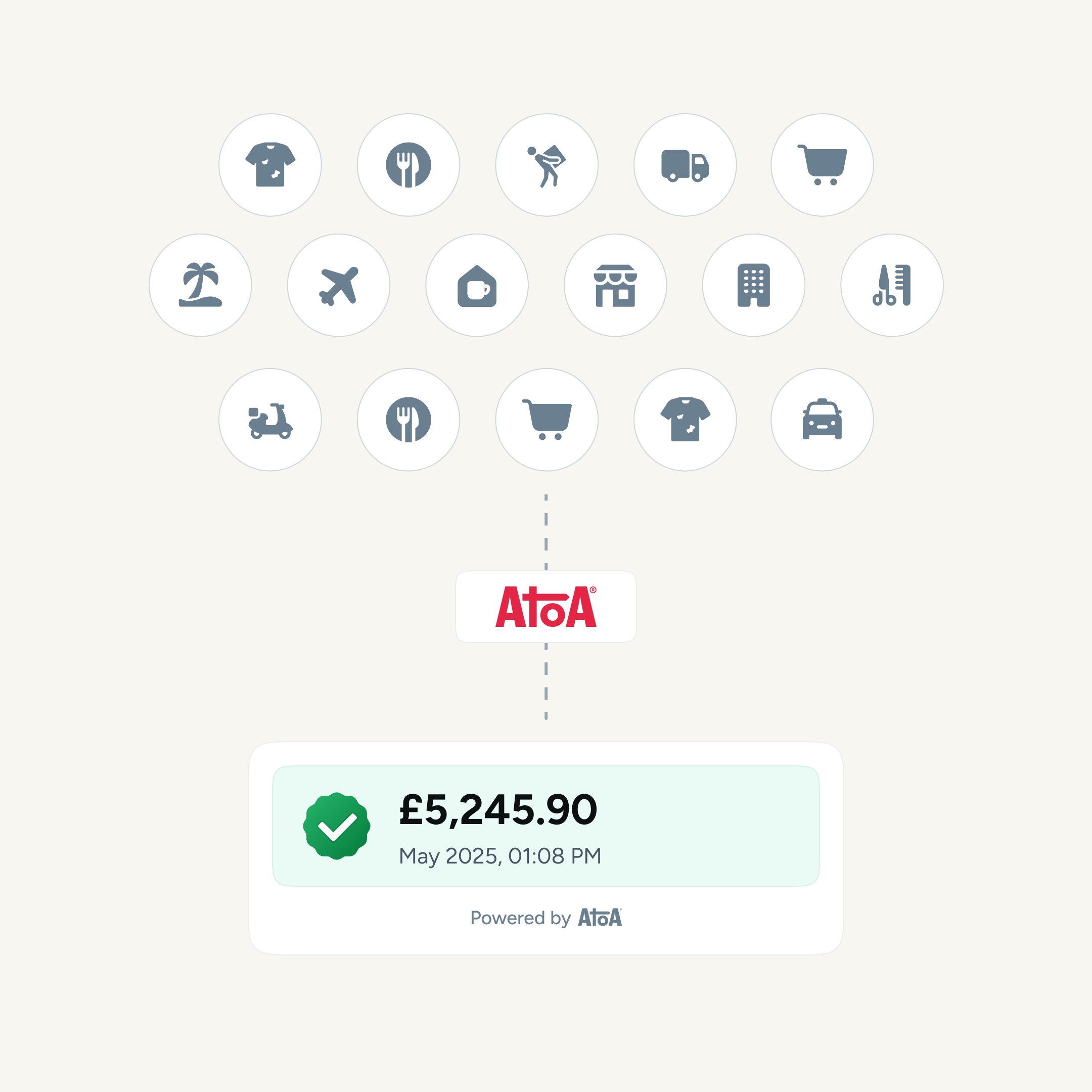

How your business can use real-time payments

Instant payments are reshaping how businesses and consumers send funds. They are becoming increasingly popular in the UK, offering a more efficient payment solution. Want to know how your businesses can harness the power of real-time payments? Keep on reading for the inside scoop…

Tap into instant funds

Make payments in seconds, without waiting days or weeks for funds to clear. This is ideal for small businesses as it offers instant access to funds for wages, stock and other overheads.

Smoother payroll

High-speed payments can help pay salaries, bonuses, and expenses on time to keep your team happy.

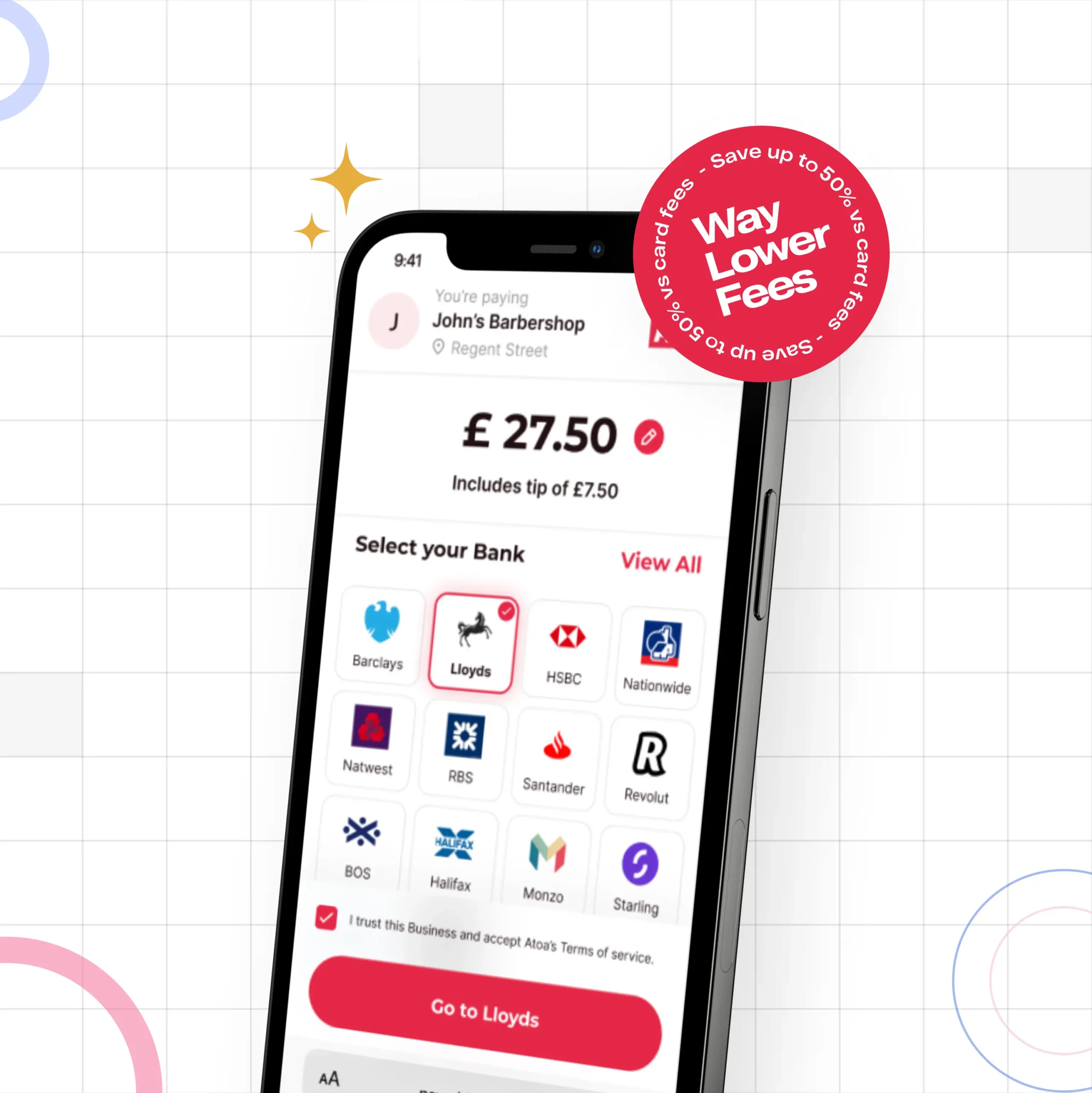

Boosted bottom line

Real time payments avoid card rails and come with much lower fees, saving your business the money it worked hard for. Plus, instant settlement means funds are there whenever you need them.

Effortless B2B payments

Instant B2B payments improve the supply chain and reduce payment disputes. This is helpful for retail and hospitality operations relying on stock and deliveries.

Instant customer refunds

Send instant customer refunds to improve satisfaction and reduce the risk of chargebacks. Your business will enjoy more return visits if customers enjoy the shopping experience.

Solid decisions

Getting funds faster can help businesses make better decisions using real-time payment data. This can help identify trends to finetune financial planning and forecasting.

Real-time payments are having a significant impact on the way businesses operate in the UK. They are helping to improve efficiency, reduce costs, and enhance customer satisfaction. As adoption continues to grow, we can expect to see even more innovative use cases emerge in the years to come.

How to accept instant online payments

Choose a payment gateway or merchant service. Research and compare pricing, features, and customer support to find the best fit for your business.

Register for an account with the payment gateway or merchant service. Sign up with basic business information and link your bank account.

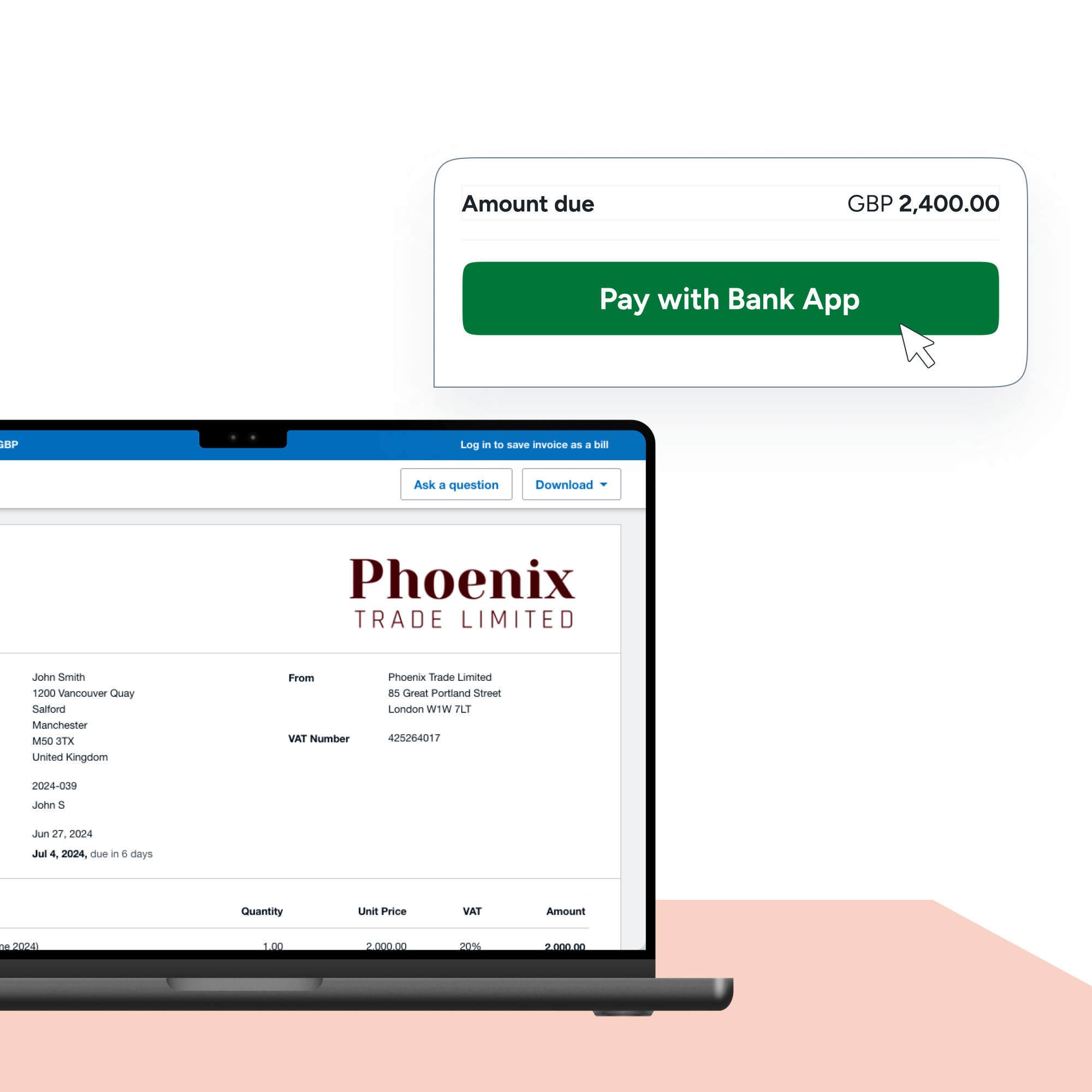

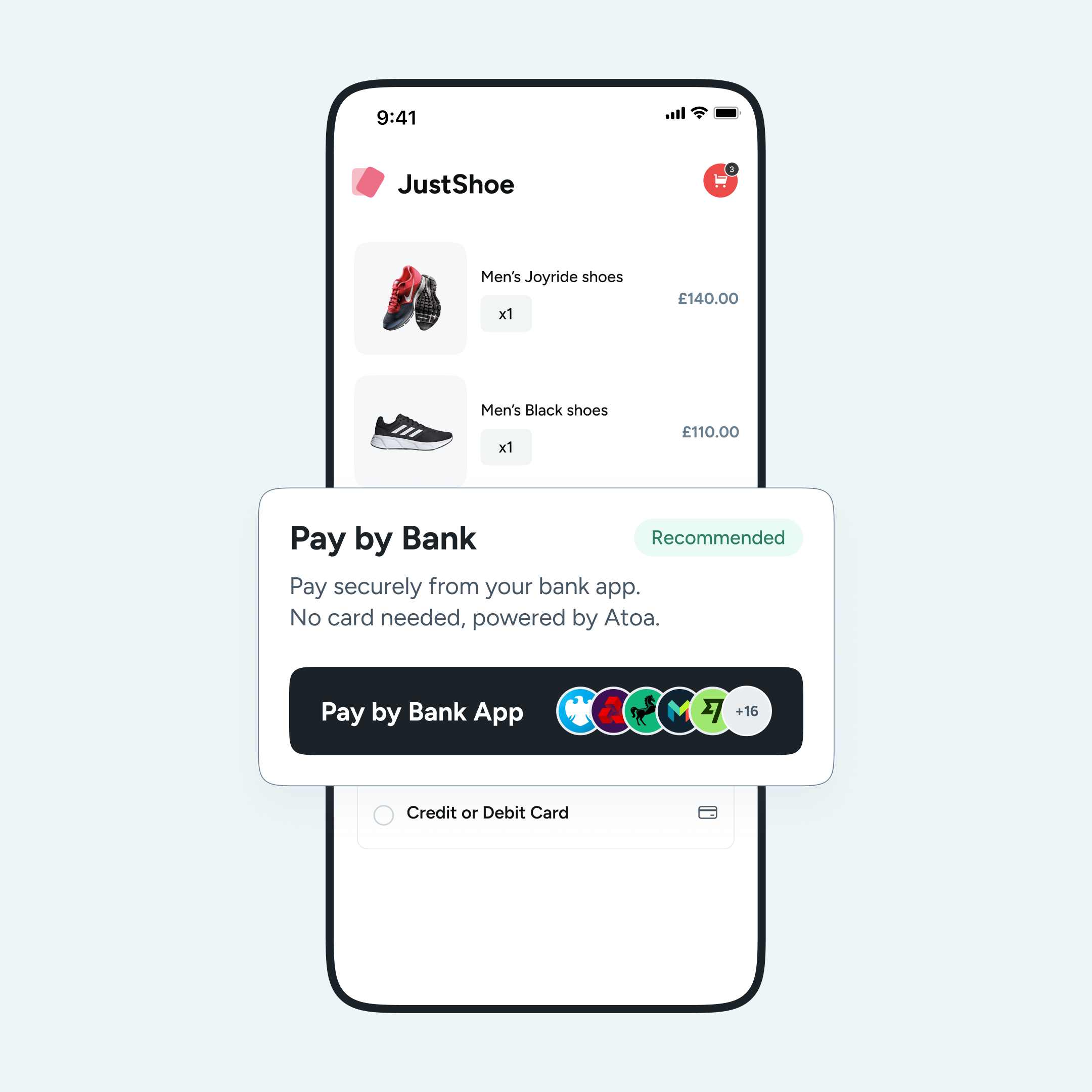

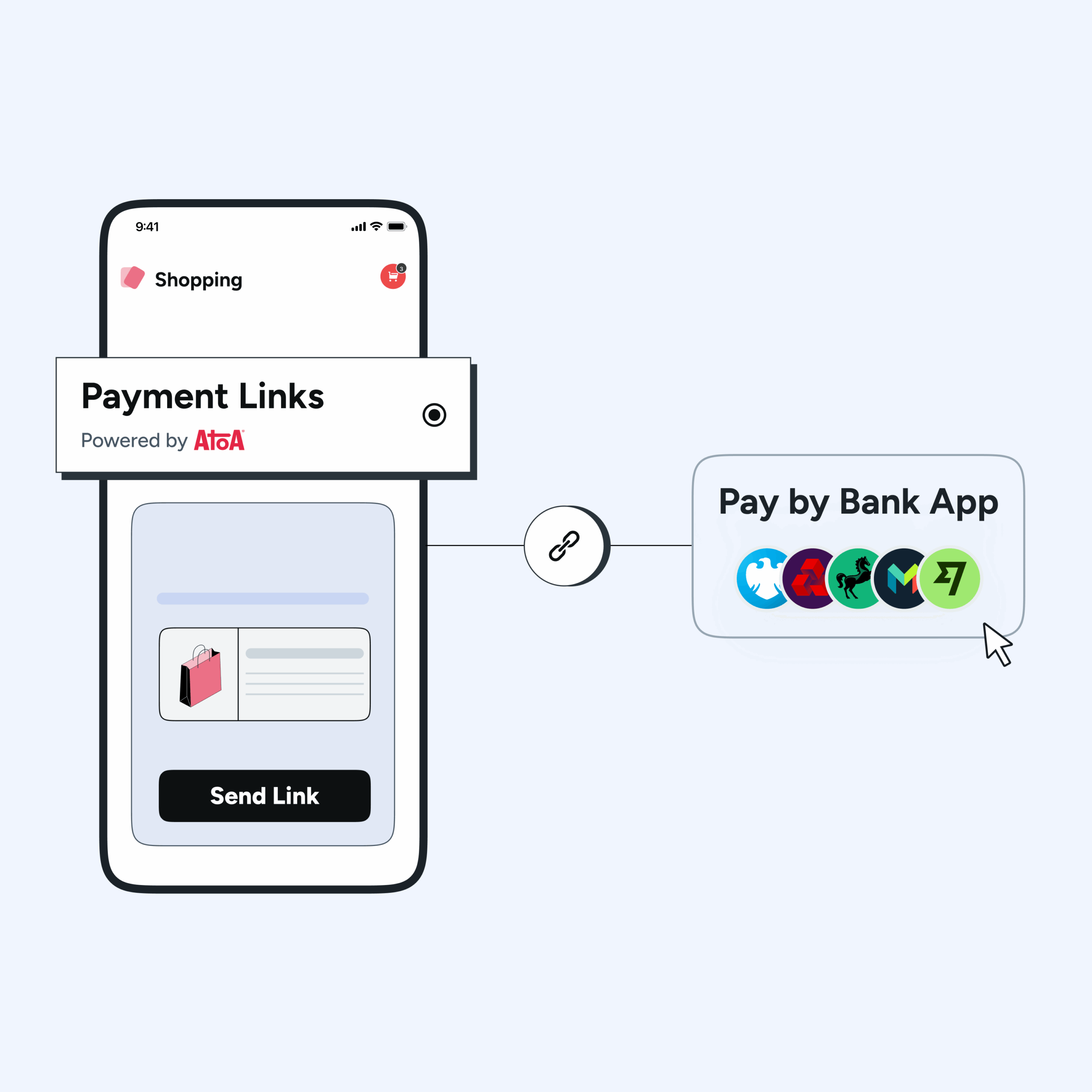

Create a payment button or link on your website or app. This will allow customers to pay you using Faster Payments.

Add the payment gateway to your website or app. This lets you accept funds directly into your bank account.

💡 Hot tip: you can accept instant online payments with Atoa using our WooCommerce plugin.

The takeaway

As merchants continue to seek out quick and easy transactions for their business, there is room for instant payments to grow.

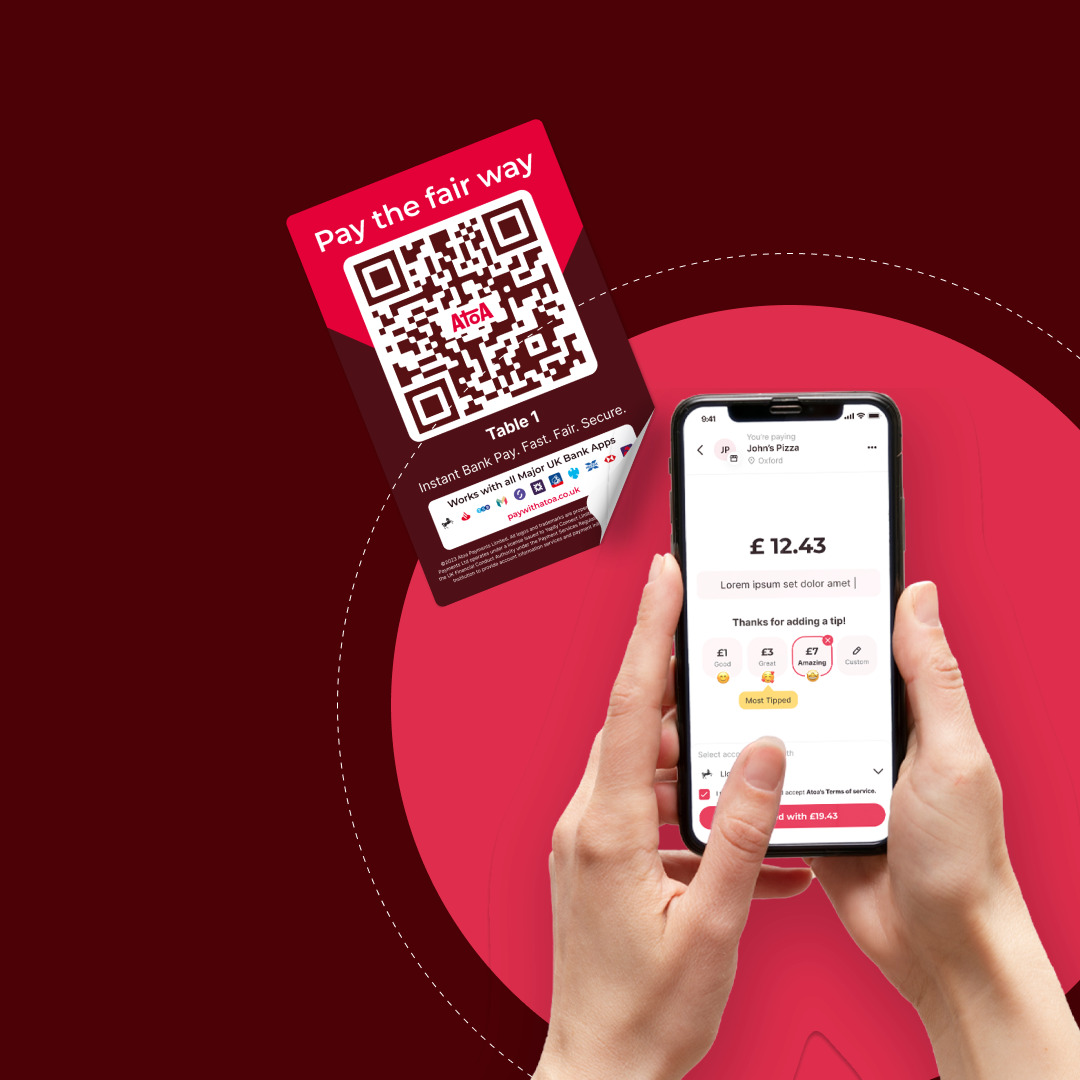

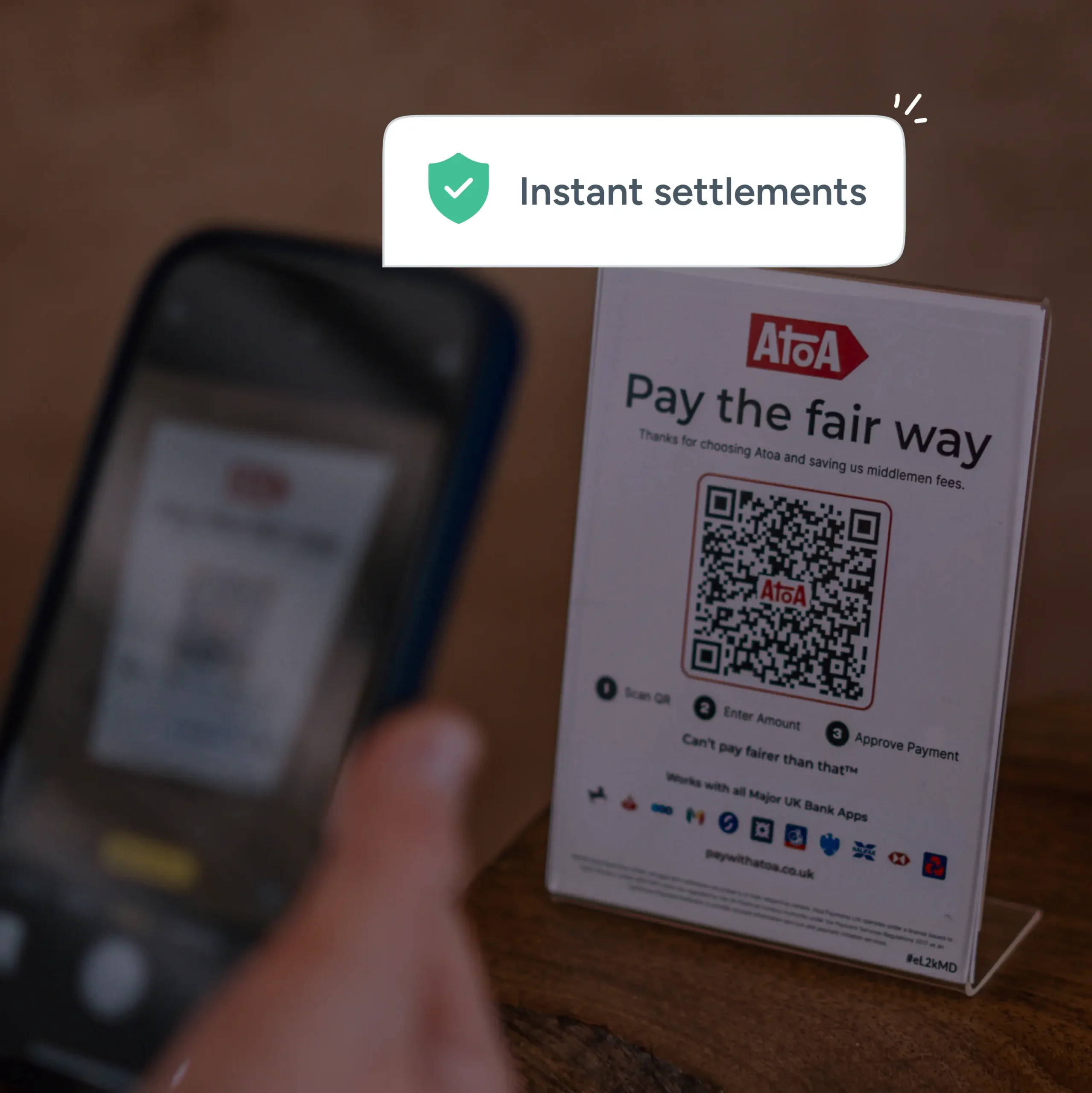

To add real-time payments to your operations, find the best payment platforms and providers to match your business needs. In-store payments can be made easily with a quick tap or scan to make same-second payments. On the flip side, e-commerce businesses can integrate real-time payment at checkout to provide a smoother experience for customers.

Real-time transactions help your customers by letting them make secure payments instantly. High-speed payments positively impact the economy, and as technology advances, the future of real-time payments looks promising.

How Atoa can help

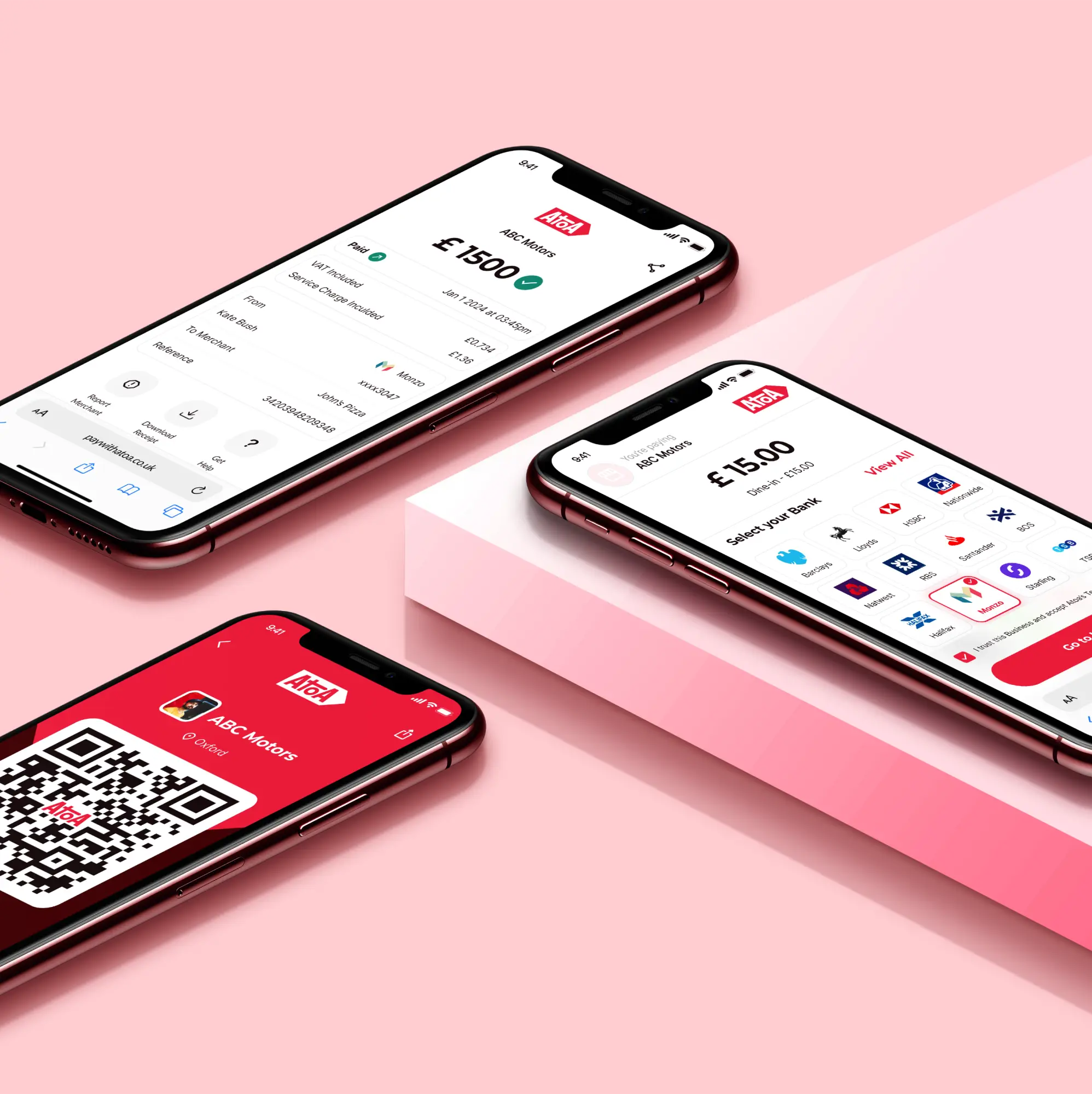

We offer fast, fair, secure instant payments directly in your customer’s bank app. No hidden fees or gotcha contracts. You only need a smartphone to accept funds using an Atoa QR code or payment link. Search for ‘Atoa Business’ in your device’s app store and give us a go. Once you download the app and sign up, you will get 7 days of free transactions for a taste of how easy your payments can be.