Remember the days when “chip and pin” seemed like something from Blade Runner? The world of payments moves fast, but luckily the UK is at the forefront. Cashless transactions benefits go sky high, meaning they’re no longer a trend but a smarter way to do business.

Fintechs (aka financial technology companies) and open banking networks are shaking up the scene. Contactless shopping and mobile wallets? They’re just the beginning. Digital business payments are changing how we pay, taking us far beyond the high-street bank. UK Finance reported that 83% of people in the UK use contactless, with no age group or region falling below 75% usage. That’s big game! So, if you’re a UK business owner, it’s time to get clued up on the benefits and a few things to watch out for when it comes to cashless transactions.

What are cashless transactions?

A cashless transaction is any financial exchange that doesn’t involve physical currency (coins or notes). It’s no surprise that these transactions are quickly changing how UK businesses and consumers make payments.

Popular cashless methods and how they work

Debit cards: Your customers insert or tap their card for funds to be debited from their bank account. However, card networks or payment providers often hold onto the fees.

Credit cards: Payments made through short-term borrowing, with a bill issued later.

Contactless payments: Cards or phones with near-field communication (NFC) tech, which allows customers to make quick “tap-and-go” payments up to £100.

BNPL (Buy Now, Pay Later): These are short-term financing plans, such as Klarna, which let customers split purchases into interest-free instalments or pay in 30 days.

Mobile wallets: Digital wallets link to existing cards, making payments easy from a phone like Apple Pay and Google Pay.

Cashless transactions benefits for your customers

Your wallet, but better

Forget digging through pockets and fumbling for change. Cashless payments make spending effortless for customers. A quick tap, a swipe, or even a wave of a phone—it’s that simple. In return, you cut time waiting at the checkout for loose change!

Security built-in

Cashless payments come with top-of-the-line security, so customers don’t need to worry about lost wallets or stolen cash. Think encryption, fraud monitoring, and instant alerts if anything seems unusual.

Get rewarded for your spending

Customers love to earn a little something back while they shop. Many businesses offer this in cashback, exclusive discounts, or loyalty programs to encourage cashless payments.

Track your habits

Cashless payments are linked directly to customers’ bank accounts, which are likely to include budgeting tools. Track spending, stick to your financial goals and round up to put a little aside for your holiday with every contactless payment.

Cashless transactions benefits for your business

The 1980s called, they want their cash register back! If you’re still keying in orders, then maybe it’s time to adopt cashless transactions. Imagine making transactions in a few taps or scans – each payment saves you time and keeps customers moving through the queues. Plus, with some challenger banks, you’ll often see that money lands in your account the same day, which boosts your cash flow.

Increase payment security

If handling physical money leaves you vulnerable, going cashless could be the protection you need. Breathe easy, as chip and pin and real-time fraud monitoring keep your digital transactions protected.

Save on processing fees

Paying high merchant fees to traditional banks is tiring. Neobanks and modern payment providers often offer significantly lower fees, which means you can keep more of your profits right where they belong—in your business.

Make automation your friend

Drowning in paperwork? Many challenger banks offer clever budgeting and forecasting tools automatically linked to your cashless transactions. See where your money flows, spot trends, and make smarter decisions to future-proof your business. Plus, integrations with accounting software like Xero will make tax season a doddle.

How fintech is reshaping cashless business payments

So how do innovative banking and payment methods fit into cashless transactions? Fintech is driving a revolution in cashless payments, offering businesses and consumers more convenient and secure ways to transact. It’s essential to understand the difference between fintech and open banking. Fintech is the broader category of innovative, tech-driven financial services that disrupt traditional banking models. Open banking, meanwhile, refers to regulations that allow customers to share their financial data with authorised third parties securely. Open banking is fueling the rapid growth of fintech solutions.

Several key players are transforming the payment landscape. Payment gateways and processors, such as Stripe and PayPal, provide the infrastructure for businesses to accept a wide range of cashless payments online.

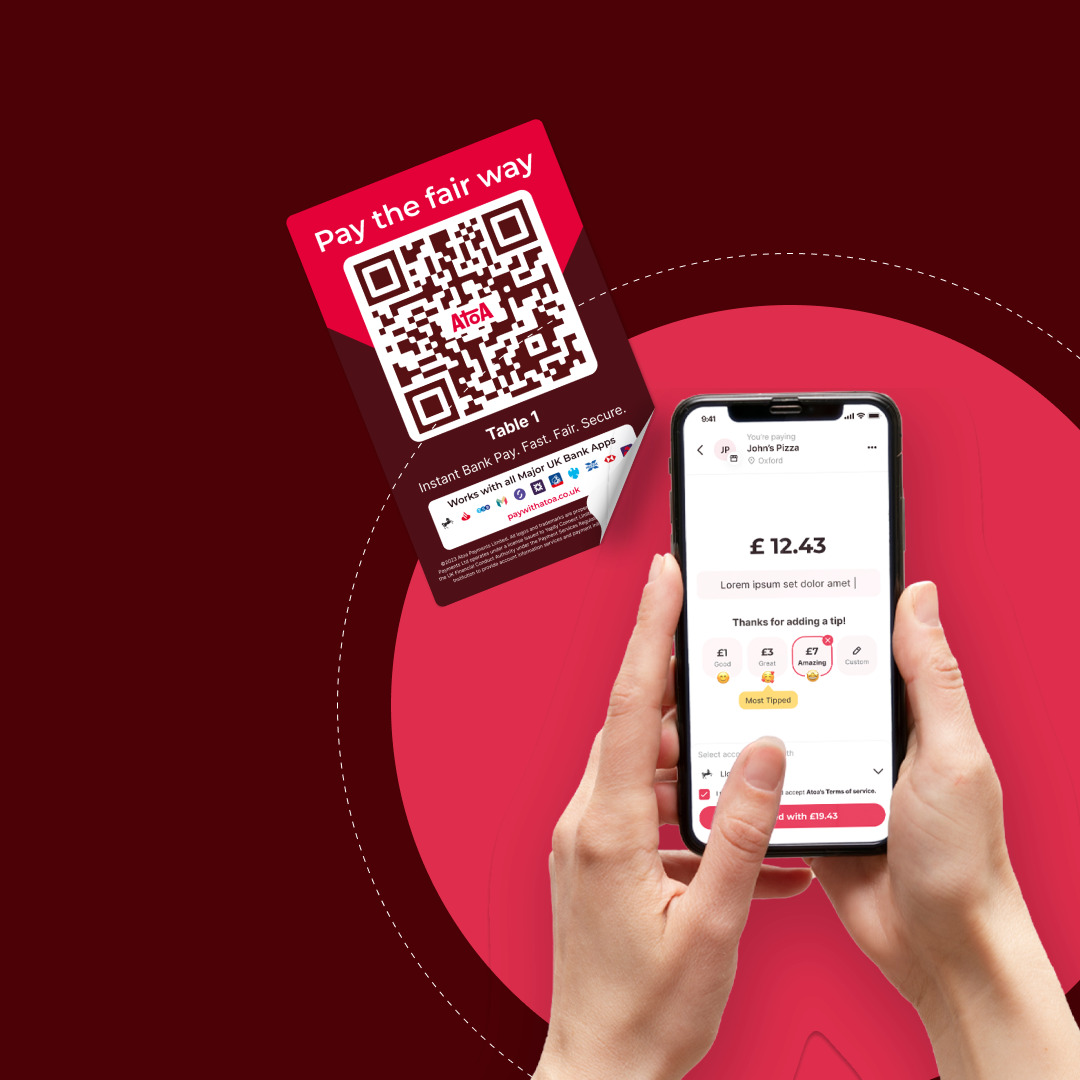

Mobile wallets like Apple Pay, along with peer-to-peer payment apps, are changing how we pay with our phones, presenting easier transactions between friends and businesses. Plus, QR code payments are gaining traction, and our instant bank pay services offer instant and secure transactions.

And let’s not forget the rising use of wearables, which let users pay with a smartwatch or other device to add another layer of convenience.

How to keep cashless transactions secure

- Keep your password game strong by using an unbreakable mix of letters, numbers, and characters for your accounts in different cases. Change regularly, and always keep them secret.

- Check your statements daily and set up alerts to notify you of any unexpected spending.

- Tap and go…safely! Contactless is cool, but know your limits.

- Lost your contactless card? Let your bank know ASAP, or freeze it in your app.

- Make sure your devices are secure, and avoid using public Wi-Fi when you’re logging in or viewing sensitive information.

- Banks and payment providers don’t ask for your logins by text. And urgent payment requests from your ‘friend’? Double-check before you hit send.

Popular cashless payment providers in the UK

Mobile wallets (e.g., Apple Pay, Google Pay) link your credit or debit card to your smartphone for contactless payments at stores or within apps. They prioritise convenience and security.

Open banking or account-to-account (A2A) payments are made from the customer’s bank account to yours. They often use QR codes, which come with lower transaction fees and faster settlement times than traditional card payments.

Online payment gateways, like PayPal, process payments on websites and e-commerce platforms. They offer a range of payment options, including cards and direct bank transfers.

Buy Now, Pay Later (BNPL) spreads the cost of a purchase over interest-free instalments. This option is popular for larger purchases and offers shoppers flexibility. Check out Klarna for this.

Cryptocurrency payments are less mainstream in the UK, yet some businesses accept payments in cryptocurrencies like Bitcoin. Transactions are decentralised, but price volatility is a consideration.

Note that regulations and adoption rates of these payment types can change. Always check the latest developments when exploring cashless solutions for your business.

Some challenges of cashless transactions

New and emerging payment methods aren’t always for everyone, even if they do see wide adoption. Don’t feel pressured to add them all. Weigh the pros and cons before jumping in. Here are a few things to keep in mind:

- It’s tempting to try every new payment option but focus on what makes sense for your business and your customers.

- Spending habits can change. Not seeing physical cash change hands can sometimes lead to overspending. Be aware of this potential risk, especially with credit cards or Buy Now, Pay Later (BNPL) options that can cause debt.

- Even with the best systems, lost cards or dead phone batteries could occasionally disrupt payments. Have a backup plan in these rare circumstances.

- Some customers may prefer cash or not have the smartphone required for some cashless methods. Consider a variety of options to serve everyone.

Cashless transactions offer convenience and efficiency, but it’s wise to proceed thoughtfully, considering your unique business needs and potential customer concerns.

The takeaway

The bottom line is that going cashless has upsides for everyone involved. It makes paying for things easier and safer and can even save businesses money. It makes sense why it’s the way things are going. Of course, some people take a little longer to get used to new things, so businesses need to keep their customers in mind before ditching cash completely.

Fintech and open banking are really changing the game when it comes to cashless payments. It’s all about making things secure and easy for businesses to get paid. Mobile wallets and QR code payments are streamlining the way we pay, while account-to-account payments offer enhanced simplicity and security. Plus, open banking gives business owners better tools to manage their money and make smart decisions.

As the cashless trend continues, businesses have to stay on top of regulations and make choices that work for their customers. Do this right, and you can make life easier for everyone, grow their profits, and leave the competition in the dust.

FAQs

Is it a good idea to go completely cashless?

Whether going completely cashless is a good idea depends on your specific business and customers. Cashless transactions offer convenience, security, and efficiency, but you might alienate some customers. It’s best to consider your target audience and weigh the potential fees against the benefits before you make the switch.

What about customers who don’t use digital payments?

While cashless is growing in popularity, it’s essential to be inclusive. Consider offering a hybrid approach (both cash and cashless) to stop customers from missing out.

Will fees for cashless payments eat into my profits?

While there are still transaction fees associated with cashless payments, they’re usually much lower than processing cards. Carefully compare providers to find the best rates and consider the benefits of instant cash flow.

Is it easy to set up cashless payments?

Setting up cashless payments is becoming very straightforward. Many providers offer simple setup processes and user-friendly interfaces. Do your research to find a solution that suits your business size and tech capabilities. Ours doesn’t have any hardware and can be set up in minutes! There’s nothing to it – start your 14-day free trial now.