So what’s the deal when it comes to QR vs credit card security? It goes a lot further than payments. QR code payments are seen as an accessible way for individuals and businesses to take part in the financial system. These pixelated squares have the potential to help financial inclusion, particularly in developing economies with limited access to traditional banking infrastructure.

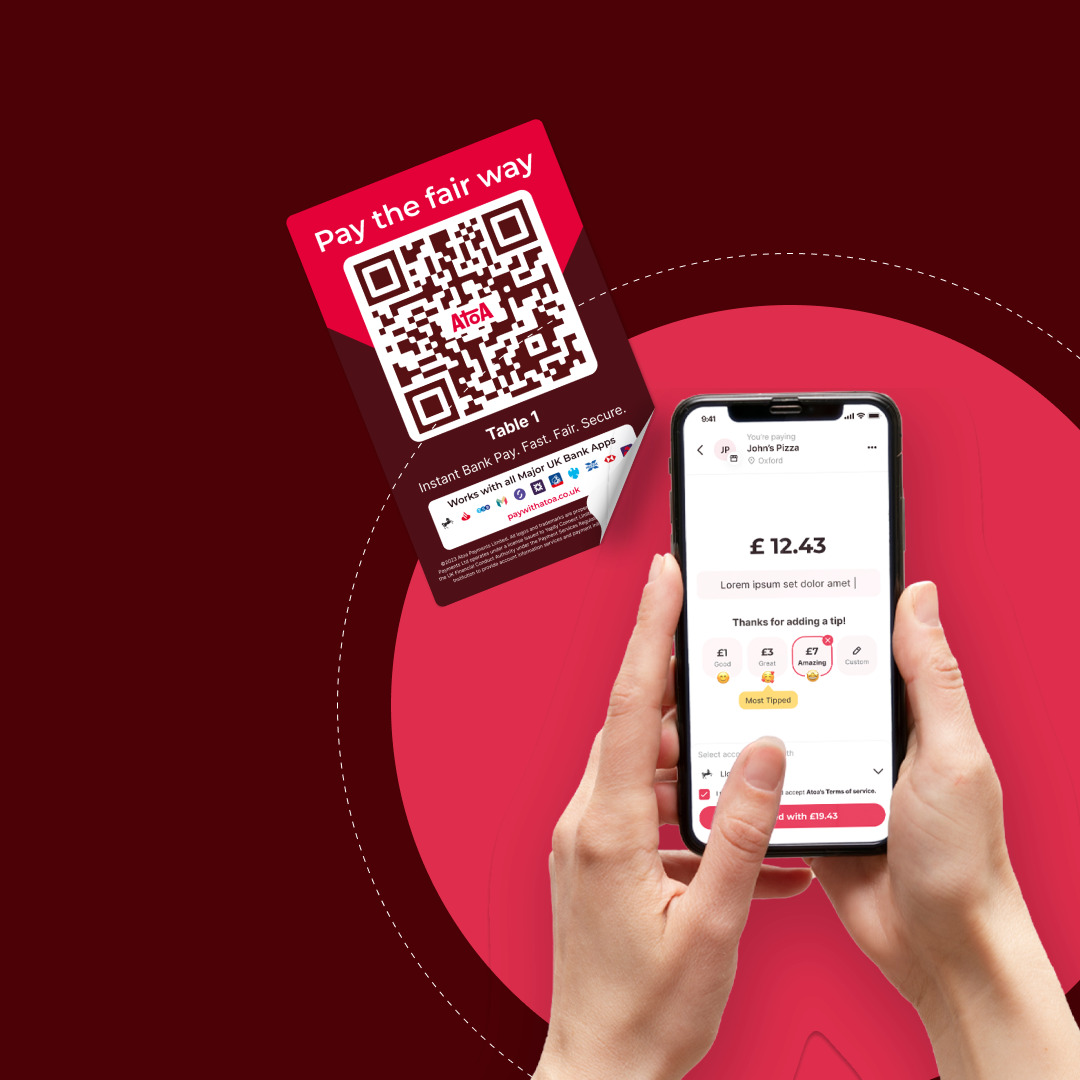

Here in the UK, QR codes offer a low-cost alternative to business owners and are also convenient for customers. After you’ve just enjoyed a midweek meal out with friends, the last thing you want is a 20-minute wait to tap your credit card. QR codes offer a quick scan-to-pay option, from printed receipts to easy table stickers linked to the point-of-sale.

But it goes much deeper than just convenient payments. Recent studies by Juniper Research predict that global QR code spending could reach over $3 trillion by 2025, up from the $2.4 trillion spent in 2022. So, not only do business owners need to take up this trend, but they also need to do it securely. QR codes can be much safer to use, from confirming the customer’s identity during payment to tighter encryption and data security. But let’s dig a little deeper…

In this article, I will explore:

- The differences between credit card and QR code payments

- A comparison of the security measures used by each payment method

- How businesses can use QR codes safely

QR vs credit card: How they compare

By now, I’m pretty sure we all know what a credit card payment is. Giving consumers easy access to loan funds, they broke ground in the USA during the 1950s with Frank McNamara’s Diners Club. They then slowly made it over to Britain in 1966, and not much changed when it came to flashing the plastic until Barclaycard went contactless with credit in 2007.

Tap to pay stole the nation’s heart, but it’s not always coming up roses with credit cards. Irresponsible usage and multiple accounts can tip cardholders into a spending spiral, leading to bad debt. Chip and PIN is a security step that makes credit cards more secure, but they’re not always used now for contactless payments. Plus, the tap-happy £100 contactless card limit can lead to some tricky chargeback situations for business owners.

The credit card payment process

Here’s what happens behind the scenes when customers pay with a credit card.

1. Dip or tap

When customers pay by card, they can tap contactless for under £100 or dip it into a chip reader and enter their PIN.

2. Encryption

The reader captures the customer’s card information (not the actual number) and encrypts it for security.

3. Authorisation

The encrypted information travels to the customer’s bank securely through a card network, like Visa or Mastercard. The bank receives the request and checks if the customer’s account is valid and has enough credit.

4. PIN time!

Depending on the transaction amount, the customer might need to enter their unique PIN. This confirms they are the real cardholders.

5. Approve or decline

If everything checks out, the customer’s bank approves the transaction and sends a signal back to the store. If there’s an issue, the transaction is declined.

6. Money moves…

The store receives the approval and deducts the amount from the customer’s credit limit. The funds are transferred to the store’s bank account within a few days.

Credit card security in action

- Encryption protects your card information throughout the process.

- PIN entry confirms you’re the authorised cardholder.

- Banks monitor transactions for suspicious activity and may decline risky ones.

- EMV chip cards offer extra security compared to magnetic stripe cards.

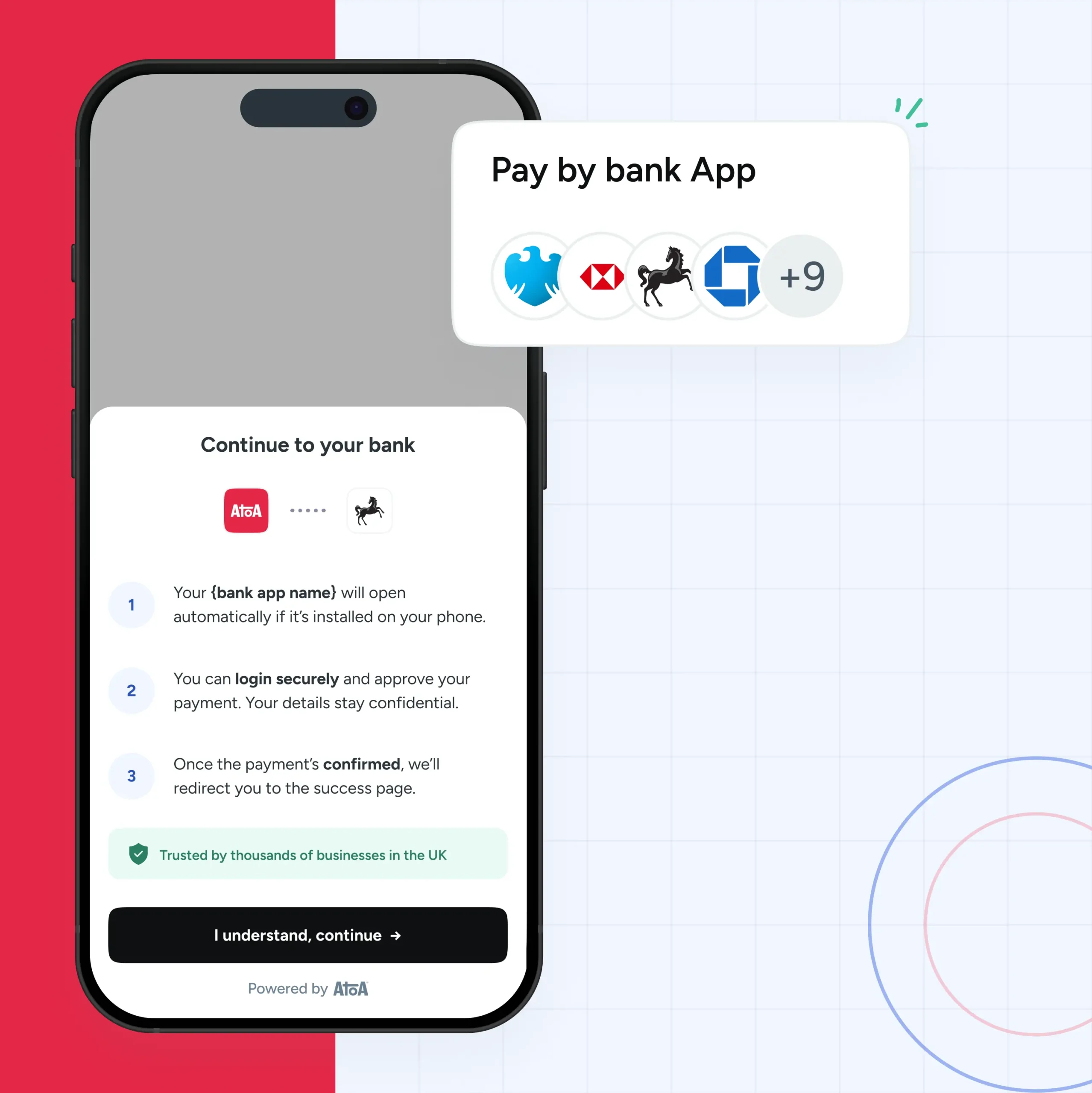

But what about the competition? QR code payments come with bank-level security practices, including Strong Customer Authentication (SCA) and biometrics. Other protections are in place, such as encryption and tokenisation. But let’s find out more in the next section.

The QR code payment process

There are two different types of QR codes, static and dynamic, each storing different data during payments. Let’s take a moment to review each code.

Static QR codes

- Usually, hold the payment links, which direct you to a page or app to complete transactions. They don’t store your card information.

- Examples: Restaurant tables with static QR codes leading to their menu and payment hub.

Dynamic QR codes

These codes typically include more data, including:

- Merchant identifier: The business receiving the payment.

- Transaction amount: Set by the business for a specific purchase.

- Unique reference number: to categorise or identify the payment.

- Optional extras: Customer information like name or email.

QR code payment security steps

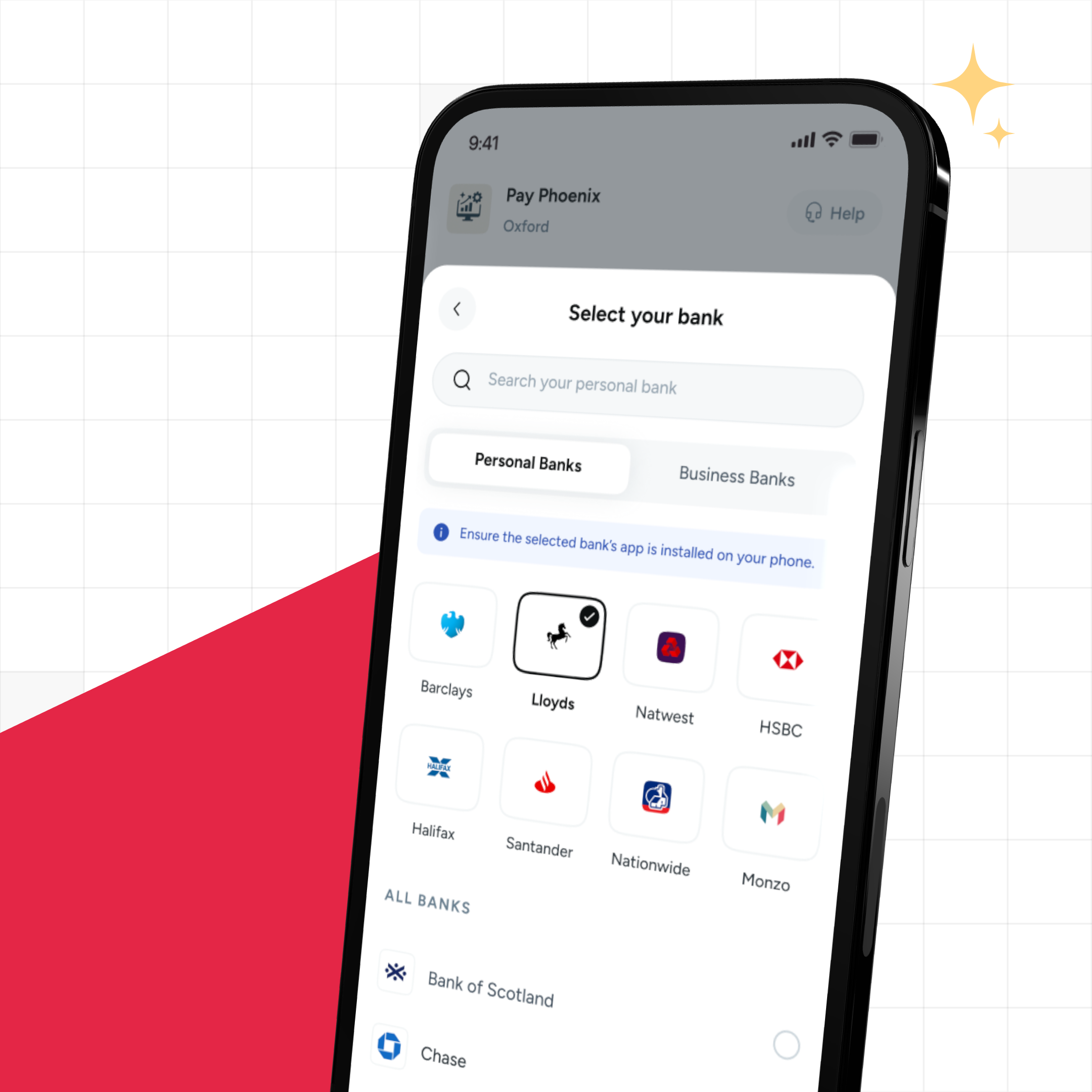

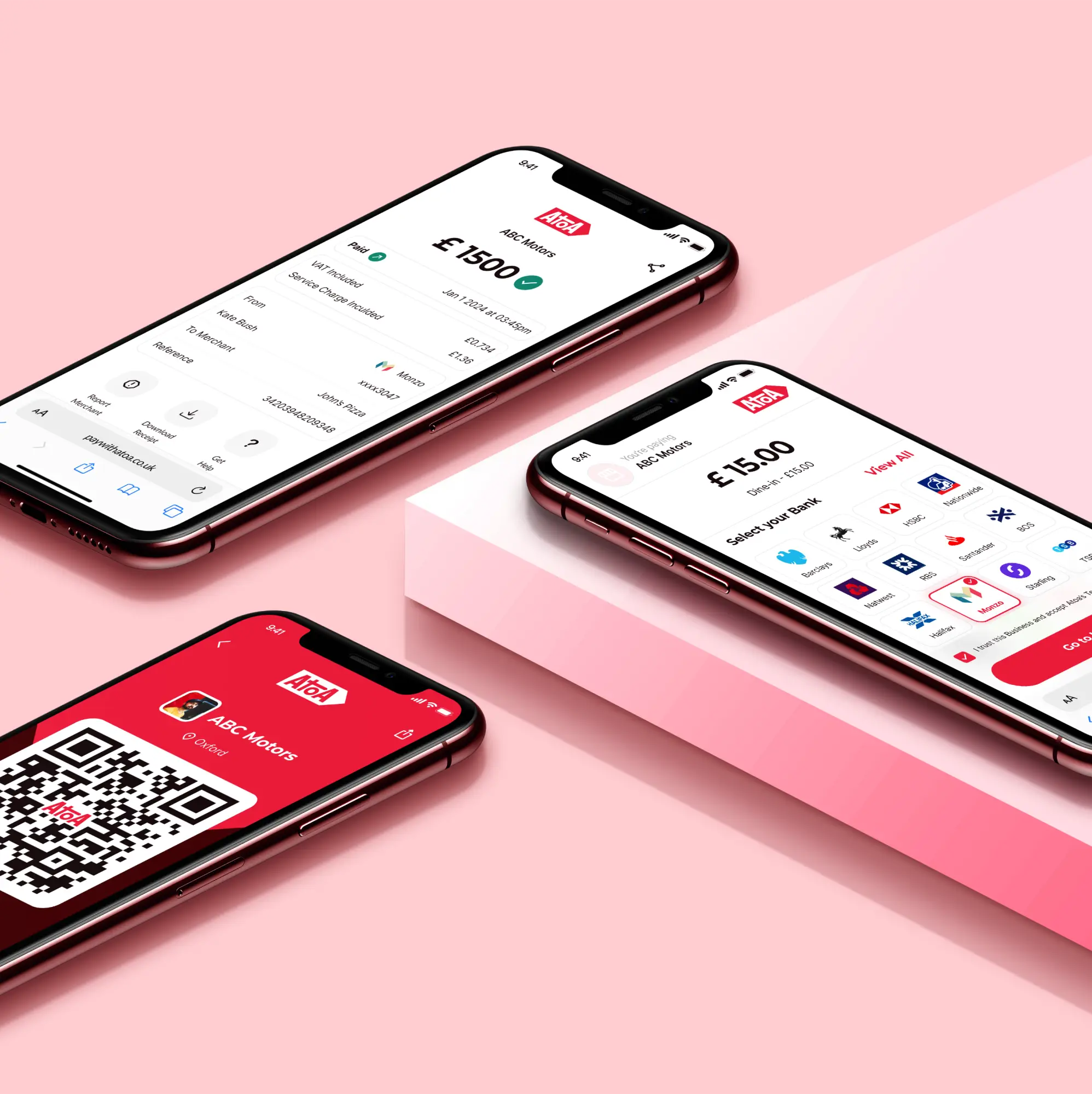

1. Scan a QR code

Both static and dynamic codes contain encrypted data, making them unreadable to the naked eye.

2. The information is read

Your phone or app scans the code and uses a secure key to decrypt the information.

How a static QR code payment happens

- The code links to a pre-defined amount and merchant information.

- Your app sends this information directly to the payment processor.

- The processor verifies your account details and completes the transaction.

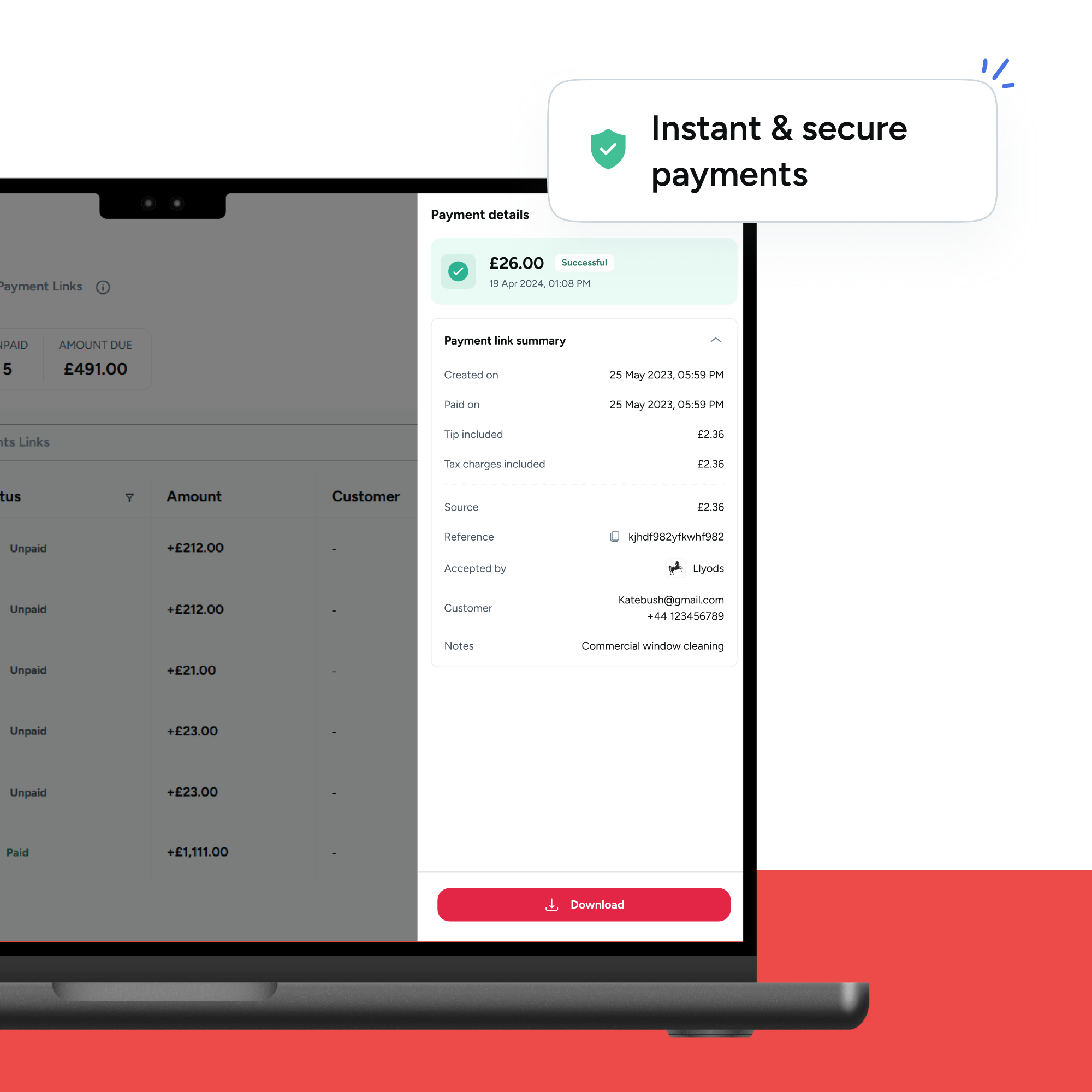

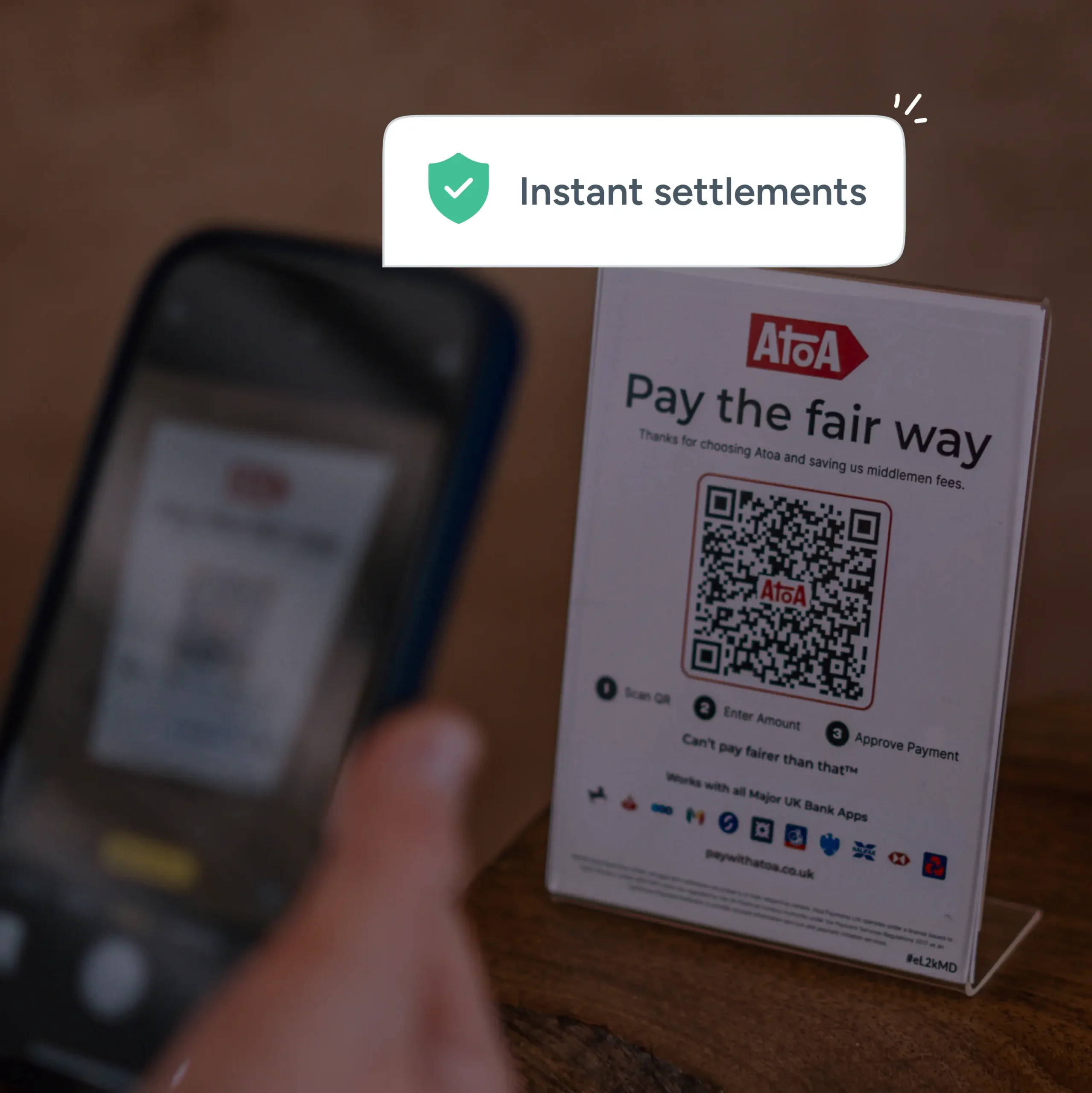

- The business receives funds instantly.

How a dynamic QR code payment happens

- The code contains unique transaction data generated for each use.

- Your app sends this data to the merchant’s server.

- The server verifies your account information and generates a one-time payment authorisation code.

- The authorisation code is sent back to your app and the payment processor.

- The processor verifies the code, and the transaction is completed.

- The business receives funds instantly.

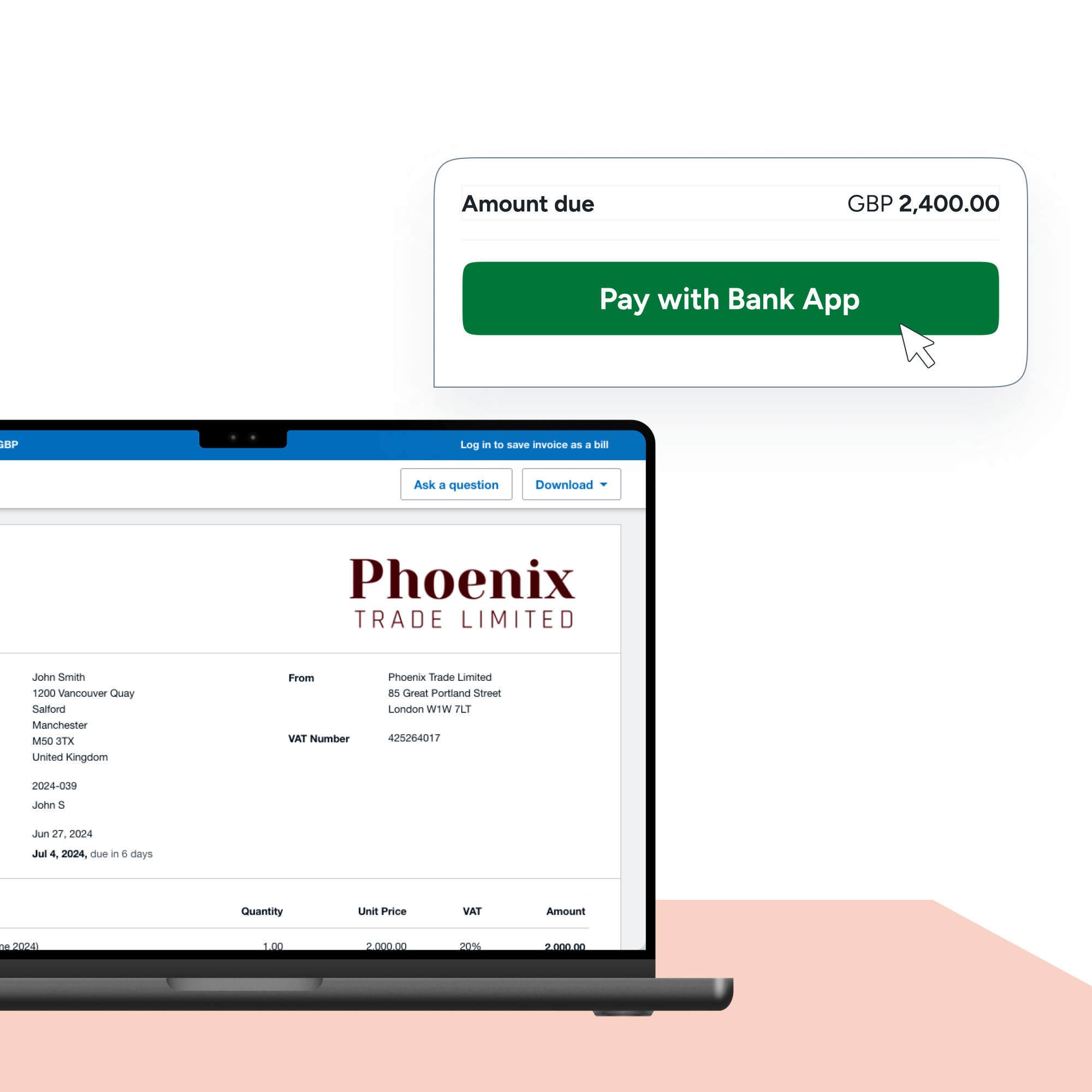

Watch the video below to see a QR code payment happening on Atoa.

QR code security in action

- Encryption protects data throughout the dynamic and static process.

- Dynamic QR codes add an extra layer of protection by using unique, one-time data, which reduces the risk of breaches.

Additional security features

- Some apps ask for Two-Factor Authentication (2FA), such as single-use codes or biometrics for added verification.

- Transaction limits can reduce fraudulent payments.

- Secure providers follow strict data security standards like PCI DSS and are vetted by the FCA.

As you can see, neither static nor dynamic QR codes store any of your bank information. Plus, customers need to physically scan and walk through a QR code payment, usually in their bank app. On the other hand, credit cards can easily be stolen and used for contactless or online payments. We know what we prefer!

Where convenience meets security

Whilst QR codes win the security race, they’re not always accessible to every consumer. Customers need a smartphone to use them, so there may be potential blocks to technology and adoption. But let’s look at some figures. Statista found that 98% of all adults aged 16-24 in the UK owned a smartphone in 2023. However, as we mentioned earlier, QR code payments open doors globally, providing the power to make payments without carrying a card.

Credit cards are a traditional payment method, and getting one can feel like a rite of passage. When it comes to paying, customers gravitate towards them as they feel comfortable with the process. However, not everyone can successfully apply for them due to bad credit or debt. Plus, they can be problematic for overspending.

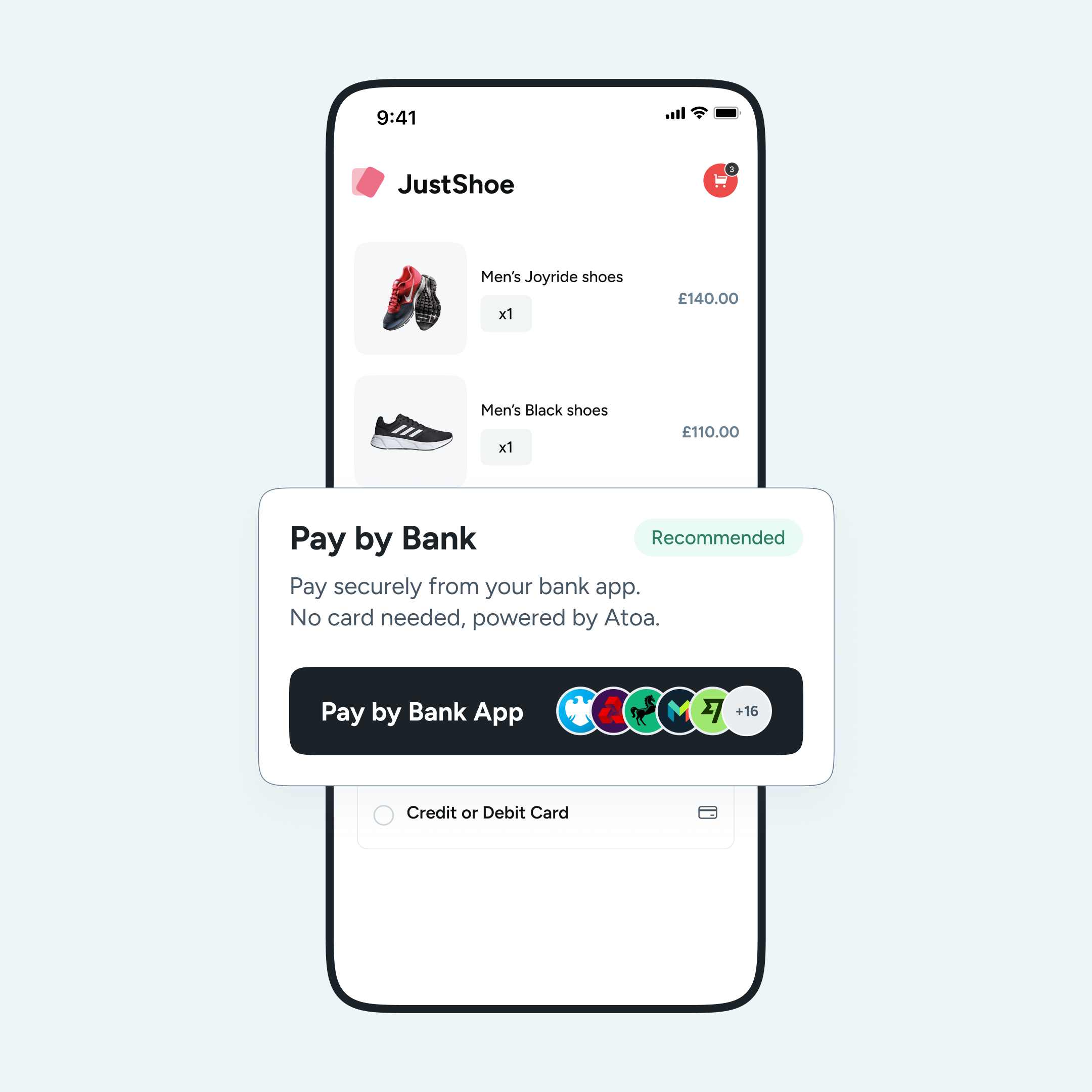

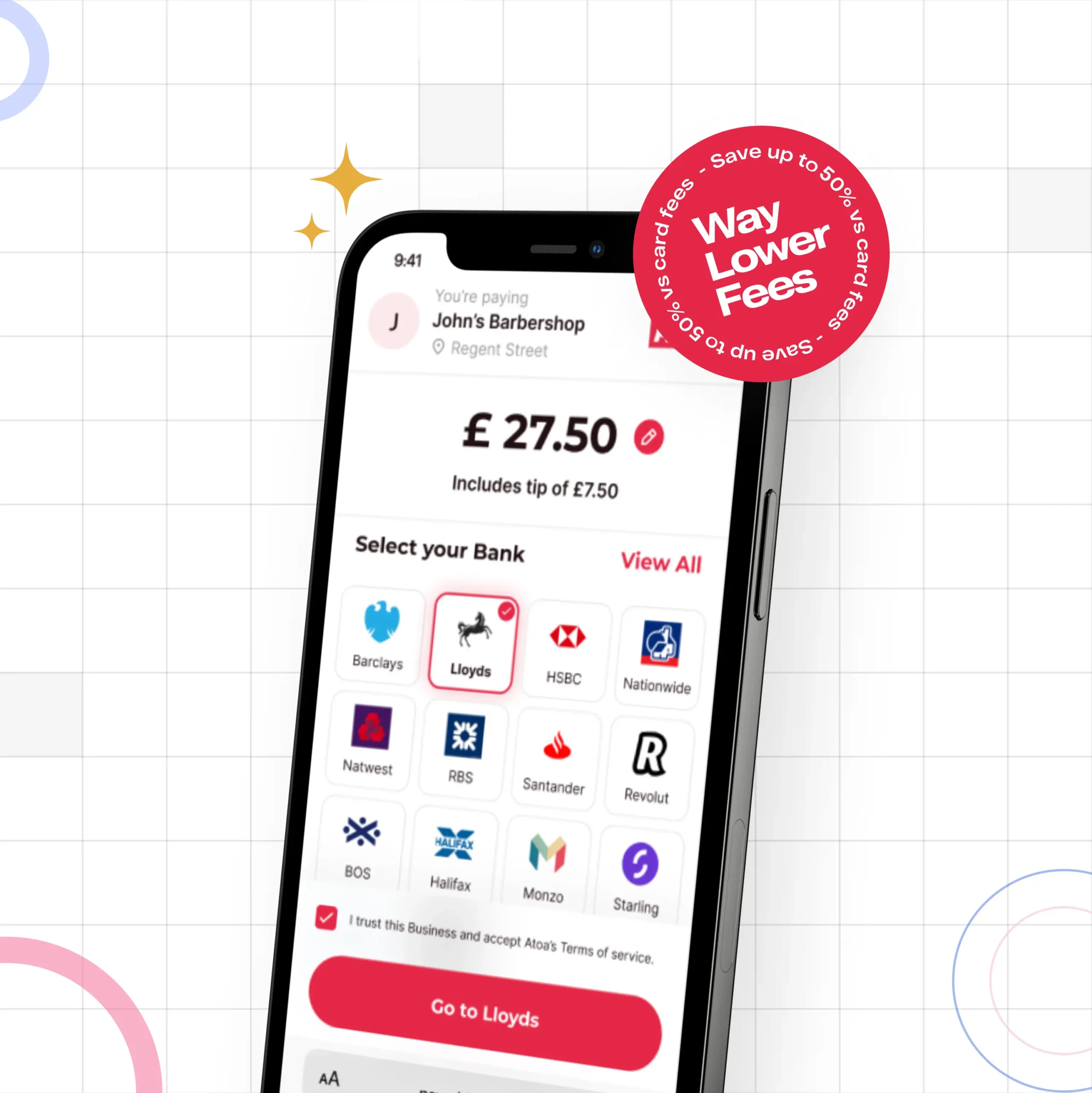

The best case scenario is accepting both traditional and digital payments in your business but encouraging customers to use QR code methods where possible to ensure secure, low-cost payments.

Choosing a secure QR code provider

When choosing a secure QR code solution provider, there are several key features you should consider to ensure the safety and privacy of your data. Here are some of the most important:

QR code security essentials

- Look for a provider with encryption measures to protect the data inside your QR codes. This helps prevent unauthorised access even if the code is tampered with.

- Choose a provider offering authentication to verify the code’s source and prevent quishing risks.

- Opt for a provider that collects and stores minimal data for QR code functionality.

- Check the provider is FCA-regulated and follows data security regulations like GDPR.

Privacy in place

- Understand how the provider handles your data and who can access it.

- Choose a provider who limits tracking and monitoring.

- Look for a provider who allows you to use a secure domain or app for payments to avoid phishing attempts.

Easy to use

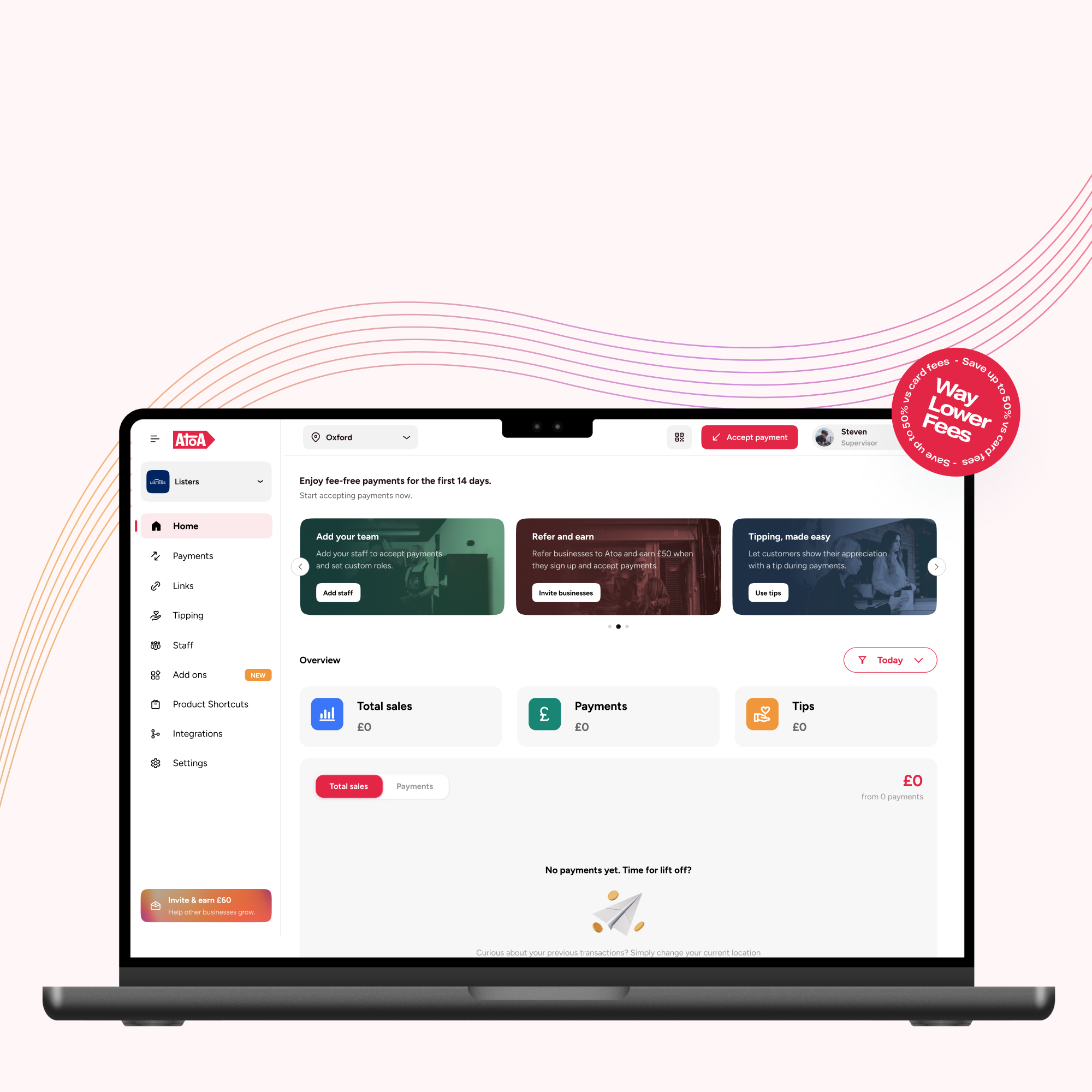

- User-friendly platforms or apps make QR code payments even easier.

- Security awareness resources: Choose a provider offering educational materials and warnings about potential security risks related to QR codes.

- Support: Opt for a provider offering reliable customer support to address any queries or concerns you may have.

Additional features

- Dynamic QR codes allow you to update the content linked to the code after creation, enhancing security and flexibility.

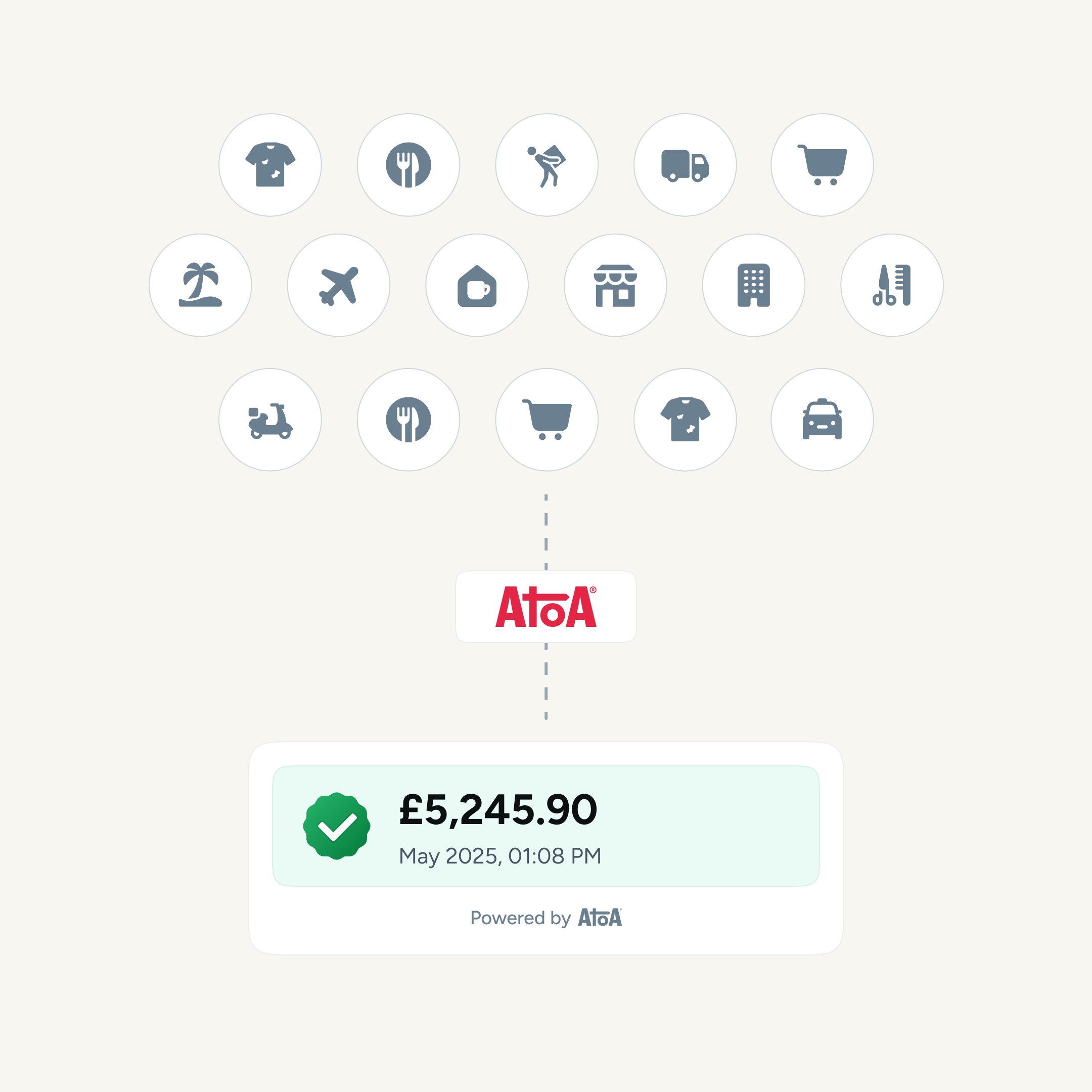

- Integrations are important across industries like hospitality and retail. Find a provider who can integrate with your existing tech and software.

The best solution for your business depends on its unique needs and customer base. Research and comparing different providers with these features may help you choose a secure payment partner.

QR vs credit card security FAQs

Are QR codes safer than credit cards?

While both methods offer unique security features, QR codes can potentially offer enhanced security advantages for UK businesses. Many QR code payment solutions integrate with fingerprint or facial recognition, adding an extra layer of security compared to credit card PINs, which can be easily stolen or shared. Dynamic QR codes can contain one-time-use information, minimising the risk of data breaches compared to static credit card details.

How common are QR code phishing scams?

QR code phishing risks can be easily avoided. First, choose a secure QR code provider with a good reputation. Then, regularly monitor transactions for suspicious activity and use up-to-date fraud prevention tools. Finally, educate your customers to scan QR codes from trusted sources only and check the URLs they are directed to.

Are there any UK regulations for QR code payments?

Secure QR code payments follow UK regulations like the Payment Card Industry Data Security Standard (PCI DSS) and Strong Customer Authentication (SCA), ensuring compliance and consumer protection.

How can I use secure business QR code payments?

Partner with a reliable QR code provider like us. We offer secure and PCI DSS-compliant solutions to protect your business and customer data. Plus, our payments easily integrate with existing POS systems, and we have a dedicated customer support team to guide you.

Can I learn more about QR code security?

Contact Atoa today for a free consultation and discover how secure QR code solutions can benefit your business and customers.

Book a demo with Conor to get started with Atoa!