Imagine tapping into a new market full of customers eager to spend. That’s the power of cross-border online payments. It’s an easy way to send and receive money across international borders. Whilst the jargon and technicalities can feel overwhelming, we’re here to break it down into simple chunks.

In this article, I will uncover:

- What cross-border payments are

- Why they’re essential for businesses

- The best cross-border payment platforms available and how you can start using them

What are cross-border online payments?

A cross-border payment is any transaction where the payer and the payee are located in different countries. These transactions can take place between individuals, companies or banks. As markets become increasingly global – thanks to easy travel and online communications – international online money transfers are essential to master.

Sending money across borders can be done in different ways. You can do it through a bank transfer, credit card payment, or other methods like e-wallets and mobile payments.

There are two main types of cross-border payments: wholesale and retail. Wholesale payments are transactions between financial institutions that support their customers’ activities or cross-border transactions. Governments and large corporations use wholesale payments for big transactions related to import and export or trading in financial markets.

Retail cross-border payments, on the other hand, are transactions between individuals and businesses. These include person-to-person, person-to-business, and business-to-business payments. One example is remittances, which are transfers migrant workers use to send funds home.

Real-life examples of cross-border payments

Personal cross-border payments

- Travelling or living abroad: Using your credit card to pay for a hotel in Ireland, withdrawing cash in Thailand, or buying clothing online in Japan.

- Sending money to friends and family: Remitting funds to a relative in India through a money transfer service or paying off a loan to a friend in Canada via PayPal.

- International investments: Buying stocks in a company listed on the foreign exchange or holding funds in an overseas bank account.

Business cross-border payments

- E-commerce purchases: A buyer in France purchasing goods from an online store in the USA.

- Import and export: A German manufacturer paying for raw materials from China or a Brazilian coffee farmer receiving payment from a Japanese roaster.

- International business services: This could be a marketing agency in the UK providing services to a client in Australia.

In-store and online cross-border payments can be as simple as buying a coffee with your debit card while travelling or as complex as expensive deals between multinational corporations.

Do it right, and you can tap into new markets overnight.

Why go global?

It’s simple – more customers, more sales, more revenue. Take London streetwear fanatics chasing exclusive drops from Japan or chefs sourcing homegrown Italian produce. Cross-border payments open doors to supply this demand, helping to take services from local to global.

And the numbers speak for themselves: by 2027, the cross-border payments market is projected to be worth a staggering $250 trillion. This presents a massive opportunity for businesses that want to expand their reach beyond the UK and tap into millions of new customers by unlocking fresh profits and potential.

To provide an easy and trusted experience for customers, businesses can offer familiar payment methods, such as PayPal, which can lead to happier customers and a healthier business. Plus, you can leave the maths skills at home – these platforms feature currency conversion tools for euros, yen, or whatever is needed. Your business and customers are also kept safe with secure authentication and risk management tools.

So, how does it work?

Think of cross-border payments like online shopping but for a business. Customers find what they want, go to checkout, choose their preferred payment method (think credit cards and e-wallets to local voucher systems like Brazil’s Boleto), and the payment reaches you.

But how annoying is it when your preferred way to pay isn’t there? Good point, right? Let’s figure out how to set these payments up without issues, but first, consider the payment options you will use for global transactions.

- Credit cards: Global giants like Visa and Mastercard are always safe bets, though transaction fees can bite.

- Debit cards: Popular in Europe and Latin America due to their instant payments and lower fees.

- E-wallets: Apple Pay and Google Pay’s convenience means they are gaining traction globally.

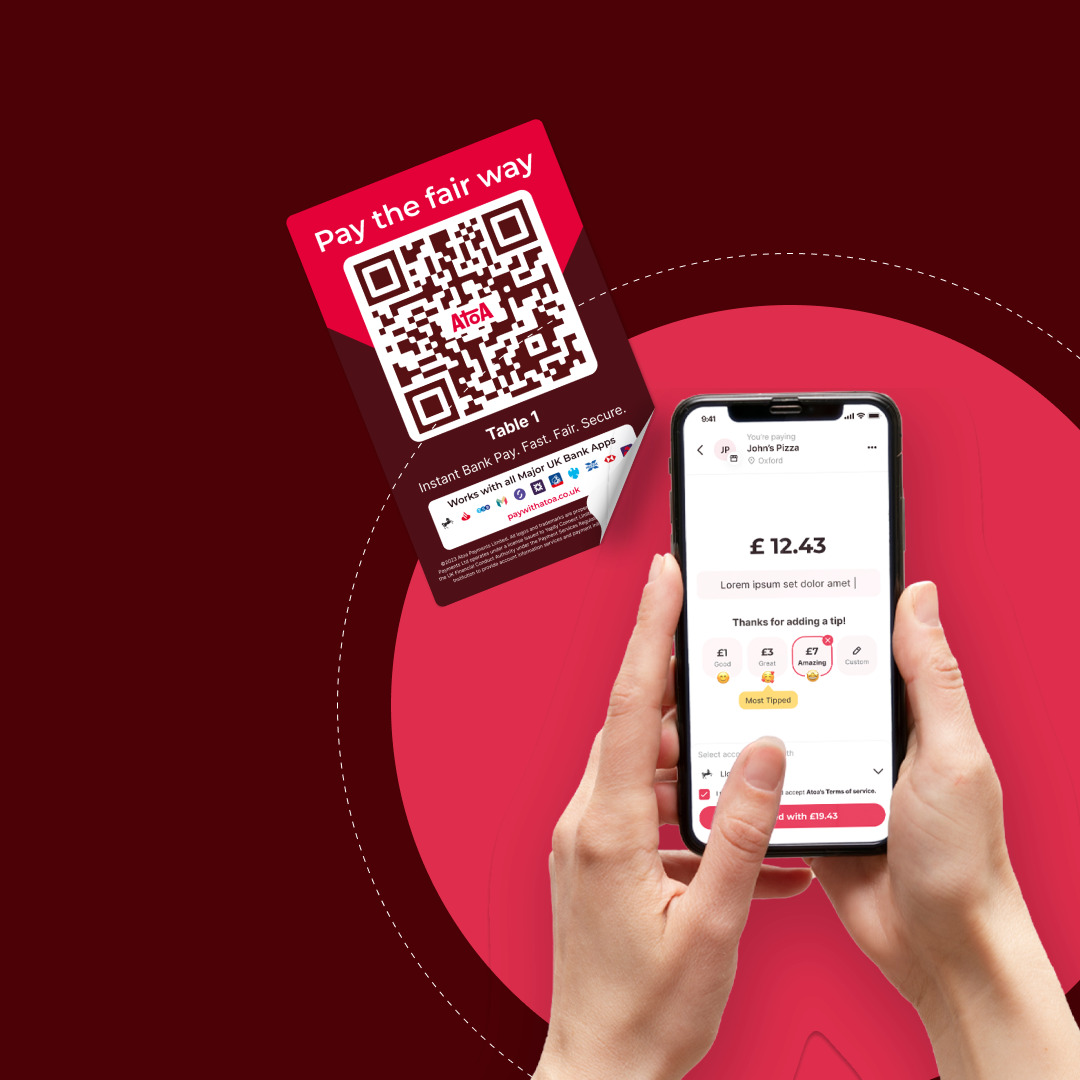

- Fintechs and local platforms: Embrace innovative preferences like QR code payments. Try regional faves such as Wise in Europe or Boleto in Brazil for higher conversion rates.

The benefits of borderless online payments

Cross-border payments can bring a ton of benefits to your business, ranging from new customer bases to lower costs.

- Global expansion: Reach millions across continents and boost your bottom line.

- Happy customers: Try to offer familiar payment methods for a smooth yet personalised experience.

- Faster, easier payments: Forget chasing invoices to get paid quickly from anywhere in the world.

- A tighter grip on the controls: Get real-time payments and manage multiple currencies for easier accounting.

- Lower costs: Choose a platform that helps avoid hefty fees and hidden charges.

And the challenges?

- Don’t be scared! Choose a user-friendly platform that meets your needs by considering the transaction volume, currencies, fees, and features you need.

- Follow the rules: Stay compliant with regional and international laws by using a reliable payment provider.

- Transparency: Look for a platform with clear fee structures and also real-time transaction tracking.

- Embrace local providers: Offer familiar payment methods to boost your customer trust and conversions.

- Staying secure: Protect your business and customers from fraud; also, choose a compliant provider with solid fraud protection.

Best platforms for overseas digital payments

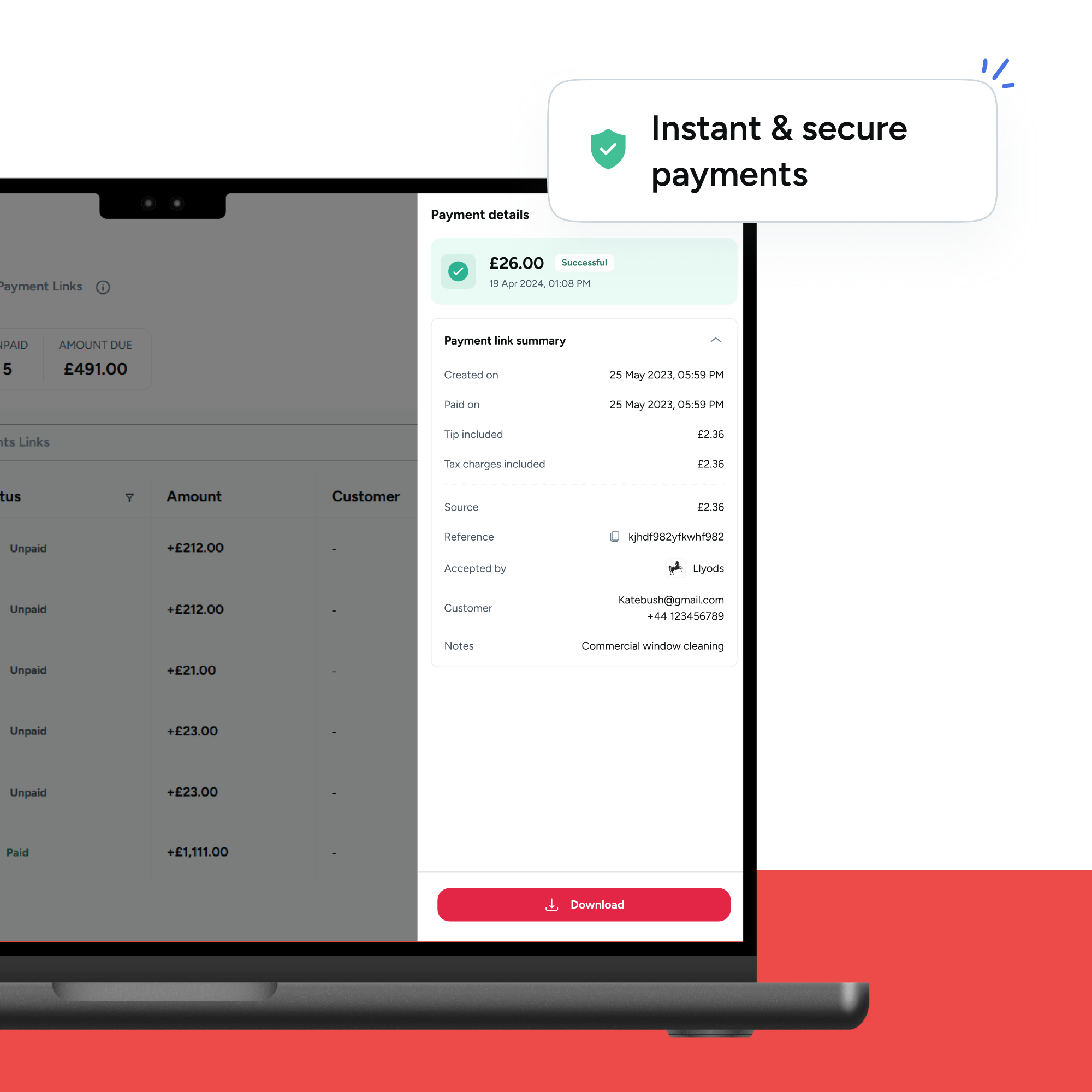

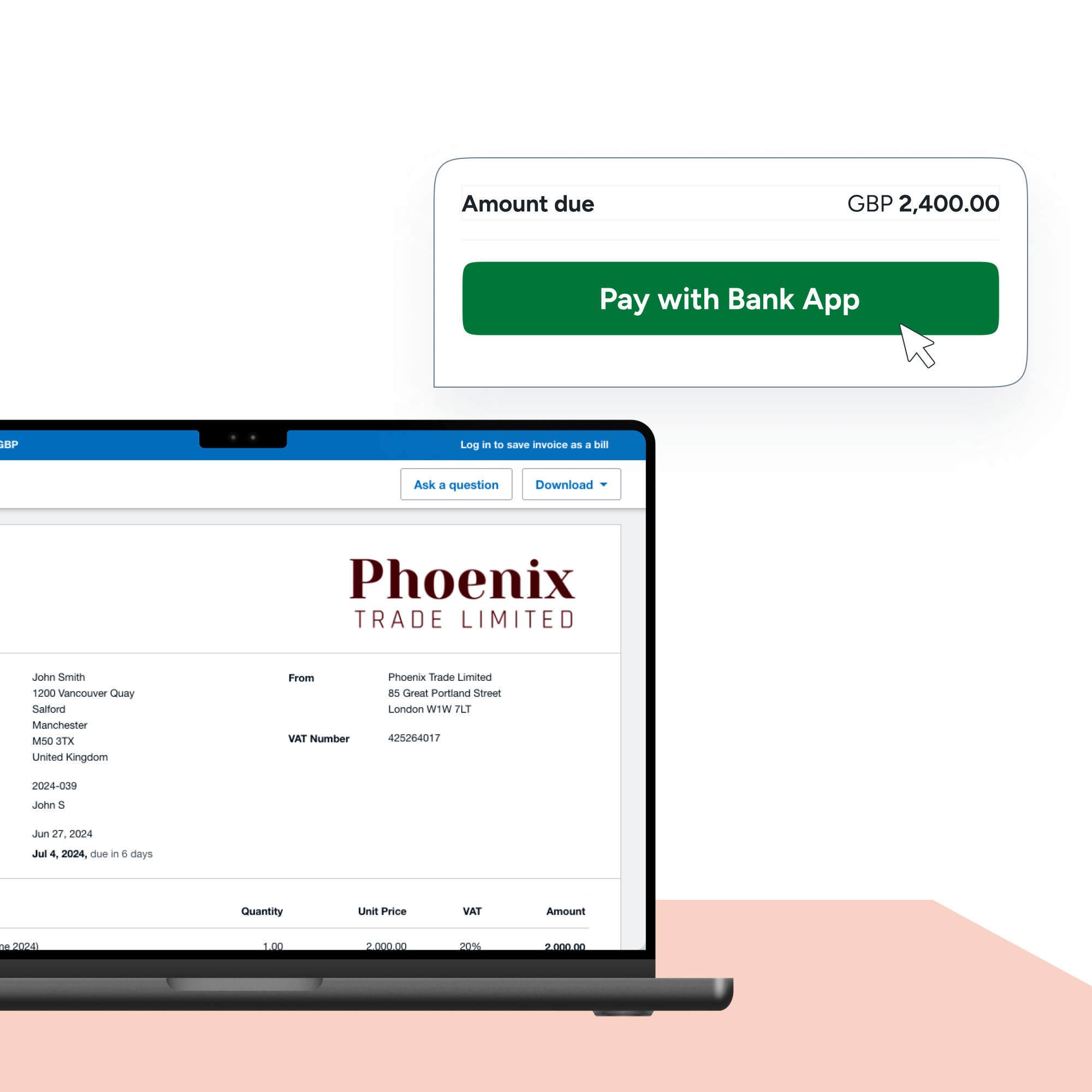

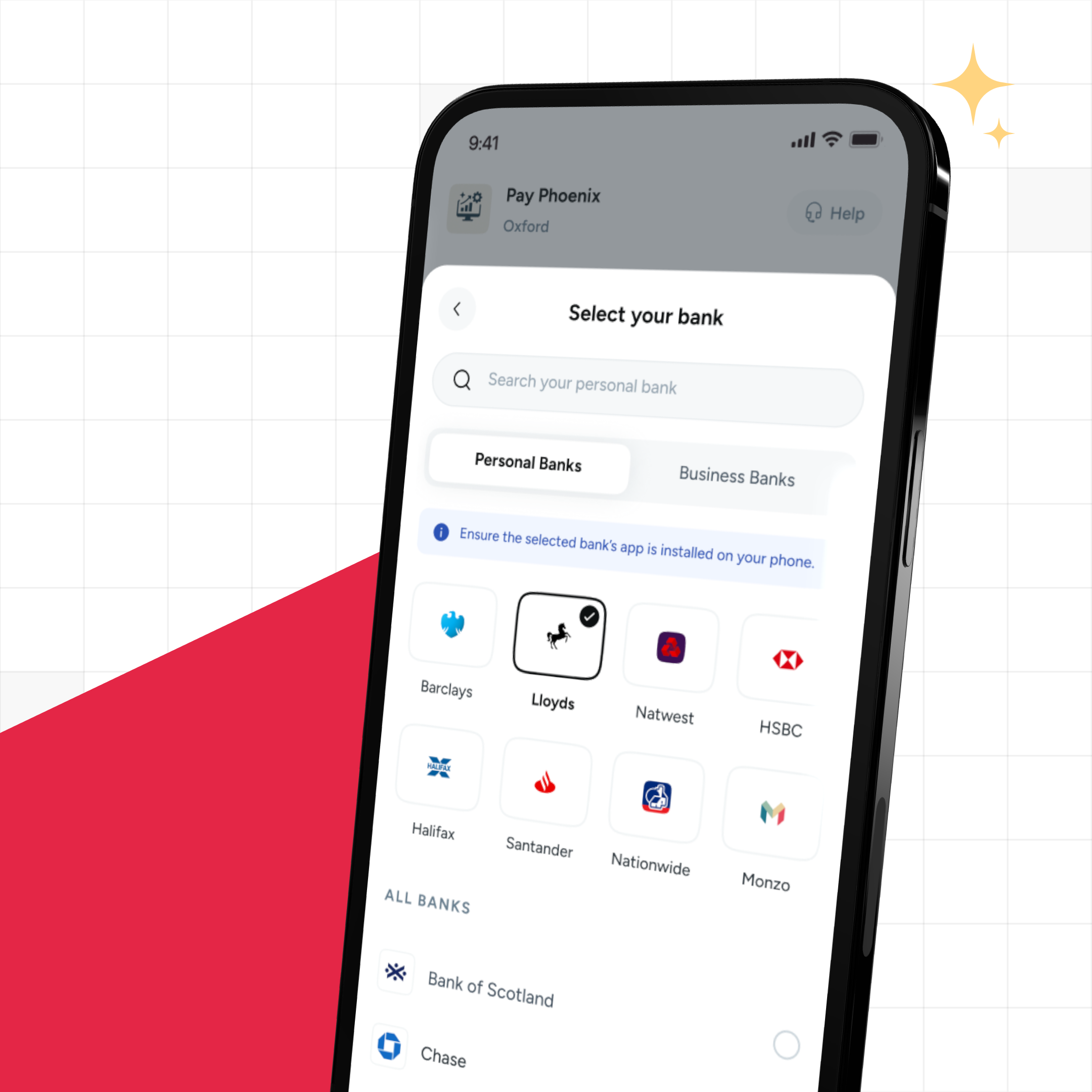

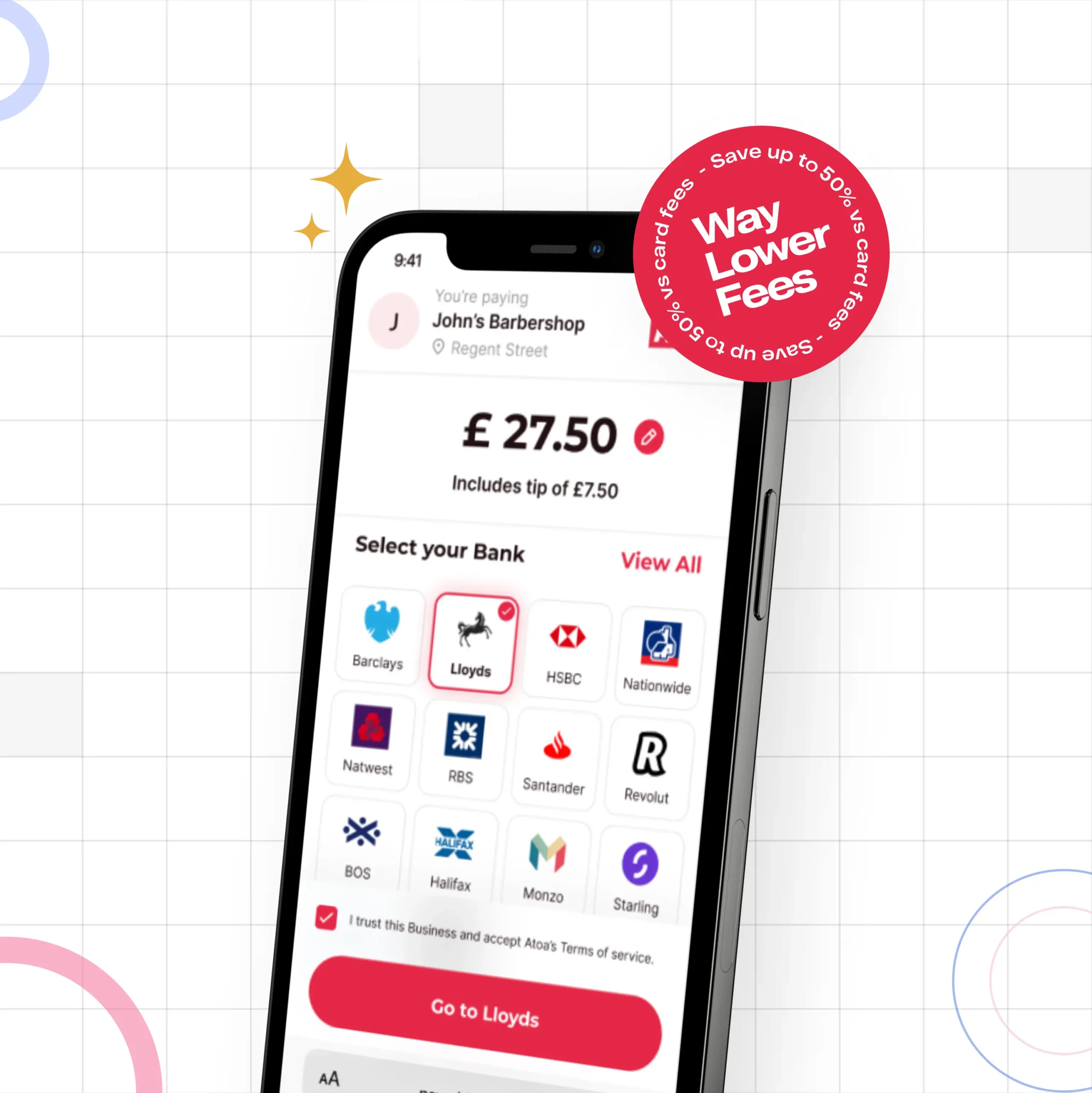

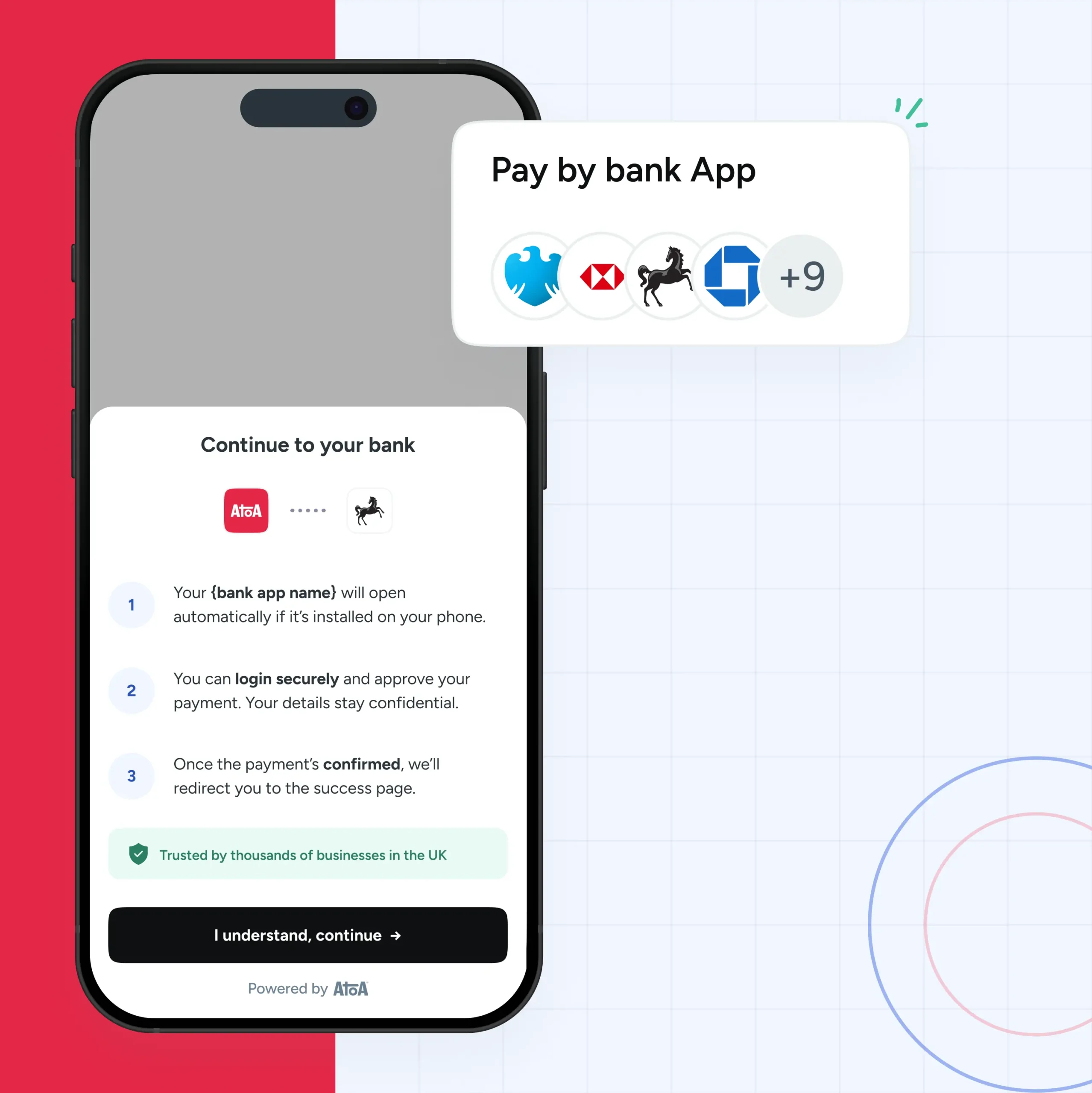

By now, you might be just about ready to check out some trusty cross-border payment providers. At the moment, Atoa can only process payments in UK bank apps, but here are a few other platforms worth checking out.

For individuals: Known for its transparent fees and competitive exchange rates, Wise is a popular choice for sending money overseas. They offer a user-friendly platform and support for over 80 currencies.

For online businesses: Available in over 200 countries, PayPal is the most obvious choice, with one-click checkouts being one of its many glowing features. However, fees can be high, so make sure you check the small print before using it!

FAQS

What are the best online cross-border payment solutions for UK businesses?

Expanding your reach beyond the UK opens doors, but managing international payments can be daunting. Fear not; popular options like PayPal, Wise, and WorldFirst offer competitive rates, fast transfer speeds, and secure platforms. Additionally, use regional providers like Payoneer for US-focused transactions or Alipay for Chinese markets.

How can I keep online transactions safe?

Choose providers with tough data encryption, fraud prevention measures, and regulatory compliance. Look for PCI-DSS certification and two-factor authentication for added security. Double-check recipient details before making transfers, and check your transactions regularly.

How can I reduce cross-border payment costs?

Fees can quickly eat into your profits, so compare transaction fees, fixed charges, and currency conversion offered by different providers. Negotiate volume discounts if you expect high transaction volumes. Tap into lower fees by considering alternative payment methods like ACH transfers or digital wallets.

The takeaway

Got your eye on the global market? Then, the right cross-border payment platform is your key. Choose one that’s secure, transparent, and makes navigating this exciting world easy. It’s time to boost your business with the power of cross-border payments.

💡 Head over to the Department of Trade and Business website for more resources on running a UK business overseas and import-export services.