How we handle our finances is evolving at a staggering pace, and one of the most striking transformations is the rise of mobile payments. Whether you’ve heard it referred to as “Pay With Phone” or “Phone and Pay,” this innovative method reshapes how we interact with money.

What is pay with phone?

Paying by phone is a convenient and secure way to pay for goods and services using your mobile. It’s a broad term that includes various digital methods, including contactless payments, mobile wallets, and payment apps. Picture this: You’re on the go, grabbing your morning coffee, and as you approach the counter, all you need to do is tap your phone. No wallet, no cash. Additionally, mobile payments are all about convenient transactions. They enable you to add debit or credit cards to your smartphone and then use your phone’s near-field communication (NFC) technology to make secure, contactless payments.

In this guide, we will explore the world of mobile payments. We will discuss its importance for consumers and businesses, plus give you the knowledge to use this technology effectively.

Different ways to pay by phone

From contactless card payments to mobile wallets, the UK has embraced phone payments with open arms, making it easy to manage finances. The table below outlines the different ways mobile users can pay merchants. It’s worth noting that the three most common mobile payment methods are contactless, mobile wallets and phone and pay apps, but we’ve added a few bonus options for those of you who like to shake it up a bit…

| Payment method | Features | Usage | Platforms | Advantages | Disadvantages | What they need to work |

| Contactless payments | Tap to pay with a NFC smartphone | In-store and online | Apple Pay, Google Pay | Quick, convenient, no need for cash or cards | Requires a NFC smartphone | Smartphone, contactless payment terminal |

| Mobile wallets | Digital wallets that store credit and debit cards on a smartphone | In-store and online | Apple Pay, Google Pay, PayPal | Convenient, secure, offers rewards | Not accepted by all merchants, requires a smartphone with NFC | NFC smartphone, contactless payment terminal, or online checkout with mobile wallet option |

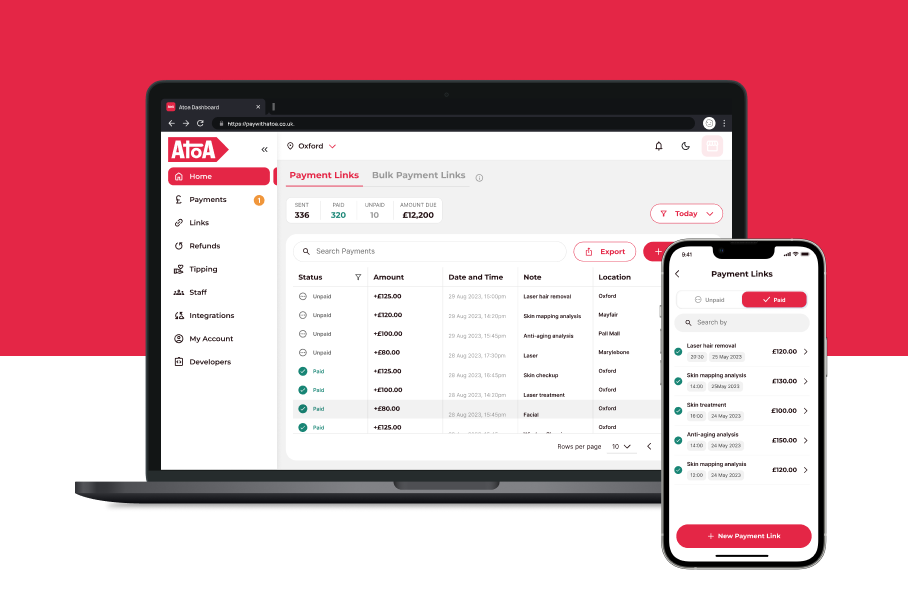

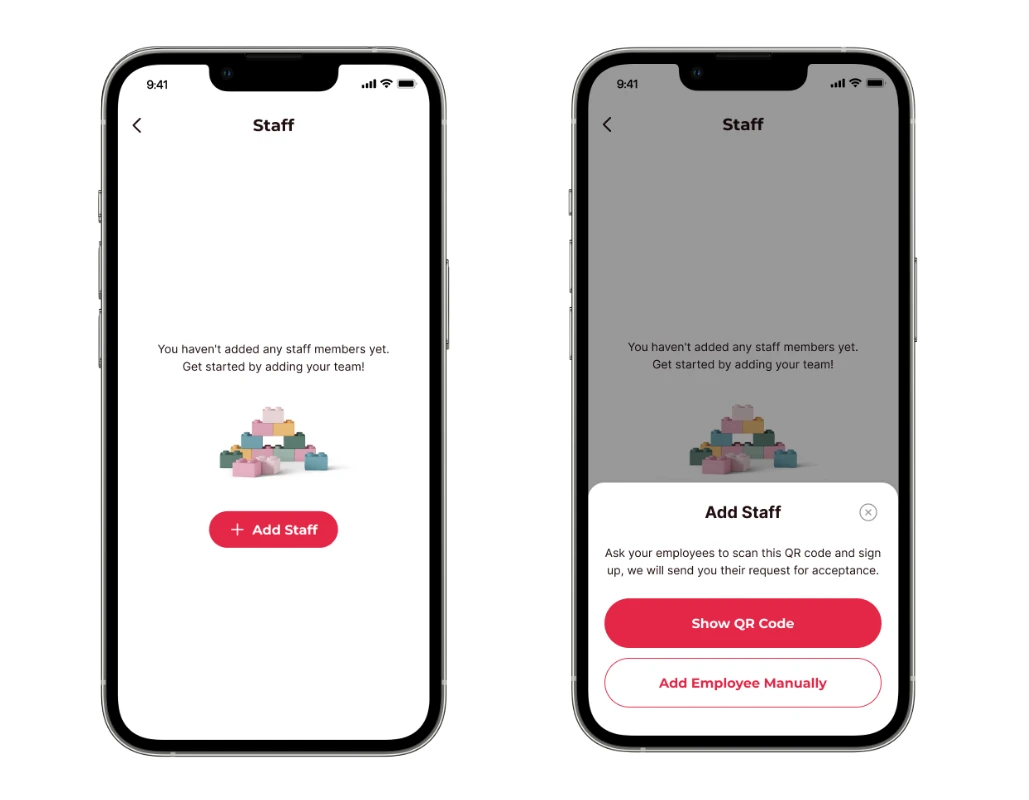

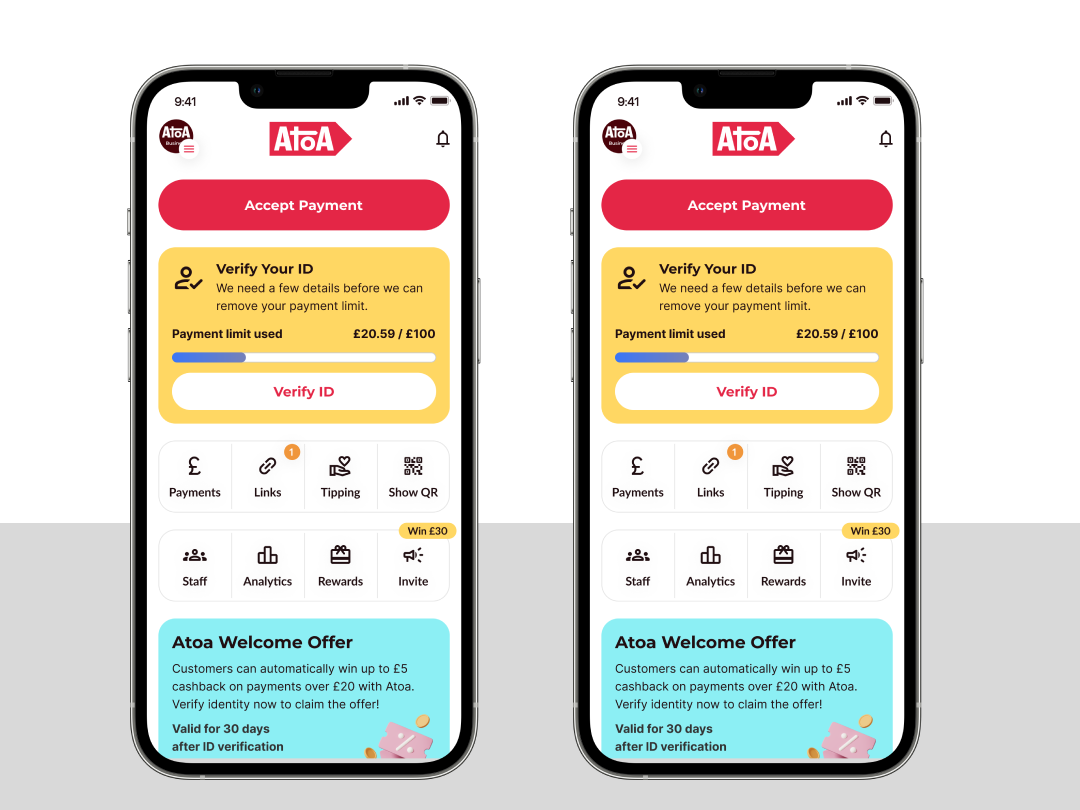

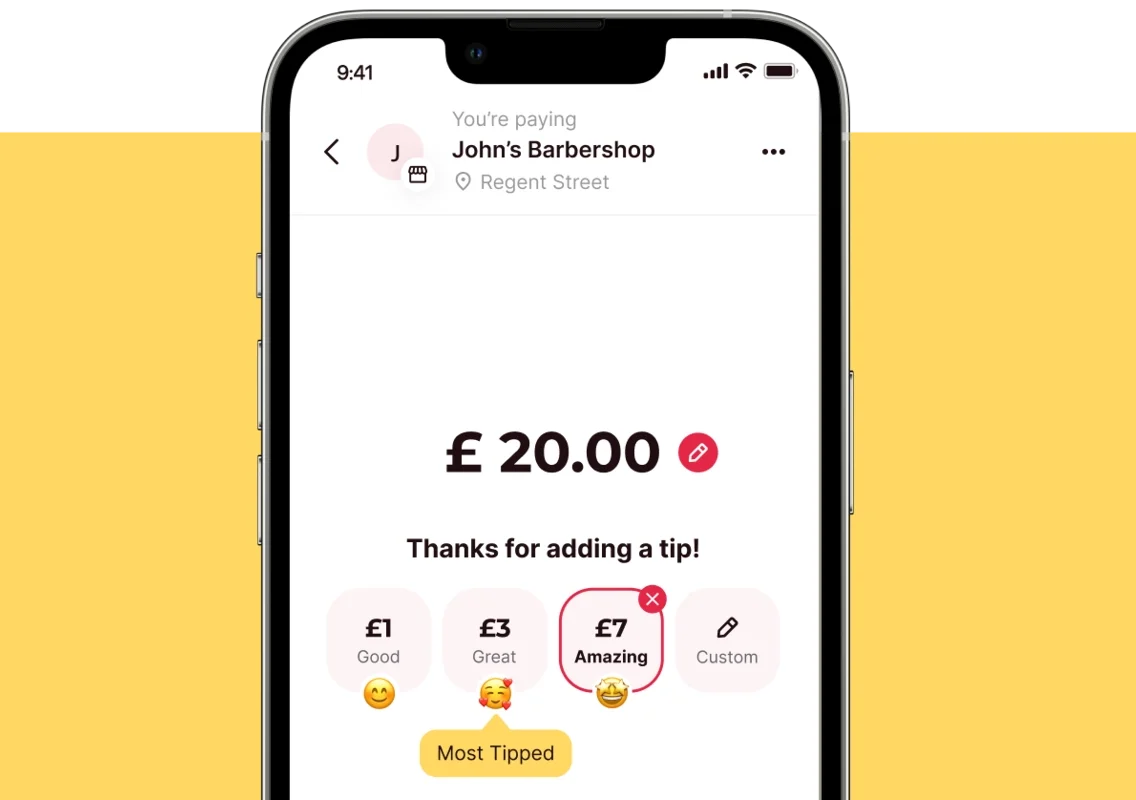

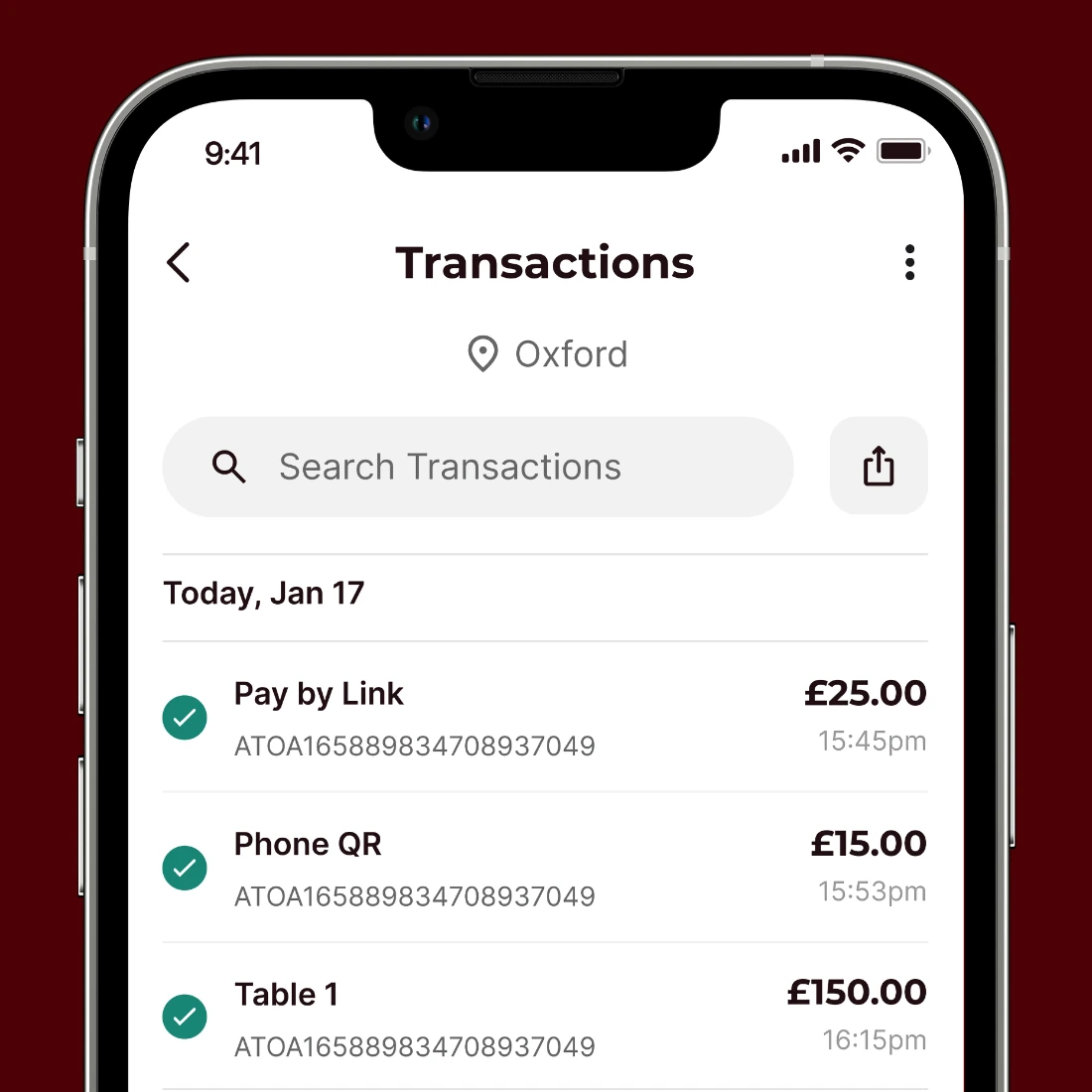

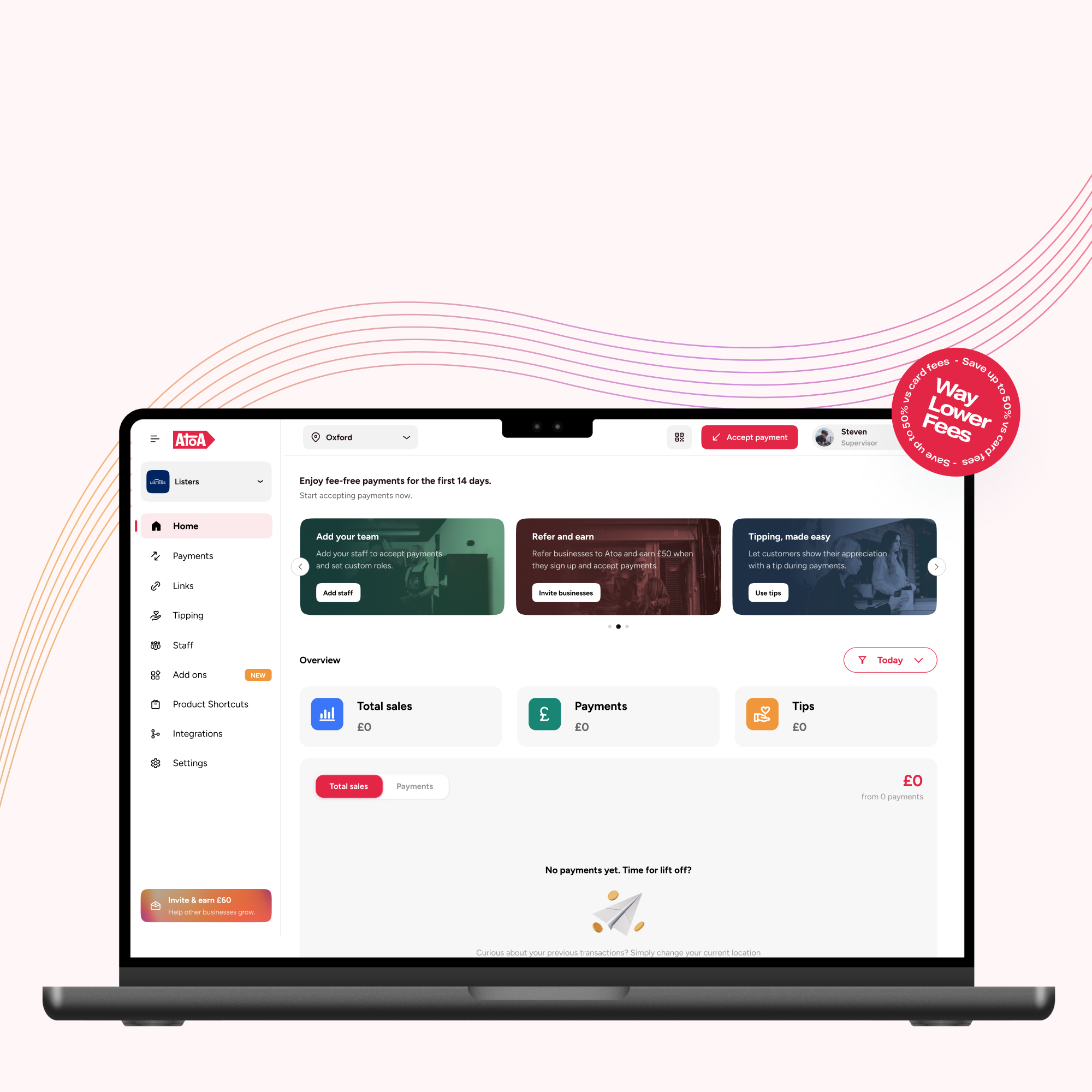

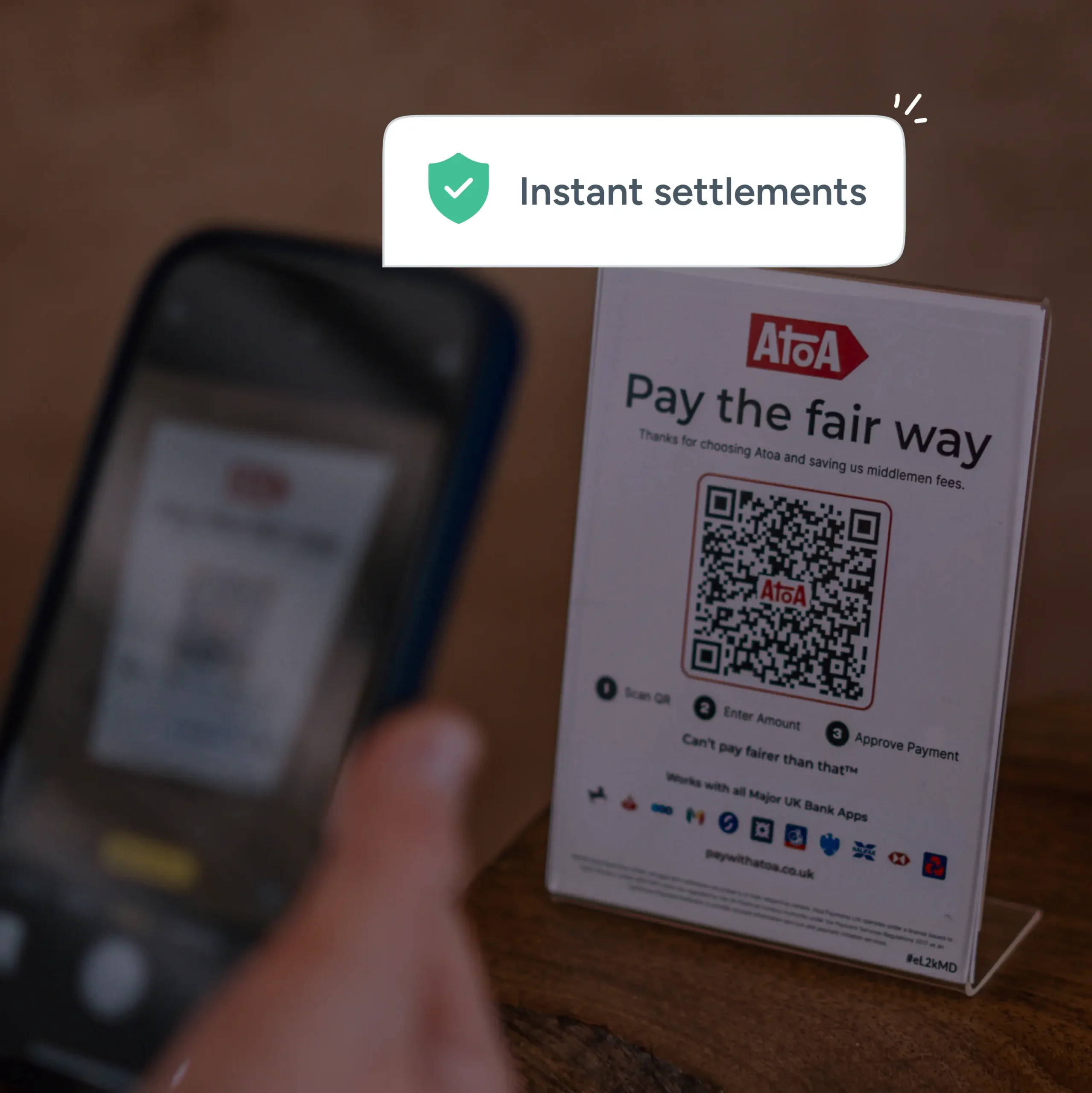

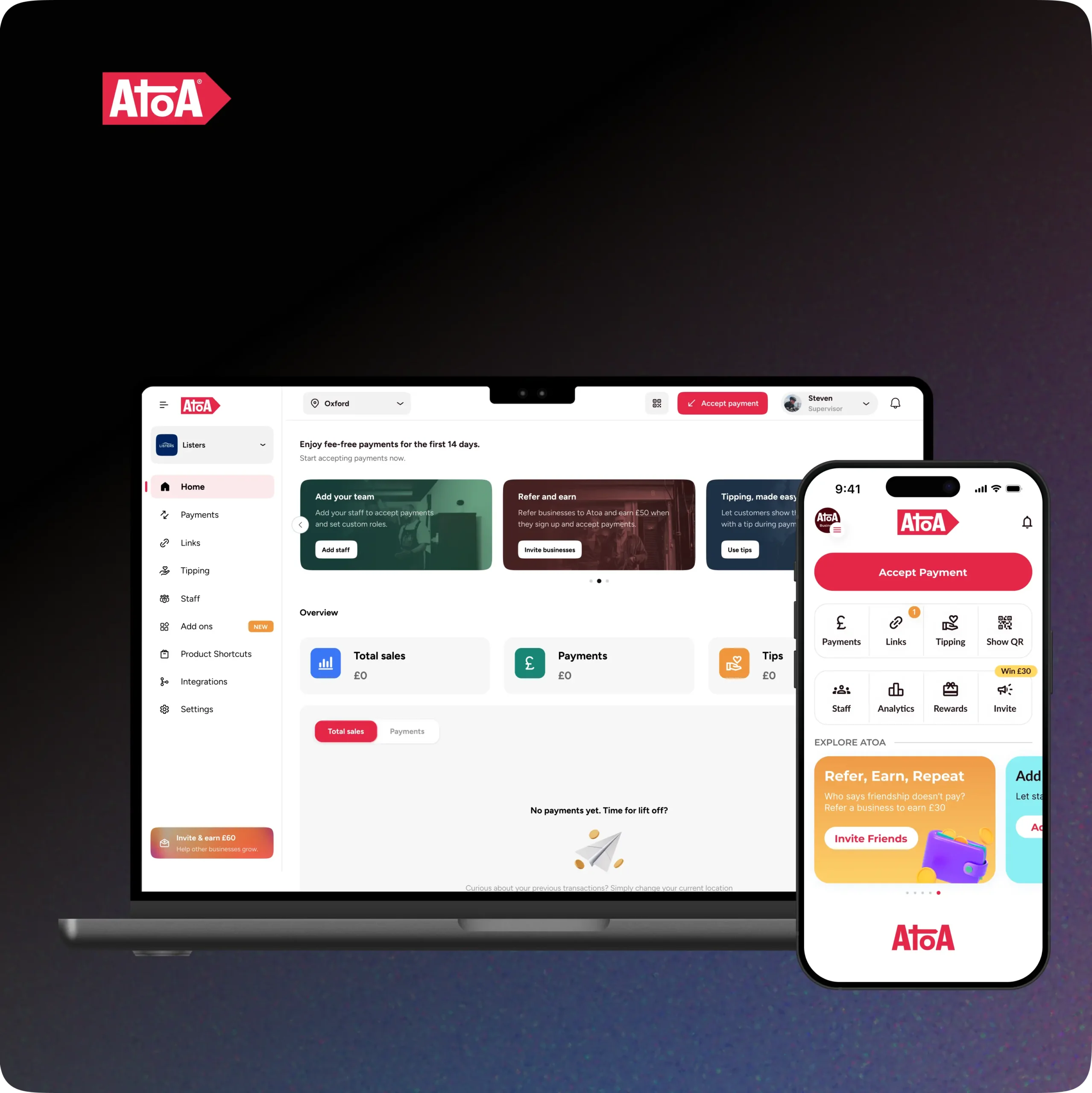

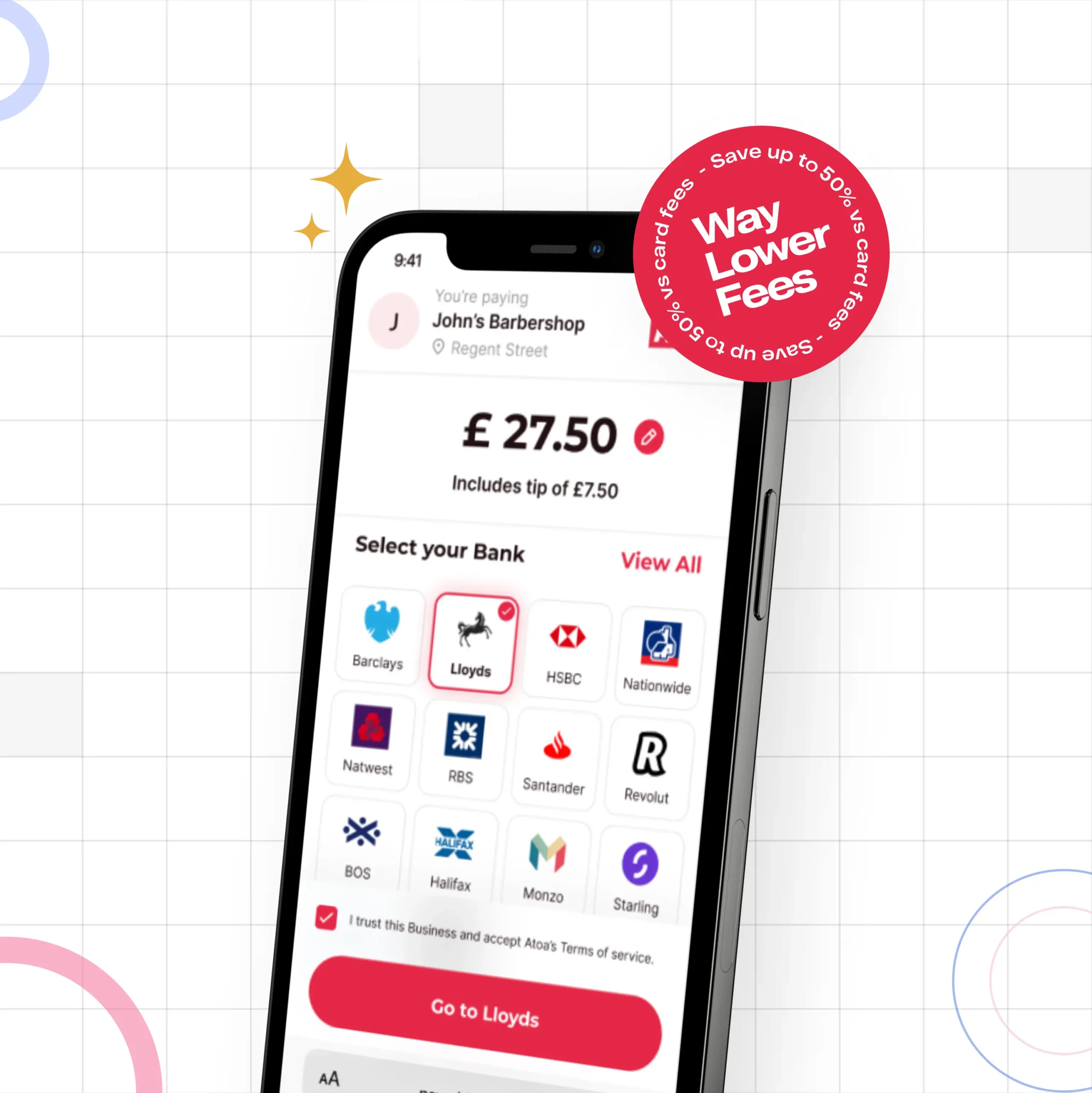

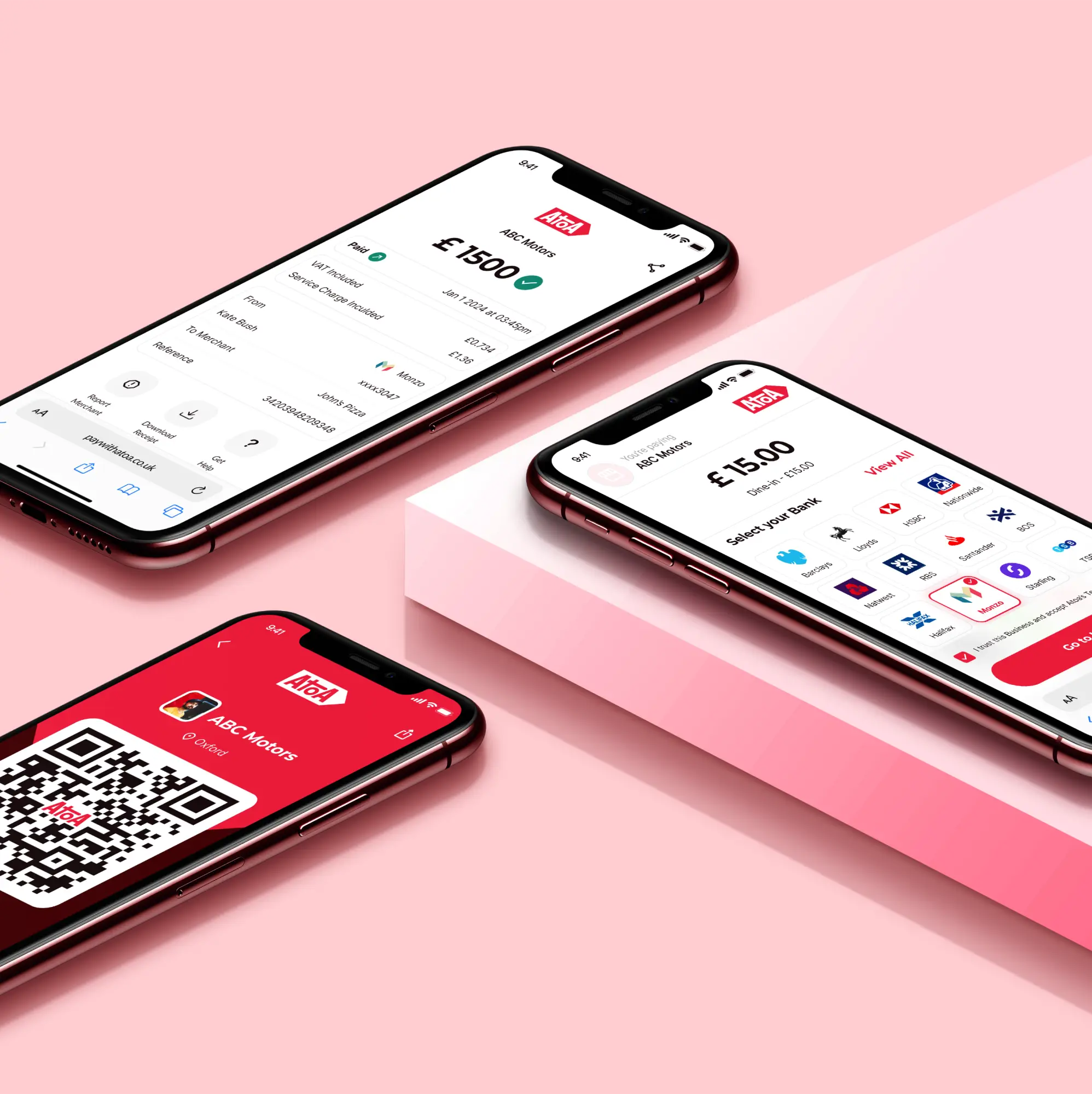

| Phone and pay apps | Mobile apps that allow users to pay by scanning a QR code | In-store | Atoa, PayPal, PayByPhone | Convenient, secure, no need for cash or cards | Not accepted everywhere, it requires a smartphone with a camera | Smartphone with a camera |

| Peer-to-peer payment apps | Mobile apps to send and receive money from other users | Online and in-person | PayPal, Atoa Pay | Convenient, secure, no need for cash, cards, or sharing bank details | Requires a smartphone | Smartphone, P2P payment app |

| Mobile payment services | Send and receive money from other users, as well as make in-store and online payments | Online and in-store | Apple Pay Cash, Google Pay Send | Convenient, secure, offers rewards | Not accepted by all merchants, requires NFC smartphone | NFC smartphone, contactless terminal, or online checkout with mobile payment option |

Why choose mobile payments over cash and cards?

In 2022, mobile wallets accounted for roughly half of global e-commerce payment transactions. The popularity and benefits of paying by phone are fairly clear-cut! The main draw has got to be convenience. You can leave your wallet or bag at home and slide your phone into a deep pocket. When it’s time to pay the bill, use mobile wallets to tap and pay or split bills effortlessly with friends. But how else do they benefit us?

An easier way to pay

Mobile payments offer a quick and easy way to pay without carrying a wallet or cards. Payments are efficient, and your receipts are stored electronically for easy reference.

Tighter security measures

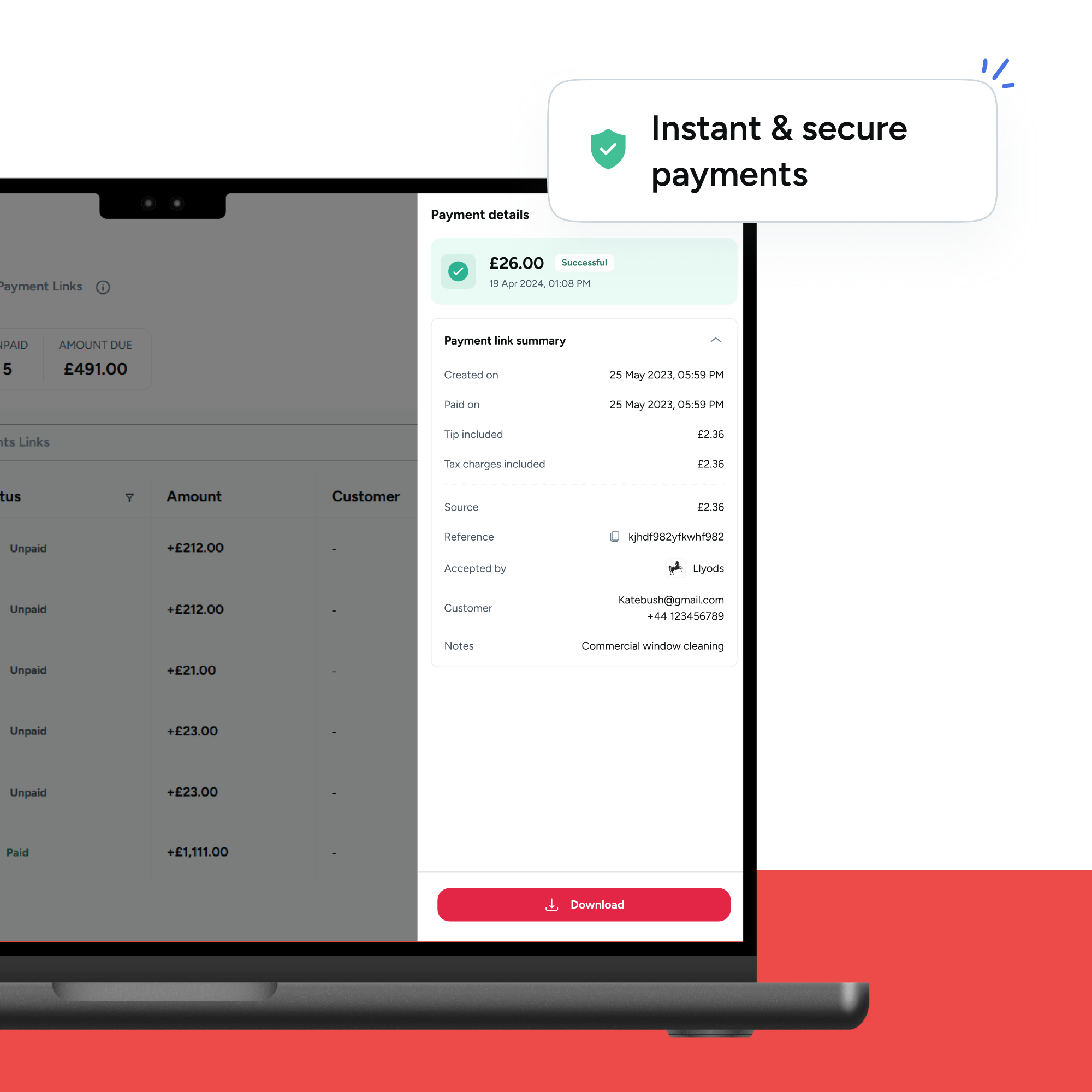

Pay with phone uses the latest security technologies to protect your financial information. Built-in features like fingerprint or facial recognition ensure that only you can authorise payments, adding protection to your transactions.

Collect rewards and points every time!

Many mobile wallets and phone and pay apps let you add loyalty programs, so you can collect points on every purchase without carrying your reward card.

The best apps to pay with phone in UK

Key pay with phone players

Apple Pay quite simply lets you “pay the Apple way.” If you’re team Apple, this easy contactless solution links to your cards so you can pay in-store, in-app and online thanks to near-field communication (NFC) technology. Security is built-in and it is very widely accepted.

Google Pay offers similar functionality as Apple Pay but for Android users. Their website also beckons you to “pay the Google way.” It offers in-store, in-app and online payments with a tap or click. Plus, easy peer-to-peer payments.

Samsung Pay is a convenient and secure way to pay using your Galaxy phone or watch and works almost anywhere that accepts contactless cards. Add your credit or debit card to the app and hold your device near the card reader to pay. It’s a safe and easy alternative to carrying cash or cards.

If you’re already a fan of PayPal for online shopping, their in-store contactless option is worth considering, especially for its strong buyer protection. Your email address, password and biometrics allow you to pay on any device, whether using a smartphone or a tablet.

Other trustworthy options

Cash App: Available in the US and UK, Cash App lets users send and receive money, stocks, or bitcoin as peer-to-peer payments. Its alias system adds a layer of anonymity to your transactions. As well as payments, users can tap into exclusive discounts with Cash App Pay and the Cash App Card.

Curve takes a different approach to contactless payments. Instead of creating a new account, it links your existing Visa and Mastercard debit and credit cards. You control everything through their app and use a single Curve card for purchases. If you’ve used the wrong card by mistake Curve lets you switch the card charged even after you’ve paid, so you can choose the best card for each purchase to get the most cashback or points. Furthermore, all your spending from different cards is displayed in one place on the app.

💡Some of these services have plans with foreign exchange fees, so keep that in mind.

How to pay with your phone

Now you know the main methods available to make fast payments on the go, it’s time to learn how the most popular ones work! Here are step-by-step instructions on how to pay using contactless payments, mobile wallets, and phone and pay apps.

Contactless payments

- Head to your phone settings and make sure your phone has NFC enabled.

- Link your credit and debit card to your smartphone.

- Open your mobile wallet app and select the card you want to pay with.

- Hold your phone up to the contactless payment terminal.

- You should hear a beep and see a confirmation message on your phone when payment is complete.

Mobile wallets

- Set up a mobile wallet and link payment cards if you haven’t already.

- Open your mobile wallet app.

- Select the card you want to use.

- If you use Apple Pay or Google Pay, hold your phone to the contactless payment terminal. If you use Samsung Pay, double-tap the Home button and wave your phone near the contactless payment terminal.

- You should hear a beep and receive a confirmation message on your phone when the payment is completed.

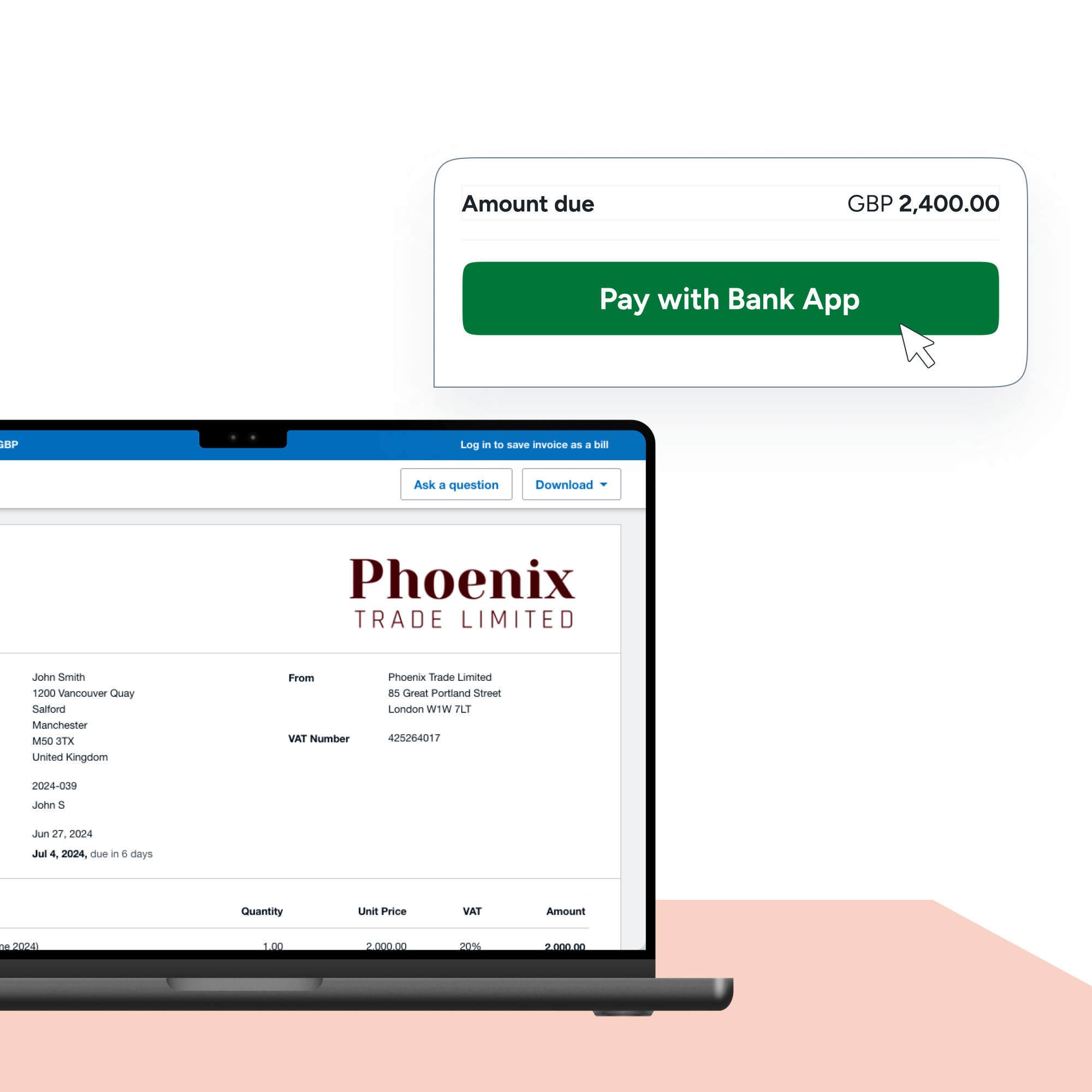

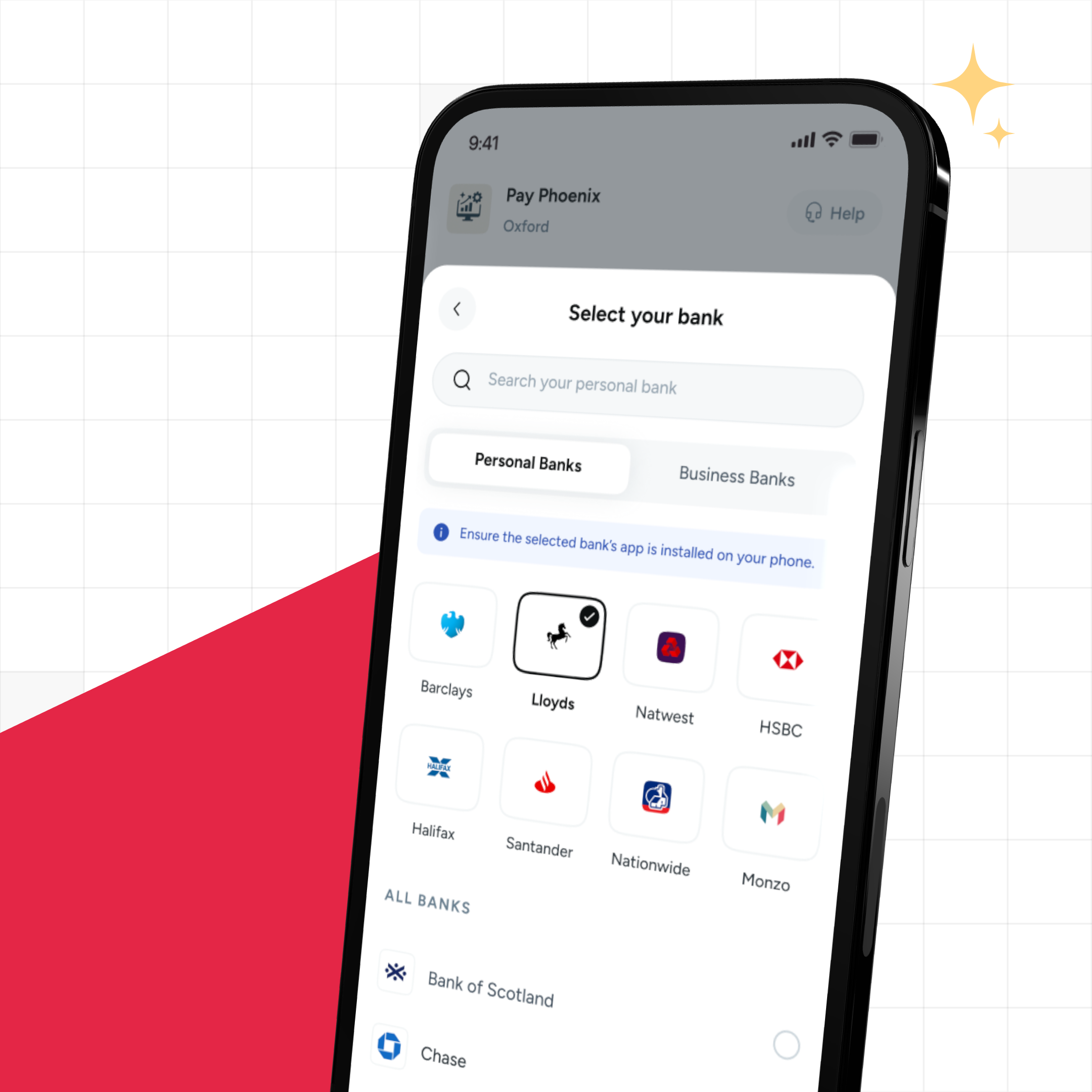

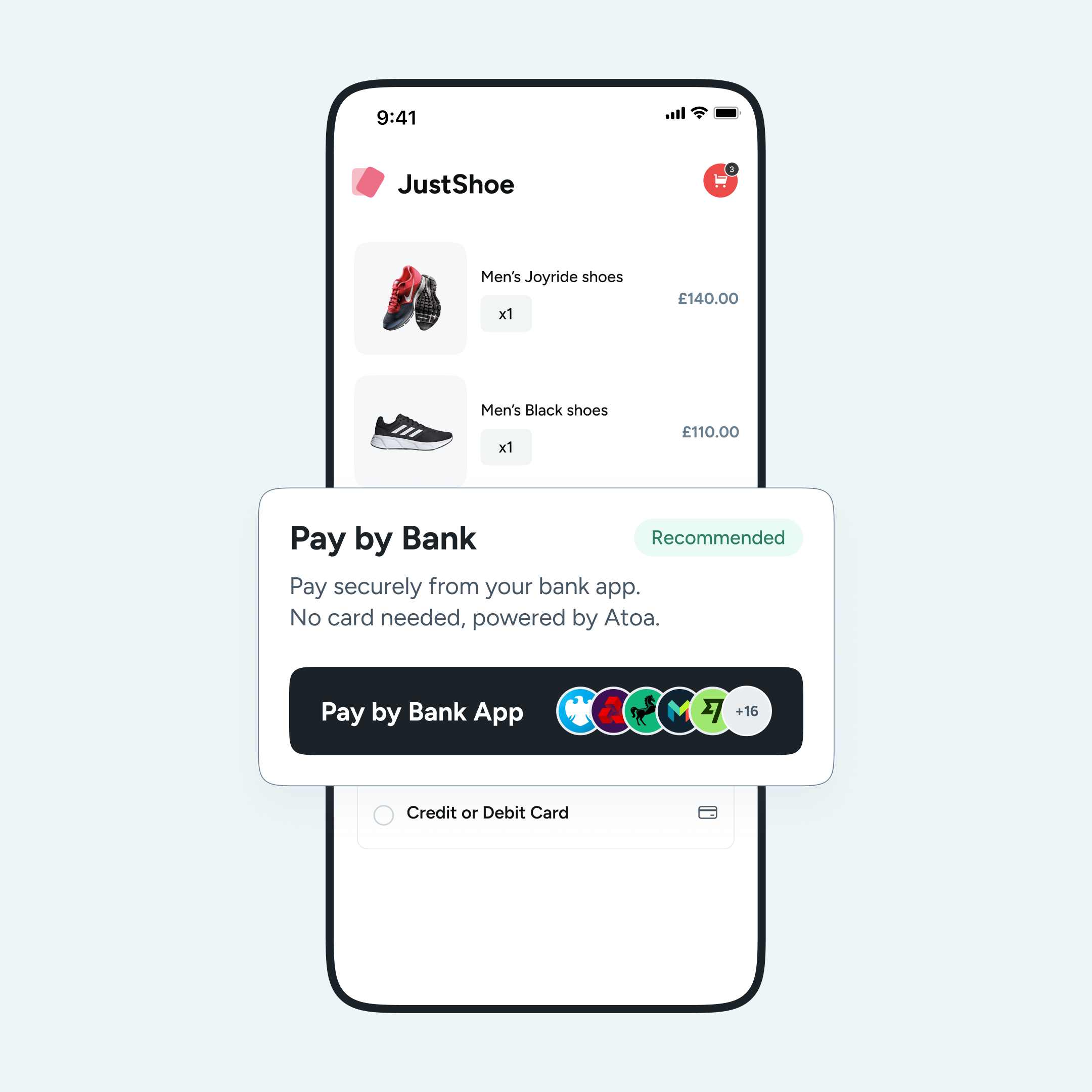

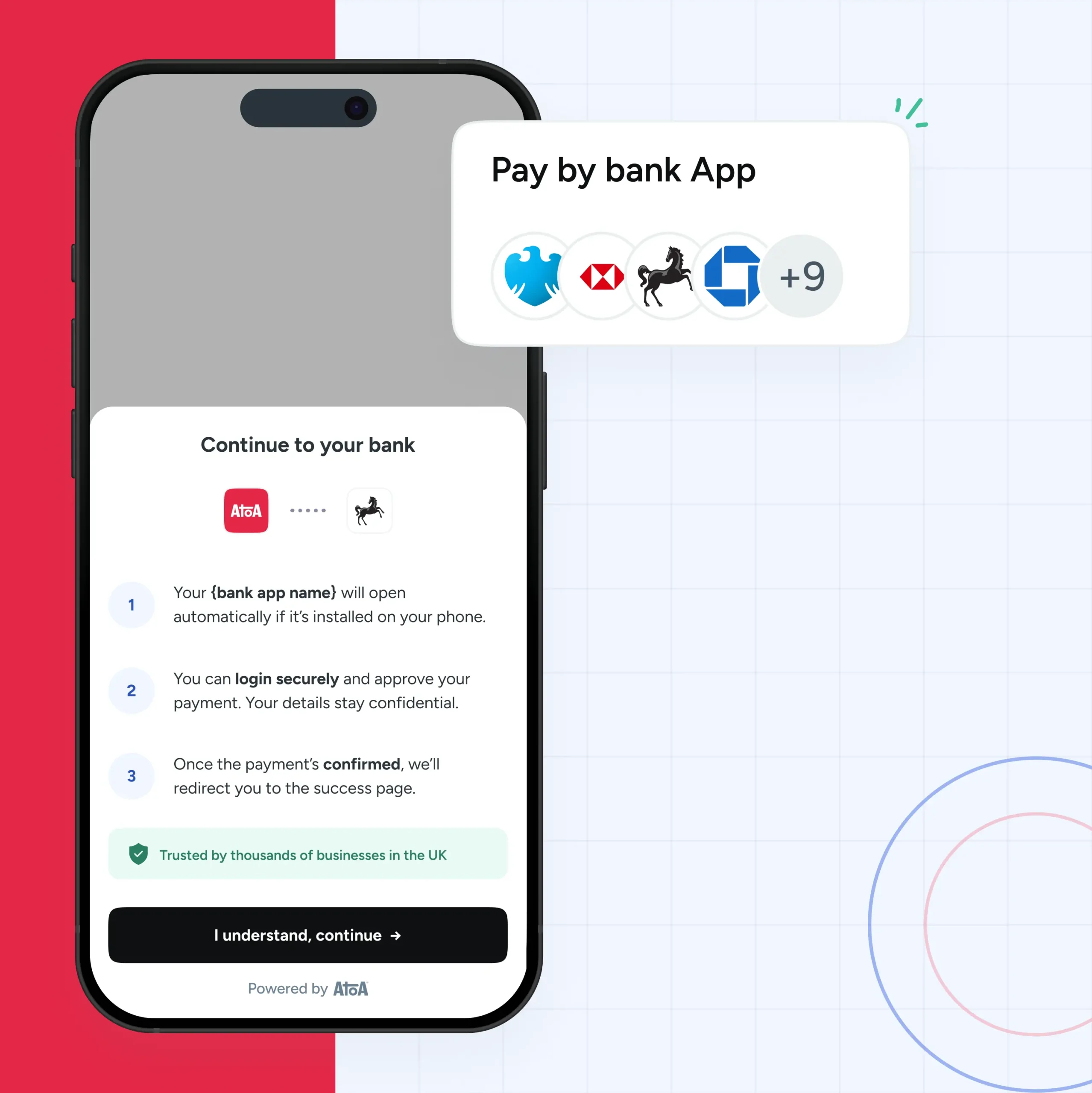

Phone and pay apps

- Open your payment app. (Some QR code payments let you skip this step by completing payment on your phone browser and bank app).

- Scan the QR code at the checkout counter.

- Confirm the amount and complete the payment by following app instructions.

- You should receive a confirmation message on your phone when the payment is complete.

Be aware that the specific steps may vary depending on the app you use. The video below shows how easy it is to pay using QR codes with Atoa as a little helping hand.

Phone payment security checklist

Charge your phone: Check your battery levels before heading out. Carrying a portable charger can also be a lifesaver if your battery runs low during the day.

Use secure Wi-Fi: Use secure and trusted Wi-Fi networks. Public Wi-Fi isn’t always secure, so use a trusted network (like your personal hotspot) to protect your financial information.

Use extra security measures: Activate PIN codes, fingerprint, or facial recognition to protect your mobile payments further.

Monitor transactions: Check your bank and mobile wallet app statements to ensure that all transactions are accurate. Report anything suspicious to your bank or payment provider.

Set up transaction alerts: This sends notifications for every payment made with your phone. This way, you can quickly detect any unauthorised transactions.

Update your phone and apps: Operating system and payment app updates usually include security enhancements. Keeping software up-to-date helps protect your mobile payments.

Be scam-savvy: Scammers may attempt to trick you into making payments over text messages, emails, or phone calls. Avoid sharing personal or financial information over these channels. Read more about data privacy and security.

Educate yourself: Keep your ear to the ground with security practices. Stay aware of common phishing and identity scams to stay secure with payments and beyond.

Frequently asked questions

What is contactless phone payment?

Contactless is a mobile payment method that uses Near Field Communication (NFC). To pay with your phone using contactless payment, open your mobile wallet app and hold your phone up to the contactless payment terminal. You’ll hear a beep and see a confirmation message on your phone when the transaction completes.

What mobile wallets can I use to pay with my phone?

There are several different mobile wallets that you can use in the UK to pay with your phone, including Apple Pay, Google Pay, and PayPal.

What are phone and pay apps?

Phone and pay apps are mobile apps that allow you to pay businesses without using your physical credit or debit card. To use a phone and pay app, open the app and scan the QR code at the checkout counter. These apps work differently, so follow the on-screen instructions to confirm the payment.

The takeaway

Paying with your phone is a quick, easy, and secure way to pay for goods and services. As we step into the future, it’s evident that mobile payments are the future of financial transactions. Furthermore, with their ability to adapt alongside technology and boost consumer experience, mobile payments will continue to shape how we pay in retail, hospitality and beyond!