Card payments have been the norm for a long time, especially since the introduction of contactless. But what if there was a better way to pay consumers and businesses?

Enter cardless payments…

Developments in open banking have paved new pathways to faster and fairer payments, but they rarely involve those pesky bits of plastic. With that in mind, what are the best cardless options? Here, we explore the ever-evolving world of payments to help you stay ahead and find the best solution for your business.

What are the benefits and limits of card payments?

Card payments may feel engrained in everyday life, but they don’t need to be. The benefits – such as universal acceptance and convenience to consumers – may seem clear-cut, but what about the challenges they face for businesses?

It often comes as a shock to learn that card intermediaries like Visa and Mastercard charge merchants up to 2% per debit card transaction. Paired with additional fees and hardware costs imposed by providers such as Dojo and Square, finding a fair margin is a race to the finish line.

It’s also worth considering the security risks card payments can pose for consumers and businesses. If a contactless debit card is lost or stolen, there’s a high chance that it could be used fraudulently, paying up to £100 multiple times without authorisation. Consumers often get fraud protection from their bank, which can hit merchants hard if they have to compensate or pay chargeback fees.

So once you dive deeper, maybe card payments aren’t so peachy after all…

What sets cardless payments apart from card payments?

But fear not; all is not lost! Thankfully, open banking and account-to-account (A2A) payments are shining a light on a more efficient and secure future for business payment solutions.

Going cardless means a fair future for payments, too! By cutting out these (unnecessary) card payment processors, businesses can unlock manageable transaction fees, unlocking more hard-earned cash.

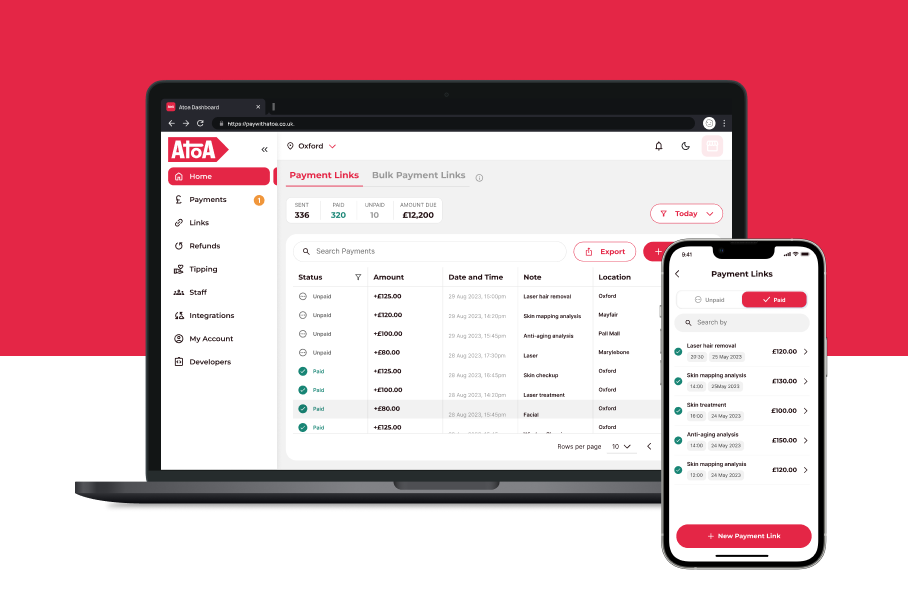

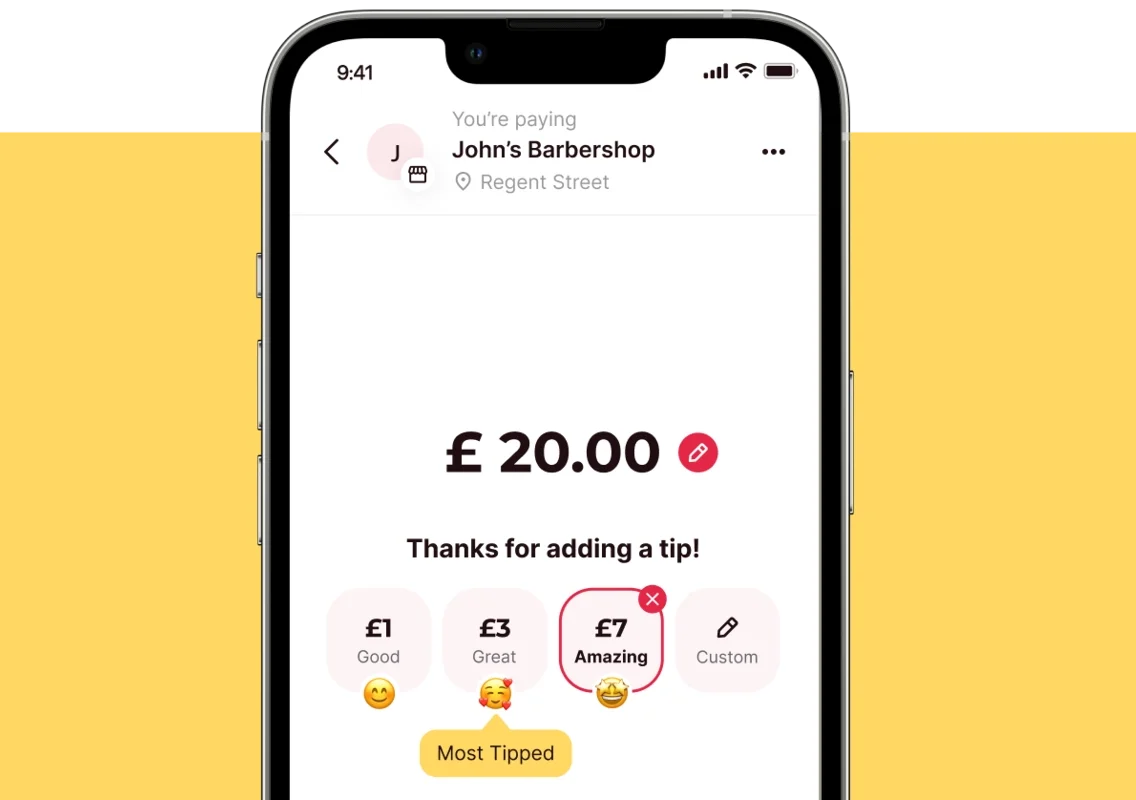

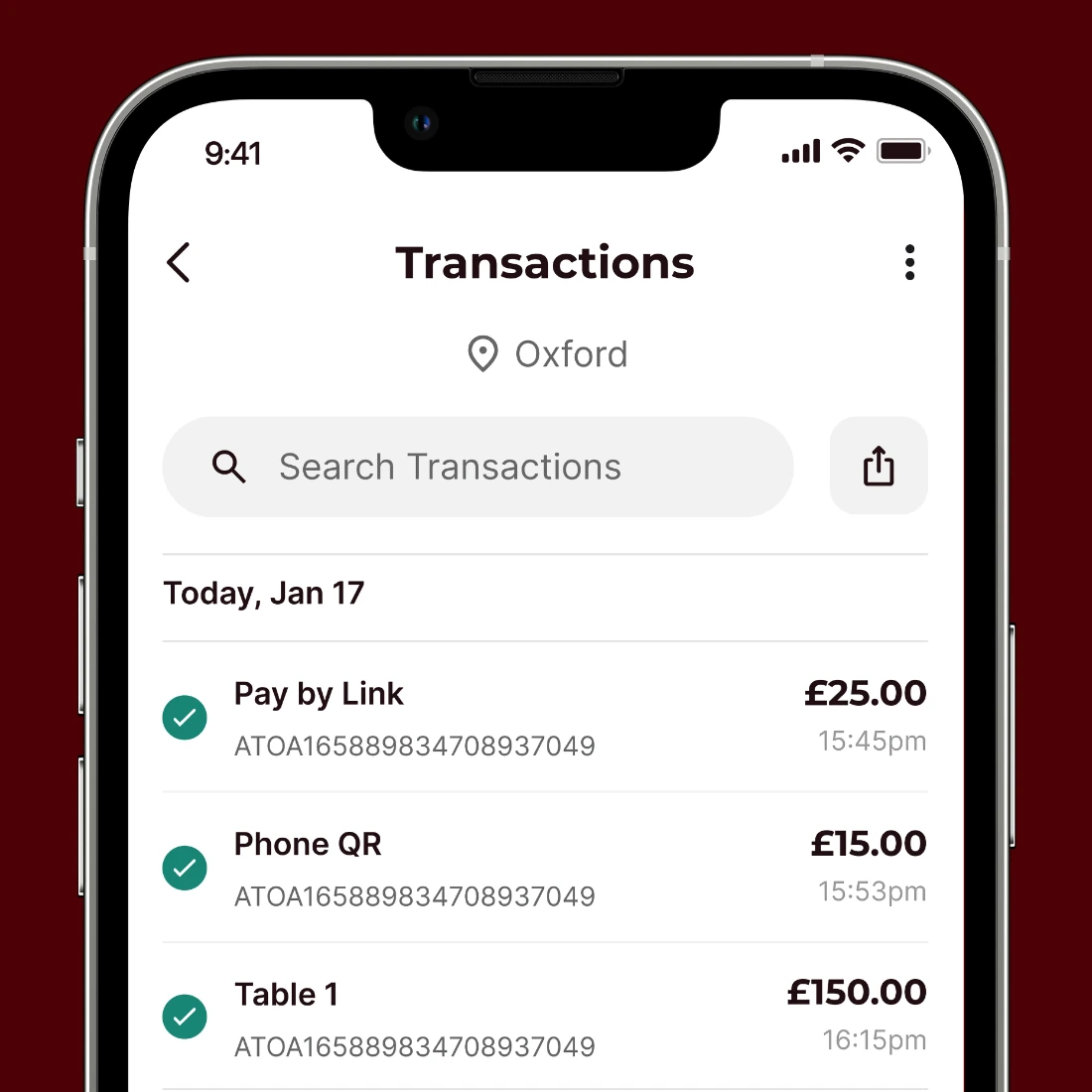

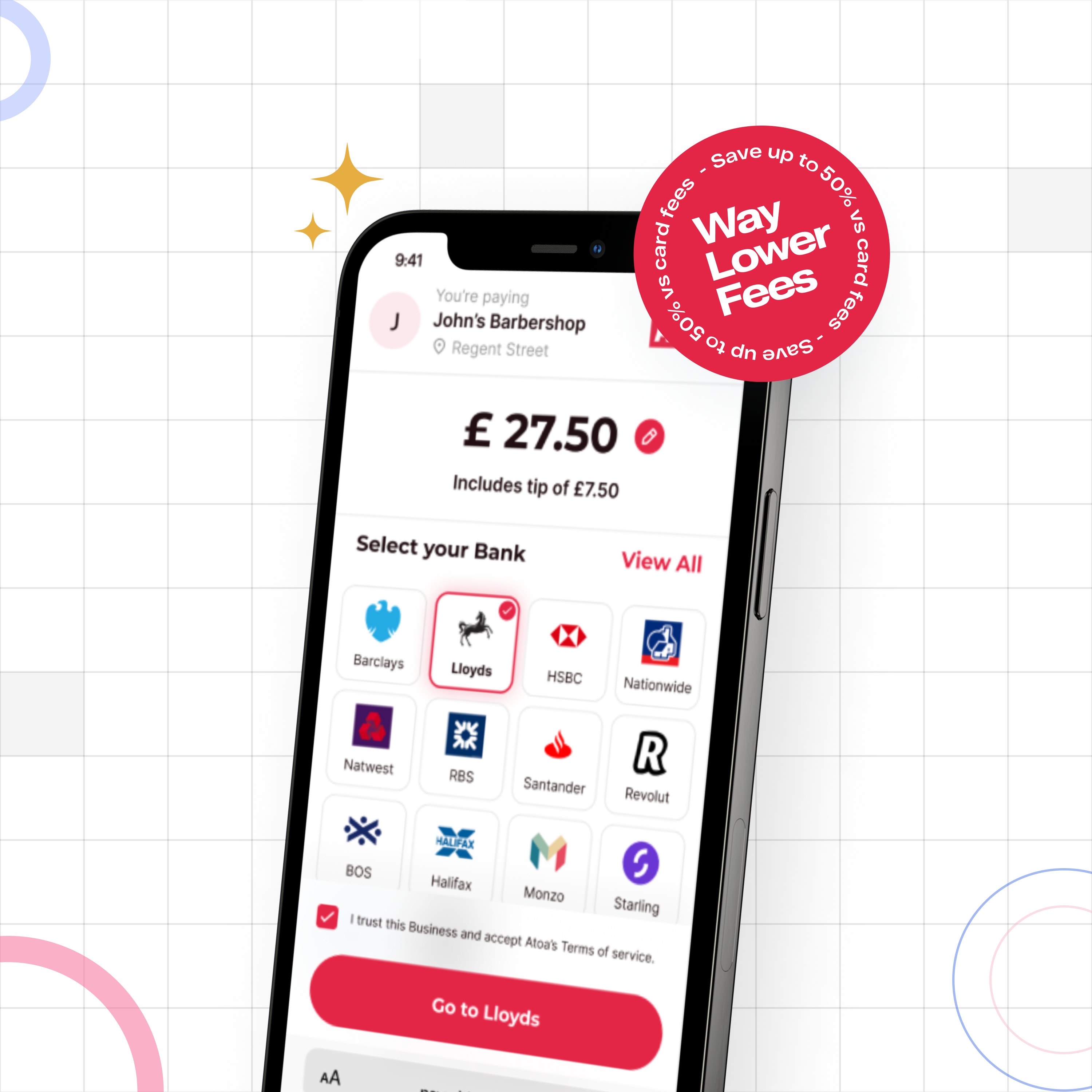

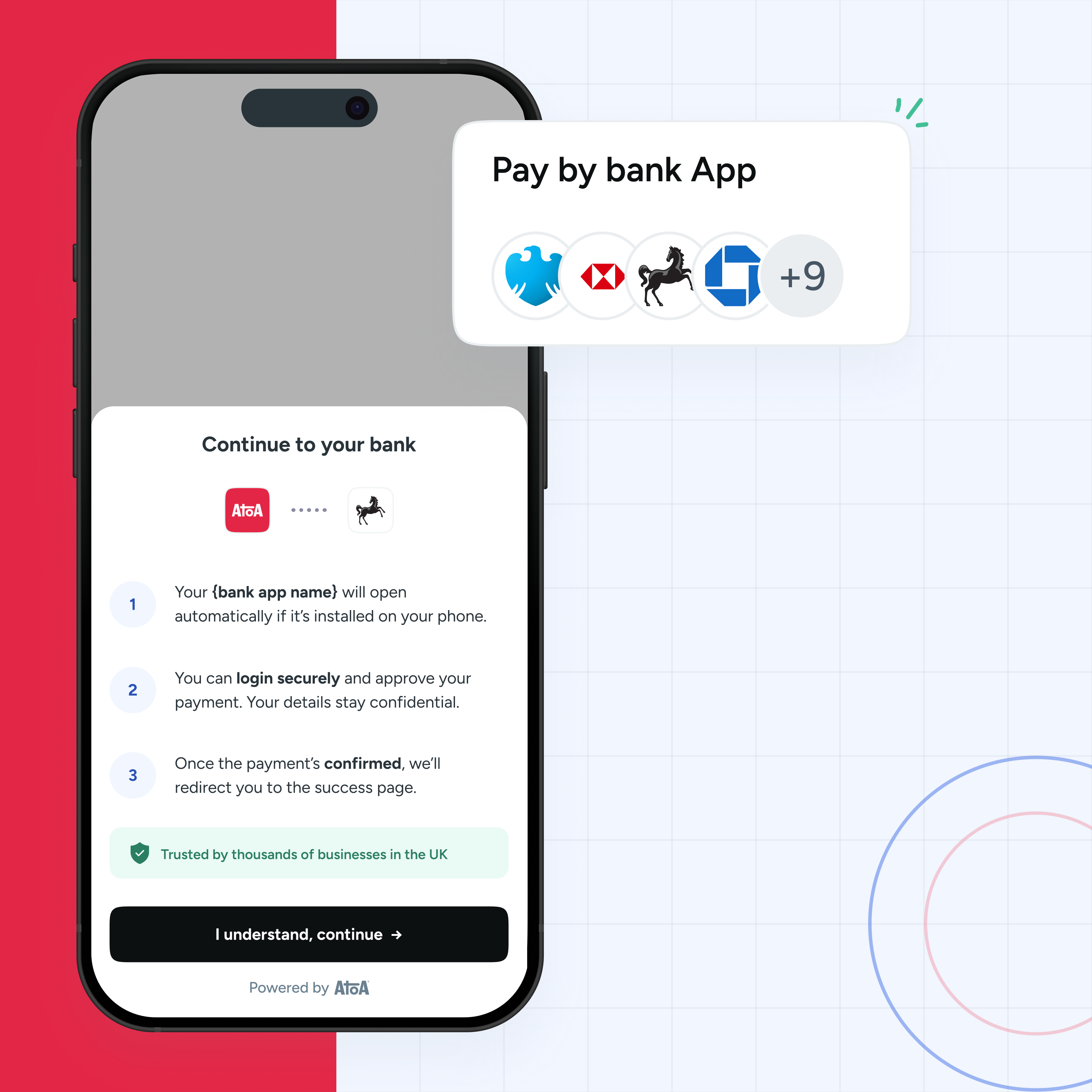

But how do cardless payments work? In effect, it’s the same as card payments, just without the nasty plastic. Most cardless providers allow you to make and take payments in your store, out and about, or from the comfort of your home using QR codes and payment links at lower rates.

How secure are cardless payments?

Card providers try to bolster security by reminding businesses that a PIN will be required. However, this often doesn’t happen until the card has been used several times.

Cardless services such as account-to-account payments offer increased protection. The customer can only pay once the banking app security confirms their identity. We know one thing – it’s pretty tough to fake a face or fingerprint scan, giving your income robust protection from chargeback risk.

The advantages of going cardless

You may have already embraced cashless, but cardless payments have even more advantages. While it may seem daunting, switching to account-to-account payments can boost your income quickly.

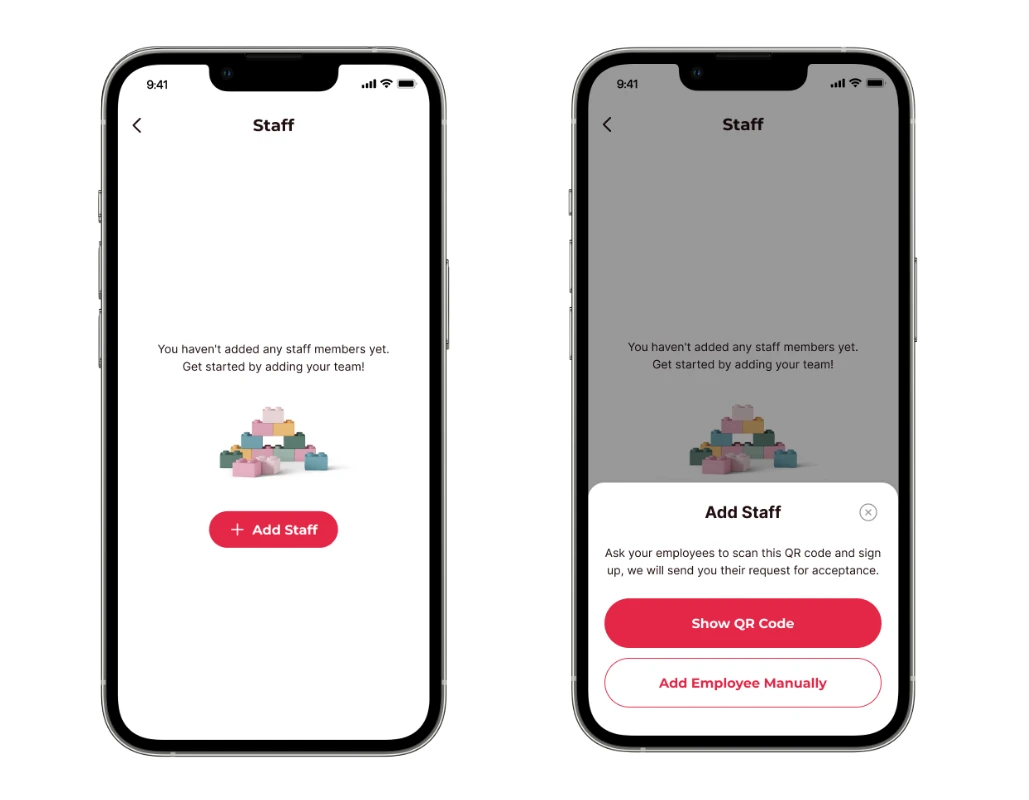

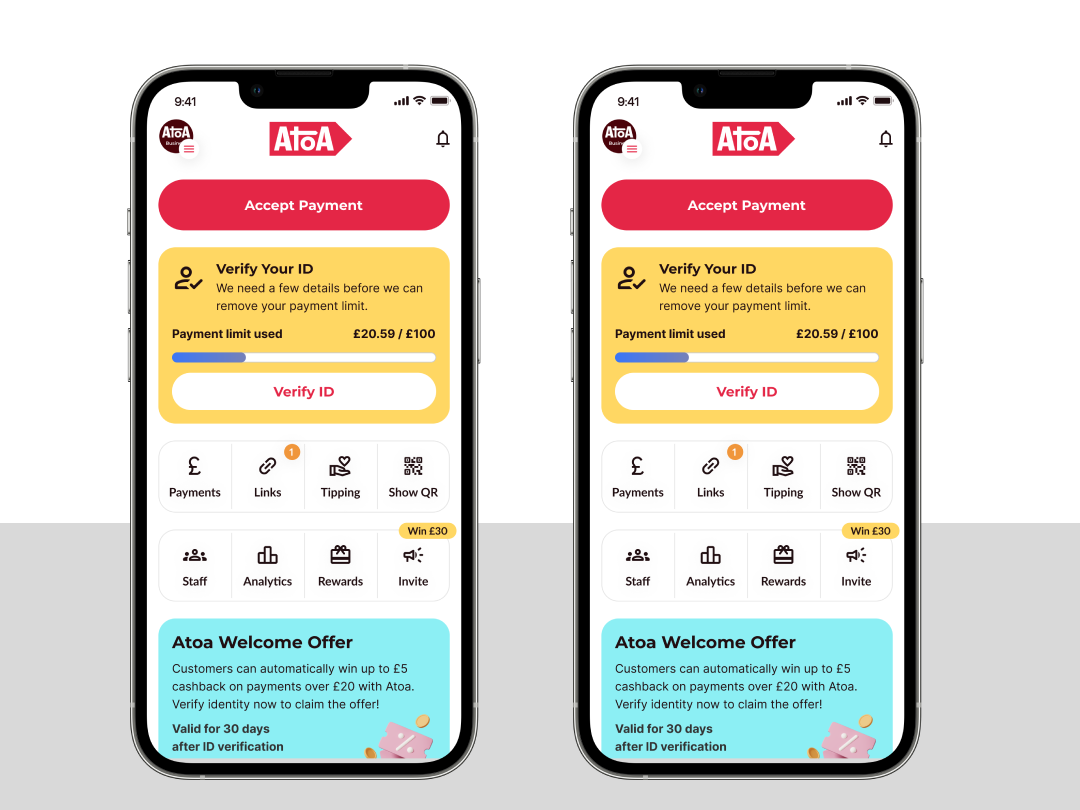

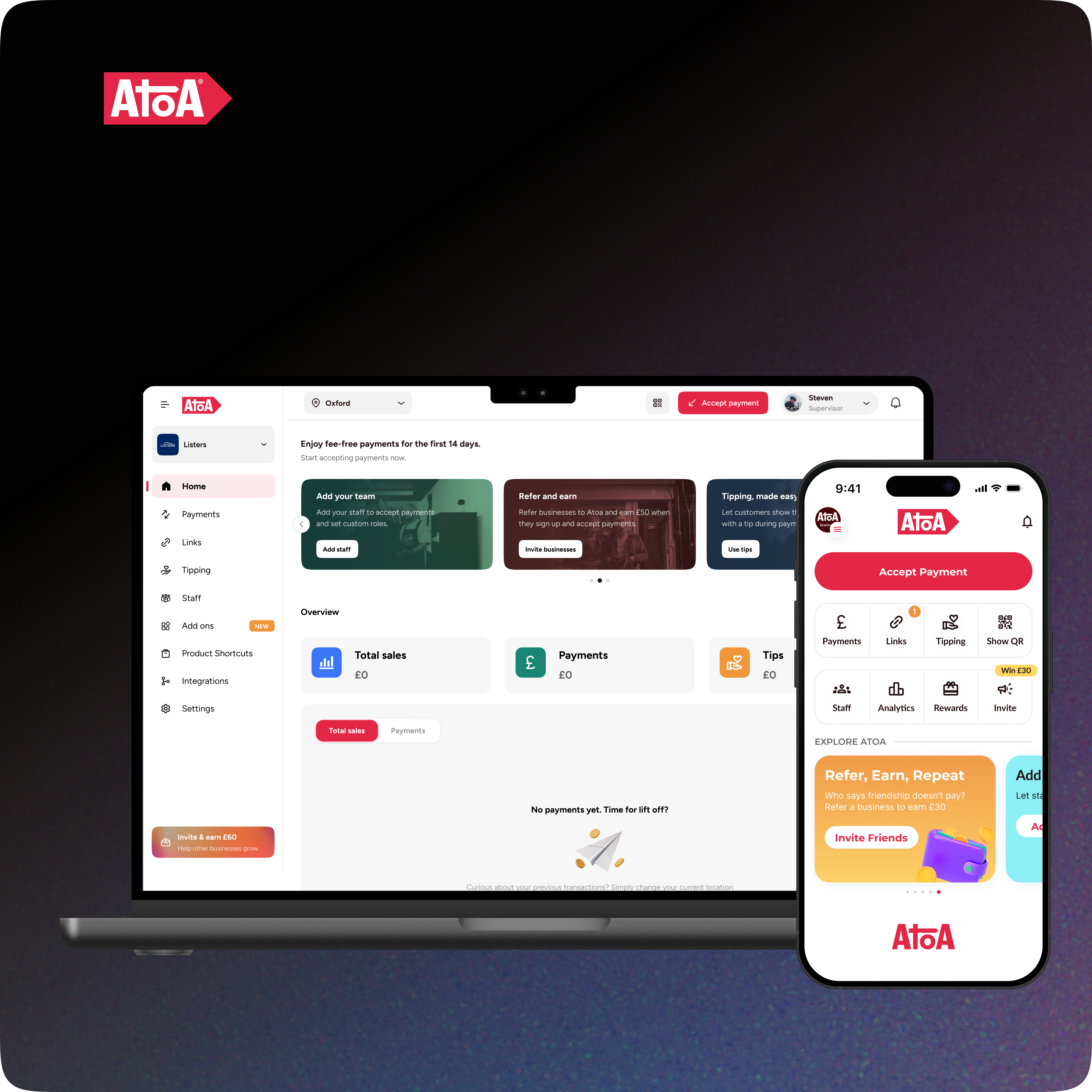

Downloading the Atoa Business app and setting up an account is quicker than making a coffee!

So now that we’ve got that awkward introduction out of the way, here are three reasons to choose Atoa Business for your cardless payments.

Fast: Say goodbye to waiting days for your payments to clear! Atoa releases funds instantly to your business account.

Fair: Our transaction fees sit at a maximum rate of 0.7% per payment, billed monthly. You can’t pay fairer than that!

Secure: Rest easy knowing your money is safe with on-the-spot bank-level security, protecting your payments from fraud.

How to integrate cardless payments into your business

Are you thinking of making the transition from card to cardless payments?

Check out the Atoa Business app for seamless transactions. Download today, and we will give you 7 days of completely free payments to get you started. After that, you’ll be billed monthly at a flat rate of 0.7% per transaction.