Struggle with chasing down late payments and invoices? You’re not alone. Automated payment systems give you the key to unlock efficient customer billing, ultimately freeing up your time and energy for what truly matters.

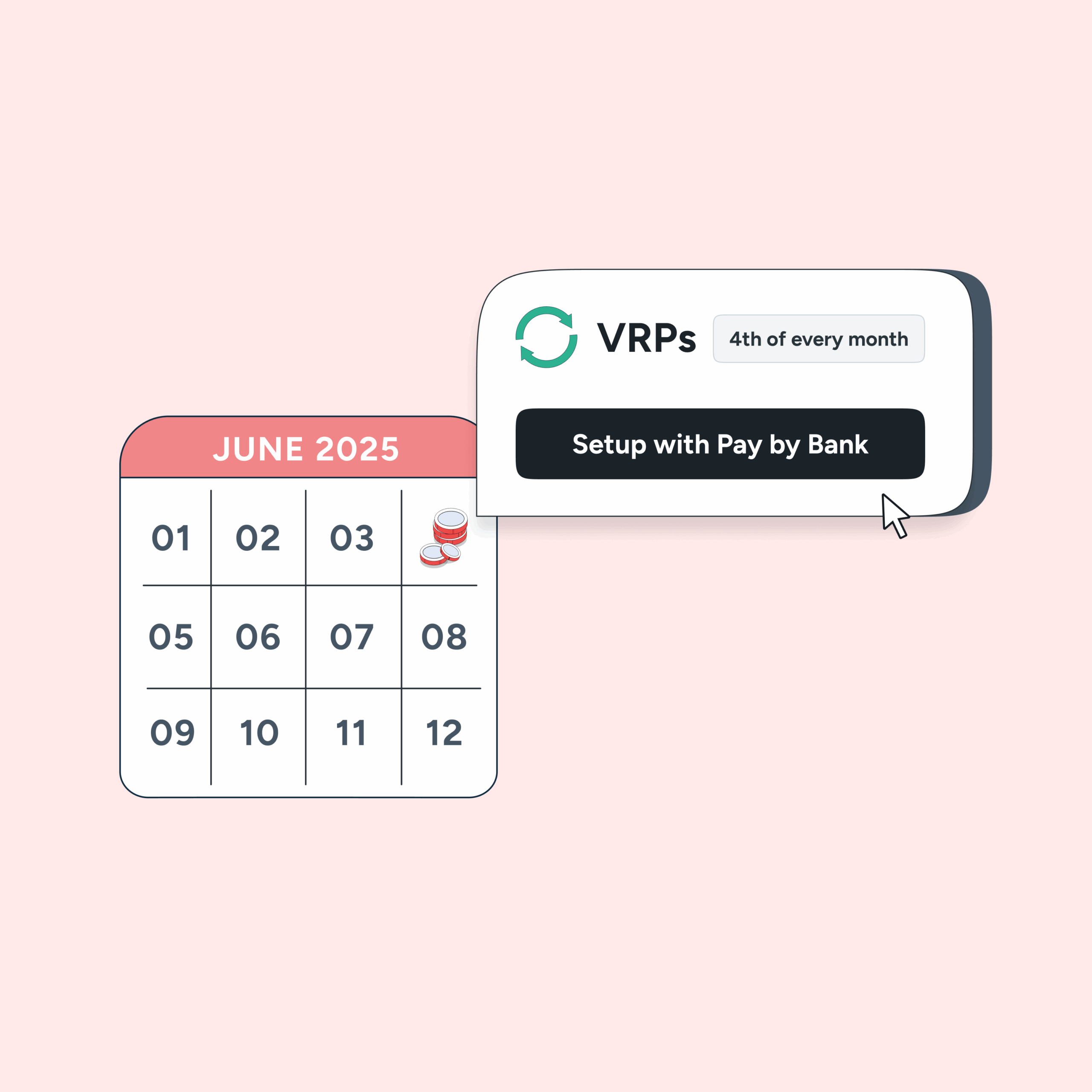

What are these streamlined systems? Simply put, they handle payments automatically, which means no more manual entry. Set up recurring schedules or one-off transactions, and your chosen system will take care of the rest, with direct debits, subscription billing systems, and automatic recurring payments all covered. The list goes on!

This article will cover the following topics:

- What automated payment systems are

- How automatic invoicing and payments can help you succeed

- How to add them to your business easily

Automated payment systems: what are they?

Automated payments are like an admin assistant who doesn’t get bored. Instead, they auto-pay monthly business bills, subscriptions and more without forgetting payments or paying late fees.

If a business owner has embraced this tech, then they’re probably putting their feet up as we speak. And why shouldn’t they? Innovative payment solutions bring a wave of efficiency, such as effortless invoice management. Imagine scheduling invoices in an app and watching the funds roll in automatically. No more awkward chasing, either!

Plug-and-play integrations, you say? Automated payments promise to work away seamlessly with your existing software, such as point-of-sale systems, accounting platforms or CRMs.

These innovative systems take care of the tedious tasks, enabling you to focus on what truly matters. Growing your own business. Let’s explore the tangible benefits automated systems bring…

How financial automation can benefit business owners

Running a business can be demanding; therefore, every little bit helps. In the relentless pursuit of efficiency, a single process improvement can be the difference between sink or swim. So, this is where automated payment systems step in, offering a wealth of advantages that can propel your business towards greater efficiency and success.

Time saved is only the beginning, so let’s delve into the top ten reasons why businesses are enthusiastically embracing automated payment systems:

1. Save the trees: Get ready to shred those dusty piles of invoices. Automated systems keep everything digital, saving you from clutter (and papercuts).

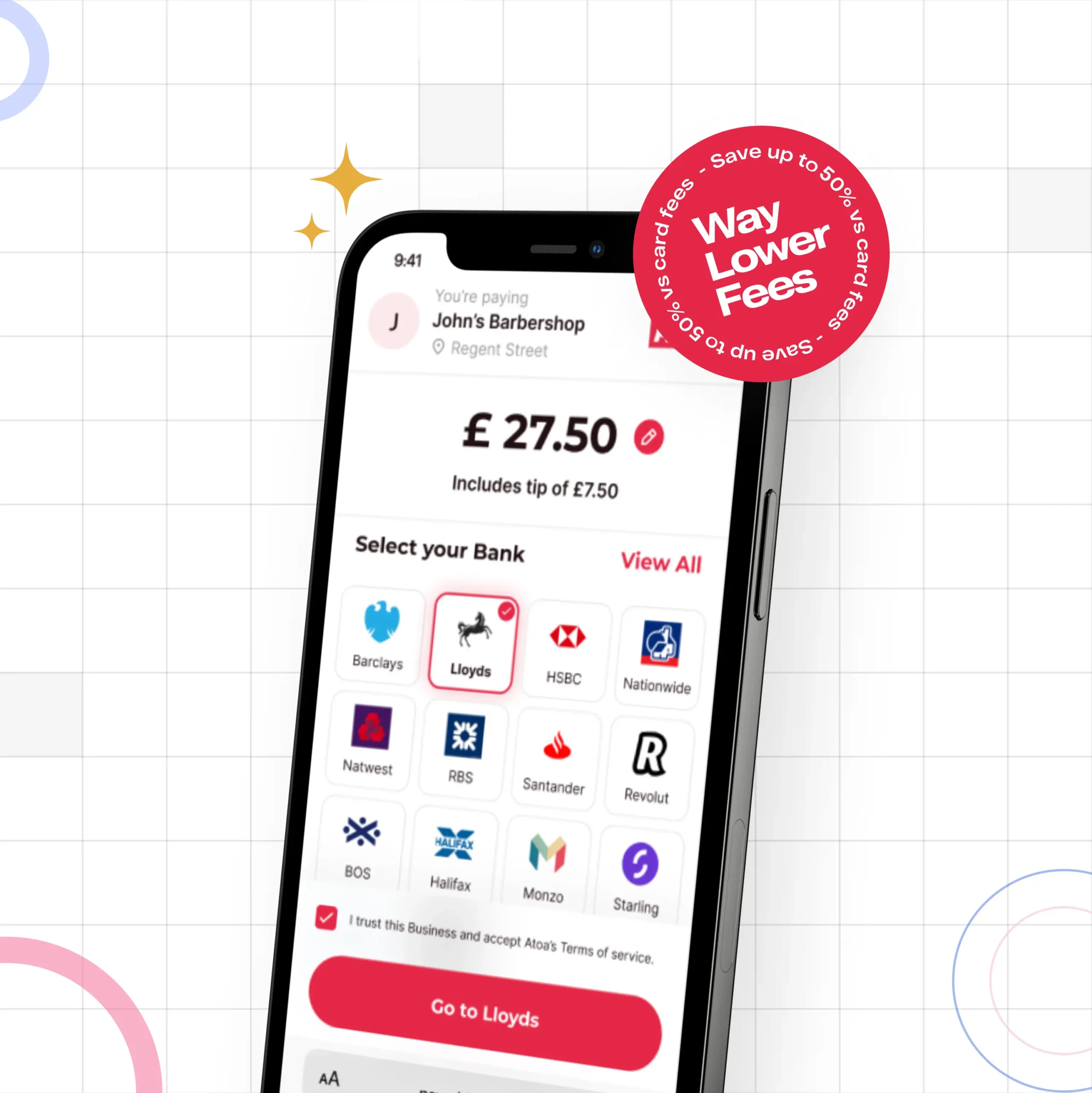

2. No more waiting: Payments zip through without thought, ultimately boosting your businesses’ cash flow.

3. Accuracy: Say goodbye to typos and transposed numbers. Instead, automation cuts human error down for you to ensure every payment lands in the right bank account.

4. Safe and sound: Transactions stay guarded to keep fraud at bay.

5. Time-saving properties: Reclaim hours spent on manual tasks. Automation frees up the team to take on more worthy challenges.

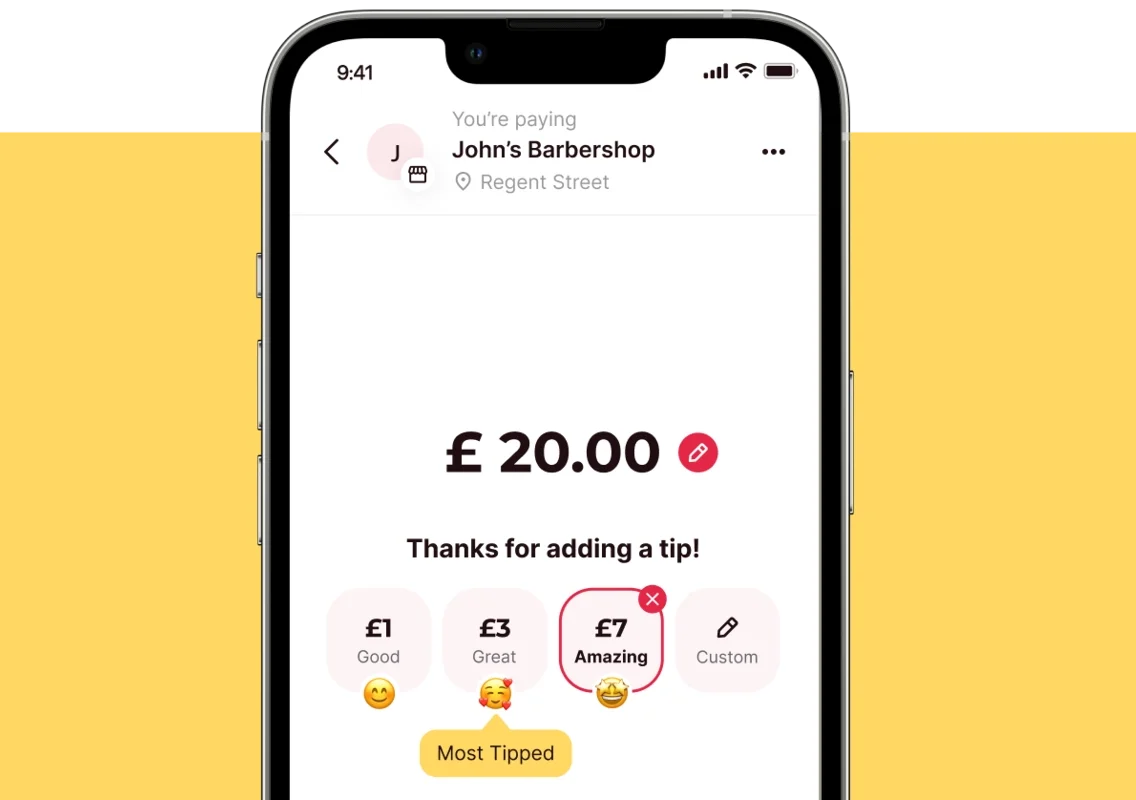

6. Happy customers for better reviews: The convenience of automated payments can help you reach that 5* Google or Trustpilot rating.

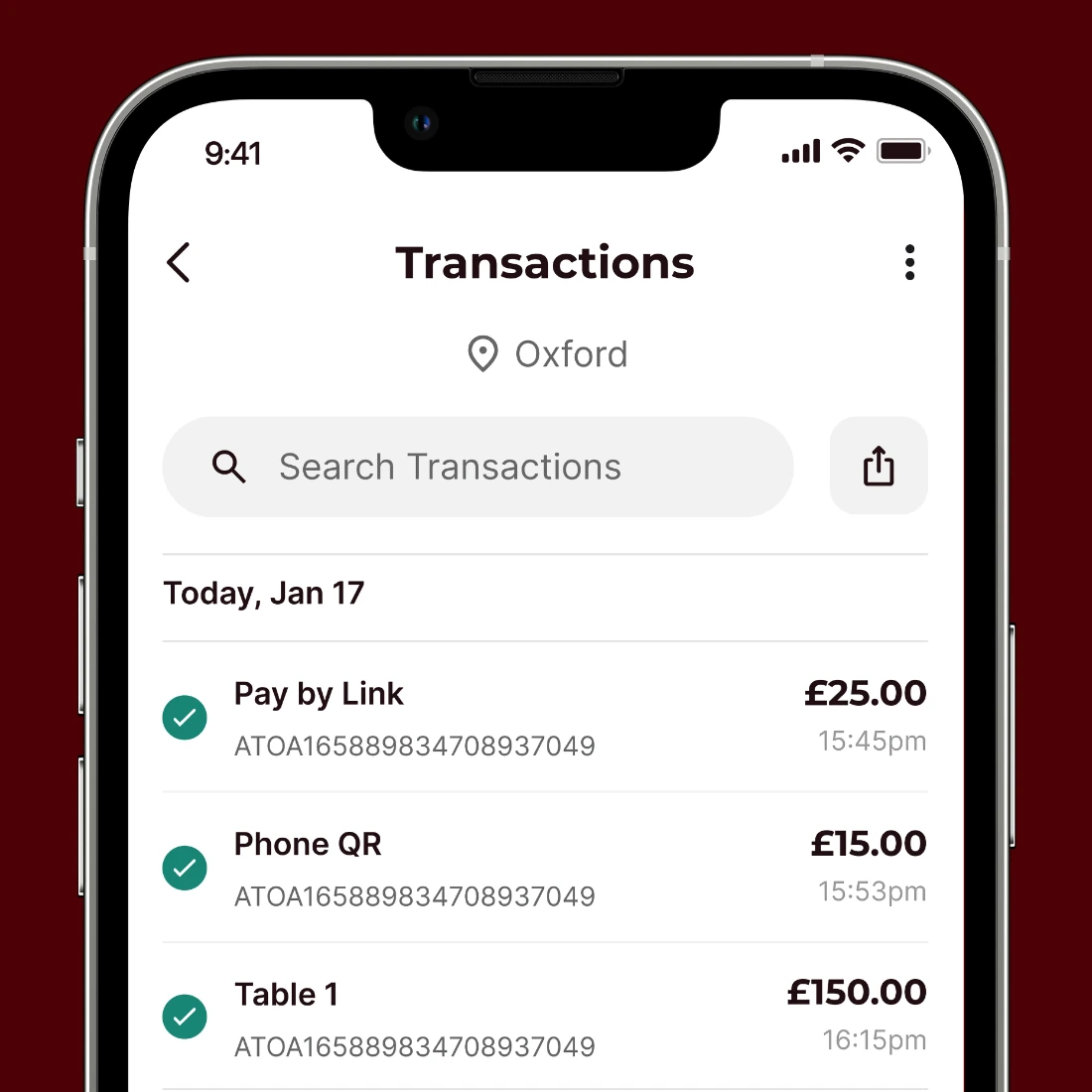

7. Insights for days: Automated systems track everything to give busy merchants valuable insights into their spending habits and customer preferences.

8. Scale up or down: Business owners love how automated systems can adapt and grow alongside their operations.

9. Take a break with work-life balance: No more late nights spent payment chasing! Instead, automation lets you spend evenings, weekends, and holidays free from financial anxiety.

10. Future-proof: Embracing automation shows your business is tech-savvy and can also give you a talking point with customers.

How to automate business payments

Ready to try it? There are plenty of UK-friendly automated payment systems out there. Finding the perfect solution for your needs hinges on what your business does, the payment methods your customers use, and your tech abilities. As such, here’s a breakdown of some popular options to help you choose.

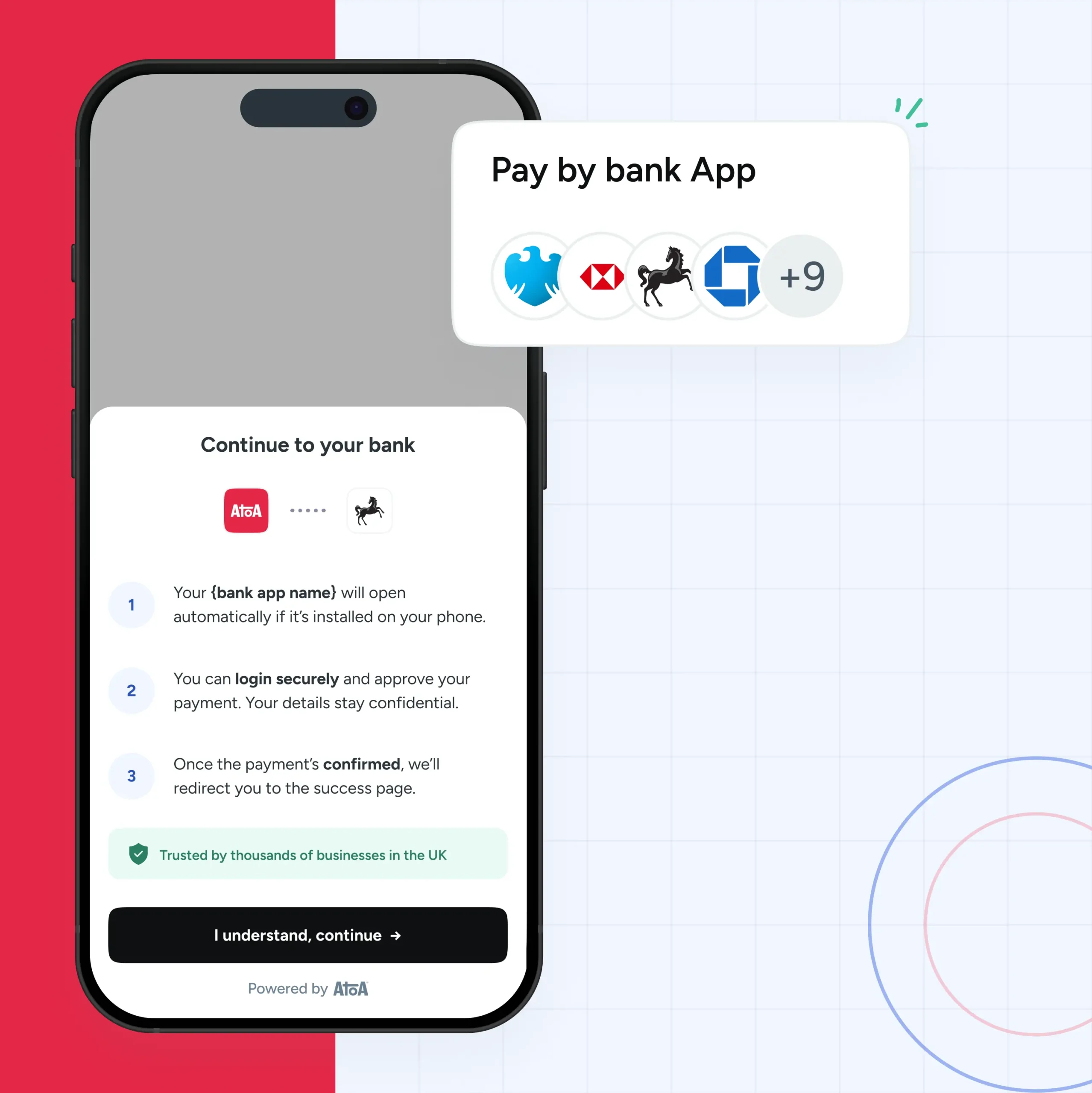

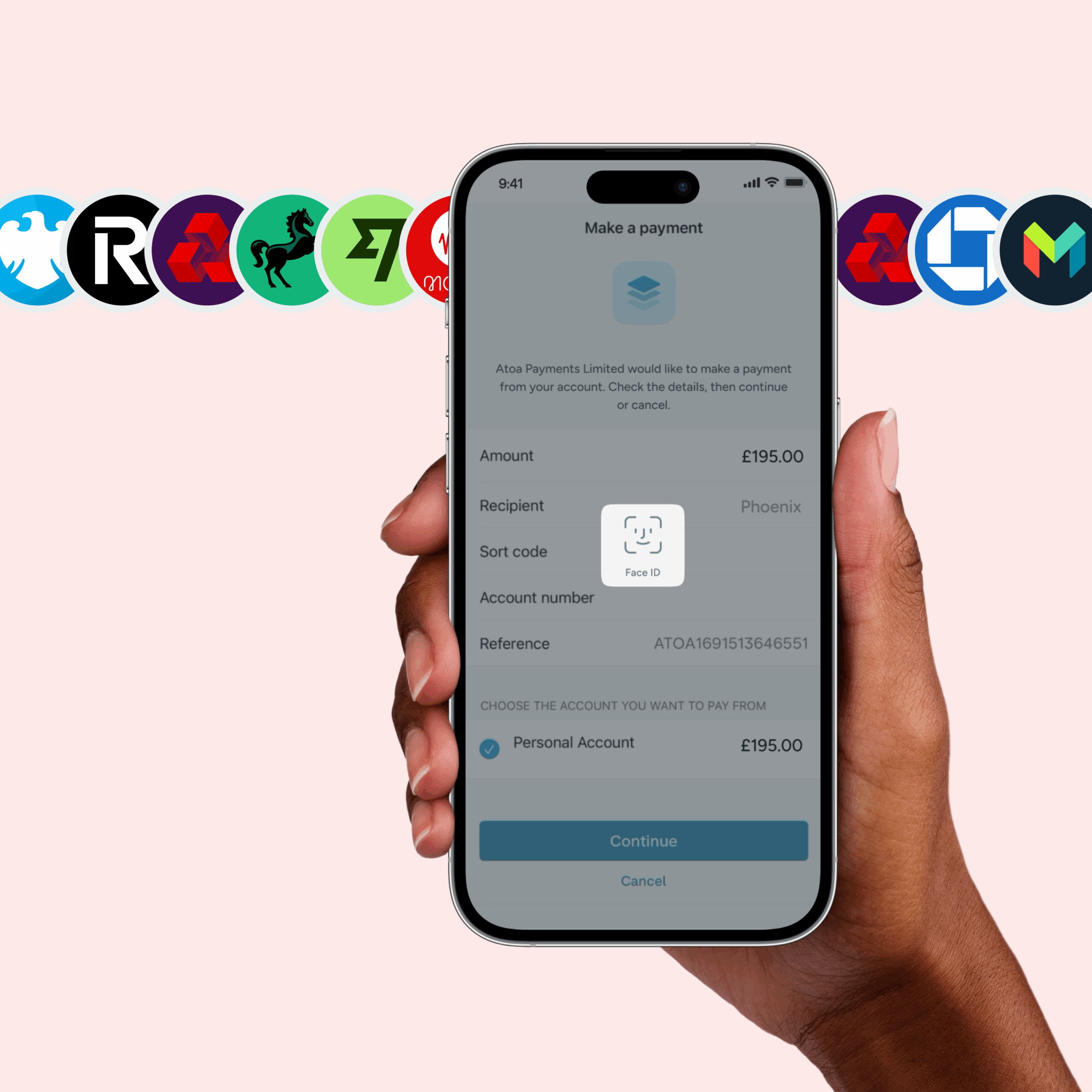

Try open banking APIs

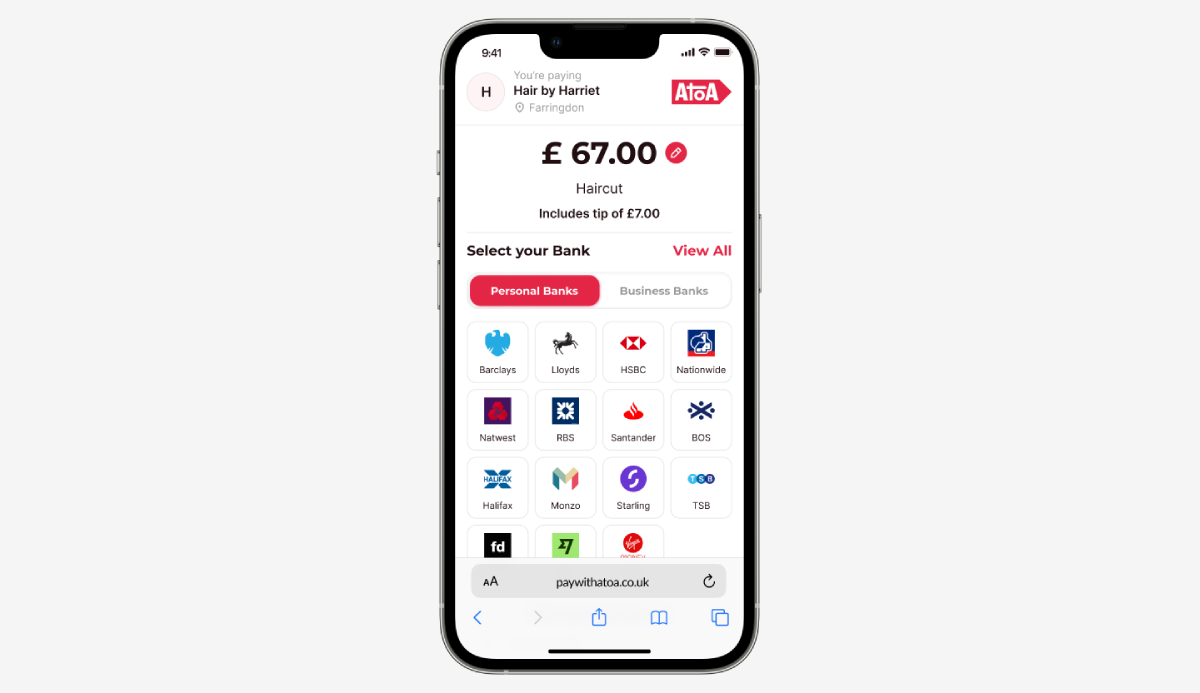

- Ideal for merchants comfortable with technology. These providers may offer mobile in-store and remote payments.

- Pros: Quick setup and integrations are on offer. Highly secure and works alongside bank accounts. Offer innovative features like account-to-account (A2A) payments. Plus, dev support and funding are more likely to be available.

- Cons: You may require some technical knowledge. Also, UK bank accounts may be the only accepted payment method.

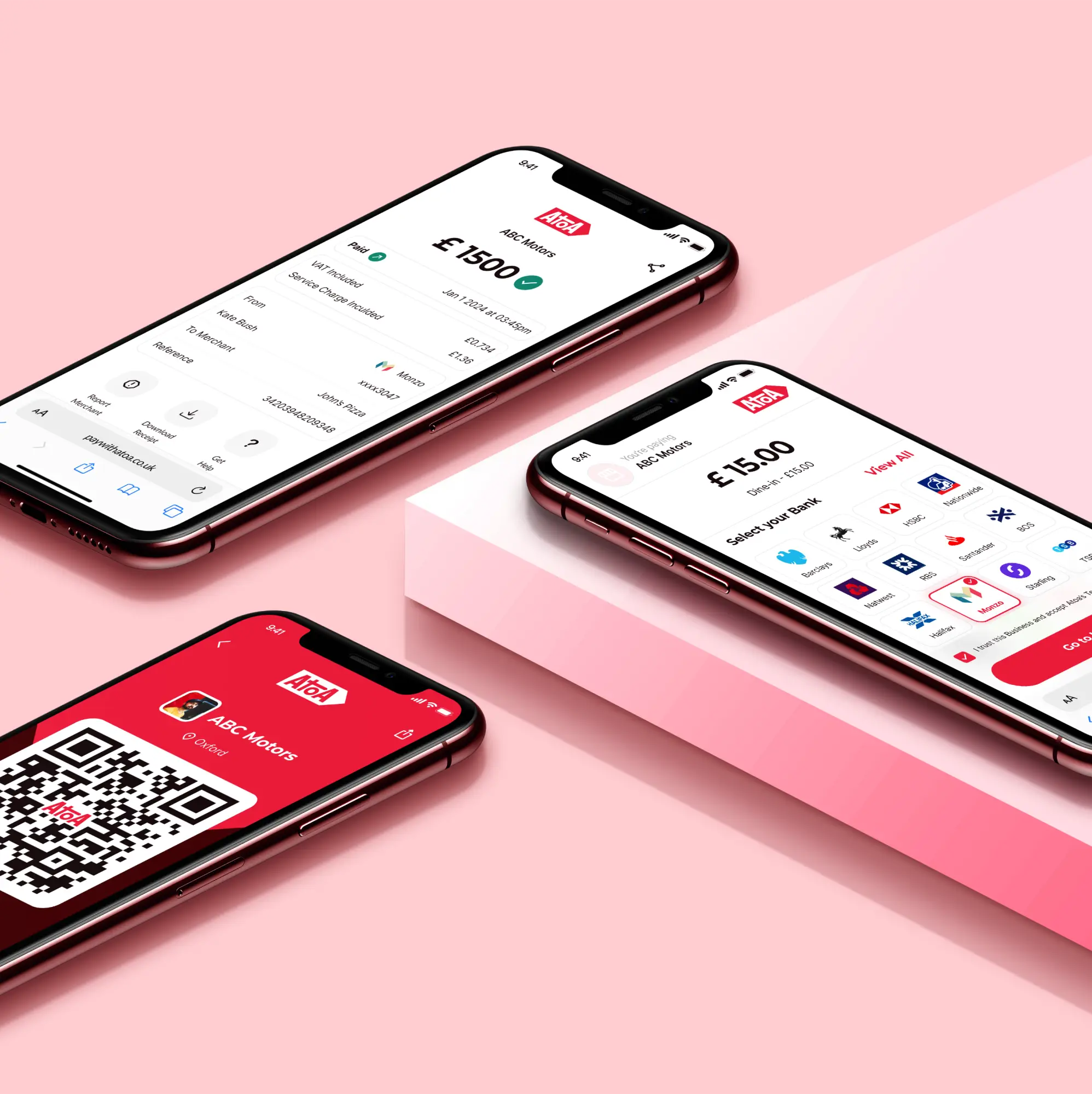

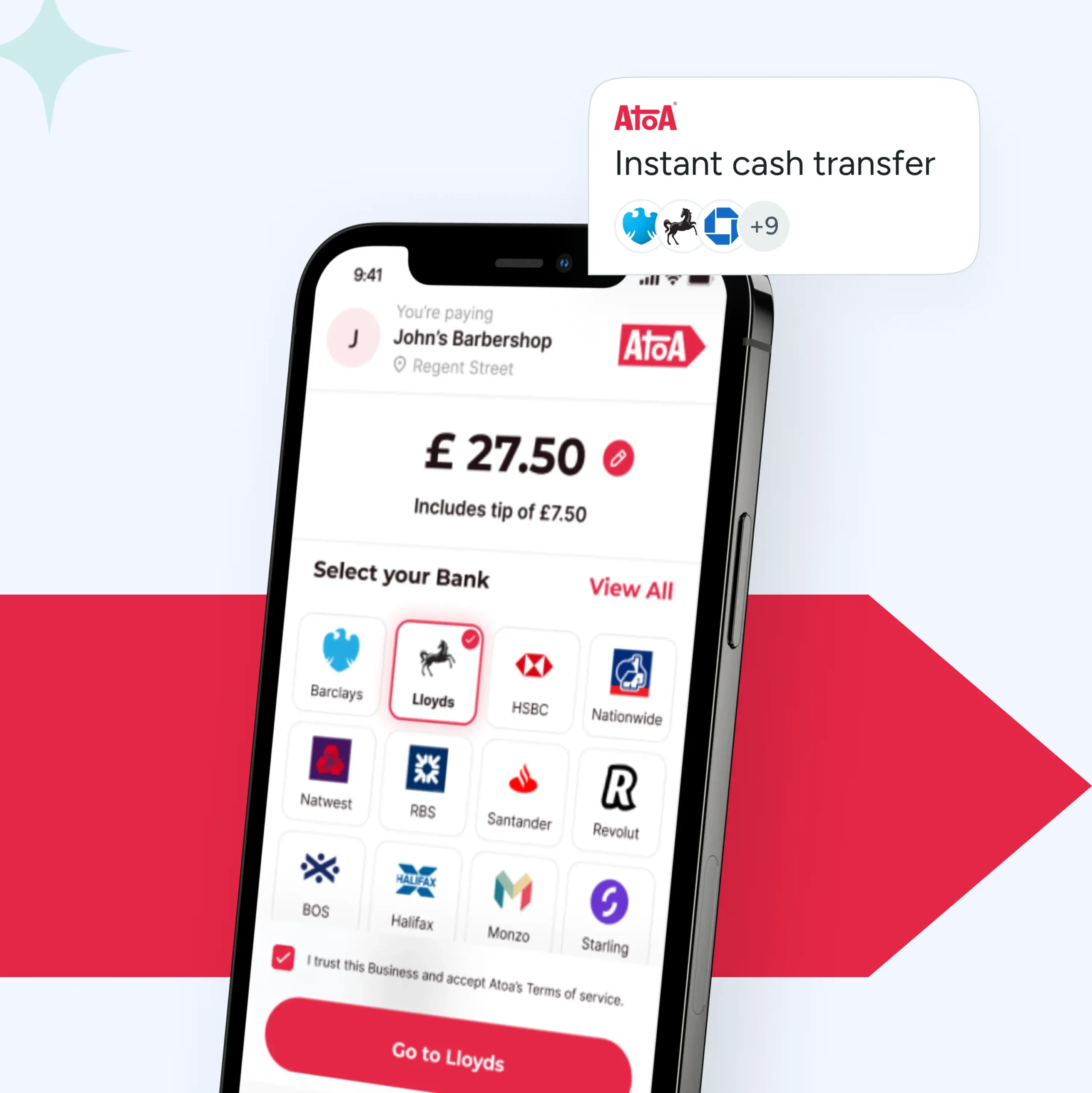

- Popular options like Atoa, Paddle, and GoCardless cater to different needs, so find your fit.

Use payment processors

- Ideal for e-commerce businesses selling online. Plus, they accept credit cards.

- Pros: Processors are usually easy to integrate with websites or apps and support multiple methods, from traditional to digital payments. Also, note that they often offer subscription management tools.

- Cons: Transaction fees add up. Also, you may experience limited direct debit functionality or need to spend extra on hardware and subscriptions.

- Check out big players like Stripe and Amazon Pay.

Automated payment systems: a quick checklist

- How do your customers want to pay? Offer a variety of payment methods to cater to different customer needs.

- Payment volume and fees: Compare transaction fees and account charges between different platforms.

- Integration needs: Choose a solution that integrates smoothly with your existing software to make the best efficiency moves.

- Check customer reviews and support: Check the provider’s reviews. If they’re bad, don’t go there! Then, check if they have a solid care team that can help iron out any issues.

FAQs

How do automated payment systems work?

Business owners set up recurring or one-off payments with their customers (think memberships or invoices), and the system does the rest. Then, payments are taken securely and land in your account like clockwork.

Can automated payments reduce late fees?

Automated payments reduce late fees in three ways: payments go out on time, cash lands faster, and finally, you can nudge customers with a gentle reminder to keep everyone on track.

What are the automated payment benefits for B2B transactions?

As a business owner, you know time is money, and chasing invoices eats into both. B2B automation reduces forgotten payments to save you money on late fees, boost operations, and also help to strengthen relationships with your suppliers.

What’s the best automated payment system for e-commerce?

Choosing the top automated payment system for your UK e-commerce business depends on your unique needs and goals. So, here are some contenders for 2024: Paddle (Saas superpower) or GoCardless (like Atoa, no card necessary!)

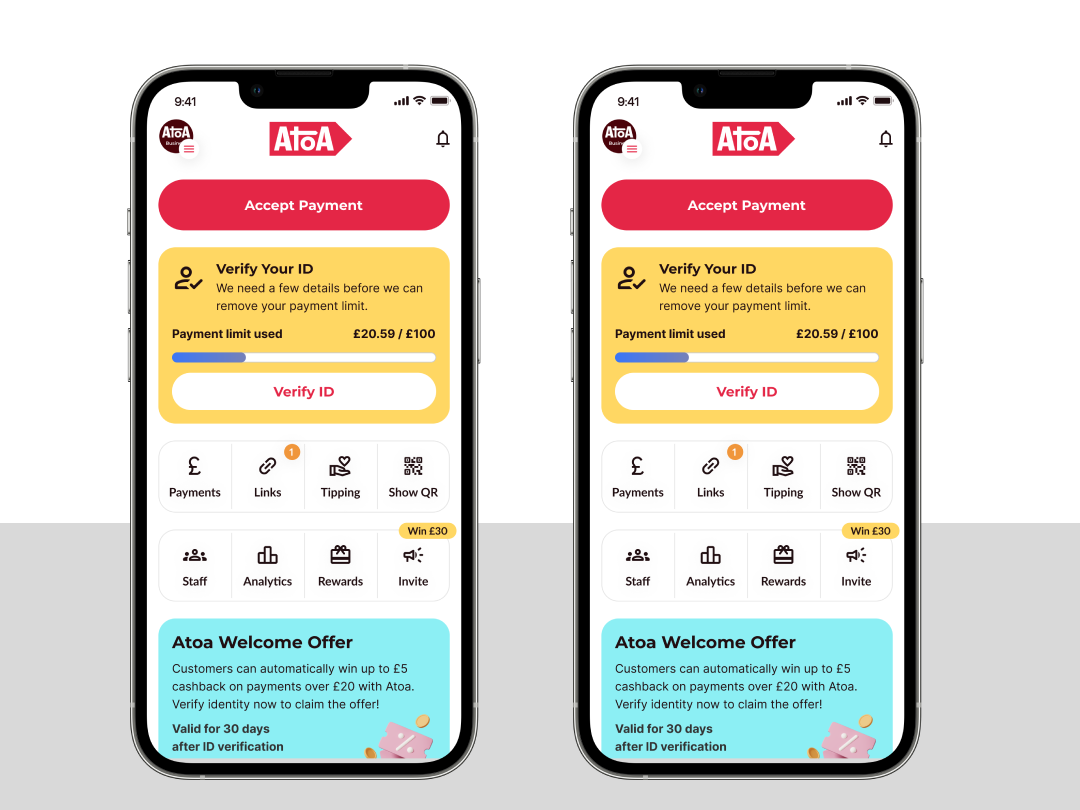

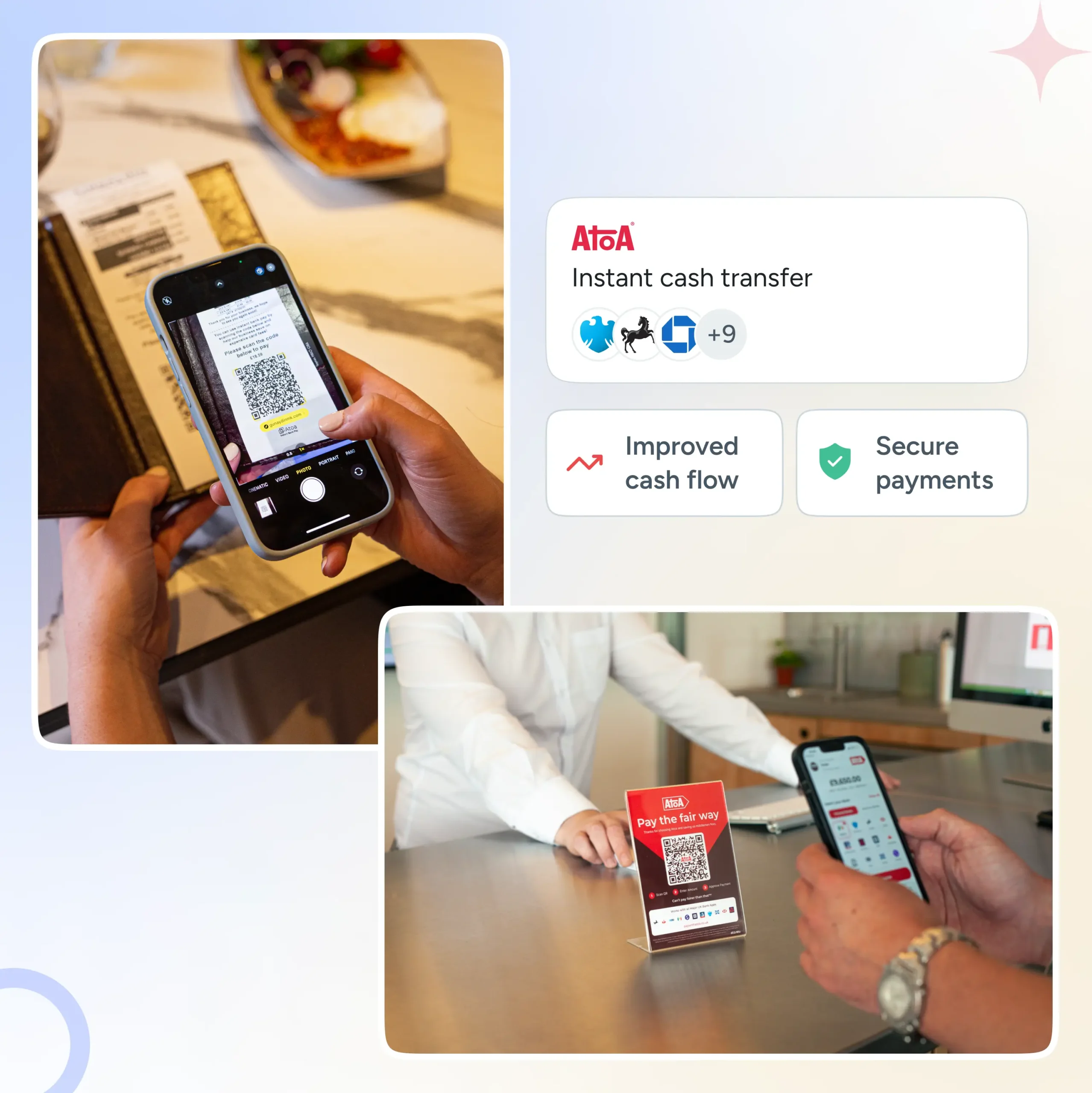

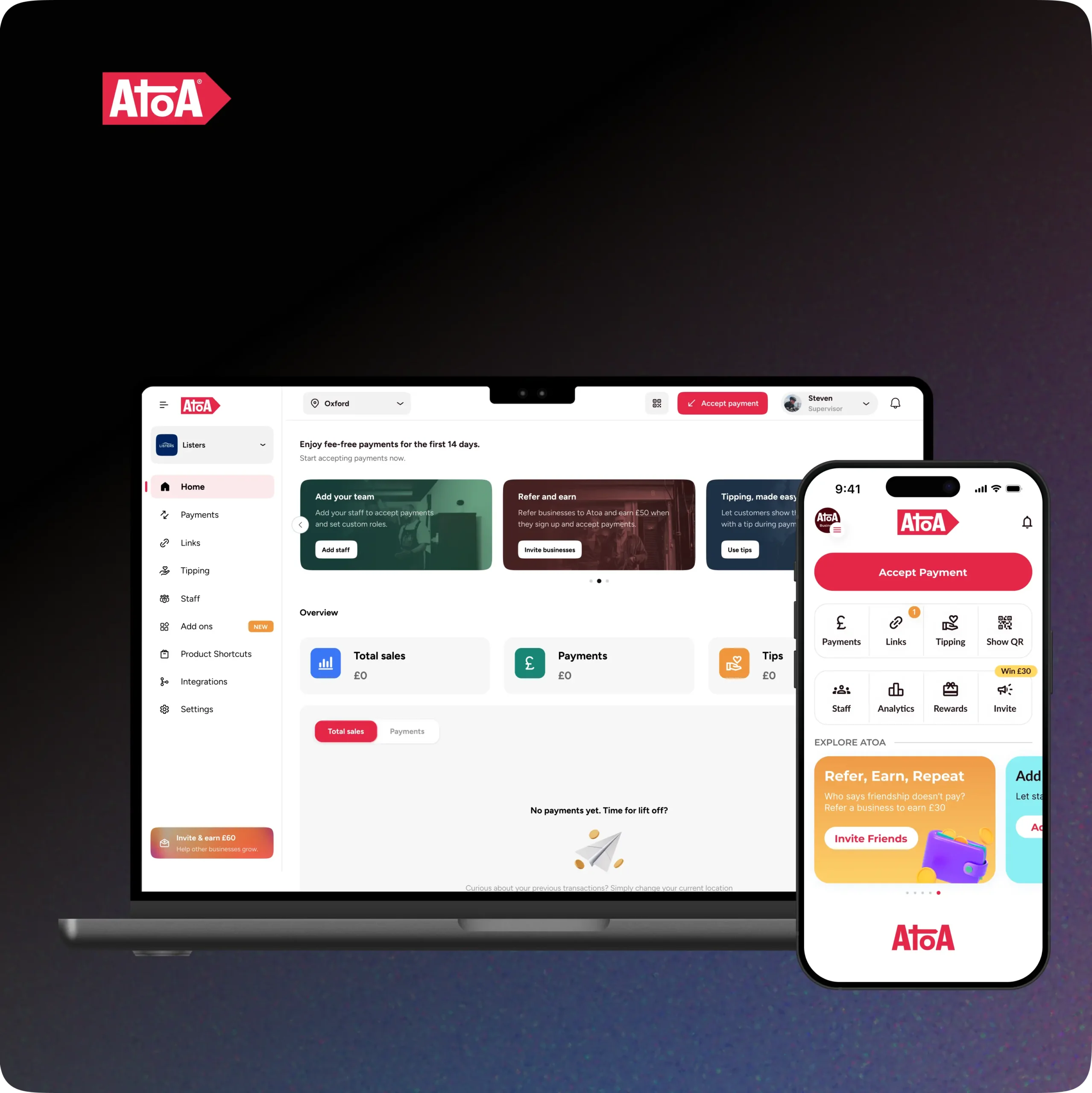

How Atoa can help

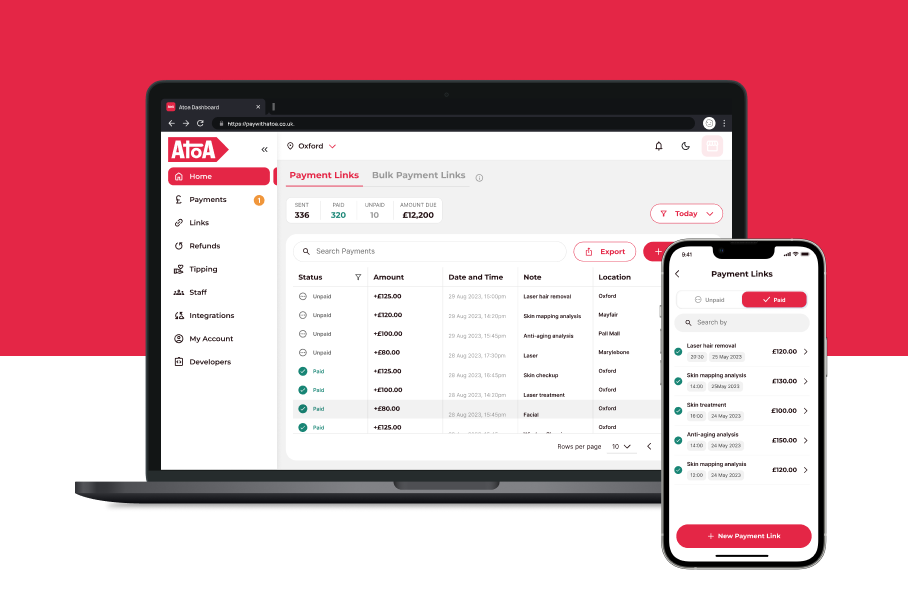

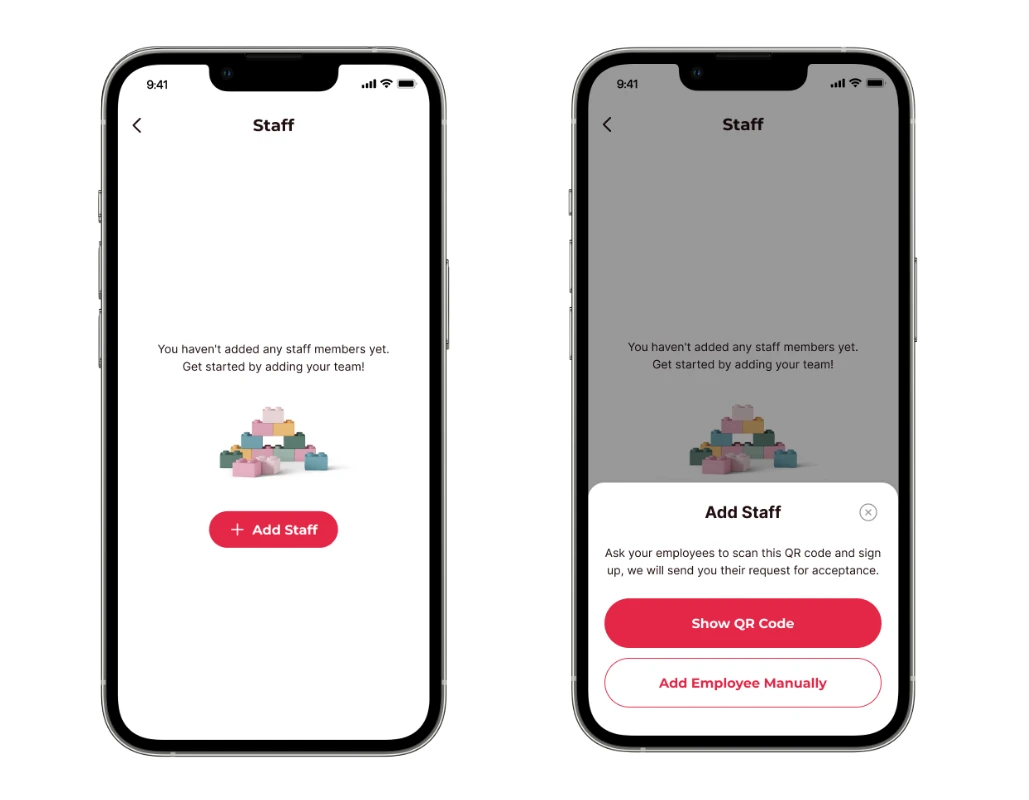

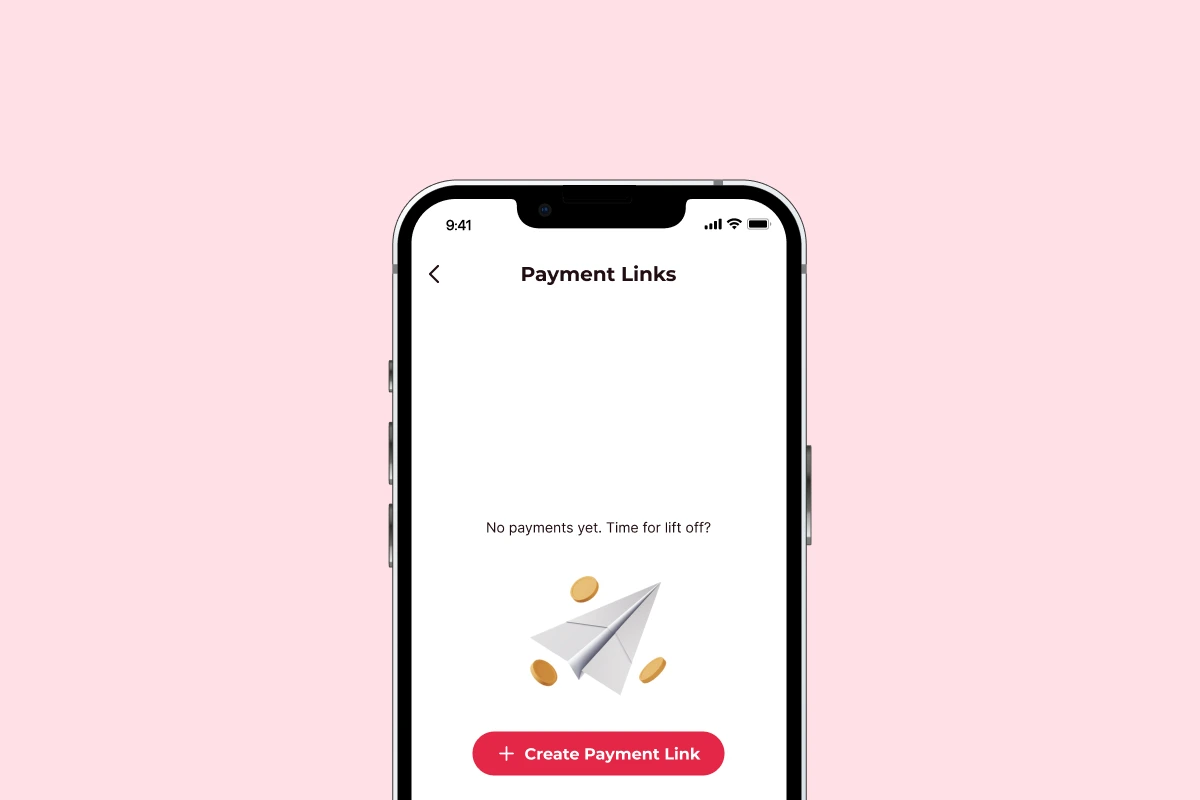

Now you know the benefits of automated payment systems, why not start your stress-free journey with Atoa’s payment solutions? We can help you send bulk payment links to your customer base with the option to nudge them if they’re slow to settle up.

Download Atoa Business to create an account. Then, we’ll hold your fees for 7 days as you find your feet. Take as many payments as you like, and we won’t charge you a penny!