Forget fumbling with cash and cards! The UK mobile payments market reportedly had over 10 million users since the coronavirus pandemic, as less cash was used for in-store transactions. Mobile wallets are changing how your customers pay – and how you get paid. But why should UK business owners care?

In this article, I will cover:

- What these mobile payments offer

- How businesses use mobile payments

- How to get started with mobile wallets

Let’s dive in!

What are mobile wallets?

Think of a mobile wallet as a digital version of your physical wallet, but it lives on your customers’ smartphones. They securely store credit and debit card information and can also help organise loyalty cards and boarding passes. To pay, they tap their phone at the checkout without keying in any details.

But why are they good for business? Let’s get down to the root of it. Convenience always wins customers over! Tap-and-go payments are fast and create a smoother experience that will keep customers returning for more. At the same time, security matters. Mobile wallets use encryption to keep financial data safe, giving customers peace of mind.

How mobile wallets are used

Mobile wallets are changing the way customers pay, and that’s great news for UK business owners. If you’re not already accepting mobile payments, maybe it’s time to consider them.

- Lines? What lines? Customers at cafes and restaurants can order through an app before they arrive and use their mobile wallet to pay. No more queues means happier customers and faster turnover.

- Checkout so fast you almost missed it: Retail shoppers love the convenience of tapping their phones at the register. Think about how much smoother your checkout process could be with mobile wallets.

- Pay without a cash machine or bank transfer: Customers can pay service businesses like plumbers or electricians without invoices or cash machine dashes.

- More than just convenient: Mobile wallets aren’t just a faster way to pay – they offer increased security that your customers will appreciate.

Think of it this way: mobile wallets transform your smartphone into a cashier, tapping you into the future of quick and easy transactions.

How to accept mobile payments

There are two main ways to accept mobile wallets:

Near Field Communication (NFC) payments are the most common mobile payment method. You’ll need a contactless reader at your point of sale (POS) system. Most modern systems come with NFC built-in but here are the 10 best POS options for businesses in 2024.

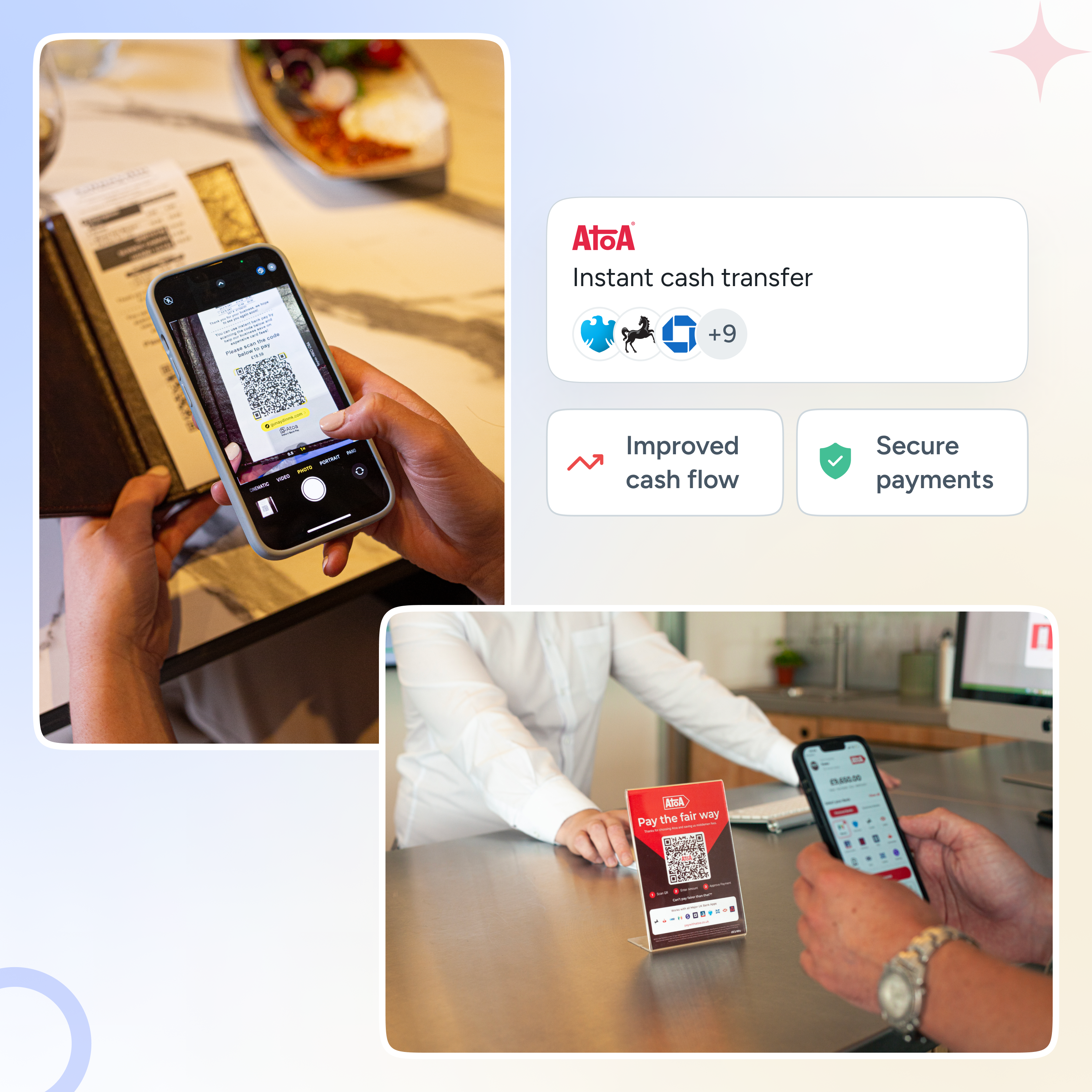

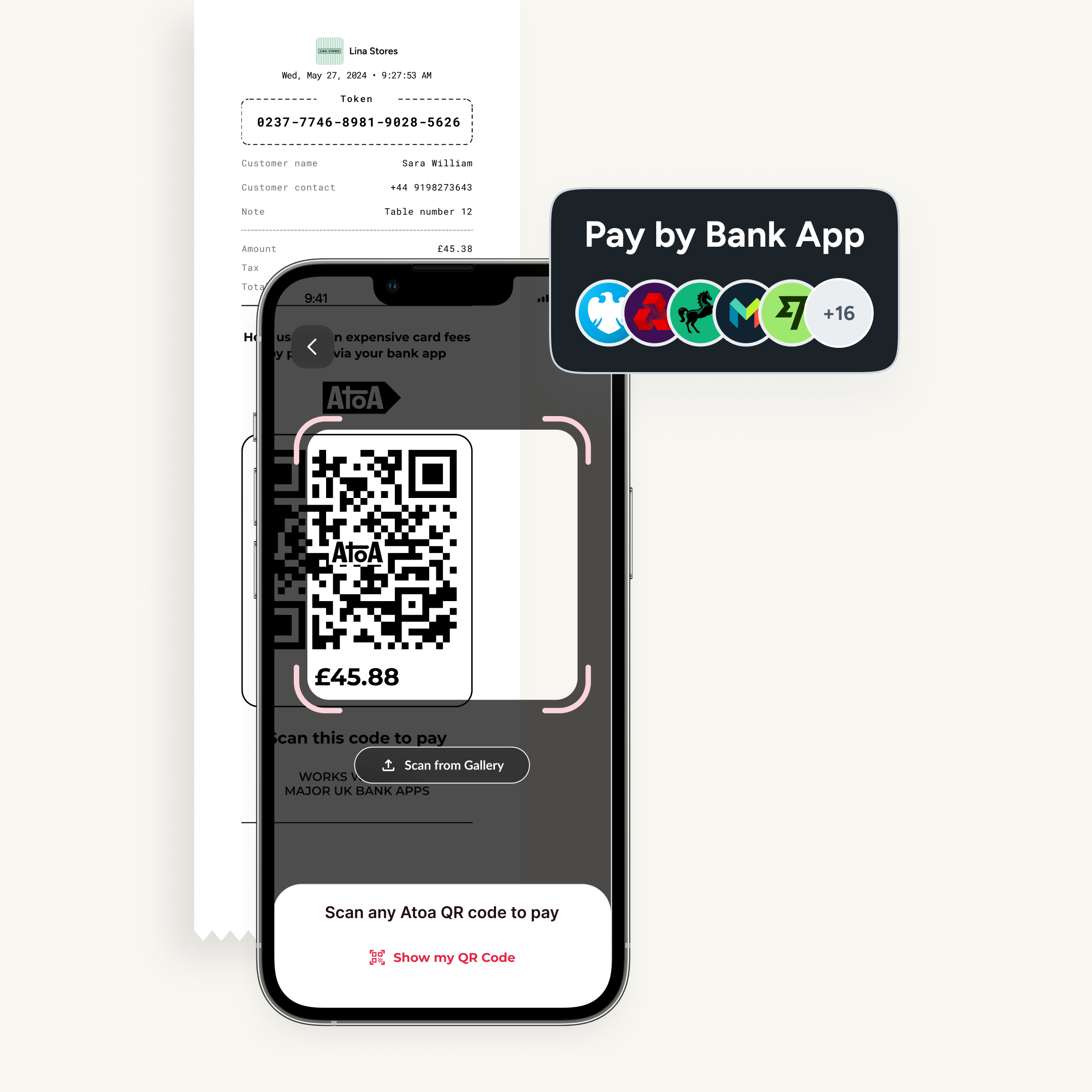

QR payments allow customers to scan a custom QR code displayed at checkout to pay. This can be a good option for businesses without a POS system.

How to get started with mobile wallets

- Choose your provider: Popular options in the UK include Apple Pay, Google Pay, and PayPal. Consider which ones your customers are already using.

- Get the right gear: You’ll need a contactless payment terminal that accepts mobile wallets. Most modern POS do this already!

- Spread the word: Let your customers know you accept mobile payments with signs and at checkout.

Choose a mobile wallet provider

Many processors come with this function, so your existing system might already be ready to accept mobile payments. Otherwise, choose one that specialises in mobile wallets. Here are some things to consider:

- Compare fees for mobile wallet transactions against other payment methods.

- The provider needs to integrate with your existing system.

But which mobile wallets do the UK public love? As usual, there’s a bit of a monopoly, but here are who I call “the big three.”

Apple Pay: Apple Pay takes the lead in popularity for in-person payments due to its automatic pairing with iPhones and Apple Watches. It’s widely accepted and gives customers access to convenient tap-to-pay transactions.

Google Pay: Popular among Android users, Google Pay offers similar functionality to Apple Pay with contactless payments. They also have a digital wallet which is commonly seen on e-commerce checkouts.

PayPal: As well as being a leader in digital wallets, PayPal has a strong mobile wallet presence. It’s a trusted brand, especially for person-to-person payments and online shopping.

But how do they work? The setup and process for customers are pretty straightforward, which is proven by their growing popularity.

1. Customers download their chosen mobile wallet app, such as Apple Pay.

2. They create an account and add payment and loyalty cards.

3. Users can now pay online, in-app, or in person with a simple tap.

Start accepting mobile payments

- Contact your payment processor to activate mobile wallet acceptance. They will guide you through the setup process.

- Some mobile payments might require you to download an app or update your POS software to use them.

Additional things to consider

- Mobile wallet providers like Apple Pay and Google Pay don’t require separate signups. Once you have a contactless reader, you’re automatically set up.

- Consider security features offered by your processor to keep transactions safe.

- Mobile wallet acceptance can improve customer experience and even increase sales due to faster checkout times.

💡 Contact your payment processor directly for personalised instructions based on your chosen system.

Mobile wallets vs. digital wallets

But what exactly sets them apart, and how can they level up your business game? Here’s how they stack up.

| Feature | Digital wallet | Mobile wallet |

|---|---|---|

| How to use them | Online payments only | In-store, in-app and online payments |

| Acceptance | E-commerce stores | Online stores and many physical retailers |

| Ease of use | Can vary, some may be complex but saves time during online checkout | User-friendly and quick |

| Offline support | Limited | Some support offline payments using NFC technology |

| Security risks | Data exposure is possible if the account or linked device is compromised | Data exposure is possible if the device is lost or stolen, although biometrics add an extra layer of security |

💡 Digital wallets are mainly for online payments on websites and apps. Mobile wallets are designed for smartphones, letting customers pay in stores and online.

A little note on digital wallets…

Craving a checkout that stores all your payment info so you can pay online in seconds? That’s basically what digital wallets do. Here’s the lowdown on how they work:

1. Get on board with a digital wallet provider. Choose one that works for your business and online checkout process.

2. Set it up by filling in your deets and verifying your account.

3. Integrate into your current online payment flow.

4. Let customers pay in seconds by selecting a digital wallet at checkout.

From super fast hotel check-ins to instant deposits at car dealerships, digital wallets are changing how we pay. Plus, they’re secure, making them a solid option for hospitality and beauty payments.

Which should UK business owners choose?

It all depends on your customers! If most of your sales happen in person mobile wallets are the way to go. But, if you’re primarily an online business a digital wallet might be enough.

Want the best of both worlds? Many digital wallets also have a mobile wallet counterpart. Make sure you do your research to offer the best possible checkout experience.

Remember, it’s all about your customers! The key is to figure out the payment methods they prefer. Offering mobile wallets shows you’re keeping up with the times and making their lives easier. That’s a win for everyone.

💡 It’s all about finding the perfect fit for your business and customers. Explore what payments are available where you shop the most and mirror them.

So, there you have it! Whatever you choose, these payment solutions help you accept payments and improve your customer experience.

FAQs

How safe are mobile wallets?

Mobile wallets are often safer than using your physical card. They encrypt your payment information, meaning it’s not stored directly on the device. Plus, biometric features like fingerprint or face recognition add another layer of security.

What do I need to get started?

Usually a smartphone. Most iPhone or Android phones include a wallet app like Apple Pay or Google Pay. Open the app, add your credit or debit card details, and start using it for contactless payments.

Can mobile wallets be used everywhere?

More and more places accept mobile payments! Look for the contactless payment symbol at shops, restaurants, and sometimes vending machines. Big online retailers often let you pay with your mobile wallet too.

What if I lose my phone?

The security features built into mobile wallets (those passwords and fingerprints we mentioned) make it harder for someone to access your info. Freeze your bank card or contact the wallet provider immediately, and they can disable payments from your device.

How we can help

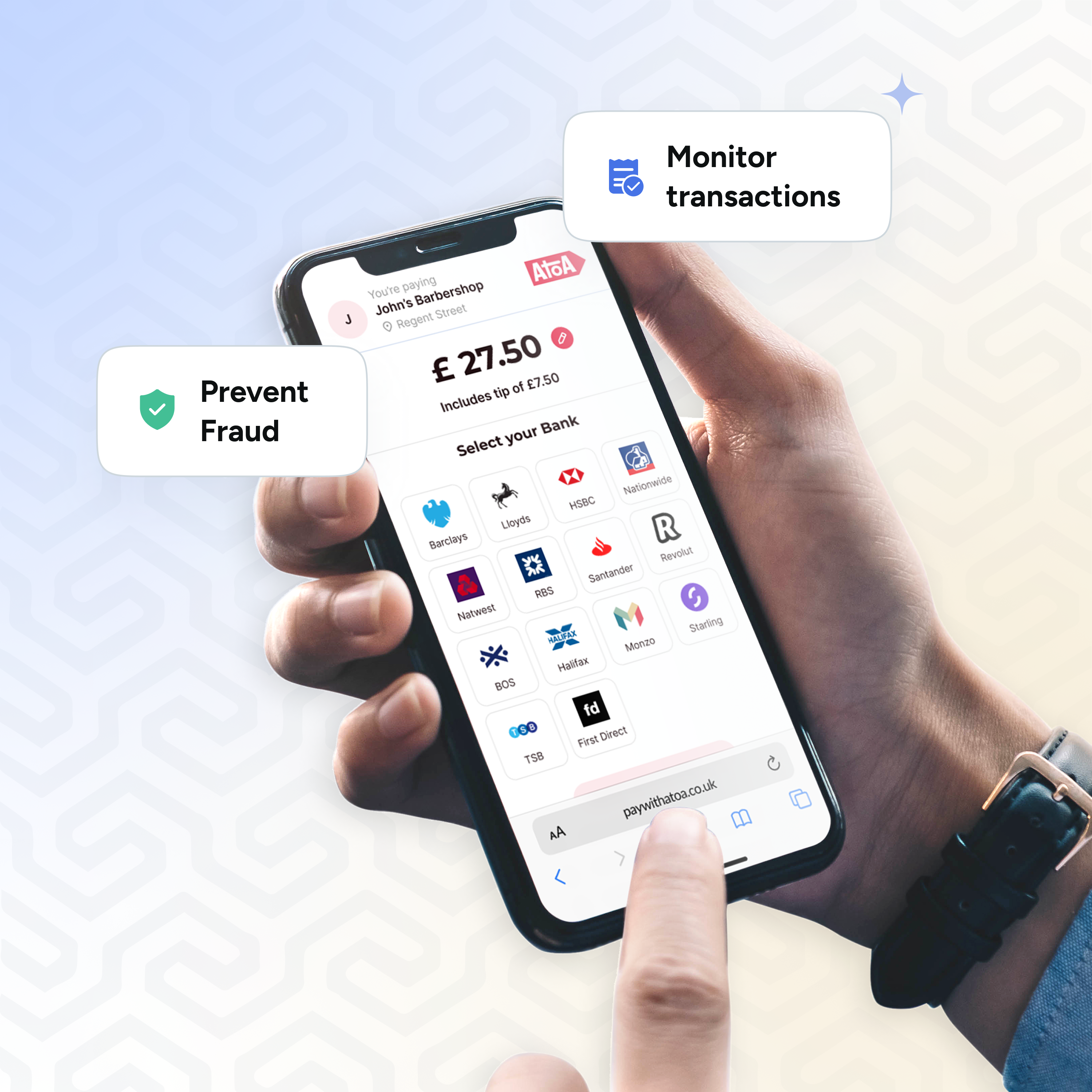

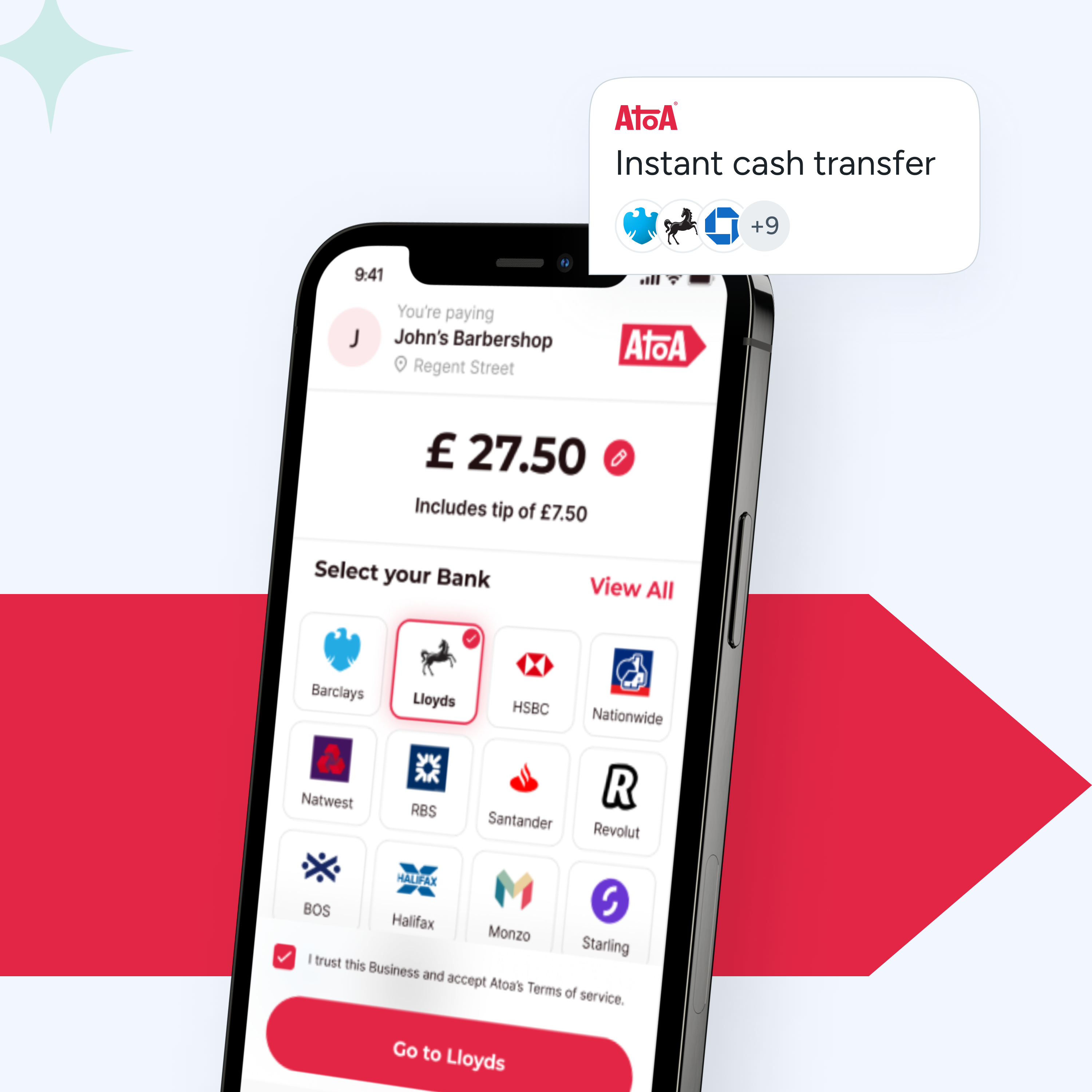

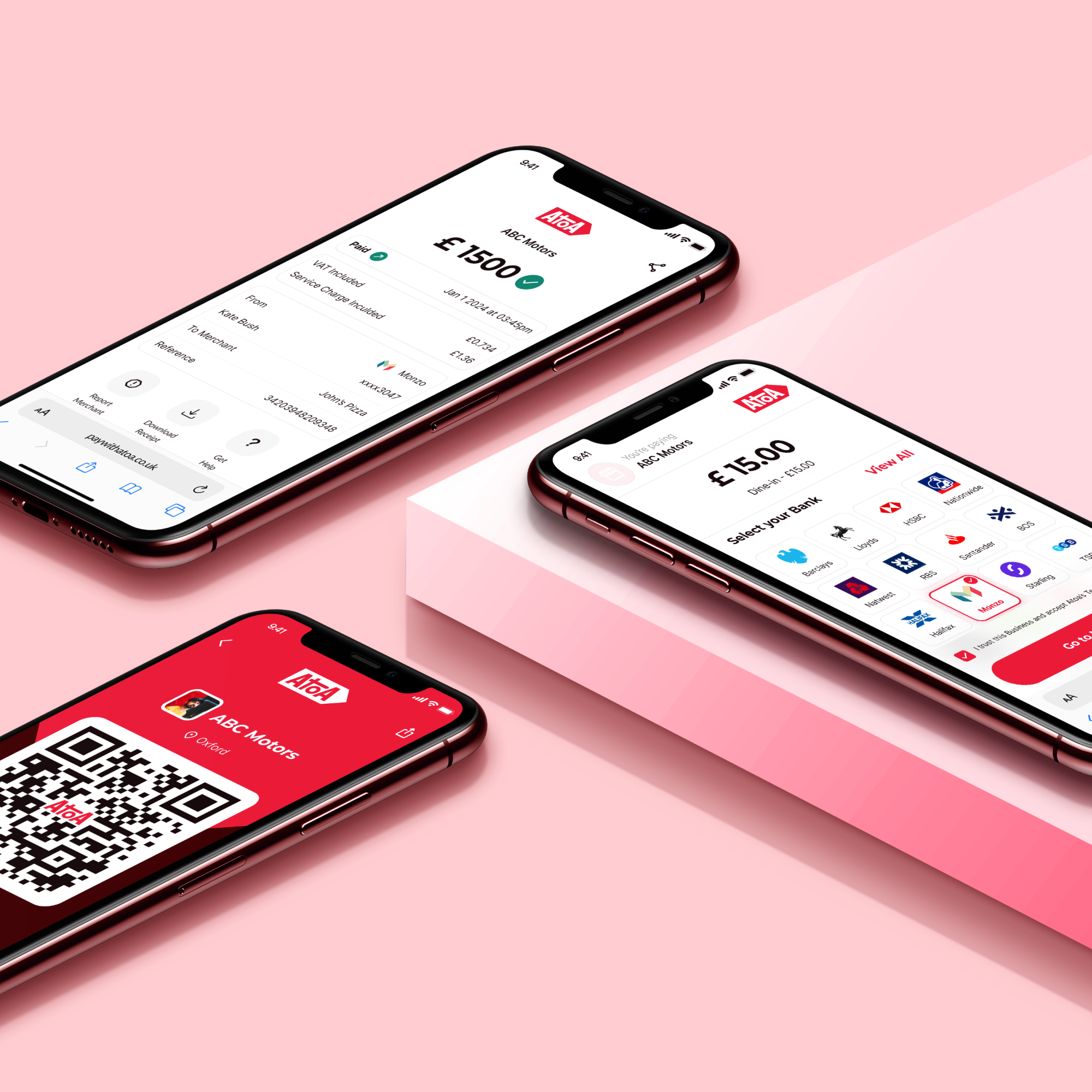

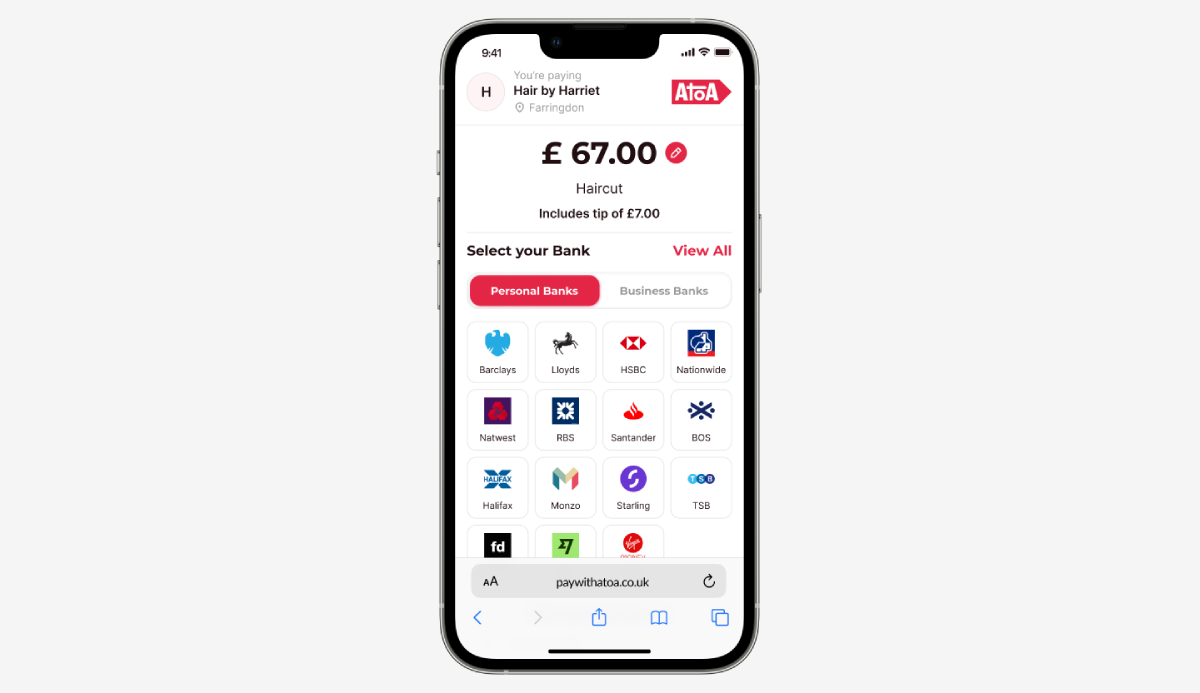

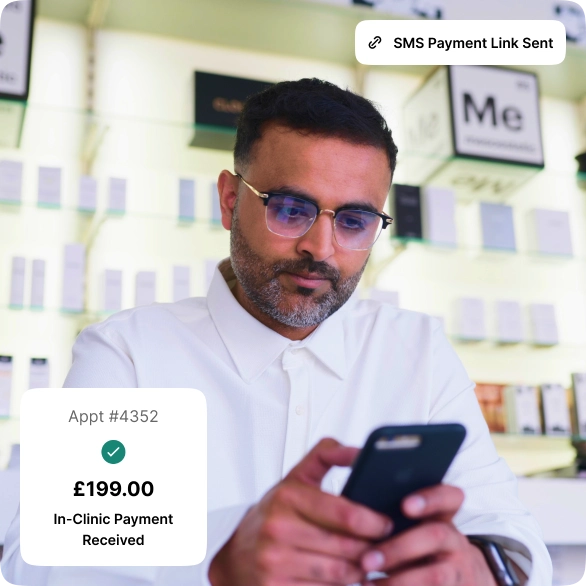

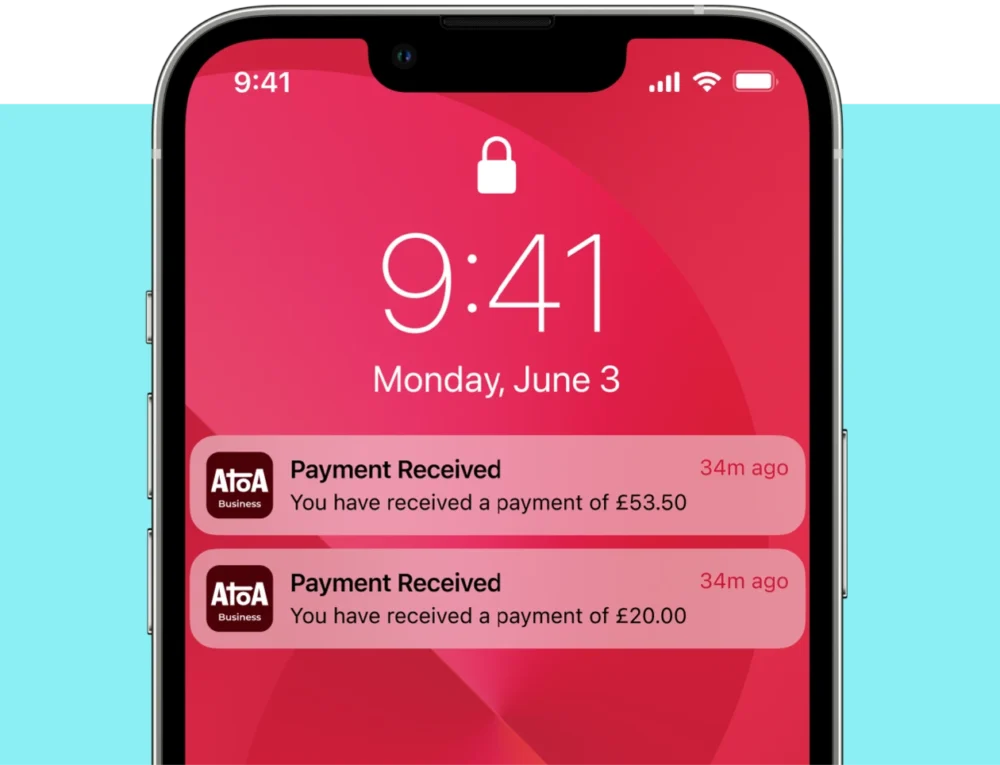

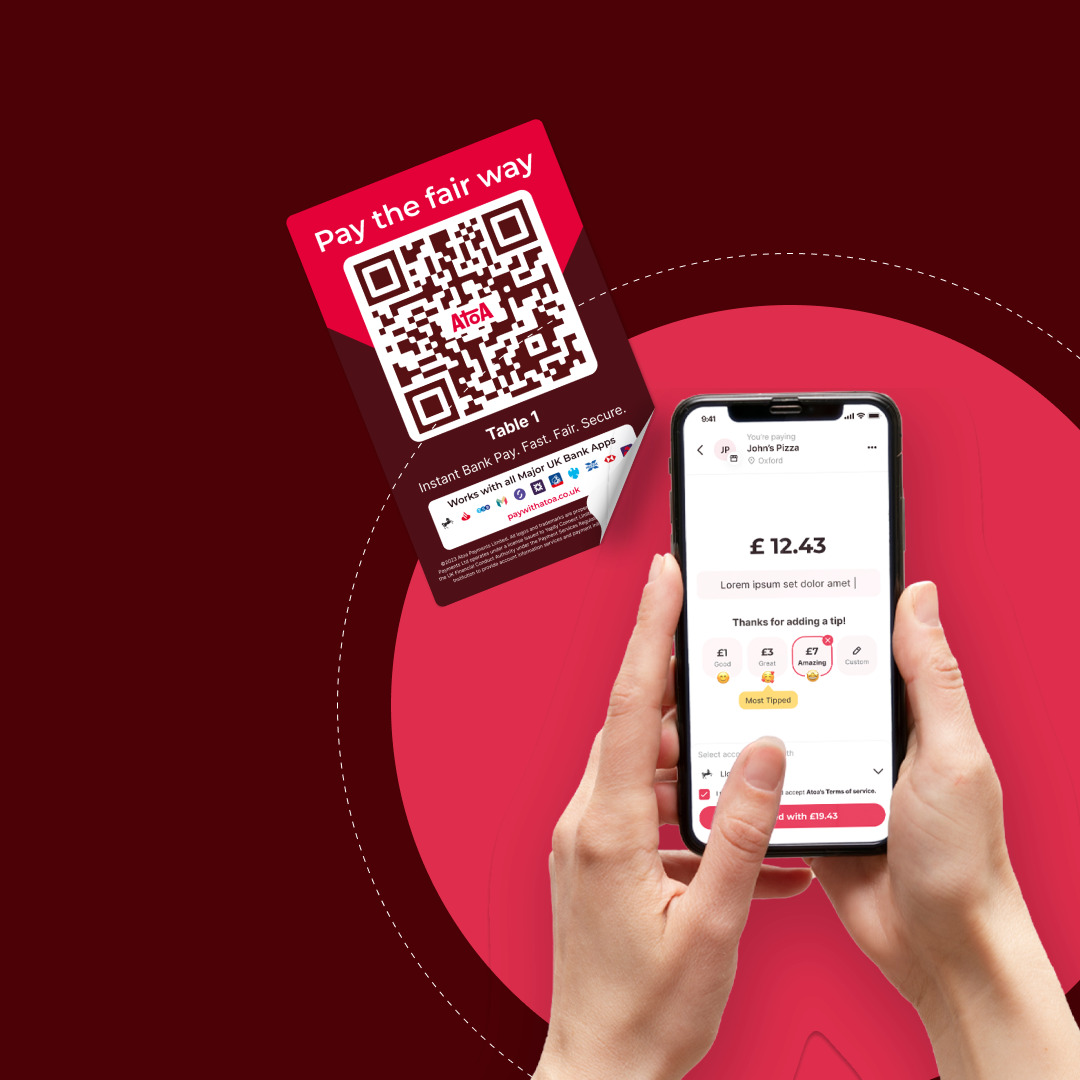

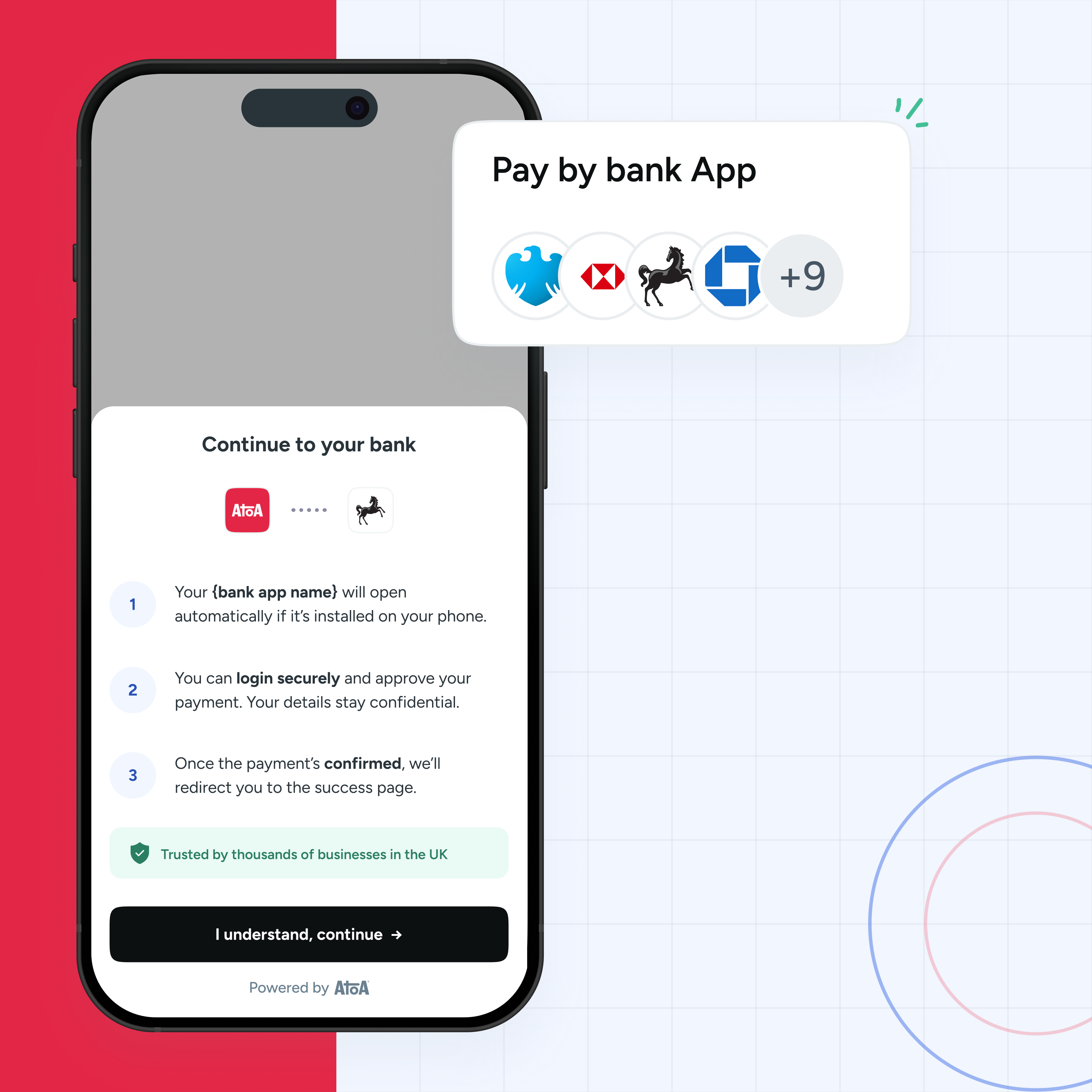

Has this article gone over your head? Or maybe you want the rewards with a little less legwork. In that case, try a free 7-day trial of Atoa.

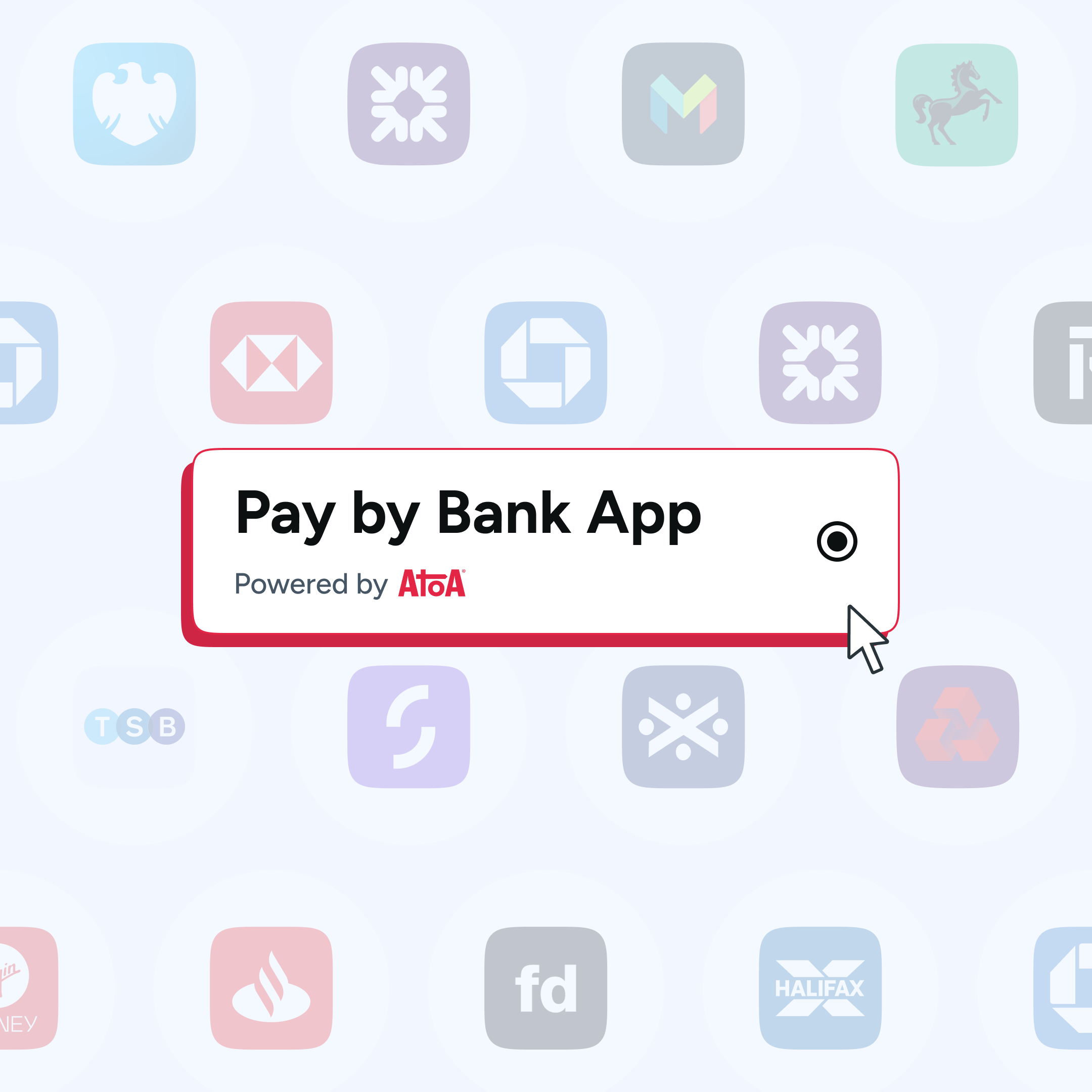

We offer pay-by-bank transactions made directly in your customer’s bank app with a quick scan or click. The result? You get funds instantly with way lower fees.

Not sure if we cut it? Check out our glowing reviews on Trustpilot.