Welcome to a new world of mobile payment technology! Staying ahead of this curve is crucial for small and medium-sized businesses. It’s a bit of a mountain, but this post aims to explore cutting-edge contactless payment solutions, placing NFC vs QR code payments for a real fintech showdown.

Gone are the days of cash and traditional card transactions running things. NFC (Near Field Communication) and QR (Quick Response) codes have taken centre stage in the future of payments, transforming how businesses and customers transact. It’s time to discover how these payment methods can boost your business operations and customer experiences.

Are you ready? Let’s dive in and explore the wonders of NFC vs QR payments…

Understanding NFC payments

NFC is like the creme-de-la-crème of contactless payments. The technology enables two devices, like a smartphone and a payment terminal, to communicate when they’re close to each other. For example, a customer strolls into your local coffee shop, orders an oat mocha, and pays for it by tapping their smartphone against your payment terminal. No fuss.

NFC in payments

Picture this: A customer in your bustling coffee shop waves their smartphone or contactless card near your payment terminal. It’s almost like a friendly high-five but in the world of technology. The payment is completed without needing physical contact or card swipes.

Think about the contactless debit card you use for your morning commute or how you access your office building with the tap of a key card. These everyday examples use NFC technology to offer both convenience and security in the palm of your hand.

Now, picture this convenience in your business. Customers complete checkout with a quick tap: they get served in seconds, and you enjoy faster, hassle-free transactions. So, as we dive deeper into NFC vs QR payments, keep this technology in mind; it might just be the game-changer your business needs!

NFC payment apps and platforms

Apple Pay and Google Pay are just some of the well-known NFC payment options that offer payments in the tap of a smartphone. Hotel key cards and public transport options such as New York City’s MTA and London’s Oyster card are other great examples of NFC usage.

Let’s dive into the fascinating world of QR code payments!

Understanding QR code payments

QR codes, short for Quick Response codes, are those clever square pixels you’ve probably seen on product labels and restaurants. These codes store information and can be scanned for quick access.

QR codes in payments

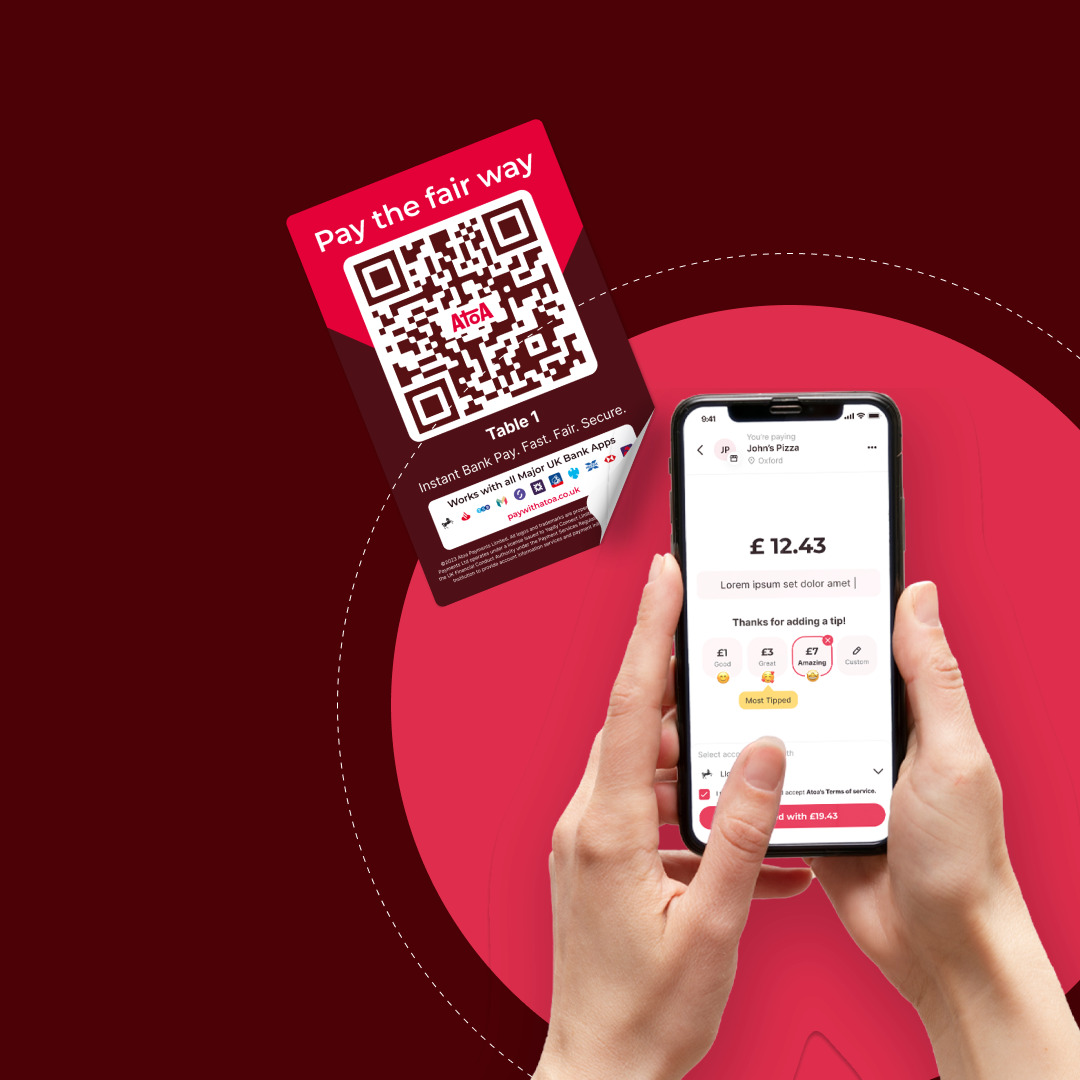

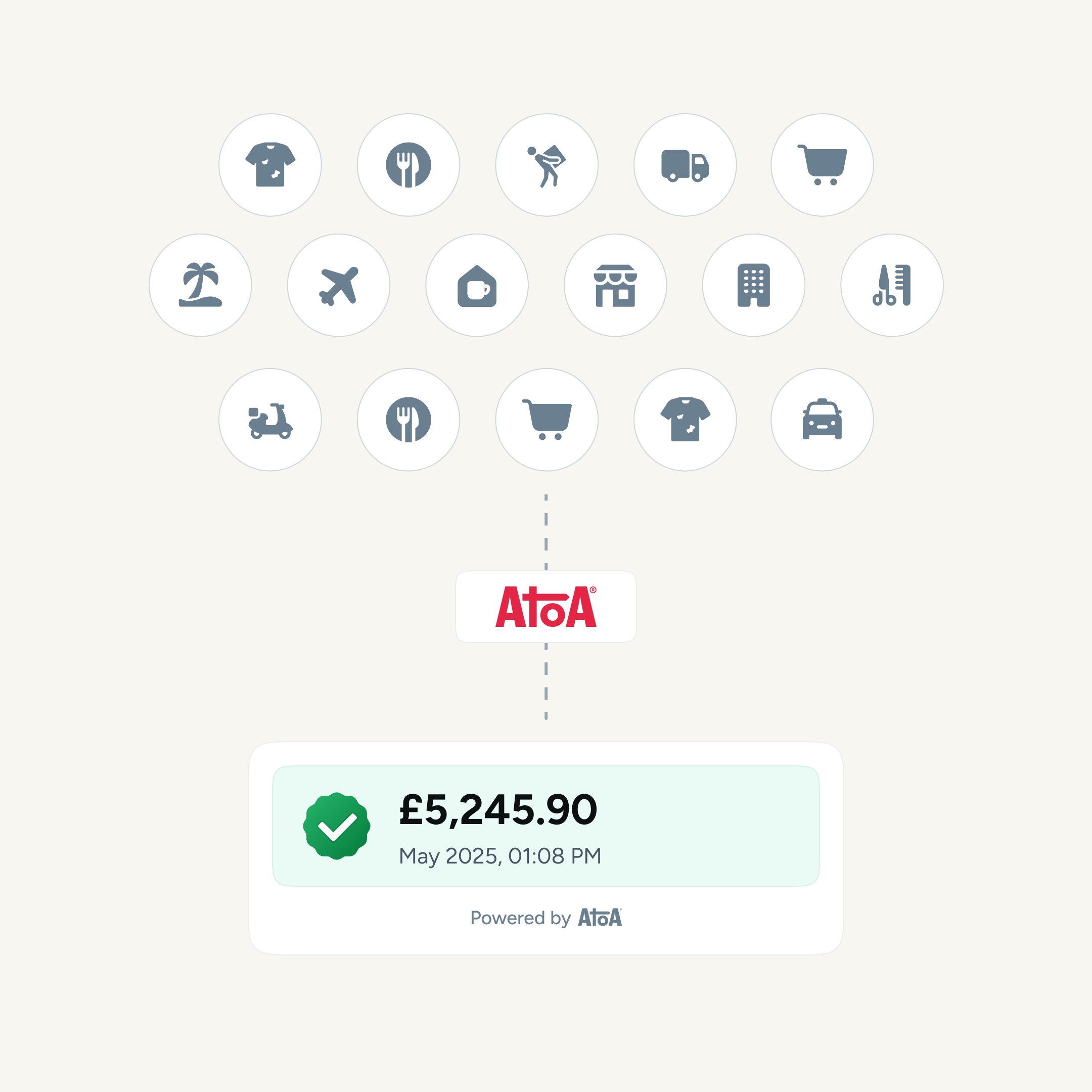

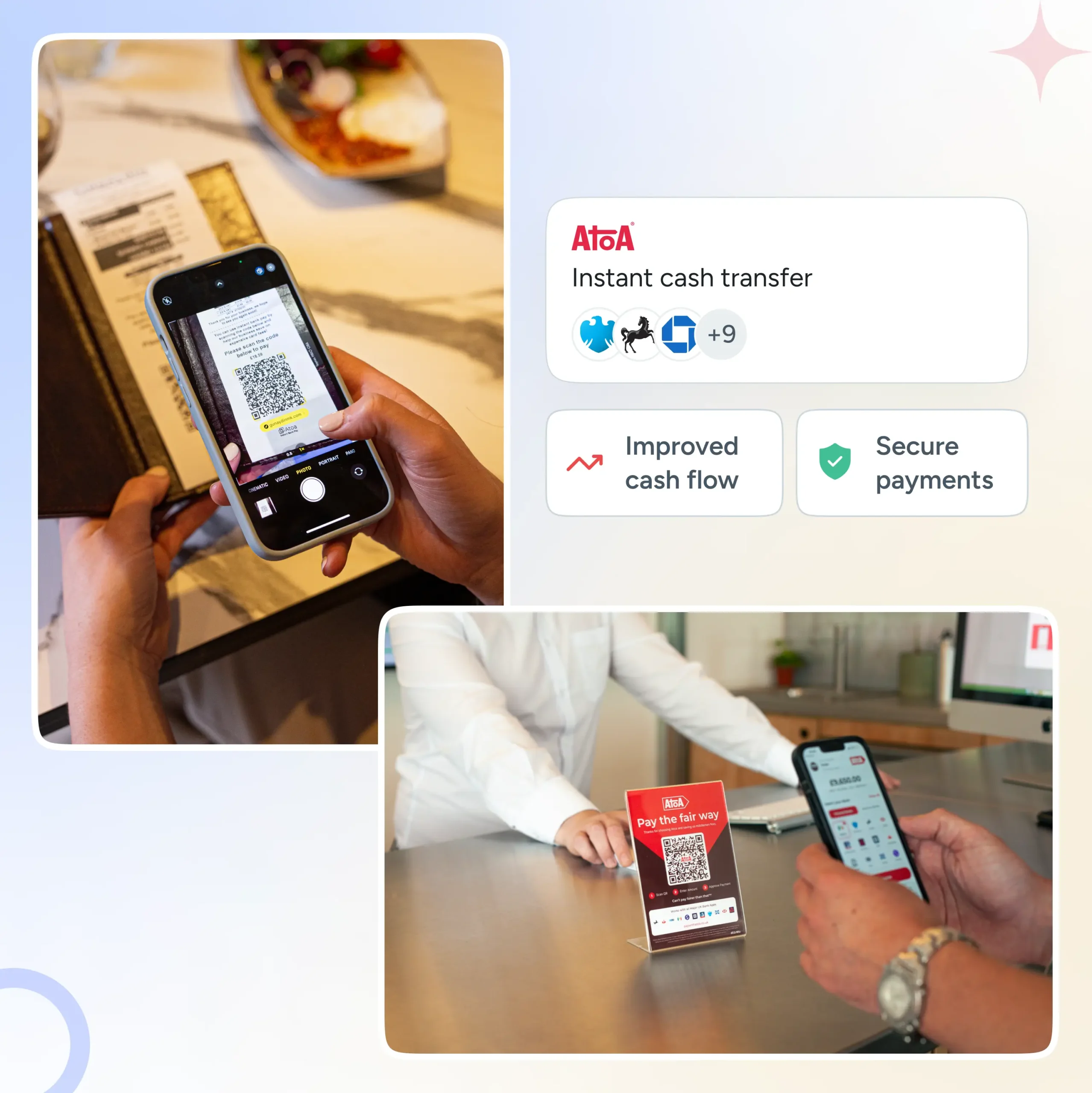

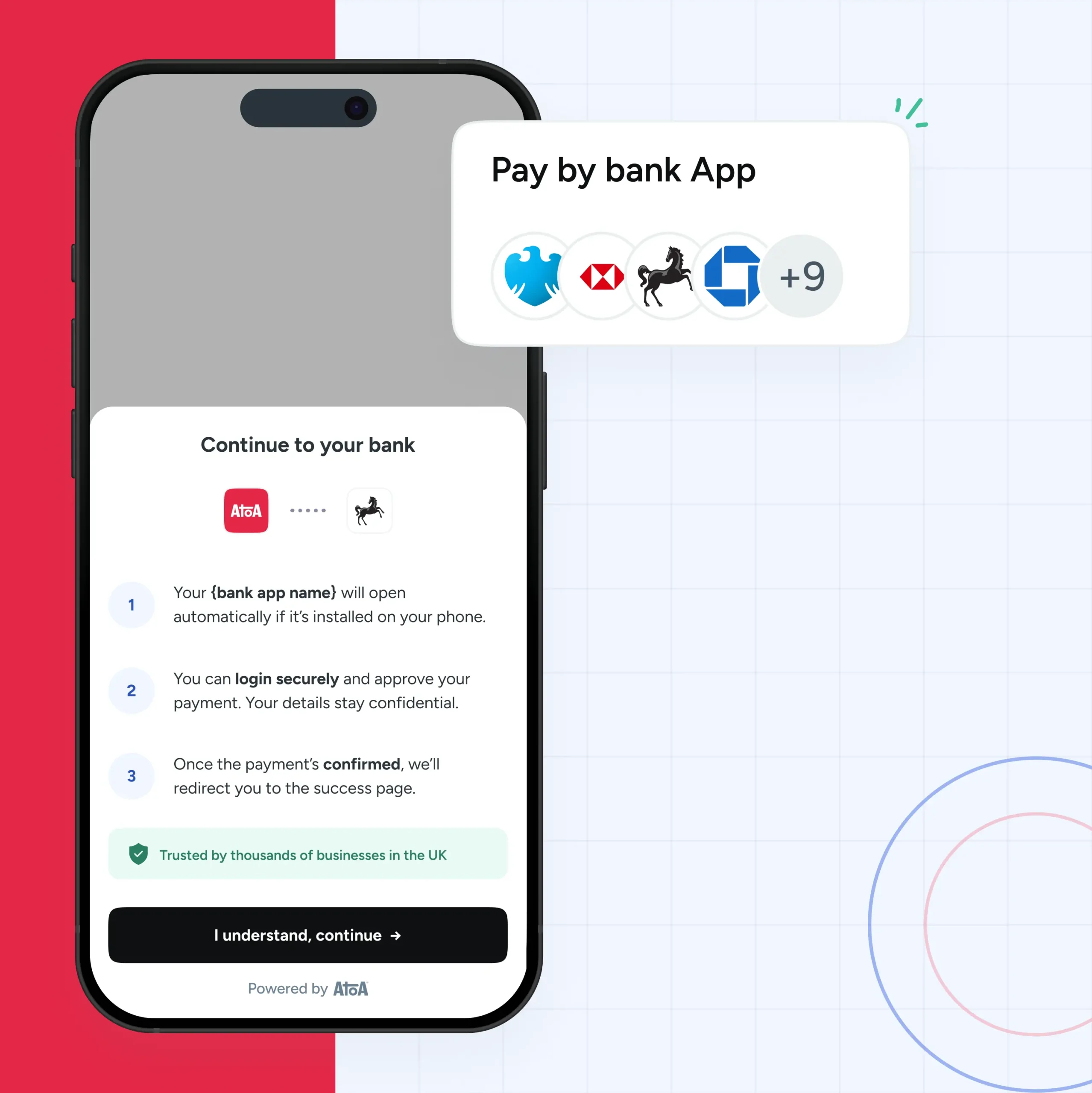

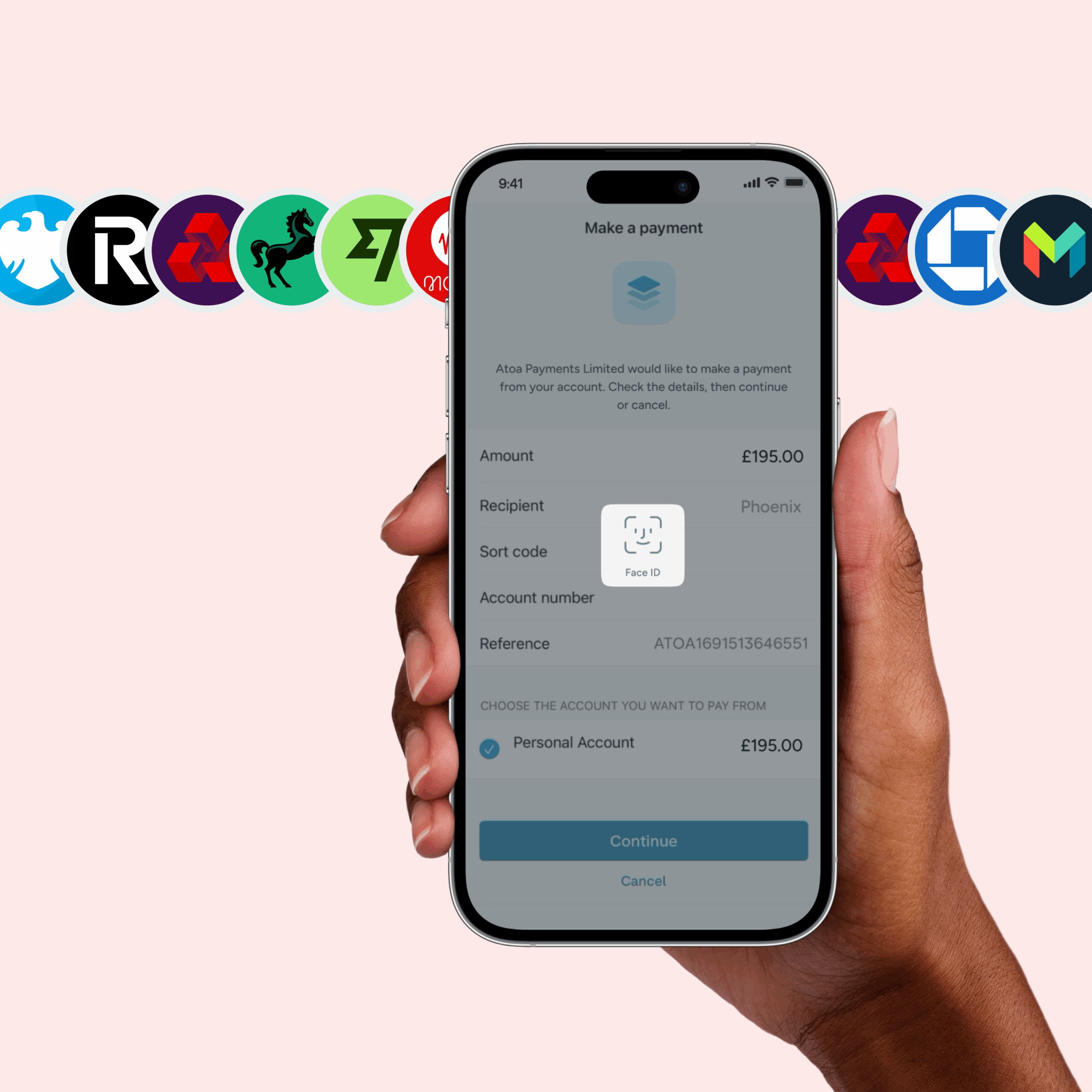

The beauty of QR codes lies in their versatility, whether it’s mobile wallets, bank apps, or payment aggregators. Plus, they’re accessible to almost anyone with a smartphone – no need for specific hardware or costly terminals. This accessibility allows even the smallest businesses to add digital payments to their day-to-day operations.

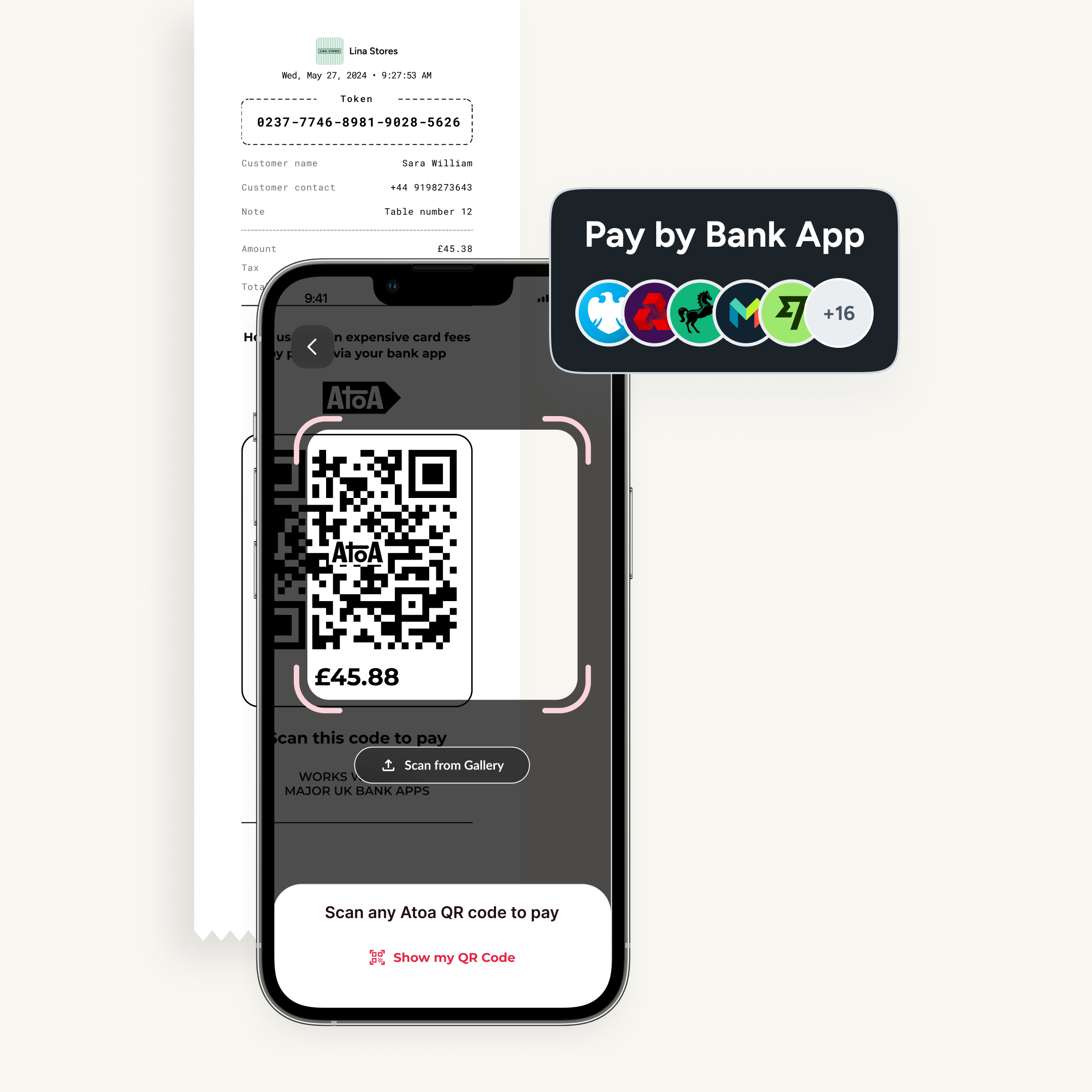

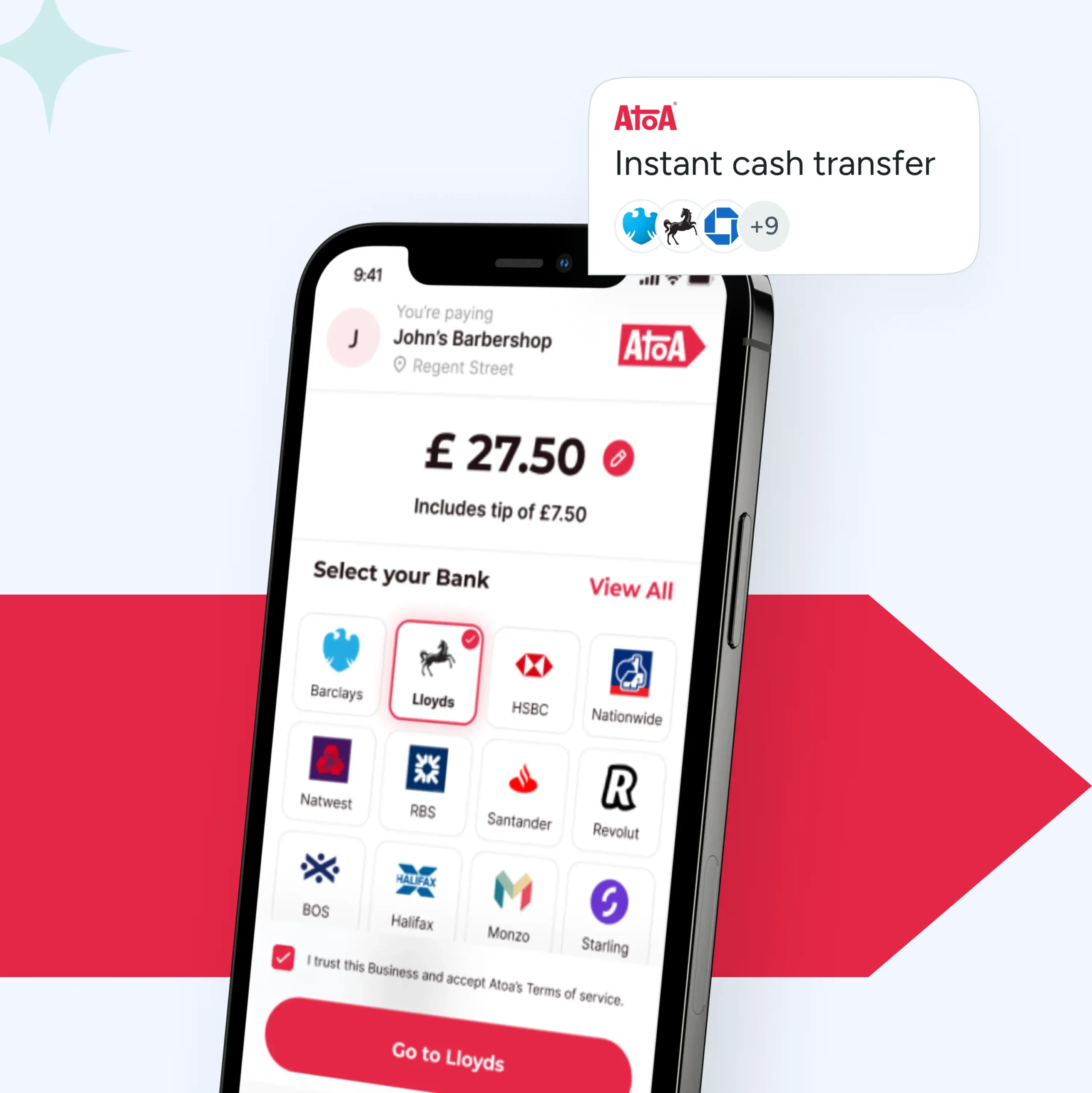

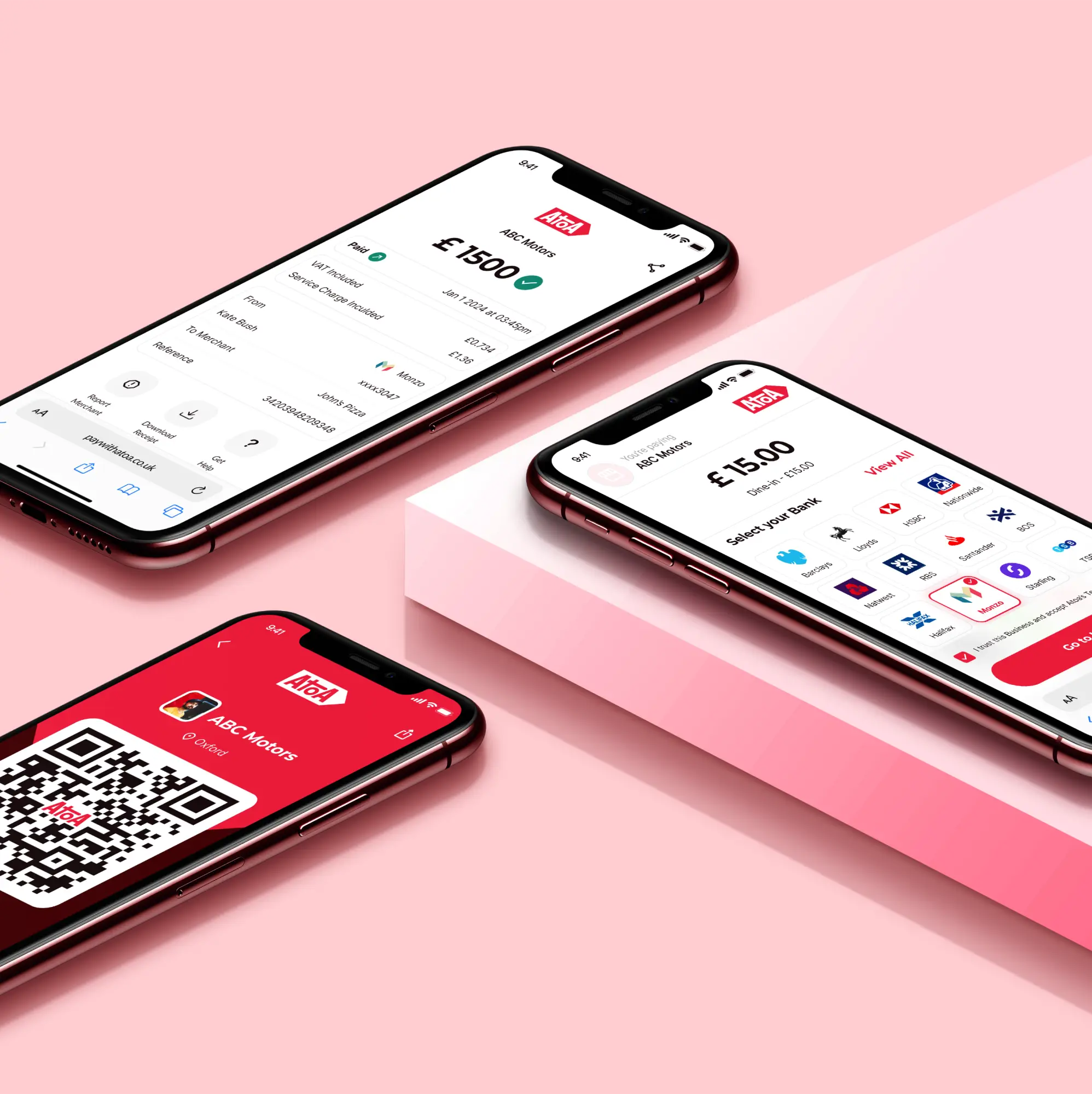

Imagine this scenario – a customer at your deli scans a QR code displayed at the counter using their smartphone. A quick scan securely transmits the payment details to the customer’s bank app to complete a transaction. QR codes simplify the payment process, making it fast and secure for customers and businesses.

QR code payment apps and platforms

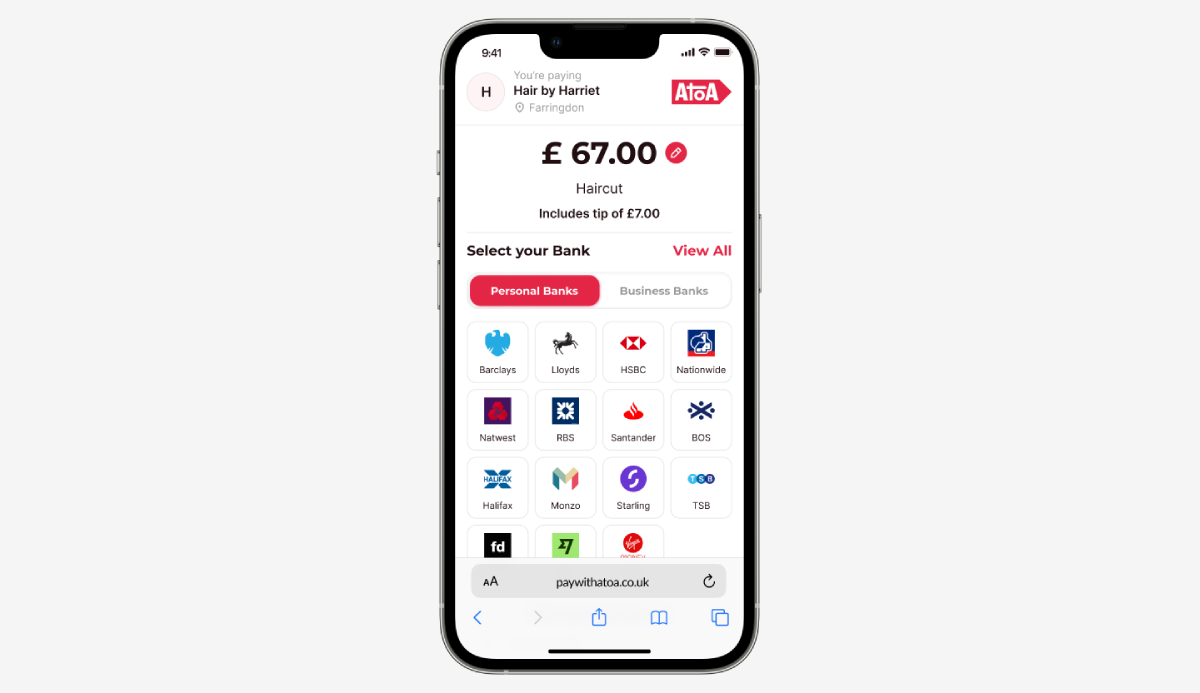

Several well-known apps and platforms have hopped on the QR code payment bandwagon. You’ve likely encountered apps like PayPal and Atoa, which allow instant payments in the UK using unique QR codes.

Head to head: QR code vs NFC payments

Round one – security 🥊

In one corner, we have NFC – the heavyweight champ regarding security. NFC payments use encryption and tokenisation, making them secure against data breaches.

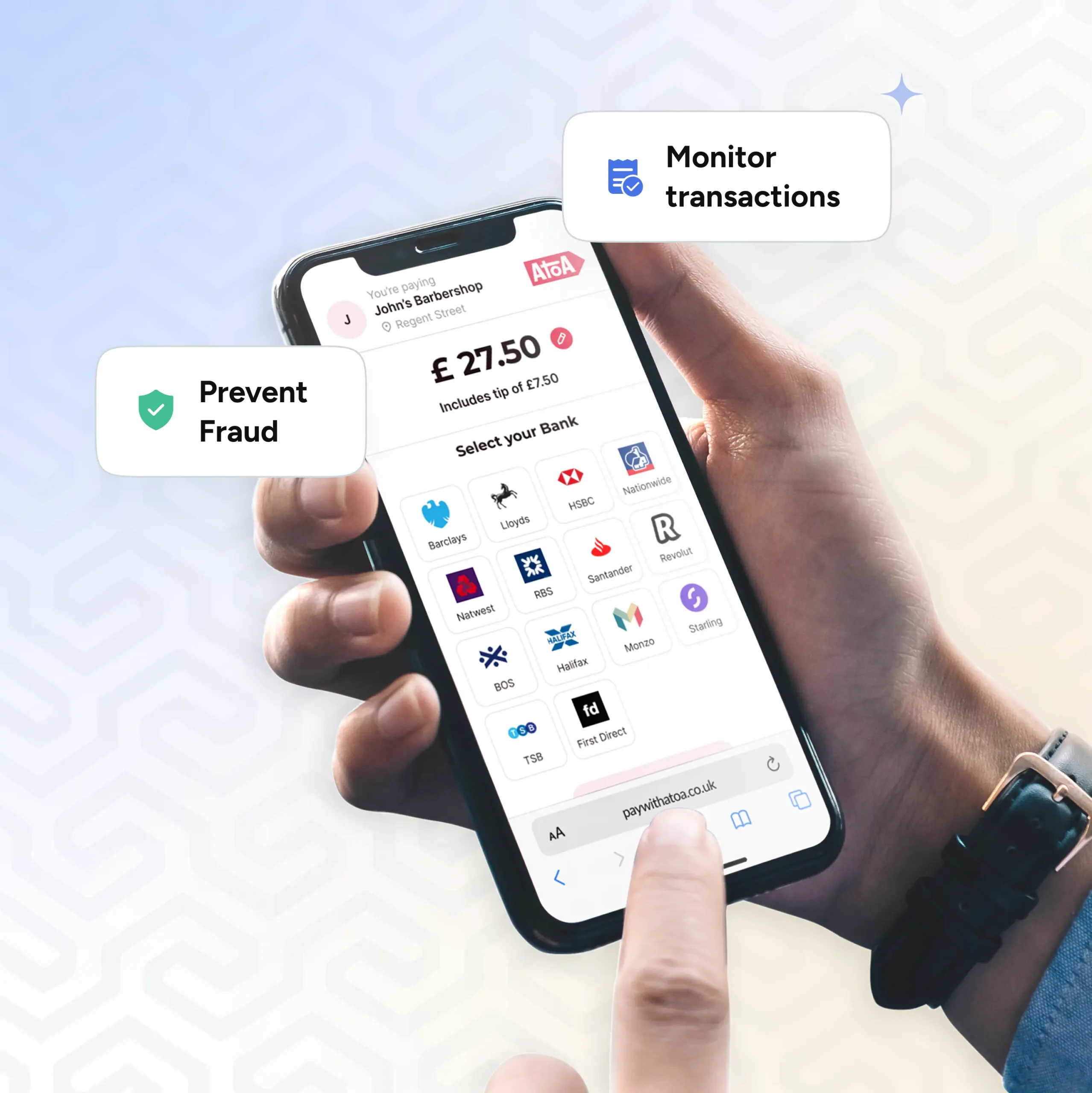

In the other corner, we have QR codes. QR code payments rely on a scan, so security measures depend on the app or platform.

Round two – speed 🥊

NFC requires a quick tap to complete payment — no waiting around.

QR codes are no snail, but they do require a scan. While it’s not slow, it may take a second or two longer.

Round three – user experience 🥊

NFC is all about that smooth, seamless experience. Customers tap to pay and then move on to what they’ve got planned next.

QR codes, on the other hand, involve a bit more effort. Scanning can sometimes be difficult but follow these easy scanning steps, and you’re on to a winner.

Remember, it’s not a real fight! It’s not necessarily about one method being better than the other; the winner is better suited to your business and customers.

The future of contactless payments

What does the future hold for contactless payments like NFC and QR codes? Flexible and secure, we personally predict QR codes to take some well-deserved time in the spotlight…

Payment technology trends to look out for

The future of payments is constantly being reshaped, with exciting trends on the horizon. We’re talking about…

Making payments with a fingerprint or a facial scan. It’s not science fiction. It’s biometric authentication…and Atoa QR codes already have this one in the bag.

Wearable tech. Smartwatches and other wearables are ideal companions for contactless payments, and we think NFC will continue to evolve with these devices.

Further innovations in NFC and QR code payments

While NFC has been the show’s star, QR codes are ready to take control. Atoa, for instance, offers instant QR code payments that businesses can adopt without hardware or extra expenses.

Atoa’s own QR code technology provides:

Enhanced security. Atoa’s QR codes have robust protection, ensuring your bank-level transactions are always secure.

Seamless integration. Atoa’s QR codes can seamlessly integrate into your existing systems, making the transition to cardless payments straightforward.

The takeaway

What’s best for your business in the long run? It depends on what you offer and your goals. If you’re looking for a flexible, cost-effective solution, QR codes could be your route to fast, fair, and secure payments, especially with Atoa’s low-fee offerings.

The key is staying adaptable, whether NFC, QR codes or something else entirely. Keeping up to speed with evolving payment technology trends will keep your business at the forefront of convenience and security.

FAQS

Which is faster, NFC or QR code payments?

NFC payments are typically faster because you only need to tap your phone. QR codes require you to open your camera, scan the code, and confirm the payment.

Are NFC payments more secure than QR code payments?

NFC and QR code payments are secure if used properly, and both methods use encryption to protect your payment data.

Do I need a phone for QR code payments?

QR code payments typically require a smartphone with a camera and an internet connection. NFC might be more suitable if you don’t have one.

What should I do if my payment doesn’t work?

Ensure your phone’s NFC feature is turned on. For QR code payments, check your camera functions properly and that you have a stable internet connection.

Are NFC or QR codes more widely accepted?

NFC payments are now widely accepted at most physical stores. However, QR code payments are gaining popularity, and you’ll find them accepted in many places.