Got yourself stuck in a queue at the bank for the fourth time this week to deposit your takings? Does deciphering your monthly statement feel like trying to solve a sudoku? You are not alone! Millions of UK customers are already tired of the dusty systems and hidden fees that traditional banking brings. But neobanks are here to shake things up. By using a mobile-first experience with cutting-edge technology such as APIs, neobanks can connect with other financial services to give you more control over your money.

With over 20% of UK adults now using neobanks, it’s time to explore how these fresh-faced players are switching up banking, one step at a time…

What are neobanks?

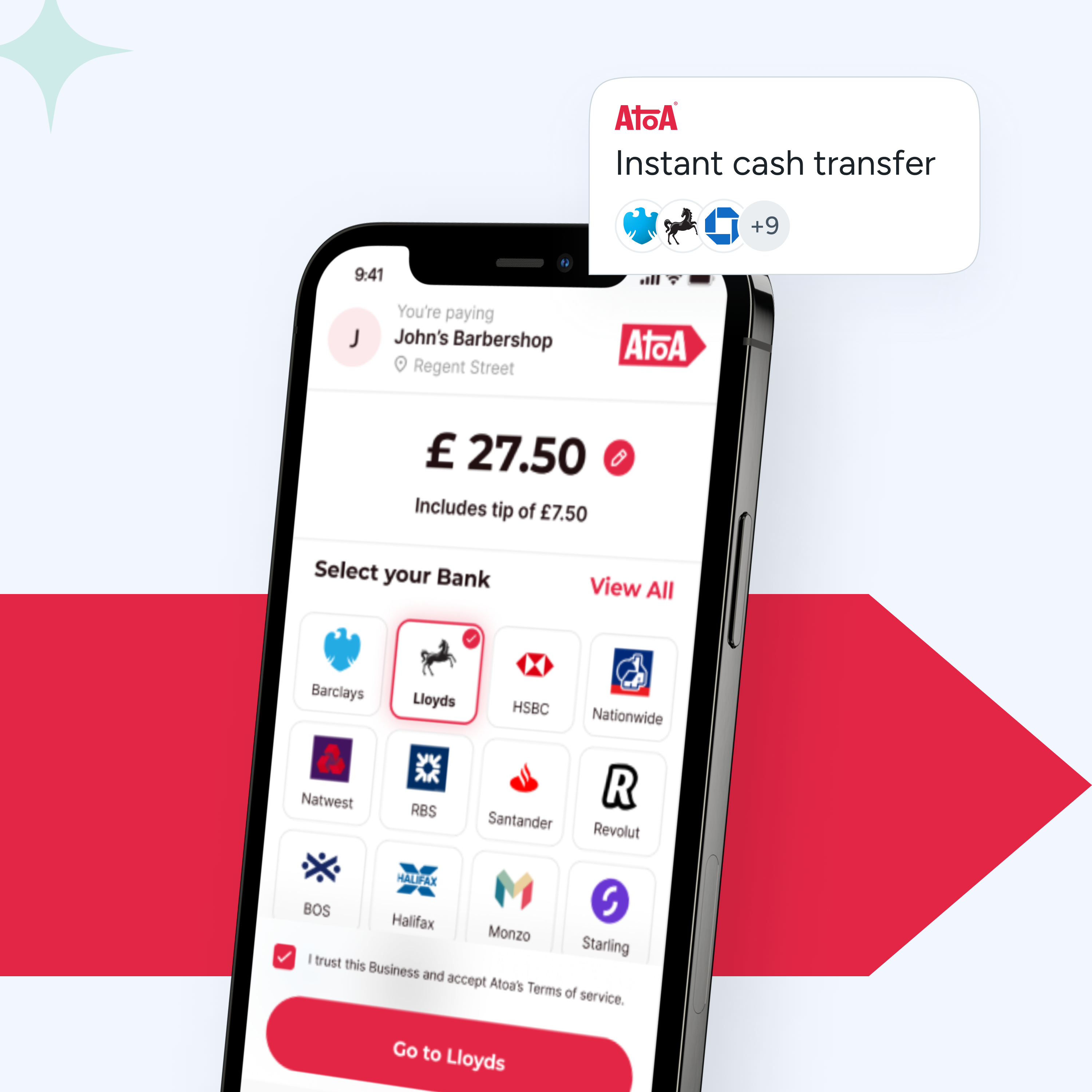

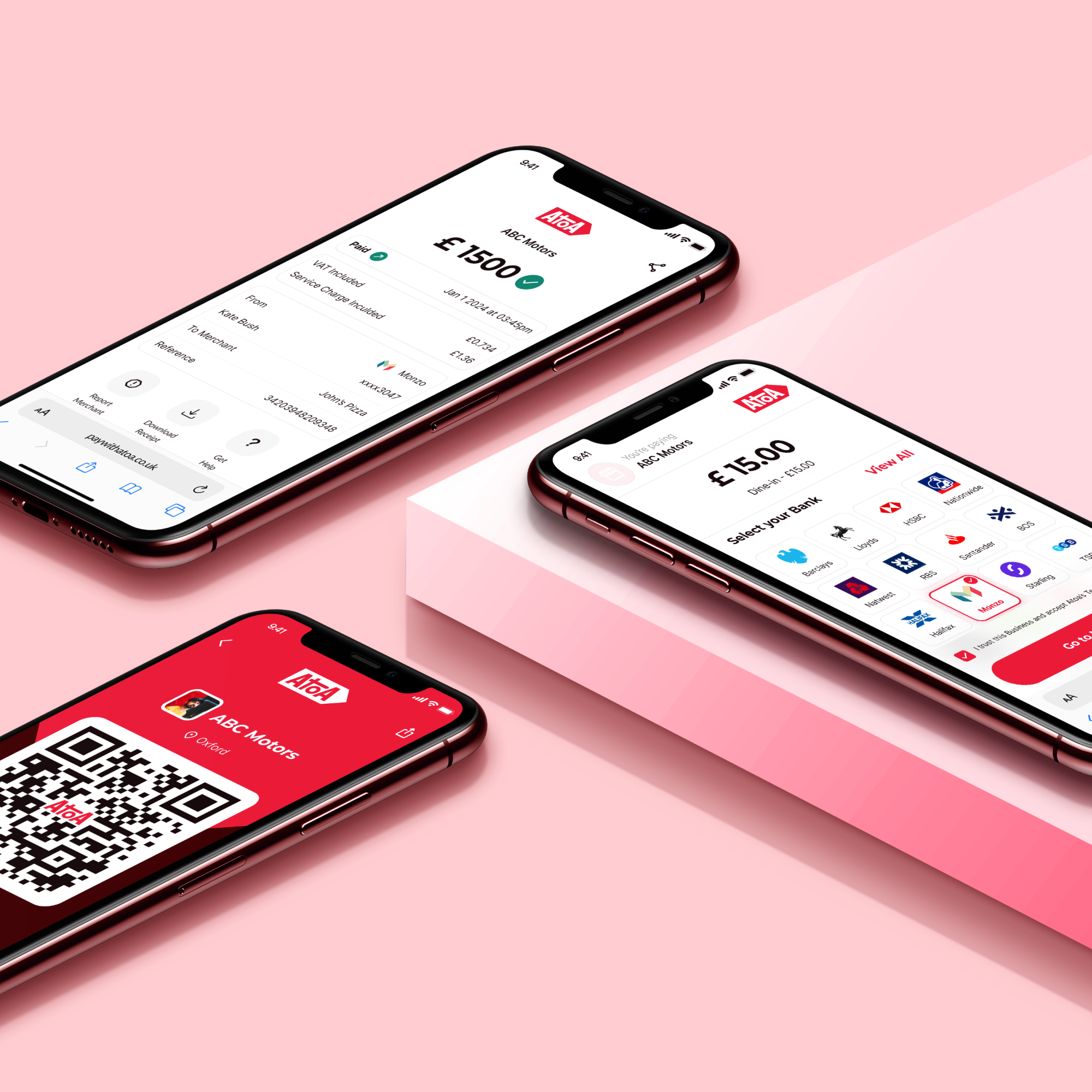

Imagine a bank that provides all its essential services within your bank app without any branches to visit or jarring websites. Well, that’s precisely what neobanks are. They suit modern lifestyles with everyday banking essentials such as current accounts, savings, and payments using bank apps.

The UK has already contributed to nurturing neobanks such as Monzo, many of which are fully licensed, just like high-street banks. This means your money is just as safe as it would be in a traditional bank.

Why neobanks are a fresh approach to traditional banking

Neobanks are digital-first, with services designed around smartphones and apps. This helps neobanks reduce the overhead costs of physical branches to pass savings on to customers. That’s why neobanks often offer accounts with minimal or no fees, such as monthly maintenance fees, overdraft fees, or cash machine withdrawal fees. Additionally, you may find savings accounts with higher interest rates than traditional banks offer.

User-centric design means opening an account can be done entirely through your smartphone in minutes. Intuitive apps and easy processes make everyday banking and money management far simpler.

Neobanks prioritise transparency with their fee structures with real-time data and spending tools that help you stay informed and make smarter financial decisions.

Understanding open banking APIs

In simple terms, APIs (Application Programming Interfaces) are a pathway between different financial apps and websites that lets them communicate with your permission. They’re a controlled, secure, and regulated way to share data.

How neobanks use APIs

Neobanks are clever when it comes to using open banking to help manage your finances more efficiently. APIs let your neobank pull transactions from all your accounts (yes, even the dusty ones at your old bank) and sort them into categories. The result? Instant clarity on exactly where your money goes.

APIs help neobanks find fintech tools that can help you, such as ways to save on bills or start investing. These are all triggered by APIs that analyse your spending data.

It’s ALL about choice. APIs put you in control by letting you decide which accounts or data your neobank sees. This means you can create a financial setup that suits your needs.

Neobanks vs digital banks: what’s the difference?

The terms “neobank” and “digital bank” are often used interchangeably, but they don’t mean the same thing. This easy-to-follow table breaks down everything you need to know about the differences between them.

| Neobanks | Digital banks | |

|---|---|---|

| What are they? | Independent financial institutions built from the ground up for digital banking | Online-only branches of established traditional banks |

| Licensing | Many have their banking licences, offering the same financial protections (FSCS) as traditional banks | Automatically have the same protections and licensing as their parent bank |

| Focus | Prioritise user experience and fresh features, often with lower fees than traditional banks | They offer online convenience but may still retain some legacy systems and fees from their traditional parent banks |

| Ideal for | Consumers who are confident using tech and looking for a fully digital banking experience with cutting-edge features | Consumers who want a mix of digital banking, the stability of an established bank, or a larger product range |

In a nutshell, neobanks disrupt the banking industry by providing consumers with a user-friendly and app-driven experience. In contrast, digital banks bridge the gap between old-school banking and the digital world.

Neobanks and fintech: how they compare

Neobanks and fintechs may sound like something from The Matrix, but they are a lot more straightforward than that. Fintech is like a huge department store that includes space for all sorts of companies using technology to make your money life easier, from paying for things to investing.

Neobanks are like a specific section within the store that deals with everyday banking. In this area, you’ll find daily essentials like current accounts, savings and even business accounts.

Fintech boasts a broader range of financial technology companies, such as payment processors and investment platforms that specialise in things like:

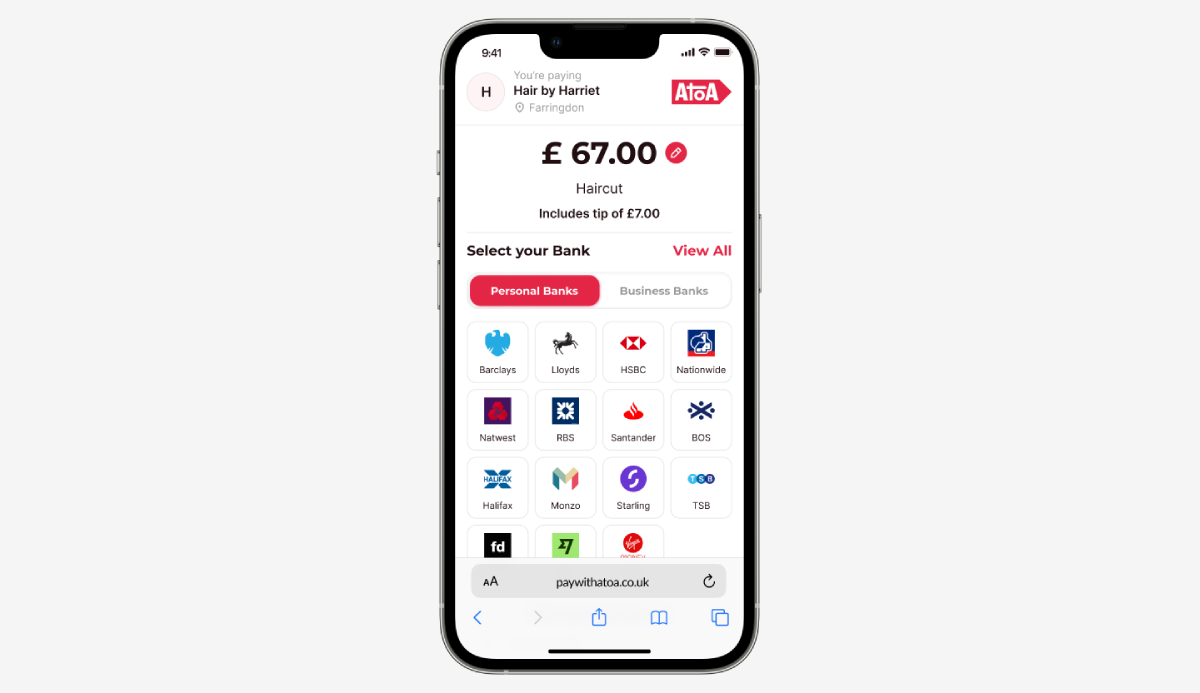

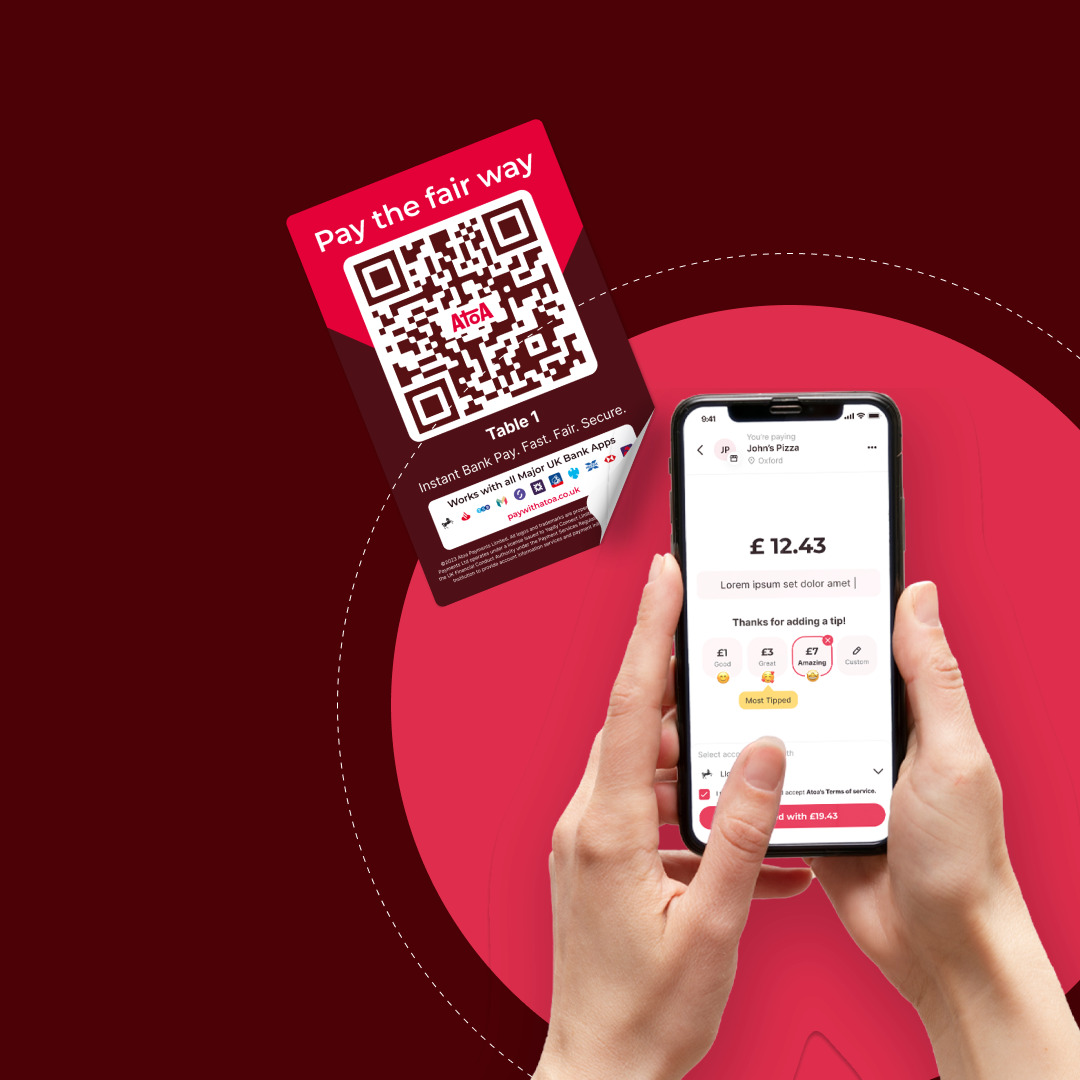

- Quick and easy payments (like us…)

- Accountancy apps that help you grow your money, such as Xero

- Budgeting software that tracks your spending to help you save

💡 All neobanks are fintech, but not all fintech solutions are neobanks.

Why does this matter?

Knowing the difference helps you choose the right tools for your needs. If you want a new way to handle your everyday banking, a neobank might be the answer. If you’re looking for specialised tools like small business payments or budgeting tools, you might find your answer in fintech products.

Should you consider switching to a neobank?

While neobanks might not yet have the same products as your high street bank, their offerings are quickly expanding.

Advantages of neobanks

- Lower or no fees, compared to traditional banking products

- User experience is much better with focused and well-designed apps

- Often offer higher interest rates for savings

- Handy budgeting and spending management tools, such as categories

- Many business accounts from neobanks sync up with accountancy apps

Drawbacks of neobanks

- They may not yet offer the full range of services as traditional banks

- You may not be able to get credit from them

- You ideally need to be confident using a smartphone to get the most from these services

- Don’t have physical branches for in-person support, but this is also becoming common with traditional banking

Top neobanks in the UK

- Monzo provides custom budgeting tools with a user-friendly interface to make banking more “fun”.

- Starling Bank offers benefits for overseas spending with minimal fees.

- Revolut introduces multicurrency accounts that are ideal for travellers or businesses.

- Atom Bank specialises in savings accounts and fixed-term bonds.

💡Check the bank has an FCA license and is part of the Financial Services Compensation Scheme (FSCS) to protect your deposits.

The future of neobanking: trends to watch

Neobanks are not simply aiming to replace traditional banks entirely. We see an evolution where traditional banks are becoming more digitally aligned, streamlining their offerings to compete better.

Some challenges that neobanks face

Traditional banks have long-established reputations, which can make it difficult for challenger banks to build trust with consumers.

Neobanks are still growing, so they sometimes have a more limited product range compared to high-street banks, with services such as mortgages still missing from their portfolio.

Regulatory hurdles: Neobanks still operate within the financial regulatory frameworks of their countries, which can sometimes present compliance challenges.

Neobanks are gaining scale and expanding their product ranges as their customer base grows.

Partnerships are forming between neobanks, fintechs, and traditional banks to combine each other’s strengths to create better products for consumers.

The takeaway

Neobanks are transforming the way UK consumers bank. With their digital focus, customer-centric approach, and lower costs, they offer a solid alternative. The UK’s regulations suggest that this sector is set for more growth with fresh new services in the years to come, so stay tuned!