Are you losing sales because you don’t offer the right online payment methods? As a UK business owner, having straightforward and secure checkout experiences should be a priority.

Recent research by Statista found that debit cards and online payment services like PayPal are the most popular ways UK shoppers pay online. However, finding the best online payment solution for your business can get confusing.

Don’t worry, we have the answers for you! Let’s break down your e-commerce payment choices for 2024 in this simple guide…

Trends shaping online payments in the UK

First up, how exactly are businesses accepting online payments? We’re lucky to have many ways to make and take payments here in the UK. But like most things, they vary in speed, security, cost and capabilities. However, what works like a dream for one business type might be a nightmare for another, so do your research!

Contactless card payments: Taping your card to pay has become the new normal, with increases in the payment limit to £100 helping to boost adoption further.

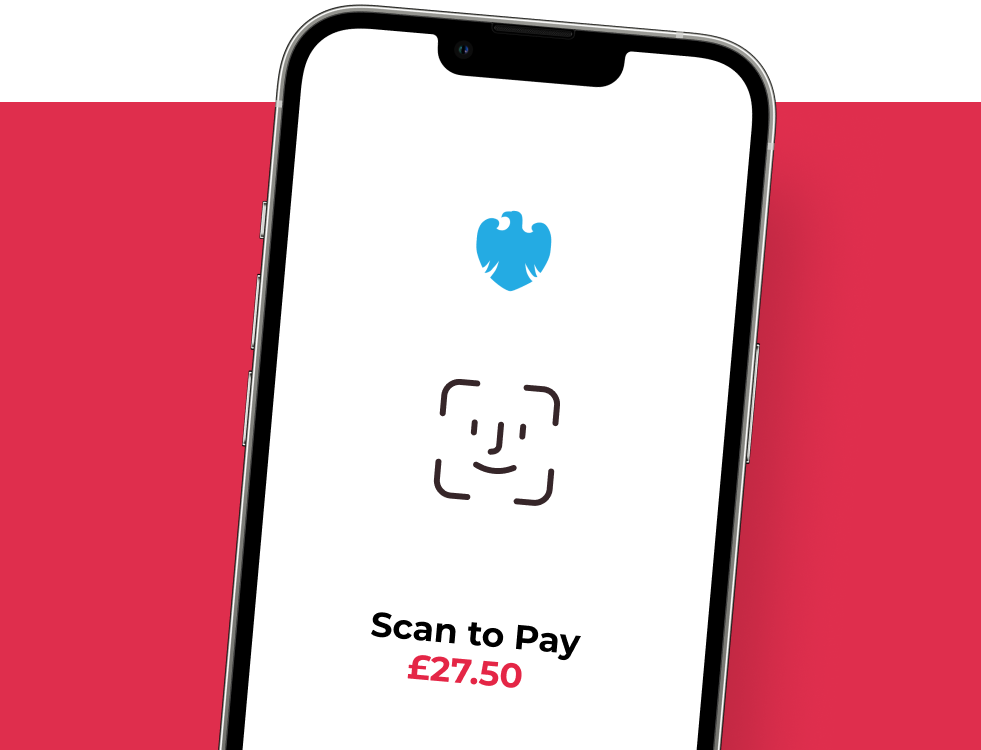

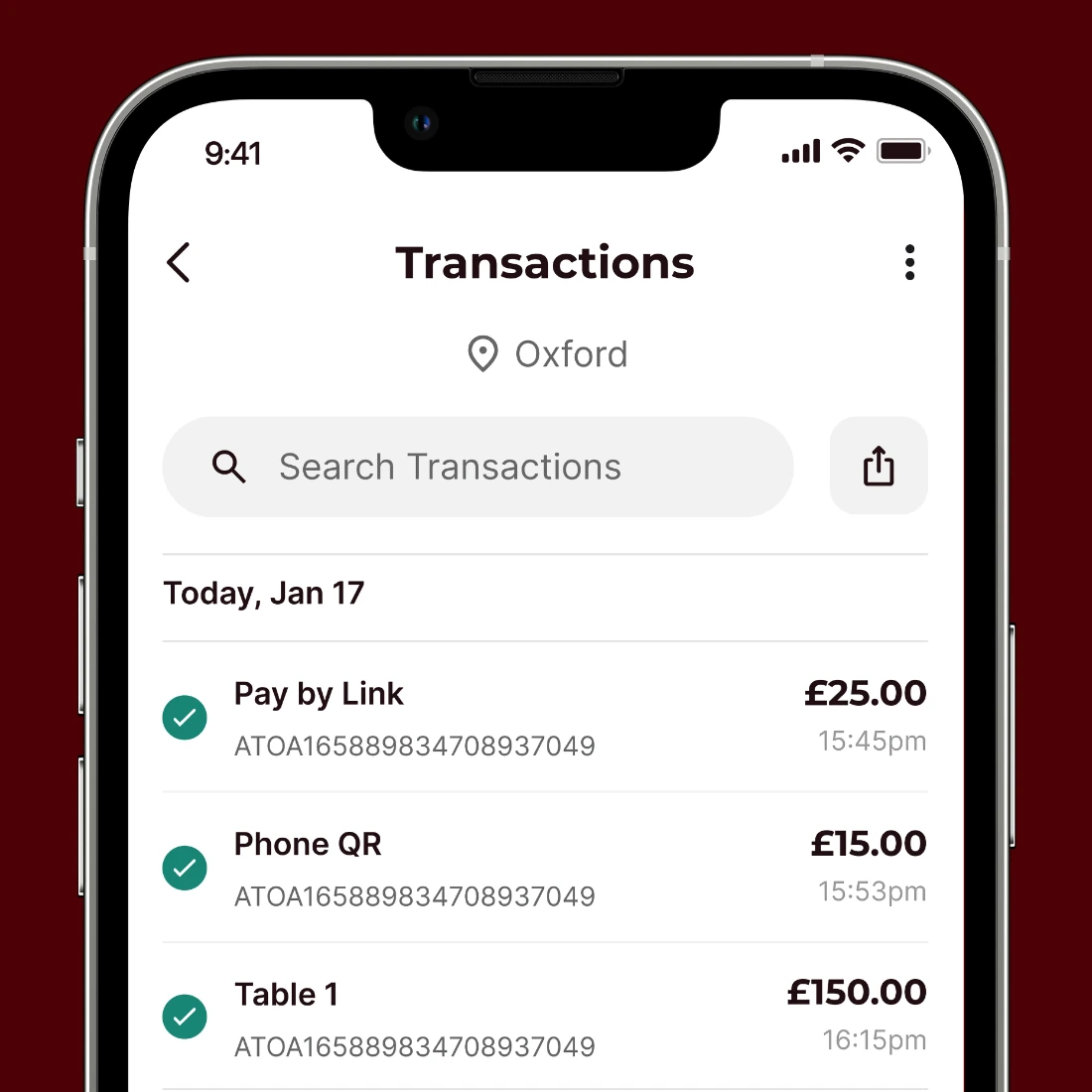

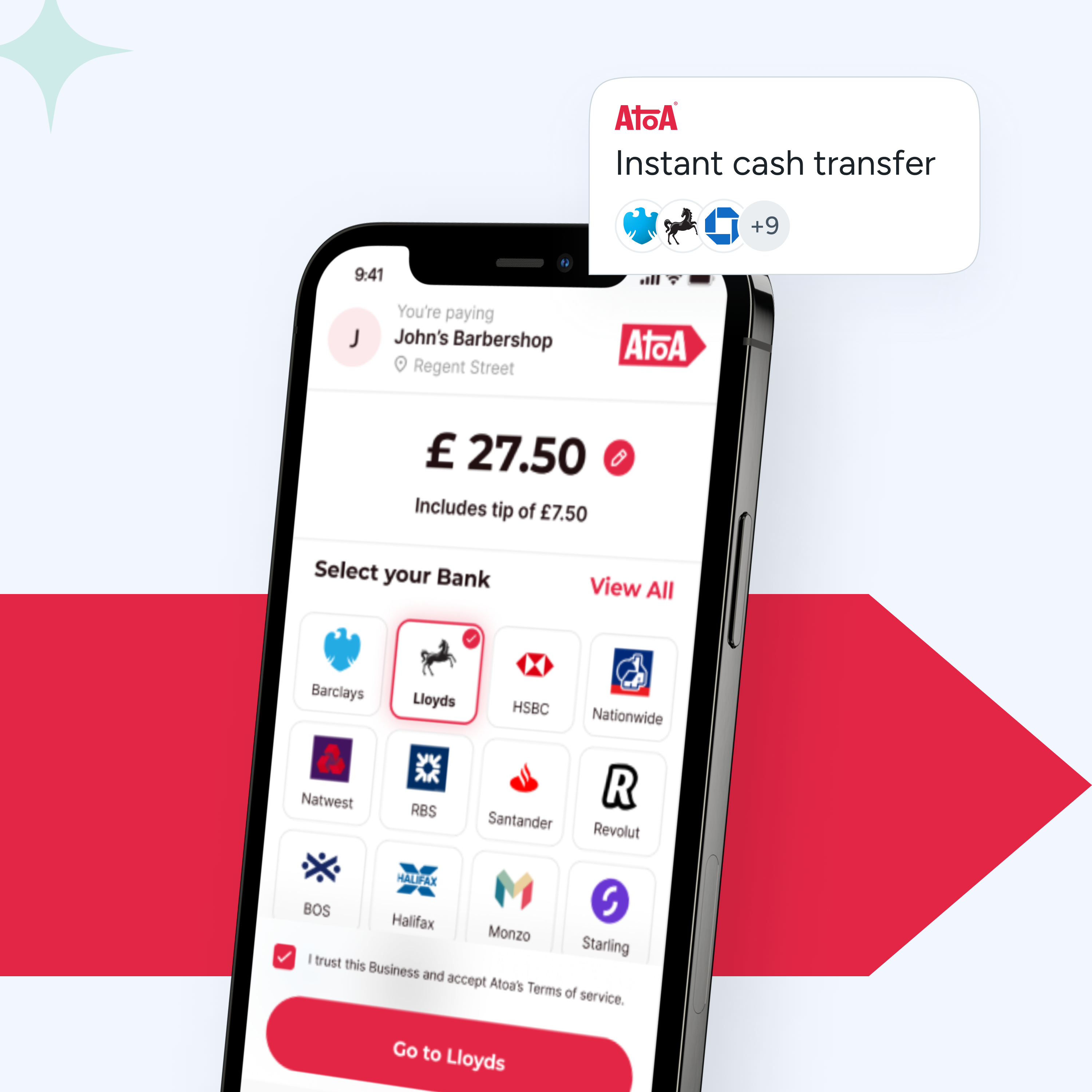

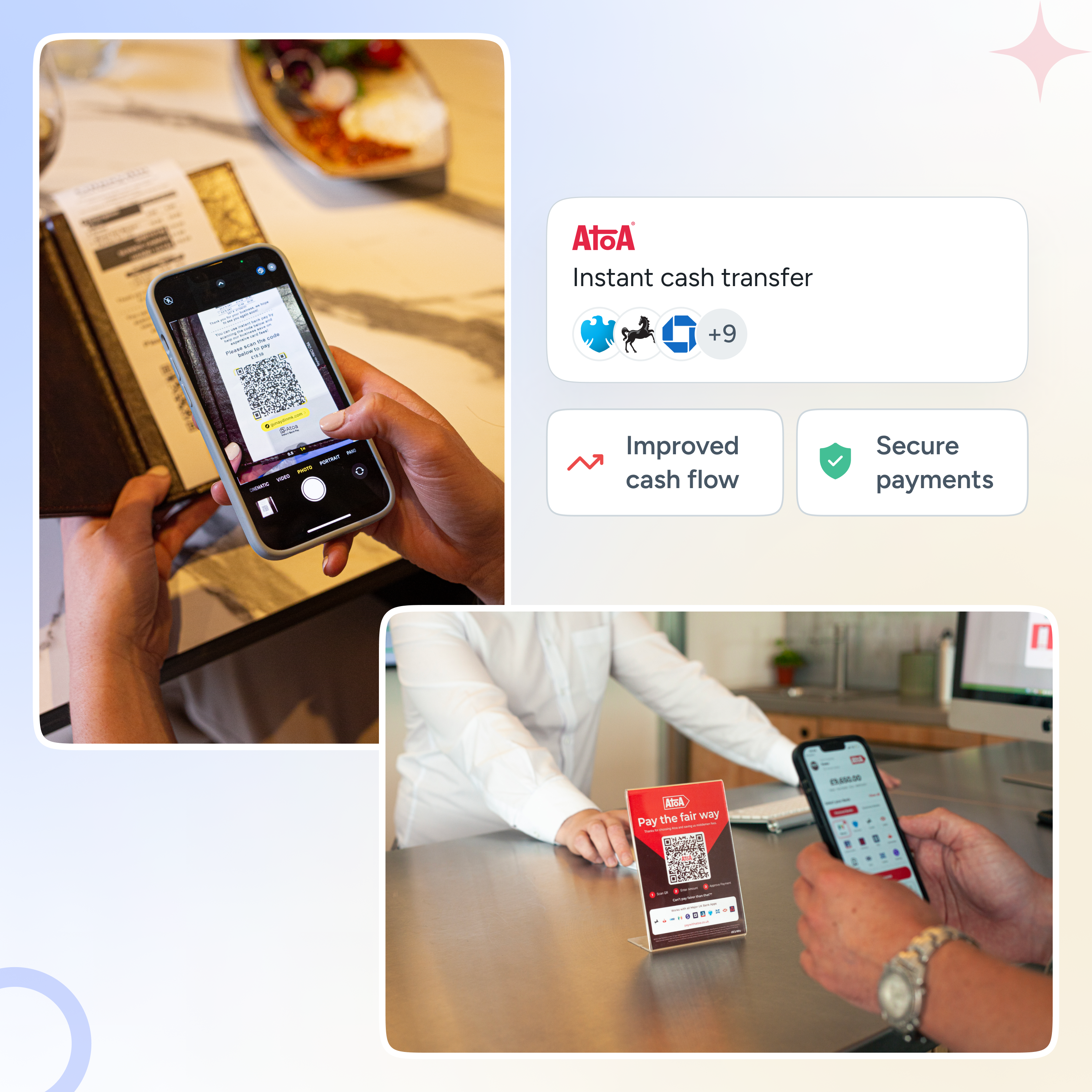

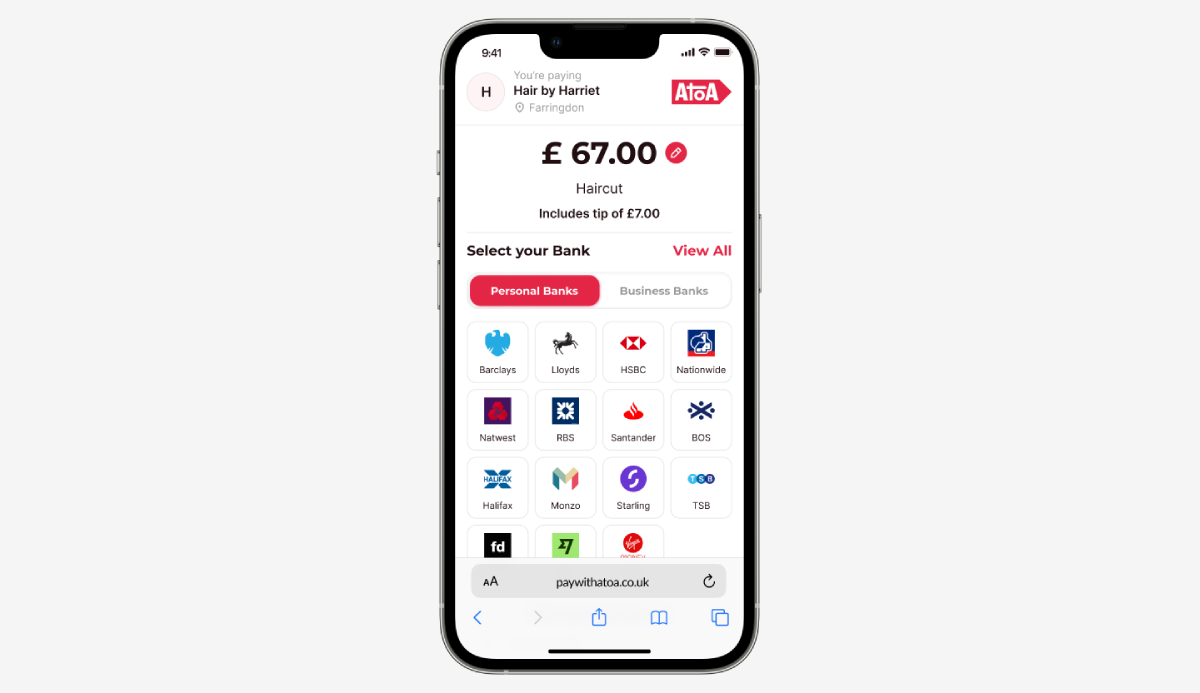

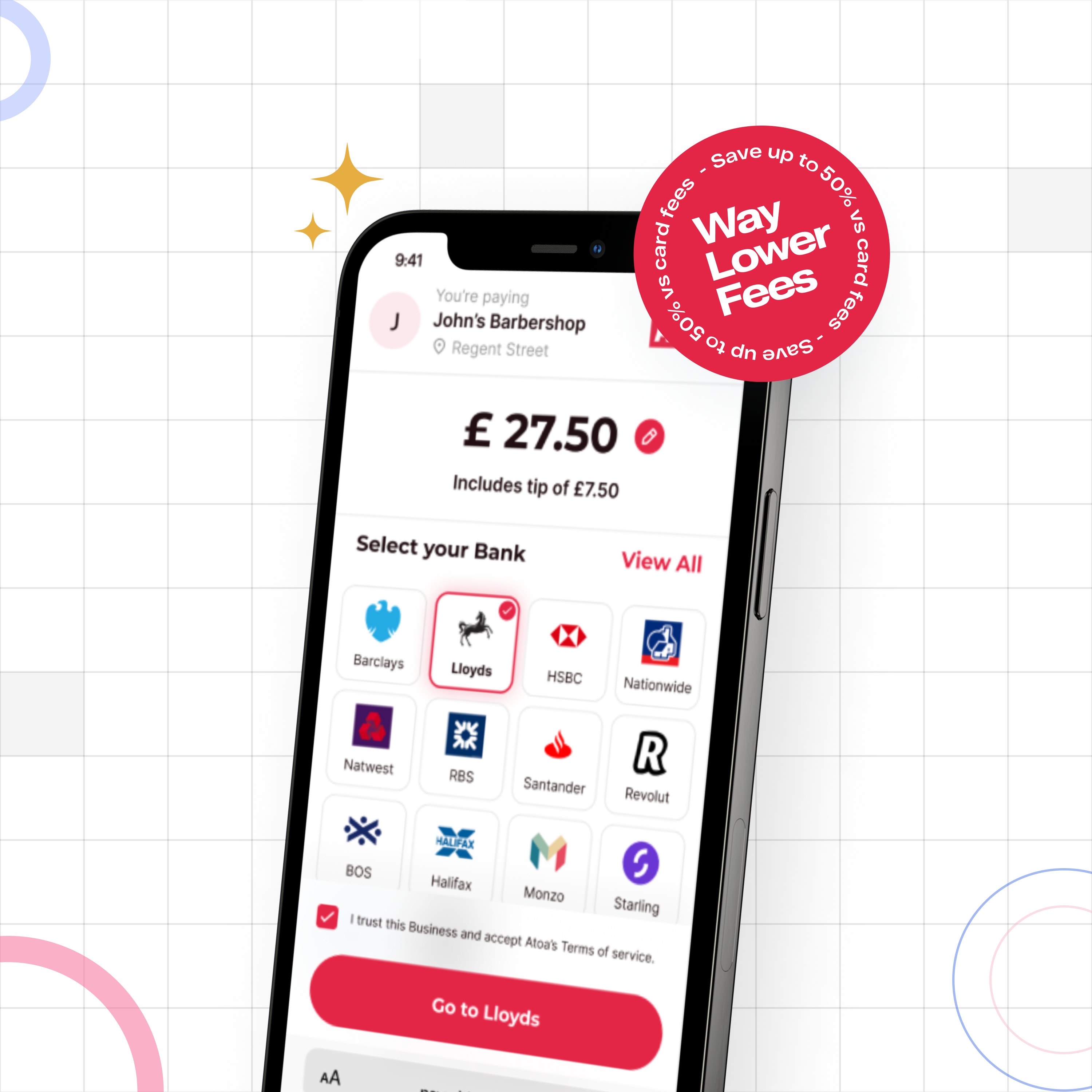

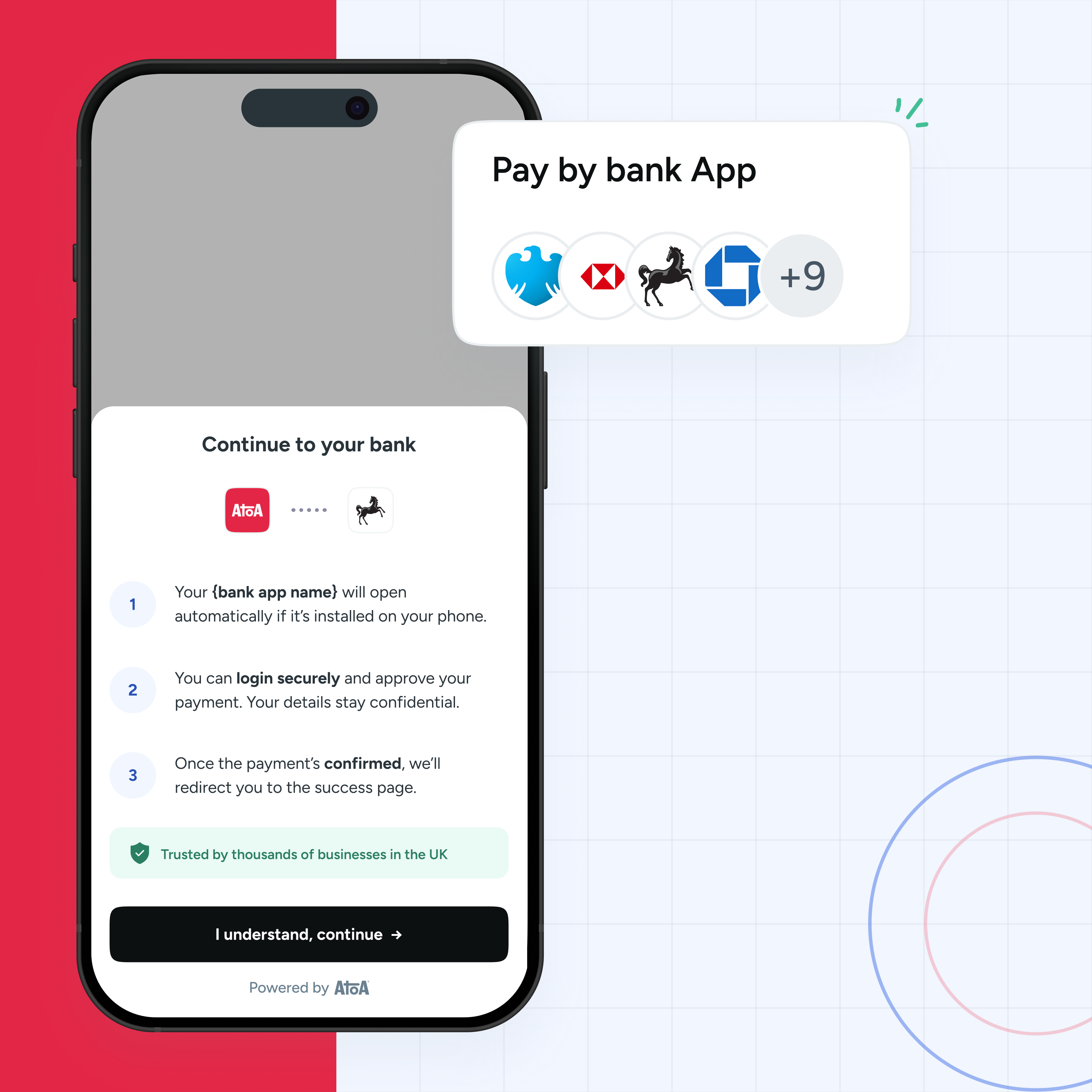

Pay by bank (or instant bank pay): Uses the Faster Payments Service to offer instant transfers between UK bank accounts. Atoa is your number one choice here!

Digital or mobile wallets: Services like Apple Pay store a user’s payment details, which makes online checkout quick and convenient. Increasingly popular in the UK!

Open banking payments: By securely sharing financial data between banks and authorised third-party providers, open banking is helping to develop new payment solutions.

Buy now, pay later (BNPL): Services like Klarna allow shoppers to split payments into installments, often interest-free. In April 2024, a survey by TransUnion reported that almost a quarter of adults (23%) said they used BNPL in the past year.

Biometric authentication: Confirming payments with fingerprint scans and facial recognition offers a higher level of security than traditional passwords, adding an extra layer of protection against fraud. Biometric payments are expected to reach $5.8 trillion with three billion users globally by 2026, according to Goode Intelligence.

Comparing online payment solutions

| Payment method | Features | Fees | Payout | Pros | Cons |

|---|---|---|---|---|---|

| Debit or credit cards | Widely accepted | 1.5% – 3% per transaction | Up to 3 business days | Familiar to a majority of customers | Fees and waiting times are higher than other methods |

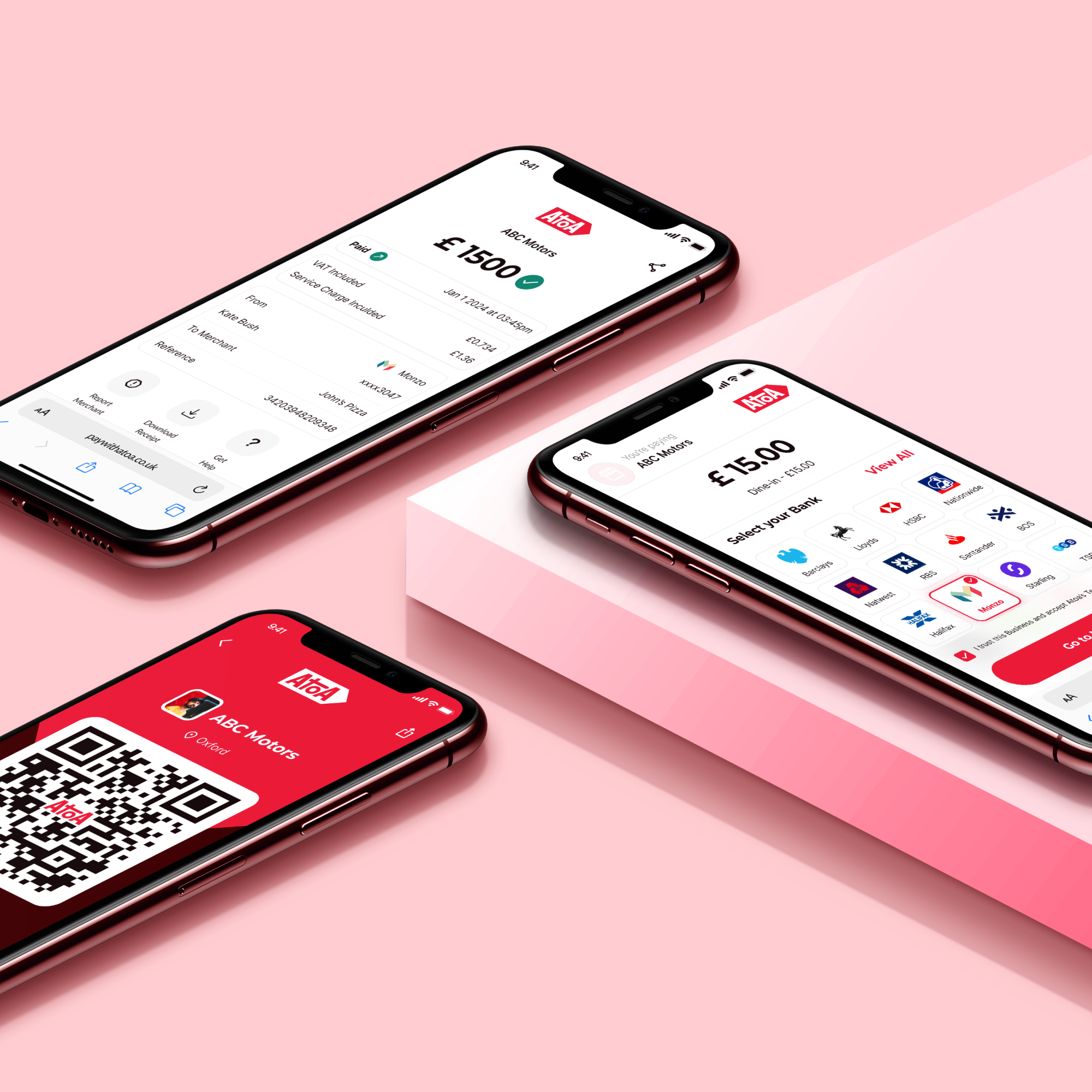

| Pay by banking using Atoa | Near instant funds using the Faster Payments Service | 0.7% per transaction | Instant | Secure payments made in the customer’s bank app | Requires a smartphone with a UK bank app so not every customer can use it |

| Digital or mobile wallets | Fast and convenient checkout | Processing fees similar to card payments | Instant | Secure, simplifies the checkout process | Still growing in adoption |

| PayPal | Buyer/seller protection, easy for customers, international recognition | 2.9% + £0.30 | Instant | Widely trusted, no card details needed for purchases | Fees can add up, occasional customer disputes |

| Payment gateways | Flexible and customisable payment options with lots of features | Varies by provider, often % based + per transaction | Up to 3 business days | Scalable with support for multiple payment methods | Complex to set up without tech experience |

Finding the best online payment method for your business

Choosing the ideal online payment method for your business means understanding your needs. It may be tempting to see the word “free” and think you’re getting a good deal. However, most “free” payment methods come with hidden costs in the form of processing fees charged on each transaction, which can quickly eat into your profits.

- PayPal: PayPal often touts fee-free transactions, but they charge high processing fees. However, they may waive initial setup costs, particularly for simpler payment solutions. This can be a game-changer if you need to get something up and running quickly.

- Freemium payment gateways: Some payment providers offer basic plans with no upfront charges. The catch is that these plans typically have limited features. As your business expands and your needs evolve, their fees often increase substantially.

Always look beyond setup when choosing an online payment solution. I’ve listed some of the numbers that are worth crunching below.

- Transaction volume: How many transactions do you expect to process?

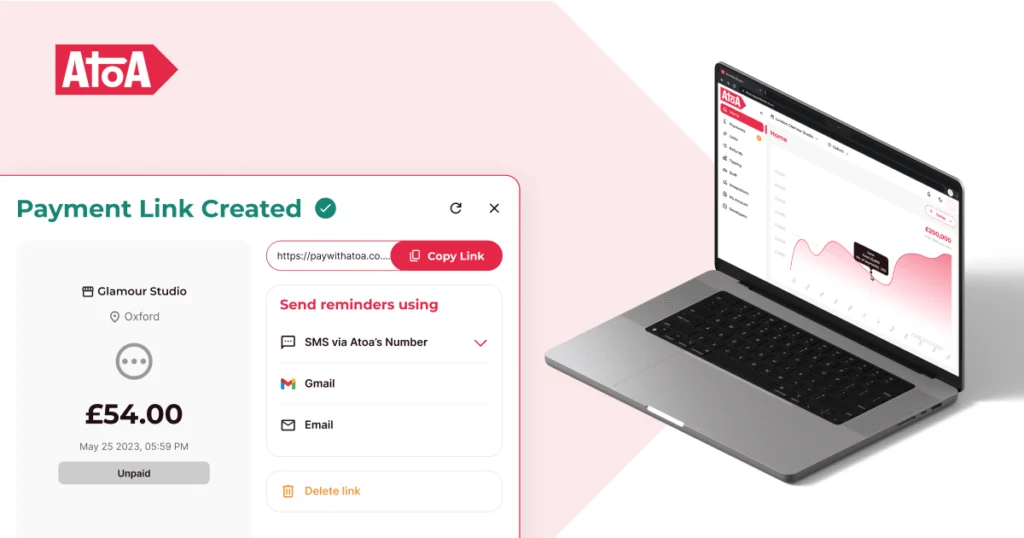

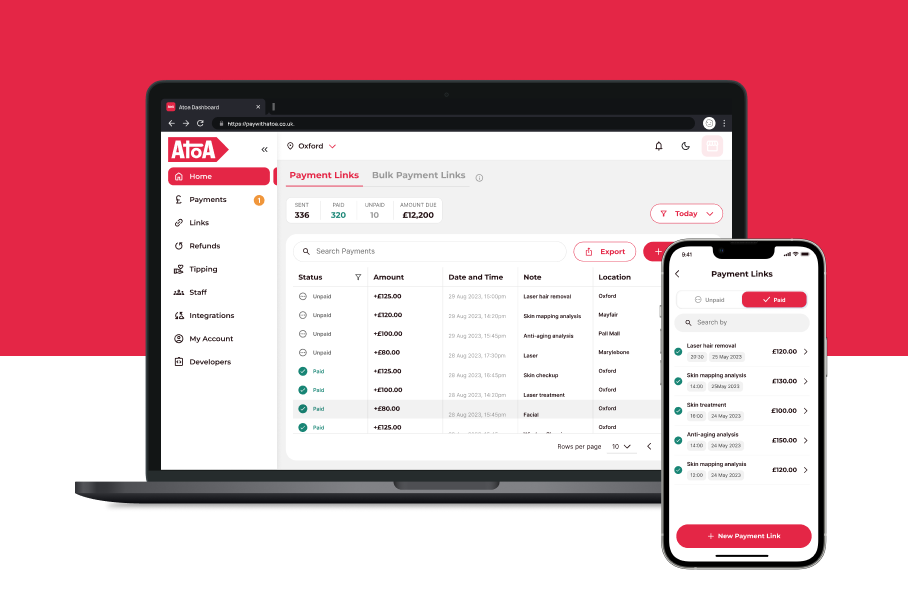

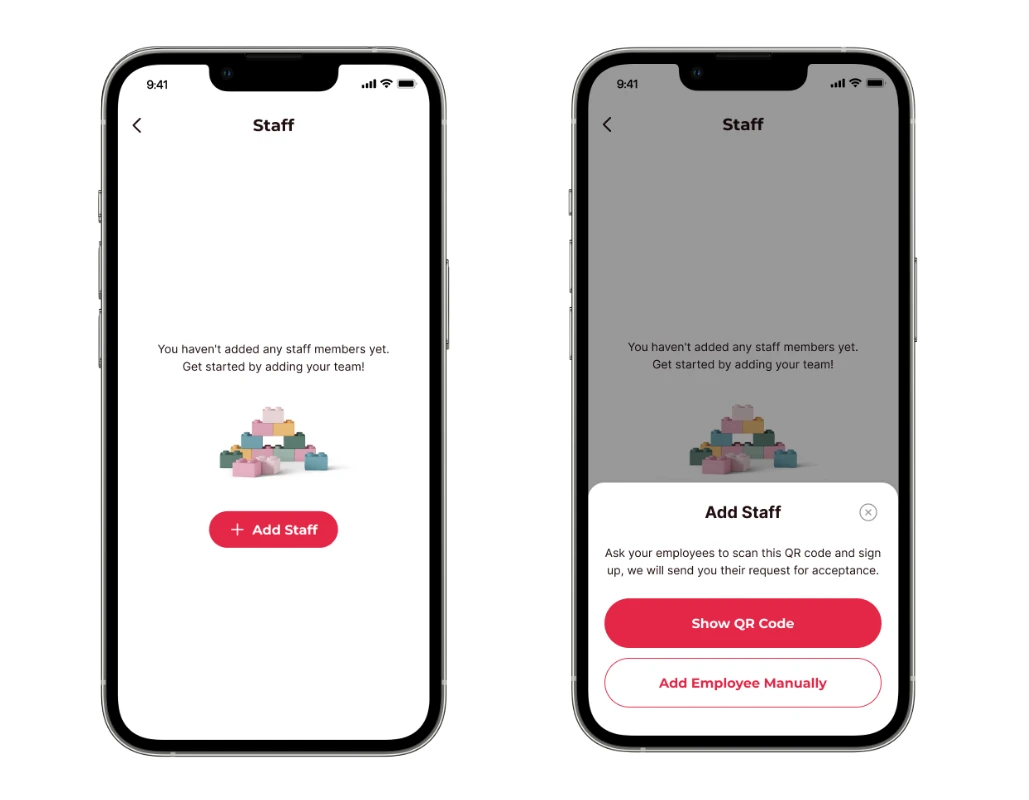

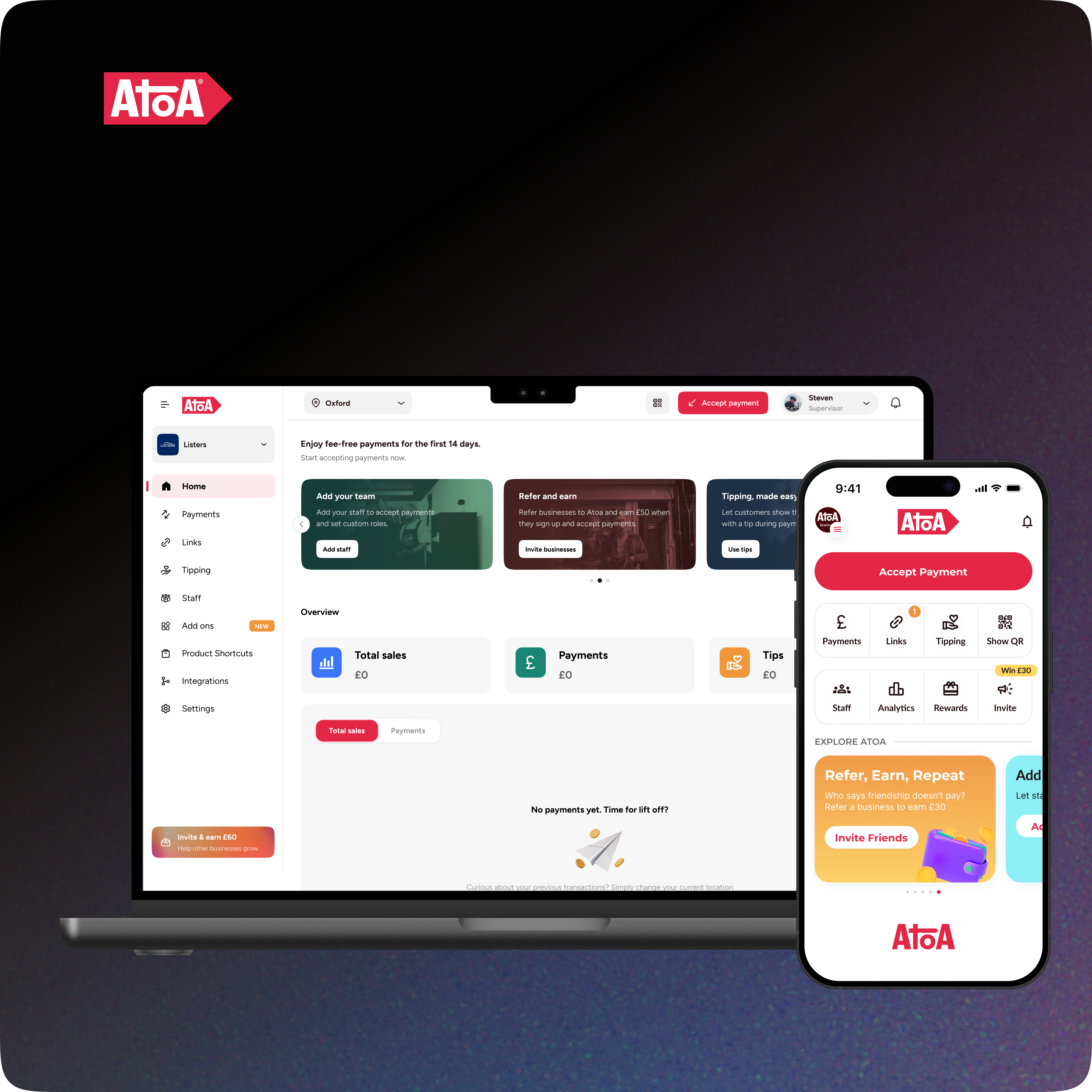

- Feature needs: Do you need to add staff to manage payments or send invoices? Atoa has the answers…

- Long-term growth: How might your business needs change over time?

💡 By looking at the big picture, you can select a payment method that may have some initial costs but offers better value as your business grows.

Absolutely! Let’s simplify this section to make it more accessible to a wider audience:

How open banking is transforming online payments

Open banking is a set of rules changing how we handle our money and make payments online. It’s opening up the banking world to new ideas and making it easier for us to control our finances. Here’s how it’s transforming online payments:

More choices and better Deals: Open banking lets trusted companies access your financial information (with your permission) to create new and exciting ways to pay online. This means you’ll have more options to choose from and can find deals that suit your needs better.

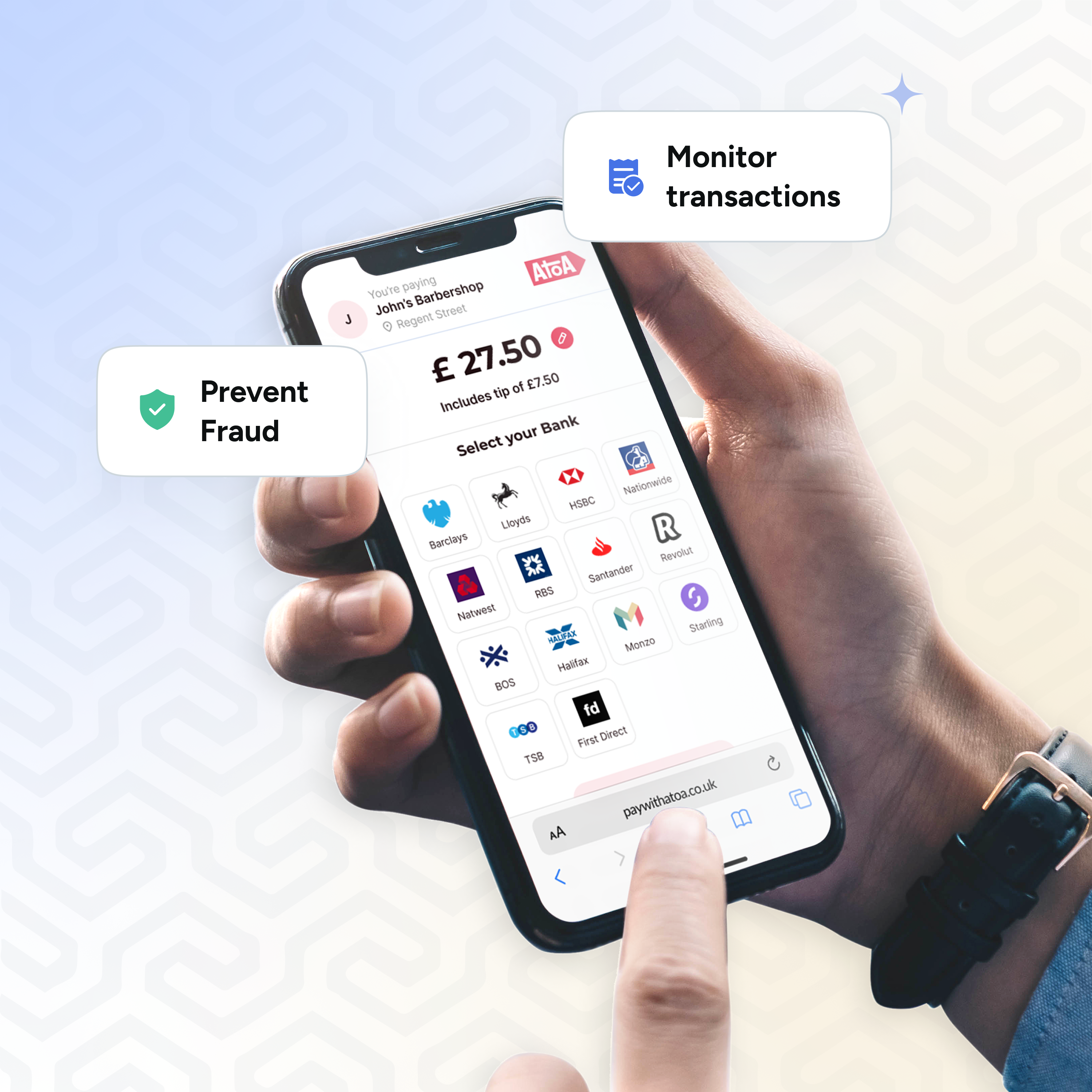

Safer and simpler payments: Instead of typing in your card details, you can pay directly from your bank account. This means there’s no need to share sensitive information, making it harder for fraudsters to steal your money.

Save money: Open Banking payments often cost less than traditional card payments. This is great news for businesses, as they can save money on fees, and potentially pass those savings on to their customers or reinvest.

Easier checkout: You won’t be sent to another website to pay, so it’s quicker and less hassle. This means businesses are likely to make more sales.

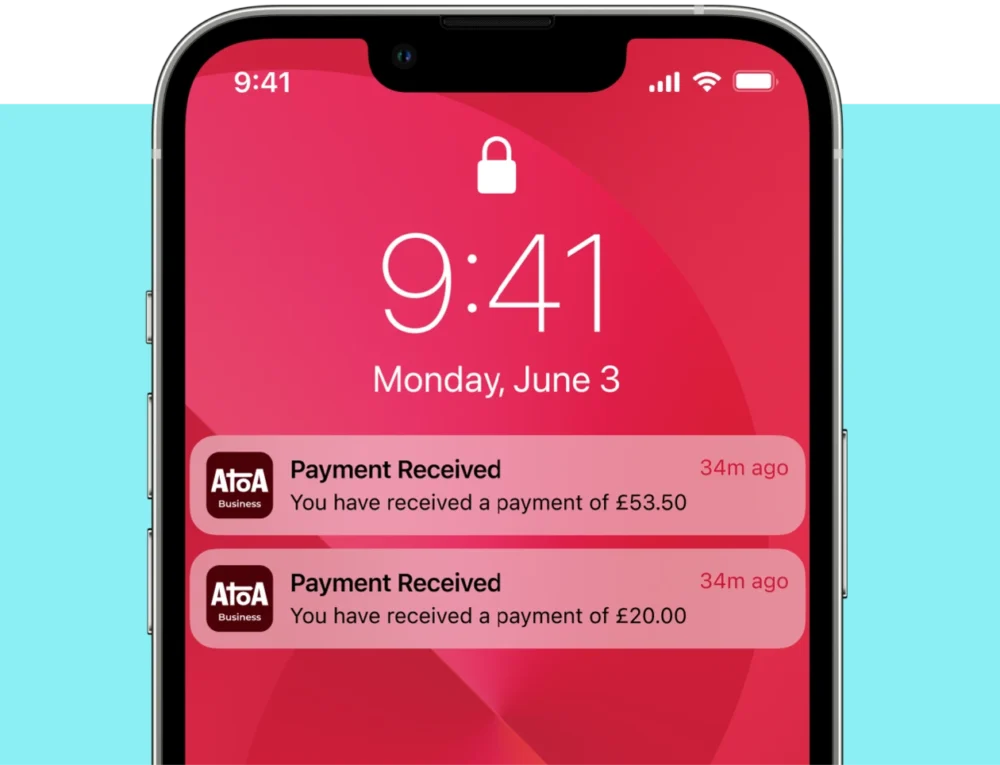

Instant payments: Payments are processed instantly, which is helpful for situations where you need cash flow from customers to buy more stock.

Want to know more about how Open Banking payments work? Check out our easy-to-understand guide.

Open banking is already making a difference in the UK. Companies like Atoa are helping businesses accept payments directly from bank accounts, making things faster and safer for everyone.

Looking for a quick setup and low fees?

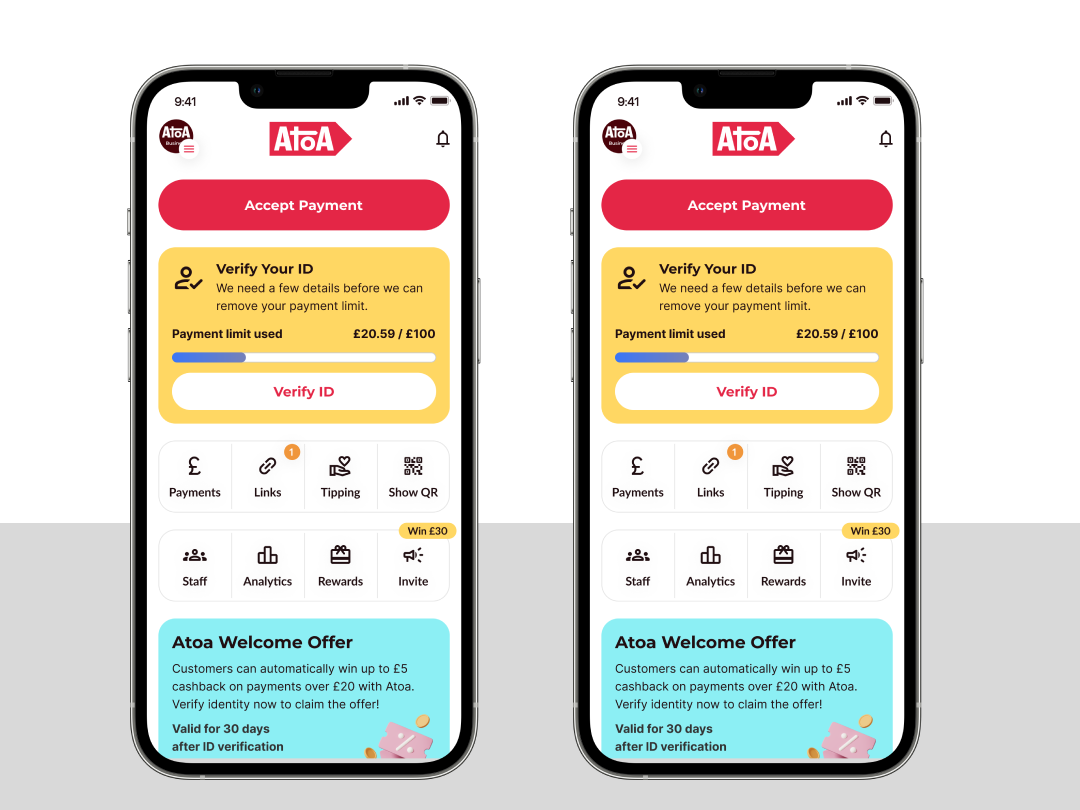

We may be biased, but Atoa and PayPal are the best choices for getting a fast online payment solution up and running. Plus, Atoa is ideal for new and existing businesses. Here’s why…

- PayPal: Widely recognised and easy-to-use option, but watch out for those fees!

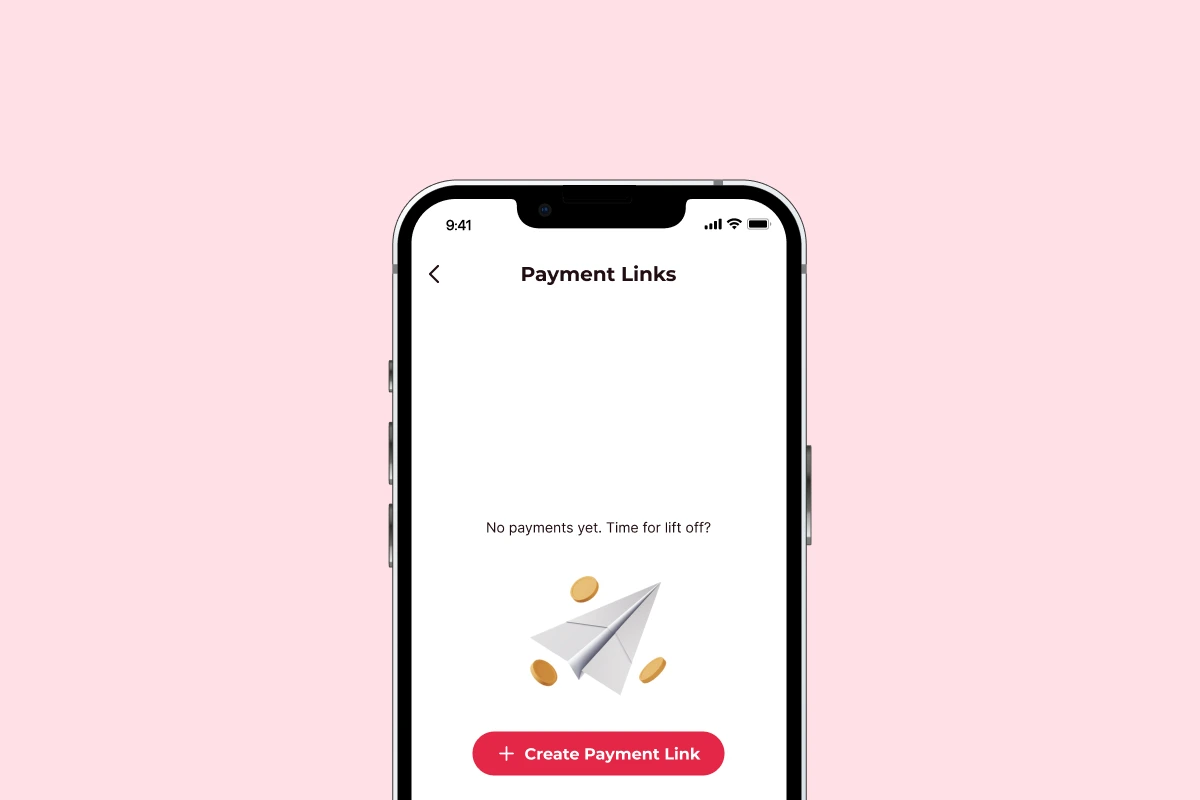

- Atoa: If you’re looking for transparent pricing with some of the lowest fees available, Atoa is a strong contender. It’s perfect if you need a fast and flexible solution that can be used on the go. It is available for e-commerce payments on WordPress sites using a WooCommerce plugin.

- Cross-border payments: If you need to accept cross-border transactions, we recommend trying Adyen.

The future of online payment methods in the UK

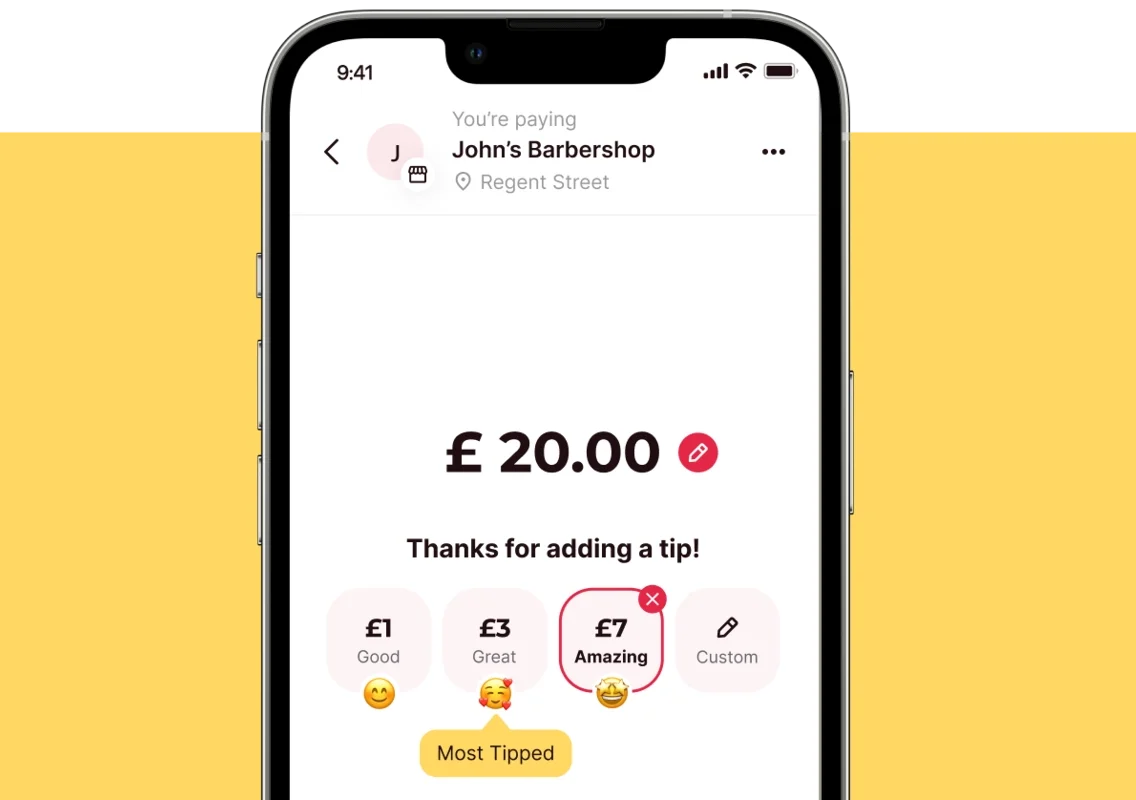

Try mobile payments: Optimise your online store for mobile wallets like Apple Pay or pay by bank options such as Atoa, providing a simple checkout experience for the growing number of mobile and app shoppers in the UK.

Transform your POS: UK businesses should make sure their point-of-sale systems accept contactless payments from various devices.

Prioritise security: As online payments become more sophisticated, so do the threats of fraud. Invest in robust security measures, such as multi-factor authentication and fraud detection tools, to protect your business and your customers.

Diversify your payment methods: Offer a variety of payment methods to cater to different customer preferences. This could include traditional card payments, mobile wallets, BNPL services, and potentially even cryptocurrencies.

Stay ahead: Keep on top of payment technologies and trends. Read relevant publications and consult with payment providers to prepare your business for the future. Also, if you find the right payment provider, they will offer guidance and support for your business.

Educate customers: Communicate the payment methods you accept, including any new additions. Show customers how to use new payment tech for better adoption.

Other factors to consider

If you’ve reached the point of choosing a provider, it’s time to ask yourself a few final questions and map out your next steps…

- Transaction fees: Carefully compare fees across different providers with attention to monthly minimums and chargeback costs.

- Integration: How easily does the solution integrate with your existing website or e-commerce platform?

- Security: Ensure the provider adheres to UK regulations and prioritises data security. Check if the provider is FCA-approved.

- Customer support: Do they have you covered if issues arise?

💡The best choice for your business will always depend on your sales model, transaction volume, and customer preferences.

Final thoughts

It might be wise to offer multiple online payment options for different customer preferences. The best solution for your UK business depends on its needs. Regularly evaluating your payment methods as your business grows is wise. Open banking is shaking up the world of online payments in the UK and shouldn’t be ignored. By embracing this new technology, businesses can find creative solutions to grow and make more money. If you choose a fair open banking payments provider like Atoa, your business can get access to the support and flexibility it needs. Low fees and instant payment are just the start, so why don’t you drop us a line?

FAQs

How safe are online payments?

Reputable payment gateways use encryption and fraud detection to protect your customers’ information. Make sure the methods you choose are compliant with UK payment regulations. Educate yourself and your customers about safe online practices, like using strong passwords and 2FA.

How much do online business payments cost?

Online payment fees might get complicated. Each payment method, whether it’s PayPal or a payment gateway, has its unique way of charging you. They may take a percentage of each sale, charge a flat fee per transaction, or earn money through setup or service fees. Compare the pricing plans of different providers carefully alongside the volume of transactions your business accepts.

Which payment methods are most popular with customers?

It doesn’t matter about any customer, it’s about what your customers like. For example, if you mainly serve younger customers, they might be more comfortable with digital wallets or BNPL options. Also, it’s important to have options that customers without tech can easily use. Offering a few popular choices – like cards, PayPal, and maybe one digital wallet – usually covers a lot of ground.

How quickly will my business receive its money?

How fast you get paid depends on the payment method. Some, like paying by bank, can be instant. Others might take a couple of business days. Consider how quickly you need the money in your account when deciding which options to offer. Also, pay attention to “settlement time,” which is how long it takes from a payment to go through to when it’s actually in your bank account and ready to be used.

What happens if there’s a problem accepting payment?

Unfortunately, sometimes things don’t go as planned. Cards can get declined, or customers might even dispute a charge, so choose a provider with good customer support. You need to know how they handle disputes and that they’ll be ready to help if problems crop up.