Calling all jewellers!

Do you need help with expensive transaction fees and outdated payment methods? Maybe you spend too much time worrying about chargeback fraud harming your cash flow.

If so, it’s time to meet a revolutionary open banking app offering instant payments with low fees.

Likely, traditional payments aren’t working for your business. Cash can easily be lost or stolen, and trips to the bank are becoming more challenging, with branches closing left, right and centre. On the other hand, card payments can be just as painful, with steep processing fees attached to high-value transactions like yours. There is also a risk of customers making chargeback claims, which can hit your profits hard. Thanks to open banking, Atoa cuts through these payment problems, giving you more of what you earn.

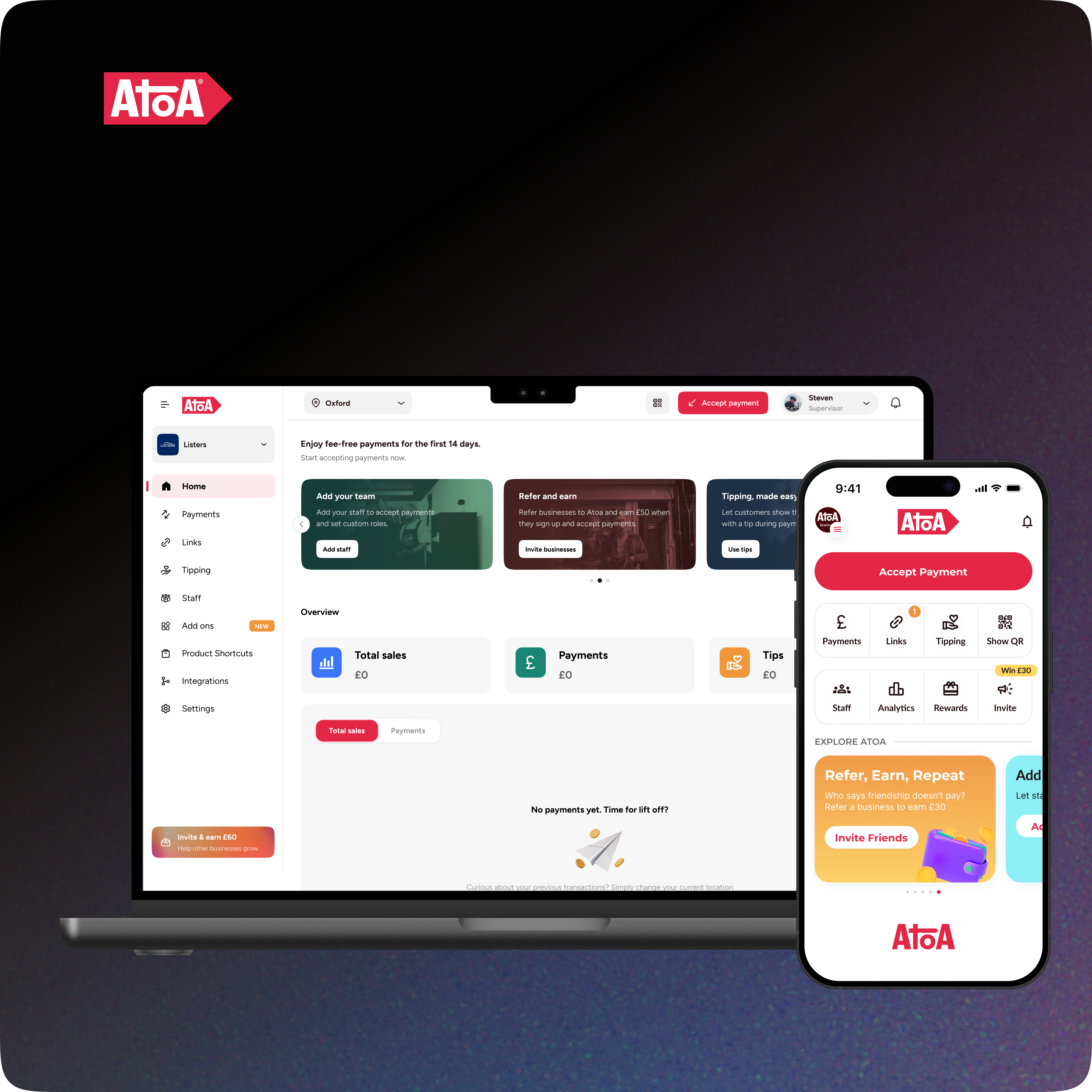

How does Atoa Business work?

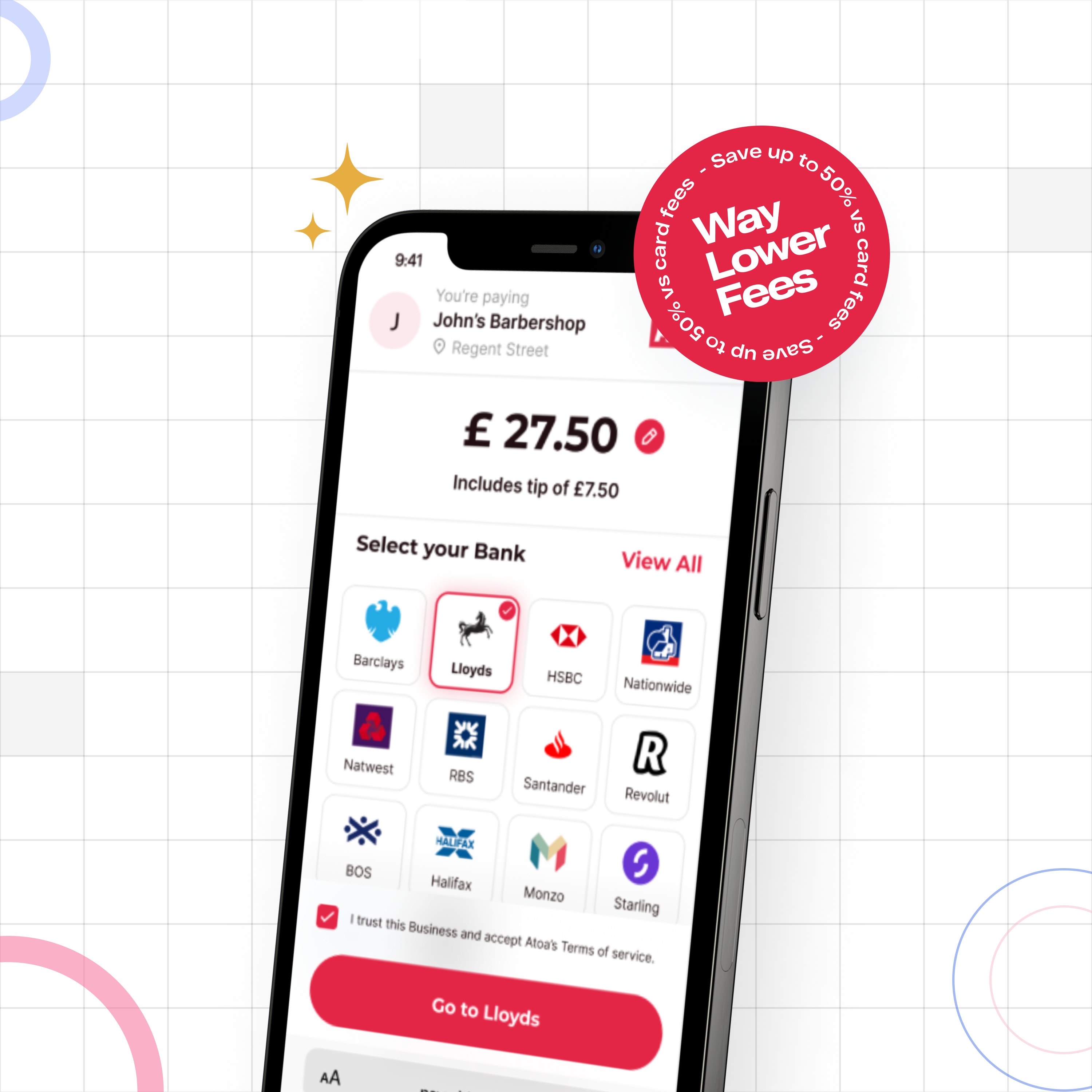

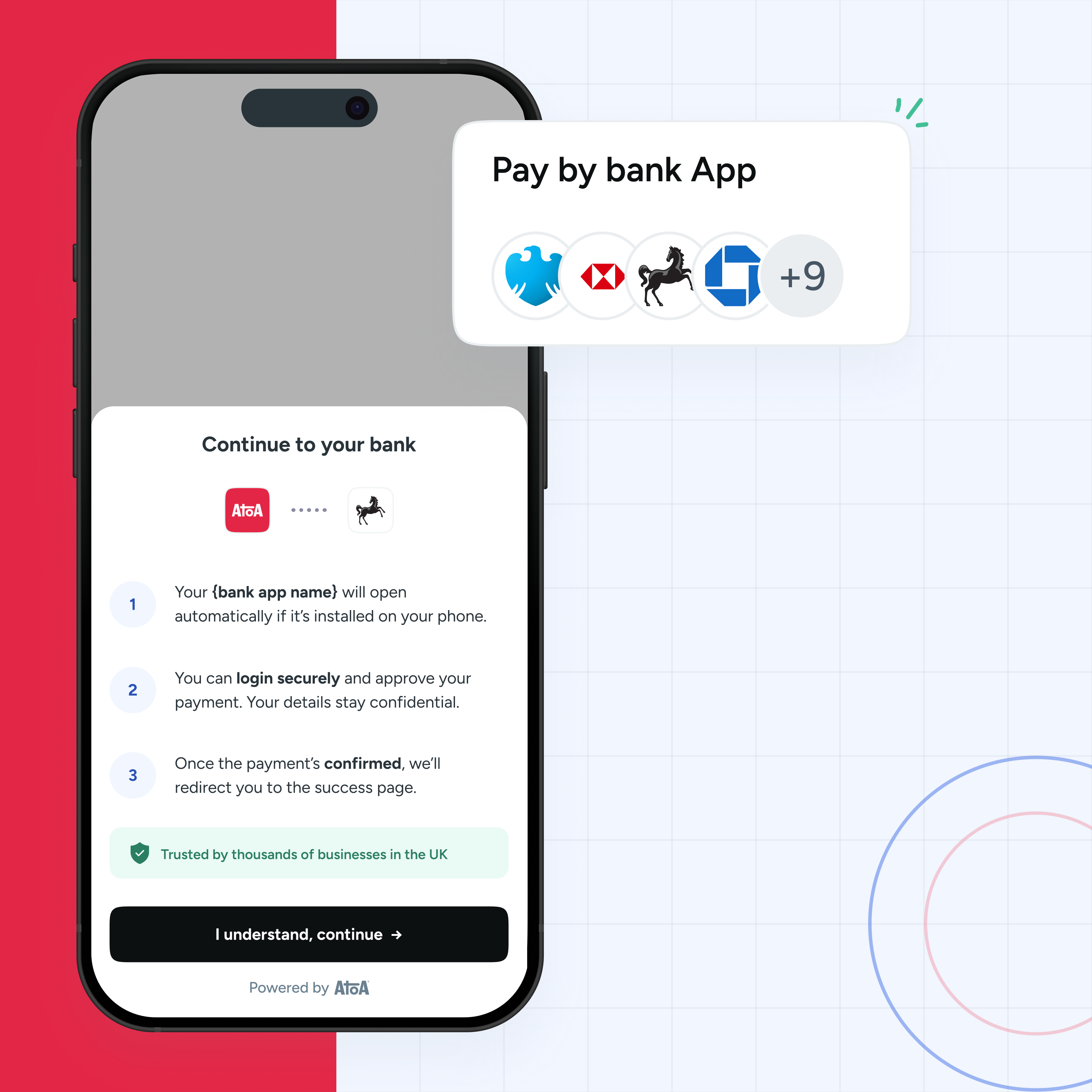

Open banking lets you connect your business bank account to a customer’s bank account, creating a direct and secure payment gateway. They’re also known as Account to Account (A2A) payments.

Most importantly, this process eliminates third-party payment processors, who bite into your profit.

Lower fees, instant payment

By removing intermediaries from traditional payments, we can offer a maximum fee of 0.7% per transaction, subsequently falling with higher volumes. Without card providers, we can give you the funds instantly. Your profit margin will thank you!

No more chargeback

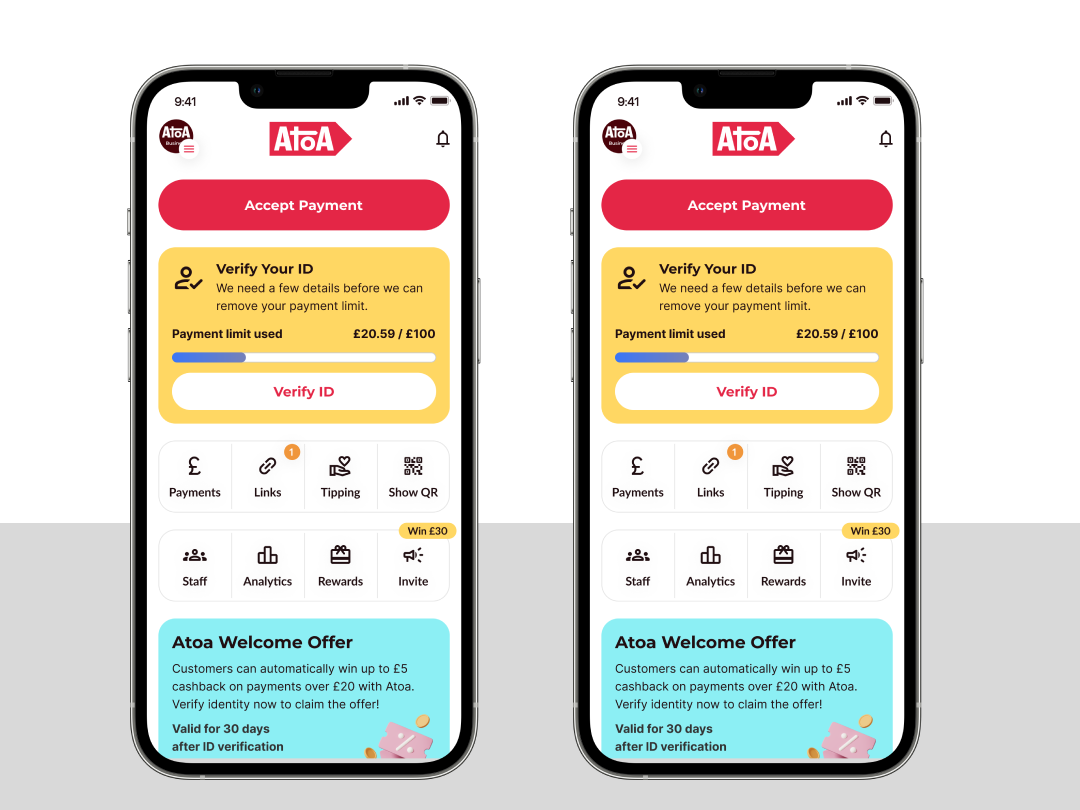

Customer identity is verified at checkout using their mobile banking app’s unique face or fingerprint ID. Payments are only approved when the customer passes security, meaning there is zero room for costly disputes.

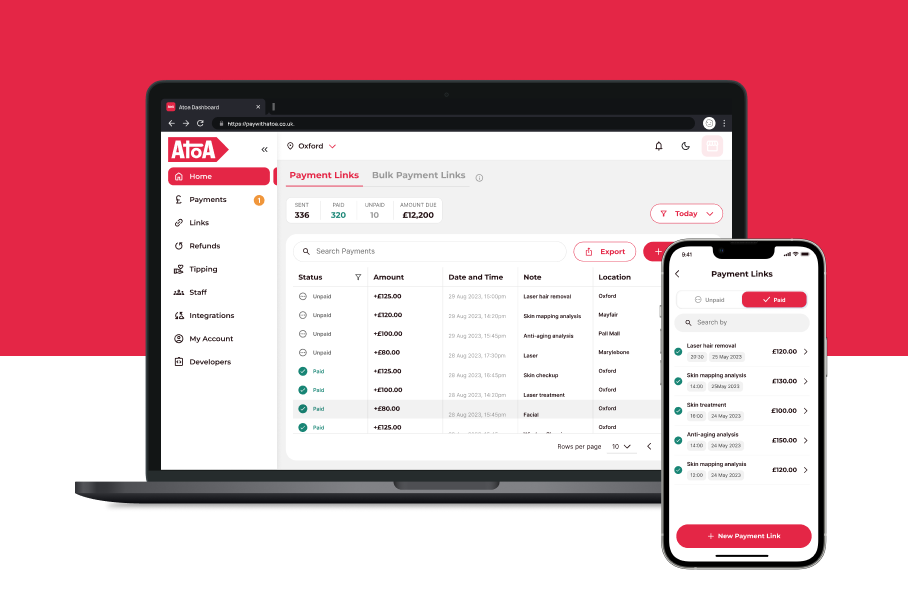

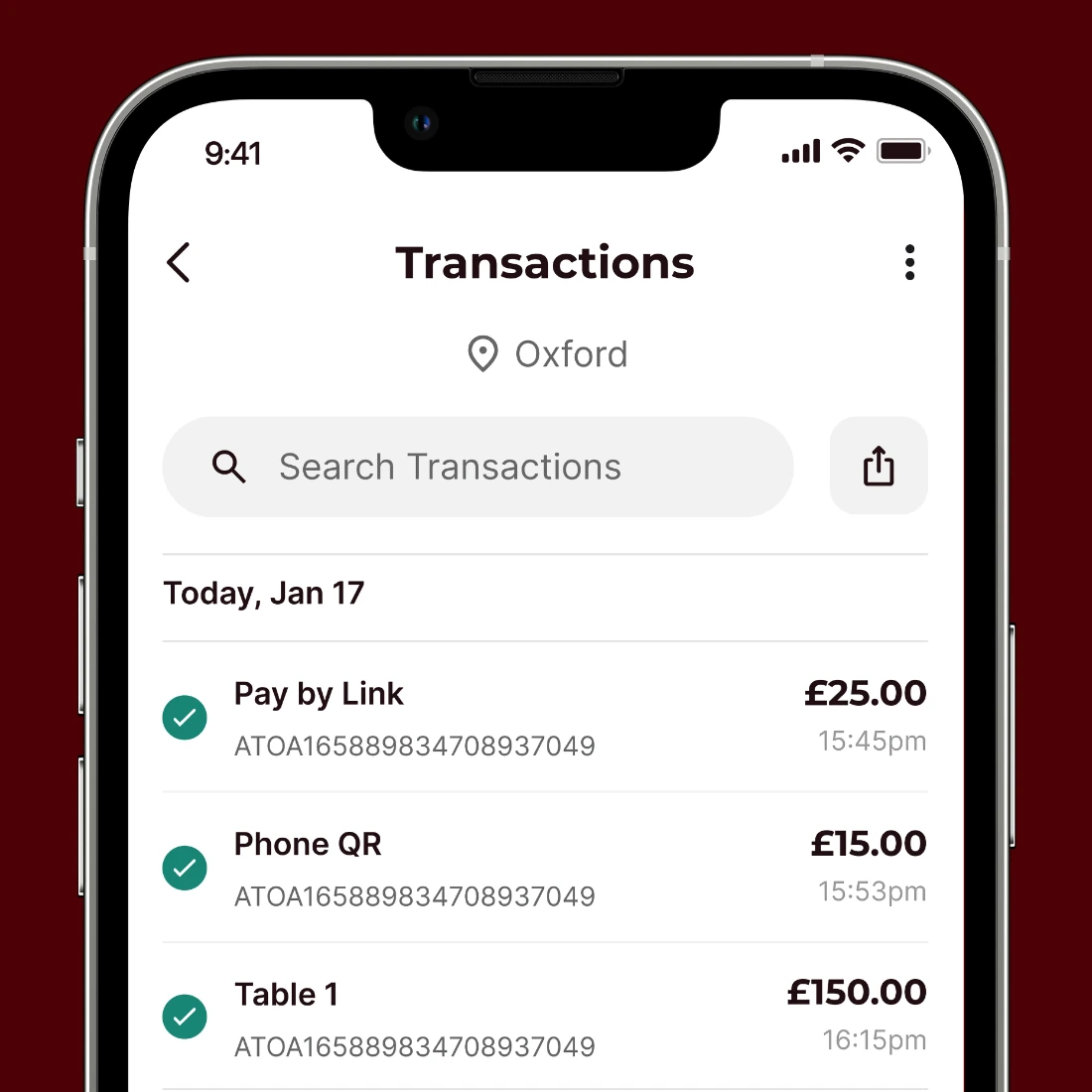

Different ways to get paid

Your customers can scan the QR code stand or on screen in person. Remote request links can be sent via SMS, WhatsApp or email if you need to take a deposit or instalments. Our transaction fees remain the same, whichever way you take payment.

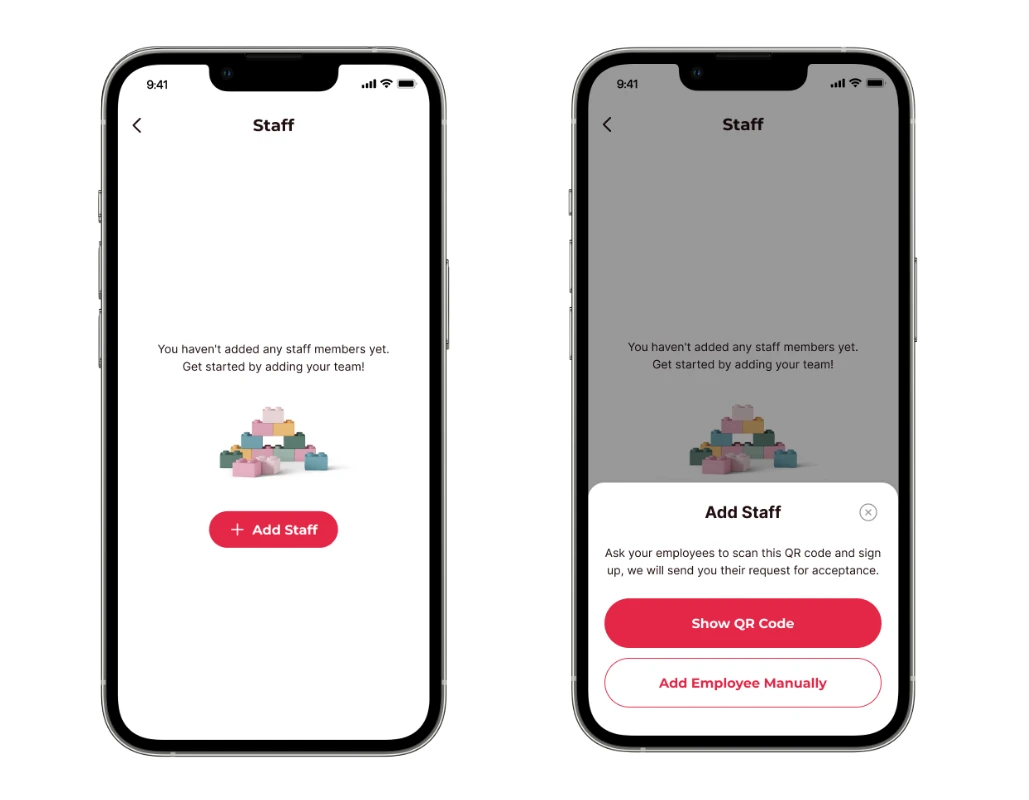

Seamless integration

Create an account in seconds to start accepting instant payments. There’s no need for card machines or complicated integration – add Atoa to your existing POS!

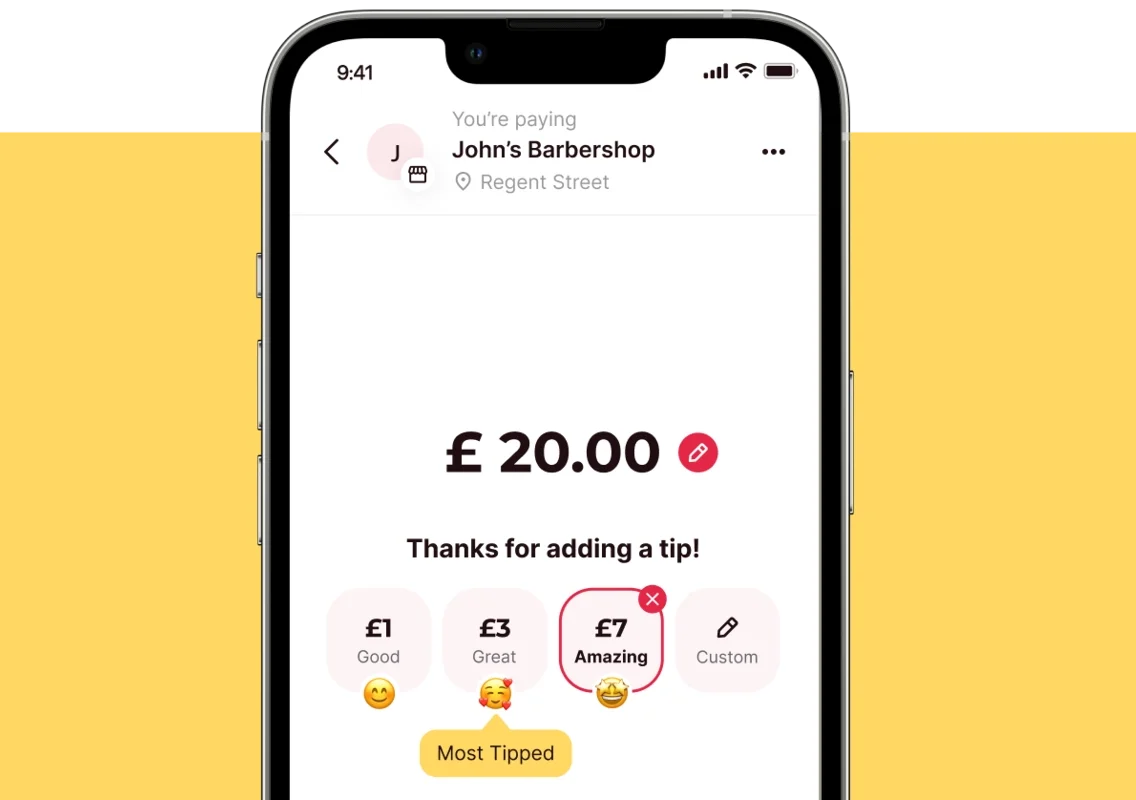

Customer experience

Customers will love the convenience of paying directly from their bank account, removing the need to enter card details or dash to the cashpoint. You can also refund customers just as quickly as they paid.

We’re confident that Atoa will save you money, but don’t just take our word for it! Download the Atoa Business app, connect your bank account in seconds and start taking low-fee and securely processed funds today. As a thank you for choosing us, we’ll give you 7 days of transaction-free payments. Alternatively, book a live product demo today!