The future of payments is speed, convenience, and security, and QR code payments are leading the way! You may have already seen our previous post introducing this exciting payment method. However, this article will show you how to generate a QR code for your customer using the Atoa Business app.

How to create a QR code payment on Atoa

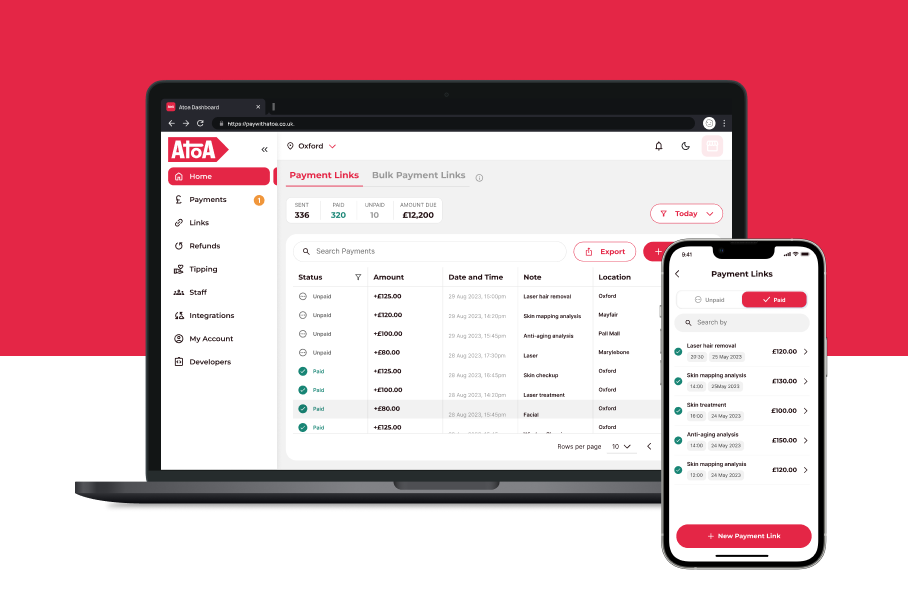

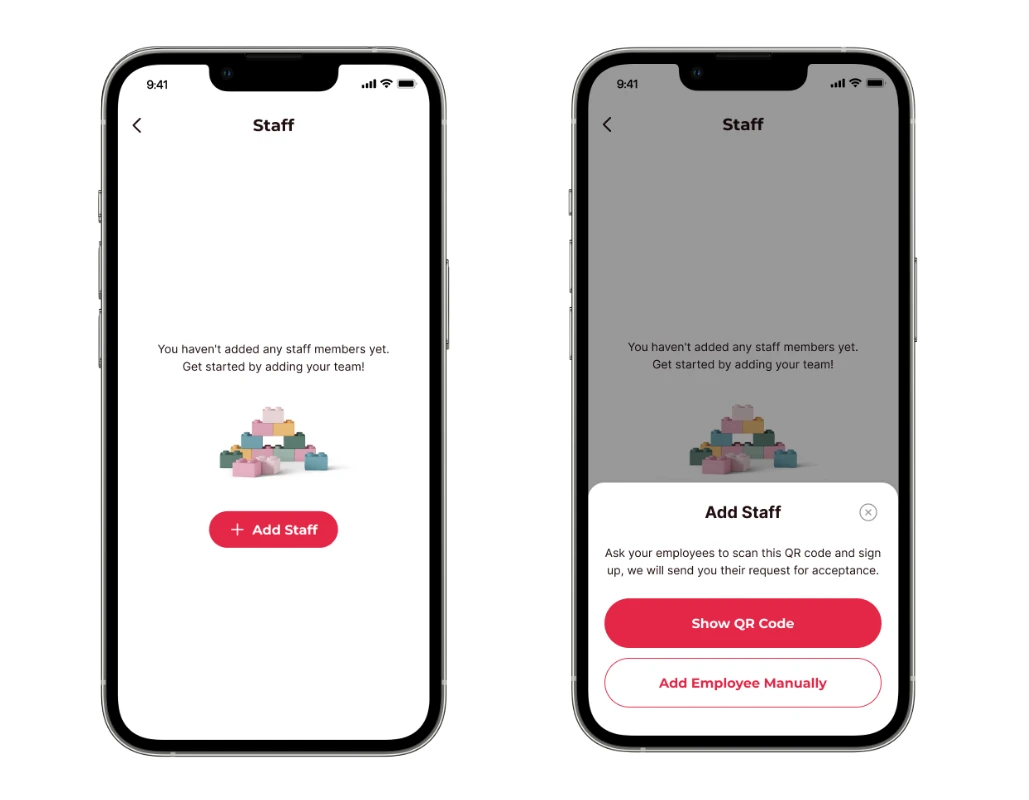

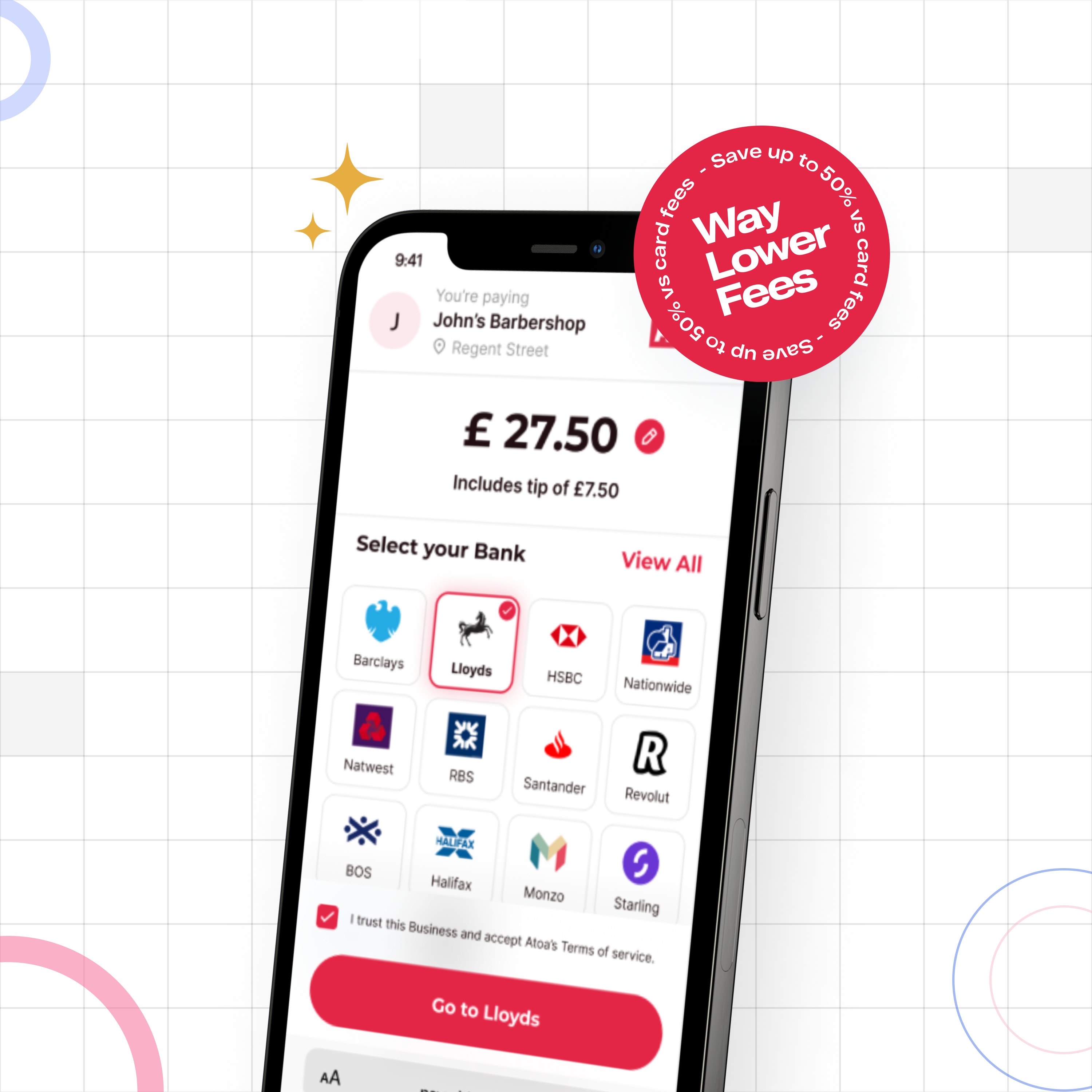

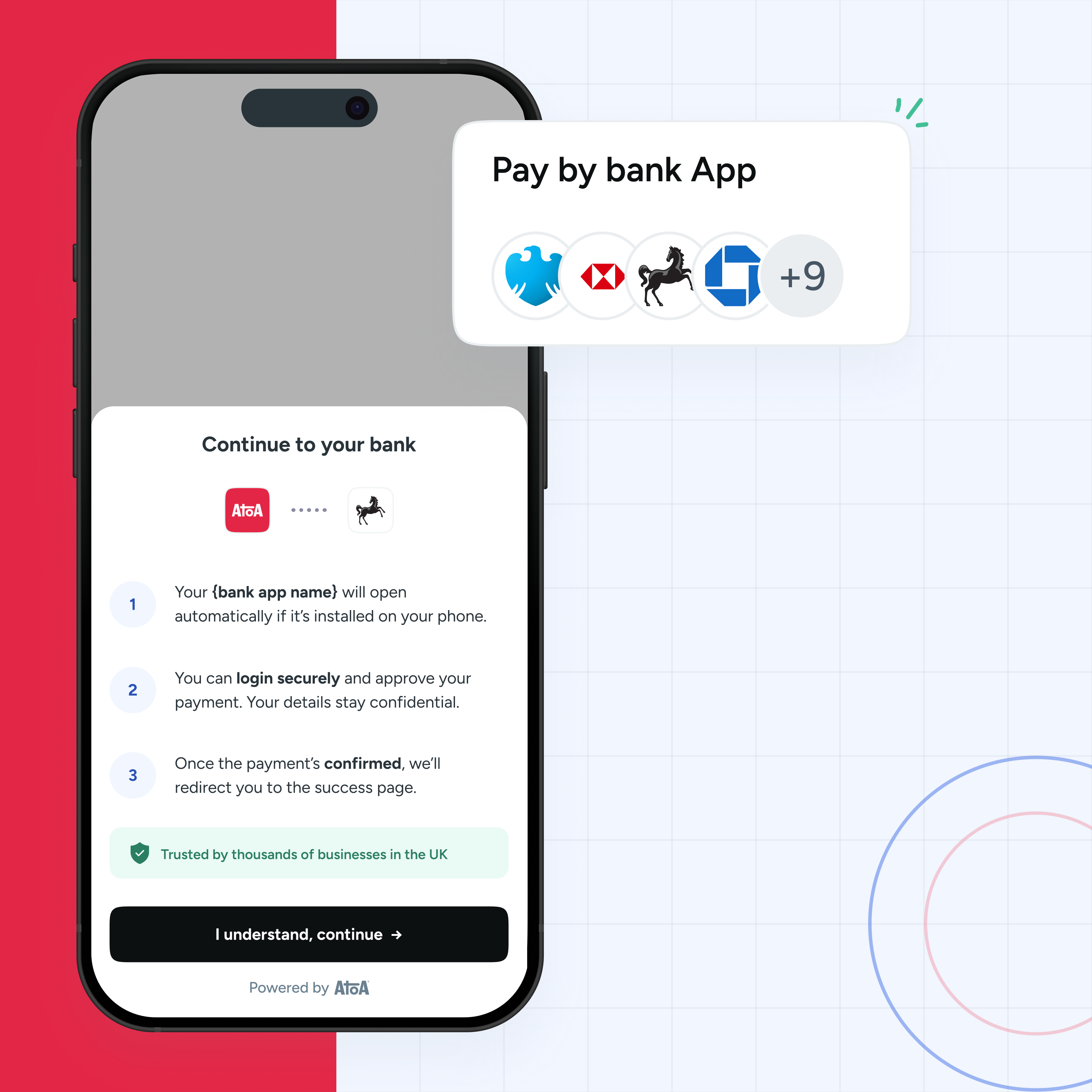

Atoa Business offers a seamless and hassle-free way to receive cardless customer payments. Our QR code payments unlock instant payment at low fees in just a few taps, ensuring safe and secure transactions verified by your customer’s banking app.

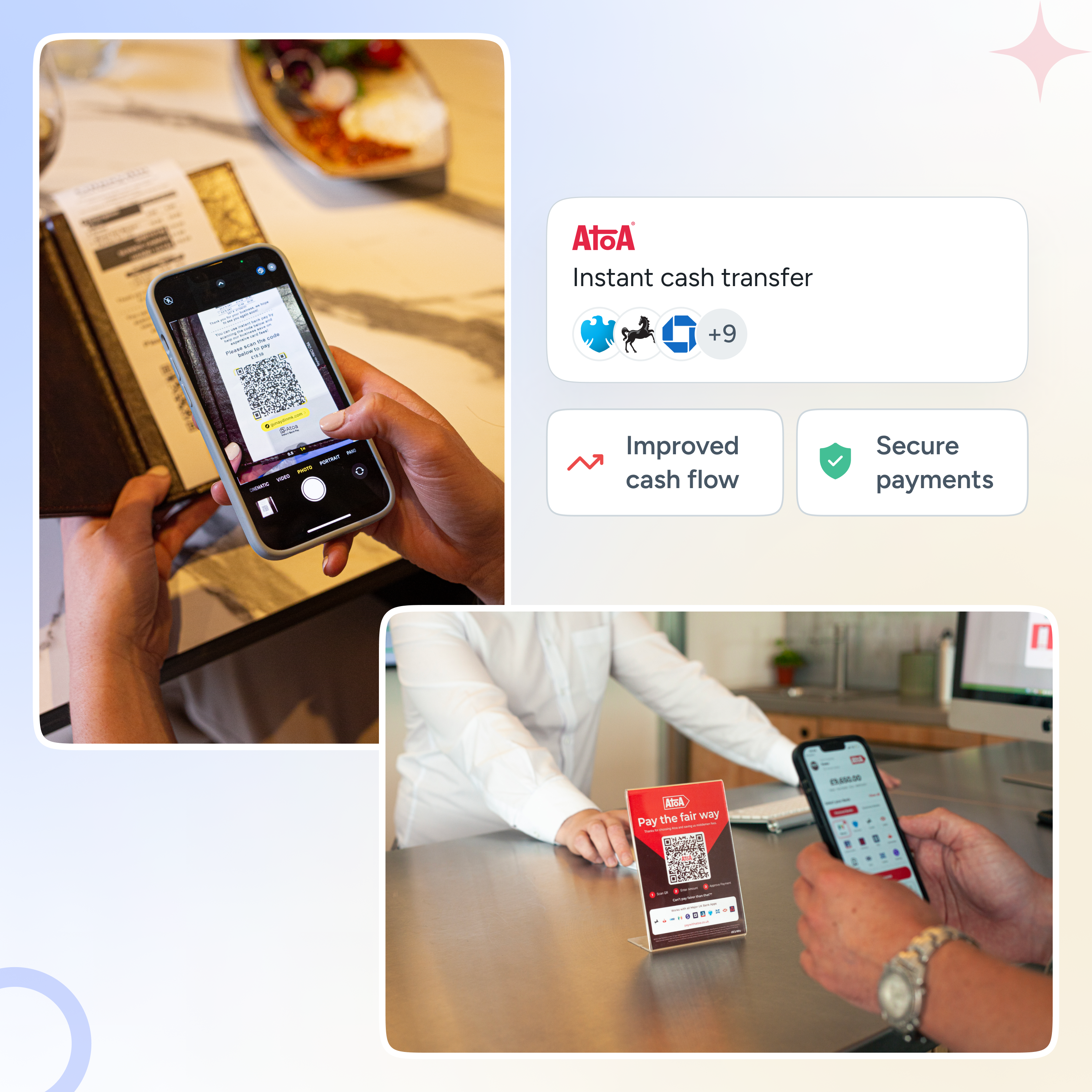

If you’re new to this, here is a step-by-step guide showing how to scan a QR code. Alternatively, watch the video below.

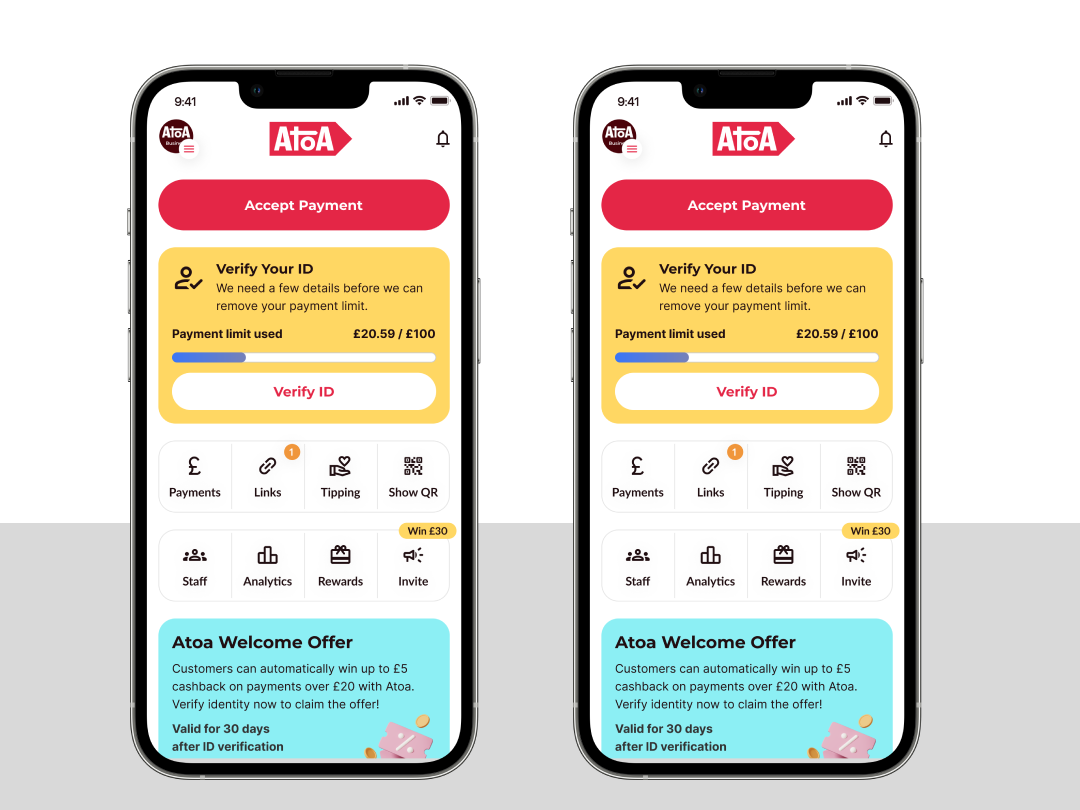

Open up the Atoa Business app and tap Accept Payments.

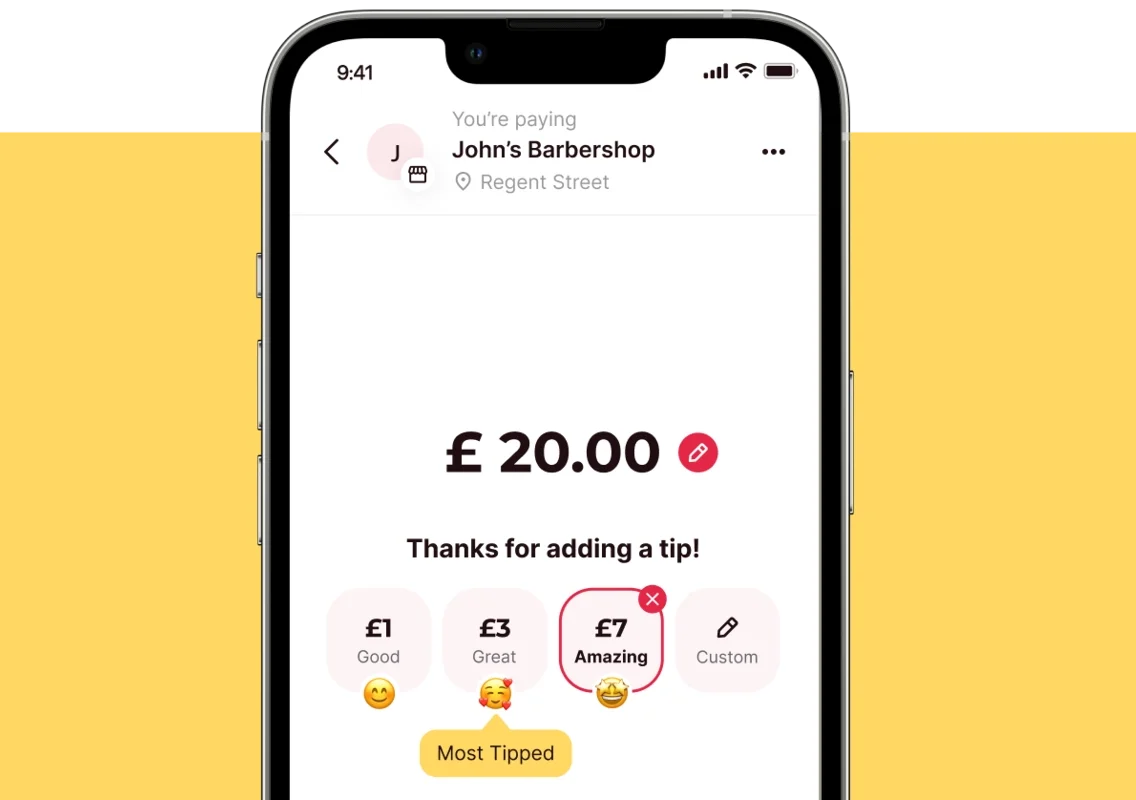

Enter the amount, then select the QR code option to generate one for your payment.

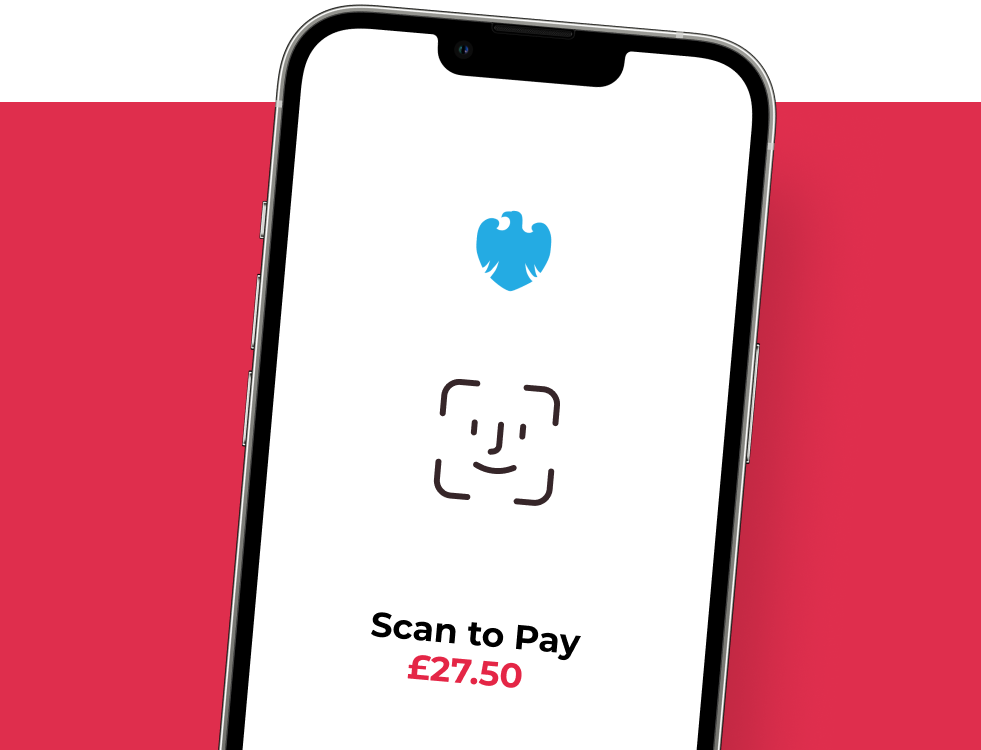

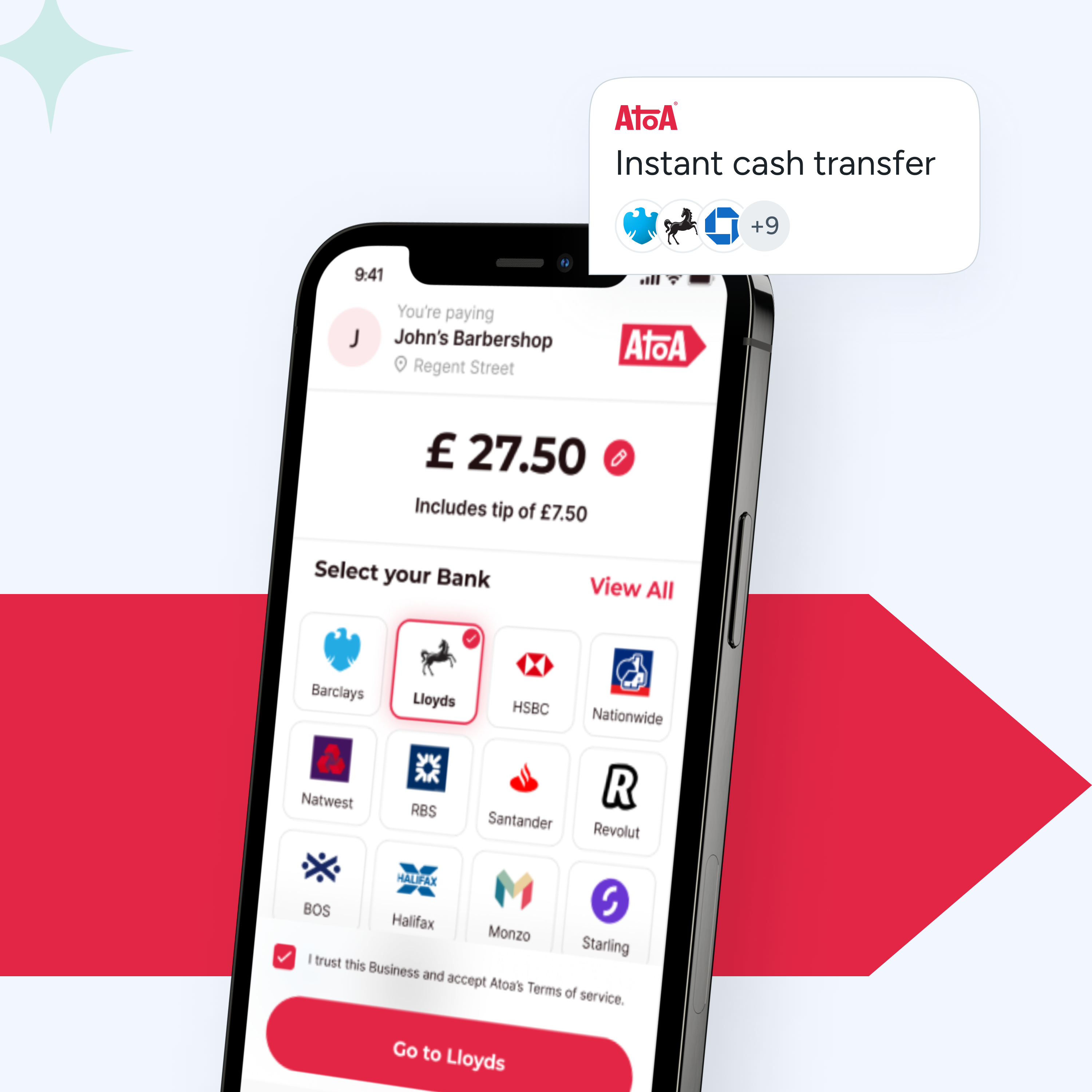

The customer scans the QR code with their smartphone camera, which triggers payment in their banking app.

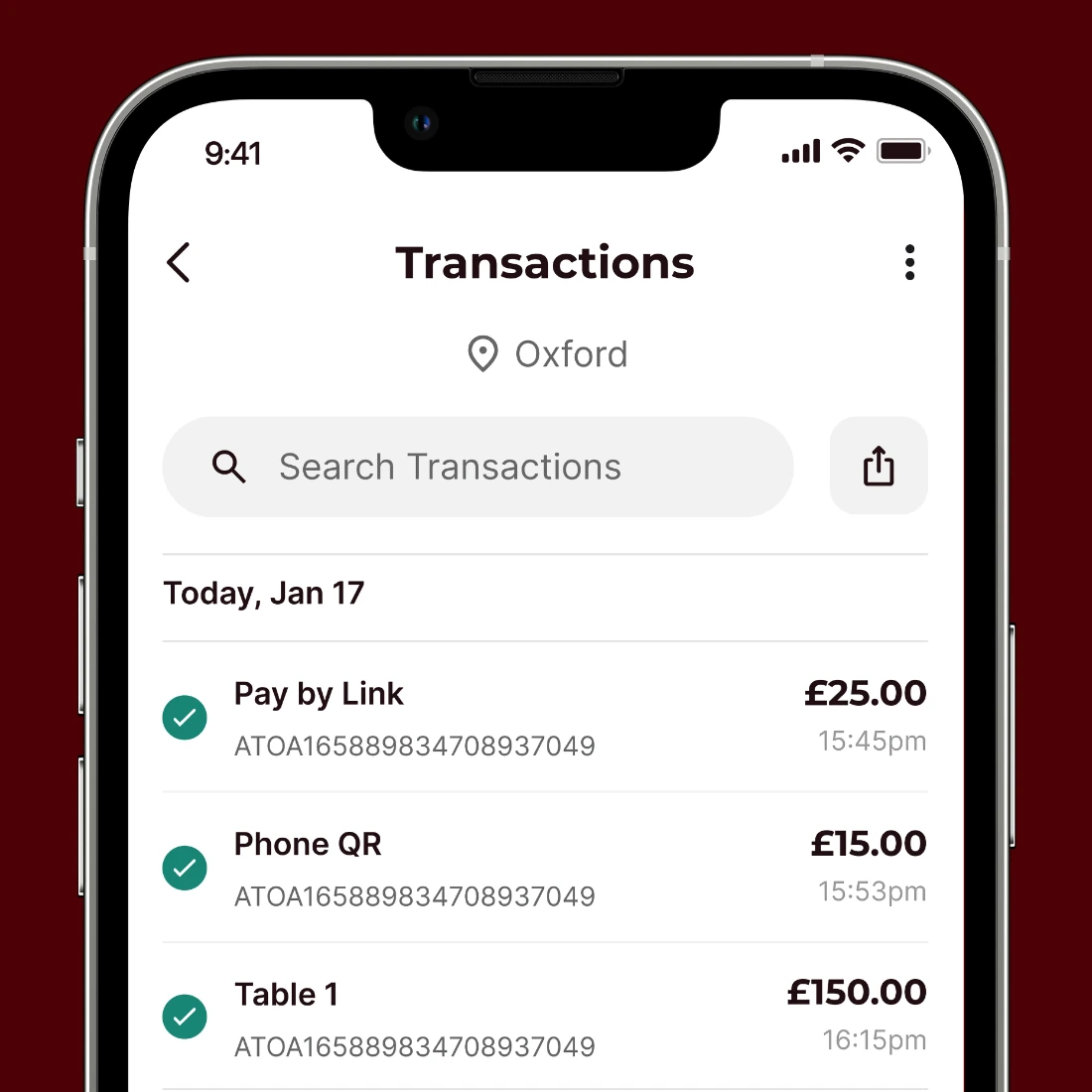

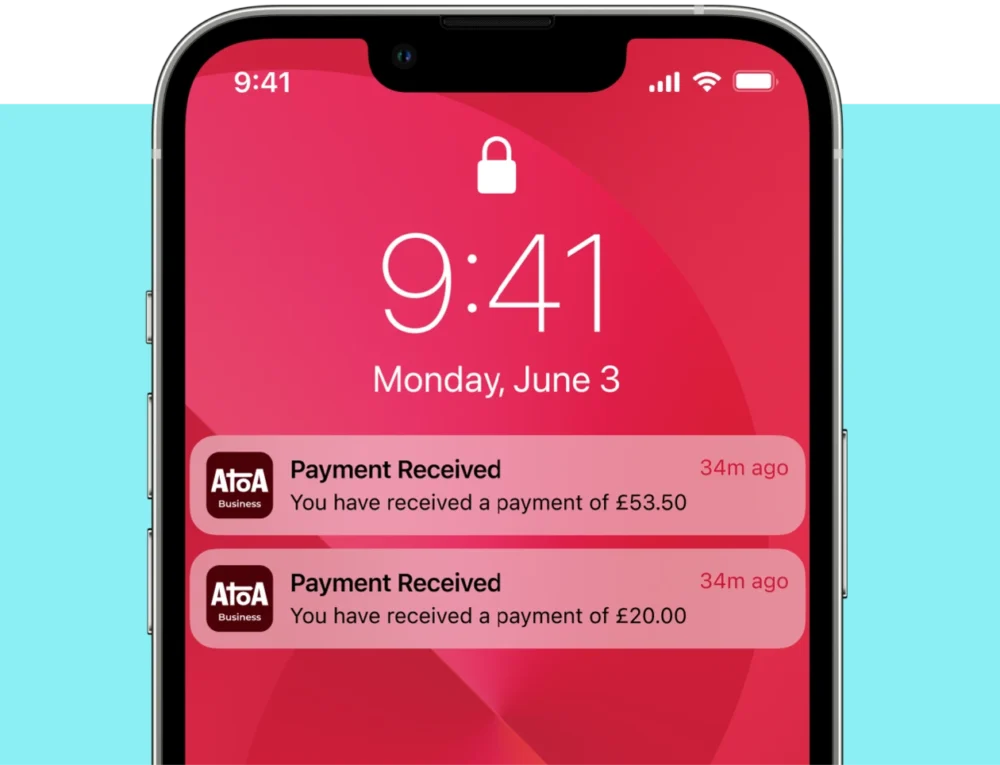

You did it! Funds land in your linked business bank account within seconds.

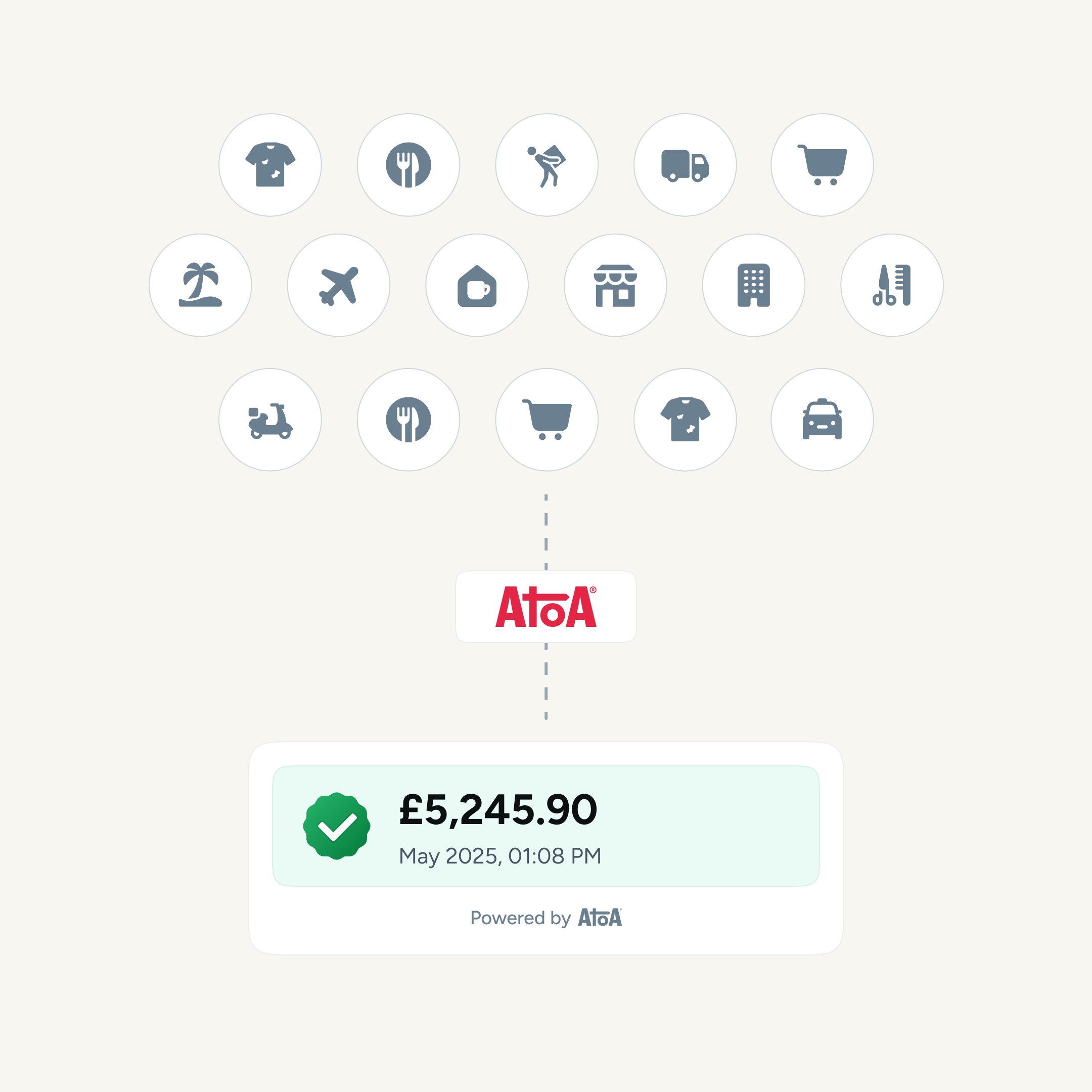

QR code payments are convenient for all businesses

Fast: Customers can pay in seconds, reducing waiting times for card machines.

Fair: Sidestep the processing fees attached to card payments and enjoy cheaper rates.

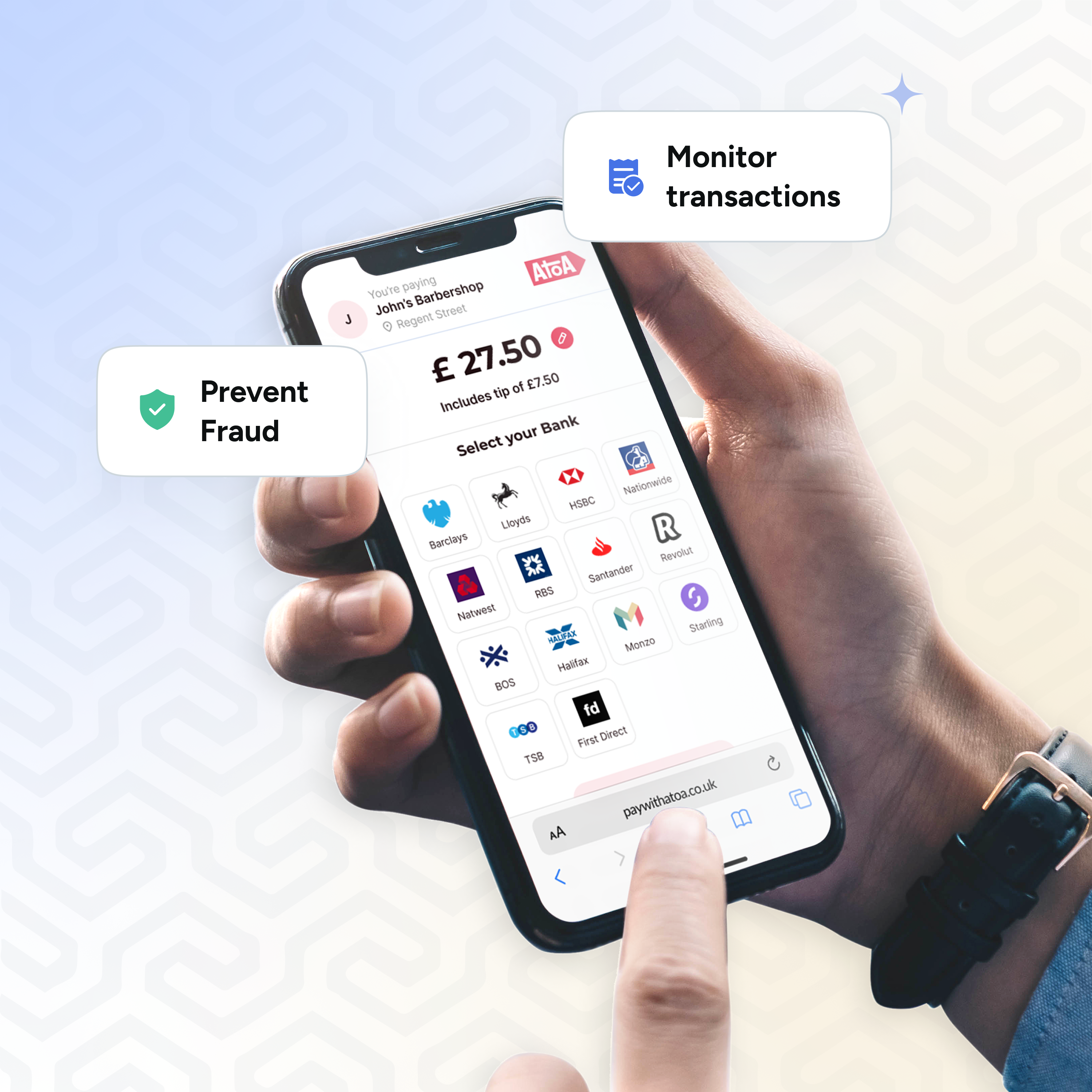

Secure: Customers verify payment on the spot, so it’s safer from payment disputes and chargeback fraud.

You don’t have to worry about card machines or handling cash, either. It’s all covered!

QR code payments improve customer experience!

Flexible payments. Print QR codes on stickers and stands or show them on screens to offer a flexible payment experience.

Settle up in seconds. Customers scan a QR code to pay instantly, reducing waiting times.

Feel good factor. Customers who choose QR code payments support small businesses, saving them money on processing fees.

What’s next?

If you’re looking for a fast, convenient, and secure way to receive payments, then QR code payments are the way to go. Your business does all the hard work, so it should be rewarded. Why not start by saving on unfair processing fees?

Download the Atoa Business app for 7 days of entirely free transactions. After that, we charge a flat rate of 0.7% per successful transaction.

Prefer the personal touch? Book a demo with our friendly team to learn more, including our easy integration options.