The rise of fintech APIs in the UK is nothing short of impressive. Driven by open banking regulations, their impact is undeniable. Statista reports that successful monthly API calls made by third-party providers skyrocketed from 1.9 million in June 2018 to over 1.3 billion in January 2024. This growth highlights the sheer potential of how open banking APIs could change how businesses and consumers use financial services.

Let’s find out what this means for the future of finance, shall we? This article explores how APIs work, their benefits, and how businesses can select and use them.

What are fintech APIs?

APIs are invisible connections that allow applications to communicate and securely exchange data, making open banking solutions possible. Here’s how they work in some relatable everyday scenarios:

- Crunching the data: Imagine using a personal finance app like Emma. With permission, APIs securely link these apps to your bank accounts to pull transaction data and give a snapshot of your finances.

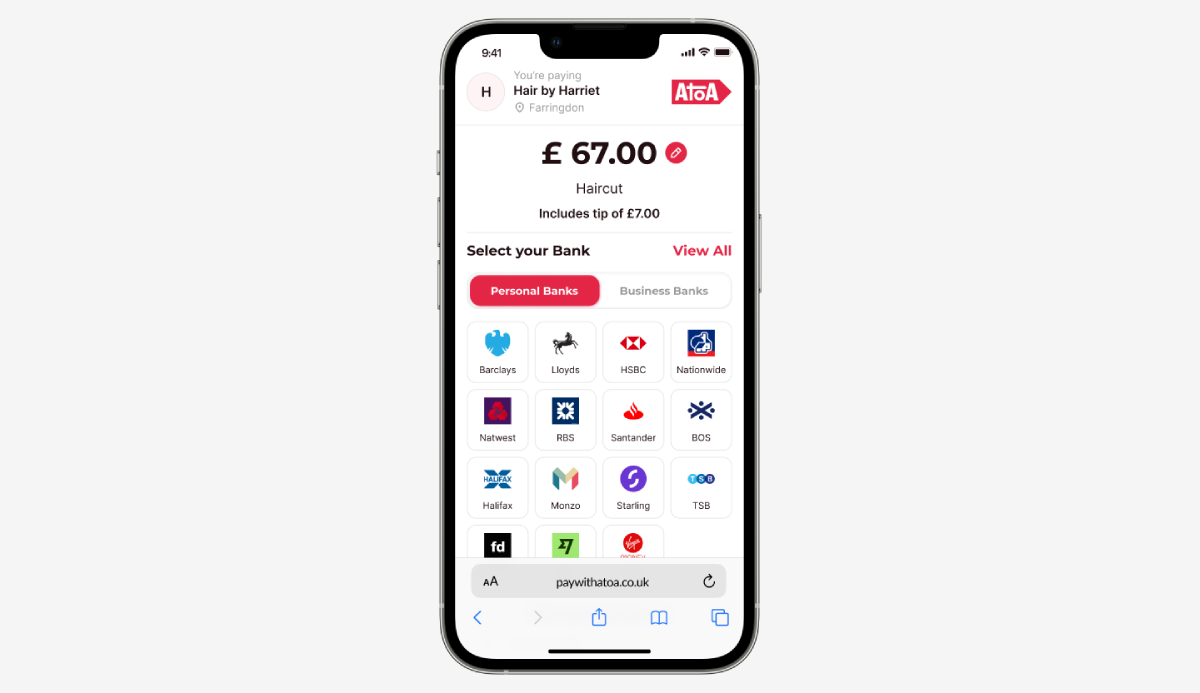

- Making and taking payments: Fintech APIs let users set up direct debits faster and with lower fees than traditional methods. Alternatively, when paying your HMRC tax bill online, you might have already paid using an open banking option powered by APIs.

- Account verification such as KYB or KYC: Open an account with Atoa or Monzo, and you will see that APIs are used to crosscheck and confirm your identity using trusted data sources.

- Risk assessment: A new business applying for a loan with iwoca might find the process super speedy. APIs access real-time financial data to help lenders make accurate credit decisions quickly.

Why fintech APIs matter for small businesses

APIs can help both consumers and businesses achieve better payments and tighter money management for better overall financial health. Here’s how:

The benefits for consumers

- Budgeting and financial tracking help link accounts to budgeting apps

- Instant account-to-account payments mean no more waiting days for funds to leave your current account

- Improved credit scores open possibilities for fairer assessments based on real-time data

The benefits for businesses

- Faster payments are guaranteed with account-to-account payments that offer instant cash flow

- Lower processing fees let you skip unfair costs imposed by card networks like Mastercard and Visa

- Automation saves your business time with more efficient accounting, invoicing and more

- Customer experience gets a boost with frictionless payment options, which means better reviews, right?

The 5 best fintech APIs for payments in 2024

Some of the most popular and reliable fintech API providers in the UK currently include the following players.

- Yapily offer a versatile API for various use cases, including payments

- Plaid focuses on account aggregation and data insights

- Stripe is a powerful payment provider that also offers a broader financial infrastructure

- TrueLayer works with streamlined open banking payments and data

- Tink have an offering that includes account aggregation, payments and more

The future of APIs

The future of fintech APIs promises even greater innovation and further transformation of the open banking payments space. Here are a few advancements to look out for.

- Financial services could become omnipresent in non-financial apps

- Open finance triggering expansion beyond banking data to investments and insurance

- AI may take more control over financial advice and risk management

- APIs may positively boost accessibility with a broader range of innovative and cost-effective solutions to help underrepresented communities

FAQs

What can banking APIs do for my business?

Payment APIs can help your business in many ways. Bypassing traditional card networks, they make receiving payments less expensive, with funds arriving directly into your bank account, often within seconds.

They also give a snapshot of your overall finances by creating a web of multiple banks and accounting tools, helping you make better decisions. Open banking APIs can automate tedious tasks like paying bills and bookkeeping. Plus, they allow customers to pay directly from their bank, which is highly desirable in busy hospitality settings or online checkouts. A great example of this is settling your tax bill with HMRC using their open banking payments.

Finally, APIs can improve the chances of borrowing money by providing lenders with more accurate figures, often considering regular outgoings like rent payments.

Are APIs safe for my business and customers?

APIs always put security first and are regulated by the UK government, which means they must follow strict standards. Plus, customers have complete control over how much of their data is shared and can remove access at any time.

How do I start using fintech APIs?

First, define what problems you want the API to solve for you, such as faster payments or improved cash flow. Then, research providers to compare their features and pricing. Finally, try demos or free trials to roadtest fintech APIs before fully committing.

Who can use APIs?

If you have a business and want to speed up processes, you’ll likely find an API that suits your needs. Some focus on specific areas like e-commerce, so choose one that suits your business type.

The takeaway

Fintech APIs are driving change to help businesses with secure and efficient tools to boost their bottom line. Companies that are ready to embrace this technology have the opportunity to grow, streamline, and create desirable customer experiences.

If you’re wondering how your business can get fast, fair, and secure payments, then look no further than Atoa. We’ve got a free 14-day trial to show you just how much money you can save—up to 70% compared to accepting card payments…