SMS payments are here to stay, and let’s be honest, it’s no surprise. Think about it – when did you last use a slow or long-winded payment method? It’s not how things are done anymore, as businesses and consumers look for easy and secure ways to pay. There are many options, but SMS payment is one of the most convenient, offering quick and hassle-free transactions directly from our phones.

What are SMS payments?

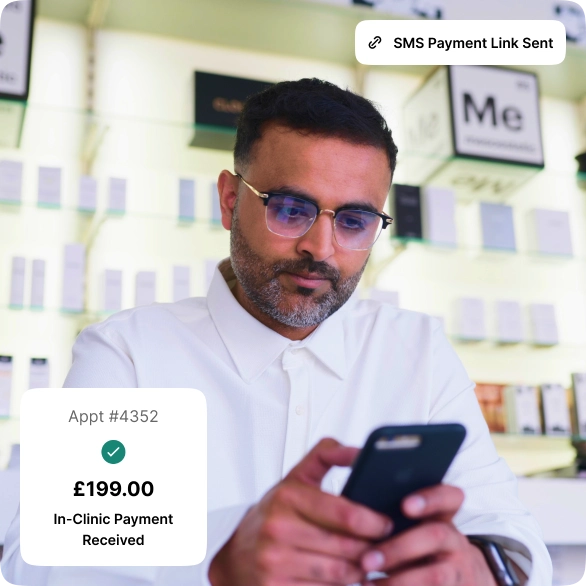

Short Messaging Service (SMS) payments are another handy digital payment method that offers flexible and convenient payments regardless of location. For customers, they offer an easy way to pay remotely or on-the-go. Bills or purchases can be settled from the privacy of a smartphone regardless of whether the customer is relaxing at home, commuting, or on lunch break. These secure payments enable businesses to collect funds quickly, such as deposits, without calling the customer and taking card details.

Different types of SMS payments

So we’ve already figured out SMS payments are your ticket to hassle-free transactions, but how do you use this user-friendly payment method? Keep reading! But before we get started, there are two main types of SMS payments you should be aware of:

Direct carrier billing allows customers to pay for goods and services by texting a keyword or shortcode to a number provided. The amount of the purchase is added to the customer’s phone bill. Direct carrier billing is most commonly used for charity donations but can also be used for other purchases, such as mobile games and apps.

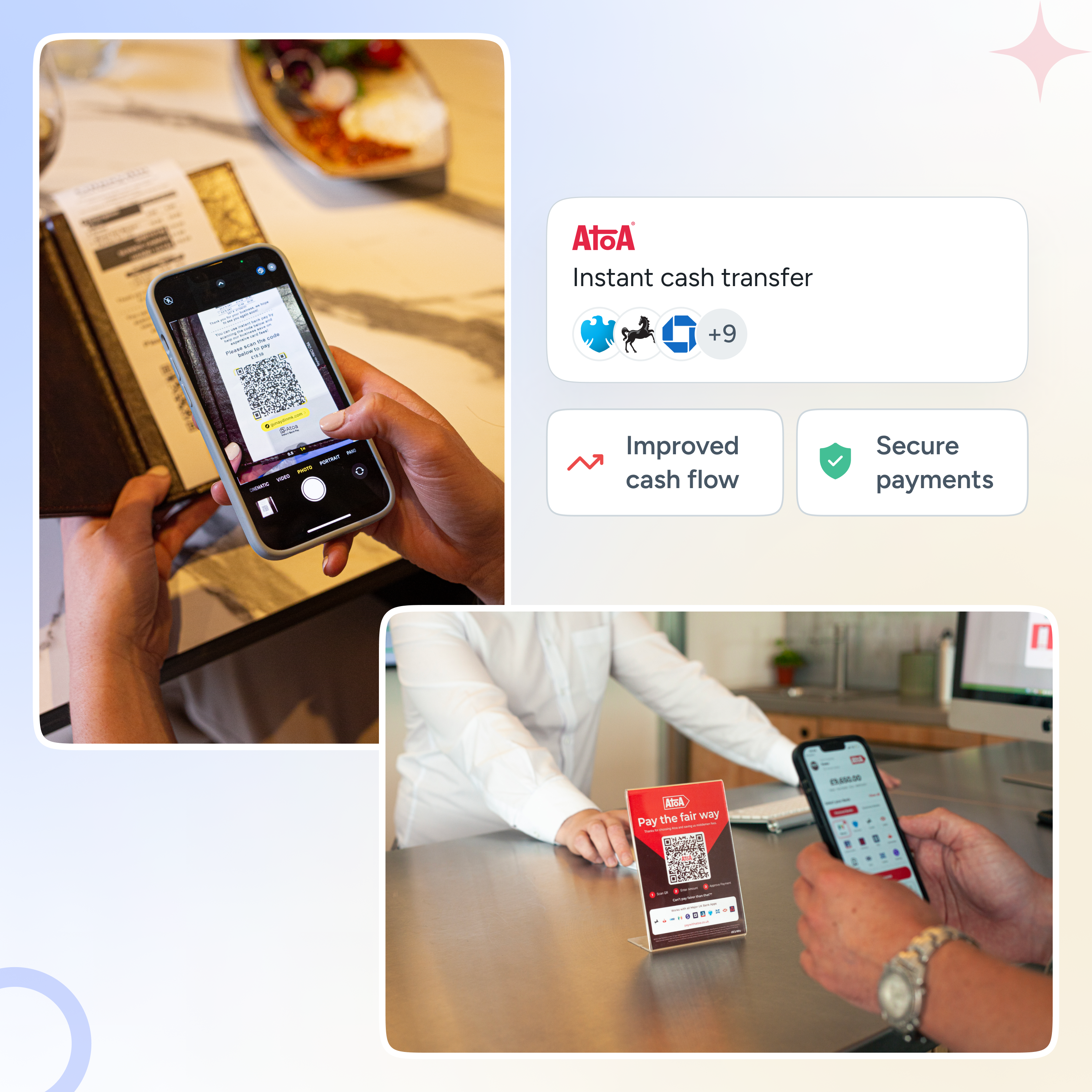

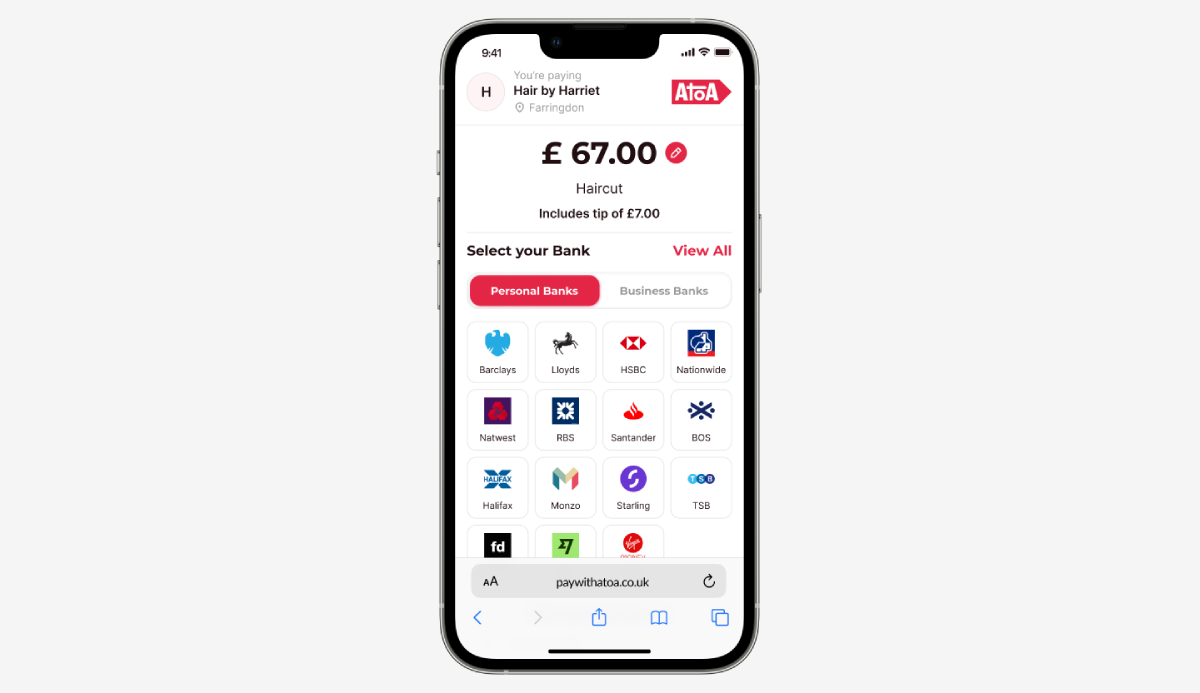

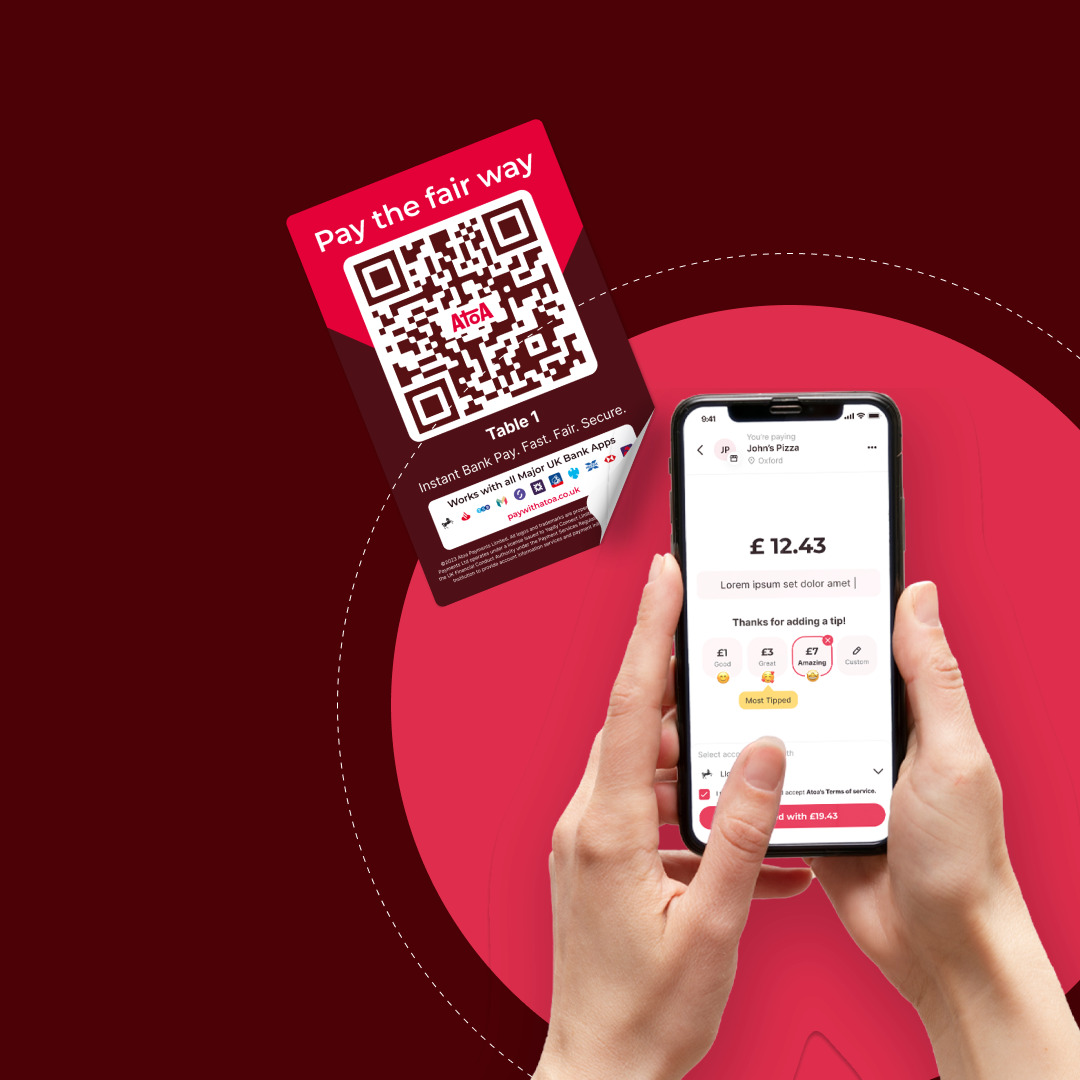

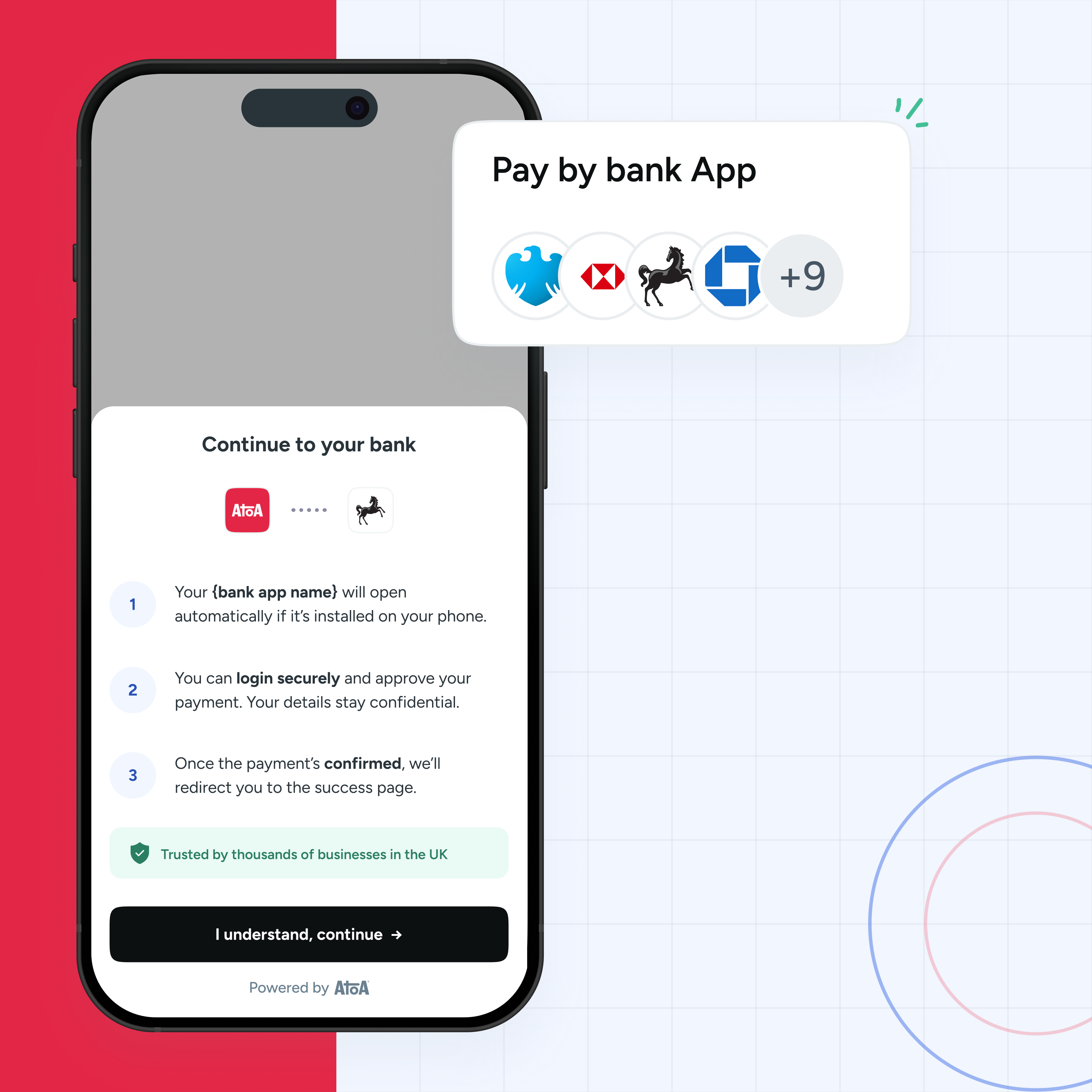

Payment links allow businesses to send a link requesting payment in a message, which the customer clicks to complete the purchase. Payment links are often used for e-commerce transactions, in-store hospitality payments or taking deposits at hair and beauty salons.

There are other variations, too. For example, some businesses allow customers to pay for goods and services by replying to a text message with a credit or debit card number. Others use SMS to send customers one-time passwords (OTPs) that can be used to verify payments made through other channels, such as online or in their banking app.

How to use text-to-pay methods effectively

Pay for parking. Dodge the ticket machine queue! Text the car park location code, confirm your parking fee and pay over text—quick, convenient, and fine-free.

Buy mobile apps and games: Customers may pay via SMS by sending a text reading “BUY” to a specific number to get a game from the Google Play Store.

Donate to charities. Are you feeling generous? Receive an SMS with a donation link, select your amount, and donate within seconds.

Use a vending machine. Mid-journey snack but no coins? Text the vending machine code, receive a payment link, and grab those salt and vinegar crisps!

Make a peer-to-peer payment. Gone halves on a pizza? There’s no need to whip out your wallet or share bank details – open your smartphone and pay your friend back by text.

How do SMS payments work?

But how does it all happen behind the scenes? Mobile carriers and service providers are key here. They ensure your customer’s money is taken securely from one account to the other. The beauty is in the simplicity, as you don’t need much more than your phone. See it as your wallet; your mobile carrier lets you pay wherever you want. So, why not consider SMS payments the next time you need a remote payment from customers? It’s as easy as sending a text – because that’s what it is!

The benefits of text-based payments

The burning question is, why go for SMS payments? We’ve put some of their main draws below, so read through and see if they work for you!

Convenience: Take and make payments with just your phone in hand. Just a simple text message, and you’re good to go!

Fast transactions: In today’s fast-paced world, speed is everything. SMS payments are lightning-fast. No more waiting in long lines or dealing with slow card machines.

Security first: SMS payments are highly secure. They often require verification codes or passwords, adding extra protection to your transactions.

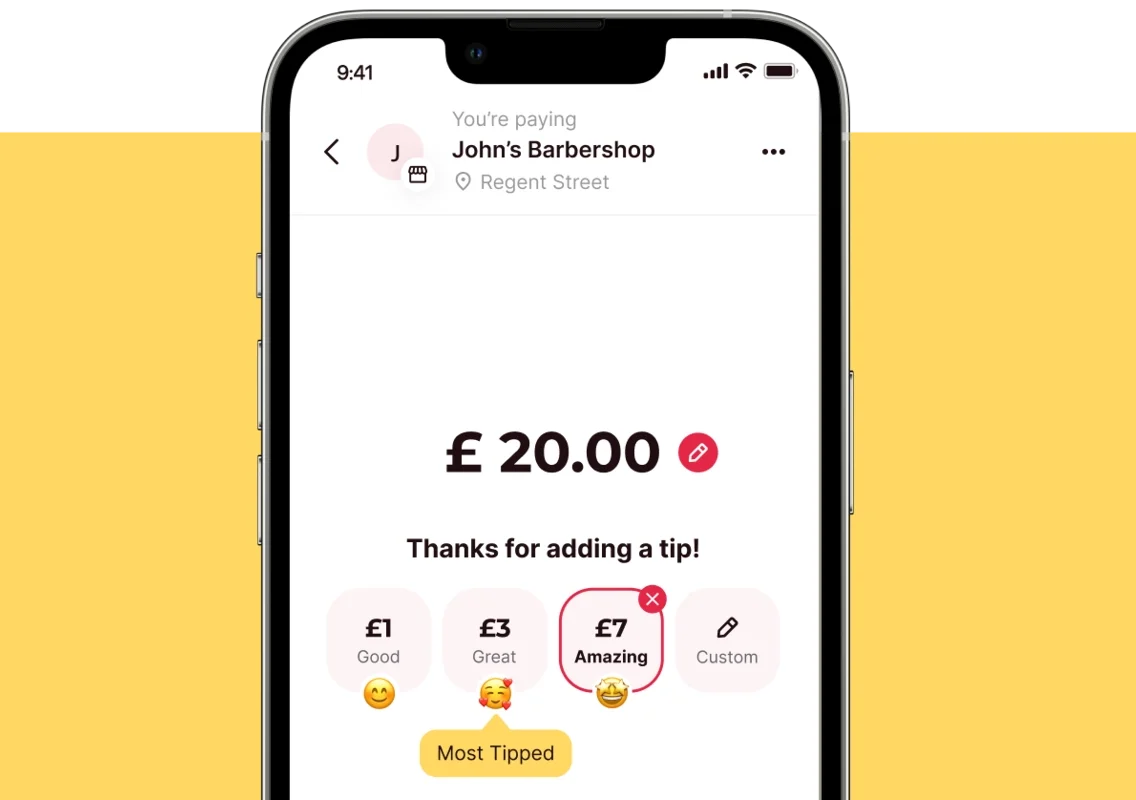

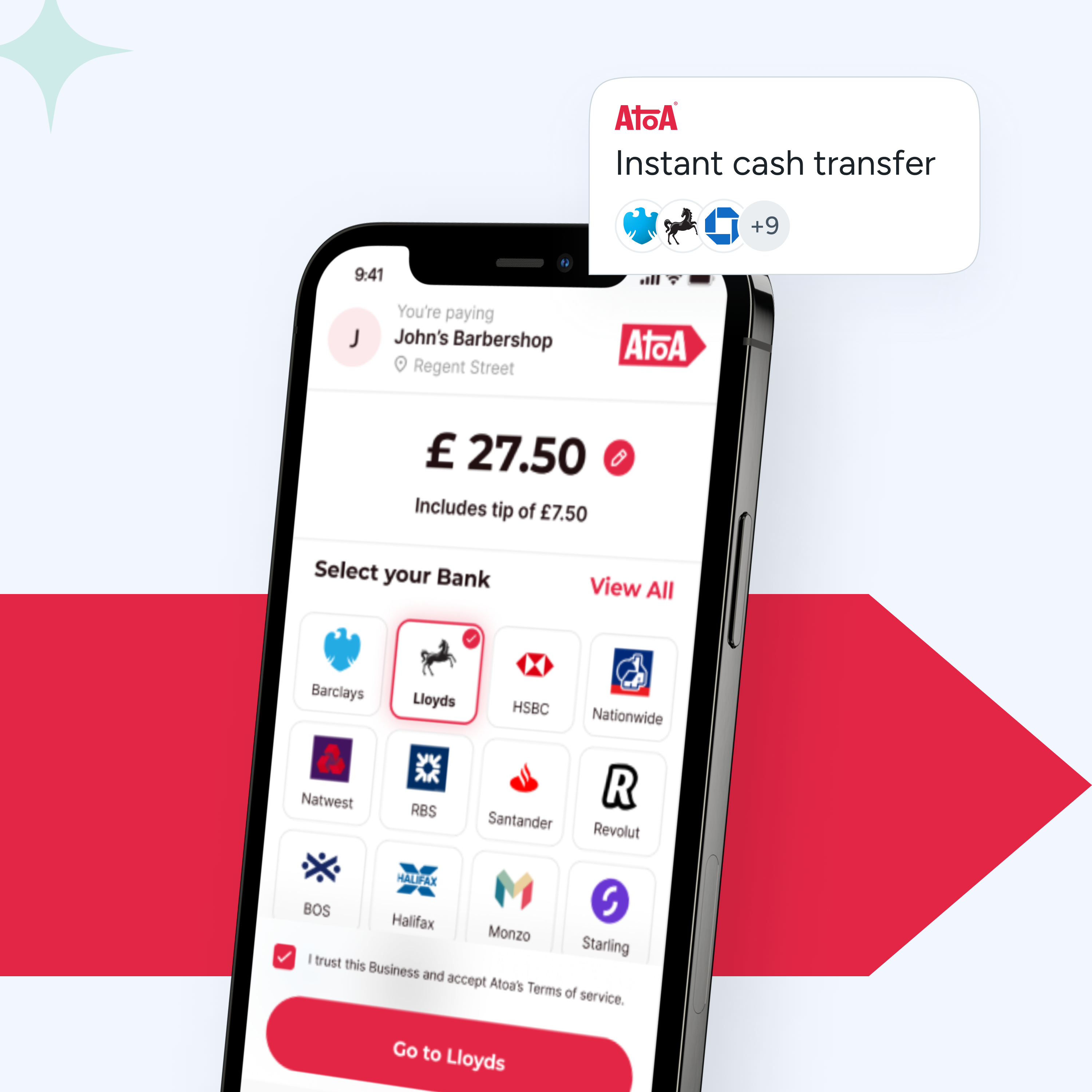

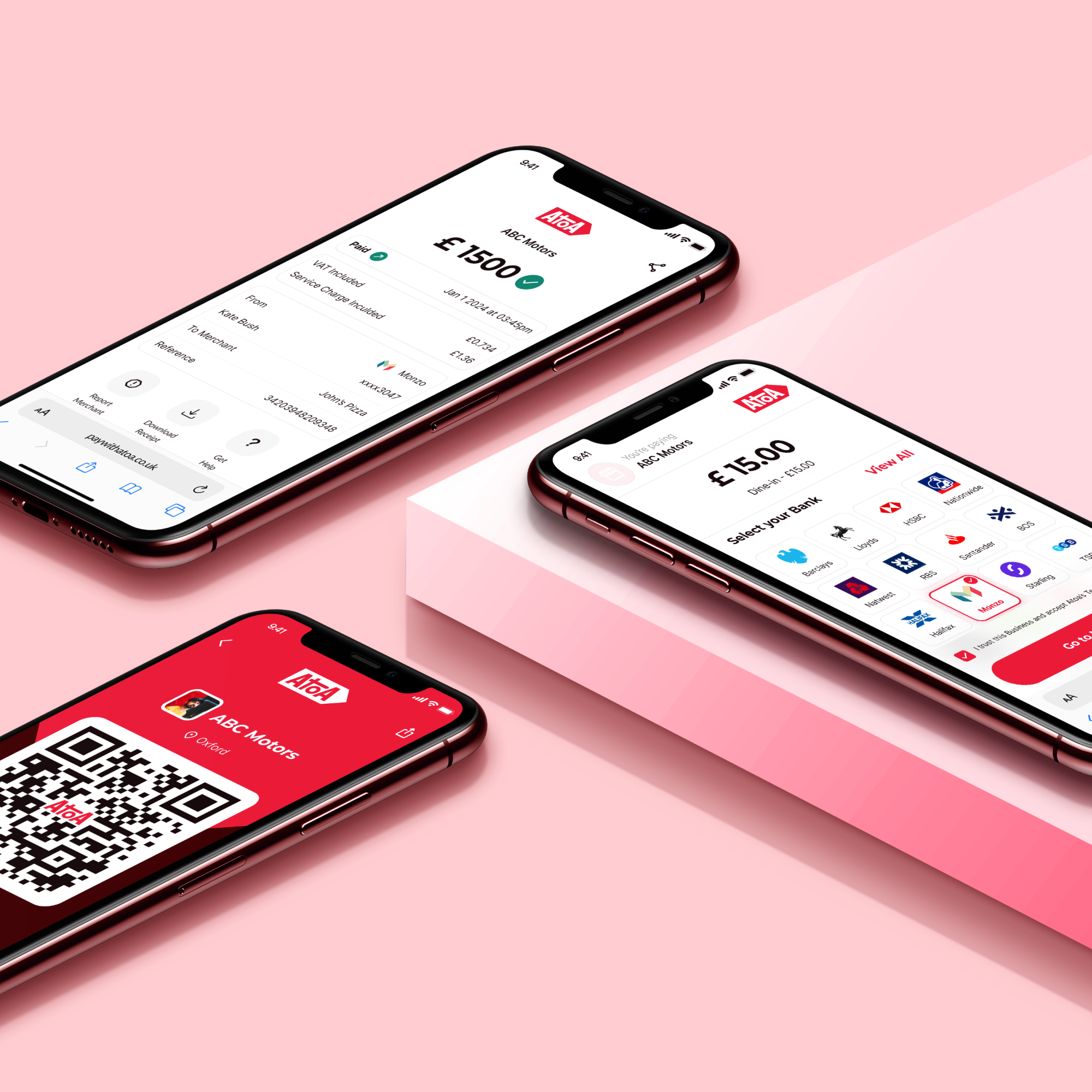

No extra apps: Customers don’t have to download an app to use Atoa payment links. They open the text, tap the link, and complete the payment in their browser and UK bank app.

Lower fees: SMS solutions will likely have lower processing fees than card payments, making them a budget-friendly choice.

In today’s fast-paced world, SMS payments have their finger on the pulse. They cater for our need for speed, security, and simplicity; making payments or transferring money with a quick text message can make all the difference in the world.

Getting started with SMS payments

We are big fans of payment links and recommend them as the number one SMS payment choice for businesses. If you’d rather set up Direct Carrier Billing (DCB) for your business, contact your mobile carrier to get started. But if payment links look like the right match, follow the steps below and trust us; when you’ve got the right provider, setting up SMS transactions is easy!

How to set up payment links

Choose a payment gateway

Select a provider that has payment link services, like Atoa. Bonus post: click the link for more information on how to send payment links using Atoa.

Create payment links

Create unique payment links for your products or services. For instance, a salon may have links for each treatment they offer.

Share links!

Share the links with your customers via SMS, email, invoices or social media. You can text a payment link before shipping goods or take upfront deposits for large amounts.

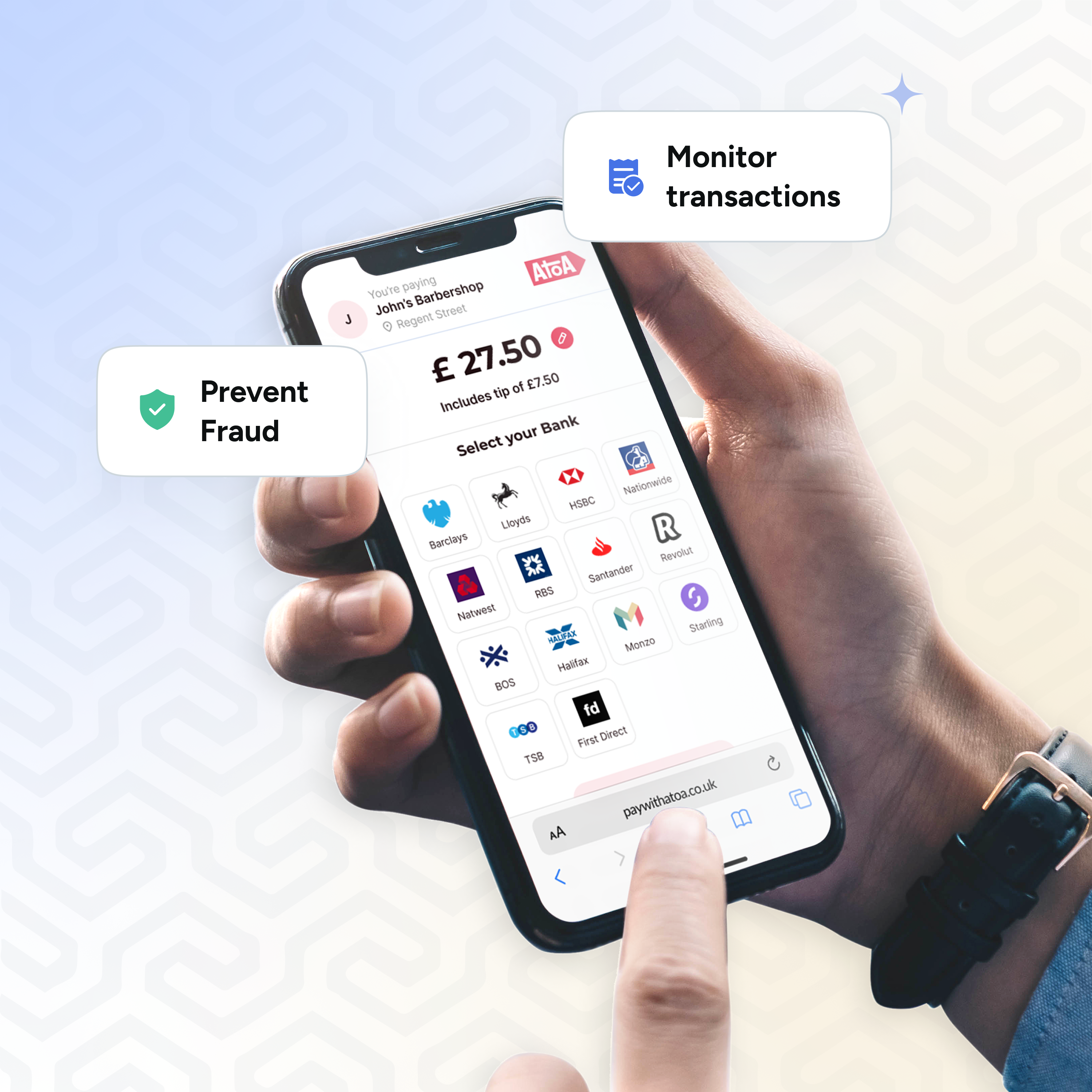

Security is a top priority in SMS payments, and several measures are in place to safeguard your transactions. Here are some key security measures and common concerns:

Keeping your payments safe and secure

Like most payment solutions, SMS data is encrypted during transmission to keep sensitive information confidential. Most SMS payment providers also add an extra layer of protection with two-factor authentication, which asks users for a verification code or PIN to complete transactions.

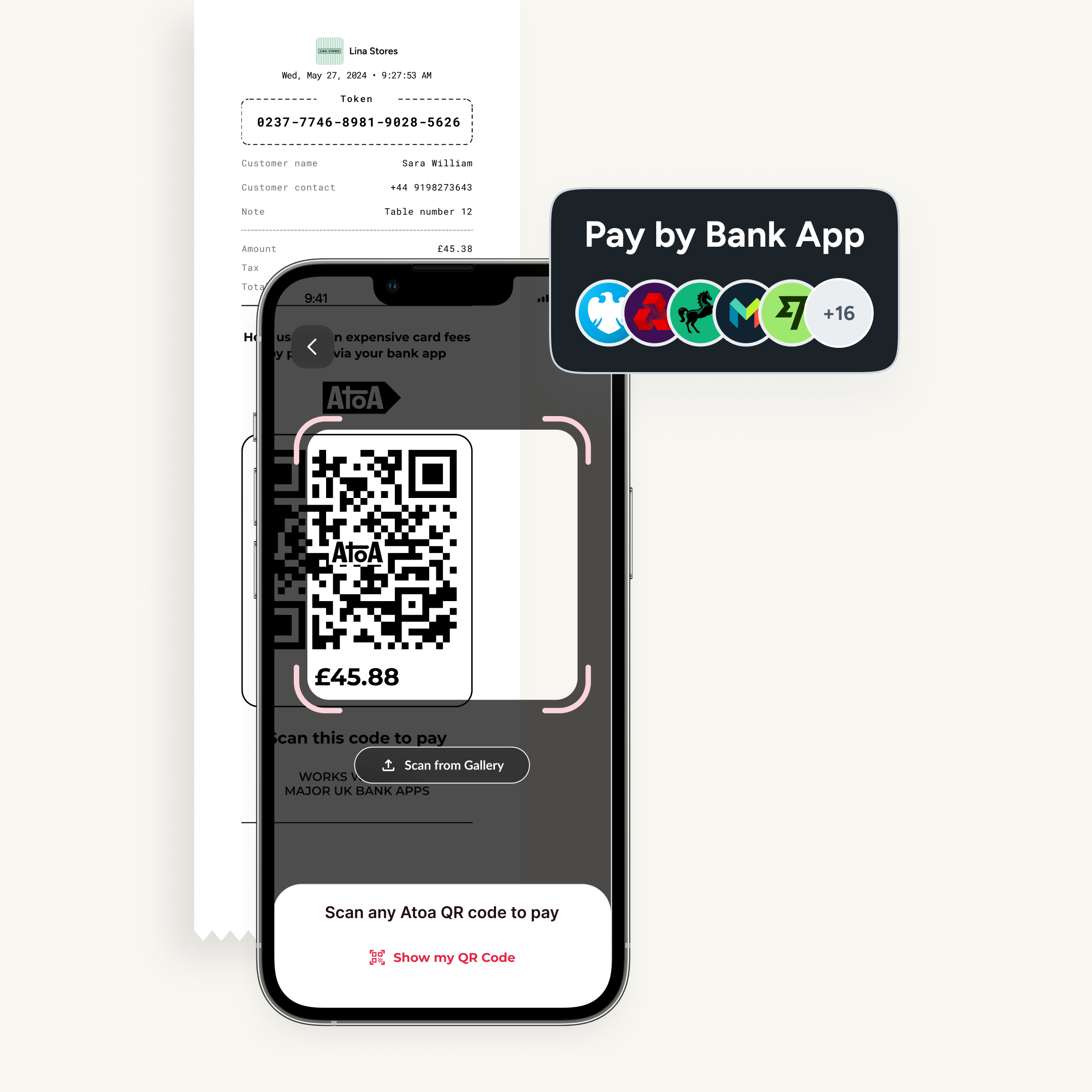

Tokenisation may be used to replace payment information with, you guessed it, tokens, which reduce the risk of exposing sensitive data during transactions.

Customers may also need to confirm their identity with biometric security such as a face or fingerprint scan. Because Atoa makes payments inside the customer’s banking app, all our transactions use this feature to combat chargeback and fraud.

SMS security checklist

Phishing and smishing: They may sound fun, but they’re not! It’s a phrase used when fraudsters send SMS messages pretending to be payment services. Avoid this scam by only clicking on links that you trust.

Lost or stolen phones: Someone could access and misuse the SMS payment method if a phone is lost or stolen. Add 2FA and lock your payment apps with a face or fingerprint ID.

Unauthorised access: Weak PINs or passwords are like leaving your door unlocked and can lead to unauthorised access. Best bet? Follow the same precautions as above.

Malware and viruses: Malicious software on a user’s device could cause problems. Stay alert to scans and regularly update devices to download the latest security patches.

Businesses should implement robust security protocols, update their systems, and educate customers about the risks and safe practices associated with SMS payments so they remain a safe and convenient way to make transactions. If you want to learn more about data security protection, here’s your chance.

So that’s SMS payments in a nutshell…or a brief blog post. If you think SMS payment links sound wise for your business, why not call Conor? Book in for a live product demo to find out how Atoa can bring you instant payments with crazy low fees. Don’t forget: you get 7 days of free transactions when you set up your account on the Atoa app. Don’t sleep!