Green banking does what it says on the tin: it puts environmentally responsible and sustainable practices first. Gone are the days of excessive paper statements and banks pumping funds into businesses that harm our environment. Like many products and industries, sustainability is at the heart of finance’s future.

This article will discuss the following:

- The basis of sustainable banking practices

- Why conscious banking matters to businesses and consumers

- What green banks, products and services are available out there

- The benefits these services hold for our planet

So, what is green banking?

It’s a good question. Although green banking is increasing, not everyone knows what it is.

This thoughtful type of banking can come in all shapes and sizes but may include heavily investing in businesses that promote renewable energy, environmentally friendly agriculture, and other conscious practices. We’re talking about banks who always put the planet first with paperless services and much more.

Maybe the bank has gone the extra mile by achieving a B Corp Certification. This means the non-profit B Lab has vetted them to meet high social and environmental performance standards, transparency and accountability.

Some of the leading green banking companies in the UK include:

- Triodos Bank is a certified B Corp that invests in projects that align with its sustainable values. It offers a variety of sustainable banking products, including current accounts, savings accounts, and loans. It ranks first in Statista’s report on the sustainability of selected banks and building societies undertaken in 2021.

- The Co-operative Bank is a mutual bank committed to social and environmental responsibility. It invests in businesses that benefit society and the environment and offers a range of sustainable banking products.

- Nationwide Building Society is one of the largest building societies in the UK and ranks second in Statista’s report. This bank is committed to environmental sustainability and offers a range of ethical banking products.

- A digital bank, Aspiration Bank invests in companies making a positive difference in the world with a range of sustainable banking products.

What green and ethical banks do

The financial sector can promote a more sustainable economy by adopting green banking practices.

Their accounts, products and services may reward customers for making sustainable purchases. Sustainable finance services should aim to reduce the environmental impact of their operations and encourage investment in sustainable businesses and projects.

How these banks use their money matters. Ethical banks may invest in businesses committed to social and environmental responsibility, such as those that pay fair wages, operate in environmentally friendly ways like going paperless, and support ethical practices. Consciously-minded banks may donate to community charities and support local businesses.

Why should I care about green banking?

There are many reasons you should care about green banking, and here are just a few. Green banking helps you align your finances with your environmental values by investing in businesses and projects committed to sustainability. This can reduce the environmental impact of your overall financial footprint.

When you choose a green bank, you support businesses making a positive environmental difference. This can nurture a market for sustainable goods and services, encouraging more businesses to adopt mindful practices. The financial sector significantly impacts the environment and must work towards a more sustainable future. Therefore, the wider industry can help promote a more conscious economy by adopting green banking practices.

Green banking lets you make informed choices about where your money is invested. Knowing that you support businesses making a positive environmental difference helps you feel more confident about your financial decisions.

Green banking products in the UK

Here are some examples of green finance services and how they can make a difference.

Everyday ‘green’ current accounts provide a range of benefits for environmentally conscious customers, such as carbon offset credits and discounts on renewable energy products.

Make your mortgage mindful. Green mortgages are specifically designed for customers who want to finance the purchase of a home that is energy-efficient and environmentally friendly.

Pension plans that invest in sustainable businesses and projects may offer higher returns than traditional options.

Loans to help finance renewable energy projects by reducing fossil fuel use and help combat climate change.

Savings accounts that invest in businesses committed to sustainability can help channel capital into more environmentally sound causes.

Credit cards to reward customers for making sustainable purchases, encouraging people to adopt eco-friendly habits.

In addition to these direct benefits, green banking can help create a more sustainable mindset. When people see that their financial institutions are committed to sustainability, it can inspire them to be more focused on the planet. This can lead to a ripple effect of positive change as more people choose sustainable practices.

Frequently asked questions about green banking

Why is green banking different to traditional banking?

Green banking focuses on environmentally sound practices and supports eco-friendly initiatives. Green banks differ from traditional banks by putting these elements at the forefront of their operations.

How can I add green banking practices to my finances?

You can choose banks with environmentally conscious policies, opt for paperless statements, and explore sustainable investment options.

How do banks promote environmental sustainability?

Banks across the globe are trying to reduce carbon footprints. Many are investing in renewable energy projects, and ensuring eco-friendly practices are at the heart of their operations.

The takeaway

Overall, green banking is a powerful tool that can help to create a more sustainable future. You can make a difference in the environment and your life by choosing a green bank.

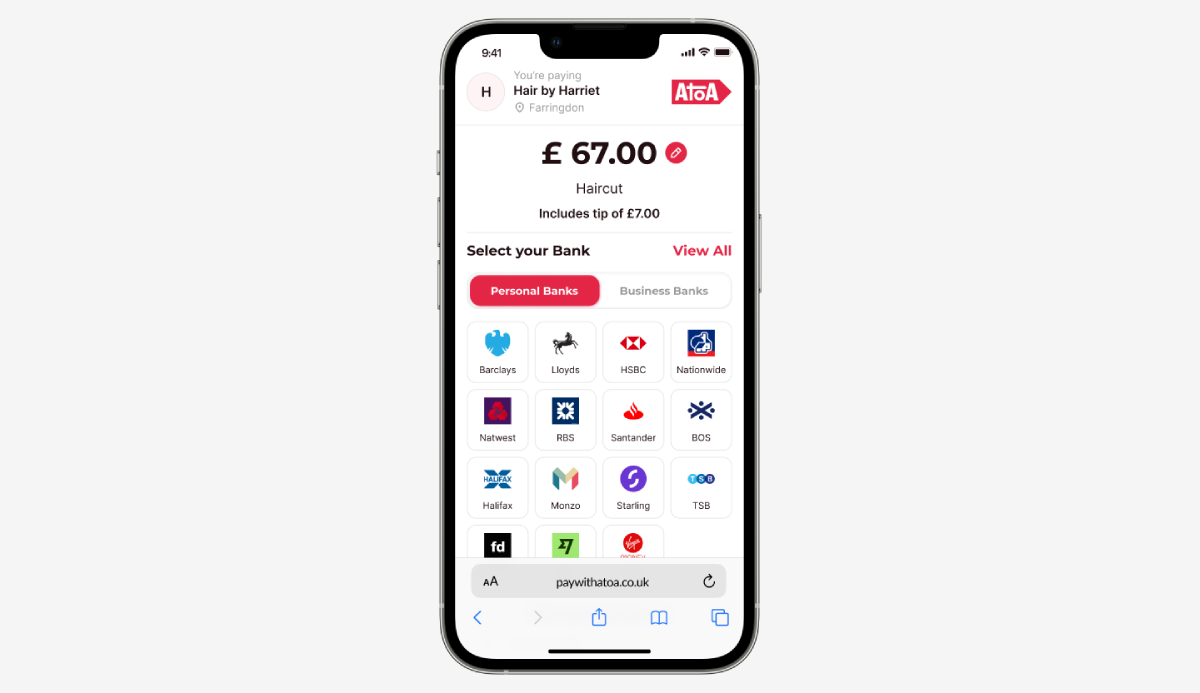

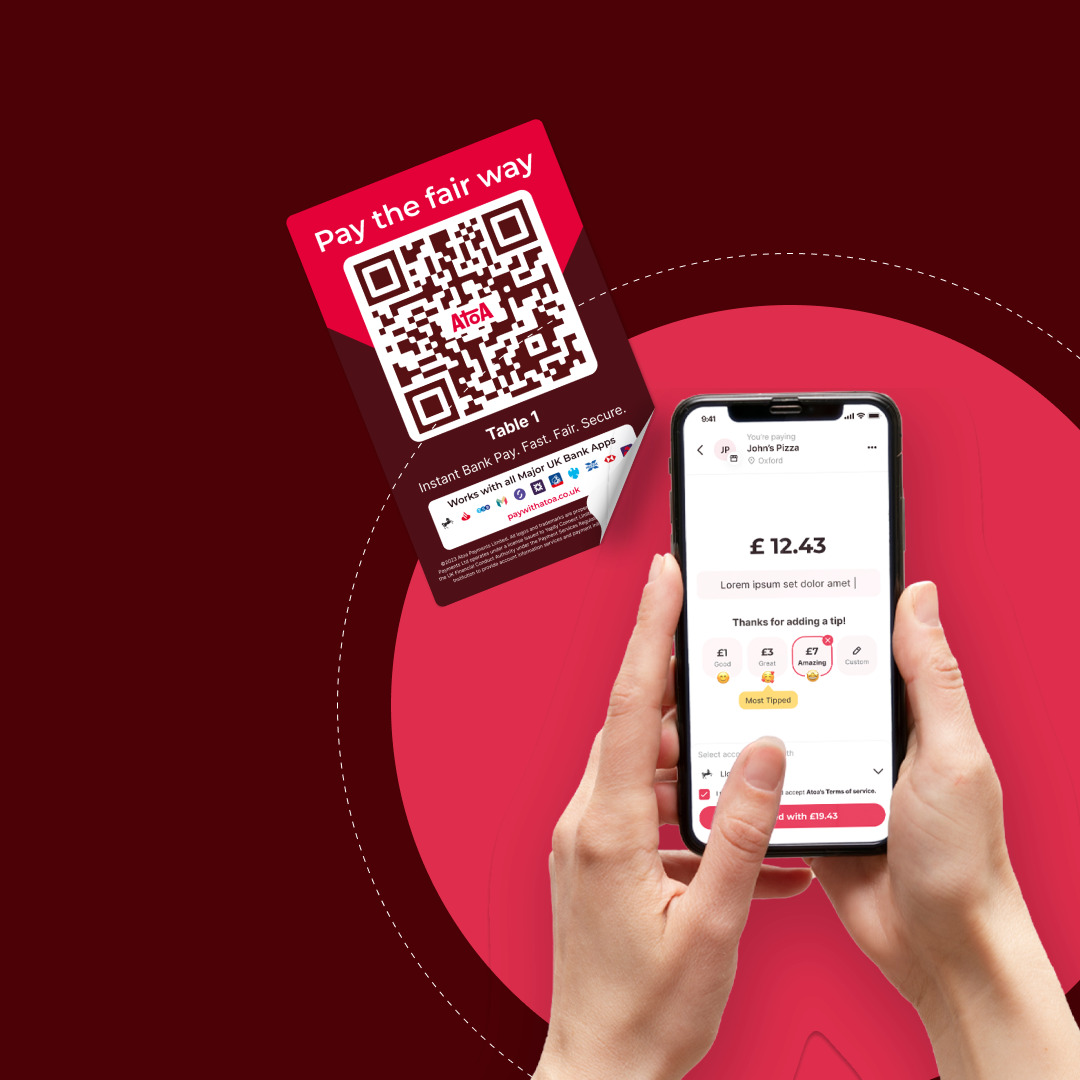

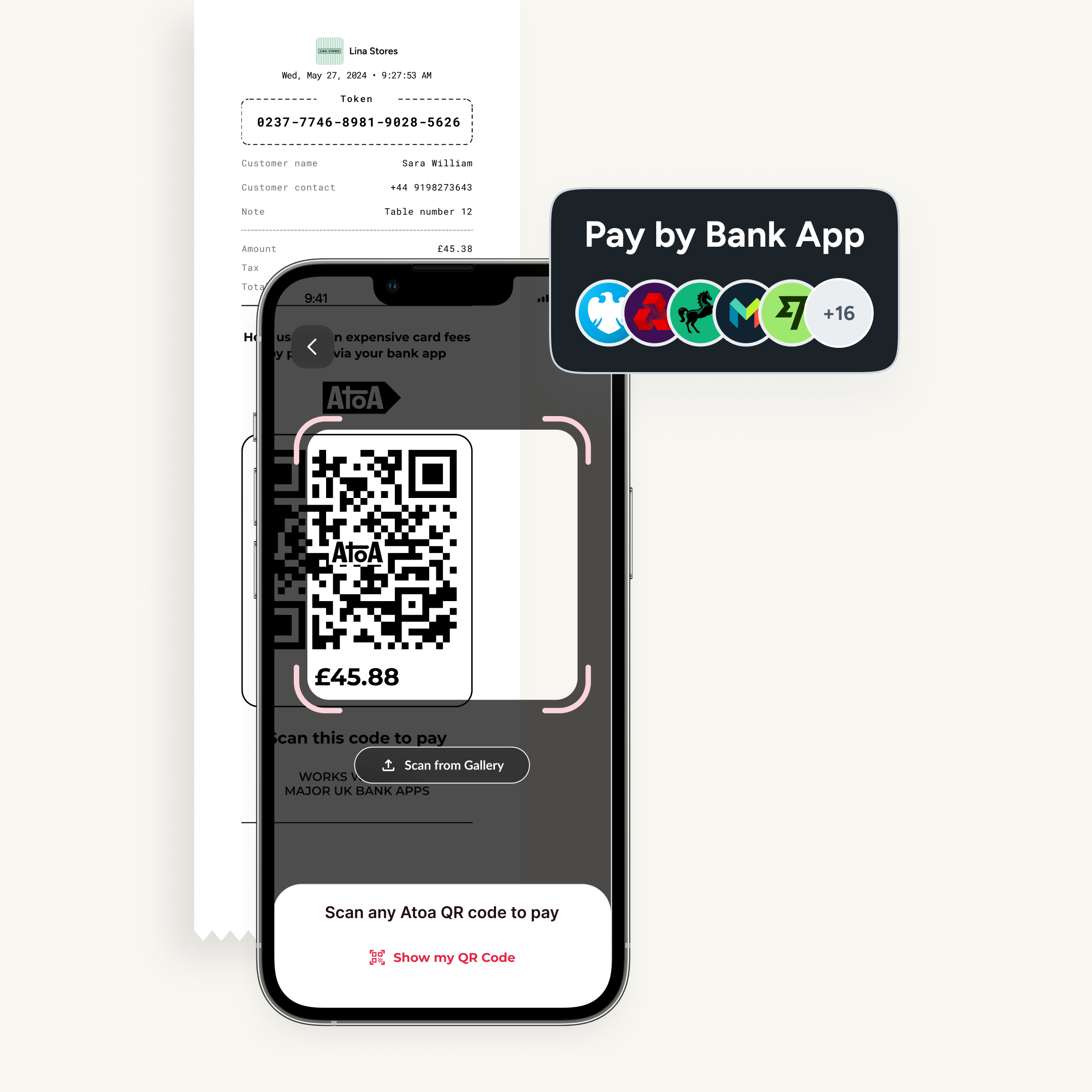

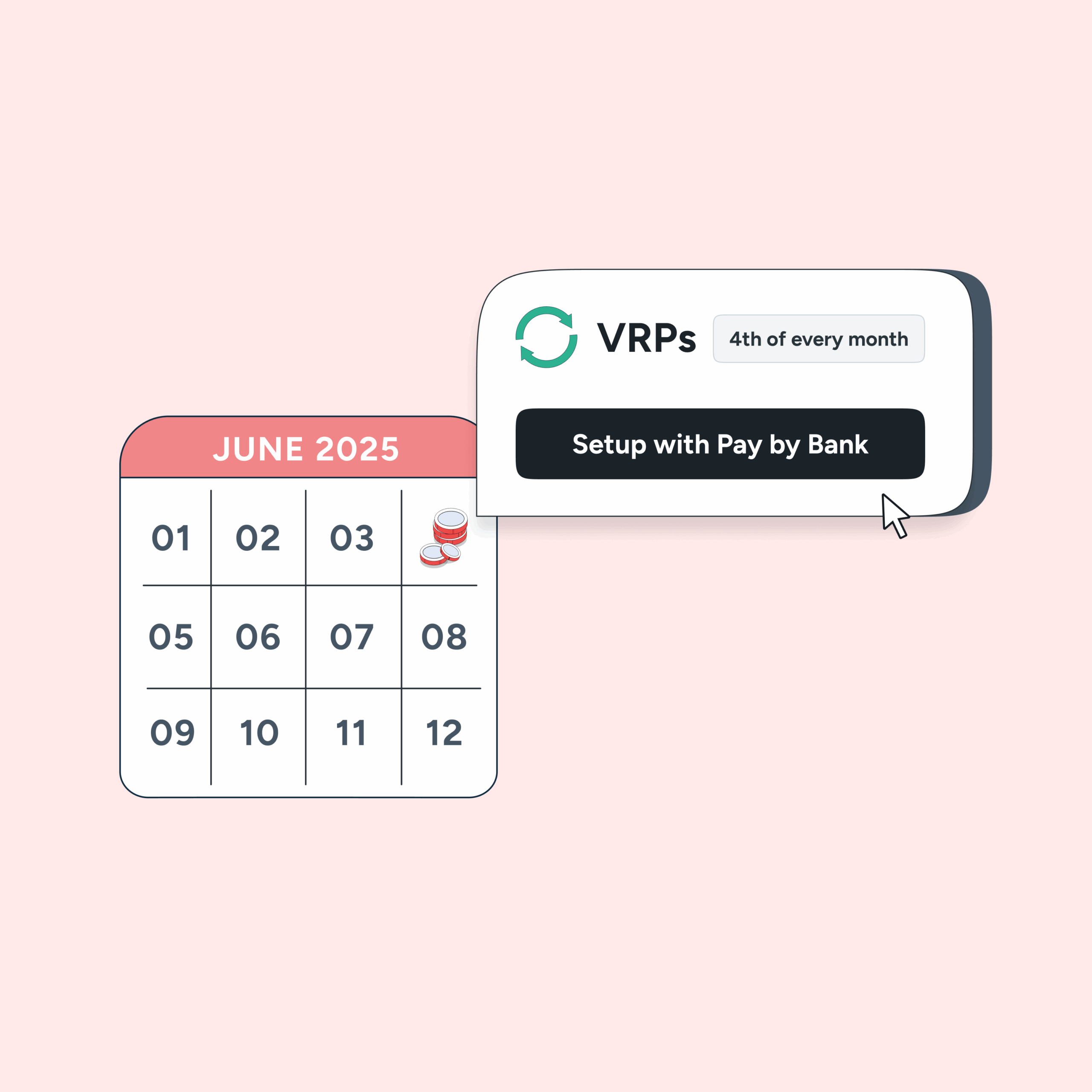

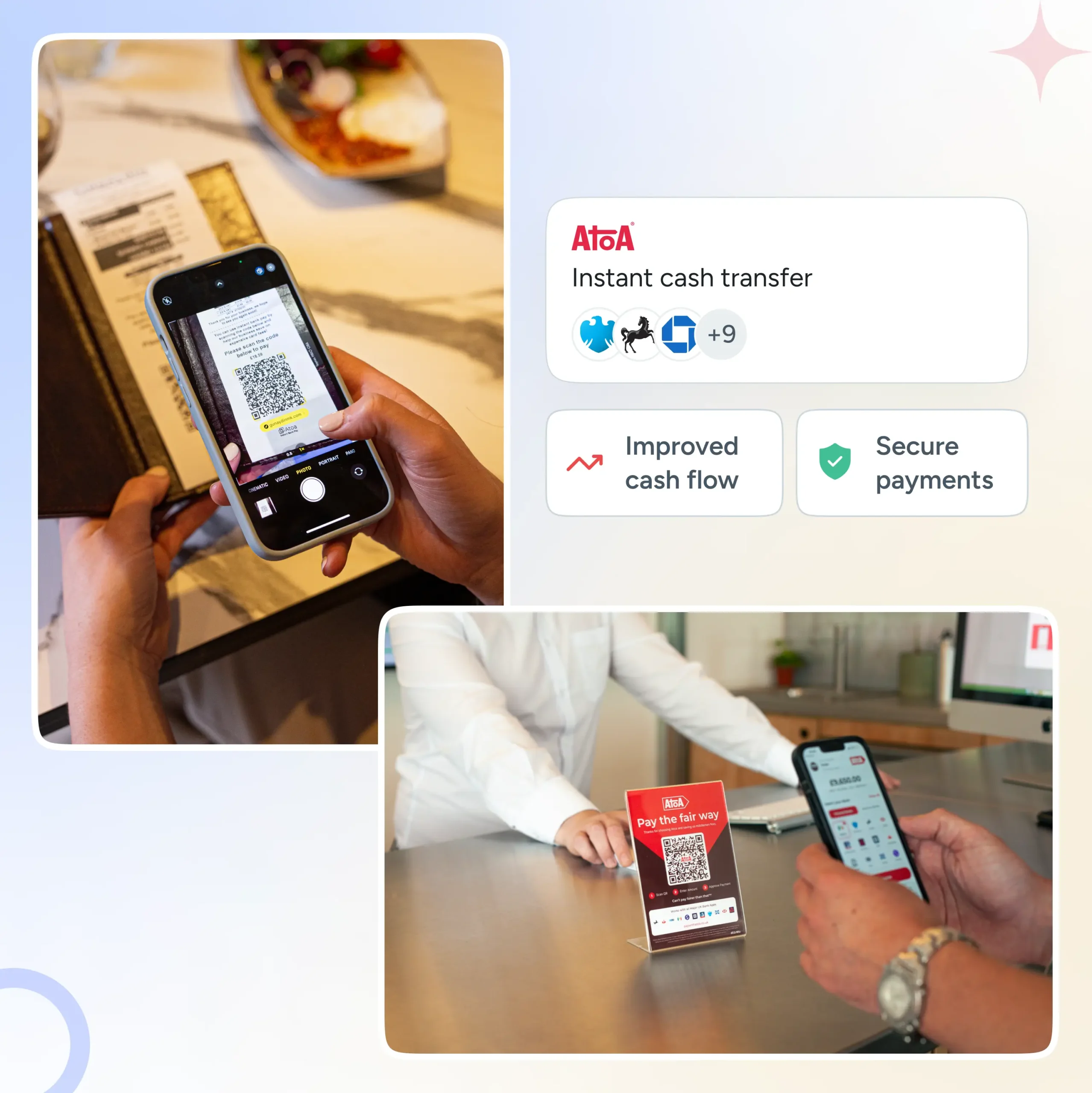

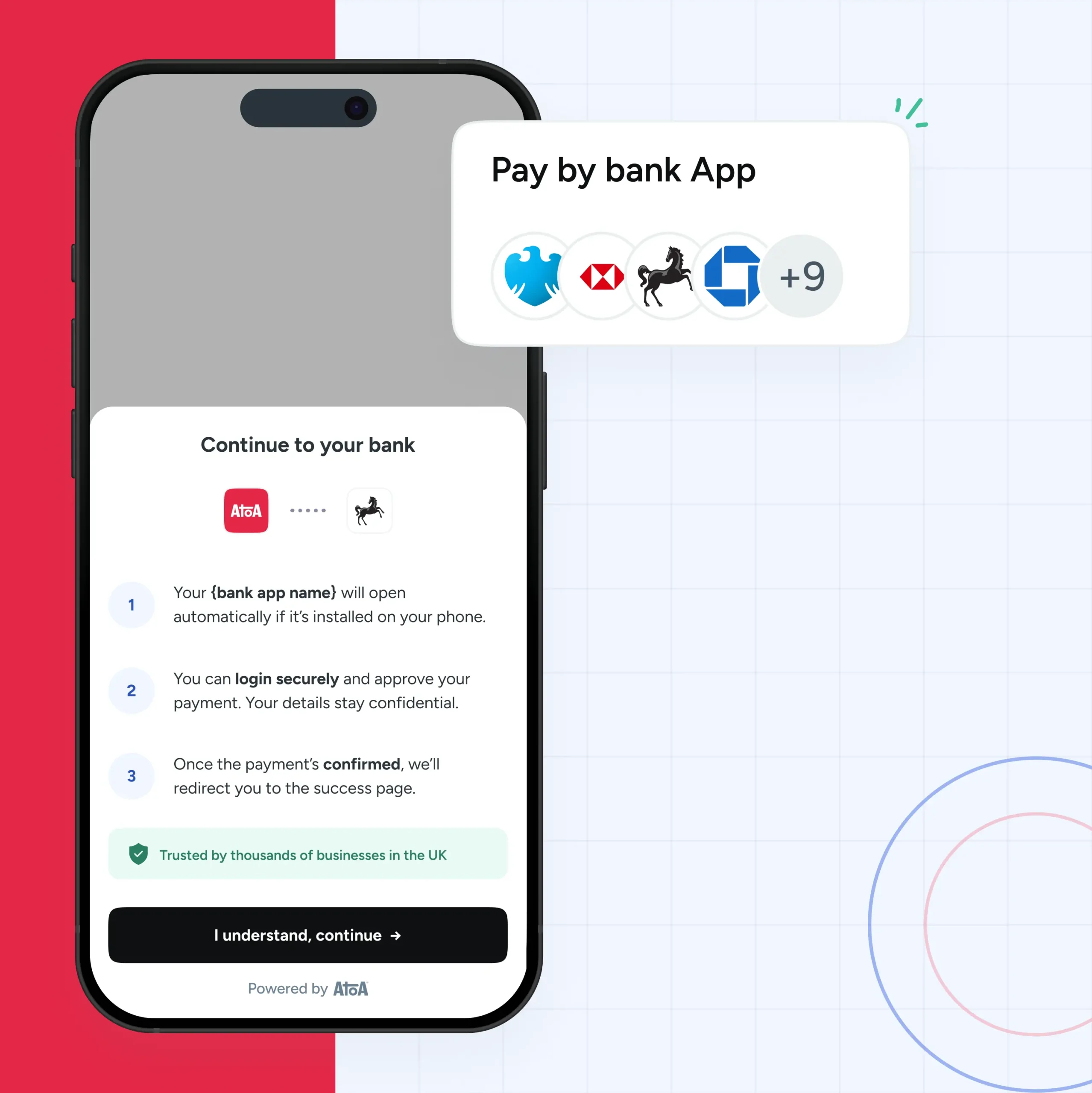

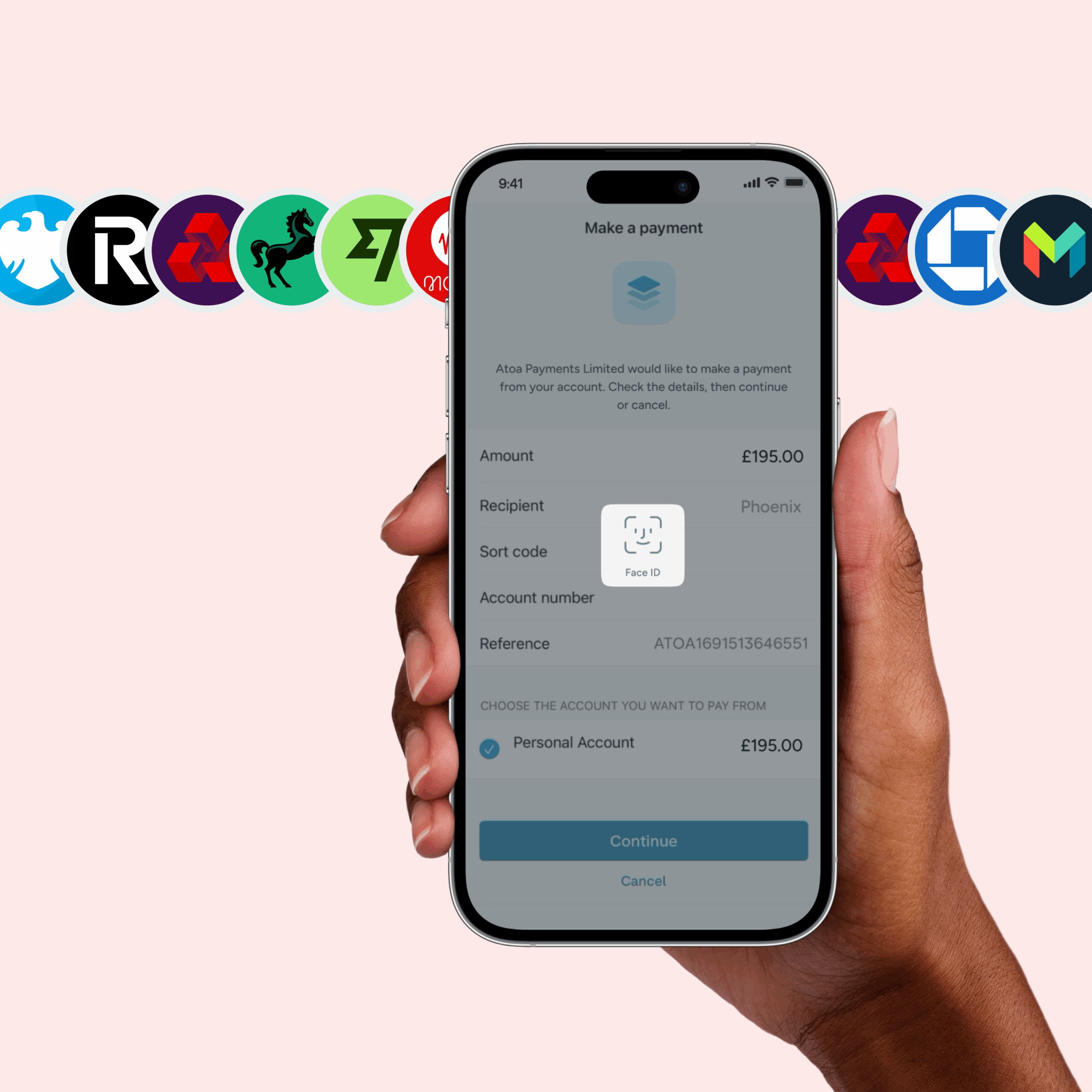

Atoa is committed to sustainable banking. We’re a digital instant bank pay app that lets you get the most out of your business. No paper receipts over here! Follow the banner below or visit your smartphone’s app store to try our app and get 7 days of fee-free transactions on us.