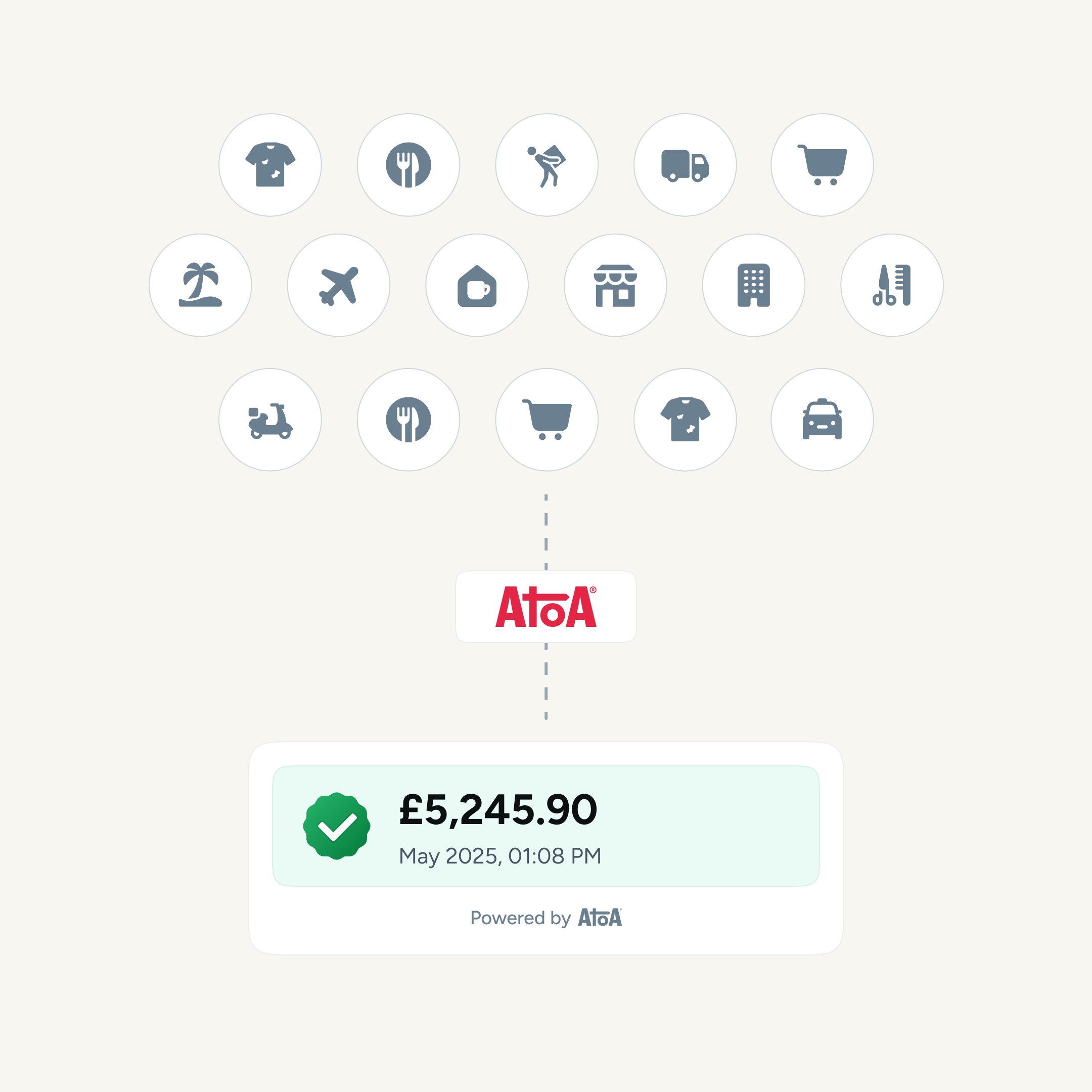

In the ever-evolving world of online transactions, account-to-account (A2A) payments are a force to reckon with. Also known as bank-to-bank or direct account payments, A2A payments are changing how money moves between bank accounts. They establish a direct path for transactions that sidestep credit card companies and payment processors. In the world of payments, the future is Account-to-Account (A2A). Forget about the hassle of card networks and their fees – these payments act as a direct route between bank accounts, making transactions smoother, faster, and more cost-effective for everyone involved.

This article explores the advantages, convenience, and security of A2A payments.

How do A2A payments work?

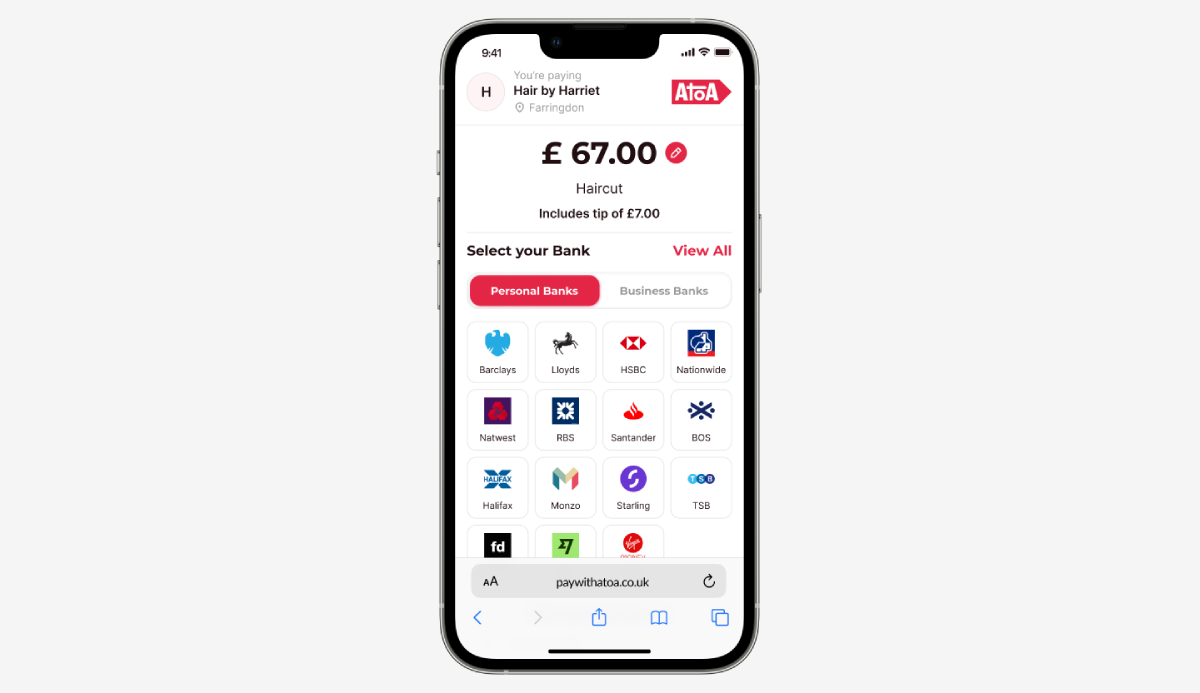

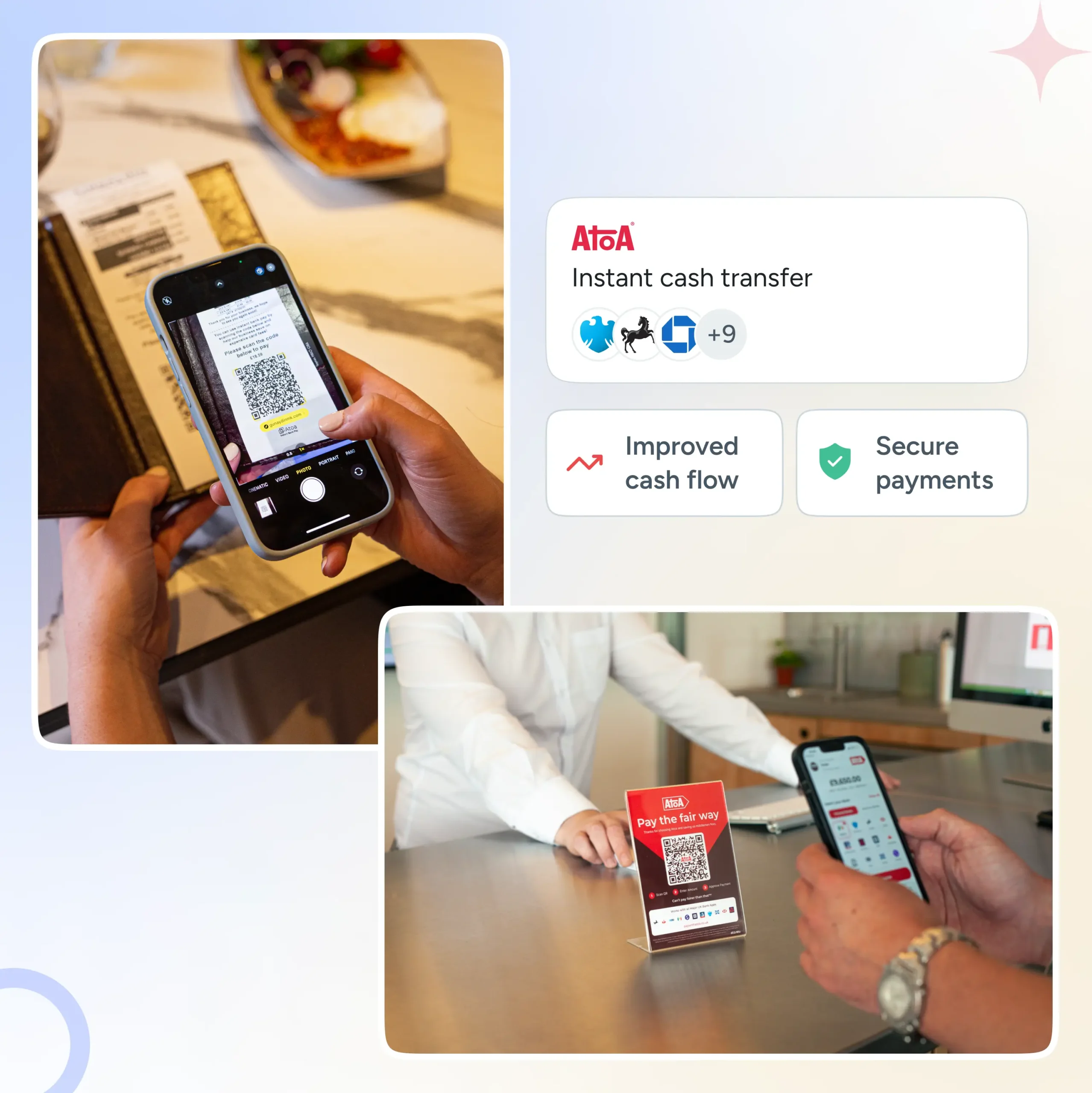

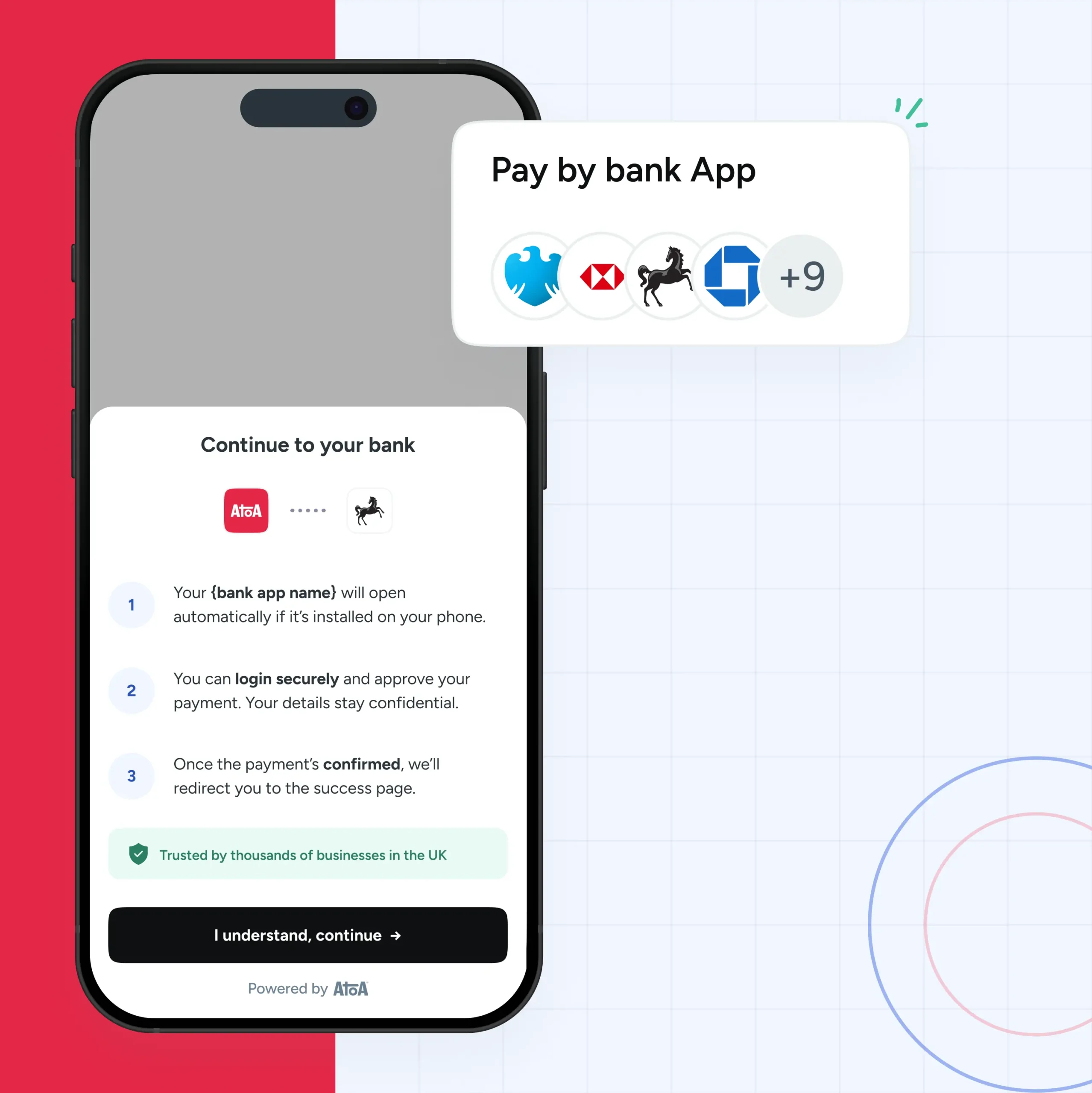

A2A payments cut out the middleman to place effortless money transfers at your fingertips. Instead of relying on card networks, money moves directly from one bank account to another. This means no more card processing fees, no more waiting for settlements, and no more security risks associated with card details. You can send or request money between bank accounts in seconds, eliminating the need for card processors and the charges that come with them.

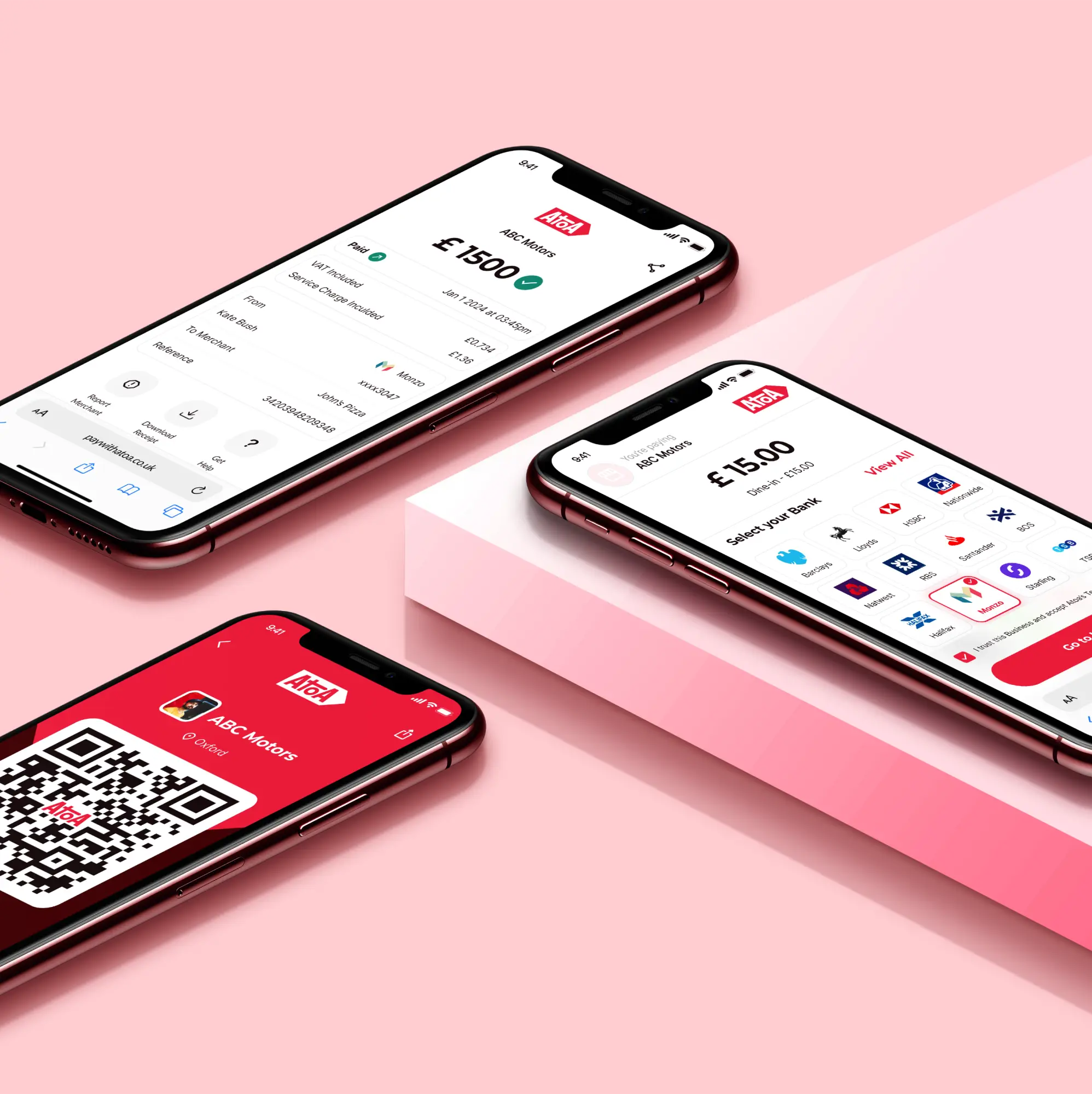

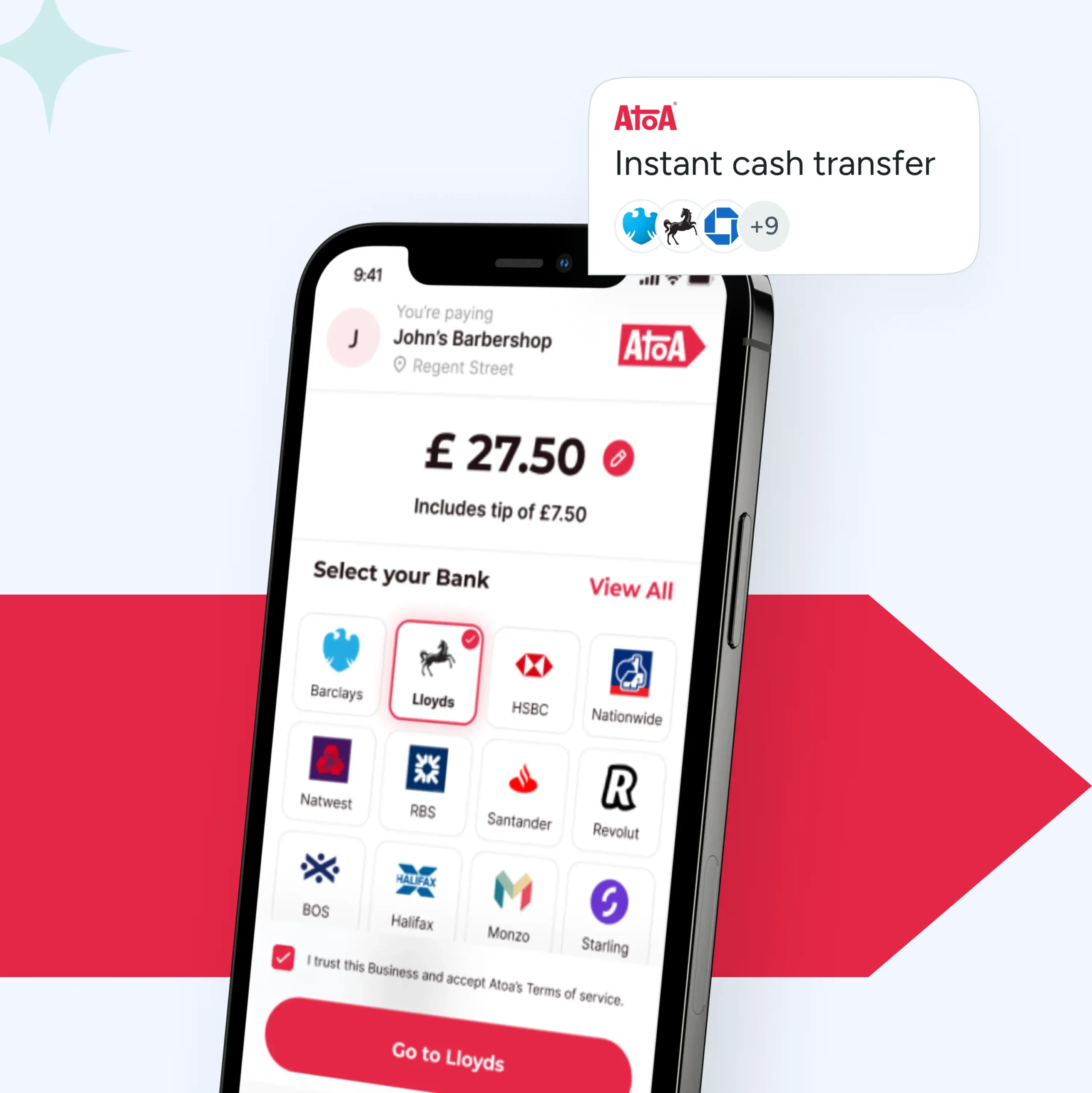

A2A payments conduct transactions conveniently through mobile banking apps, removing the need for debit cards. Methods are flexible; for instance, you can take payment away from the till by scanning a QR code.

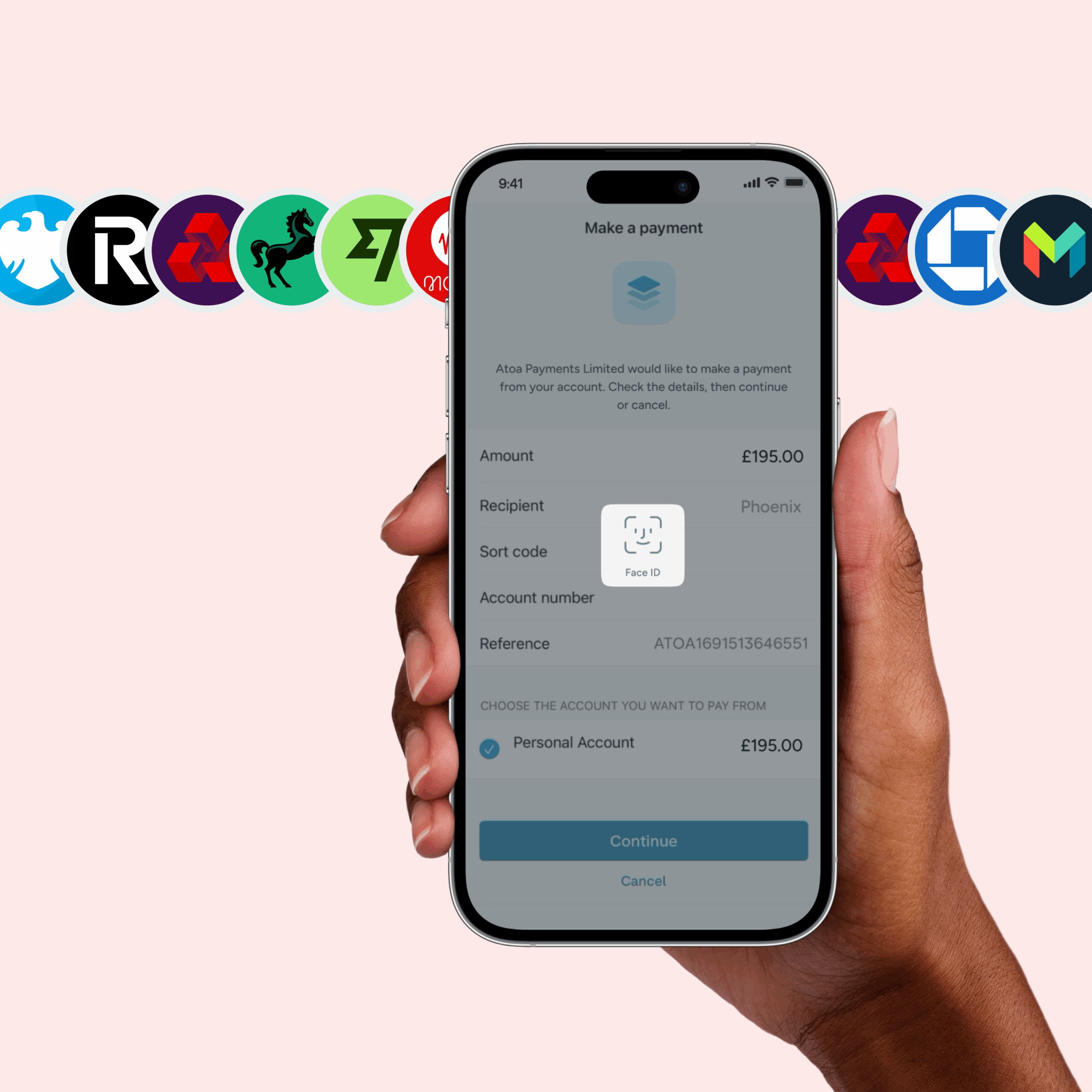

Picture this: A customer completes their purchase, and instead of reaching for their wallet, they authorise a payment through their banking app. That’s it. No more entering long card numbers or worrying about lost cards. A2A payments are the epitome of convenience and security.

Are A2A payments secure?

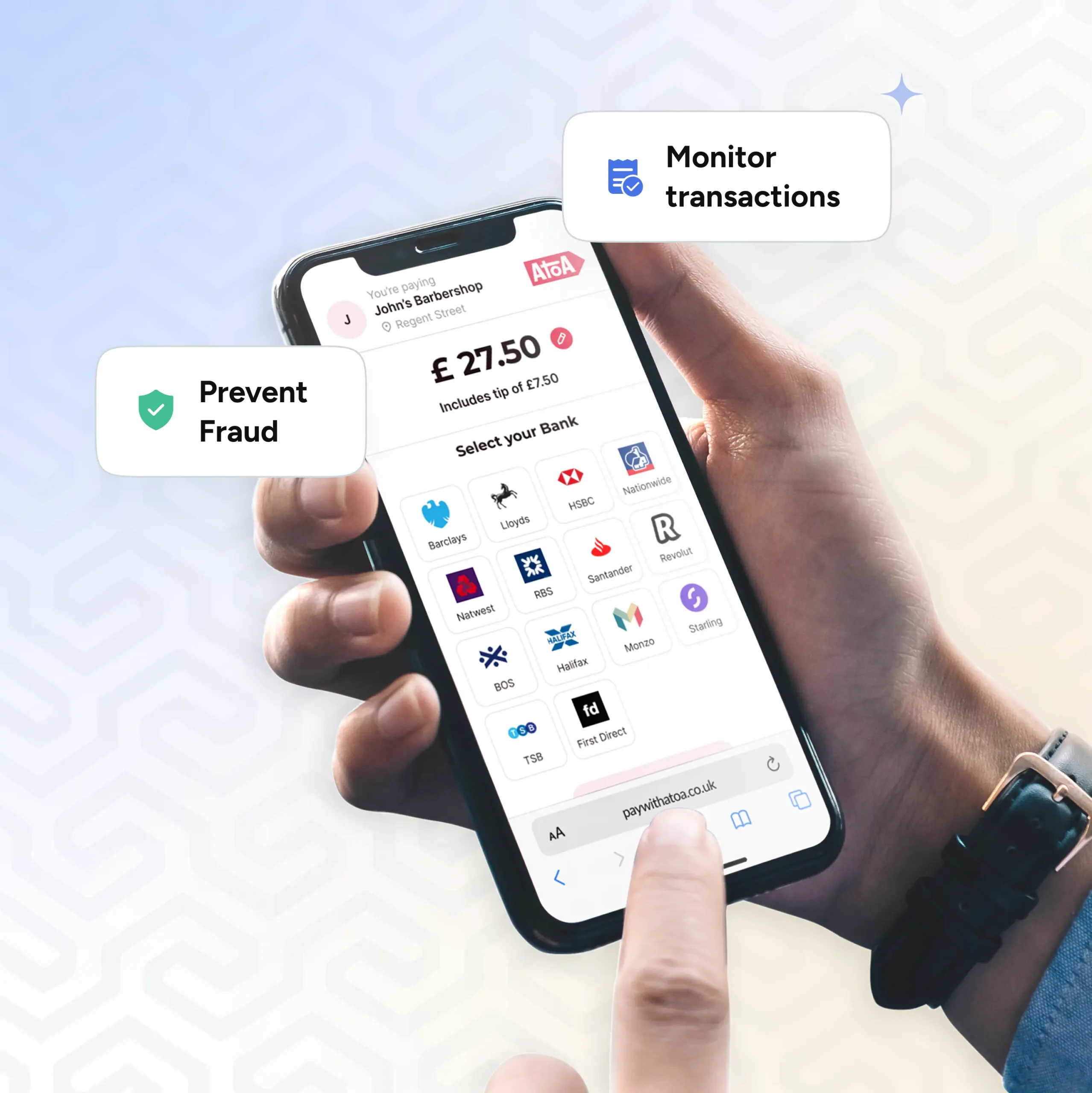

By leveraging the security measures of your banking app, A2A payment security is unique to the customer, ensuring heightened protection against fraud and unauthorised purchases.

Efficient payment options

By bypassing intermediaries, A2A payments save businesses the time and costs that come with card processing fees, giving you more money for your hard work. Check our pricing calculator to find out how much your business could save.

How do merchants benefit from A2A payments?

Merchants can enjoy many benefits from account-to-account payments, including:

Reduced costs: Compared to card payments, A2A payments have lower transaction fees. They remove unfair expenses like merchant service charges, card terminal hire and chargeback costs.

Instant settlement: A2A payments in the UK are delivered promptly through the Faster Payment Service (FPS), ensuring quick access to funds.

Enhanced security: A2A payments boast multi-factor authentication, upping protection against payment fraud for consumers and businesses.

Streamlined user experience: Open banking payments eliminate the need for lengthy card details, allowing customers to make payments using fingerprint or face ID authentication effortlessly. No more frantic dashes to an ATM in the rain!

Integrates like a dream: Easily add to your POS to use QR codes on receipts or payment kiosks throughout your location. Request funds remotely with links.

No chargebacks: Without card networks, open banking payments remove the complex and time-consuming chargeback process. This saves businesses valuable time and costly payouts.

Increased fraud protection: By eliminating card rails, open banking payments reduce the risk of card-not-present (CNP) fraud.

The takeaway

As a direct and secure method to transfer funds between bank accounts, A2A payments have already revolutionised online banking. Merchants can fully embrace their convenience and cost-effectiveness with Atoa Business, unlocking seamless financial transactions.

But it’s not just merchants who benefit! Mindful shoppers can also support local businesses by choosing A2A payments.

Why? Because it saves your local traders money by avoiding costly card fees.

Why not give it a try? As a token of appreciation for choosing us, enjoy 7 days of fee-free transactions. After that, you’ll only be charged a starting rate of 0.7% per transaction, billed monthly, dropping with higher volumes.

If you’d like extra help getting started with Atoa, don’t hesitate to book a demo with our team today!

You might want to check out some of this related content: