You win!

Are you curious about the latest payment methods that are revolutionising financial services? Look no further than open banking. This game-changing technology is shaking up the instant payment world and offering new methods for merchants and consumers. Atoa is making strides in this area by cutting unnecessary steps to simplify your payments and make them much cheaper than taking cards. Innovative services use account-to-account payments (A2A) to send money directly from one bank account to another. Hopefully, this article will help you understand how open banking can help your business win the payments game…

Open banking vs card payments: where to begin?

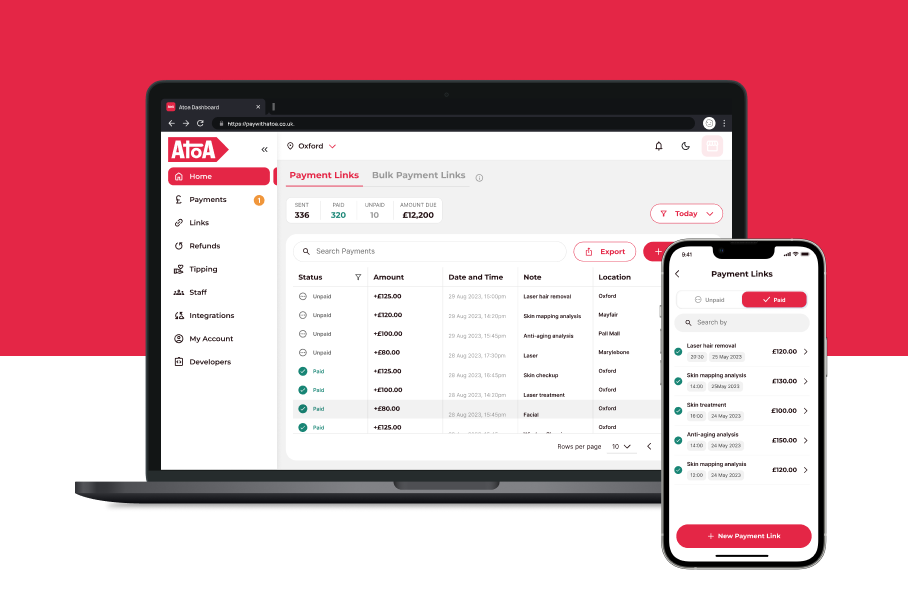

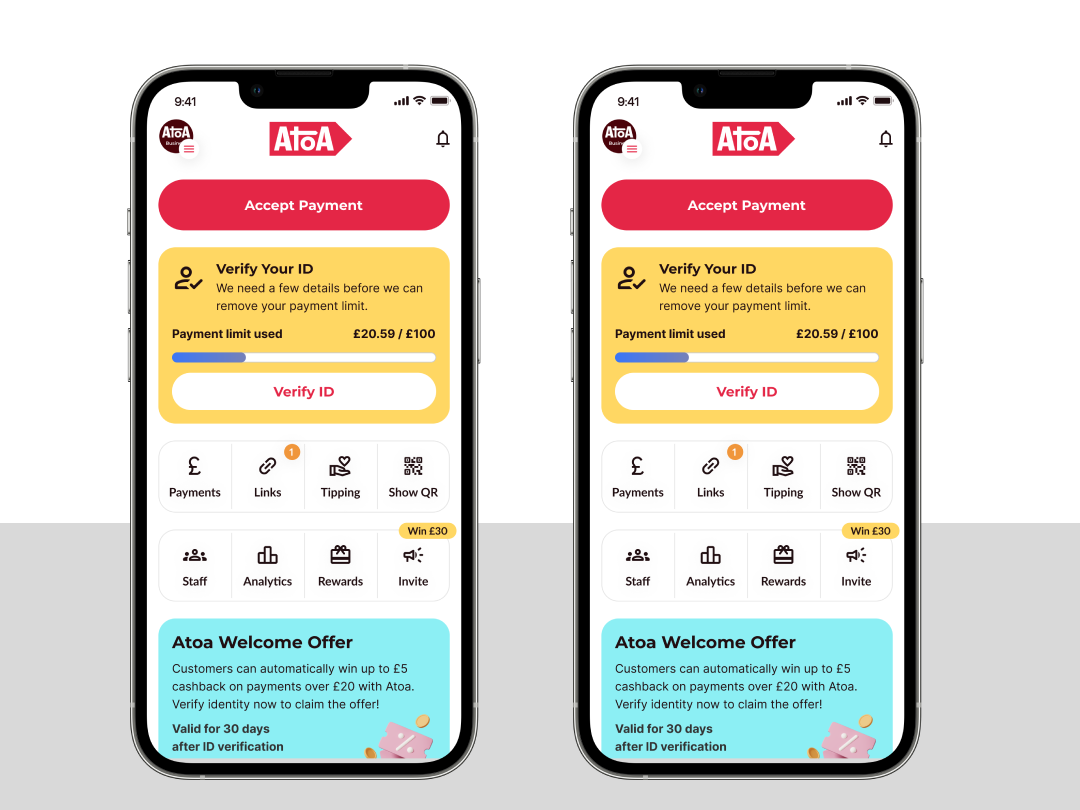

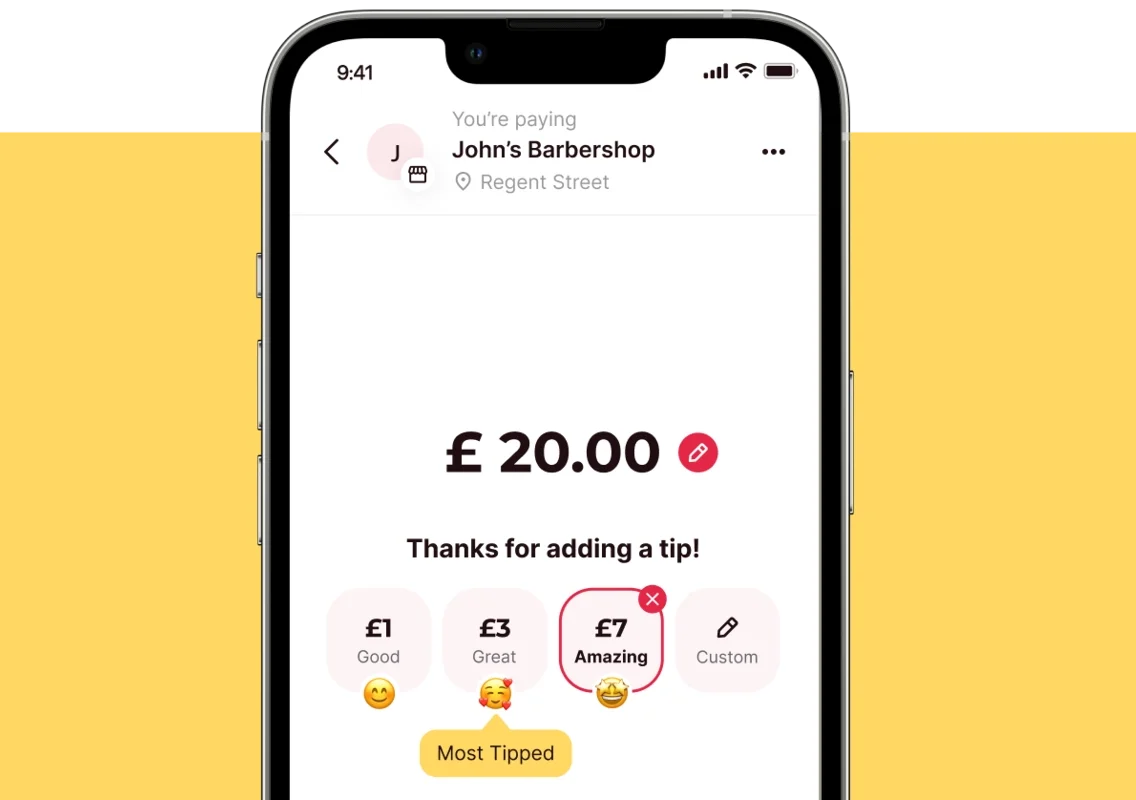

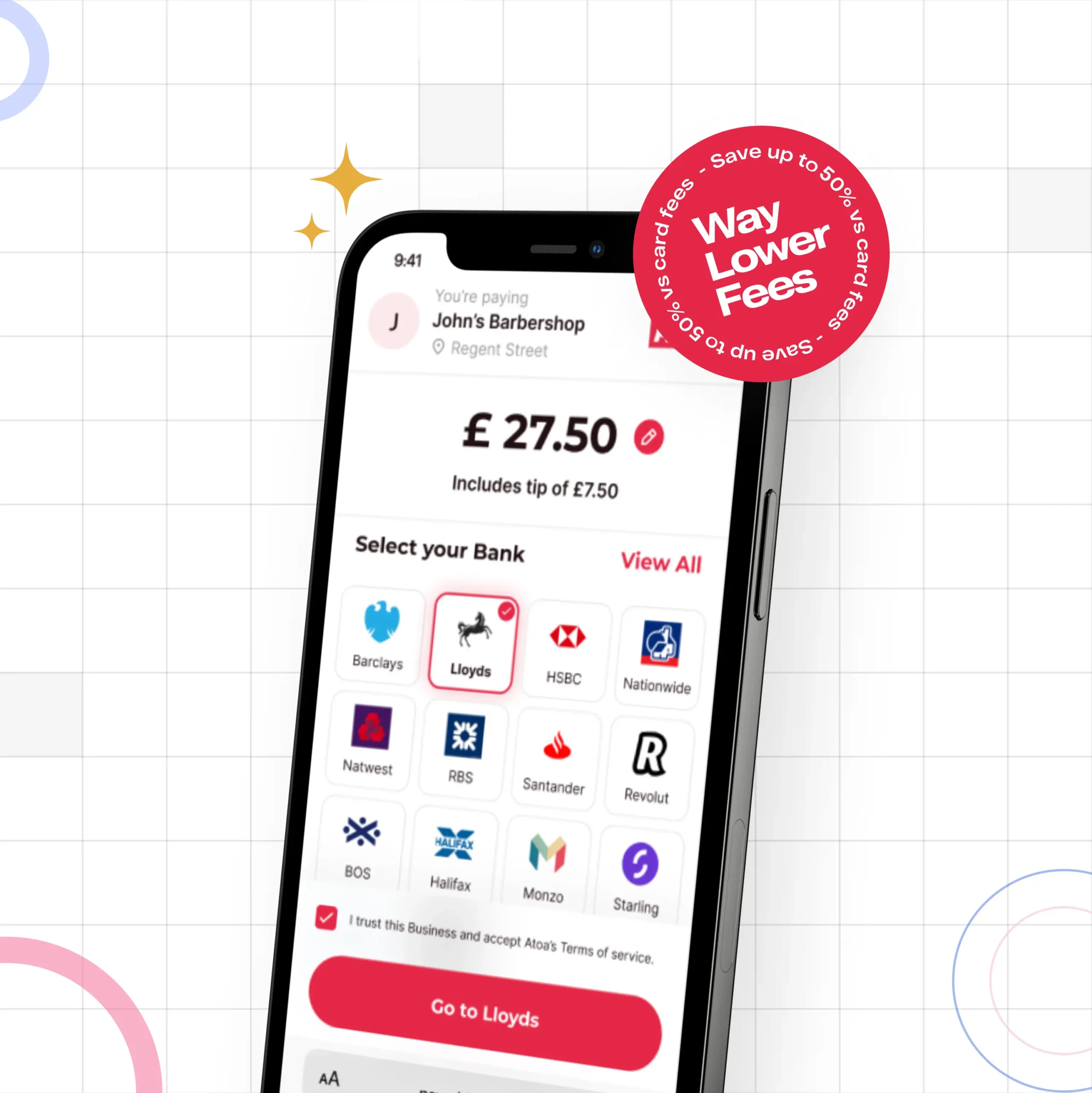

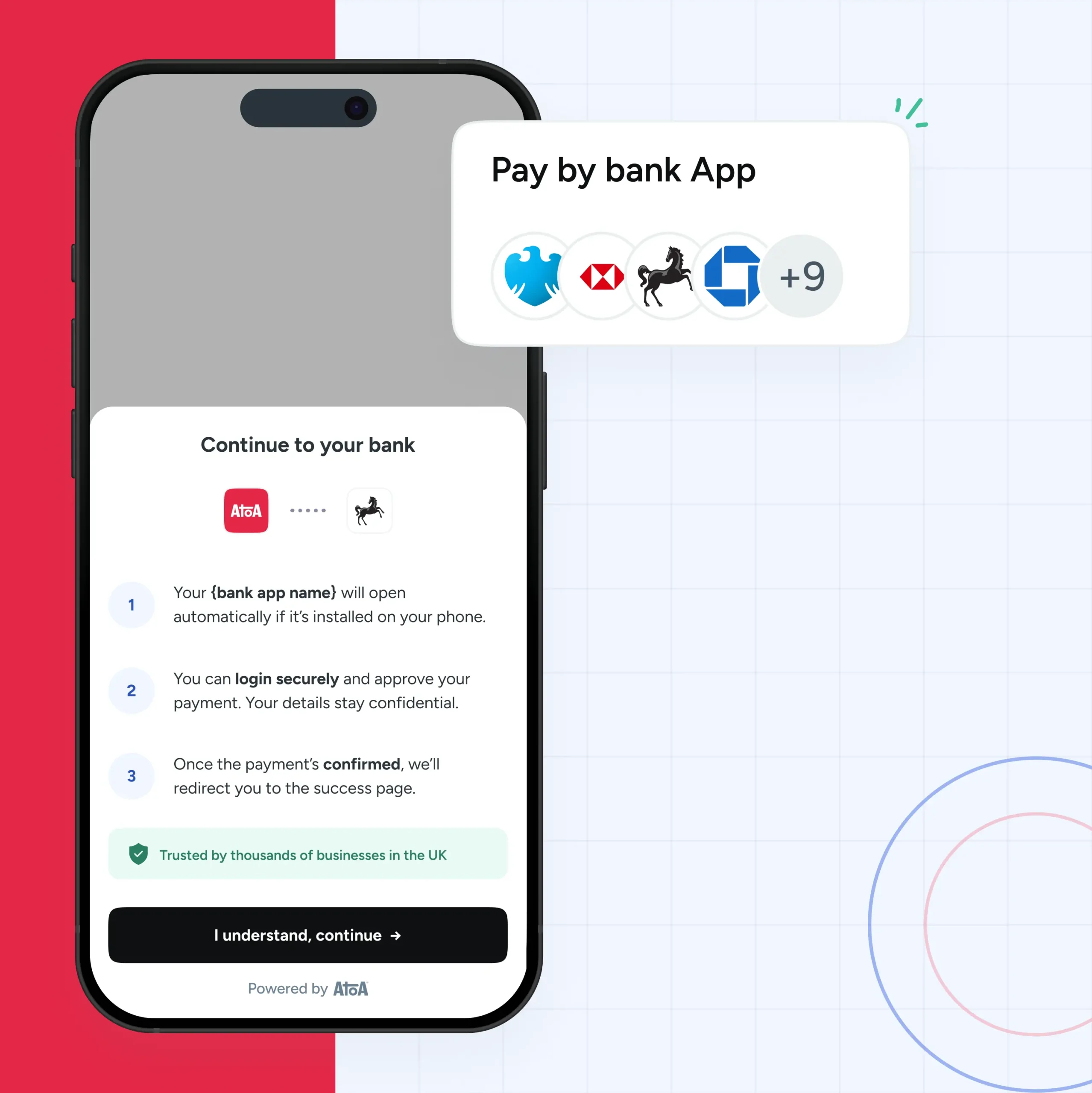

Open banking payments refer to transactions made directly between two bank accounts without needing a card or bank details. Instead, they use open APIs (Application Programming Interfaces) to securely read different customers’ data and trigger requests when permitted. In Atoa’s case, a scanned QR code or clicked payment link request triggers a request between the business and the customer’s mobile banking app, resulting in payment once the customer’s secure face or fingerprint recognition is approved. The results are tighter security, faster transaction times and lower costs, which Atoa then passes on to business owners like yourself.

The biggest benefit is shortening the payment process by removing card providers and ‘card schemes,’ which add unnecessary extra costs. Technically, all these intermediaries do is communicate with your bank to see if you have enough funds to clear payment.

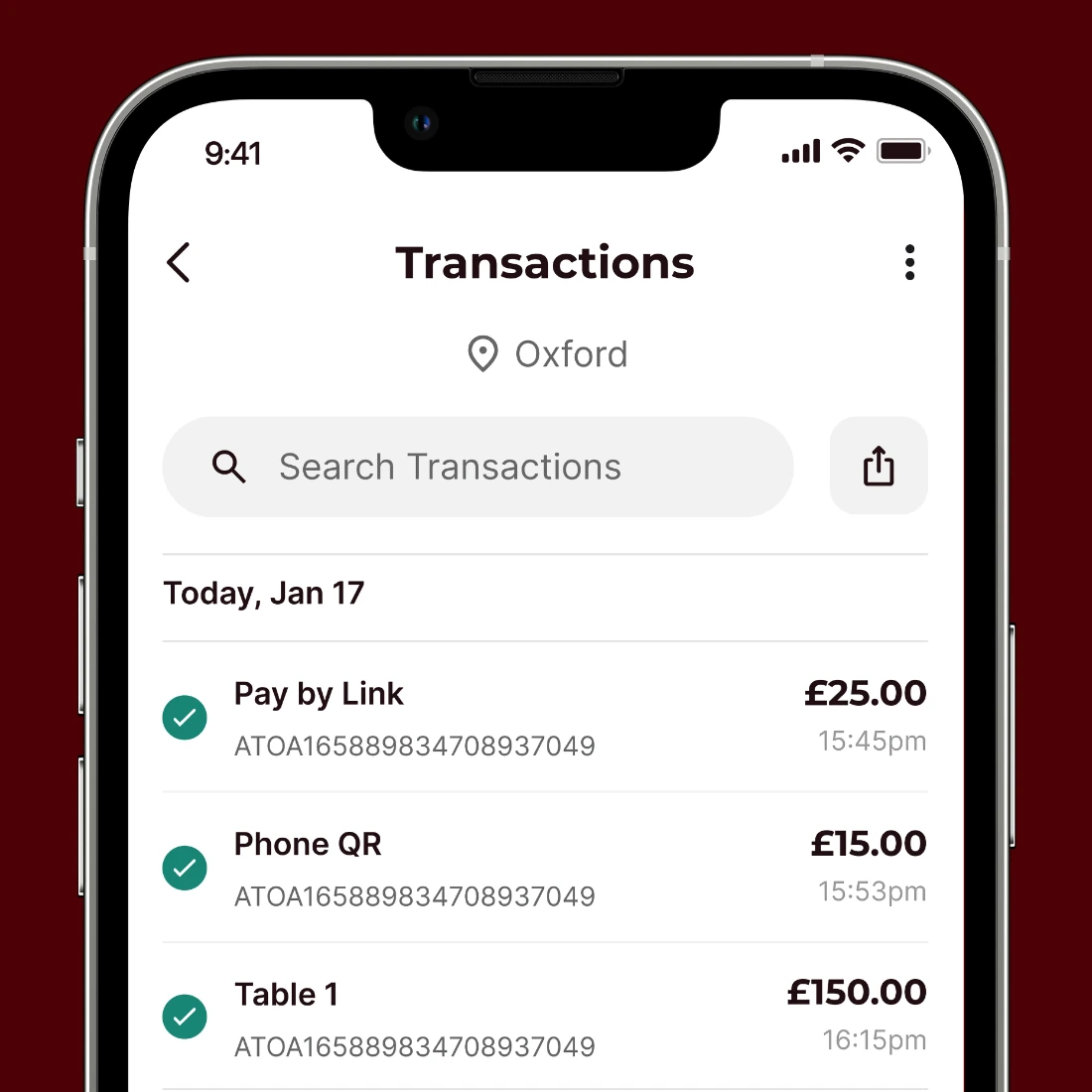

Open banking methods remove this step to communicate directly with your bank, which approves the payment on the spot and instantly deposits it into your business account. Yes, you read that right…instantly!

Other reasons to go cardless…

Low transaction fees: By removing card intermediaries from traditional payments, Atoa can offer a maximum fee of 0.7% per transaction.

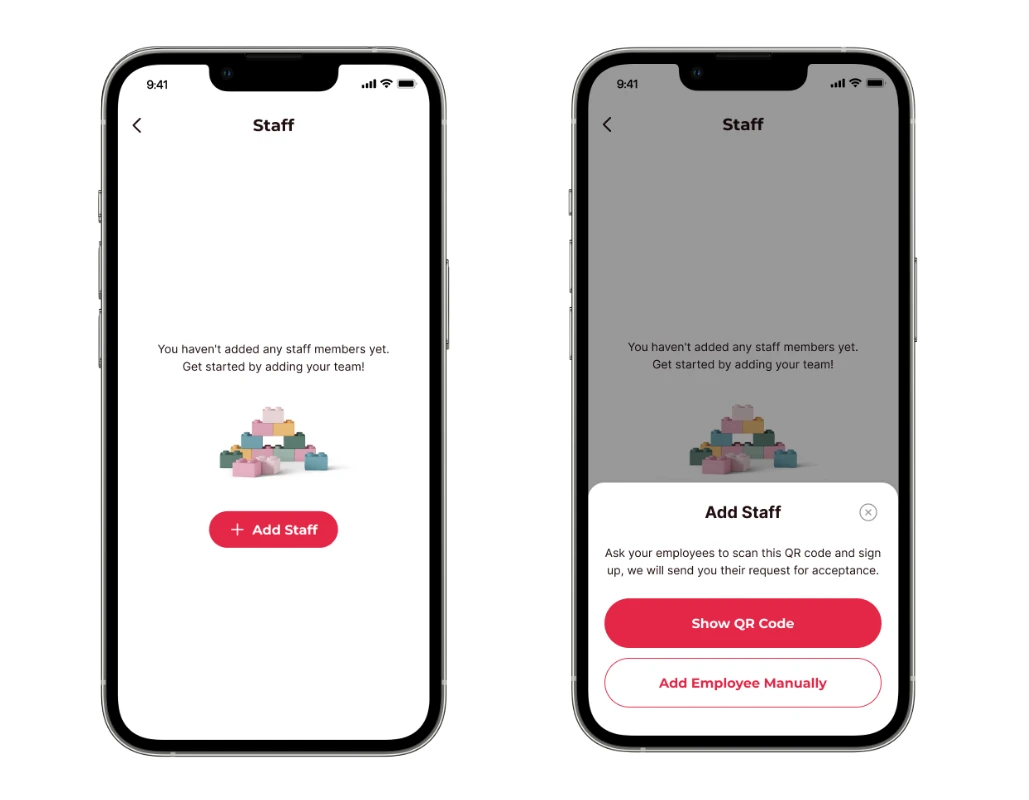

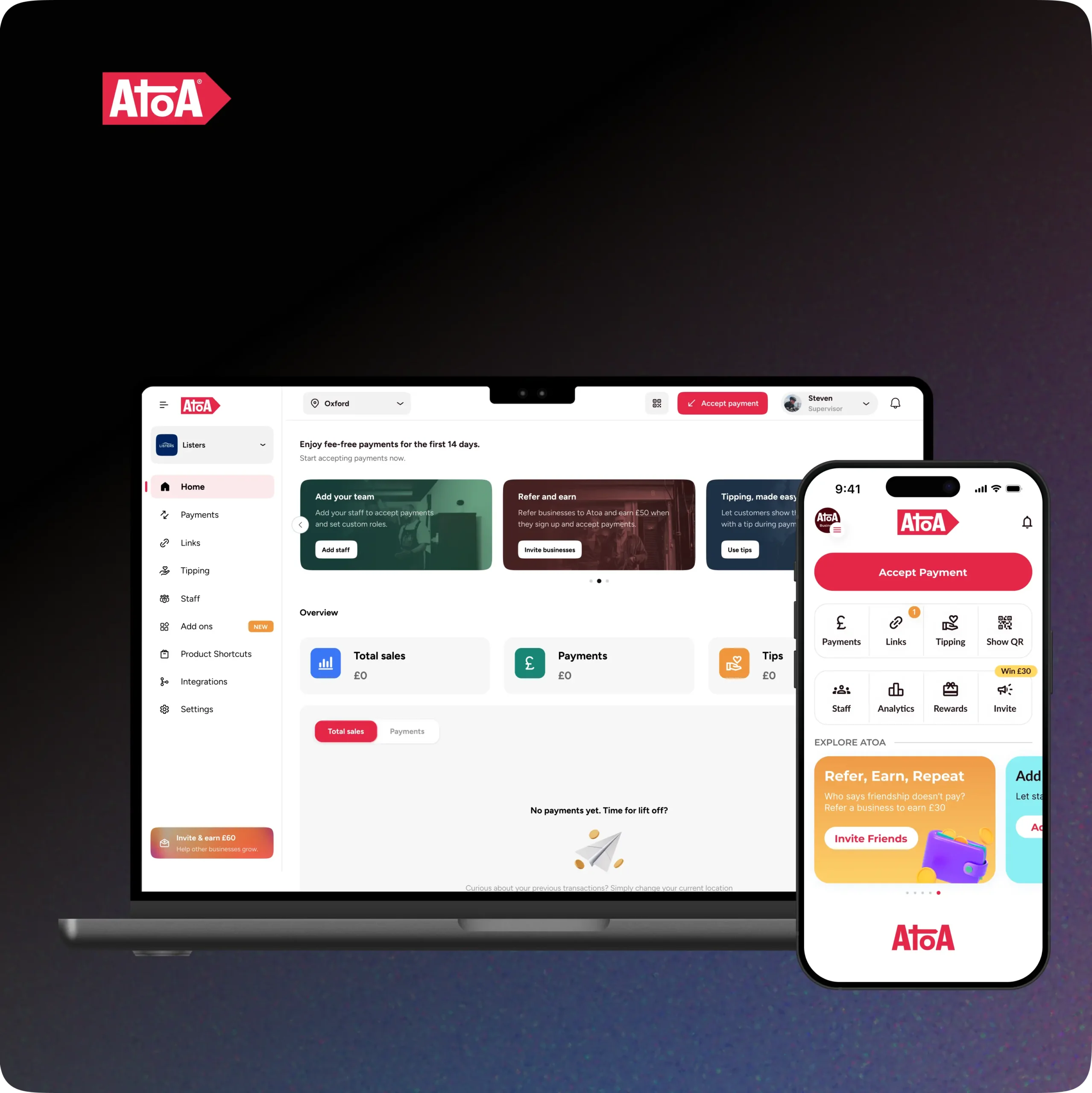

No hardware required: You don’t require fancy equipment to use Atoa, just a smartphone. This saves businesses considerable money on costly payment machines and maintenance expenses. Plus, making payments using your phone is simple and user-friendly for staff of all skill levels.

Speed to market: Getting started with Atoa is easy. Create an account in seconds and use our instant payment service hassle-free. With Atoa, there’s no need for card machines or complicated integration, making it quick and efficient.

Speed of settlement: Our instant payments eliminate waiting for card payments to clear, allowing you to access your money immediately. With this approach, you can keep your finances in check and focus on growing your business without worrying about cash flow issues.

Security: Biometric security during payment removes customer disputes and the potential for withdrawal of funds from your account. This means you can safely make transactions without the risk of negatively impacting your business and profits.

Open banking vs. card payments: breaking the cycle…

Open banking payments are relatively new in finance, so we know the occasional technical challenges. For starters, those without a smartphone won’t be able to join in. But food for thought: statistics suggest that in 2022, only 16% of adults in the UK didn’t own a smartphone. To encourage people to use open banking payments, it’s important to make them feel safe and comfortable. Atoa is affordable and fast, and it makes transactions easy. If customers feel confident, it’ll be a walk in the park.

The only way to fully experience the magic open banking payments can do for your business is to give it a go. Download Atoa Instant Bank Pay today, and we will give you 7 days of free transactions as a thank-you for ditching the card machine.

You might want to check out some of this related content: