Are you thinking of starting a new business? Maybe you want to kickstart payments for one you already run? Looking into card machine providers might well be your first port of call. But what if there was an alternative?

Businesses are facing more challenges than ever with rising costs and staff shortages, so high fees from card payment processors are the last thing you’ll want to spend your hard-earned cash on. With that in mind, it’s worth doing some research…

First up, what is a payment processor?

A payment processor facilitates transactions between your customers and business bank accounts. They verify and approve transactions to transfer money within a specified timeframe, sometimes up to a week, which isn’t always ideal when you’ve got bills and staff to pay! Payment processors are often called payment gateways, as they are frequently combined into a single product by many companies.

Choosing the right card machine provider can be daunting, especially when so many options are on the market. Dojo, SumUp, and Zettle are considered the leading providers, but their charges and payment clearing times can be confusing. We’ve done some legwork for you so that you can make an informed decision.

SumUp

- To start taking payments, the SumUp Air machine will cost you £29 + VAT

- No monthly fee

- SumUp charges 1.69% per card transaction

- Payout to your bank account takes 1-3 days

Zettle by PayPal

- Before you get started, Zettle charges £29 + VAT for a card reader

- No monthly fee

- Zettle charges 1.75% for card transactions and 2.5% for payment links and invoices

- Payout to your bank account takes 1-2 days

Dojo

- £15-20 monthly rental fee dependent on turnover

- 6-month minimum, then rolling monthly

- 1.4% + 5p charge on all transactions made

- Payout to your bank account takes one day

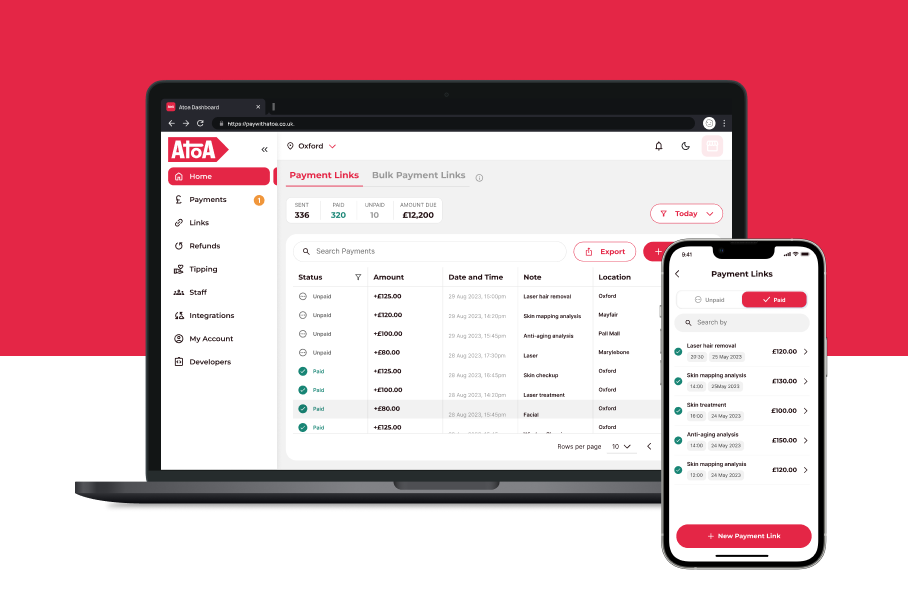

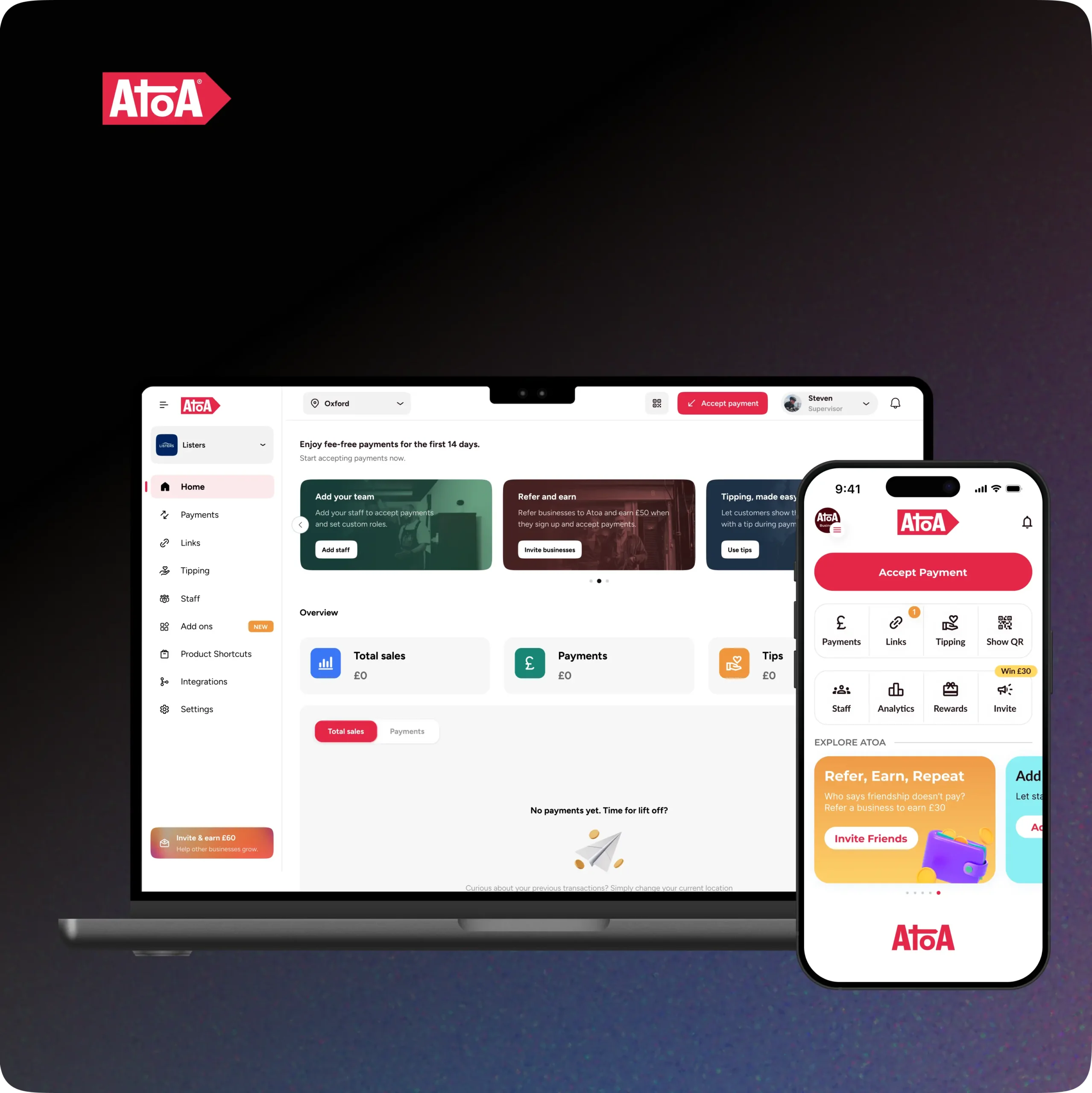

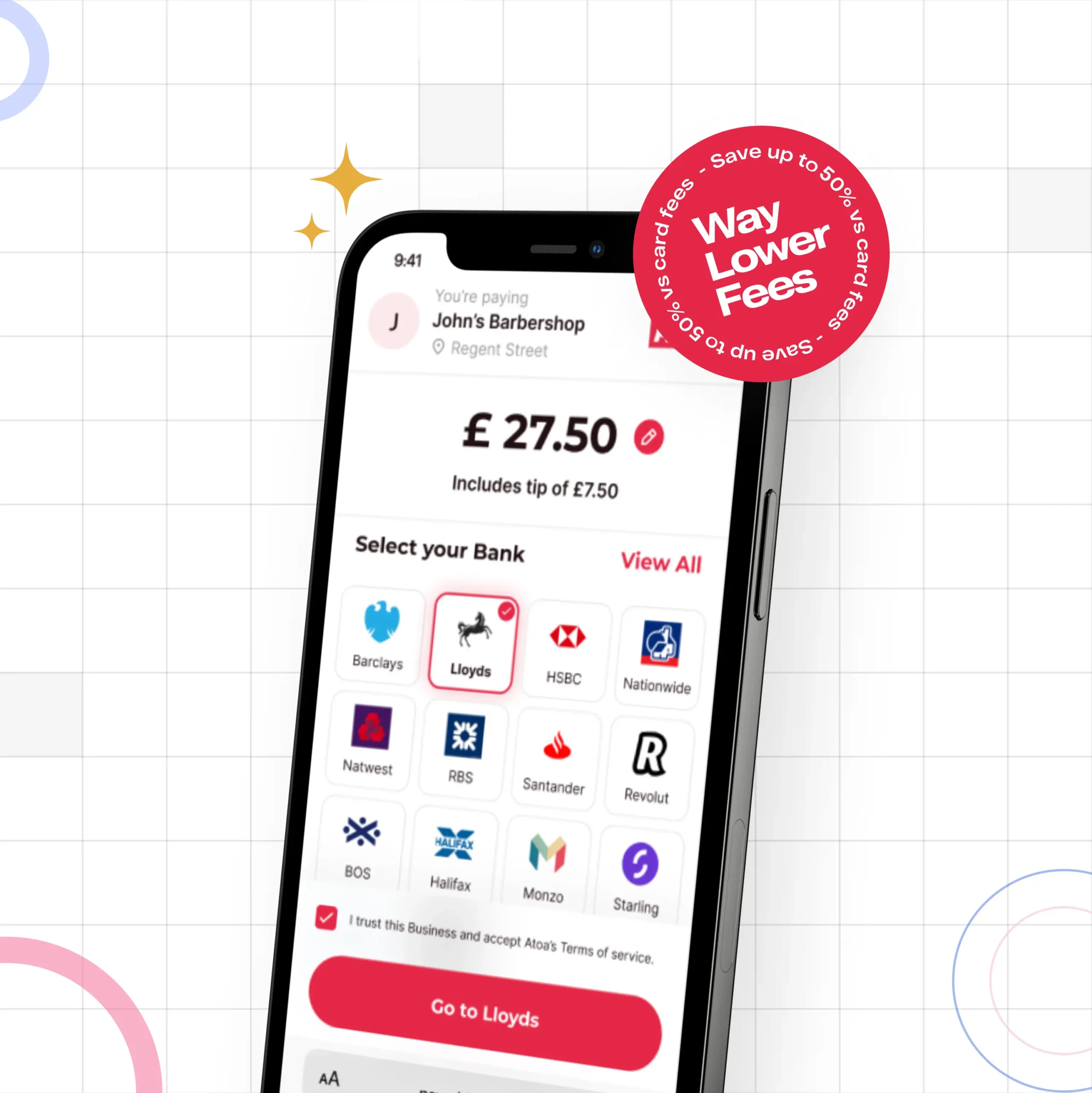

Atoa

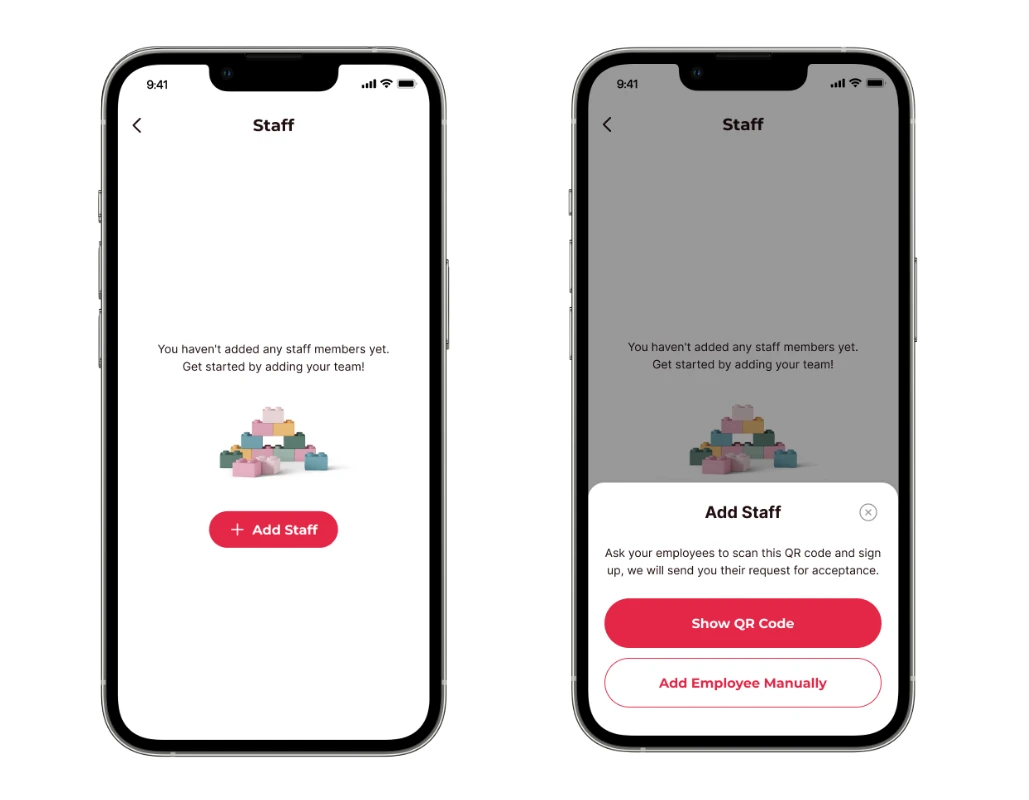

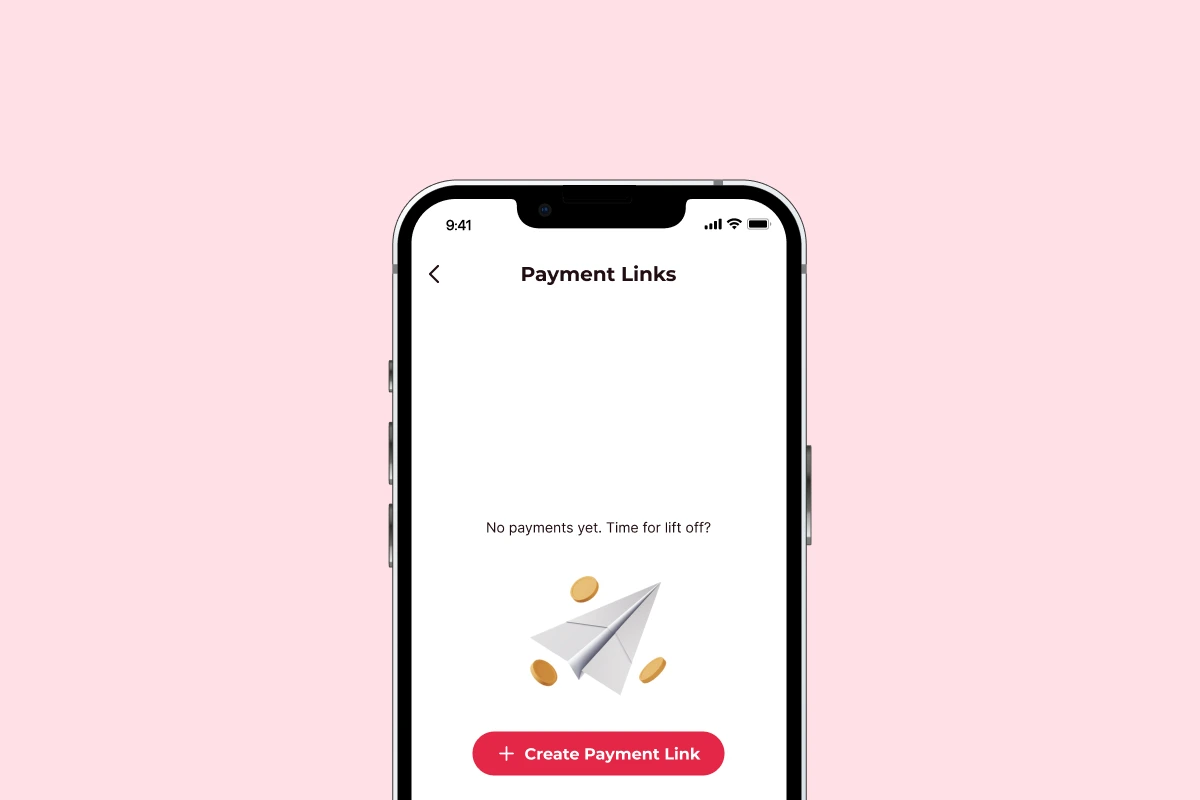

- £0 hardware cost, no card machines required, just the Atoa Business app on your smartphone

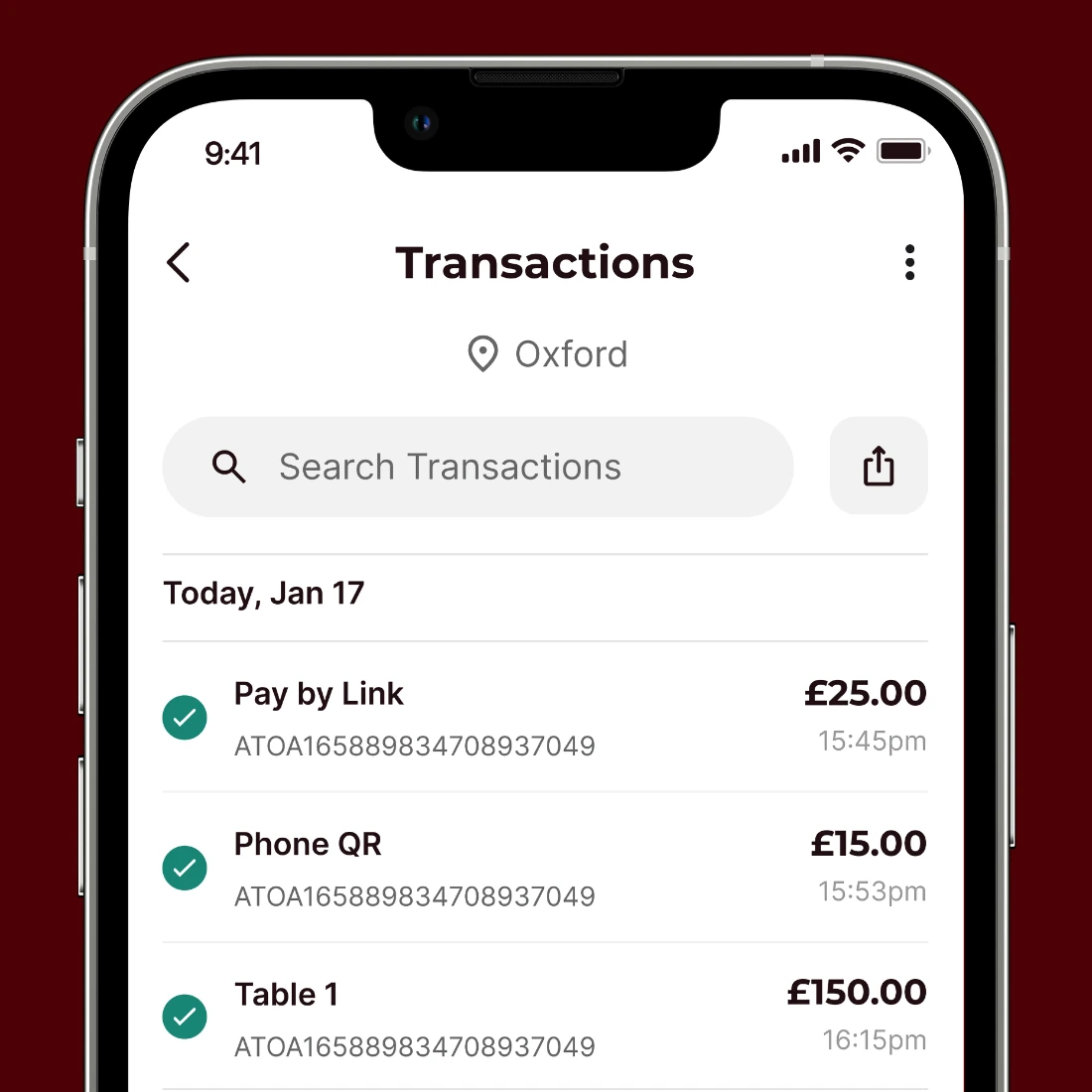

- Pay by QR code or a payment link, maximum 0.7% transaction fee

- Pay-as-you-earn service, billed monthly on the total amount of successful transactions

- Payout to your account within seconds

How do I set up a card machine?

- Choose a merchant account provider to process your payments. There are many providers, so comparing their rates and features is important before signing up.

- Select a card machine. Many different types of card machines are available, so it’s important to choose one that is right for your business. Some factors to consider include the type of payments you will accept (credit cards, debit cards, contactless payments), the volume of transactions you process, and your budget.

- Set up your merchant account. You will need your business name, address, and tax ID number. You will also need to choose a payment processor.

- Connect your card machine to your merchant account. Instructions should arrive with your card machine.

- Start accepting card payments!

How much do card machines cost?

It depends on the type of machine you choose, the features you need, and your merchant account provider. However, you can expect to pay anywhere from £0 to £200 for a basic card machine. Some merchant account providers may also charge a monthly rental fee.

Do I need a card machine provider?

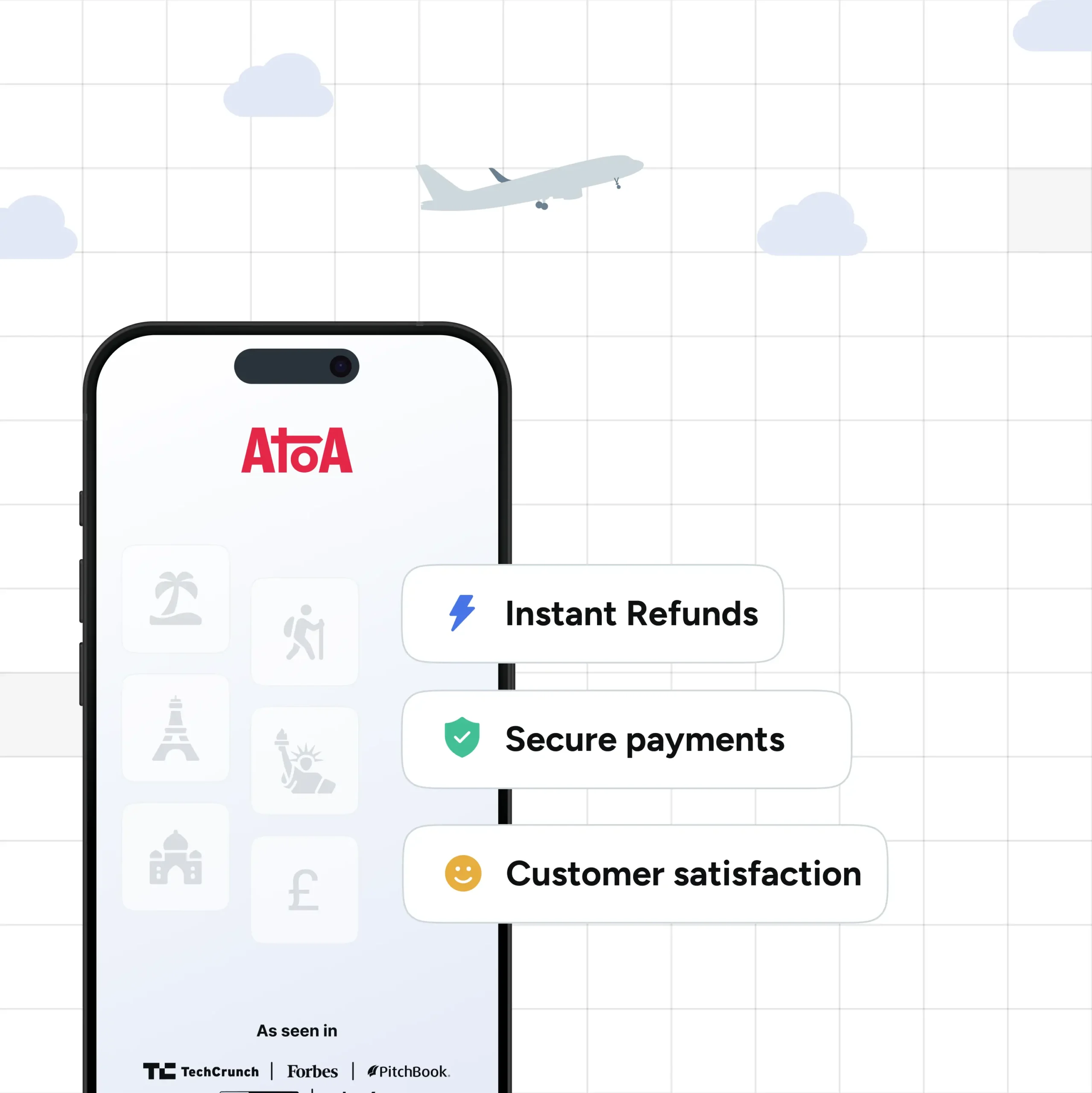

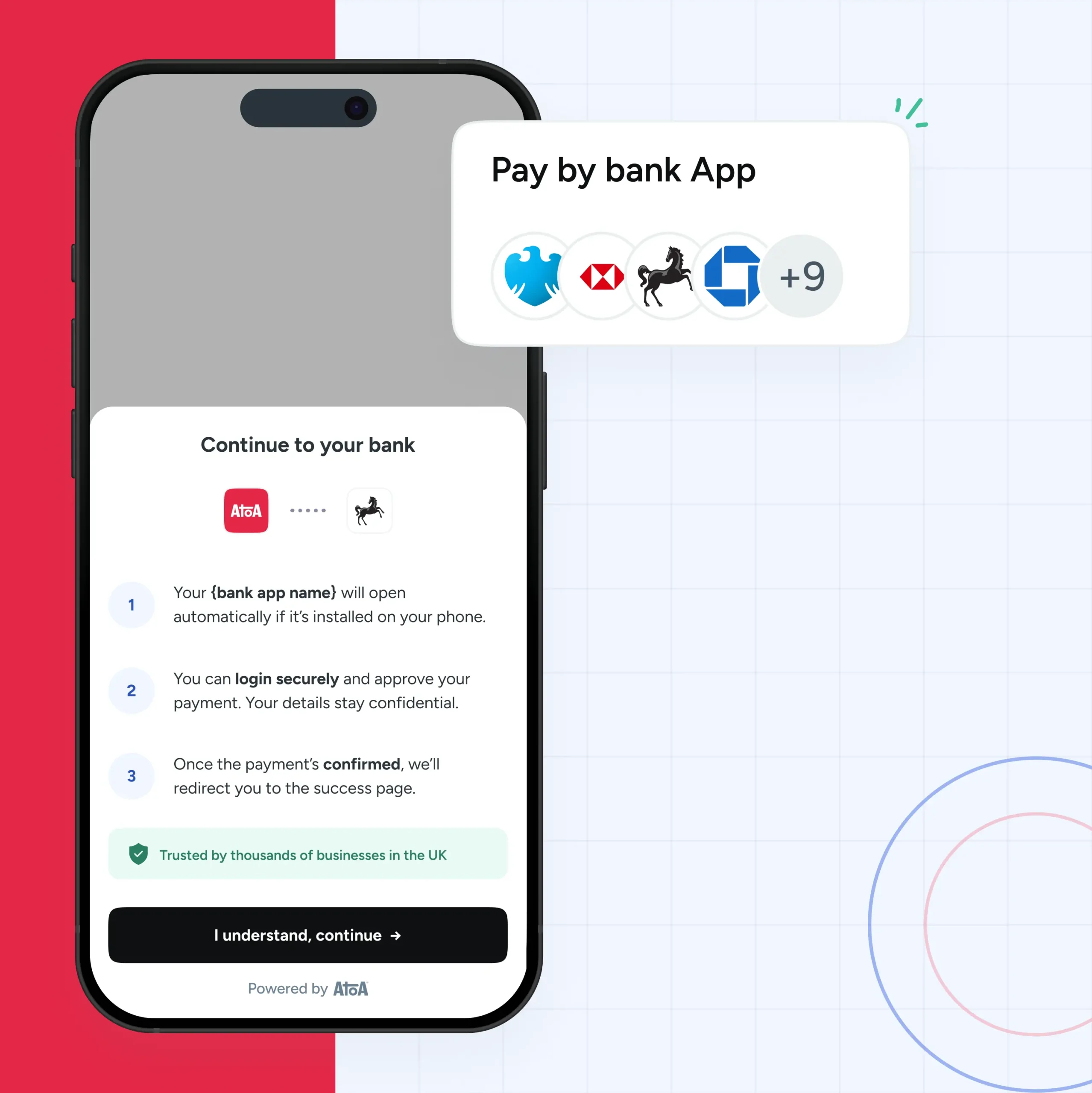

The answer is no. Open banking and account-to-account (A2A) payment services have opened new avenues for small business payments, allowing an easy bypass of contracts and card processing fees to take home more of your earnings.

We are committed to loosening the grip high fee card payments have on the UK high street by offering low-fee transactions (0.7%) with instant settlement.

You won’t find a cheaper rate that puts payment in your pocket in seconds. Watertight biometric security means there’s no room for chargeback fraud, letting you take payments without risk. You did the work, so you should get the reward!

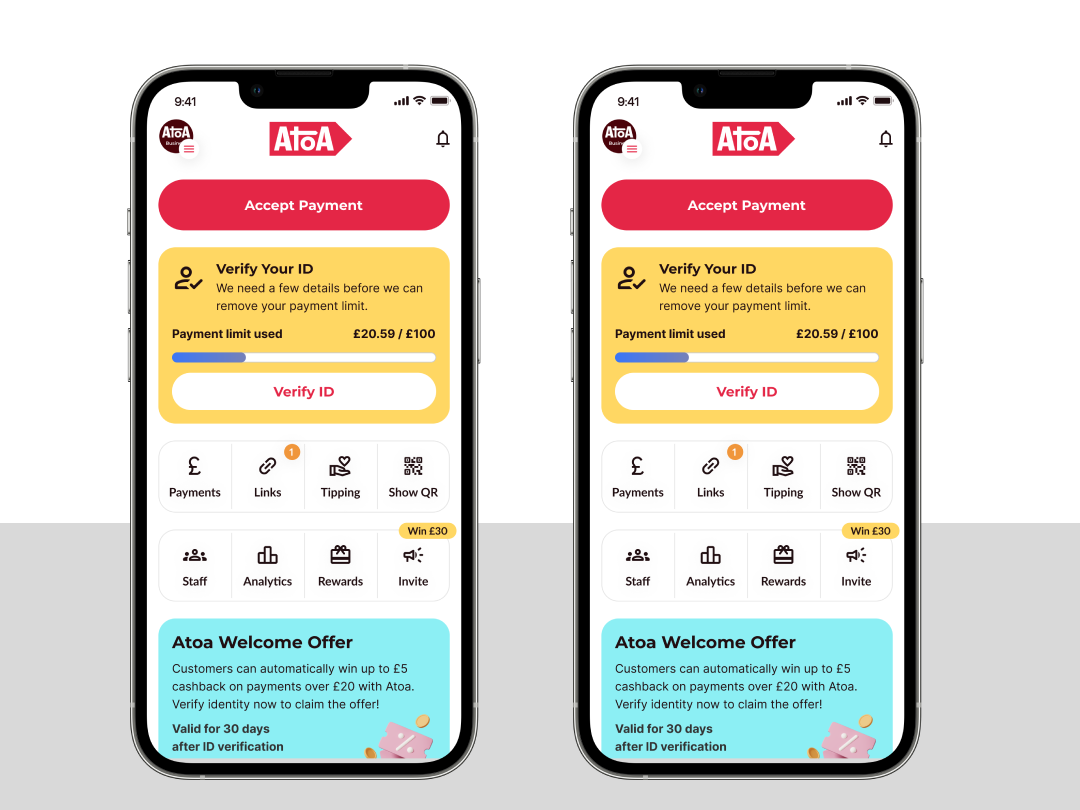

A quick reminder of how Atoa can boost your business…

Fees are lower with Atoa. No catches, no funny business!

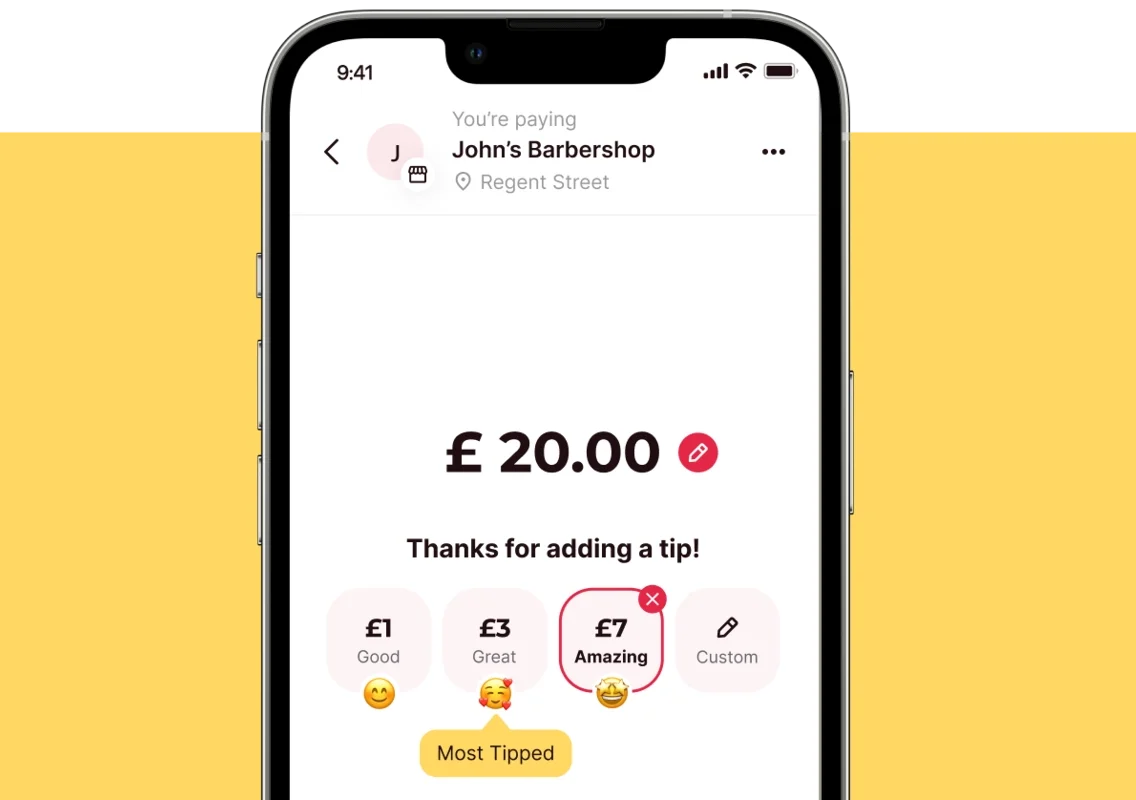

Fair fees – unbeatably low rates whichever way you choose to be paid, starting at 0.7% and dropping with higher volumes. You only pay when you make a transaction, billed monthly.

High security – open banking A2A payments using your smartphone banking app security method. No risk of chargeback or disputes.

Payment flexibility – QR code in-store or remote payments via link (WhatsApp, SMS, email), all provided at the same rate.

Easy integration – no hardware fees, service charges or contracts.

Even more savings for high-volume companies – the more you pay with Atoa, the more you save!

Here are some other articles that may interest you

Do I need a merchant account?

The best business payment solutions

Digital payments for businesses