Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

As a UK business owner, you constantly set your sights on efficiency. Your motto is, “Work smarter, not harder.” You’re always looking to get paid faster and keep your well-oiled machine running smoothly. Well, that’s where open banking payments can help you. This exciting payment technology is a secure, simple, and cost-effective way to transform your cash flow and business operations.

According to data from the nine largest banks and building societies, the number of successful open banking payments in the UK jumped to 455% between the first half of 2021 and the first half of 2023. That shows a jump from 9 million payments to over 54.5 million in just two years.

This sheer growth highlights a shift in customer behaviour, which poses a powerful opportunity for businesses. Open banking payments offer a secure way for customers to pay directly from their bank accounts in seconds, sidestepping cards, lengthy checkouts and unfair processing fees.

As a business owner, this allows you to tap into even more benefits:

- Faster, easier checkouts, meaning more customers completing purchases.

- Save money with lower transaction fees compared to traditional methods.

- Minimise fraud risk by allowing customers to pay directly from their bank app.

What is open banking?

This groundbreaking technology has been making waves in the UK since January 2018. It aimed to increase competition in the banking sector by allowing customers to share their financial data securely with third-party providers (TPPs) using APIs. This means approved apps and services can connect with your bank accounts for various purposes, including payment requests.

How do businesses use them for payments?

Finextra recently reported that 99% of Gen Z and 98% of millennials use bank apps to manage their finances, so why not add them to your payment strategy?

Open banking payments let your business accept funds directly from your customer’s bank account through an authorised third-party provider (like Atoa). It’s also known as instant bank pay or pay by bank. It may seem overwhelming, but it’s pretty simple. Forget entering card details or carrying your cards – transactions are made with a smartphone scan and a few taps in the customer’s bank app.

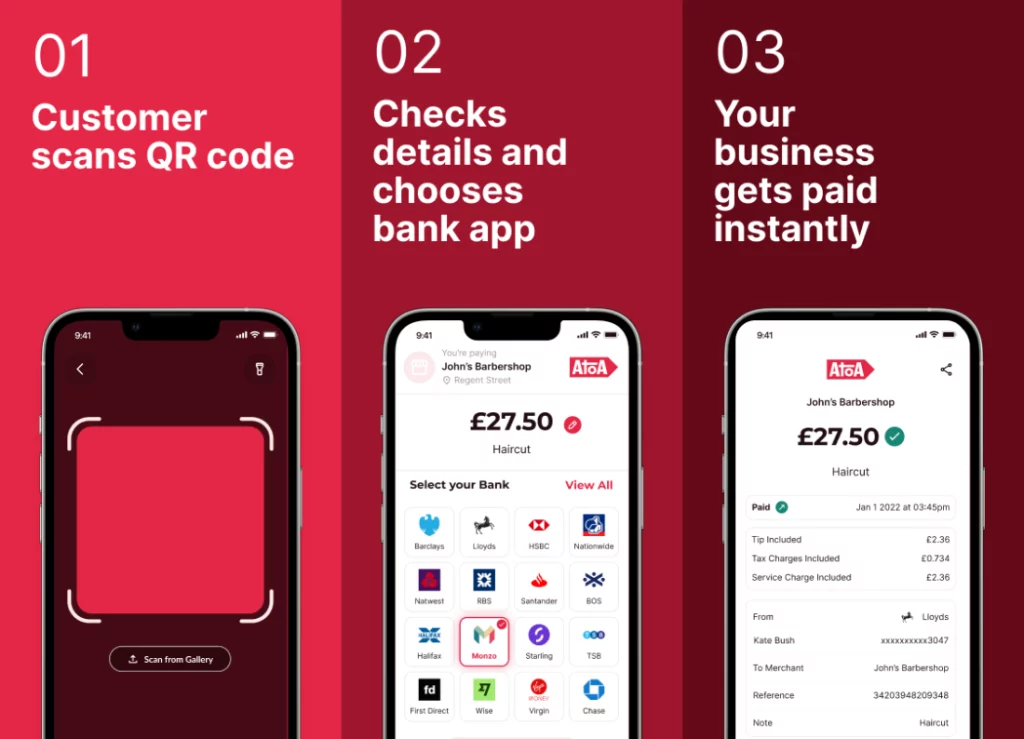

How do open banking payments work?

- The customer makes a payment to your business: Instead of entering lengthy card details or downloading payment apps, your customer scans a QR code or clicks a link to pay directly from their bank account.

- Your customer confirms the amount: They’re securely redirected to their bank to check and approve the payment details.

- And completes security steps: A face or fingerprint scan confirms the customer’s identity to release funds.

- Your business receives an instant bank pay transfer: Funds go from the customer’s account to yours without using card networks (for lower fees and faster payouts!)

How do businesses use them?

- Easy in-person payments: Customers scan a QR code stand or receipt to start a payment from their bank app.

- Accept e-commerce payments: Many online stores now offer open banking as a payment option at checkout, redirecting customers to their bank app to make the payment.

- Request remote payments: Request payments from customers over SMS or email, who click a link to pay directly from their bank account. This is ideal for invoices, bills or deposits and upfront payments.

- Payroll and supplier payments: Manage bulk payments, like payroll or supplier invoices, through secure bank-to-bank transfers using open banking.

Get paid in-store with QR codes

Open banking QR codes are shaking up how we pay in the UK. Your customer scans a code with their phone, confirms the payment in their banking app, and you get funds instantly. This tech isn’t just convenient – it can help your cash flow with lower fees than card payments, instant settlements, and no need for expensive hardware. Plus, it’s a modern and convenient way for customers to pay. From corner shops to online stores, QR codes are the future of payments in the UK.

Use payment links remotely

Are you getting tired of waiting for payments? Why not collect them using SMS payment links instead? Send customers a link over text or email to pay directly from their bank app. Money lands in your account instantly without eye-watering card fees or chasing invoices. The result is happier customers and a healthier cash flow for your business.

💡Open banking SMS payment links are perfect for invoices, deposits, online shops, or charity donations.

What are the benefits for businesses?

If you want more from your business, you’re not alone. But what if we told you a shortcut to better profits and efficiency? Open banking payments are significantly cheaper than card transactions, and lower processing fees mean more money stays in your business.

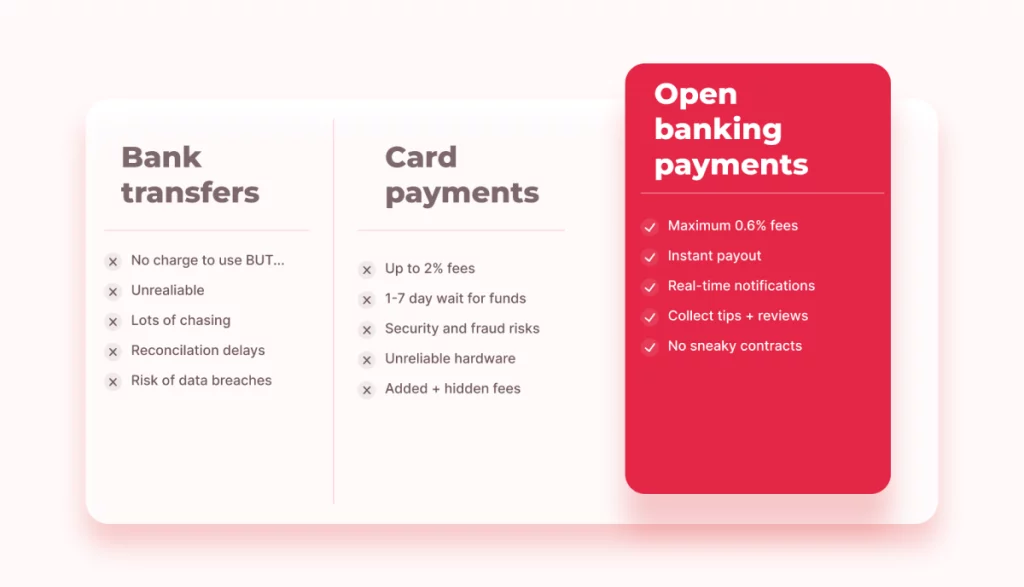

This table shows how instant payments compare to traditional methods like cards and bank transfers:

But, that’s not all! Here are a few other ways account-to-account payments can help you achieve your goals faster:

- Reduce your costs: Open banking often has lower transaction fees than traditional card payments, potentially saving you money on processing costs, especially with higher values or volumes.

- Improve cash flow: Transactions payout within seconds, unlike card payments or bank transfers. You have quicker access to your hard-earned money, which improves cash flow.

- Save time: Automatic reconciliation takes the stress out of chasing invoices or manually matching payments to orders.

- Make it smoother for customers: Offer a secure payment option that saves customers from entering card details. Account-to-account (A2A) payments remove the hassle of remembering card details or moving money between apps to pay. This straightforward experience boosts satisfaction and loyalty. Plus, faster payments may lead to higher conversion rates.

- Fraud reduction: Since customers confirm payments directly with their bank using biometrics such as SCA, open banking can help minimise the risk of fraudulent transactions and subsequent chargeback costs.

- Get to know your business better: Connect your business account to open banking-powered accounting or analytics tools. This can give you more control over your finances with better insights into spending patterns and busy periods.

What are the benefits for customers?

But of course, don’t forget your customers. After all, they bring money to your door and make your world go around. Whatever your industry, it’s about the experience. Buyers want to glide through checkout without any hitches, or maybe pay a deposit for that shiny new car without sharing your bank details over the phone. And guess what? Open banking payments can help you achieve this easily.

QR code payments mean less waiting. Customers can scan and pay at the till without fuss, letting them leave at their own pace.

Open banking payments are faster than cards…and safer, too. Digital payments can be confirmed directly in the customer’s bank app with a face or fingerprint scan, making them impossible to fake. Customers don’t share card details with businesses, which may reduce fraud risk.

Payment links also combine convenience, speed and security in a few clicks. Collect deposits by sending a link to the customer to pay in a few taps. This is so much easier than sharing bank details for a transfer or reading out card details over the phone.

That little bit extra: Customers can leave tips and reviews during payment to help your business grow.

But, will my customers want to use open banking payments? Whilst it’s a fairly new concept, many customers enjoy the convenience and security of open banking payments.

How we use open banking at Atoa

Atoa taps into the power of open banking to transform your business payments. Customers scan a QR code or click a payment link, then confirm the transaction securely in their bank app. It’s fast, it’s convenient, and you will see the difference in your processing costs overnight.

But Atoa doesn’t stop there. We’ve packed in extra features to help your business go the extra mile. Accept tips during payment, collect reviews to increase your visibility, boost conversions, track sales and more – all in one place.

How The Beauty Wardrobe increased deposits with payment links

The Beauty Wardrobe in Bradford used to spend hours collecting deposits over the phone. It was risky around GDPR compliance and inconvenient for busy customers to share bank details on calls. Payment links let owner Harminder connect the company’s bank account to Atoa and send an SMS request for upfront payments so customers can pay from their bank app. The salon uses the Atoa dashboard to filter unpaid links and send reminders from Atoa’s phone number, saving revenue lost on no-show appointments.

What are the benefits of payment links?

- Create customer lists to send multiple payment requests in one go.

- Save time storing and entering payment details for each client.

- The Beauty Wardrobe enjoys lower transaction fees than other providers and has increased deposits by 60-80%.

- Your team gets real-time visibility of incoming payments from the app or dashboard.

Is open banking right for my business?

Open banking payments offer benefits for businesses across various industries. Here are a few ways they can be used:

- Straightforward checkout experiences help tap into higher e-commerce conversion rates and lower fraud risks with secure contactless payments.

- B2B transactions: Instant payments can improve payment processes for supplies, services, and large invoices.

- Better bookkeeping: Link your bank account to your accounting software for automatic reconciliation and pay-by-bank invoice payments.

- Easy integrations: Open banking payments connect easily to your existing software, such as point-of-sale (POS) systems.

Are open banking payments secure?

Yes, your money is safe. Open banking payments are designed with your security in mind. They’re often considered safer than card payments because they don’t share your card details, lowering the risk of fraud.

Strict regulations control open banking to keep your money and data safe. It’s overseen by the Financial Conduct Authority (FCA), which ensures that companies offering open banking services are authorised and follow the rules. These regulations give you peace of mind, knowing that your financial information is protected and using a trustworthy service.

What is the future of open banking payments?

The face of open banking payments in the UK is rapidly changing. Here’s what you can expect from this movement in the next few years…

- Expect fresher products from fintechs and disruption from challenger banks.

- We anticipate increased participation from traditional banking institutions, giving users better choices.

- Wider adoption means more businesses are expected to start using open banking payments.

Adopting open banking payments can give your business a competitive edge, boost efficiency, and give customers a better experience. In other words, it’s a dream solution to keep your business at its best.

💡Always check with your bank or payment provider for specific regulations and requirements if you use open banking in your business.

Key takeaways

- Open banking is a secure and easy digital payment solution for UK business owners.

- Pay by bank offers customers a convenient way to pay for goods and services.

- Open banking payments offer instant cash flow and reduce fraud chargebacks.

- They also offer businesses flexibility, such as QR code payments in-store or payment links for remote payments.

Are you ready to tap into the benefits they hold for your business? Try a no-string attached 7-day free trial with Atoa. A full week of free payments, which moves to 0.7% per transaction plus VAT once the introductory period ends.