Ready to get started?

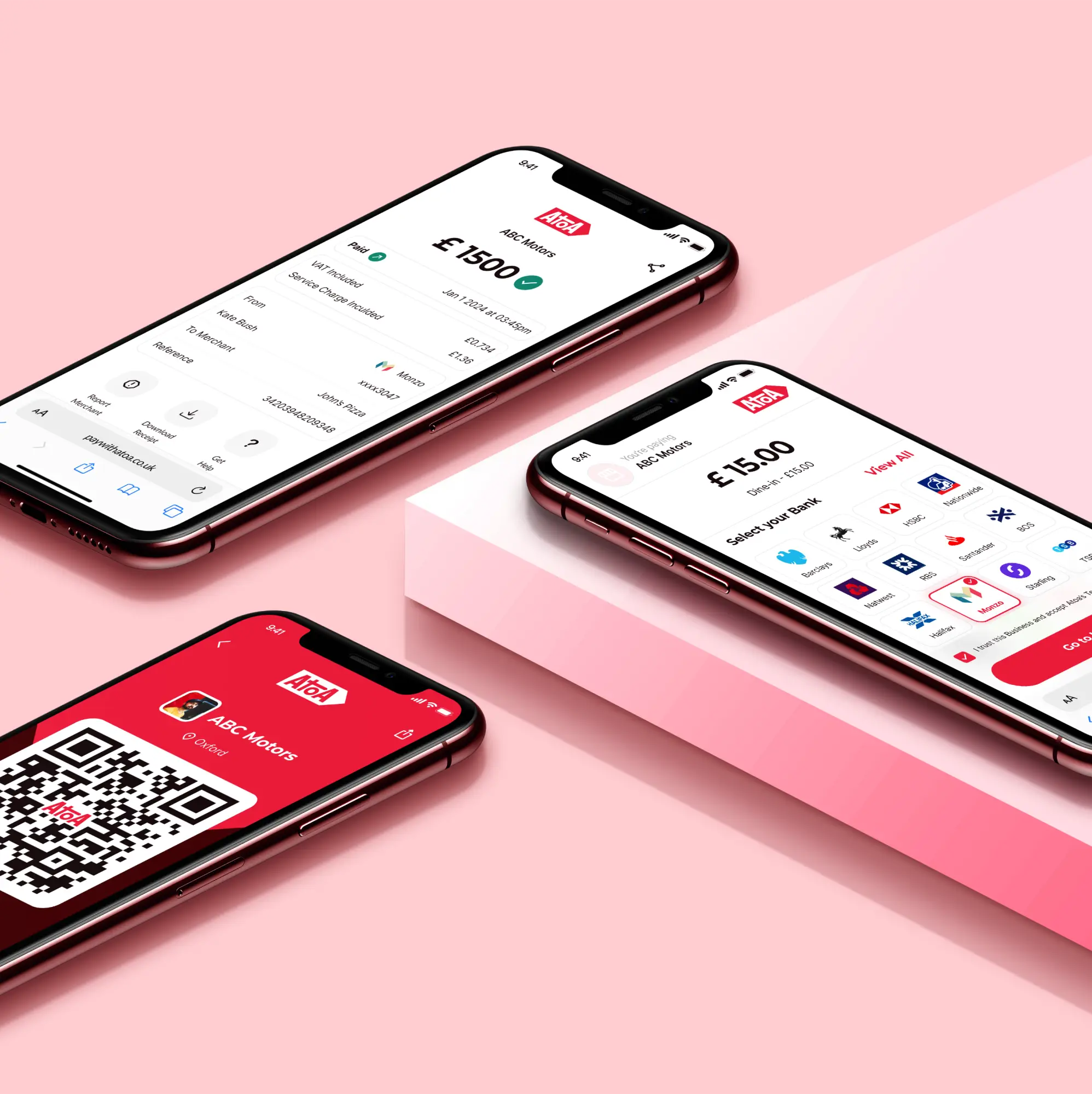

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Traditional payments come with their fair share of headaches—high transaction fees, slow settlements, and security risks. Businesses often wait days for payments to clear, while consumers are stuck navigating outdated, clunky checkout processes. Open banking payments are changing that. It is reshaping the way businesses and consumers handle transactions, offering faster, cheaper, and more secure payment options.

The UK has been a frontrunner in open banking adoption. As a result, businesses are increasingly turning to account-to-account (A2A) payments, Payment Initiation Services (PIS), and real-time transactions. The result? A more efficient and customer-friendly payment landscape. So, whether you’re a business owner looking for smoother transactions or a consumer tired of outdated banking systems, these changes are set to benefit everyone.

Let’s take a closer look at what’s happening, the biggest trends shaping payments, and what the future holds.

Key trends in open banking payments

The way we pay is changing, and open banking is paving the way for some exciting innovations. Here are the biggest trends to watch:

1. Account-to-account (A2A) payments – No more card fees

Ever wondered why businesses lose a chunk of their earnings to card processing fees? So, account-to-account (A2A) payments solve this by enabling direct bank transfers between customers and businesses—no need for card networks or extra charges.

✔ For businesses: Lower costs, instant payments, and better cash flow.

✔ For consumers: A smoother, more direct way to pay without dealing with card declines.

2. Payment Initiation Services (PIS) – Smoother checkouts

No more card details, no more hassle. Payment Initiation Services (PIS) let customers pay straight from their bank accounts in just a few taps.

Imagine buying something online and paying securely via your banking app instead of typing in long card numbers. It’s faster, safer, and removes the risk of card fraud. Big names like Amazon and Uber are already exploring this approach.

3. Enhanced security & fraud protection

With open banking, security is built in from the ground up. Strong Customer Authentication (SCA), encryption, and biometric approvals (like fingerprint or facial recognition) make transactions safer than ever.

This reduces fraud risks, making payments not just faster but also far more secure compared to traditional card payments.

Why businesses & consumers will benefit

Lower costs: Without card networks taking a cut, businesses keep more of their money, meaning better prices for customers.

Instant payments: Say goodbye to waiting days for funds to clear. Open banking payments move money in seconds.

Better cash flow for businesses: Faster payments mean fewer cash flow worries, making it easier to manage expenses and grow.

Seamless payment experience: No more dealing with card details or delays. Customers can pay in a quick, secure, and hassle-free way.

Challenges ahead: What needs to be fixed?

While open banking has huge potential, a few hurdles still need to be addressed:

Compliance & regulation: The financial sector is highly regulated, and open banking providers must constantly adapt to evolving rules.

Consumer trust: Many people are still wary of sharing financial data, even with strict security measures in place. Education and awareness will be key to driving adoption.

Merchant adoption: Not all businesses have integrated open banking payments yet, so customers don’t always have the option to pay this way.

The good news? These challenges are being tackled as adoption grows, paving the way for an even smoother payment experience in the future.

What’s next for open banking payments?

The future of payments in an open banking world is full of exciting possibilities. Here’s what’s on the horizon:

Beyond open banking: The rise of open finance

Open banking is just the start—Open Finance is the next big leap. This will expand data-sharing beyond bank accounts (with consent) to include mortgages, pensions, investments, and insurance. For businesses, this could mean smarter cash flow management, real-time credit assessments, and easy integration with accounting and tax data. The UK government is already laying the groundwork for this shift, making financial services more interconnected than ever.

Banks & fintechs: Partners, not competitors

Rather than competing, banks and fintech companies are joining forces to enhance open banking payments. Many UK banks now offer ‘Pay by Bank’ services powered by fintech innovation, making transactions faster and more secure. These partnerships are a win-win—banks bring trust and stability, while fintechs drive innovation.

AI & automation: Smarter, effortless payments

AI is making open banking payments more secure and personalised. Fraud detection tools stop suspicious transactions in real time, while AI-driven insights help consumers track spending and find better deals. Businesses benefit from smarter cash flow predictions and optimised payment timing.

The bottom line

With lower fees, real-time transactions, and improved security, both businesses and consumers have a lot to gain. While there are still a few hurdles to clear, one thing is certain—payments are becoming faster, safer, and more seamless than ever before. Now’s the time for businesses to explore these innovations and stay ahead of the curve.

Would you switch to open banking? If you’re curious about how it could work for your business, it’s easy to find out. Book a demo with Atoa and see how seamless, secure, and cost-effective payments can be!