Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

QR codes payments are rapidly taking hold across many industries and the wedding sector is no exception. Businesses can use these squares to offer quick, convenient, and secure open banking payments to wedding planners and service providers. The Open Banking website shared that there were 16.27 million successful open-banking payments in March 2024. So, why not use them for wedding payments and make that special day even easier to organise?

When you plan a wedding there’s a web of businesses and industries in the mix, from venue hire and catering to bridal gowns and beauty services. Many issues accepting wedding payments can be fixed using instant bank pay services. Customer experience is key in this industry, so you should consider giving clients an easy way to pay you. Settling up quickly from their bank app might be the stress-free experience they’re looking for…

So, whether your business offers some or all of these services, this article explores how and why you should start using QR code payments, including:

- How wedding businesses can use QR codes

- Different benefits and advantages

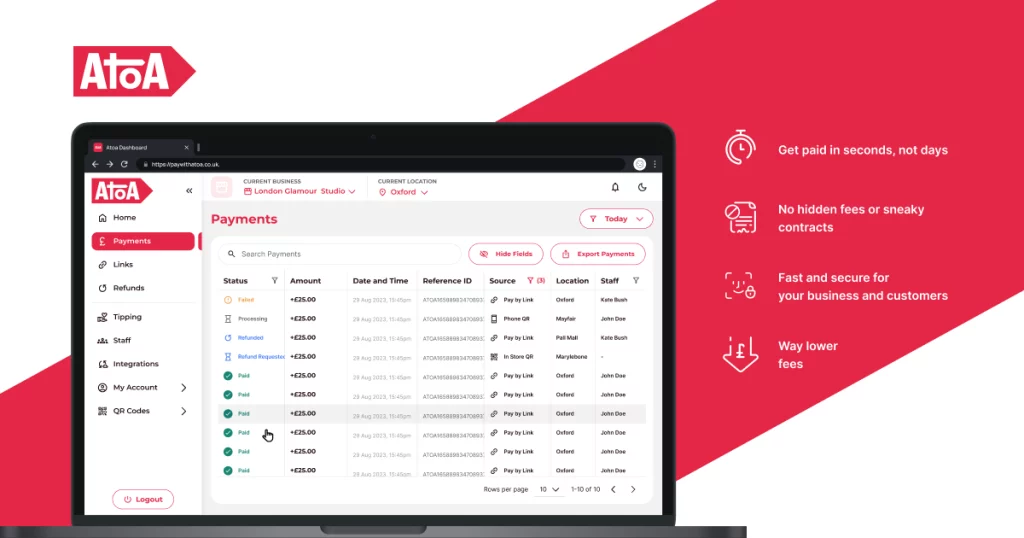

- How Atoa can help your business

What are QR code payments?

QR code payments are a new way for customers to pay from their bank app using their smartphone. Powered by open banking, you may also know them as pay by bank or instant bank pay. They are similar to retail barcodes but hold more information packed in their pixels, and can offer easy contactless payments.

To start using them, sign up with a QR code payment provider and create a unique QR code linked to your business account. Then, display the QR code at your checkout or even print it on receipts. Customers scan the code with their phone’s camera to pay you. The code tells the app your business information and the amount to pay if it’s a fixed price or lets them enter an amount.

The customer confirms the payment on their phone, and everything is done. The funds go straight to your linked business account within seconds.

Payment links are a great way to collect deposits or upfront payments and follow a similar process. You create a payment link for your client in the Atoa app or dashboard and share it with them using Atoa’s private number. Our share options cover all bases, like SMS, email, WhatsApp and a simple copy link function.

The customer receives the link, clicks it, and then complete the payment in their smartphone bank app. Funds will be with your business in seconds! Plus, if they’re a little slow to pay you can send them a polite nudge.

Things to remember

You’ll need to register with a QR code payment provider, verify your account and link your business bank app. Have your ID ready!

QR and open banking payments aren’t the norm but are becoming increasingly popular. You might need to give customers a quick and friendly explanation of how they work.

To use instant bank pay, customers will need a smartphone with their personal UK bank app active.

The benefits of QR codes for wedding payments

So we’ve had a brief lesson on QR codes and how they fit into everyday payments, but why are they so good for wedding payments? For starters, they can transform your operations and give clients a stress-free experience.

Here’s some further insight:

- Give guests the experience they crave: Let’s say a potential client loves your floral arrangements or catering menu. QR code payments let them secure your services on the spot. Guests can scan a QR code or click a link to complete payments within seconds. This straightforward and instant process also improves their payment journey.

- Faster transactions mean more business: QR code payments cut traditional payment method delays, giving you access to quick and efficient cash flow. Plus, they make it easier to take payments, which means you can serve more customers!

- Deposits: QR codes can be emailed or printed on contracts and invoices, allowing couples to pay deposits or the final bill quickly and securely from their phone. This saves you the hassle of chasing payments and makes everything nice and clear for them.

- Safe and secure transactions: Open banking payment platforms offer secure transactions through encryption, biometrics and strong customer authentication to protect guests’ and vendors’ financial information.

- Flexible payment options: Accept QR code payments in-person and payment links remotely. Plus, payment links are a great way to take deposits, which can cover long or expensive jobs.

- Go cashless: No more worries about running out of change or handling notes and coins. Placing a QR code at the bar lets guests scan and pay for their drinks, keeping things smooth (and free from daunting calculations!)

- Get tips: Traditionally, tipping vendors can be awkward. But with QR codes, guests can show appreciation to staff with a quick scan and a tap on their phone.

It’s all about secure wedding payments

Whether you’ve been let down by no-shows or baked a wedding cake nobody ate, QR code payments and deposits can help lessen the blow. Accepting instant bank payments can be safer than cash and cards. After all, QR codes are harder to counterfeit than cash, and your customer wouldn’t hand over their banking app password to a stranger, would they?

Cash and cards can leave you exposed

Your cash can go missing. Let’s face it, a lost wallet is bad news, and there’s no way to trace misplaced or stolen cash.

Card skimming means sneaky devices can secretly read your customer’s card details and make unauthorised payments.

Feel like you’re constantly looking over your shoulder? With reason, as someone might see you type in your PIN when paying and remember it.

Open banking payments protect your cash flow

Many QR payment solutions use unique or dynamic codes for each transaction. So even if someone grabs a copy of one code, it’s useless for the next purchase.

All of yours and the customer’s data is scrambled to protect it. Plus banking and payment apps often require face or fingerprint scans to open them and approve payments, adding extra protection on the customer’s side.

No card to lose either! The customer’s payment info doesn’t appear on a physical card that can be stolen or copied.

QR code payments are generally more secure but there are a few wise checks to make. First up, are they FCA-regulated? Then, get familiar with their methods and fees, plus read through their reviews to find a company with a good track record.

How to add QR code payments to your wedding business

If you’re ready to start using QR codes for wedding payments, you are in the right place! We want you to choose Atoa, but here are a few simple steps to follow whichever provider you decide on.

- The research stage: This is where you find your perfect open banking payments provider. Research fees, contracts, features usability, and their reviews to get the full picture.

- Get ready to sign up: You’ll need to register with a QR code payment provider, verify your account and link your business bank app to receive funds.

- Create your first QR code: Partner with a QR code payment provider to create QR codes that include your bank details. Atoa QR codes take seconds to generate.

- Watch the money roll in: You’ll soon see the benefits to your cash flow once instant payments start flooding in.

- Share your new payment method: Add QR codes to your invoice and receipts so clients know they can pay from their bank app by scanning them. Include this information in your initial quote and other communication leading up to the event.

- Make sure customers are comfortable: It may sound ridiculous, but check they know how to scan a QR code properly! Once you’ve achieved that, the world is your oyster.

- Track and manage payments: Most QR platforms provide an app or dashboard to monitor transactions and improve reconciliation.

Remember, QR codes are still a reasonably new way to pay. But a friendly sign or a quick explanation can go far. By offering QR codes alongside traditional payment methods, you’re giving your clients more options and reaping benefits for your business.

Key takeaways

QR code payments are convenient and secure. Customers can complete payments quickly and easily using smartphones, and the technology offers bank-level security features.

Open banking is growing in popularity. QR code payments are fast, fair, and secure, which benefits both businesses and consumers.

QR codes provide better wedding payments. This is especially beneficial in the complex web of payments surrounding weddings:

- Deposits for services

- Final payments

- Payments at the venue

- Tips for staff

QR codes provide a better client experience. They offer a faster, more convenient payment process that aligns with the need for convenience.

Faster cash flow. Businesses receive funds instantly rather than waiting days for traditional payment methods to clear.

Reduced risk. QR code payments reduce the risks associated with cash and card transactions, such as theft or fraud.

How we can help

QR codes give you a fast, fair and secure payments. They’re a good offering alongside traditional methods to attract tech-focused customers and improve checkout. Why not give Atoa a go by signing up for our 7-day free trial?

If you want to know more about us first, find out what our customers say on Trustpilot. (Hint, they think we’re ‘Excellent’).