Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Did you know that the UK’s open banking ecosystem is already worth over £4 billion to the UK economy? With 10 million users now on board, it’s clear that this technology is gaining momentum. So, how do open banking payments stack up against traditional methods like card payments, bank transfers, and payment gateways? This article will break down these differences and highlight why open banking could be the upgrade your business needs.

What is open banking?

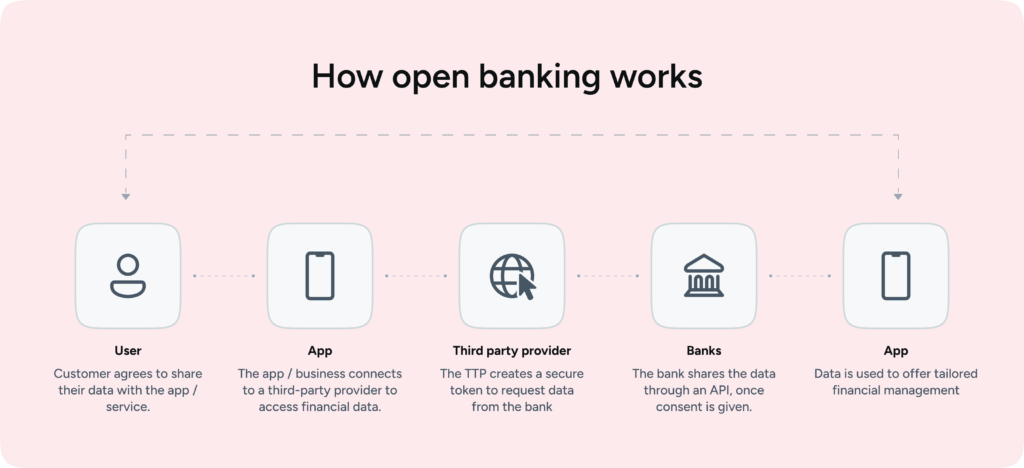

Open banking is a system that enables your bank to securely share your financial information with third-party services, such as apps or businesses, but only with your permission. It allows access to details like your name, transaction history, and payment information in a safe and regulated manner. This setup helps you to make smarter financial decisions and simplify payments. Think of it as connecting your bank to a new world of financial tools designed to make managing your money simpler and more efficient.

It also cuts costs with fewer intermediaries at play and makes payments instant. Plus, it boosts security with bank-level authentication, reducing fraud risk.

Open banking vs traditional payment methods

Let’s take a look at how open banking payments compare to more traditional payment methods like card payments, bank transfers, and payment gateways/wallets.

| Feature | Open banking | Card payments | Bank transfers | Payment gateways/ wallets |

|---|---|---|---|---|

| Cost | Lower transaction fees | Higher fees due to multiple intermediaries | Varies; often more than open banking | Can incur significant fees |

| Speed | Instant settlement | Multi-day processing | Typically takes 1-3 days | Varies; often slower than open banking |

| Security | Enhanced bank authentication | Vulnerable to fraud and chargebacks | Manual errors possible | Varies; can have vulnerabilities |

| Automation | Seamless transfers without manual input | Requires manual entry | Manual input needed | Often requires setup and maintenance |

| Reconciliation | Integrated systems for easy tracking | Manual matching required | Manual reconciliation | Can be complex and time-consuming |

| Flexibility | No intermediaries | Dependent on card networks | Limited flexibility | Limited adaptability |

Why mid-market businesses will love open banking payments

Open banking payments are stepping up as the modern, smarter alternative for mid-market businesses in the UK. So, here’s why it’s winning hearts (and wallets).

1. Lower fees, more profit

Traditional banking or card transaction fees can add up. Open banking slashes those annoying transaction fees, leaving more money where it should be—in your pocket. Every penny saved is a penny earned, right?

2. Faster payments, happier customers

Waiting days for payments is as old as dial-up internet – and just as frustrating! But with open banking, you can send and receive money instantly. This helps improve cash flow, which means less stress and more time to focus on growing your business.

3. Real-time insights, not guesswork

Open banking gives you real-time access to your financial data across all accounts. As a result, you don’t have to wait for end-of-month statements or juggling spreadsheets. It’s like having a financial crystal ball(minus the mysticism), helping you make smarter decisions faster.

4. Everything in one place

You don’t have to log into a million different systems. Open banking seamlessly connects with your accounting software, POS, and other tools. It’s like tidying up your financial clutter—everything’s where you need it, when you need it.

5. Built for the digital age

Open banking is built with top-notch security features, like SCA, so your customers’ data is always protected. Plus, it’s fully compliant with the UK’s PSD2 standards, which means it’s future-proof and ready for whatever comes next.

6. Innovation at your fingertips

From cash flow forecasting to personalised lending, open banking unlocks a world of fintech tools. And traditional banking just can’t keep up with this level of innovation.

7. Scalability—grow with confidence

Open banking payments support faster settlements and better cash flow management, so your business can handle increasing transaction volumes without breaking a sweat. The faster the money comes in, the quicker you can reinvest in expanding your business.

How Atoa’s open banking solution stands out

At Atoa, we’ve made open banking simple. So, our platform is designed for businesses that want lower fees, instant payments, and flexible integrations that work seamlessly with your existing systems.

Here’s what sets Atoa apart:

Instant settlements: With Atoa, your payments are settled as instantly as hitting “send” on a meme. You don’t have to wait around for your funds to clear – your money is in your account right away.

Lower fees: We don’t like hidden fees, and we bet you don’t either. Atoa cuts out the middleman, slashing transaction fees by almost half in comparison to card payments so that it doesn’t eat into your profits.

Secure payments: Payments on Atoa are made directly from the customer’s bank app and uses a face or fingerprint scan to approve funds.

Integrated insights: Atoa connects effortlessly with your existing accounting software like Xero, Sage, and QuickBooks. So, this means you get real-time insights without the hassle of juggling multiple systems.

Seamless self sign-up: Getting started with Atoa is a breeze. You can sign up in under five minutes—no lengthy forms or complicated setups.

Try Atoa for free! You can now experience the benefits of Atoa for 7 days at no cost—no strings attached!

FAQs

How long does it take to set up Atoa?

Setting up your account takes just five minutes!

Is there a trial period?

Yes! You can enjoy a 7-day free trial of our services.

What if I have questions during the transition?

Our friendly UK-based care team is here to help you every step of the way.

Are there any fees associated with open banking payments?

Open banking has lower transaction fees compared to traditional payment methods, making them more cost-effective for businesses.