Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Are barber and beautician apps like Boosky or Treatwell putting a strain on your cash flow? If so, then it’s about time you met Atoa…

Our cardless instant pay service is designed to boost your payments, giving you the power to keep on winning in the beauty industry. So prepare to snip away at high-fee third-payment processing and welcome a new era of efficiency and super-charged savings at your salon…

Atoa is packed with health and beauty business-boosting features

‘Scuse our French, but we like to sum Atoa up with a quick “FFS!”

That being our instant cardless payment solution is…

Fast: Funds are received into your business account seconds after the customer approves.

Fair: We only charge you 0.7% per transaction, falling with higher volumes, billed monthly.

Secure: Payment is approved using biometric security on the customer’s banking app. No room for chargeback or disputes!

On top of this, Atoa also offers an efficient and flexible way to pay and be paid. No more dashes to the cash machine!

We give customers the same convenience as card payments, but merchants pocket more, saving up to 60% in processing fees.

Explore even more ways Atoa can help you to cut costs here.

How do I get the most out of Atoa?

We can’t compete with Booksy or Treatwell on appointment management, but we can give you fairer payments. Most salon apps collect payments via Stripe, which still comes with unnecessary card middlemen fees and long waits for payouts.

Don’t waste time waiting to be paid less. There’s no obligation to take payments in your salon app. Tap your Atoa app and flash that QR code when your next appointment ends…

Because let’s be honest, you deserve more of what you earn.

If you take an average of £5,000 per month through Atoa, you’ll save a whopping £600 per year on card fees. Eye-opener: Treatwell’s basic plan costs £199, so you could pay for that three times over with money saved on card fees.

2 to 3-day waits for card funds are condensed to seconds with Atoa. This gives you more room to spice up your fade game or add a little bang to your next balayage. It’s your extra time and money, so how you spend it is up to you!

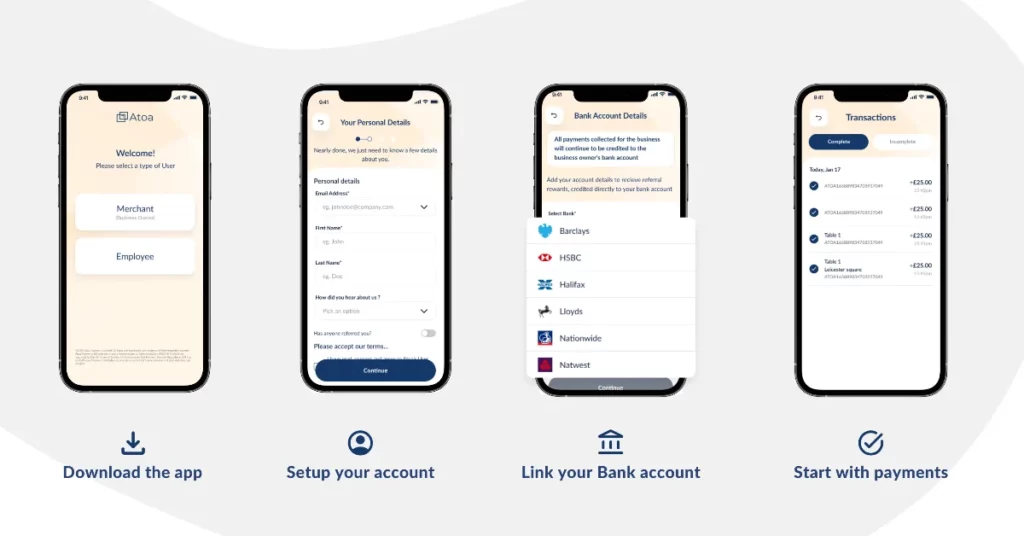

How do I get started with Atoa?

Atoa is a pay-as-you-earn service. You only need a smartphone app and a UK bank account to use it. There are no catches, and we won’t sneak any contracts, hidden service or hardware fees in. Integration is easy, and we don’t charge extra to add extra employees. So whether you’re using Booksy, Treatwell, Timely, Vagaro, Square, Phorest (or simply your iCal for appointments), it’s time to get Atoa booked in…

Download the Atoa Business app, and we’ll give you 7 days of free transactions to get you started. After that, you’ll receive a monthly invoice of 0.7%* of your total transaction amount.

If you’d like extra help getting started with Atoa, don’t hesitate to book a demo with our team today!

*Rates can lower with higher transaction volumes, so keep flashing those QR codes at customers to save even more with Atoa.

FAQs

How does Atoa enhance my payments? With fair, fast and secure cardless payments, Atoa improves your salon’s cash flow in just a few taps.

How does Atoa work with salon management apps? Use Atoa Business to collect instant payments instead of taking them in your appointment app or by debit card. They’ll likely both charge you around 1.5%+ per transaction. You’ll never be charged more than 0.7% with Atoa.

What benefits can Atoa bring to my salon? Enjoy way lower fees with instant payout, billed monthly. Easily enhance efficiency and flexible payments with QR codes and links. Most importantly, there are no contracts, catches, or hidden fees!

Is Atoa suitable for any size business? Our sweet spot is small and mid-sized businesses. You can have multiple locations under one store and add employees free of charge. As well as saving on payments, you can quickly view and export transaction details from the app for bookkeeping and analysis.