Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

With a market share expected to hit US$513.10 billion in 2024, digital payments are the future. Their improved speed, convenience and security over traditional methods are just a few reasons why digitalisation is key. So, is your UK retail store ready to take its share? Retail stores big and small need to jump on this trend to stay competitive. Furthermore, digital wallets make accepting payments easy, so it’s hard for cash and cards to keep up. We’ve discussed why digital payments are a step forward for UK businesses, but this article shines a light on how to use digital transactions in retail.

This article explores how and why UK retailers should use digital payments. Read on to learn how easy it is to add digital payments to your checkout and keep customers happy.

What are digital payments?

Digital or electronic payments are transactions made without physically exchanging cash. Instead of traditional cash or card payments, digital payment solutions send and receive money electronically through smartphones, bank apps, computers or digital wallets.

The most common types of digital payments

There’s every chance you’ve made plenty of digital payments already, but here are a few examples of common digital transactions in retail.

- Contactless card payments allow customers to tap a debit or credit card on a reader to make secure payments.

- Account-to-account (A2A) payments or pay by bank which trigger a payment from one bank account to another.

- Mobile wallets like Apple Pay or Google Pay store card information on your smartphone for payments in-store and online.

- Online payment gateways like PayPal or Stripe securely process payments for e-commerce websites.

- Bank transfers like direct debits move money electronically between bank accounts.

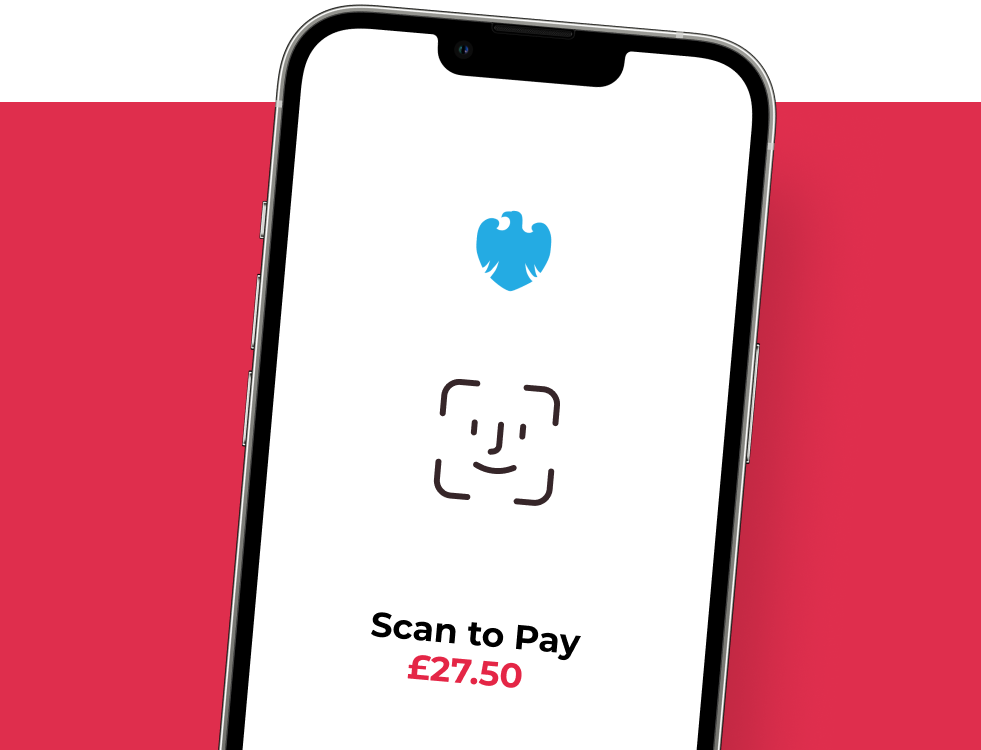

- QR code payments allow customers to scan a code with their smartphone to start payments from their bank app.

- BNPL (Buy Now, Pay Later) offers short-term financing plans, such as Klarna, which lets customers split purchases into interest-free instalments or pay in 30 days.

- While less common in everyday retail, cryptocurrencies like Bitcoin also function as digital payments.

The benefits of digital payments for retailers

UK Finance recently reported that 83% of people in the UK use contactless, with no age group or region falling below 75% usage. But why? Maybe it’s because digital transactions offer a more convenient experience than traditional methods, like cash.

If you want to know why, keep reading to discover even more benefits digital transactions offer small business owners.

You might enjoy fairer fees. We all know card networks like Visa and Mastercard are taking a cut when a customer pays by card. Digital transactions can reduce this burden, giving you more funds to reinvest. Or spend on yourself!

Your business gets its money faster. Are you fed up with waiting days for your card machine provider to send your funds? Slow settlement times are a thing of the past with digital solutions, especially when you use instant bank pay.

Customers love them. Tap to pay is here to stay.

And probably come back for more. Having straightforward payments can help encourage repeat visits and ultimately, more sales.

They’re more secure. Digital payments in retail often use encryption and other security measures like biometrics and 2FA to protect data. Protection like this means you’re less likely to get stung with surprises, like chargeback fees.

Choosing a digital retail payment system

Before signing up with new providers, consider your business’s payment volumes, budget, and target customers. Transaction fees can significantly impact your bottom line, so choose a solution with a fee structure that aligns with your sales. Security should come first for digital transactions in retail as this helps you and your customers stay protected.

What’s the cost? Transaction fees can vary wildly between providers. Be sure to shop around and understand the full fee structure, plus any contracts, hardware or hidden service fees.

Put security first: Choose reputable providers with a strong focus on fraud prevention and data protection.

Check integrations and usability: You need a straightforward setup process and a user-friendly interface for your team and customers. This reduces the cost of training and also helps to boost adoption.

Cater to everyone: Don’t go crazy using every payment method under the sun, but don’t exclude anyone. Accept cash and cards, but also make a concerted effort to pitch new options such as QR code payments. Also, share the benefits as loyal customers may adapt for you.

Comparing digital solutions

Deciding which payment methods to add at checkout means weighing up who uses your business and how. A local retail store selling mobility products will have a different clientele than a late-night fast-food joint. Therefore, you need to identify your customers, what technology they have access to, and how you think they would like to pay. Digital transactions might not even be relevant to your business type or industry.

We’ve drawn up a handy table comparing digital transaction methods, their features and a few things to consider to help you on the way.

| Digital transaction type | Features | Things to consider |

|---|---|---|

| Contactless card payments | Customers tap cards or devices on a reader This may require investing in a POS terminal | Widely accepted, secure and familiar to customers Transaction fees may vary by provider |

| Pay by bank | Customers scan a QR code to initiate payment using their smartphone camera Fast transactions, easy to implement Transaction fees can vary, some providers offer flat fees | Low-cost setup (often requires just a smartphone app) Dramatically lower fees dues to sidestepping card networks Instant settlement to your business bank account Identity confirmed in the bank app, removing chargebacks |

| Mobile wallets | Customers use smartphones to pay with stored card details Requires a compatible POS terminal, but many contactless readers support mobile wallets | Enhanced security (tokenization), convenient for customers (no physical card) Transaction fees may be lower than traditional cards |

| Online payment gateways | Expand reach beyond physical stores and offer diverse payment options | Expand reach beyond physical stores and diverse payment options Look for providers with clear pricing structures |

💡Always shop around and compare different providers before making the jump. Look for transparent pricing structures, user-friendly interfaces, and reliable customer support. Many offer free trials so you can test the service before signing up.

How The Beauty Wardrobe uses digital transactions

The Beauty Wardrobe is a family-owned business in Bradford, which has been in operation for over 25 years. They discovered Atoa in 2023 and haven’t looked back. 80% of the salon’s payments are made on debit cards, making our account-to-account transfer process a viable alternative. And with no extra hardware or fees, The Beauty Wardrobe got up and running with Atoa on the same day. Here’s what manager Harminder has to say about our digital transactions.

“We’ve got all of our treatment terms and conditions on WhatsApp Quick Replies, so we now send this to the customer with a link from Atoa Business for the deposit. I’ve seen around a 60-80% upturn in people paying deposits since using Atoa’s payment links as it’s so quick and convenient.”

Read our case study or watch the video below to discover how The Beauty Wardrobe tapped into faster cash flow with Atoa.

The takeaway

Digital payments not only simplify transactions but also open up new doors for retail businesses. With many user-friendly and cost-effective solutions available, why wait? To help you get started, we offer a 7-day free trial of our instant payment solution. Register and verify your account to take as many transactions as you like without fees. Don’t miss this opportunity to take your business to the next level!

FAQs

What are the different types of digital payments?

The main types of digital transactions include mobile wallets, pay-by-bank or account-to-account (A2A) payments, peer-to-peer (P2P) payment apps, online payment gateways, and bank transfers.

Which type of digital payment is right for me?

It depends on your business needs but we recommend looking for fast, fair and secure payments when choosing the right fit.

What are the benefits of digital transactions in retail?

Digital payments offer convenience, security, and speed. Plus, sometimes even rewards for you and your customers.

Are there any challenges?

Challenges include fees and security risks which vary depending on your provider. Also, customer adoption can be an issue, so make sure the method fits your target audience.