Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

The legal sector in Britain has long been burdened by rising costs, from administrative expenses to managing client payments. Open banking payments are emerging as a powerful tool that enables firms to streamline financial operations, reduce expenses, and improve client trust. But what exactly is open banking, and how can it help your firm save money?

What is open banking?

Open banking allows businesses to securely get financial data and make payments directly from bank accounts through Application Programming Interfaces (APIs). This innovation cuts out unnecessary intermediaries, speeds up transactions, and improves financial transparency. For law firms dealing with multiple payments, escrow accounts, and complex financial reconciliations, open banking simplifies processes while also significantly reducing transaction fees.

How Can Law Firms Reduce Costs?

Open banking offers law firms a great way to manage payments, optimise financial workflows, and ultimately cut down on expenses. So, take a look at the key areas where law firms can benefit.

Automating administrative processes

One of the biggest financial drains for law firms is the sheer volume of administrative work required to manage payments. From reconciling invoices to processing transactions, traditional financial management eats up time and resources.

However, with open banking, these processes become automated. Payments are instantly matched to bills, cutting out manual reconciliation and reducing errors. Real-time payment reconciliation, for example, allows client payments to be automatically matched to outstanding bills. This frees up valuable time for higher-value tasks.Payit by NatWest conducted a survey and it showed that UK businesses using open banking report spending 150 hours less on operational tasks annually compared to non-users. So, these businesses save on payment processing fees annually versus those using other payment methods.

Lowering payment processing fees

Traditional payment methods—especially credit and debit card transactions—come with fees that add up quickly. On average, card processing fees range between 1-3% per transaction, cutting into a firm’s bottom line.

By enabling direct bank-to-bank transfers, open banking bypasses card networks entirely, significantly reducing transaction costs. Law firms handling large payments, such as property settlements or corporate transactions, can save thousands per year by switching to open banking solutions.

Plus, faster settlements mean law firms can allocate resources more efficiently, reducing dependence on credit lines and improving overall financial health.

Enhancing client trust and retention

Transparency and trust are crucial in legal services, particularly when managing client funds. Open banking offers real-time insights into transactions, allowing clients to track payments and see exactly when they’ve been processed. This eliminates confusion, reduces the need for follow-ups, and enhances overall client confidence in your firm’s financial operations.

A survey by BigHand found that 45% of UK law firms have reported an increase in client demand for real-time financial updates on legal matters. Open banking makes sure you meet these expectations, positioning your firm as modern, transparent, and client-centric.

Improving compliance and security

Financial compliance is a non-negotiable aspect of running a law firm. Firms must adhere to strict regulations set by the Solicitors Regulation Authority (SRA) to ensure proper handling of client funds. Open banking simplifies compliance by offering detailed transaction records, real-time audit trails, and automatic reconciliation.

Security is another major advantage. Open banking leverages encrypted APIs, fingerprint scanning, and facial recognition to protect transactions, making it as secure—if not more secure—than traditional banking methods. This reduces the risk of fraud while making sure that payments are processed safely.

Future-proofing legal practices

The legal industry is evolving, and firms that embrace new technologies will stay ahead of the competition. Open banking is not just a cost-cutting tool—it’s a strategic advantage that helps law firms operate more efficiently, improve cash flow, and offer better financial transparency.

Key Takeaways

Open banking presents law firms with a smarter way to manage finances, reduce overheads, and enhance client trust. By automating payments, cutting out card fees, and ensuring regulatory compliance, firms can save time and money while focusing on what truly matters—delivering top-tier legal services.

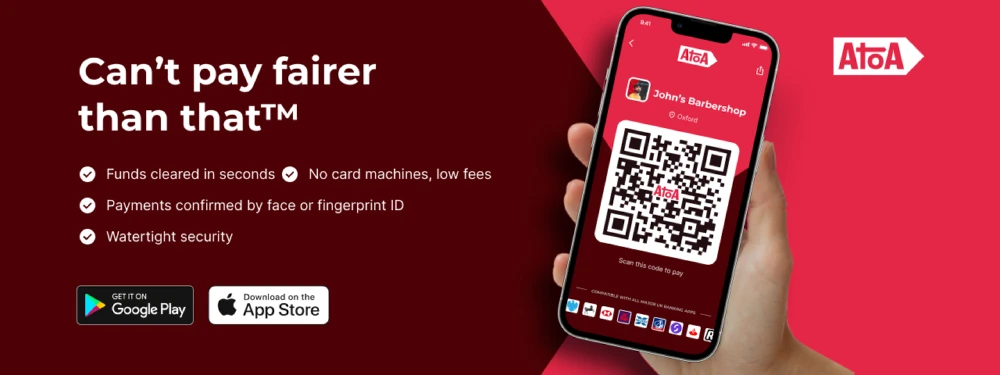

With financial efficiency becoming a key priority for modern law firms, finding the right solution can make all the difference. Brands like Atoa provide a seamless way to integrate open banking into your payment processes, helping you increase savings and make operations smoother.

Benefits of Atoa

- Zero hidden fees: Atoa offers transparent, fair fees compared to traditional card payment methods.

- Instant payments: Transactions are processed in real-time, improving cash flow and reducing wait times.

- No card machines: With Atoa, customers pay directly from their bank accounts using QR codes or payment links. No expensive card readers or complicated setups.

Thousands of UK businesses trust Atoa to simplify payments and improve financial operations. If your firm is ready to take advantage of open banking, try Atoa free for 7 days at zero cost and find out how it can benefit your firm firsthand.

FAQs

Is open banking safe?

Yes, open banking is highly secure, adhering to strict regulations like PSD2. It uses encrypted APIs, strong customer authentication, and only FCA-authorised providers can access data with user consent.

How does open banking enhance client relationships for law firms?

Giving your clients real-time insights into payment statuses, open banking offers greater transparency, fostering trust and reducing payment-related inquiries.

What types of law firms can benefit from open banking?

Any law firm dealing with high-value transactions, such as property law, corporate law, or dispute resolution, can benefit from the reduced fees and faster processing times open banking offers.

How quickly can my law firm start using open banking solutions?

Most open banking solutions, including Atoa, offer seamless integration with existing payment infrastructure, allowing firms to start benefiting in a day’s time.