Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

In recent years, the payments industry has seen a shift towards faster, more secure, and cost-effective solutions. Among these innovations, Payment Initiation Services (PIS) have emerged as a promising alternative to traditional card payments. By enabling direct bank-to-bank transfers, PIS offers businesses a way to reduce fees, speed up transactions, and enhance security. In this article, we’ll explore what PIS is, how it fits into the Open Banking framework, and the benefits and challenges it presents for businesses across different industries.

What are Payment Initiation Services (PIS)?

Payment Initiation Services (PIS) allows businesses and consumers to move money directly from a payer’s bank account to a merchant’s without relying on traditional card networks. Introduced under the Revised Payment Services Directive (PSD2) in the EU, PIS is a vital component of the Open Banking ecosystem, enabling secure and efficient bank-to-bank payments.

Unlike card payments, which involve multiple intermediaries and higher fees, PIS simplifies transactions by directly linking bank accounts. This direct approach reduces costs and speeds up settlements, making it an attractive option for businesses looking to optimise their payment processes.

How PIS fits into the open banking ecosystem

Open Banking is all about giving consumers control over their financial data, enabling authorised third-party providers (TPPs) to access bank information securely. PIS providers fall under this category, leveraging Open Banking APIs to initiate payments on behalf of users.

For example, a customer purchasing a flight online can authorise a PIS provider to transfer funds directly from their bank account to the airline’s account. The transaction is quick, secure, and bypasses card networks, reducing both costs and the risk of chargebacks.

Key benefits of Payment Initiation Services

1. Lower fees

One of the most appealing aspects of PIS is the cost savings. By eliminating card networks and their associated fees, businesses can significantly reduce payment processing costs. Traditional card payments can incur fees ranging from 1.5% to 3.5%, while PIS transactions typically cost a fraction of that amount.

Example: An e-commerce business processing £100,000 monthly in card payments could save up to £3,500 monthly by switching to PIS, boosting profit margins without increasing sales.

2. Enhanced security

Security is a core advantage of PIS. Unlike card payments, which expose sensitive card details at multiple points, PIS relies on bank-level security and Strong Customer Authentication (SCA). This reduces the risk of fraud and ensures that payments are authorised directly by the payer.

3. Faster settlements

Traditional card payments can take 2-3 days to settle. PIS, however, leverages real-time payments infrastructure, enabling near-instant settlements. This accelerated cash flow can significantly benefit industries like e-commerce and travel.

Challenges of adopting PIS

While the benefits of PIS are compelling, there are challenges that businesses need to consider:

1. Consumer awareness and adoption

PIS is relatively new, and many consumers are still unfamiliar with it.

2. Integration complexity

Integrating PIS with existing payment systems can require technical expertise and resources.

3. Limited bank coverage

While Open Banking adoption is growing, not all banks fully support PIS yet.

Real-world applications of PIS

In E-commerce:

E-commerce businesses can benefit significantly from PIS by reducing payment fees and minimising the risk of fraud.

In travel:

The travel industry, often burdened by high chargeback rates and fraud, finds PIS particularly valuable.

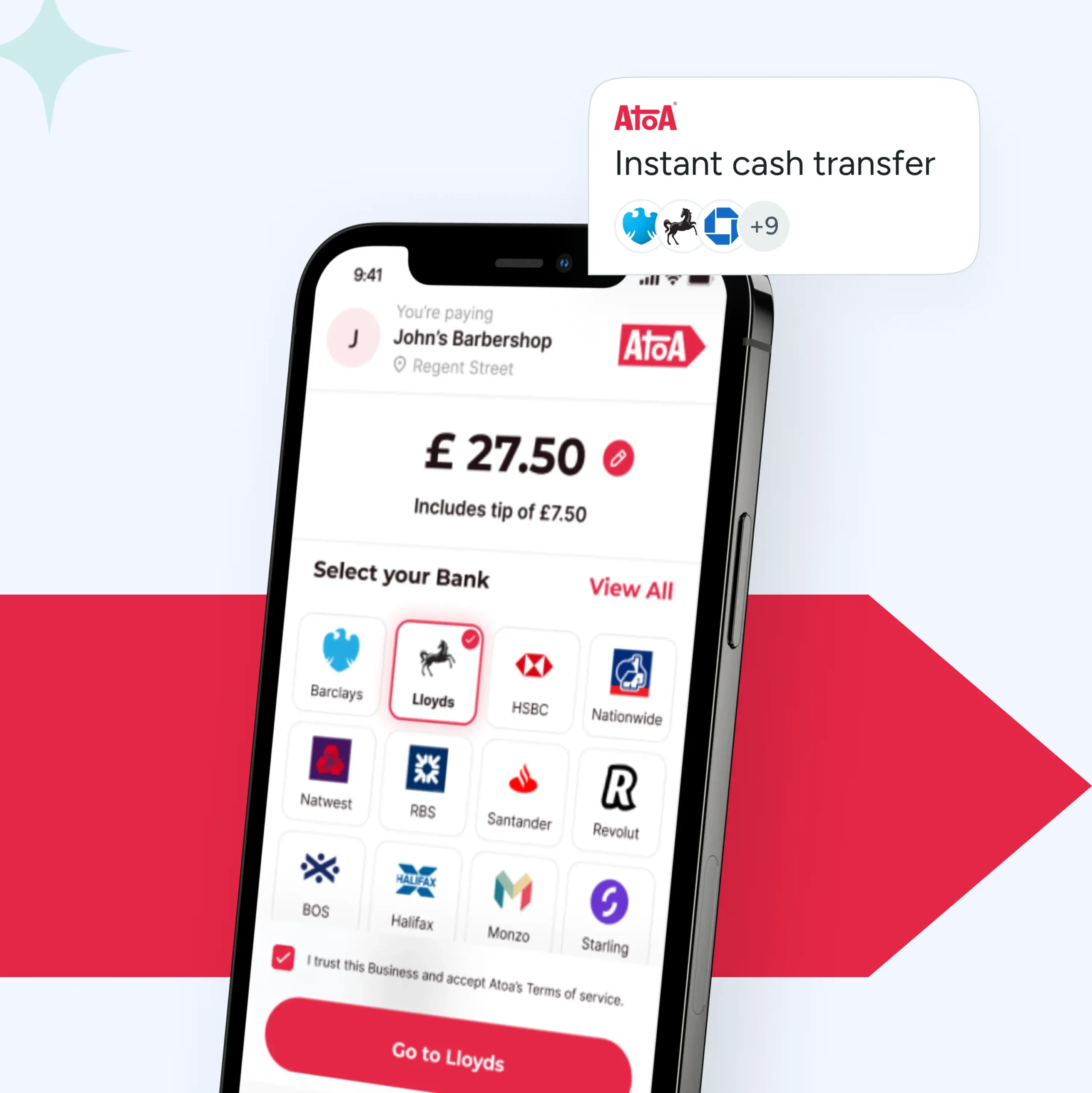

With Atoa:

Atoa Instant Bank Pay facilitates transactions using Payment Initiation Services. This service enables all Atoa merchants to accept payments directly from customers’ bank accounts, bypassing traditional card networks. By doing so, Atoa makes it faster and cheaper for merchants to process payments, enhancing their profitability and efficiency.

The future of Payment Initiation Services

The adoption of PIS is set to grow as Open Banking becomes mainstream. Enhanced API standards, broader bank coverage, and increasing consumer familiarity will further drive PIS uptake.

Looking ahead, we can expect to see PIS becoming a standard payment method across industries, particularly for high-value transactions where security and cost efficiency are paramount.

Conclusion

Payment Initiation Services offer a fresh approach to payments—faster, cheaper, and more secure than traditional methods. While challenges remain, the benefits for businesses and consumers alike are clear.

By staying informed and proactive, businesses can leverage PIS to enhance customer trust, reduce costs, and streamline their payment processes, ensuring they remain competitive in an increasingly digital world.