Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

For large businesses processing hundreds or thousands of transactions each month, the cost of getting paid isn’t just a line item, it’s a strategic concern. While card payments have long been the standard, they’re not necessarily the smartest option anymore. With transaction fees, hardware requirements, chargebacks, and delays in settlement, the cost of accepting card payments continues to climb, while quietly eroding margins. In such a climate, Pay by Bank may seem like a blessing. It’s a fast, secure way for customers to pay directly from their bank accounts, without cards, terminals, or unnecessary intermediaries. But does it actually cost less?

The short answer? Yes. Let’s break it down.

The cost of cards vs. Pay by Bank

Card payments come with a mix of visible and hidden fees. Once you account for interchange, acquirer, compliance, and hardware costs, many UK businesses end up paying between 1.5% to 3.4% per card transaction. That’s before considering chargebacks or the cost of delayed settlement.

By contrast, Pay by Bank, which is powered by open banking infrastructure, cuts out card networks entirely. Most providers charge a flat fee of around 0.7% to 1% per transaction, often with real-time settlement and no hardware dependency. For businesses processing larger volumes, many providers offer even lower rates, making the savings even more significant at scale.

Real-world impact: The Ponko case study

Take Ponko, a leading car dealership and workshop in Cambridge managing over 300 vehicles. They switched to Atoa for Pay by Bank payments and now use it for 96% of their transactions. The results? Over £6,000 saved in monthly card fees, faster settlements, and a smoother experience for both staff and customers. That kind of cash flow improvement doesn’t just look good on paper, it reshapes how a business operates day to day.

Beyond savings: A strategic advantage

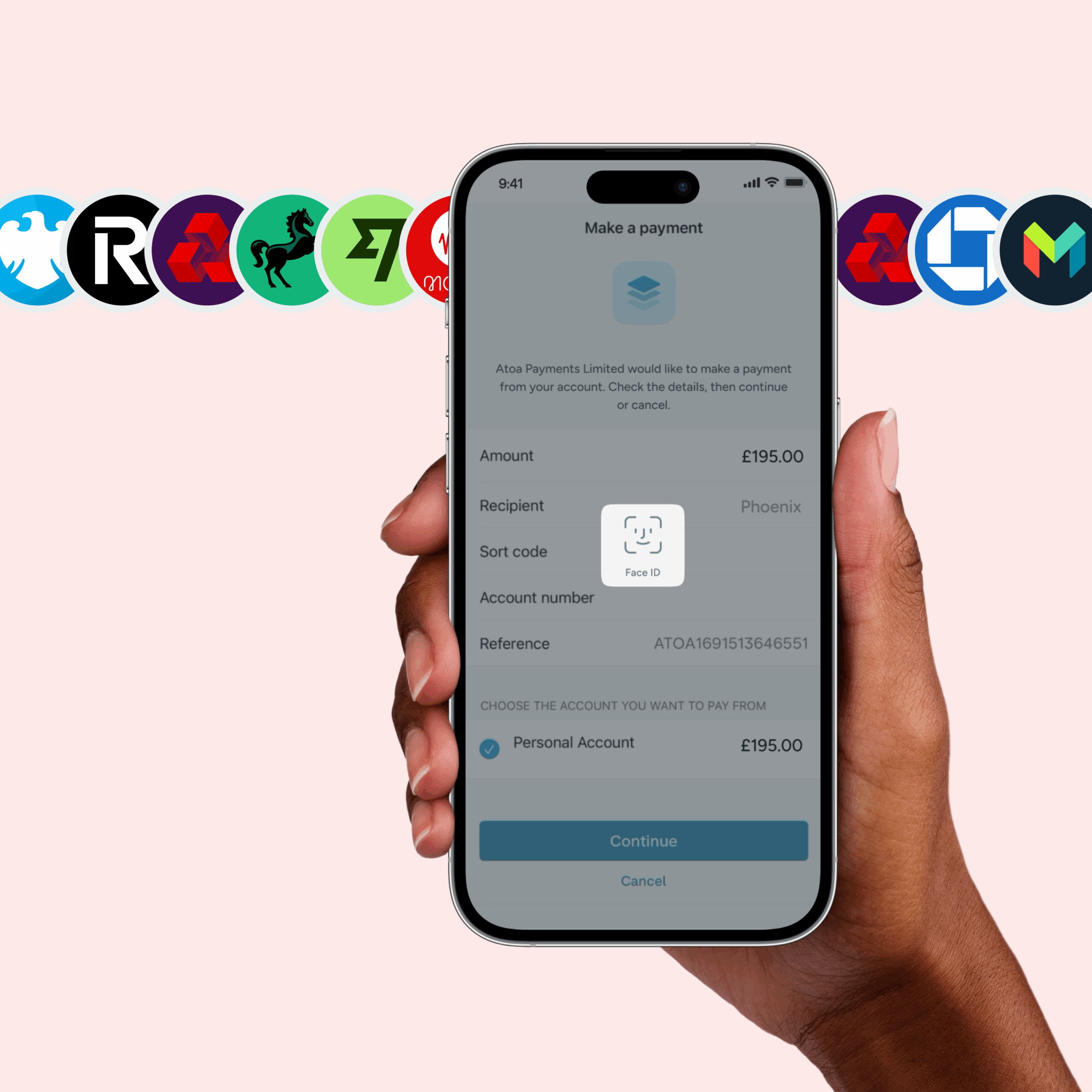

Switching to Pay by Bank doesn’t just cut costs, it streamlines operations. There’s no need for terminals, no cards to manage, and fewer payment failures. Customers authenticate payments through their banking app, offering strong security with minimal friction.

For finance teams, that means faster reconciliation, better visibility, and fewer disputes. And for businesses with high average transaction values or repeat customer payments, the difference can be substantial, both financially and operationally.

The bottom line

If your business is still relying solely on cards, it might be time to re-evaluate. With lower fees, instant settlements, and stronger control over payment flows, Pay by Bank is proving to be a smarter, leaner way to get paid. And as open banking continues to mature in the UK, it’s becoming an increasingly viable and preferred payment method for both businesses and customers.Curious to see what your savings could look like? Try Atoa or similar providers that offer real-time settlement, low fees, and simple onboarding, without the complexity or card-related overhead.