Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Chargeback fraud—often called “friendly fraud” (though there’s nothing friendly about it!)—is a growing issue for businesses of all sizes. Chargebacks were originally designed to protect consumers from unauthorised transactions, but unfortunately, some customers take advantage of the system. They might request a refund while keeping the product or claim they never made a purchase, even when they did.

For businesses, this can mean lost revenue, higher fees, and even reputational damage. But don’t worry—there are steps you can take to prevent chargeback fraud and keep your business running smoothly.

Understanding chargebacks: Legitimate vs. fraudulent

Not all chargebacks are scams—some are legitimate disputes. Knowing the difference can help you put the right safeguards in place.

Legitimate chargebacks happen when:

- A transaction is unauthorised

- A product never arrives

- An item isn’t as described

These cases usually stem from miscommunication or errors, which is why great customer service and clear policies go a long way in preventing them.

Fraudulent chargebacks occur when a customer knowingly disputes a valid transaction. They might claim they never received an order, that it was defective, or that they never made the purchase—all while keeping the item. Some misunderstand return policies, while others are intentionally taking advantage of the system.

The real cost of chargeback fraud

Chargeback fraud doesn’t just affect your bottom line—it creates headaches across your entire business.

Financial impact: Every chargeback means a lost sale, plus extra fees from payment processors. If your chargeback rate gets too high, you could face increased transaction fees or even risk losing your ability to accept card payments.

Operational drain: Fighting chargebacks takes time and effort. You have to gather proof, submit responses, and work with banks—time that could be better spent growing your business.

That’s why preventing chargeback fraud before it happens is key.

Smart strategies to prevent chargeback fraud

Here are some proven ways to keep chargebacks at bay:

1. Strengthen fraud detection

Using smart fraud detection tools can stop fraudulent transactions before they happen. Consider:

- Address verification system (AVS): Ensures the billing address matches the cardholder’s details.

- Card security codes (CVV/CVC): Requires the three-digit security code for extra verification.

- Two-factor authentication (2FA): Adds an extra security step to confirm the customer’s identity.

For more payment security tips, check out this guide on strong customer authentication.

2. Improve customer communication

Many chargebacks come from simple misunderstandings. Clear communication helps prevent disputes before they start.

- Make refund and return policies easy to find and understand.

- Provide excellent customer service so customers reach out to you first instead of their bank.

- Send order confirmations, tracking numbers, and estimated delivery times to reassure buyers their purchase is on the way.

3. Keep detailed transaction records

If a chargeback dispute does arise, having solid proof is your best defence. Keep records of:

- Receipts and invoices

- Order confirmation emails

- Shipping and tracking details

- Customer communication logs

Having this information handy can make the difference between winning or losing a dispute.

4. Use secure payment methods

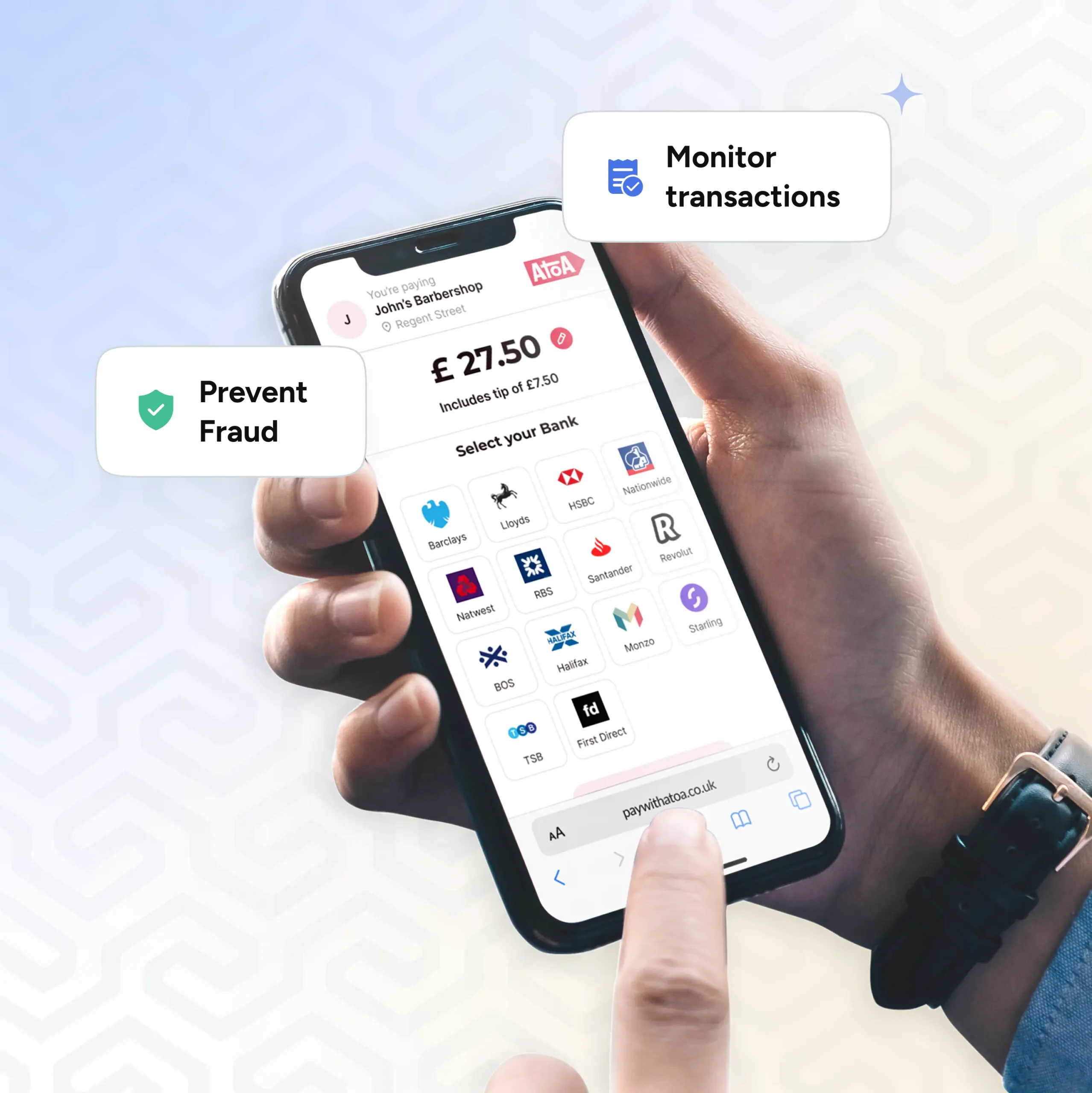

Card payments are a common target for chargeback fraud. One way to minimise risk? Use secure payment alternatives like account-to-account payments.

Open banking solutions, like Instant Bank Pay, offer secure transactions that don’t rely on traditional card networks, reducing the risk of chargebacks while keeping payments seamless and secure for both you and your customers.

What to do if you get a chargeback

Even with the best prevention strategies, chargebacks can still happen. When they do, responding quickly and effectively is key.

- Review the chargeback notice – Understand why the claim was filed.

- Gather your evidence – Collect receipts, shipping confirmations, and customer interactions.

- Submit a response – Provide a clear, detailed explanation with supporting documentation.

- Follow up – Stay in contact with your payment processor to ensure the dispute is reviewed properly.

Keeping your chargeback rate low

A low chargeback rate keeps your business in good standing with payment processors and protects your revenue. Some best practices include:

- Monitoring transactions for suspicious activity

- Updating security protocols regularly

- Training staff on fraud prevention

- Offering a seamless, transparent customer experience

Conclusion

Chargeback fraud is a real challenge, but with the right strategies, you can stay ahead of it. By strengthening fraud detection, improving customer communication, maintaining solid transaction records, and using secure payment options like Atoa’s Instant Bank Pay, you can reduce disputes and protect your revenue. Looking for a smarter way to handle payments? Book a call with our team of payment specialists.