Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Cash flow challenges are prevalent in the legal sector, with firms often facing delayed payments from clients, high processing fees for traditional payment methods, unpredictable revenue streams due to the nature of legal work, rising operational costs, and poor law firm payment systems. According to a Law Society survey, UK law firms currently experience an average of 128 days of lock-up time. This comprises both work-in-progress and debtor days—leading to significant cash flow issues.

This article will provide five actionable strategies to improve cash flow.

1. Embrace open banking payment solutions

To boost cash flow, businesses must focus on both increasing the number of payments and enhancing their efficiency. Open banking has been a turning point in this regard, significantly improving the speed and volume of payment transactions. Between 2021 and 2023, open banking payments surged from 9 million to over 54.5 million. This data was collected from the nine largest banks and building societies in the UK. Such explosive growth demonstrates how open banking is transforming financial transactions—making them faster, more efficient, and ultimately more effective for businesses striving to improve cash flow.

For law firms, adopting open banking payment solutions can lead to significant improvements in cash flow. Some of the benefits include:

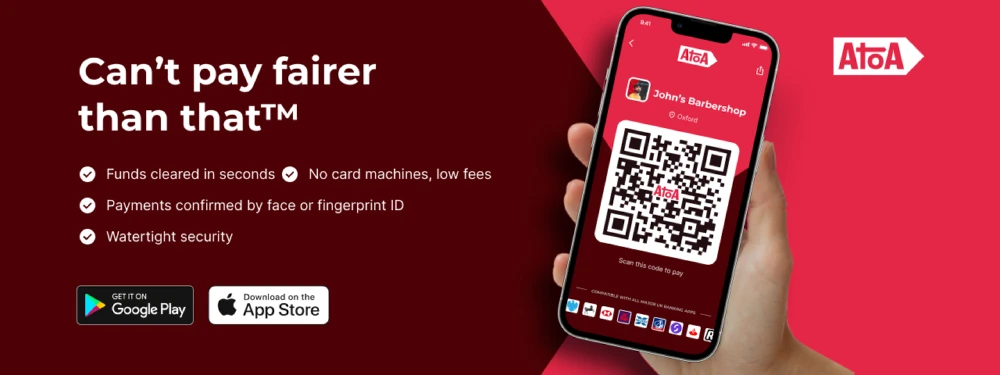

- Faster payments: Open banking transactions typically settle within minutes. This is a stark contrast to traditional bank transfers that can take several days. This quick processing means that firms can receive payments more quickly.

- Lower fees: The processing fees for open banking transactions are much lesser than card transactions. This reduction in costs can directly enhance a firm’s profitability.

- Saves time: With automatic reconciliation, you can say goodbye to the hassle of chasing invoices and manually matching payments to orders, freeing up valuable time.

- Reduces fraud: With open banking, customers confirm payments directly with their bank using biometrics like fingerprint scans and face recognition, which significantly lowers the risk of fraudulent transactions and the associated chargeback costs.

2. Streamline billing processes

Clear invoicing is essential for maintaining healthy cash flow, so your law firm payment systems should focus on creating concise and professional invoices that clients can easily understand.

Using Business Intelligence (BI) tools is another way to streamline processes and enhance cash flow. According to BigHand’s 2025 Annual Law Firm Finance Report, legal firms are increasingly adopting BI tools. Currently, 44% of firms are using BI solutions, with an additional 20% planning to implement these tools over the next year.

With BI, you can dive into your financial data and spot trends that help you forecast future cash flow. This means you can see potential shortfalls coming and plan ahead, rather than being caught off guard. Plus, these tools let you track your financial health in real-time, so you know exactly where your money is going.

3. Implement flexible payment plans

Flexible payment plans are a great way to boost client satisfaction and improve your cash flow. You can break down the payments into manageable installments so it’s easier for clients to stay on track while ensuring a steady flow of funds for your firm. To make these plans effective, here are two key steps to follow:

- Draft a clear agreement template: This agreement should specify the payment schedule is bi-weekly, monthly, or quarterly—and accepted payment methods like cheque, card, or digital payments. Also, outline terms for late payments: Will there be a grace period? Will penalties apply? In the UK, firms can charge interest on late payments at 8% above the Bank of England base rate under the Late Payment of Commercial Debts (Interest) Act 1998. A clear agreement fosters transparency and trust.

- Have an efficient billing system: While you can manually send invoices and reminders, this can be time-consuming. Instead, consider using payment systems like Atoa Instant Bank Pay that have features like sending automated payment reminders. This reduces administrative burdens and ensures timely collections, contributing to better cash flow management.

4. Review and reduce operating costs

Identifying cost-saving opportunities is essential for boosting your cash flow and ensuring the long-term success of your legal practice. Start by conducting thorough reviews of your operating expenses—think software subscriptions, office rent, utilities, and marketing costs. These are often areas where you can uncover significant savings. Don’t hesitate to negotiate better deals with vendors; securing more favourable terms can make a real difference to your bottom line. Also, consider exploring cost-effective alternatives like cloud-based services and energy-efficient office equipment, which not only help reduce costs but can also enhance your firm’s operational efficiency.

5. Maintain an emergency fund

Having an emergency fund is crucial for any legal practice. It acts as a financial safety net during unexpected situations. Whether it’s a sudden downturn in business or unforeseen legal challenges, having reserves can help you navigate these bumps in the road without jeopardising your operations.

Aim to accumulate enough to cover at least three to six months’ worth of operating expenses. You can do this by setting aside a percentage of your profits each month specifically for this purpose. This approach not only helps you build a substantial cushion over time but also instills a sense of financial security within your firm. This way, you’ll be well-prepared to handle any surprises that come your way.

In conclusion

Improving cash flow is essential for the sustainability and growth of your legal practice. By implementing the strategies discussed, you can effectively tackle the financial pressures.

With Atoa, you can expect a range of benefits that will elevate your financial management through innovative law firm payment systems.

- Enjoy faster transactions with instant payments that reduce the time spent waiting for funds to clear.

- Benefit from lower processing fees of 0.7% compared to 1.5-2% charged for credit card payments, meaning more revenue stays within your firm.

- Atoa prioritises security, ensuring that every transaction is verified through biometric authentication, giving both you and your clients peace of mind.

By using Atoa, you can improve cash flow and enhance overall financial health as well.

Get ready to experience these benefits like 1000s of other UK business owners. Try Atoa for a 7-day free trial and enjoy a full week of transaction-free payments.