Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Gone are the days of chequebooks and signing on the line for credit card payments. Times change, and so does your business payment strategy. If the payment climate starts to change, you need to be ready to adapt. Faster Payments processed 384.4 million payments in March 2024, which amounted to a staggering total of £324 billion. That poses the question – is it time your business gets paid faster and more fairly?

If so, you’re in the right place. In this article, I will cover:

- What a business payment strategy is

- Things your business should consider

- How to put together a plan for your business

What is a payment strategy?

A payment strategy is how a business accepts payments to manage cash flow. It’s a plan that combs through everything your operation needs to process secure payments. It’s more than just choosing a card machine though – it spans from managing cash flow to protecting against fraud, and keeping customers happy so they make a return visit.

But realistically, a salon will need a different approach to accepting payments than a car dealership. All payment strategies should align with the nature of the business in mind, its customer base, and how it functions daily, amongst other things!

Why your business needs a payment strategy

Creating a payment strategy tailored to your business needs can help improve cash flow, boost customer satisfaction, and put you miles ahead of the competition. Here is a little more food for thought on why they matter…

- Get paid faster with a clear plan prioritising payment methods that settle quickly to improve cash flow.

- Protect yourself and your customers with a good strategy including security measures to prevent fraud and keep everyone safe.

- Save money by comparing different payment providers and transaction fees to find the most cost-effective options for your business.

- A flexible strategy helps you stay ahead and adapt to new payment trends like contactless or buy now, pay later as they emerge.

- Keep customers happy through convenient payment methods like cards, mobile wallets, or online payments that make it easier for customers to buy from you.

💡 Remember, every business is different, so your payment strategy should be too. Consider:

- Your industry: A salon might focus on card and contactless payments, while a car dealership might need a way to transfer money quickly.

- Your customers: What payment methods do your target customers prefer? Use this information to build a range of options that meet their needs.

- Your priorities: If you need to collect deposits or regularly accept high-value transactions, choose payment providers that support those needs.

How to build a strong payment strategy

Here’s a breakdown of why having a payment strategy is important and the key elements involved. Grab a piece of paper or open your notes and let’s get down to it.

Choose your payment methods wisely

Dialling up the right payment methods for your customers is central to your business’ success. But how do you choose? The ways customers like to pay varies massively between industries, so you’ll need to get your research hat on. First, look at the trends within your business. Then venture a little further afield and see how your competitors are accepting payments. Does it differ from how you’re doing it?

Consider these popular options to get started:

- Card payments: Accept major credit and debit cards in-store and online to cater to most customers.

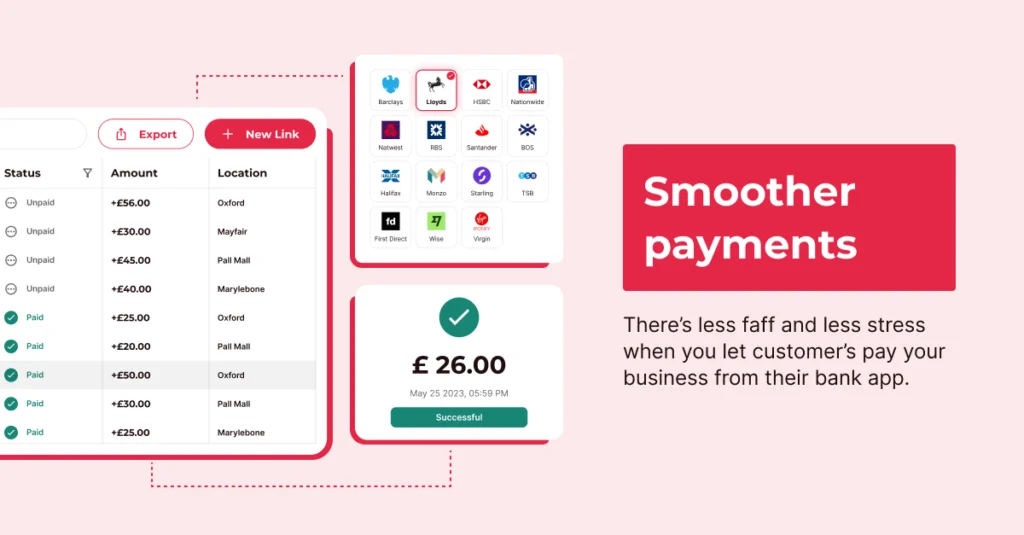

- Open banking payments: This new kid on the block offers a cost-efficient method that adapts to various business models with watertight security to avoid chargeback risks.

- Direct debit: Ideal for subscription services or regular bills, direct debit automates recurring payments for convenience and improved cash flow.

- Bank transfers (BACS): Cost-effective for high-value transactions, although generally less convenient.

- Digital wallets: Embrace the growing trend of mobile payments by adding Apple Pay, Google Pay, PayPal, and other popular digital wallets to checkout.

- Contactless payments: Allows businesses to accept quick in-store transactions up to the contactless limit set at £100 as of June 2024.

Remember that customer preferences can vary wildly depending on your business type. Research your industry to understand how your target customers prefer to pay. Look at your competitors’ payment options and consider new technologies like Atoa to stay ahead of the curve. Furthermore, whilst customer needs should be fulfilled, you should focus on choosing payment methods that work for your business and financial goals. Offering a range of payment options can maximise customer satisfaction, increase sales, and provide smooth payment experiences.

💡Payment tech is also expanding at a rapid rate thanks to fintechs and challenger banks, so see if there’s anything new out there, like Atoa!

Register with a payment provider or gateway

Once you’ve determined the payment methods your business will accept, the next step is choosing the right payment system to process transactions securely. Here’s what to consider:

- Names you trust: Opt for well-established and trusted payment processors like Stripe, PayPal, Worldpay, and others that offer reliable services and robust security features.

- Reducing transaction fees: Carefully compare transaction fees across different providers, as they vary significantly. Consider your typical transaction volume and types to find the most cost-effective option.

- PCI DSS compliance: Prioritize providers that adhere to the Payment Card Industry Data Security Standard (PCI DSS) to ensure the highest level of security for your customers’ payment data.

- Open banking payments: Consider account-to-account payments like Atoa which offer faster settlements with lower fees and no hardware shopping list.

Remember to evaluate the solution against your unique business needs, such as:

- Features: Does the provider offer features you need, such as recurring billing, invoicing, or fraud prevention tools?

- Integration: How easily can you use this payment gateway with your existing website or e-commerce platform?

- Customer support and reviews: Is the provider’s customer support responsive and helpful if you encounter any issues?

💡Take your time to research and compare different providers to find the perfect fit for your business. Choosing wisely can streamline payment processes, boost security, and improve customer experience.

Have you already chosen? Then learn how to add a payment gateway to your business with our simple guide.

Make it easy to pay

Customers value a hassle-free shopping experience and guess what? Your payment process plays a big part in that. By making payments simple and transparent, you’re not just getting paid – you’re building trust and keeping customers loyal to your business.

Make it super easy for customers to check out on your website. Think fewer clicks, no unnecessary pop-ups, and easy guest checkout options.

Always keep in-store transactions quick, easy and in line with customer preferences.

Be clear with invoices, receipts, and statements that are easy to understand.

Let customers know about upcoming payments and any changes, and always send a confirmation when a payment goes through.

When paying is simple, customers are happy. And happy customers are more likely to return, talk positively of your business, and help you succeed in the long run. (P.S. Did we mention that Atoa can handle these things for you?)

Prevent fraud with secure payments

Fraud prevention is a huge part of e-commerce transactions, especially online marketplaces. A study by TSB found more than a third of Facebook Marketplace ads could be scams, with customers losing up to £60m in 2023. Nobody wants to deal with fraud. It’s a headache for businesses and a nightmare for customers. But with the right payment tools and strategies, you can protect yourself and your hard-earned money.

Simple tools and rules for extra security in your payment strategy

- AVS and CVV double check the cardholder’s information matches up for an extra layer of security.

- 3D Secure adds another step to online checkouts by sending a one-time password or code to the cardholder’s phone to make sure they are making the purchase.

- Fraud detection software can spot suspicious activity and flag it for you to review.

- Strong Customer Authentication (SCA) is a must for online card payments. It requires two forms of identification, like a password and fingerprint, to help prevent fraud.

- The contactless card payment limit is currently £100. Consider offering other payment options for high-value purchases.

- Keep up with the latest fraud trends and regulations to stay ahead.

Play by the rules (and regulations)

The UK has strict rules around protecting payments and customer data, therefore it’s important to follow these regulations to keep your business safe and your customers’ information secure.

- PCI DSS (Payment Card Industry Data Security Standard) is in place to make sure businesses protect sensitive information.

- GDPR (General Data Protection Regulation) protects customers’ data, ensuring businesses use, collect, and store it responsibly.

- Strong Customer Authentication (SCA) adds extra security for online payments, usually requiring two forms of identification (like a password and fingerprint) to release funds.

Open Banking payments follow all these rules, making them a secure option for your business. Here’s why:

- Providers are regulated by the Financial Conduct Authority (FCA), meaning they’re held to high standards for security and data protection.

- Open Banking payments use SCA to verify the payer’s identity, adding an extra layer of security.

- Open Banking uses encryption to protect your data, making it difficult for anyone to intercept or misuse it.

By following these regulations and choosing secure payment methods like Open Banking, you can protect your business, build trust with your customers, and stay on the right side of the law.

Here’s one I made earlier: pizza payment strategy

Let’s pretend I run a local pizza restaurant and bar in Manchester city centre that caters to a young demographic. To make this more interesting, I also take my pizza to the masses at festivals.

Buzzing bars with table service thrown into the mix is a challenge, so how do you make sure people pay up fast whilst still getting a top-dollar hospitality experience? Let’s slice up this dummy payment strategy pie…

Contactless is the stuffed crust of this payment strategy

Nobody wants to see “cash is king” posters around here. Why? Beca contactless is where it’s at! Young diners expect to tap and go, usually with Apple Pay on their phones. But you could easily shake this up and be clever. The first port of call is QR codes at tables for customers to order and pay directly from their bank app. Because after all, nobody wants to speak much after a long day at work! That’s how you minimise wait times to maximise those extra orders.

Have you got regulars relying on you? Let them run a tab and leave you a tip without the faff. Consider running service how you’d want to be served to create flawless experiences to keep your regulars flocking back.

And if you’ve got the food truck set up outside or further afield, the same still applies. Stick with contactless and don’t let the lack of WiFi stop you. As a heads up, mobile payment solutions like Atoa will work with your phone signal so you can get paid anywhere…

Up next is convenience

Young people are all about instant gratification. Make every payment as quick and painless as possible. Get ready to experiment with the latest payment tech, as it’ll make your life easier and your customers happy too.

Don’t skimp on security. Using payments with SCA or biometrics and keeping data under wraps is a must to keep everyone’s data safe.

Bonus info (like an extra layer of nduja)

Got a strategy but still trying to get it off the ground? Consider offering customers a discount for their first time paying by QR codes. It’s a small investment that can build trust and pay off in the long run. Plus you’ll make it all back by saving on card processing fees!

But whatever you do, don’t get caught out. Whether you’re slicing up in-store or out in a muddy field, always have a backup payment method. Cash is still a good fallback.

FAQs

What payment methods should I accept?

Accept the most popular options like cards, mobile wallets and QR codes. Consider adding buy now, pay later if it suits your products as it can help customers spread the cost.

How do I choose the right payment processor for my business?

Look for a processor with low fees and the features you need. Research and compare different providers to find the best fit.

How can I make payments easy and secure for my customers?

Use a well-known payment processor, display security badges on your website, and offer guest checkout to save one-time customers the hassle of creating an account.

How do I protect my business from online payment fraud?

Use a payment processor with strong fraud protection, ideally using biometrics to avoid chargebacks. Make sure your team knows how to monitor transactions for anything suspicious.

The bottom line

Better payments mean easier cash flow. It may feel like rocket science but it isn’t.

A payment strategy should evolve with your business and changing trends. Take time out to regularly review and update your payment methods to stay competitive and provide the best experience for your customers.

Want to make a good strategy even better? Try a no-string attached 7-day free trial with Atoa. A full week of free payments, which moves to 0.7% per transaction plus VAT once the introductory period ends.