Getting paid on time is still one of the biggest challenges for UK businesses. Invoices go out, but there are payments delays. Bank transfers get pushed aside, and reconciliation takes hours that could be better spent running the business. Remote payments, in particular, highlight these pain points: customers want something simple, and businesses need cash flow that doesn’t stall. It’s no surprise then that mobile payments are booming. In 2024, the UK mobile payments market was valued at USD 2.65 billion, and it’s projected to reach USD 14.4 billion by 2033, growing at a remarkable 20.67% CAGR.

This surge is fuelled by mobile banking apps, the convenience of contactless payments, and the rise of new payment methods like SMS Pay, which turns a simple text into a fast, secure way to collect money remotely. For businesses, it’s a chance to reduce late payments and make it easier for customers to pay anytime, anywhere.

In this article, we’ll explore what SMS Pay is, how it works, and why it’s becoming an essential tool for UK businesses that want to simplify collections and speed up cash flow.

What is SMS Pay?

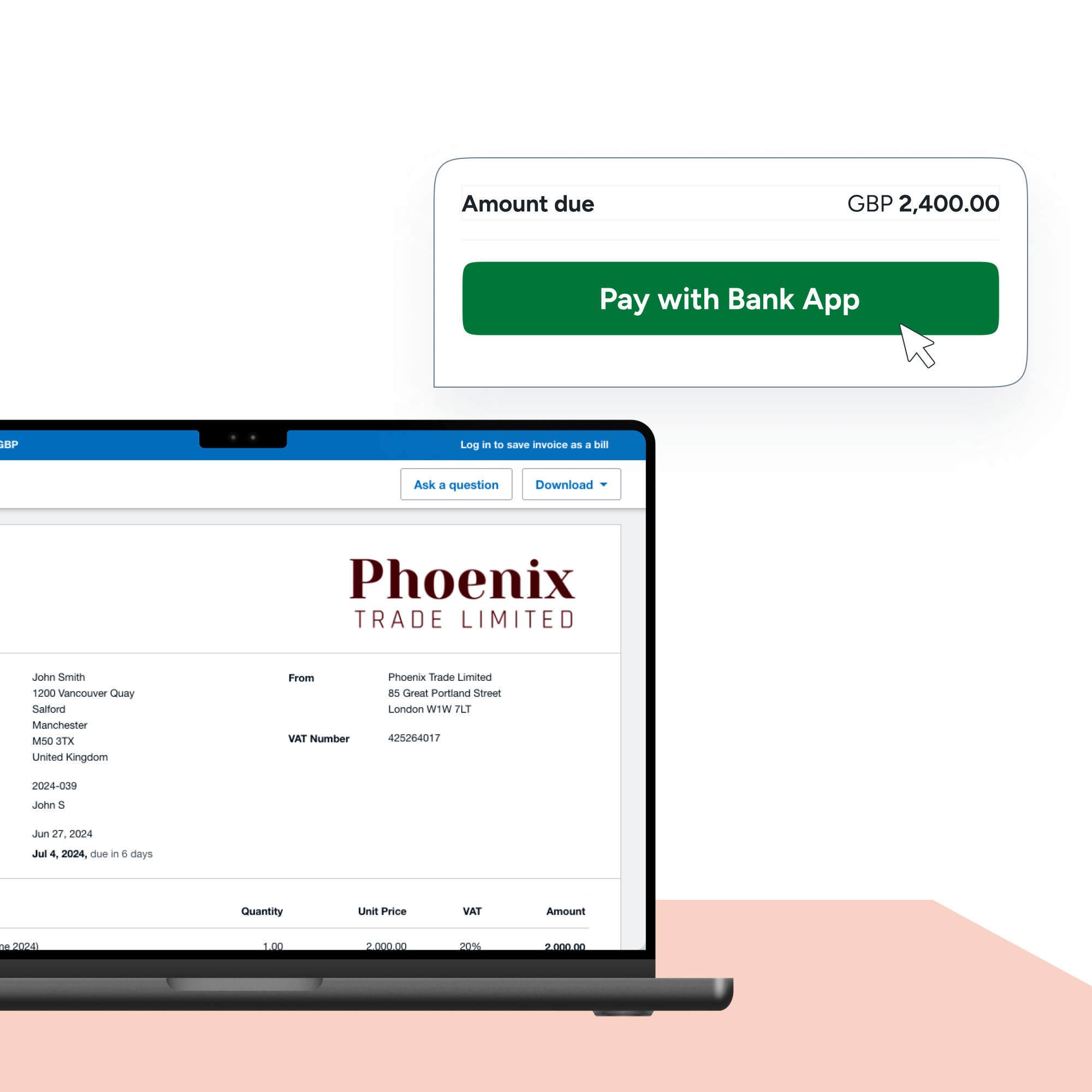

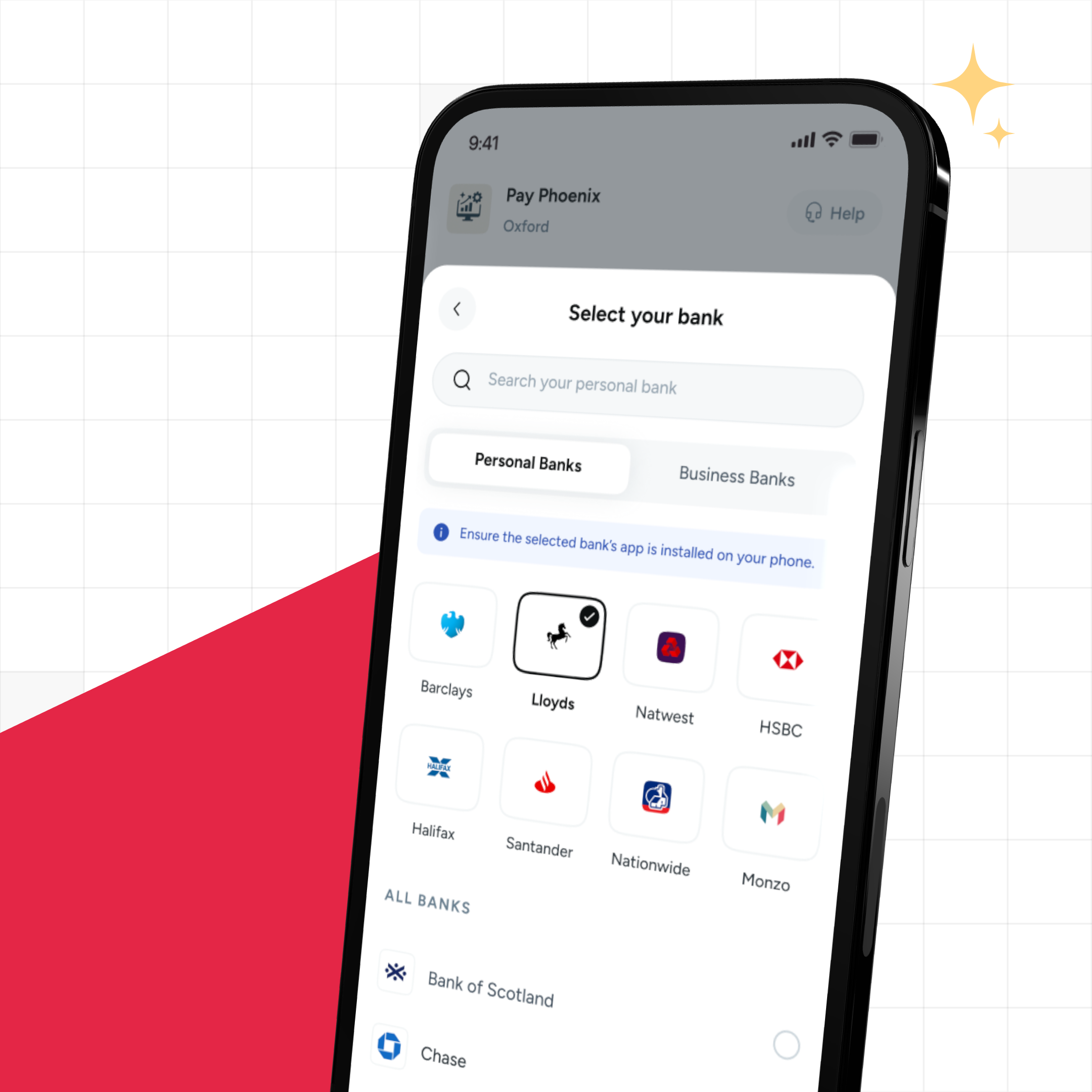

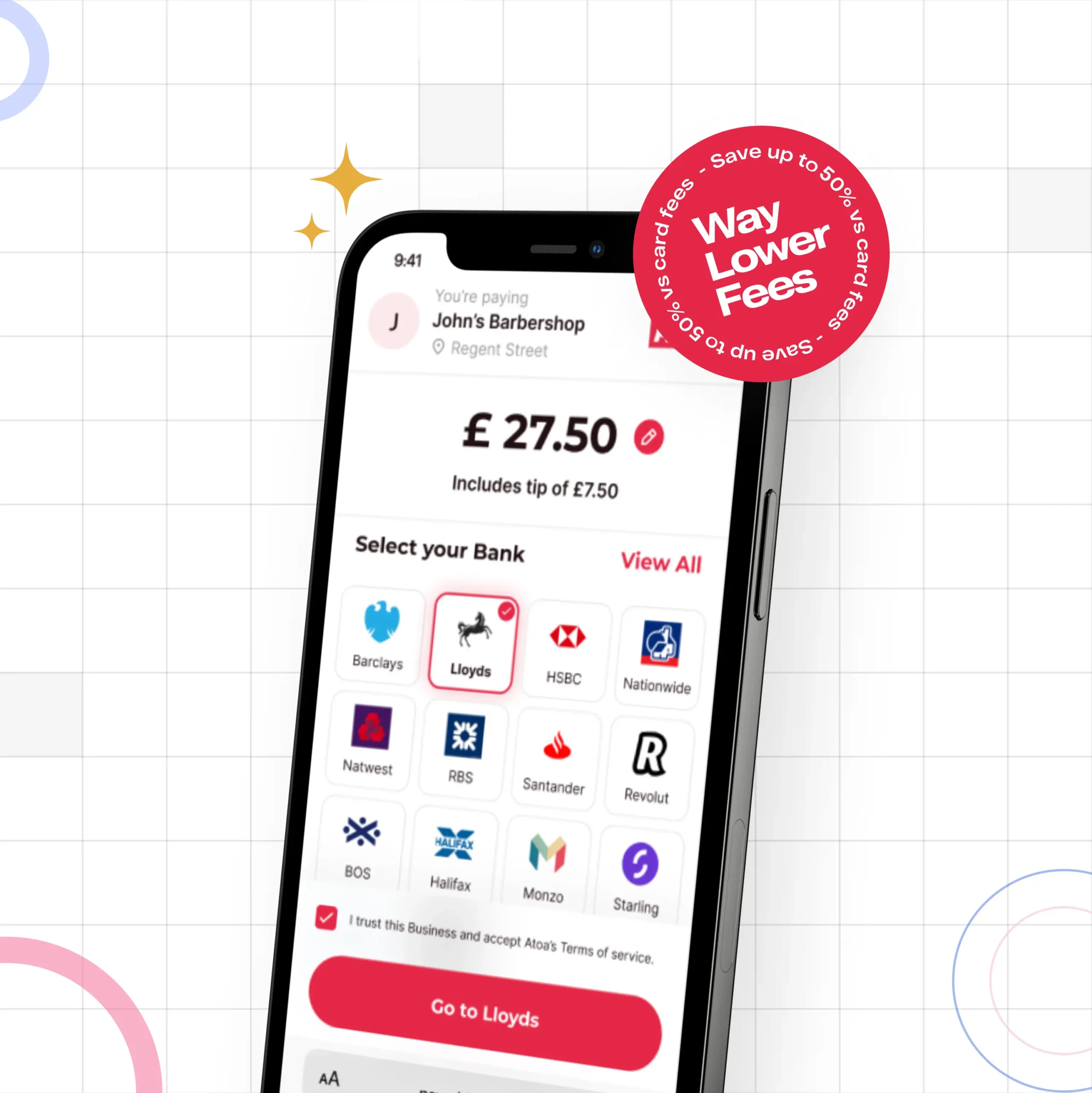

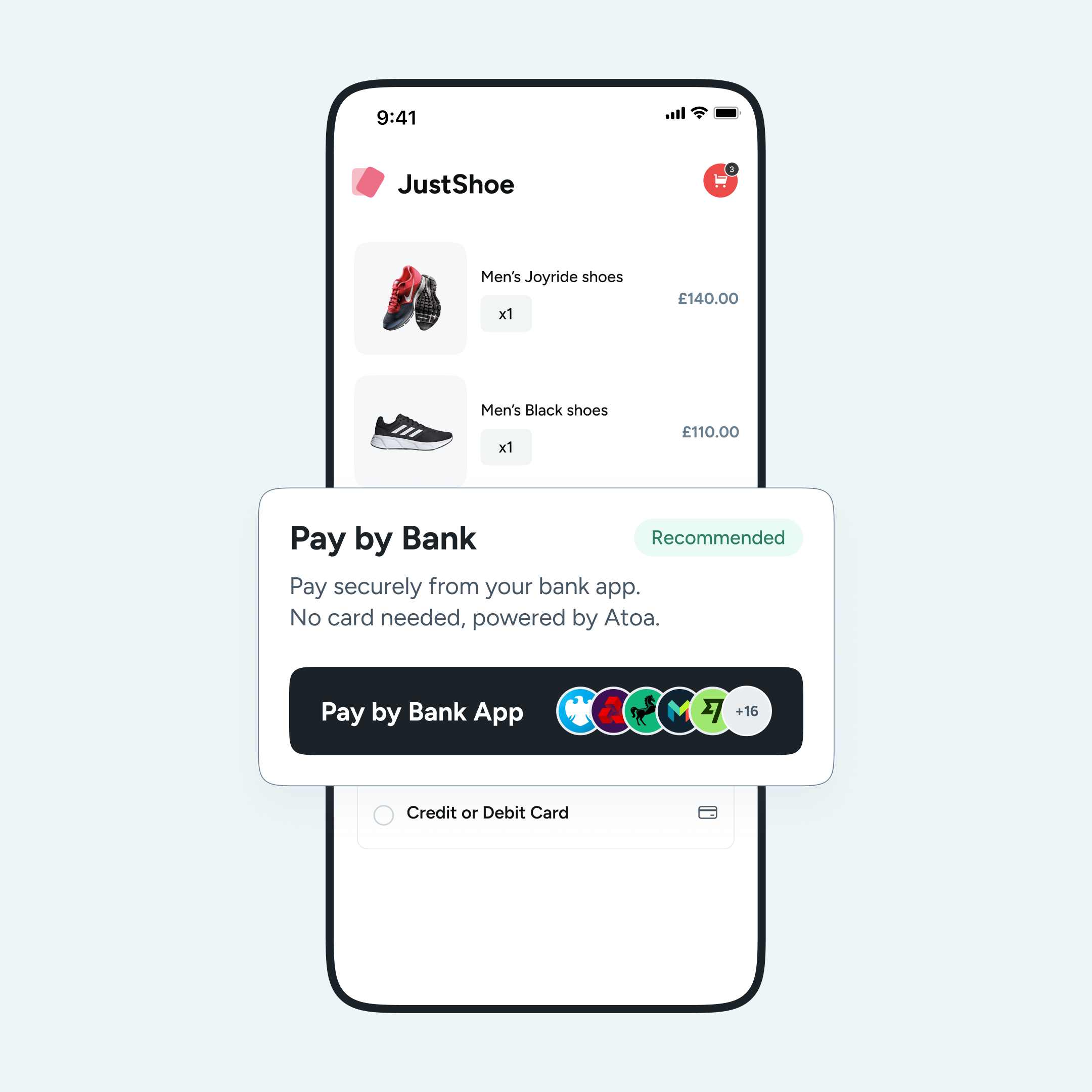

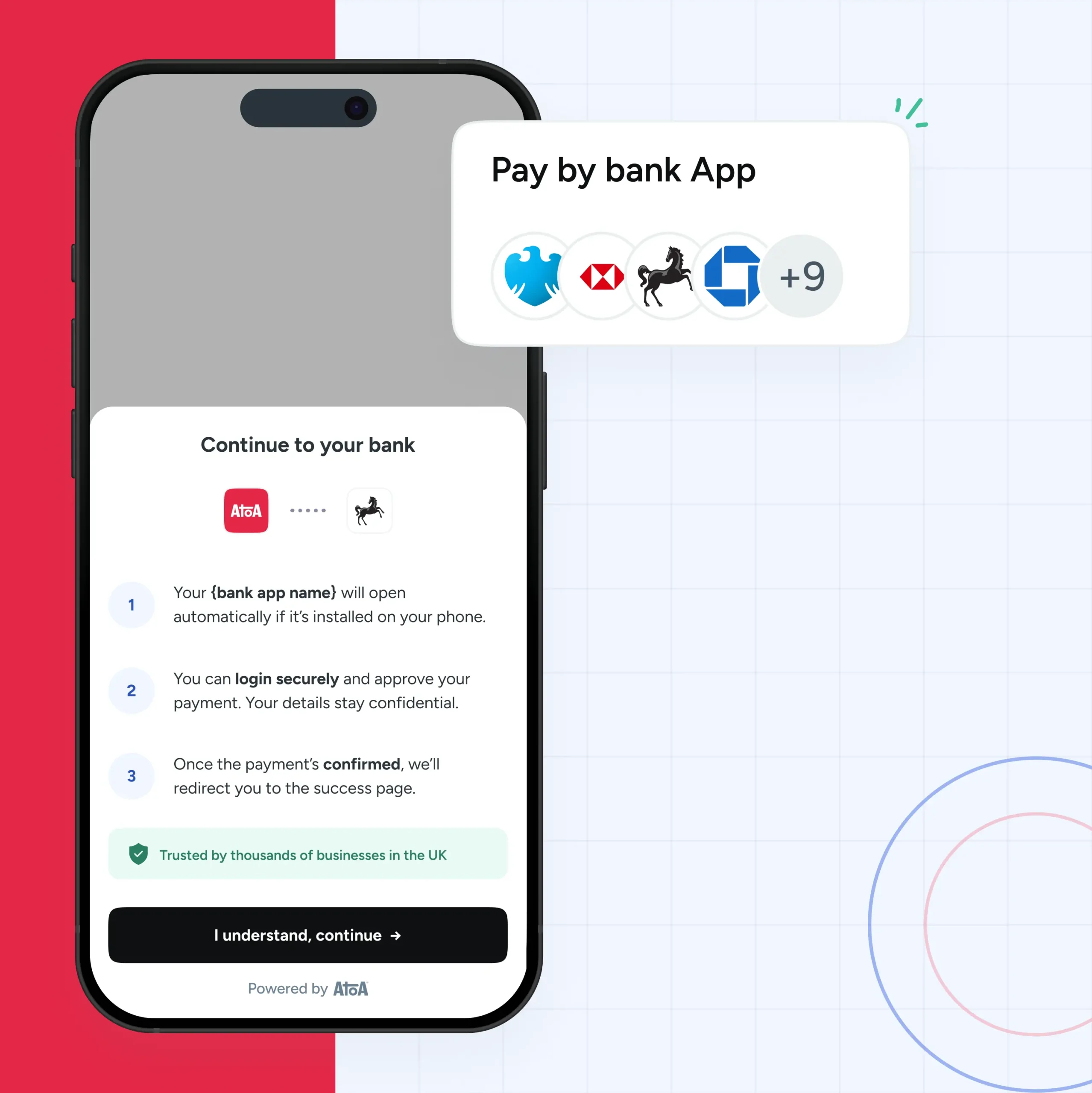

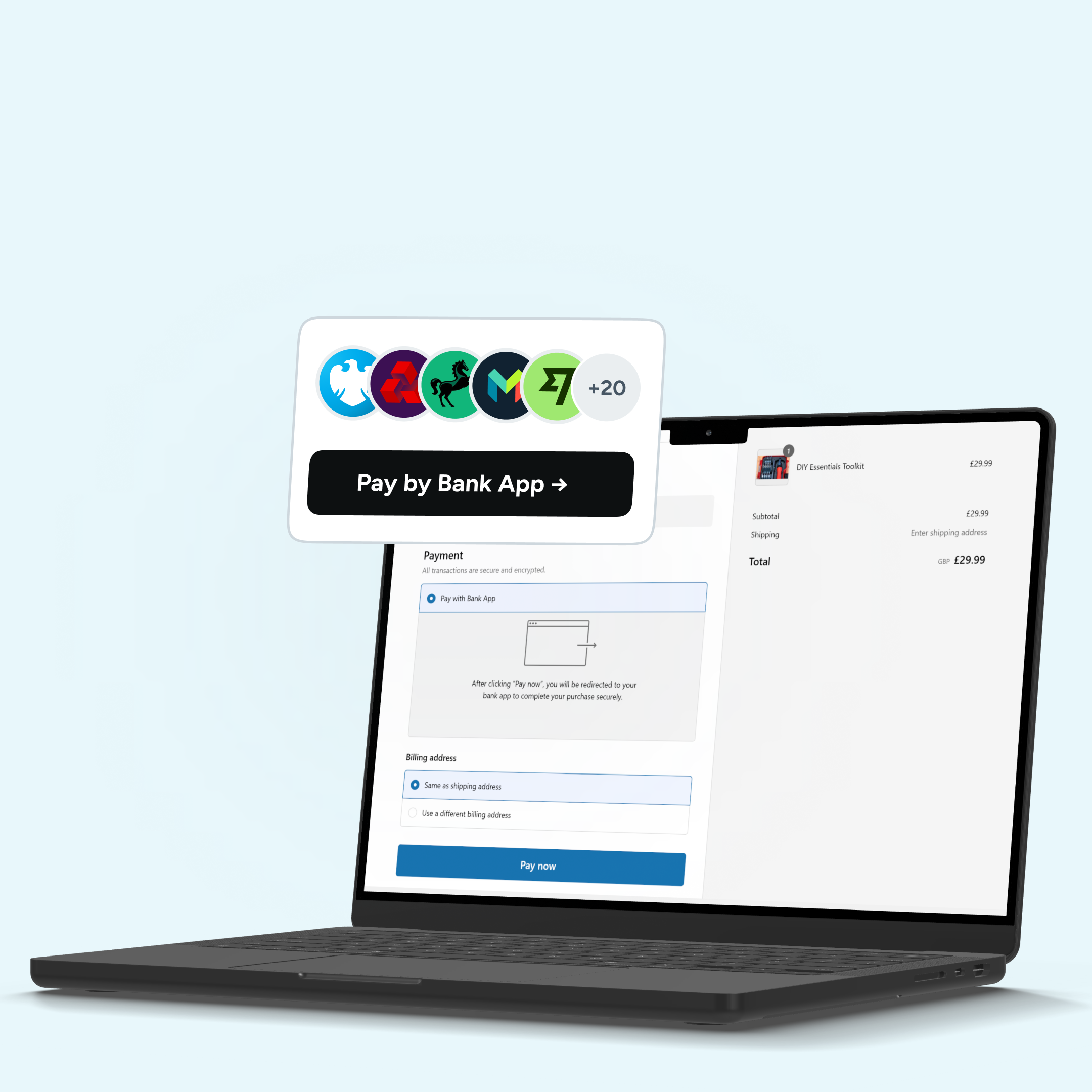

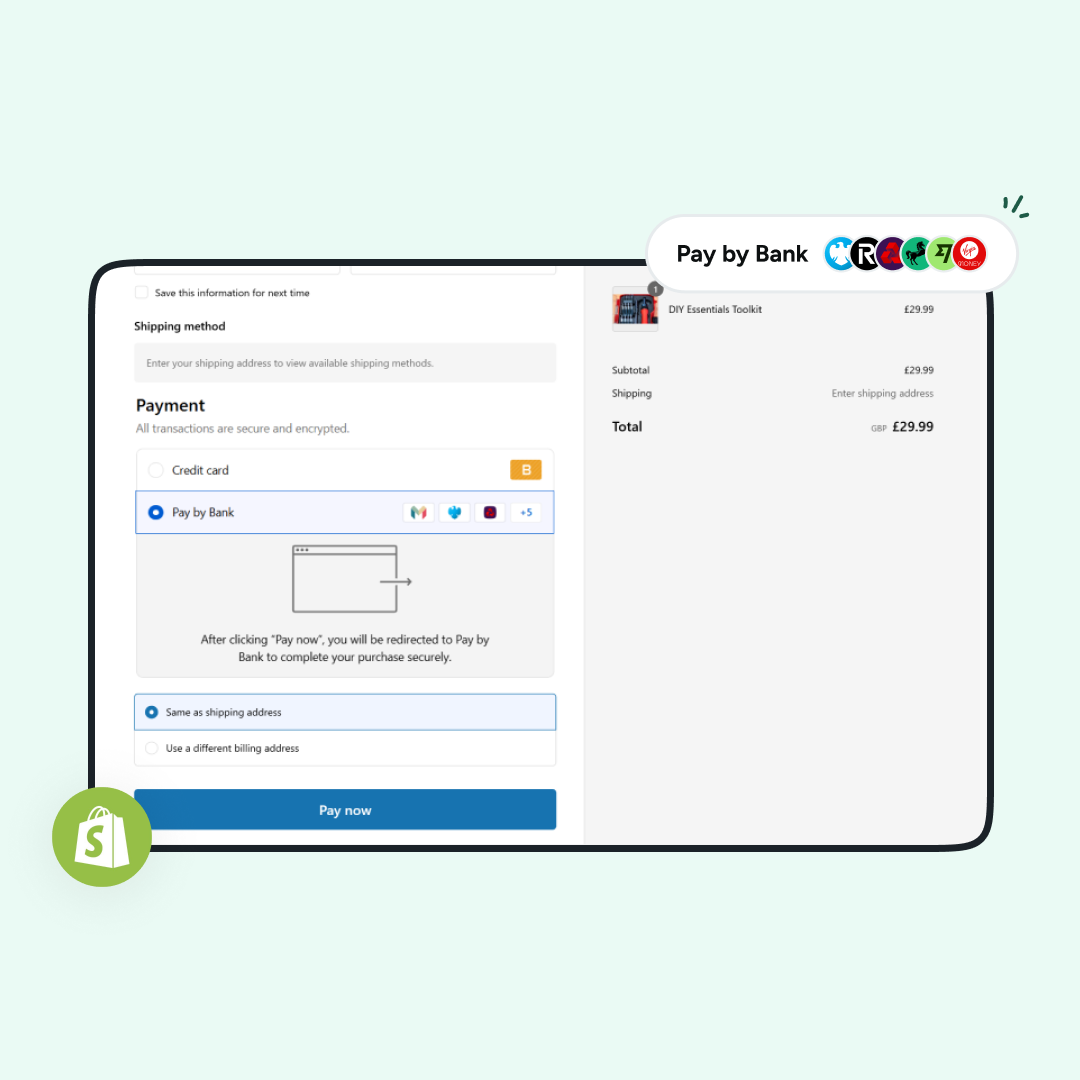

SMS Pay (sometimes called Pay by SMS) is a payment method where businesses send a secure payment link to customers via text message. The customer simply clicks the link, selects their bank, and authorises the payment in their mobile banking app or online banking portal.

No apps to download, no card details to type, and no waiting for manual bank transfers. For customers, it’s as easy as replying to a text. For businesses, it means there are no delays in settling invoices and outstanding balances.

How does SMS Pay work?

The process is straightforward:

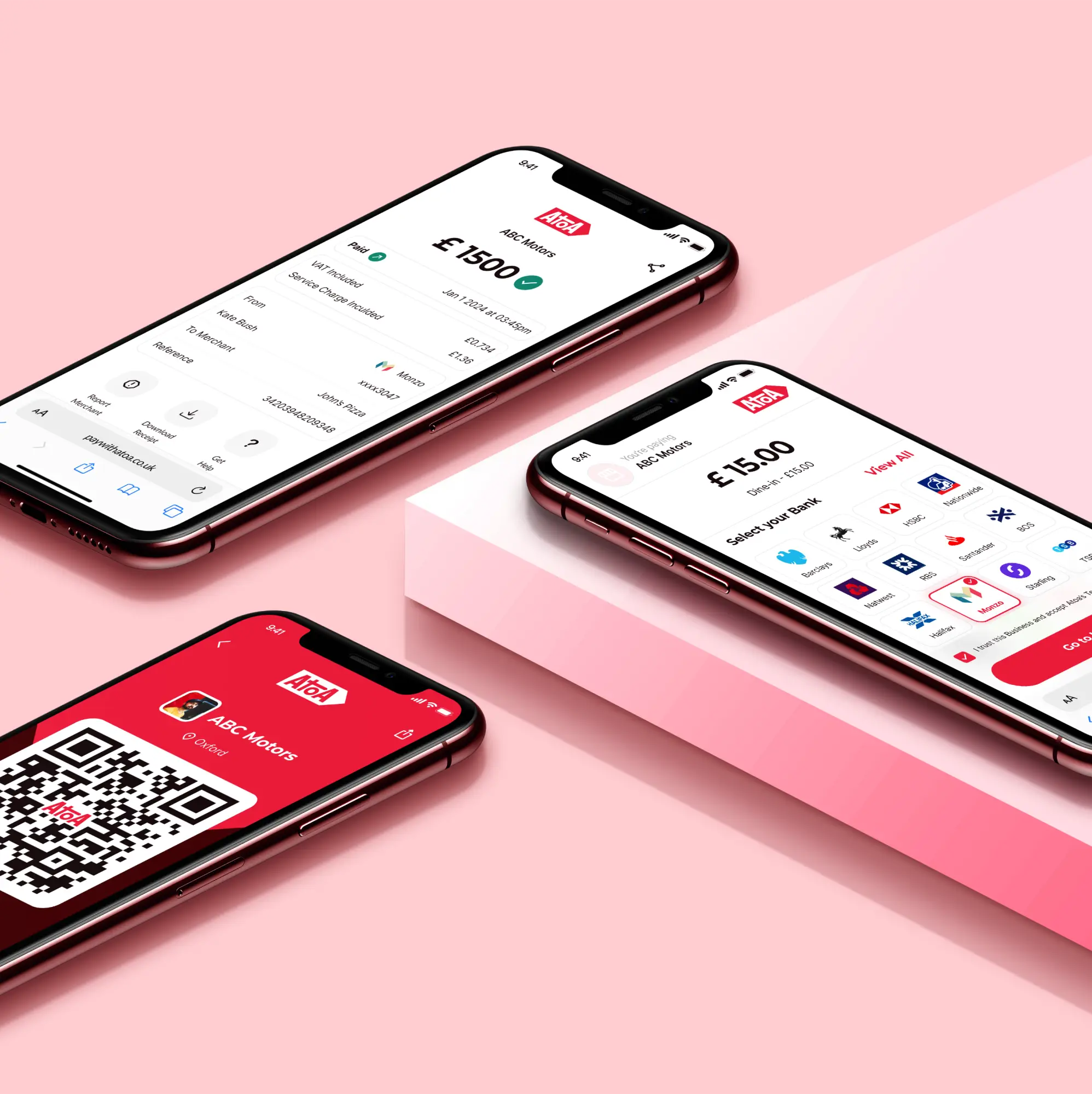

- The business generates a payment link using their preferred provider.

- That link is sent to the customer by SMS.

- The customer clicks the link, selects their UK bank, and authorises the payment.

- The funds move directly from the customer’s account to the business’s account.

- The business receives instant confirmation of that payment.

This simple journey makes SMS Pay particularly powerful for remote transactions where handing over a card or processing cash isn’t possible.

Why businesses use SMS Pay

The main reason businesses adopt SMS Pay is convenience. Almost every customer has access to SMS, which makes it one of the most effective ways to request payment. Unlike emails, which can get lost or ignored, SMS messages are read quickly and acted on just as fast.

For businesses, SMS Pay reduces admin time, accelerates cash flow, and eliminates common excuses for late payments. It works across industries, from retail and hospitality to professional services, and adapts equally well to one-off charges or repeat billing.

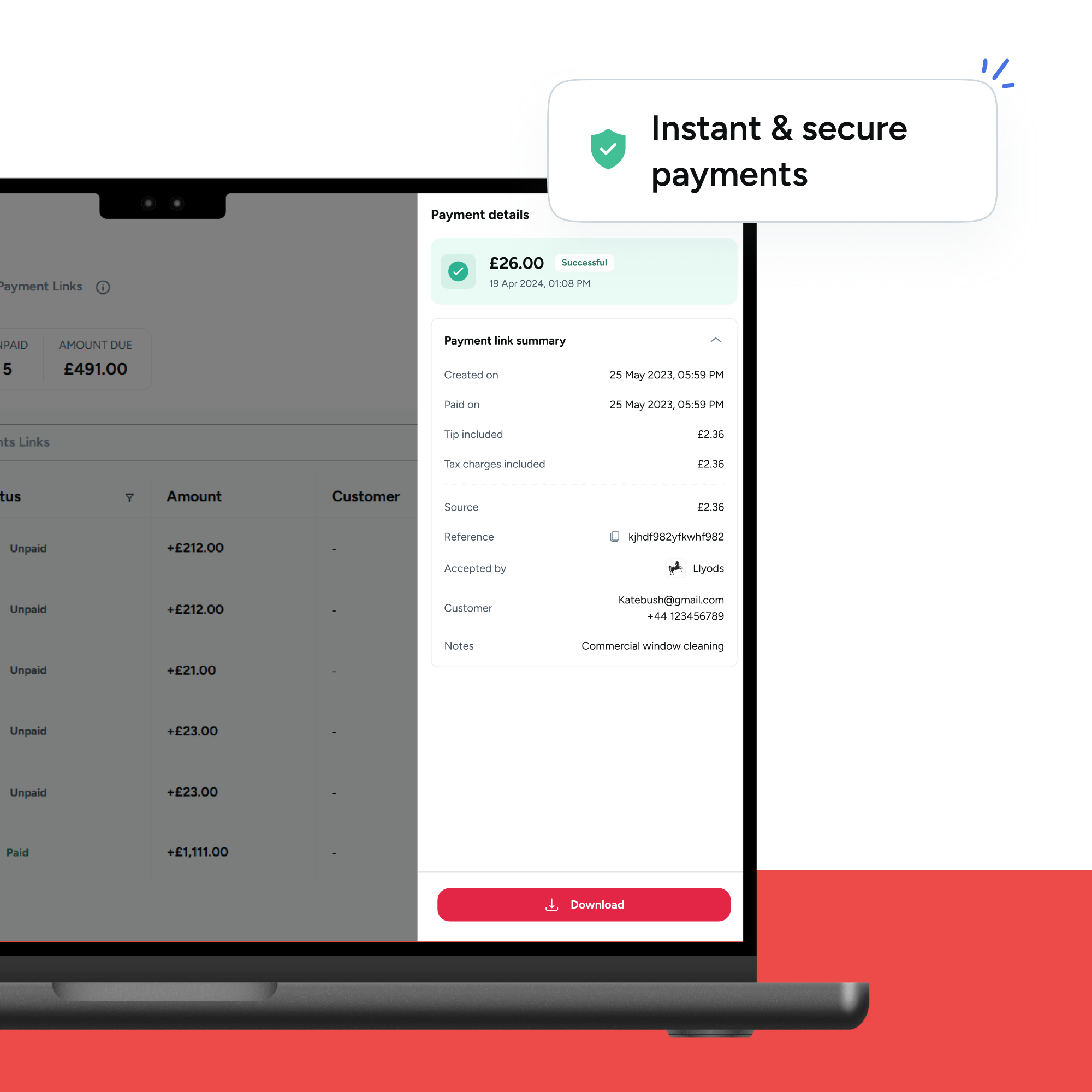

Security and trust in SMS Pay

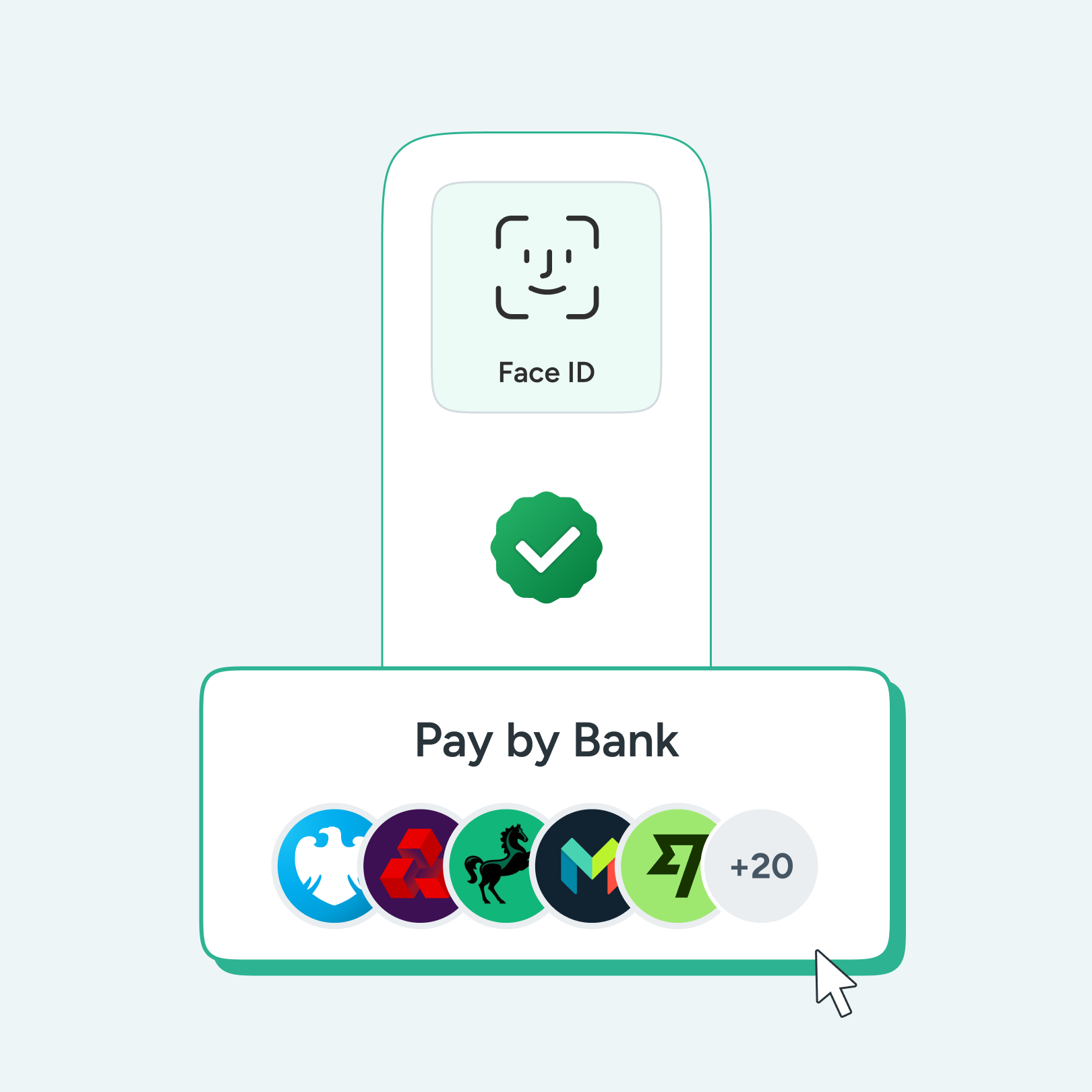

Payments need more than just speed, they need trust. SMS Pay uses secure, bank-backed technology. Customers authorise payments directly in their banking app or online banking portal, protected by their bank’s security measures such as Face ID, fingerprint, or passcodes.

Because the money moves directly from one bank account to another, there are no intermediaries holding funds. That reduces risk for both customers and businesses, and removes the worry of fraud or disputes that can arise in less secure payment methods.

Practical use cases

- Car dealerships: Customers can settle deposits or balance payments instantly, even if they’re not in the showroom.

- Law firms: Firms can collect retainers or settle outstanding fees quickly without waiting for bank transfers or chasing cheques.

- Hospitality: Restaurants or hotels can secure bookings by sending an SMS link for deposits or prepayments.

- Trades and home services: Electricians, plumbers, and cleaners can request payment as soon as the job is done. This removes the need for on-site terminals.

- Healthcare and memberships: Clinics, gyms, or clubs can send automated SMS payment reminders, making it easier for clients to stay up to date.

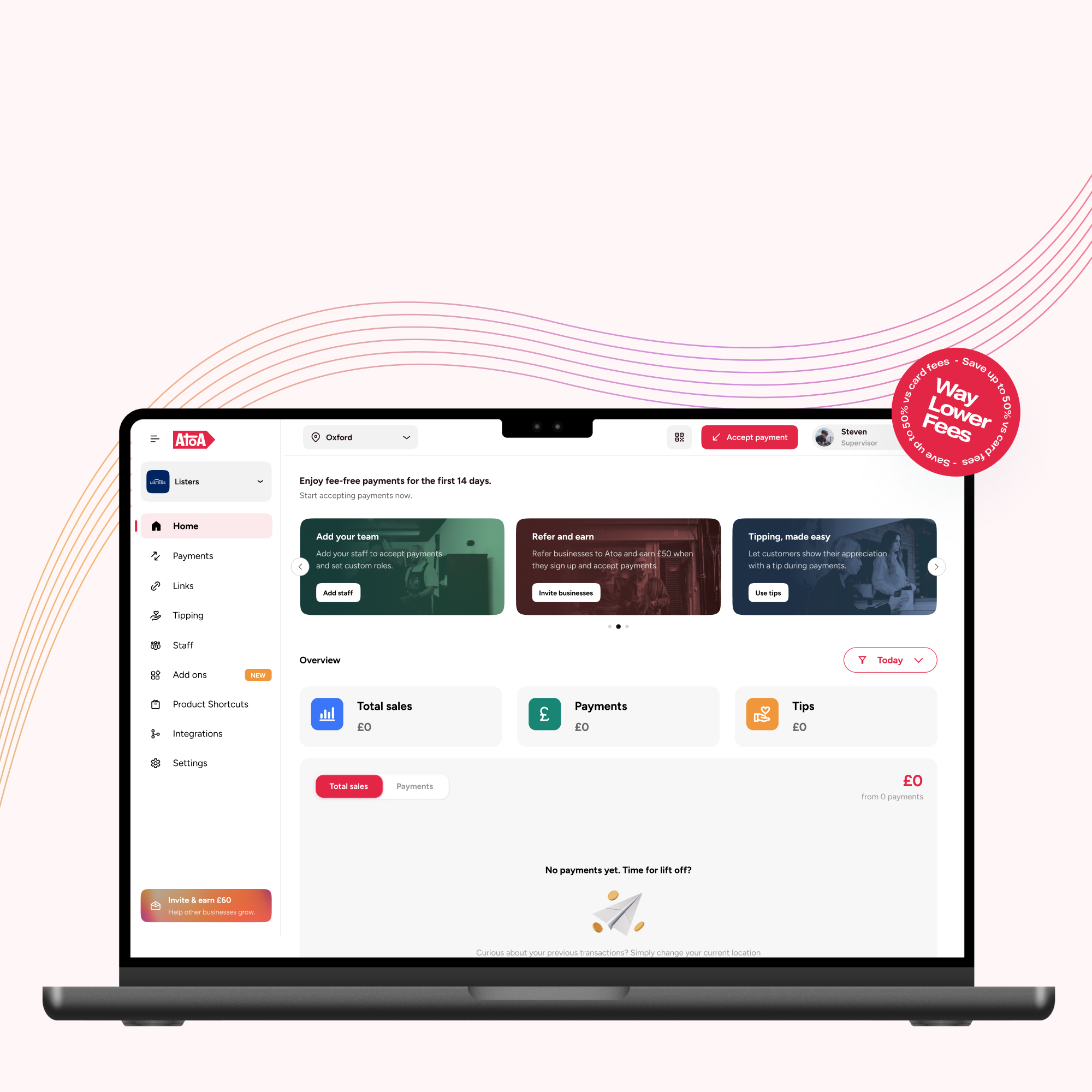

Where Atoa fits in

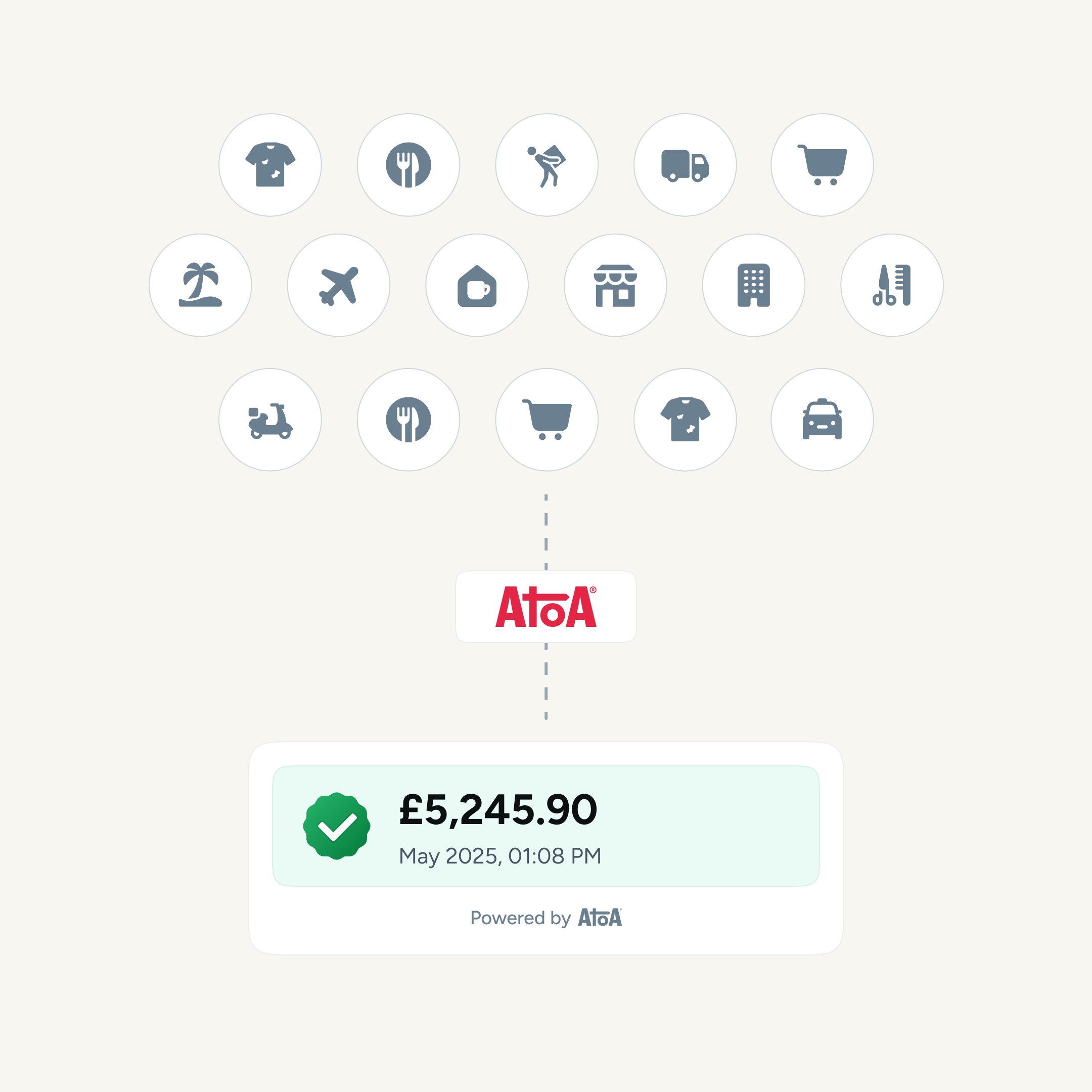

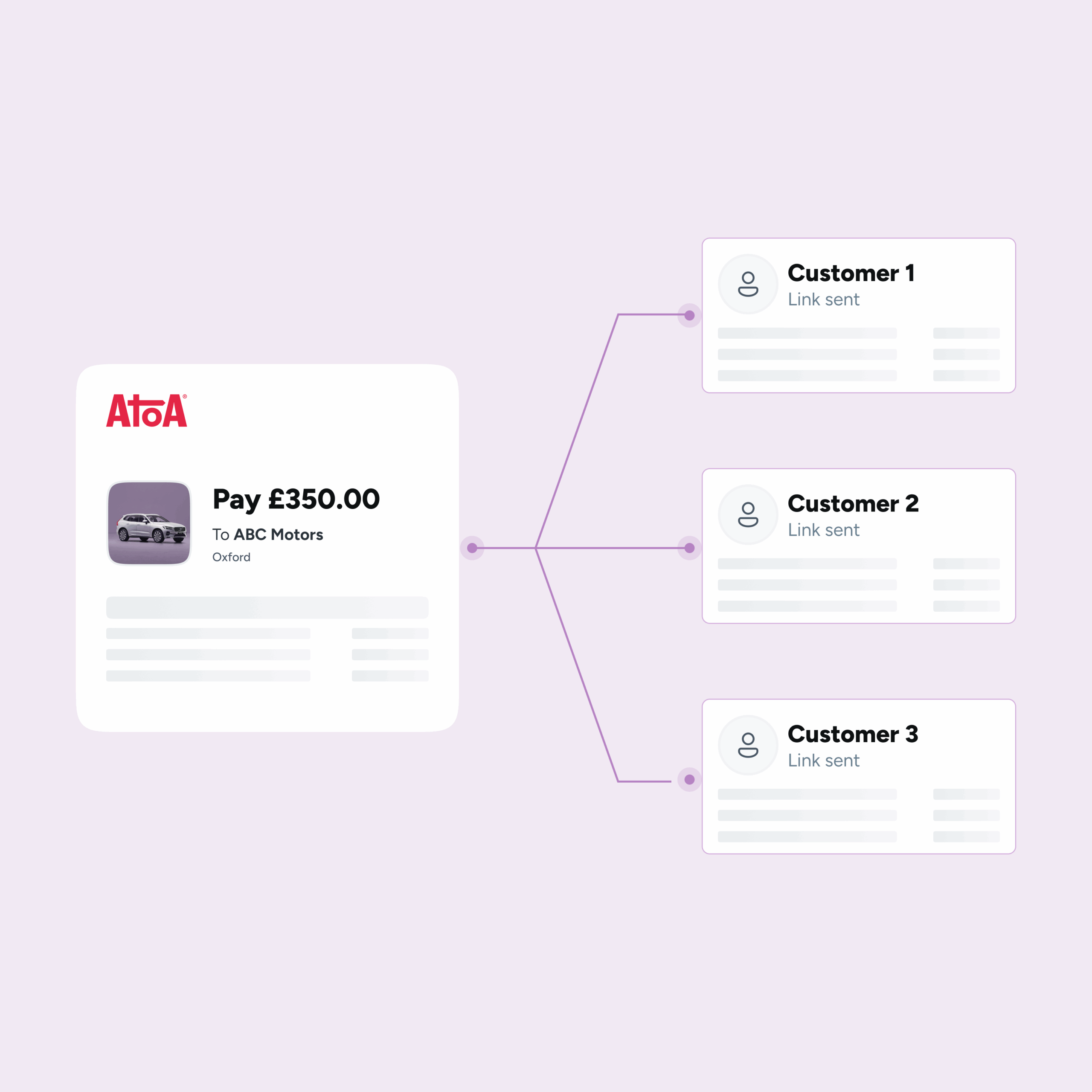

There are several providers offering SMS Pay in the UK. Atoa, for example, enables businesses to send Pay by Bank links directly by SMS. Customers pay securely through their bank app, funds settle instantly, and payments sync automatically in your account. For businesses, that means fewer costs, fewer delays, and fewer missed payments, all through something as simple as a text.

Conclusion

SMS Pay takes something as universal as a text message and turns it into a powerful payment tool. It’s convenient, secure, and especially effective for remote transactions where traditional methods fall short. For UK businesses, adopting SMS Pay means less chasing, faster cash flow, and a smoother experience for customers. And so with providers like Atoa making Pay by Bank accessible through SMS, businesses can collect payments instantly, securely, and at a fraction of the cost of older methods.