Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

Efficient billing is the lifeblood of any law firm. When invoices are delayed or payments go uncollected, it doesn’t just pinch cash flow—it can also strain client relationships. Yet many firms struggle with billing inefficiencies — from tracking time accurately to collecting payments on time. In fact, a Thomson Reuters survey found that the average law firm loses 18% of potential revenue due to billing challenges, with 81% reporting issues with unpaid or delayed invoices. These gaps don’t just cut into profits—they create cash flow challenges that no firm can afford to overlook.

In this article, we’ll explore the most common billing challenges law firms face and walk you through practical solutions to help your firm improve cash flow and reduce administrative headaches. By the end, you’ll have a clear roadmap to a more efficient, stress-free billing process.

Common billing challenges law firms face

Many law firms grapple with several billing obstacles leading to payment delays. Take a look at some of them.

Inaccurate time tracking: Many lawyers still track time manually or log hours at the end of the day, leading to lost billable time. In fact, waiting until the end of the week can cost firms 10-25% of their billable hours—that’s revenue slipping away before it even gets billed!

Confusing invoices: Clients want to know exactly what they’re paying for. Vague invoices lead to disputes, frustration, and even lost business.

Billing delays = Payment delays: The longer a firm waits to send invoices, the longer it takes to get paid. The UK’s top law firms face an average lock-up period of 124 days—sometimes extending to 200 days—tying up important working capital.

Manual errors: Manually entering billing details can lead to small but costly mistakes. Fixing these takes time and adds unnecessary delays—something no law firm wants to deal with.

Chasing payments: Sending an invoice doesn’t always mean getting paid on time. Many firms find themselves following up repeatedly with clients, which takes valuable time away from legal work. Late or unpaid invoices not only slow down cash flow but can also create unnecessary tension in client relationships.

How to improve your law firm’s billing process

Implementing effective billing strategies can significantly enhance a law firm’s efficiency and client satisfaction. Here are some recommendations:

- Use smart time-tracking tools: Ditch the guesswork and manual time logs. Instead, use digital time-tracking software to record billable hours in real time, reducing errors and helping you get paid for all the work you do.

- Make billing crystal clear: Be upfront about your billing structure so clients aren’t caught off guard. Detailed, itemised invoices help avoid confusion, build trust, and prevent disputes down the line.

- Automate invoicing & payment reminders: Use software to create invoices and send automatic reminders to save time (and hassle). For instance, many law firms use Atoa’s payment reminder feature to send polite nudges, ensuring payments aren’t overdue without constant follow-ups.

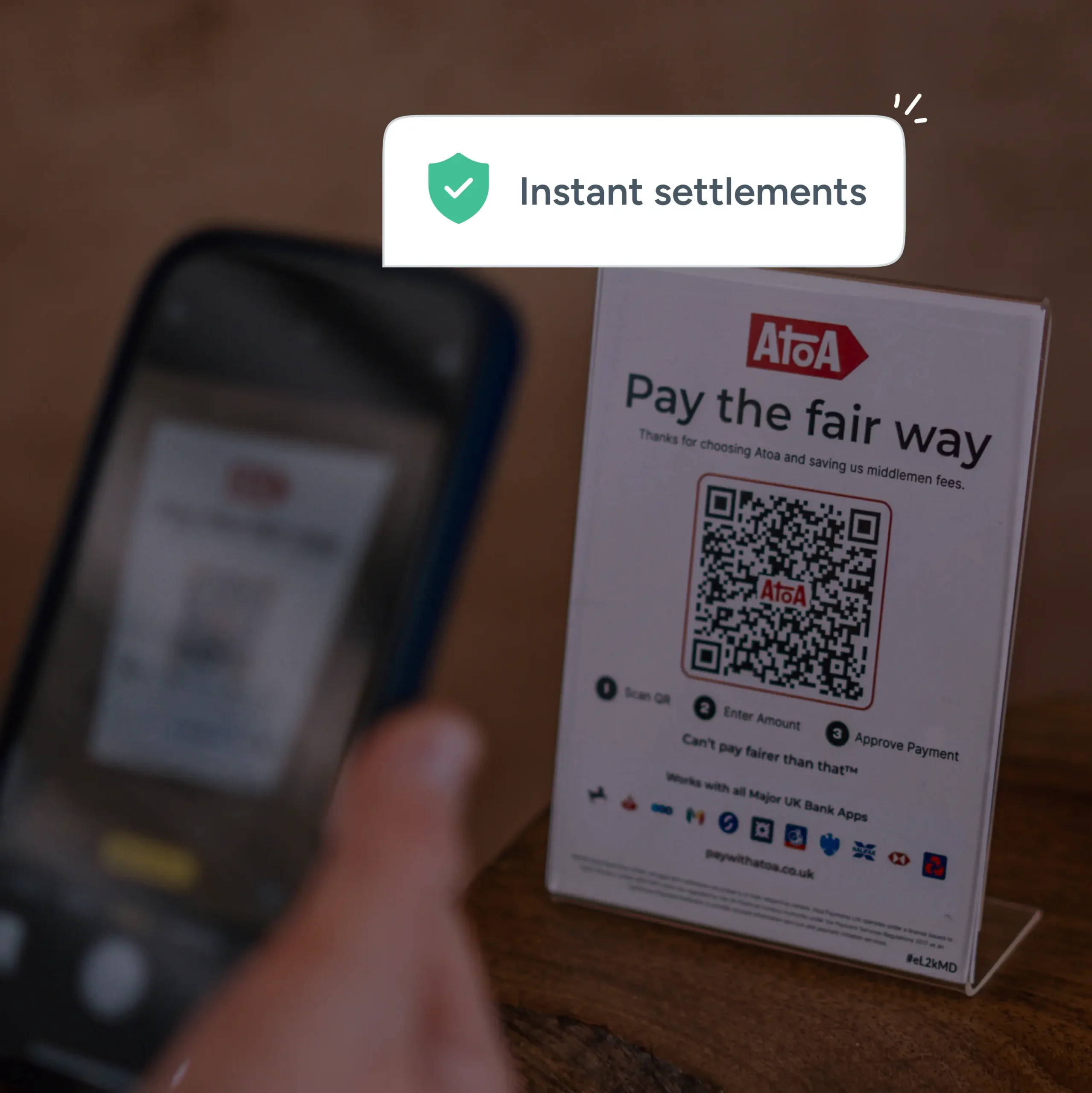

- Offer easy payment options: The simpler it is for clients to pay, the faster you get paid. Providing multiple payment methods, including online options and instant bank transfers, makes the process smooth and stress-free.

- Regularly review & improve your process: Billing isn’t a “set it and forget it” task. Check what’s working (and what’s not), then make small tweaks to boost efficiency and reduce delays.

Why it’s worth the effort

- Better cash flow – Quick invoicing and faster payments mean fewer financial headaches.

- Happier clients – Clear, hassle-free billing keeps clients satisfied and more likely to return.

- Less admin work – Automating tasks frees up time for more important things.

- Fewer disputes – Accurate tracking and transparent invoices reduce confusion and disagreements.

Final Thoughts

Improving your law firm’s billing process isn’t just about getting paid faster—it’s about making life easier for everyone involved. By using the right tools, setting clear expectations, and offering flexible payment options, you can keep cash flow steady and clients happy. A few smart changes can make a big difference!

Try Atoa

Atoa makes billing easier for law firms by offering instant bank payments with lower fees—helping you get paid faster without the hassle. In fact, thousands of businesses already trust Atoa to streamline their payments and improve cash flow. So, why not see how it works for your firm? Book a call with our team to explore how Atoa can simplify your billing and keep your firm running smoothly—no commitment, just a smarter way to get paid!