Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

The way we pay is changing faster than ever. In just a few years, some of the payment methods we rely on today could feel as outdated as writing a cheque. For businesses, learning about cutting edge solutions is an opportunity to get ahead of the competition.

As we move into 2025, several powerful trends are set to reshape the payments landscape, making transactions faster, safer, and cheaper. From real-time payments and open banking expansion to advanced security measures, understanding these trends is crucial for business leaders who want to stay ahead of the curve.

In this article, we’re breaking down the top 5 payment trends you need to watch in 2025. You’ll learn what they are, why they matter, and how to prepare your business to thrive in this rapidly evolving space.

1. Real-time payments gain momentum

Real-time payments (RTP) are fast becoming the norm, allowing instant fund transfers between banks, 24/7. This trend is fueled by growing consumer demand for immediacy and advancements in payment infrastructure. In 2025, we can expect broader adoption of RTP systems worldwide, making slow transaction times a pain of the past.

Implications for businesses:

- Improved cash flow: Businesses can access funds immediately, enhancing liquidity and operational efficiency.

- Better customer experience: Instant payments reduce friction, making checkout processes smoother. In some instances, such as purchasing a car, this results in leaving the dealership with the new vehicle on the day.

Challenges:

- Integration complexity: Adapting legacy systems to handle RTP can be costly and technically demanding.

- Security risks: Faster payments mean less time to detect and prevent fraudulent activities. It will come down to the payment gateways to provide proactive layers of protection to combat potential fraud.

2. The expansion of open banking

Open banking is evolving from a regulatory requirement to a significant driver of innovation. In particular, by allowing third-party providers access to financial data (with customer consent), it unlocks new payment solutions and personalised financial services. Looking ahead, in 2025, open banking’s reach is expected to extend beyond the EU and UK, eventually influencing markets in the US, Canada, and Asia.

Implications for businesses:

- Enhanced payment options: Direct account-to-account payments reduce reliance on card networks, cutting costs.

- Personalisation opportunities: Access to richer data enables tailored offerings and improved customer loyalty.

Challenges:

- Interoperability challenges: Ensuring open banking solutions work seamlessly with multiple banks can be a hurdle for some providers. So, as a business, it’s important to pick a provider that has fully operational connections to all leading banks.

- Customer trust: Transparent data usage practices are essential to gain and retain consumer confidence.

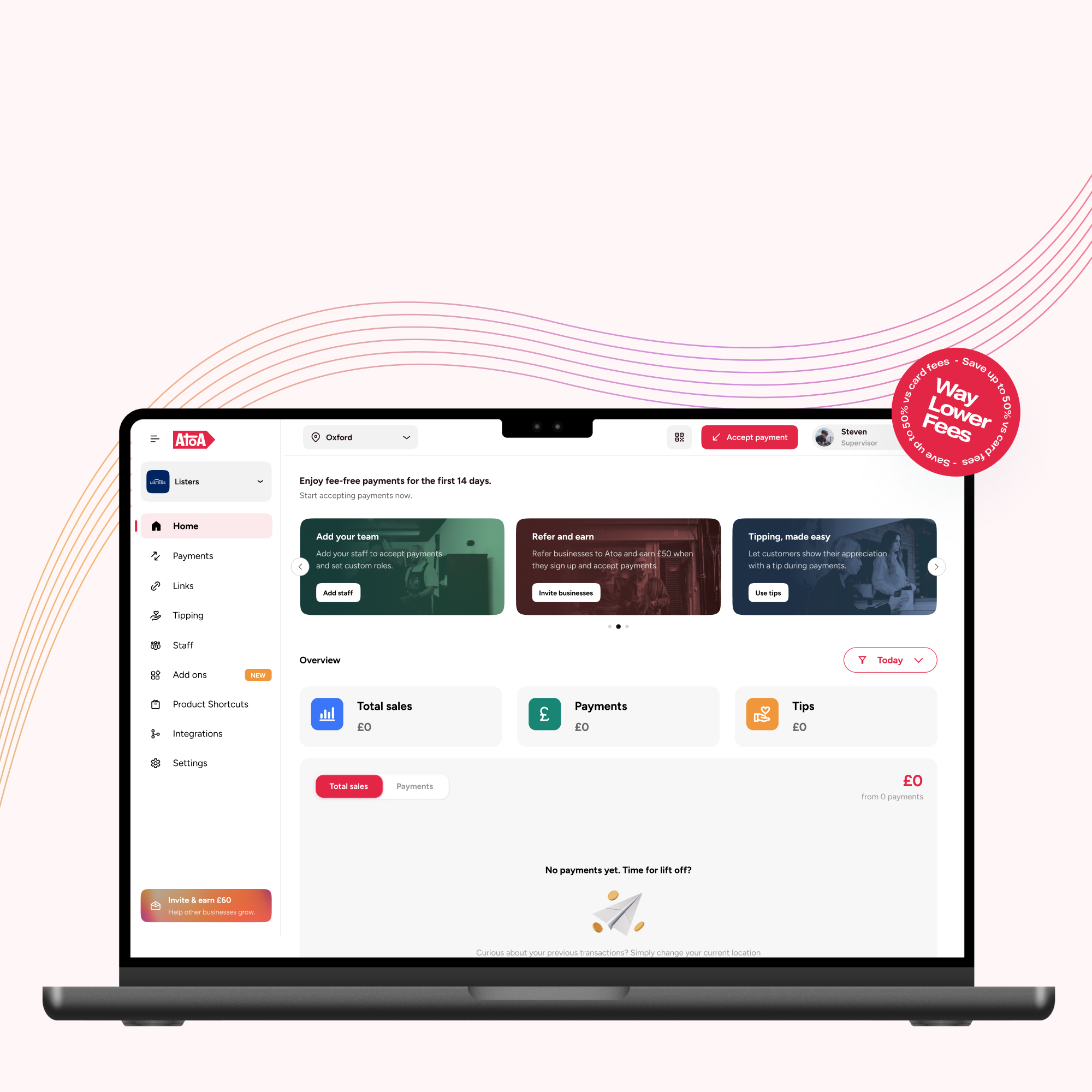

Looking to harness the power of open banking? Atoa helps businesses like law firms, car dealerships, and restaurants save up to 50% on their payment fees while offering instant settlement. Our solutions not only streamline payments but also enhance security and compliance.

3. Security enhancements: Beyond encryption

As payment methods diversify, so do security threats. In 2025, businesses will move beyond traditional encryption to adopt more sophisticated security measures, including biometric authentication, tokenisation, and AI-driven fraud detection. The goal is to balance security with user convenience.

Implications for businesses:

- Reduced fraud risk: Advanced AI algorithms can detect anomalies and prevent fraud in real-time.

- Frictionless experience: Biometrics eliminate the need for passwords, making payments quicker and safer for consumers.

Challenges:

- Costs: Implementing advanced security technologies could require significant investment. Therefore, choosing a provider that already has robust security in place is important.

- Data privacy: When businesses use biometric (fingerprints, facial recognition) or behavioral data (how someone types or interacts with a device), they must handle this sensitive information with extreme care. Many countries have strict regulations, like GDPR in Europe or CCPA in California, which dictate how companies can collect, store, and use personal data. Failing to follow these laws can lead to hefty fines and reputational damage. To stay compliant, businesses should work with payment providers that use strong encryption, secure storage, and transparent data-handling policies in order to protect customer information.

4. Embedded payments revolutionise transactions

Embedded payments allow customers to complete purchases within an app or platform without being redirected to a separate payment gateway. As a result, this seamless integration is transforming industries like retail, travel, and fintech by making transactions faster and more convenient.

Implications for businesses:

- Higher conversion rates: A smooth checkout experience reduces cart abandonment.

- Stronger brand loyalty: Offering frictionless payments enhances customer satisfaction and retention.

Challenges:

- Integration hurdles: Embedding payments into existing platforms can require significant development resources.

- Compliance risks: Handling payments directly increases the complexity of regulatory compliance.

5. The rise of digital wallets

Digital wallets are no longer just a convenient payment option; they are becoming essential. With mobile payment volumes surging, businesses must adapt by supporting popular wallets like Apple Pay, Google Pay, and Samsung Pay. In 2025, digital wallets are set to dominate both in-store and online payments.

Implications for businesses:

- Expanded reach: Supporting multiple digital wallets can attract a broader audience.

- Enhanced security: Tokenisation in digital wallets minimises risks associated with card payments.

Challenges:

- Compatibility: Ensuring seamless integration with various wallets and platforms.

- Fees: Some digital wallet providers charge higher transaction fees compared to traditional methods.

Adapting to payment trends in 2025

Keeping pace with these payment trends is not optional—it’s a necessity. The key is to focus on flexible payment solutions that enhance security, reduce costs, and simplify the customer experience. Leveraging open banking, real-time payments, and embedded payment options can significantly boost competitiveness. By embracing these innovations thoughtfully, businesses can navigate the evolving payments landscape with confidence and agility. Ready to simplify payments for your business? Discover how Atoa’s open banking solutions can help you stay ahead of these trends over a short demo call.