Ready to get started?

Easily integrate next-generation payments and financial data into any app. Build powerful products your customers love.

For decades, invoicing has been the backbone of B2B transactions. Businesses send invoices, wait weeks (or months) for payments, and rely on predictable cash flow cycles. But as technology advances, so do financial expectations. With the introduction of instant payments, businesses no longer need to rely on outdated payment methods to keep the lights on.

Instant payments are rapidly gaining traction in B2B finance, promising faster settlements, reduced admin, and improved cash flow. But does that mean the invoice is destined for extinction? Not quite. While instant payments present undeniable advantages, traditional invoicing still holds value for many businesses (and might even work in conjunction with invoices!).

Why traditional invoicing still matters

Despite the growing interest in instant payments, many businesses continue to rely on traditional invoicing. Here’s why:

- Payment terms provide flexibility: Invoicing allows businesses to offer payment terms (e.g., Net 30, Net 60). This gives customers time to manage their cash flow before settling outstanding balances.

- Predictable cash flow cycles: Businesses that operate on invoicing can forecast their revenue more reliably, ensuring smoother financial planning.

- Established accounting practices: Most businesses, especially larger corporations, have accounting processes deeply rooted in invoicing. Shifting to instant payments requires significant changes in financial workflows.

- Contractual norms: Many B2B agreements are built around invoicing cycles. Altering these could require renegotiations that not all parties are prepared for.

These factors mean that for many businesses, invoices remain a crucial tool—not just a payment request, but a structured financial instrument supporting long-term stability.

Instant payments: A game-changer for B2B transactions

Instant payments—or Pay by Bank—allows businesses to send and receive funds within seconds, 24/7, without relying on traditional card networks or lengthy invoicing cycles. Unlike standard B2B payments that can take days to process, instant payments settle immediately. This provides both parties with immediate confirmation and access to funds.

While traditional invoicing still has its place, the delays, manual steps, and admin-heavy processes involved have made many businesses rethink how they move money. Here’s why instant payments are gaining traction in B2B:

- Faster access to funds: Instant payments remove the waiting period associated with invoices, improving liquidity and enabling businesses to reinvest sooner.

- Reduced administrative burden: Automated real-time transactions cut down on manual invoicing, chasing payments, and reconciliation efforts.

- Lower costs: Traditional invoicing often involves processing fees, bank charges, and human intervention thus streamlining these costs, making transactions more efficient.

- Enhanced supplier relationships: Faster payments lead to better supplier relationships, reducing friction and fostering trust.

Given these advantages, it’s easy to see why industries with high transaction volumes and tight cash flow cycles are turning to instant payments.

Challenges and considerations

Neither system is perfect, and businesses must weigh the challenges of both approaches before deciding on the right payment model.

- For traditional invoicing: The biggest risk is delayed payments. Even with terms in place, late or missed payments can disrupt cash flow, creating financial strain. Manual processing also adds unnecessary complexity.

- For instant payments: Adoption requires technological updates, process shifts, and potential training. Additionally, some businesses may prefer holding onto funds longer rather than paying immediately.

- Hybrid models: Some businesses are opting for a middle ground. They are retaining invoicing for larger transactions while leveraging instant payments for recurring or lower-value transactions.

Xero + Atoa: Bringing instant payments to invoicing

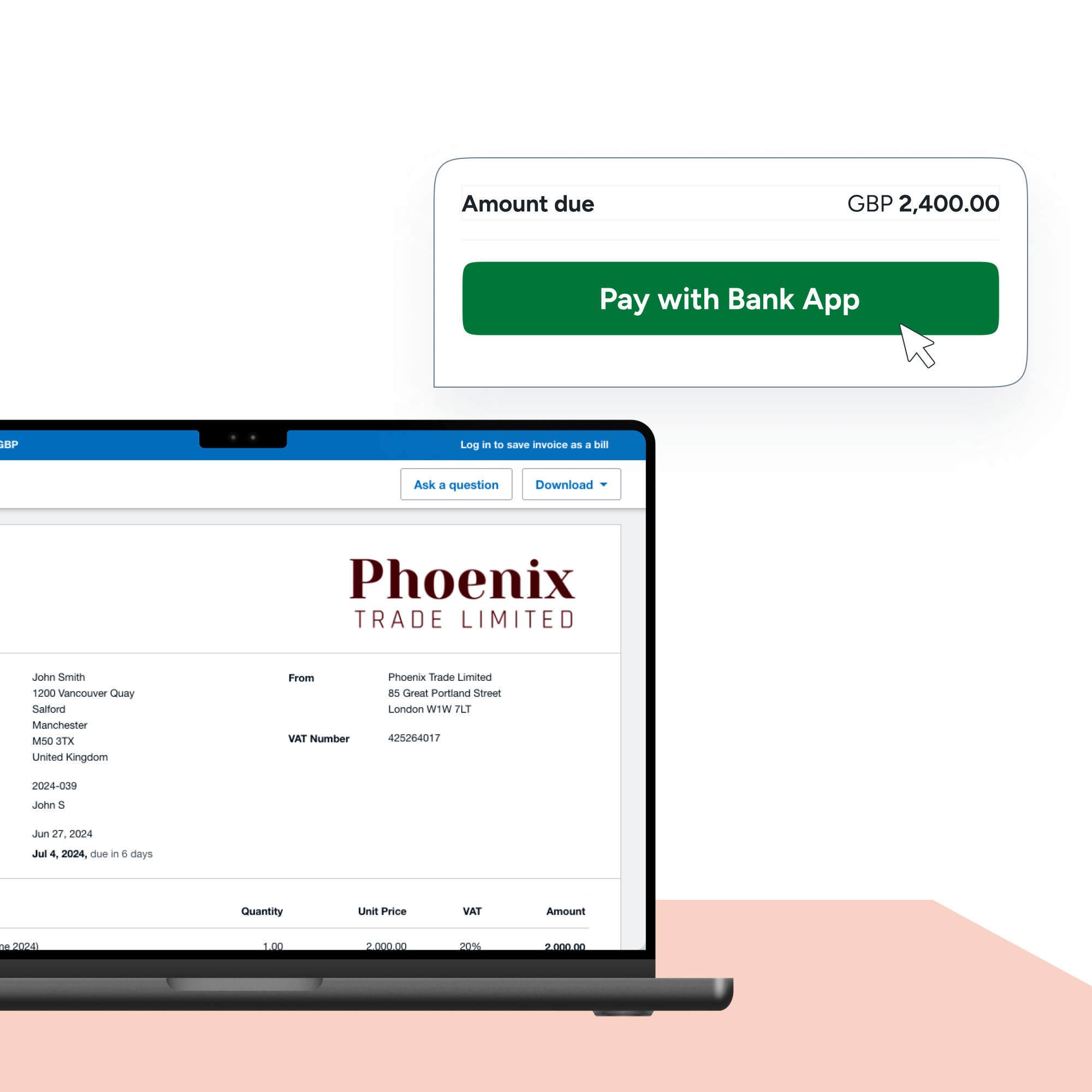

For businesses that rely on invoicing but still want the speed and efficiency of instant payments, Atoa offers a seamless bridge—especially when paired with Xero. Through Atoa’s Pay by Bank feature, businesses can now embed instant payment links directly into their Xero invoices.

This means customers can settle their invoices in seconds via bank transfer, without needing to enter card details or log into online banking manually. The result? Faster payments, fewer delays, and reduced admin.

Here’s how Atoa supercharges Xero invoices:

- Real-time settlement: Once a customer pays via the embedded link, funds are received instantly. No more waiting days for card or bank transfers to clear.

- Lower payment costs: Atoa bypasses traditional card networks, helping businesses avoid hefty processing fees.

- Automatic reconciliation: Completed payments sync directly back into Xero, simplifying bookkeeping and eliminating manual data entry.

- Improved customer experience: The payment process is fast, secure, and frictionless—customers click, approve via their banking app, and they’re done.

For businesses exploring hybrid models—retaining invoices but wanting the speed of instant payments—Xero + Atoa offers the best of both worlds.

The future of B2B payments: Which path to take?

So, is the traditional invoice dead? Not entirely. While instant payments are revolutionising how businesses manage transactions, invoicing still holds an essential place in financial operations. Rather than replacing invoicing entirely, many businesses may find that a hybrid approach—blending traditional invoicing with instant payment capabilities—offers the best of both worlds. Ultimately, businesses must evaluate their specific needs, industry practices, and financial goals before deciding whether to transition fully to instant payments or maintain invoicing as part of their strategy. One thing is certain—the landscape of B2B payments is evolving. Businesses that adapt strategically will be better positioned for long-term success.