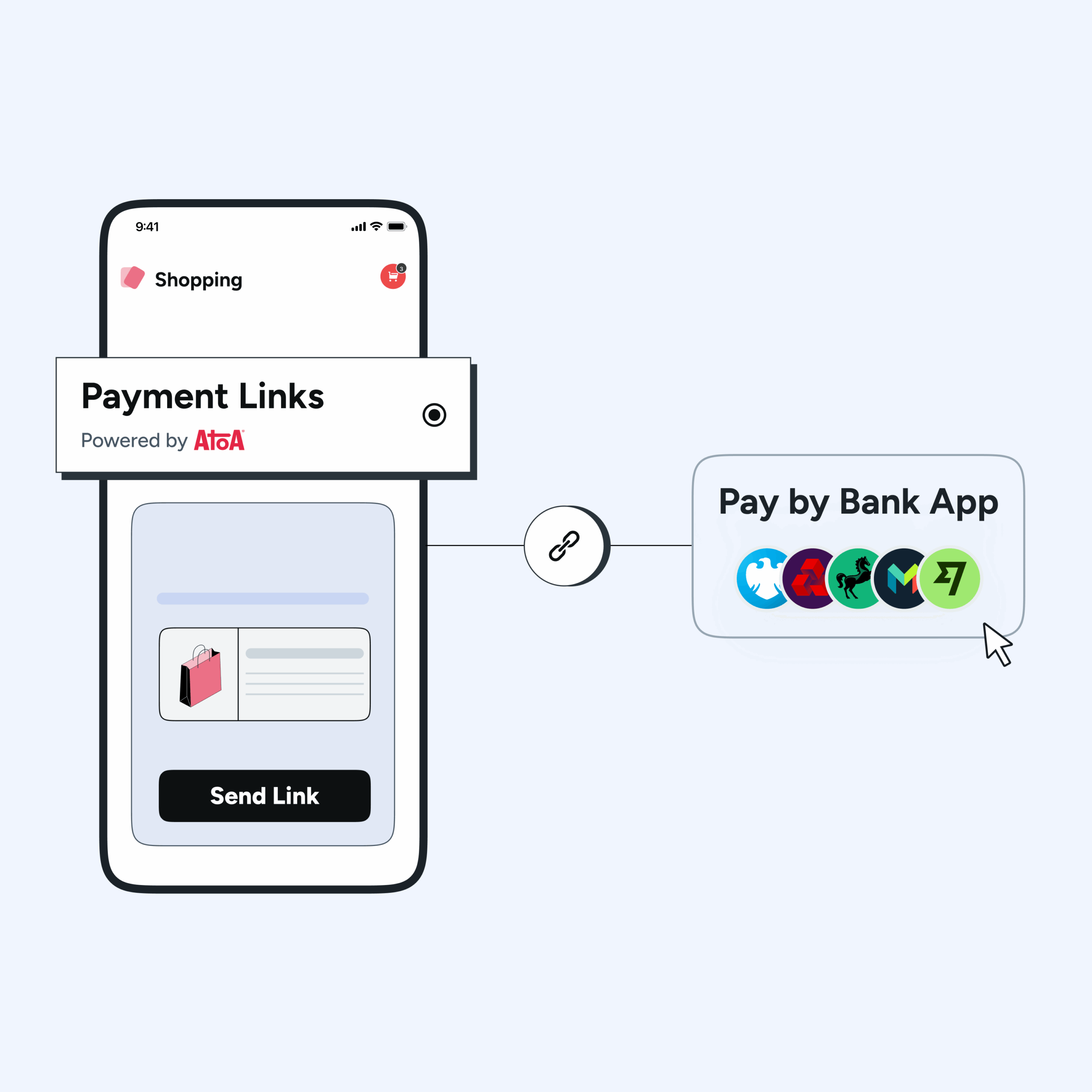

When people hear “payment link,” they often think of a one-time, small-business solution. A quick fix. A temporary shortcut. But for growing UK businesses looking to scale efficiently, payment links are becoming a powerful, strategic alternative to traditional card payments and clunky in-person setups. Here’s what you actually need to know.

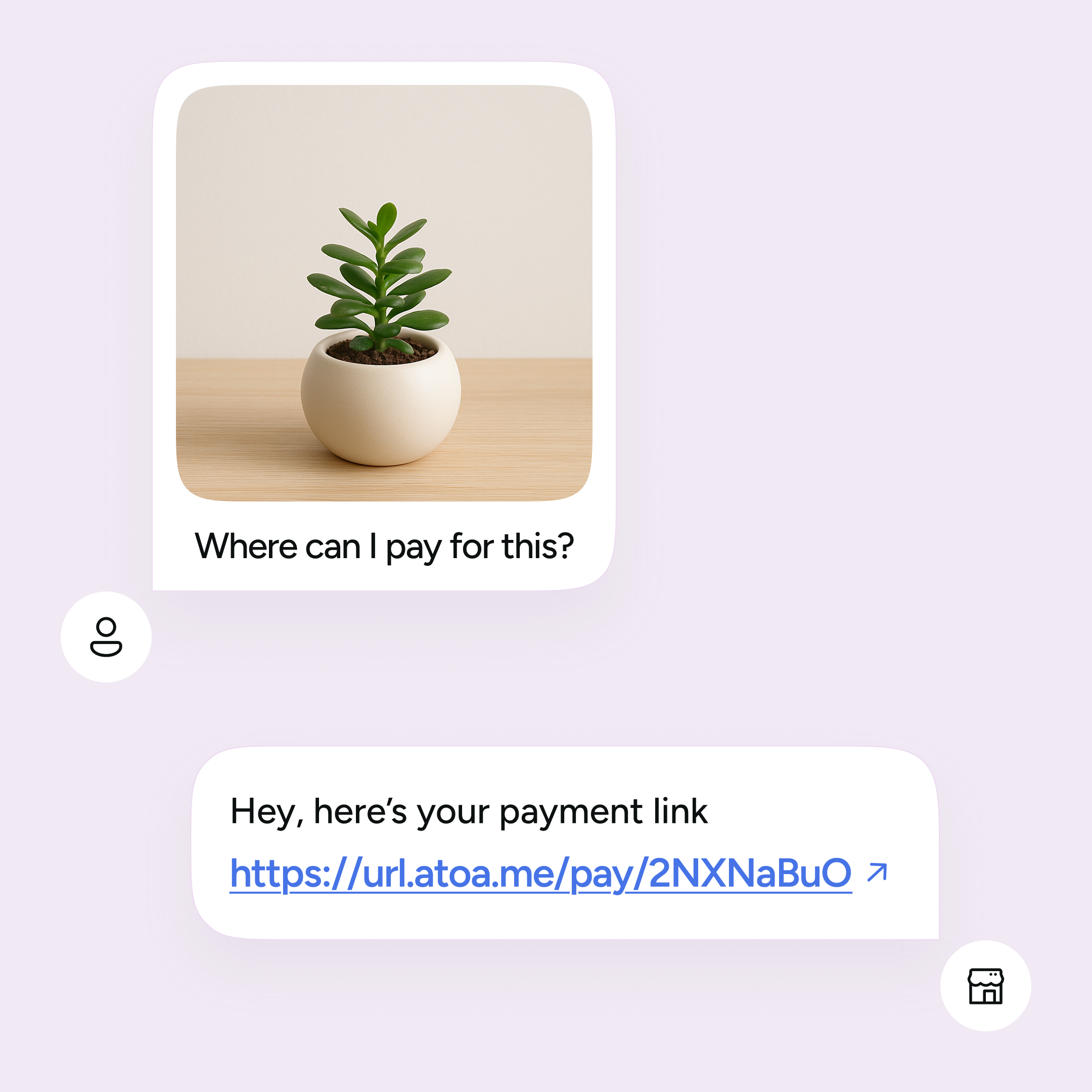

What is a payment link really?

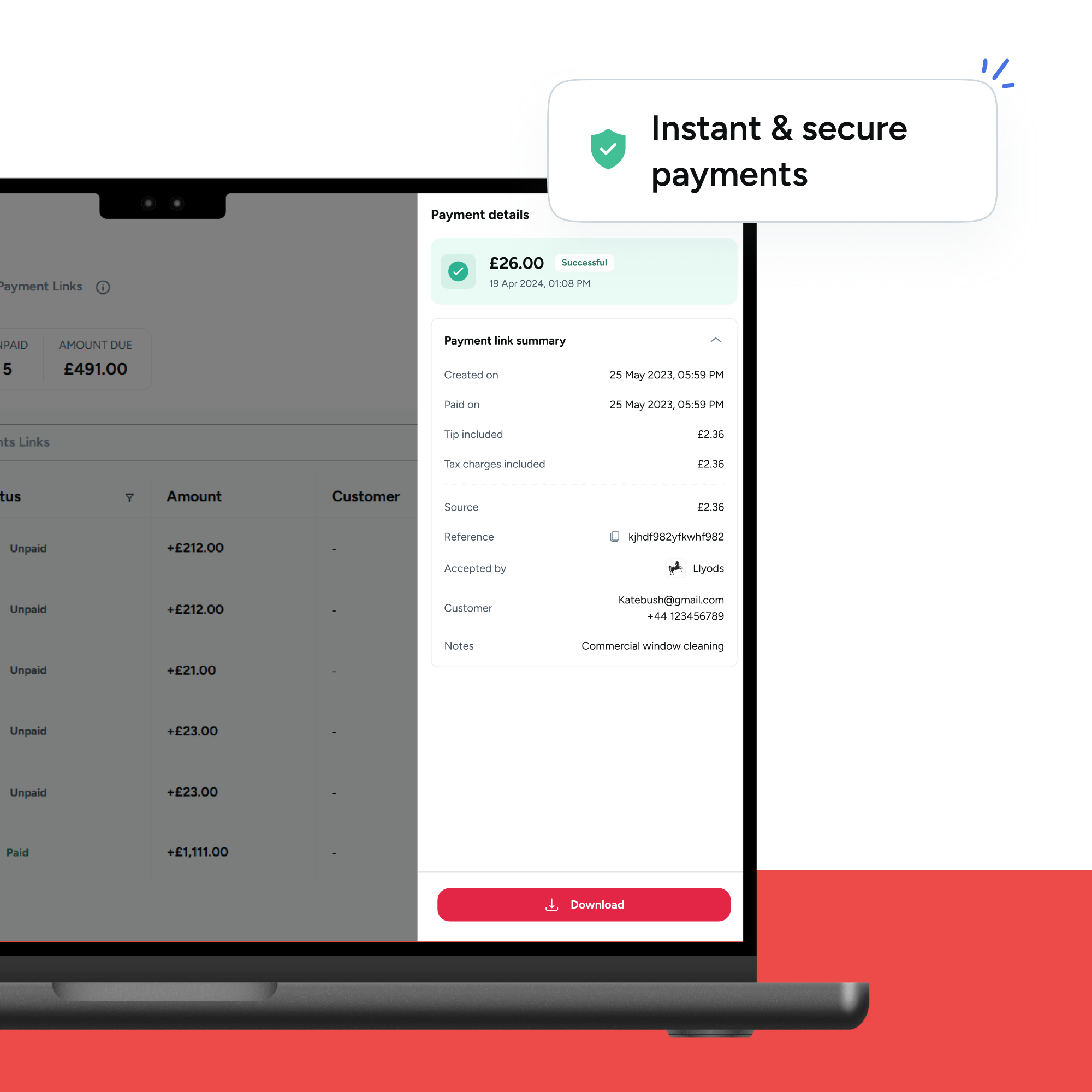

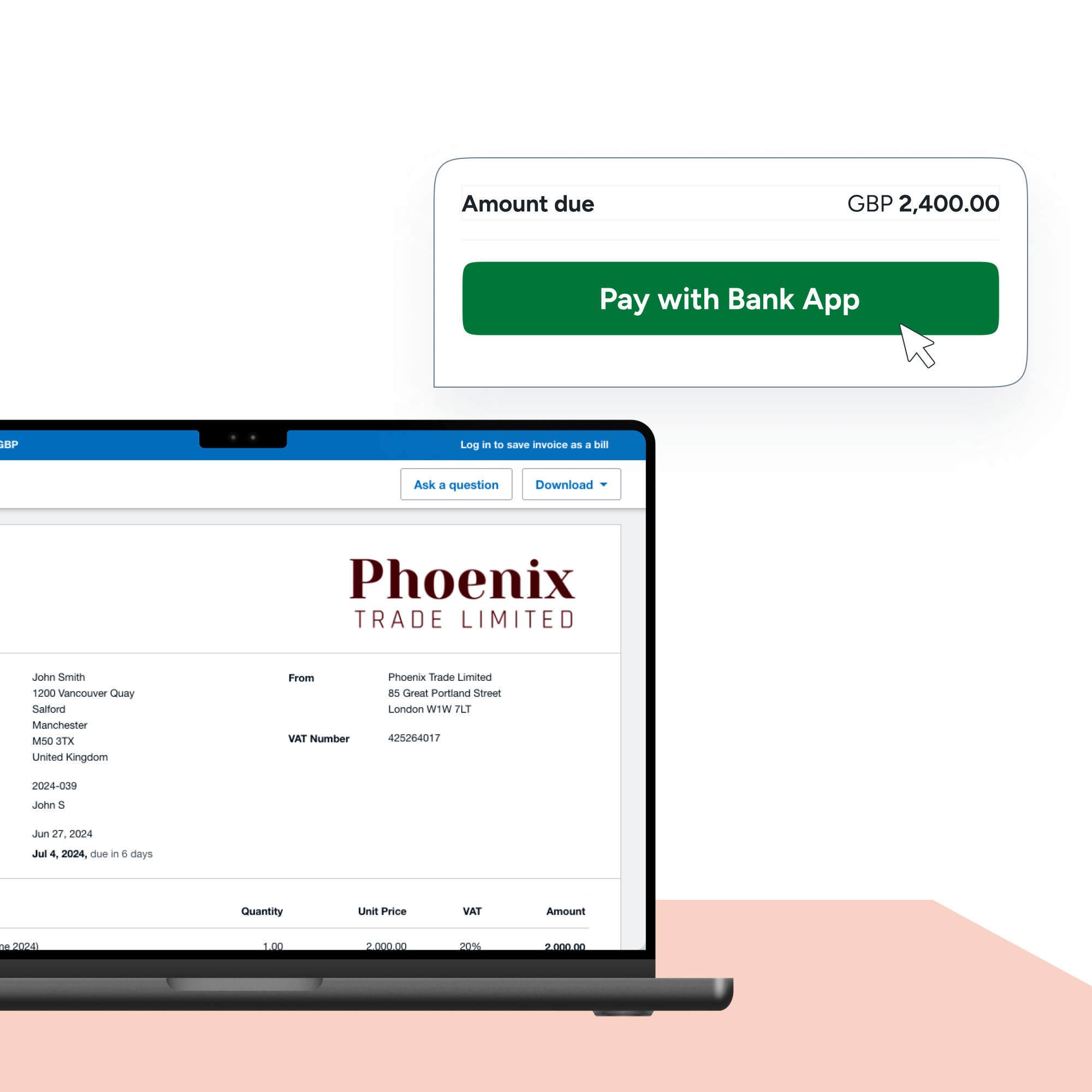

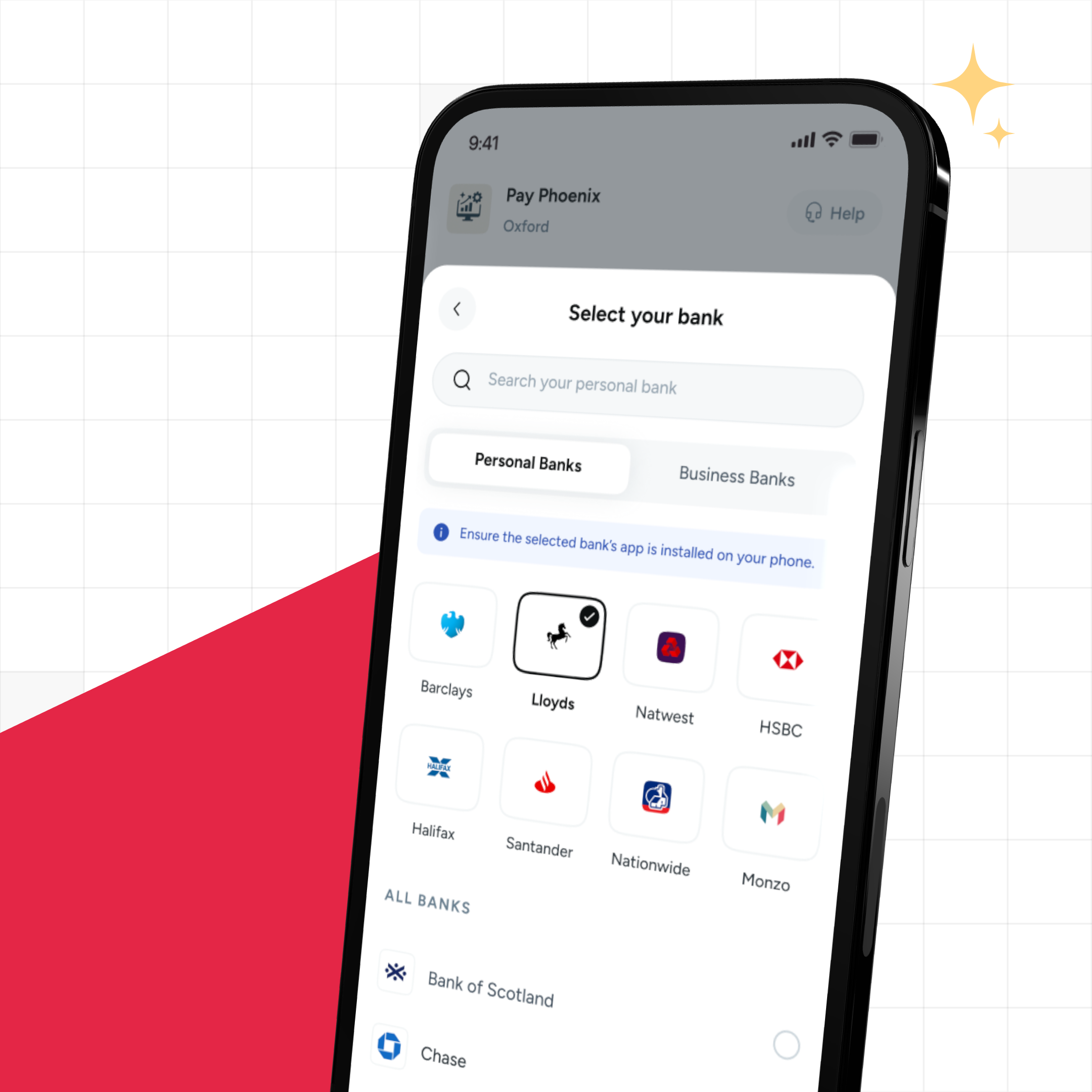

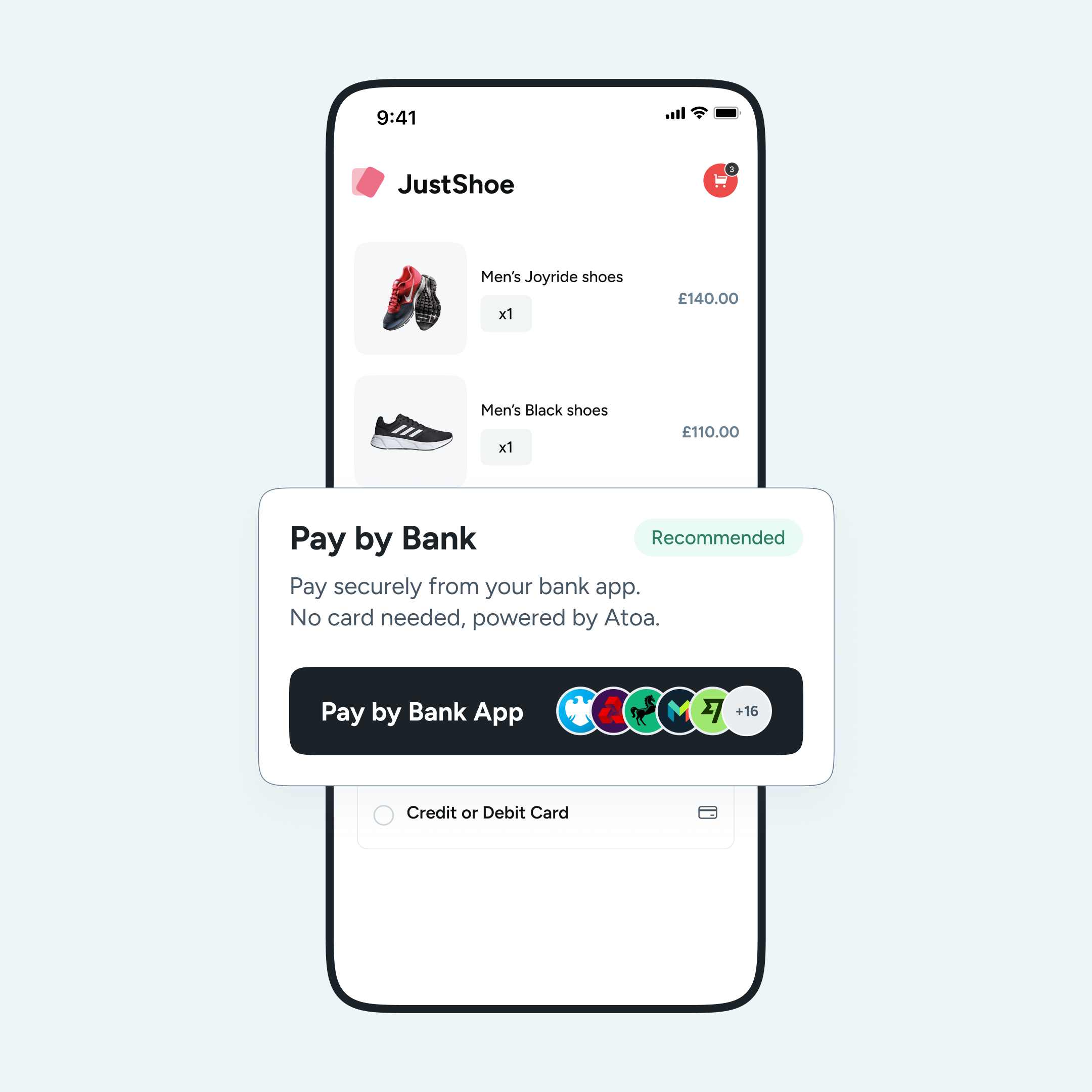

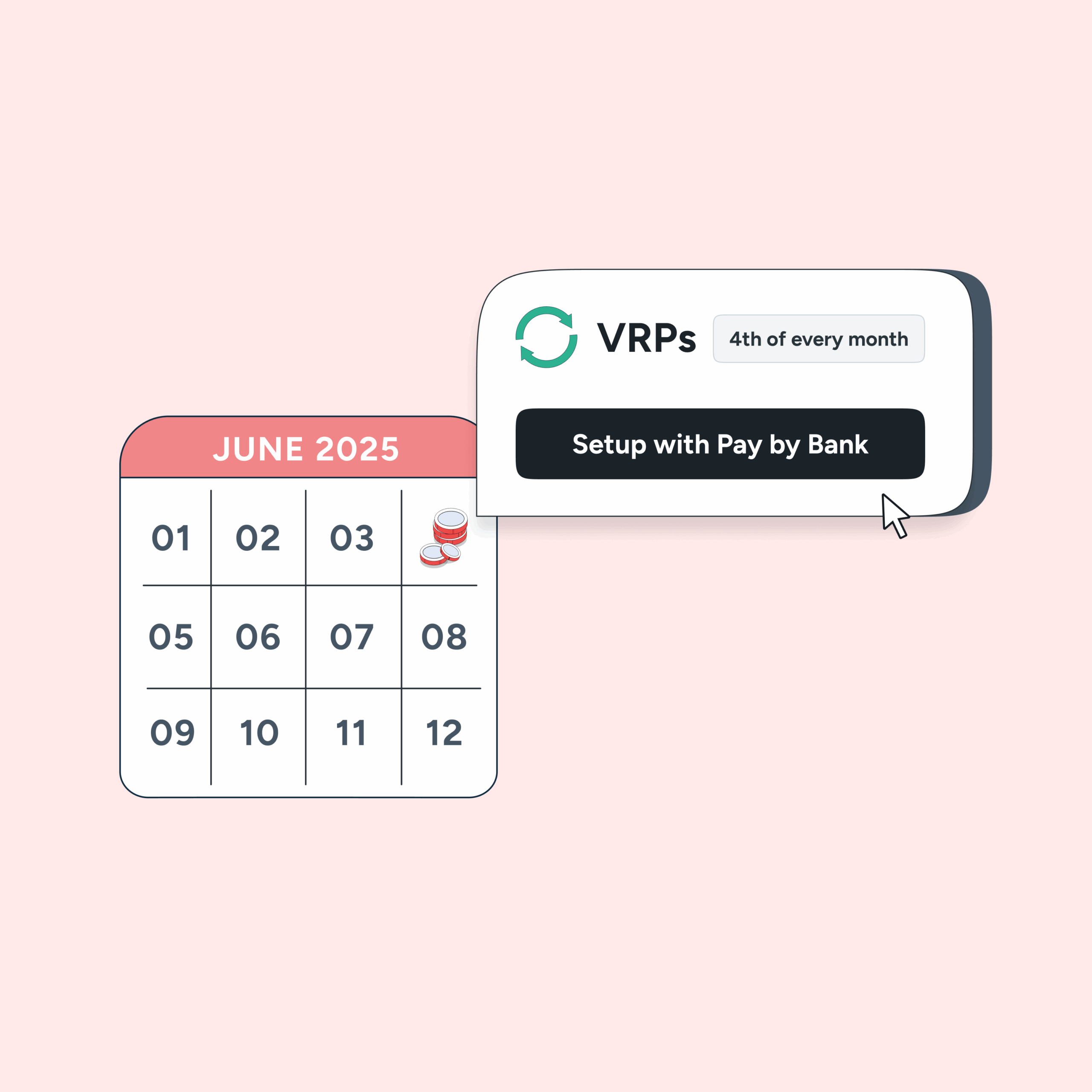

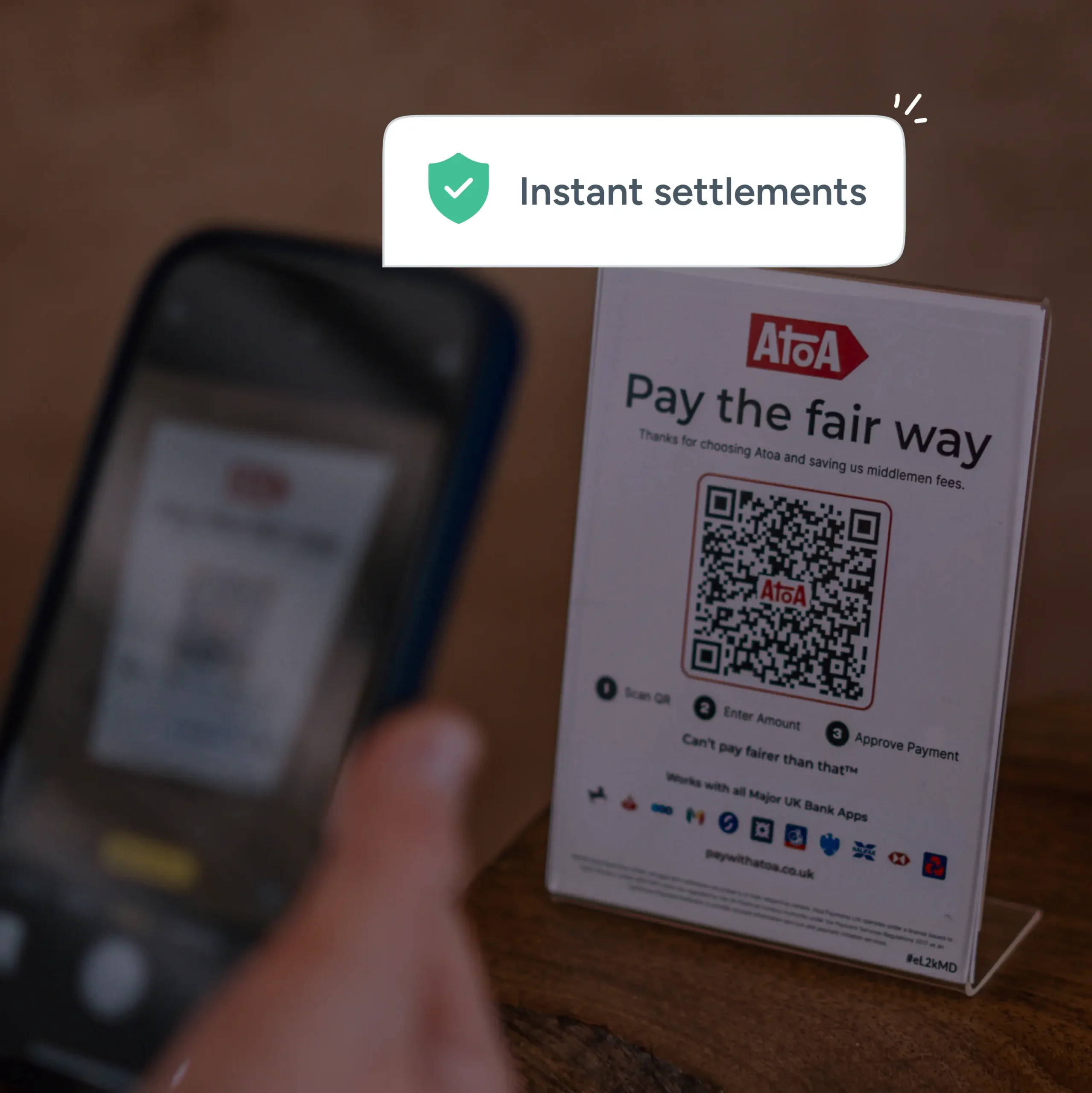

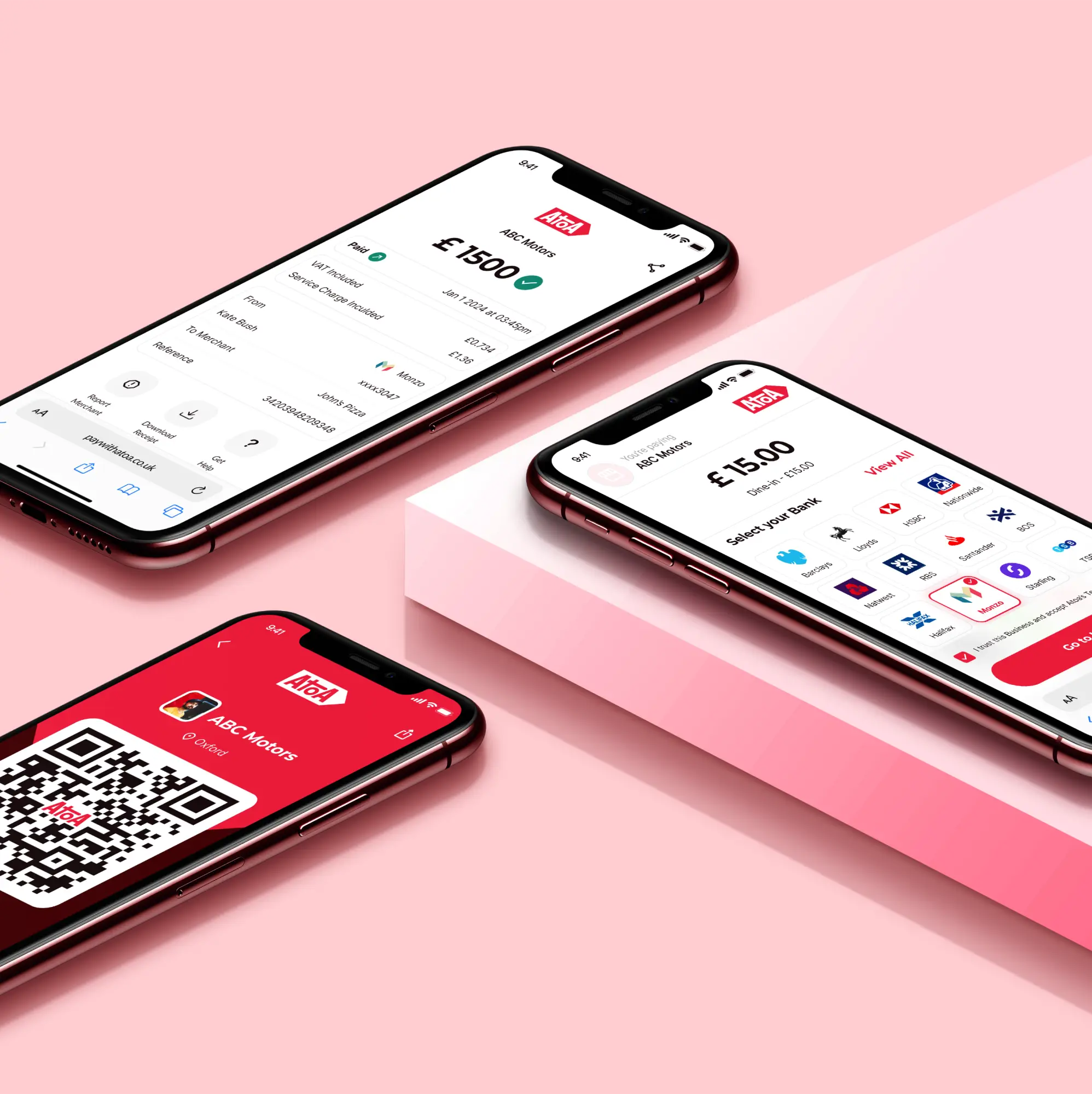

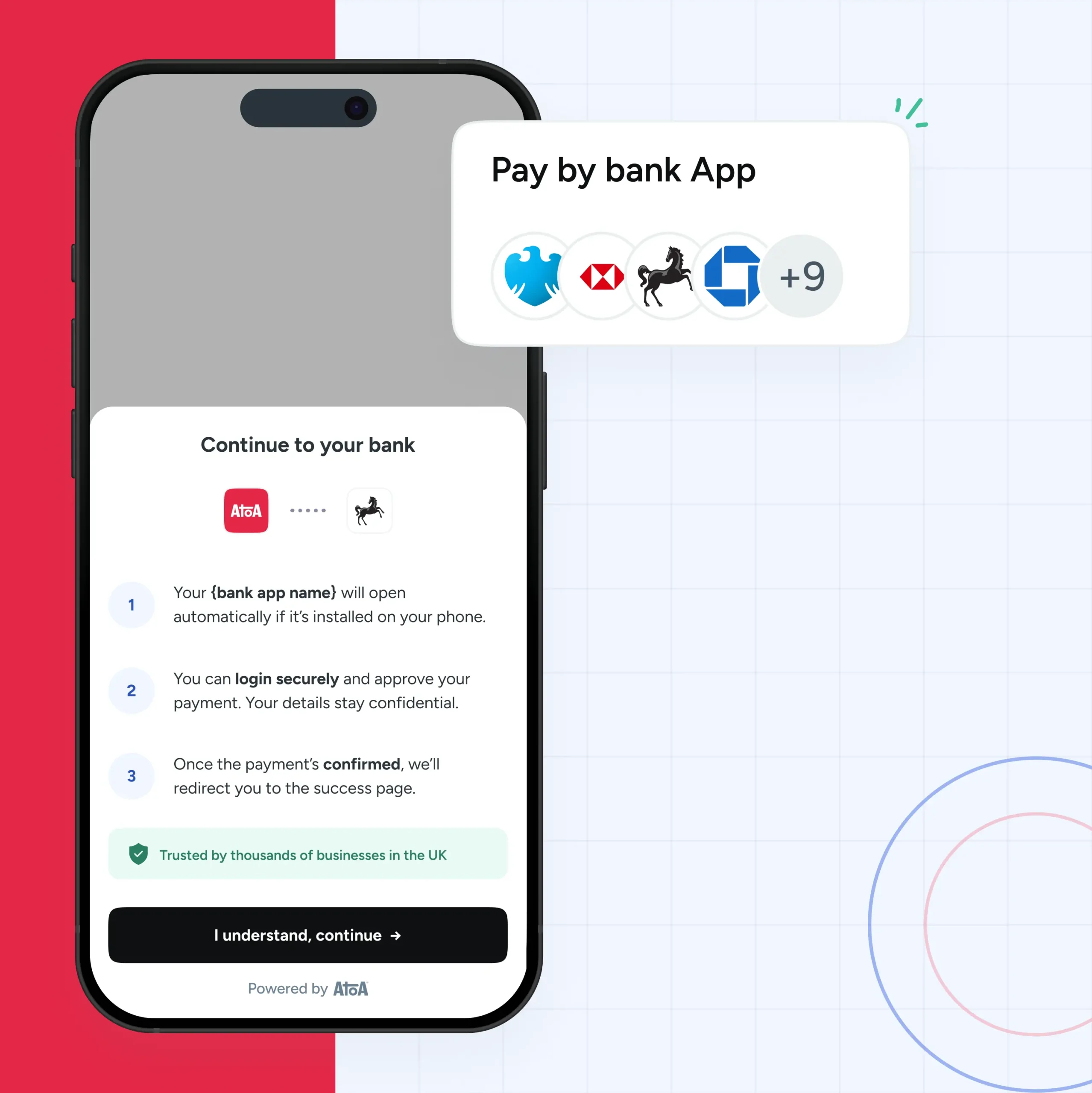

A payment link is a secure, bank-backed checkout that can be shared via email, SMS, or embedded in invoices and confirmations. Your customer clicks the link, selects their bank, approves the transaction, and the money lands in your account, often in seconds. Depending on your provider, you can generate one-time or reusable links, track status in real time, and brand the payment page to fit your business.

Why they’re more than just convenient

Yes, payment links are easy to use. But the real value lies in what they replace:

- No card terminals to rent or maintain across locations

- No chasing payments or waiting for cheques

- No apps for customers to download

- No surprise fees or chargebacks

They also plug seamlessly into your CRM, booking tools, or ERP platforms, making them ideal for remote-first, multi-channel operations.

Use cases you might not have considered

Let’s take a look at how payment links are being used in unexpected but powerful ways.

- Automotive & legal: Collect deposits or retainers upfront.

- Healthcare & clinics: Send post-appointment payment links or allow pay-ahead options.

- B2B & wholesale: Perfect for repeat orders and top-ups without logging into portals.

- Field teams: Engineers, technicians, and delivery agents can send links on-site to close payments in real time.

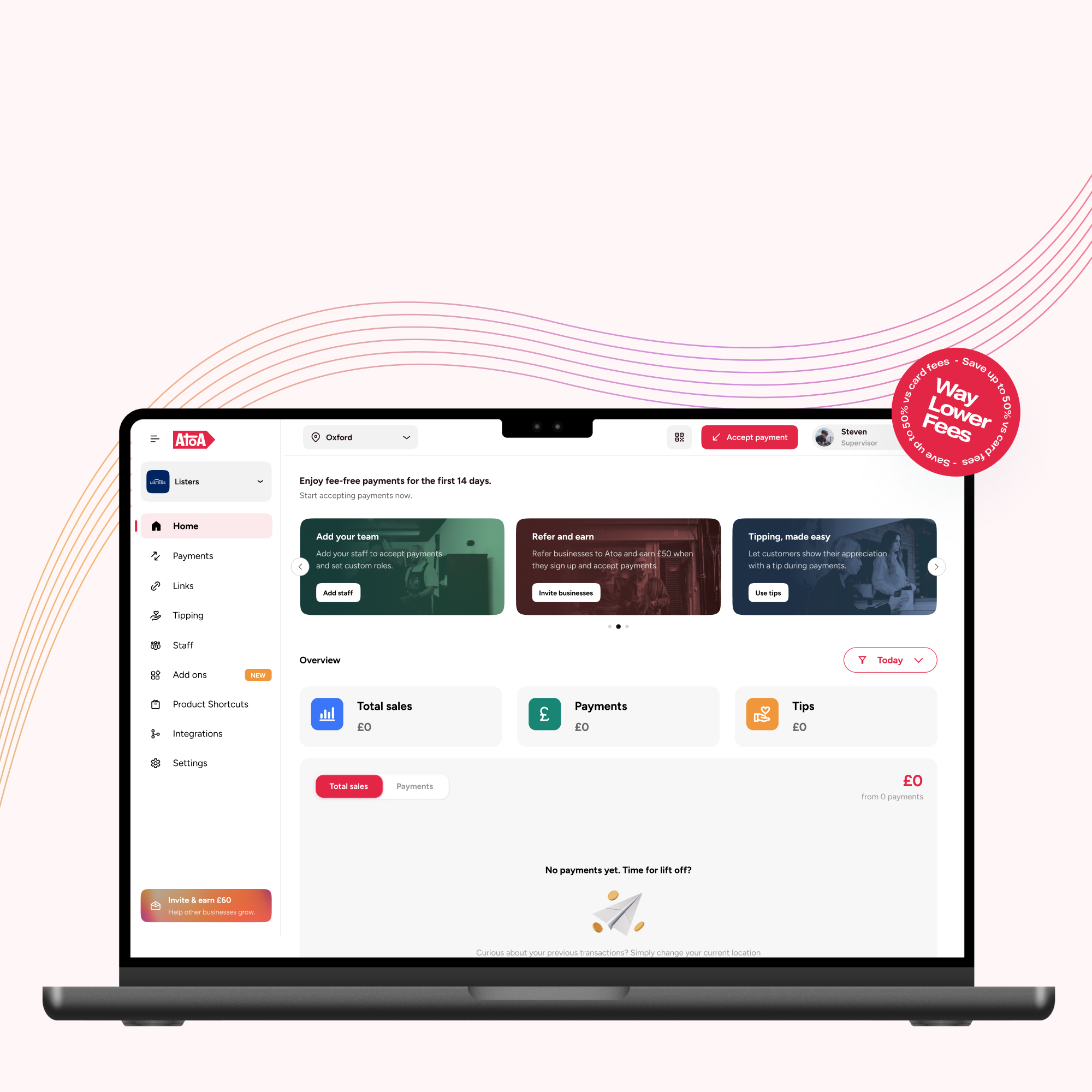

A financial strategy, not just a feature

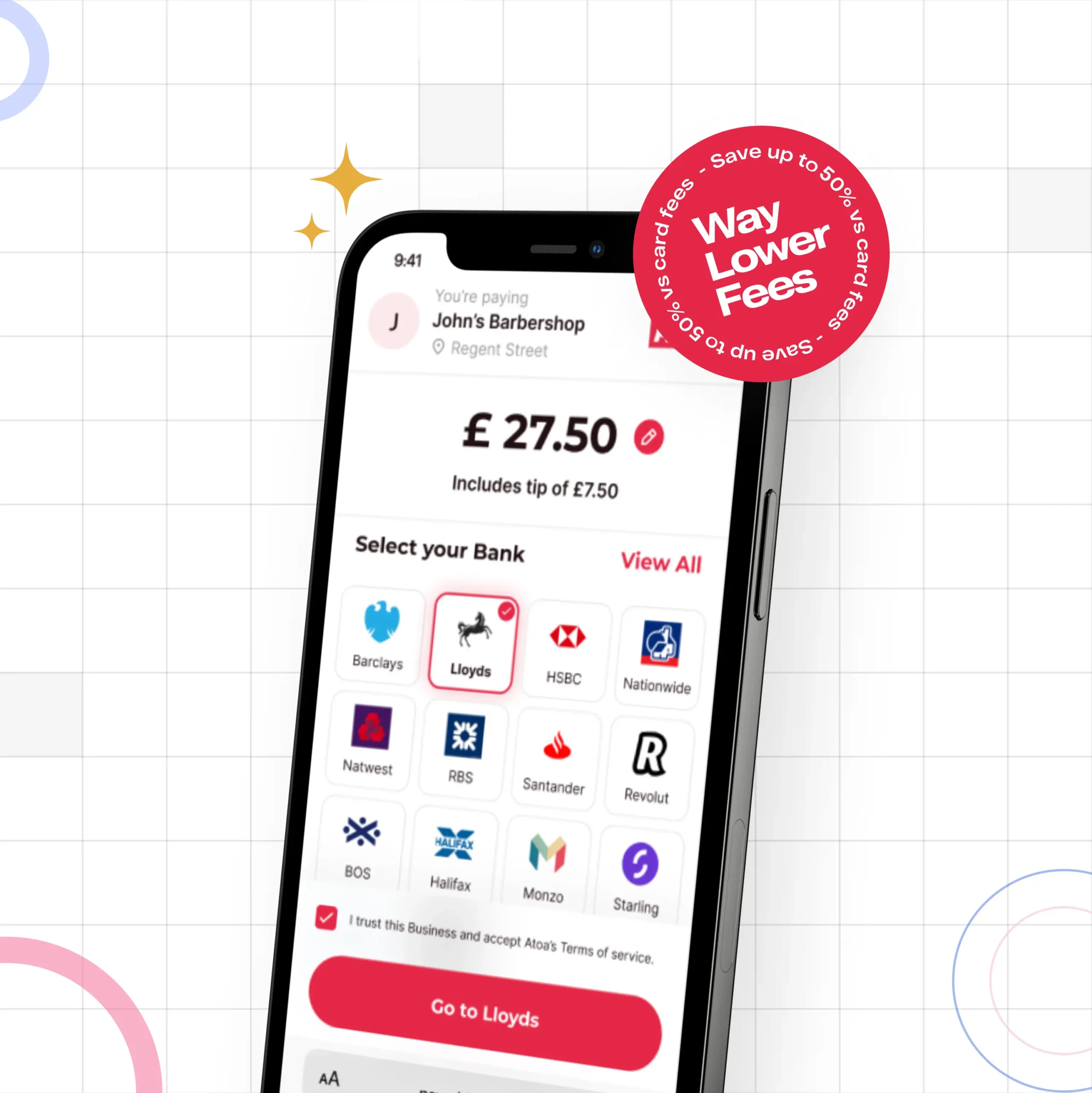

Beyond ease, payment links offer measurable impact:

- Faster cash flow with same-day settlements

- Lower transaction fees

- Clear audit trails and easier reconciliation

- Fewer failed or abandoned payments

When margins matter, switching payment methods can be a surprisingly effective lever.

Built for the open banking era

Modern payment links are powered by Pay by Bank rails, meaning they connect directly to your customer’s bank, with no card networks involved. These payments follow Strong Customer Authentication (SCA) standards, are encrypted end-to-end, and are processed by FCA-regulated providers like Atoa.

Common misconceptions about payment links

- “It’s just a bank transfer.” — Not quite. Payment links don’t require sort codes or manual entry.

- “My customers won’t get it.” — Most UK consumers already use mobile banking, and over 10 million have adopted mobile payments since the pandemic. It’s familiar, frictionless, and fast.

- “It’s only for small businesses.” — On the contrary, large operations use links to standardise and automate payments across teams and locations.

Getting started without disruption

One of the biggest advantages of payment links is how easy they are to implement. You don’t need to overhaul your systems, invest in hardware, or put your teams through retraining. Most businesses begin by adding a payment link to an invoice, a booking confirmation, or a follow-up email, just one use case to start. It’s a low-effort, low-risk way to see immediate results. Once you see how quickly customers respond and how smoothly the process fits into your workflow, it becomes easy to scale across departments, locations, or teams.

Takeaway

Payment links are more than a convenience, they’re a strategic upgrade. In an economy where speed, flexibility, and customer experience matter more than ever, payment links help businesses stay agile and in control. If you want to reduce payment friction, improve cash flow, or simplify reconciliation, the right payment link solution can support those goals without disruption. And with remote banking now used by the majority of UK adults, the shift is already underway. The question is no longer if businesses should adopt payment links, but how soon.